Professional Documents

Culture Documents

Ch12 Financial Reporting and Translation of Foreign Entity Statements

Ch12 Financial Reporting and Translation of Foreign Entity Statements

Uploaded by

osgggggCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch12 Financial Reporting and Translation of Foreign Entity Statements

Ch12 Financial Reporting and Translation of Foreign Entity Statements

Uploaded by

osgggggCopyright:

Available Formats

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Chapter 12

Multinational Accounting: Issues in Financial Reporting and Translation of

Foreign Entity Statements

Multiple Choice uestions

The !alance in "e#sprint Corp$%s foreign e&change loss account #as '1()((( on *ece!er

+1) 2((,) !efore any necessary year-end ad-ustent relating to the follo#ing:

.1/ "e#sprint had a '10)((( de!it resulting fro the restateent in dollars of the accounts of

its #holly o#ned foreign su!sidiary for the year ended *ece!er +1) 2((,$

.2/ "e#sprint had an account paya!le to an unrelated foreign supplier) paya!le in the

supplier%s local currency unit .1C2/ on 3anuary 10) 2((4$ The 2$S$ dollar5e6ui7alent of the

paya!le #as '0()((( on the *ece!er 1) 2((,) in7oice date and '0+)((( on *ece!er +1)

2((,$

1$ 8ased on the inforation pro7ided) in "e#sprint%s 2((, consolidated incoe stateent)

#hat aount should !e included as foreign e&change loss in coputing net incoe) if the

1C2 is the functional currency and the translation ethod is appropriate9

A$ '2,)(((

8$ '1+)(((

C$ '20)(((

*$ ',)(((

2$ 8ased on the inforation pro7ided) in "e#sprint%s 2((, consolidated incoe stateent)

#hat aount should !e included as foreign e&change loss in coputing net incoe) if the

2$S$ dollar is the functional currency and the reeasureent ethod is appropriate9

A$ '10)(((

8$ '1()(((

C$ '20)(((

*$ '2,)(((

12-1

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+$ Infinity Corporation ac6uired ,( percent of the coon stoc: of an Egyptian copany on

3anuary 1) 2((,$ The good#ill associated #ith this ac6uisition #as '1,)+0($ E&change rates at

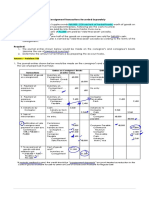

7arious dates during 2((, follo#:

;ood#ill suffered an ipairent of 2( percent during the year$ If the functional currency is

the Egyptian <ound) ho# uch good#ill ipairent loss should !e reported on Infinity%s

consolidated stateent of incoe for 2((,9

A$ '+)=>(

8$ '+)>((

C$ '+)=,(

*$ '+)=4(

?$ Infinity Corporation ac6uired ,( percent of the coon stoc: of an Egyptian copany on

3anuary 1) 2((,$ The good#ill associated #ith this ac6uisition #as '1,)+0($ E&change rates at

7arious dates during 2((, follo#:

;ood#ill suffered an ipairent of 2( percent during the year$ If the functional currency is

the 2$S$ dollar) ho# uch good#ill ipairent loss should !e reported on Infinity%s

consolidated stateent of incoe for 2((,9

A$ '+)=,(

8$ '+)=>(

C$ '+)=4(

*$ '+)>((

12-2

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0$ Sion Copany has t#o foreign su!sidiaries$ @ne is located in France) the other in

England$ Sion has deterined the 2$S$ dollar is the functional currency for the French

su!sidiary) #hile the 8ritish pound is the functional currency for the English su!sidiary$ 8oth

su!sidiaries aintain their !oo:s and records in their respecti7e local currencies$ Ahat

ethods #ill Sion use to con7ert each of the su!sidiary%s financial stateents into 2$S$

dollars9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

Michigan-!ased 1eo Corporation ac6uired 1(( percent of the coon stoc: of a 8ritish

copany on 3anuary 1) 2((,) for '1)1(()((($ The 8ritish su!sidiary%s net assets aounted to

0(()((( pounds on the date of ac6uisition$ @n 3anuary 1) 2((,) the !oo: 7alues of its

identifia!le assets and lia!ilities appro&iated their fair 7alues$ As a result of an analysis of

functional currency indicators) 1eo deterined that the 8ritish pound #as the functional

currency$ @n *ece!er +1) 2((,) the 8ritish su!sidiary%s ad-usted trial !alance) translated

into 2$S$ dollars) contained '1>)((( ore de!its than credits$ The 8ritish su!sidiary reported

incoe of ++)((( pounds for 2((, and paid a cash di7idend of ,)((( pounds on @cto!er 20)

2((,$ Included on the 8ritish su!sidiary%s incoe stateent #as depreciation e&pense of

+)0(( pounds$ 1eo uses the !asic e6uity ethod of accounting for its in7estent in the 8ritish

su!sidiary and deterined that good#ill in the first year had an ipairent loss of 20 percent

of its initial aount$ E&change rates at 7arious dates during 2((, follo#:

12-+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

=$ 8ased on the preceding inforation) #hat aount should 1eo record as Bincoe fro

su!sidiaryB !ased on the 8ritish su!sidiary%s reported net incoe9

A$ '>2)4+(

8$ '02)0((

C$ '>2)=((

*$ '=4)+((

>$ 8ased on the preceding inforation) the receipt of the di7idend #ill result in a credit to the

in7estent account for:

A$ '1=),((

8$ '1>)=,(

C$ '1,)(((

*$ '1>)=((

,$ 8ased on the preceding inforation) on 1eo%s consolidated !alance sheet at *ece!er +1)

2((,) #hat aount should !e reported for the good#ill ac6uired on 3anuary 1) 2((,9

A$ '+=),?0

8$ '+4)2,=

C$ '+=)4(0

*$ '+=)=(>

4$ 8ased on the preceding inforation) in the stoc:holders% e6uity section of 1eo%s

consolidated !alance sheet at *ece!er +1) 2((,) 1eo should report the translation

ad-ustent as a coponent of other coprehensi7e incoe of:

A$ '14)??(

8$ '1>)(((

C$ '1,)>,=

*$ '14)+,(

12-?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1($ Ahich of the follo#ing defines a foreign-!ased entity that uses a functional currency

different fro the local currency9

I$ A 2$S$ su!sidiary in 8ritain aintains its accounting records in pounds sterling) #ith the

a-ority of its transactions denoinated in pounds sterling$

II$ A 2$S$ su!sidiary in <eru conducts 7irtually all of its !usiness in 1atin Aerica) and uses

the 2$S$ dollar as its a-or currency$

A$ I$

8$ II$

C$ 8oth I and II$

*$ "either I nor II$

11$ Ahen the local currency of the foreign su!sidiary is the functional currency) a foreign

su!sidiary%s in7entory carried at cost #ould !e con7erted to 2$S$ dollars !y:

A$ translation using historical e&change rates$

8$ reeasureent using historical e&change rates$

C$ reeasureent using the current e&change rate$

*$ translation using the current e&change rate$

12$ Ahen the local currency of the foreign su!sidiary is the functional currency) a foreign

su!sidiary%s incoe stateent accounts #ould !e con7erted to 2$S$ dollars !y:

A$ translation using historical e&change rates$

8$ reeasureent using current e&change rates at the tie of stateent preparation$

C$ translation using a7erage e&change rate for the period$

*$ reeasureent using the current e&change rate at the tie of stateent preparation$

12-0

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1+$ If the restateent ethod for a foreign su!sidiary in7ol7es reeasuring fro the local

currency into the functional currency) then translating fro functional currency to 2$S$

dollars) the functional currency of the su!sidiary is:

I$ 2$S$ dollar$

II$ 1ocal currency unit$

III$ A third country%s currency$

A$ I

8$ III

C$ II

*$ Either I or II

1?$ If the 2$S$ dollar is the currency in #hich the foreign affiliate%s !oo:s and records are

aintained) and the 2$S$ dollar is also the functional currency)

A$ the translation ethod should !e used for restateent$

8$ the reeasureent ethod should !e used for restateent$

C$ either translation or reeasureent could !e used for restateent$

*$ no restateent is re6uired$

10$ All of the follo#ing stoc:holders% e6uity accounts of a foreign su!sidiary are translated at

historical e&change rates e&cept:

A$ retained earnings$

8$ coon stoc:$

C$ additional paid-in capital$

*$ preferred stoc:$

1=$ *i7idends of a foreign su!sidiary are translated at:

A$ the a7erage e&change rate for the year$

8$ the e&change rate on the date of declaration$

C$ the current e&change rate on the date of preparation of the financial stateent$

*$ the e&change rate on the record date$

12-=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1>$ If the functional currency is the local currency of a foreign su!sidiary) #hat e&change

rates should !e used to translate the ites !elo#) assuing the foreign su!sidiary is in a

country #hich has not e&perienced hyperinflation o7er three years9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

1,$ If the functional currency is the local currency of a foreign su!sidiary) #hat e&change

rates should !e used to translate the ites !elo#) assuing the foreign su!sidiary is in a

country #hich has not e&perienced hyperinflation o7er three years9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

12->

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

14$ Ahich co!ination of accounts and e&change rates is correct for the translation of a

foreign entity%s financial stateents fro the functional currency to 2$S$ dollars9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

2($ Ahich co!ination of accounts and e&change rates is correct for the reeasureent of a

foreign entity%s financial stateents fro its local currency to 2$S$ dollars9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

12-,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

21$ The assets listed !elo# of a foreign su!sidiary ha7e !een con7erted to 2$S$ dollars at !oth

current and historical e&change rates$ Assuing that the local currency of the foreign

su!sidiary is the functional currency) #hat total aount should appear for these assets on the

2$S$ copany%s consolidated !alance sheet9

A$ '=+=)(((

8$ '=?,)(((

C$ '>(,)(((

*$ '4=()(((

22$ The gain or loss on the effecti7e portion of a 2$S$ parent copany%s hedge of a net

in7estent in a foreign entity should !e treated as:

A$ an ad-ustent to the retained earnings account in the stoc:holders% e6uity section of its

!alance sheet$

8$ other coprehensi7e incoe$

C$ a translation gain or loss in the coputation of net incoe for the reporting period$

*$ an ad-ustent to a 7aluation account in the asset section of its !alance sheet$

12-4

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2+$ *o7er Copany o#ns 4(C of the capital stoc: of a foreign su!sidiary located in Italy$

*o7er%s accountant has -ust translated the accounts of the foreign su!sidiary and deterined

that a de!it translation ad-ustent of ',()((( e&ists$ If *o7er uses the e6uity ethod for its

in7estent) #hat entry should *o7er record in order to recogniDe the translation ad-ustent9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

2?$ For each of the ites listed !elo#) state #hether they increase or decrease the !alance in

cuulati7e translation ad-ustents .assuing a credit !alance at the !eginning of the year/

#hen the foreign currency strengthened relati7e to the 2$S$ dollar during the year$

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

12-1(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

20$ "ichols Copany o#ns 4(C of the capital stoc: of a foreign su!sidiary located in Ireland$

As a result of translating the su!sidiary%s accounts) a de!it of '1=()((( #as needed in the

translation ad-ustents account so that the foreign su!sidiary%s de!its and credits #ere e6ual

in 2$S$ dollars$ Eo# should "ichols report its translation ad-ustents on its consolidated

financial stateents9

A$ As a '1??)((( increase in the stoc:holders% e6uity section of the !alance sheet$

8$ As a '1??)((( reduction in consolidated coprehensi7e net incoe$

C$ As a '1=()((( de!it in stoc:holders% e6uity section of the !alance sheet$

*$ As a '1=()((( reduction in consolidated coprehensi7e net incoe$

2=$ 2nder the teporal ethod) #hich of the follo#ing is usually used to translate onetary

aounts to the functional currency9

I$ The current e&change rate

II The historical e&change rate

III$ A7erage e&change rate

A$ I

8$ III

C$ II

*$ Either I or II

12-11

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Mercury Copany is a su!sidiary of "eptune Copany and is located in FalparaGso) Chile)

#here the currency is the Chilean <eso$ *ata on Mercury%s in7entory and purchases are as

follo#s:

The !eginning in7entory #as ac6uired during the fourth 6uarter of 2((>) and the ending

in7entory #as ac6uired during the fourth 6uarter of 2((,$ <urchases #ere ade e7enly o7er

the year$ E&change rates #ere as follo#s:

2>$ Refer the inforation pro7ided a!o7e$ Assuing the 2$S$ dollar is the functional

currency) #hat is the aount of Mercury%s cost of goods sold reeasured in 2$S$ dollars9

A$ '1)=,(

8$ '1)>12

C$ '1)>((

*$ '1)=42

12-12

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2,$ 8ased on the preceding inforation) the translation of cost of goods sold for 2((,)

assuing that the Spanish peseta is the functional currency is:

A$ '1)>(($

8$ '1)>=($

C$ '1)=,($

*$ '1)=42$

24$ The 8ritish su!sidiary of a 2$S$ copany reported cost of goods sold of >0)((( pounds

.sterling/ for the current year ended *ece!er +1$ The !eginning in7entory #as 1()(((

pounds) and the ending in7entory #as 10)((( pounds$ Spot rates for 7arious dates are as

follo#s:

Assuing the dollar is the functional currency of the 8ritish su!sidiary) the reeasured

aount of cost of goods sold that should appear in the consolidated incoe stateent is:

A$ '1(,)>0($

8$ '112)0(($

C$ '11?)20($

*$ '120)>(($

12-1+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+($ The 8ritish su!sidiary of a 2$S$ copany reported cost of goods sold of >0)((( pounds

.sterling/ for the current year ended *ece!er +1$ The !eginning in7entory #as 1()(((

pounds) and the ending in7entory #as 10)((( pounds$ Spot rates for 7arious dates are as

follo#s:

Assuing the pound is the functional currency of the 8ritish su!sidiary) the translated aount

of cost of goods sold that should appear in the consolidated incoe stateent is:

A$ '1(,)>0($

8$ '112)0(($

C$ '11?)+(($

*$ '120)>(($

Elan) a 2$S$ corporation) copleted the *ece!er +1) 2((,) foreign currency translation of

its >( percent o#ned S#iss su!sidiary%s trial !alance using the current rate ethod$ The

translation resulted in a de!it ad-ustent of '20)((($ The su!sidiary had reported net incoe

of ,(()((( S#iss francs for 2((, and paid di7idends of 0()((( S#iss francs on Septe!er 1)

2((,$ The translation rates for the year #ere:

The 3anuary 1 !alance of the In7estent in the S#iss su!sidiary account #as '1)=(()((($

Elan ac6uired its interest in the S#iss su!sidiary at !oo: 7alue #ith no differential or

good#ill recorded at ac6uisition$

12-1?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+1$ Elan%s In7estent in S#iss su!sidiary account at *ece!er +1) 2((,) is:

A$ '1),,1)(0($

8$ '1)41=)(0($

C$ '1)42+)40($

*$ '2)(01)0(($

+2$ Elan%s consolidated #or:paper eliinations related to the foreign currency translation

ad-ustent #ill include #hich entry9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

++$ Seattle) Inc$ o#ns an ,( percent interest in a <ortuguese su!sidiary$ For 2((,) Seattle

reported incoe fro operations of '2$( illion$ The <ortuguese copany%s incoe fro

operations) after foreign currency translation) #as '1$1 illion$ The foreign currency

translation ad-ustent #as '12()((( .credit/$ Consolidated net incoe and consolidated

coprehensi7e incoe for the year are:

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

12-10

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

@n 3anuary 2) 2((,) 3ohnson Copany ac6uired a 1((C interest in the capital stoc: of <erth

Copany for '+)1(()((($ Any e&cess cost o7er !oo: 7alue is attri!uta!le to a patent #ith a

1(-year reaining life$ At the date of ac6uisition) <erth%s !alance sheet contained the

follo#ing inforation:

<erth%s incoe stateent for 2((, is as follo#s:

12-1=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

The !alance sheet of <erth at *ece!er +1) 2((,) is as follo#s:

<erth declared and paid a di7idend of 2()((( FC2 on @cto!er 1) 2((,$ Spot rates at 7arious

dates for 2((, follo#:

Assue <erth%s re7enues) purchases) operating e&penses) depreciation e&pense) and incoe

ta&es #ere incurred e7enly throughout 2((,$

12-1>

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+?$ Refer to the a!o7e inforation$ Assuing the local currency of the country in #hich <erth

Copany is located is the functional currency) #hat are the translated aounts for the ites

!elo# in 2$S$ dollars9

A$ @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

+0$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of translation ad-ustents that result fro translating <erth%s trial

!alance into 2$S$ dollars at *ece!er +1) 2((,9

A$ '+4=)0(( de!it

8$ '2,0)((( credit

C$ '?(0)((( credit

*$ '?11)((( credit

+=$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of patent aortiDation for 2((, that results fro 3ohnson%s

ac6uisition of <erth%s stoc: on 3anuary 2) 2((,$ Round your ans#er to the nearest dollar$

A$ '11)0((

8$ '11),,?

C$ '>)==>

*$ '4)+4?

12-1,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+>$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of translation ad-ustent that appears on 3ohnson%s consolidated

financial stateents at *ece!er +1) 2((,9

A$ '?14)1,? credit

8$ '?1=),,? credit

C$ '?(0),,? de!it

*$ '+4,)0(( credit

+,$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the !alance in 3ohnson%s in7estent in foreign su!sidiary account at

*ece!er +1) 2((,) assuing use of the e6uity ethod9

A$ '+)21=)0((

8$ '+)0=()(((

C$ '+)0=,)+((

*$ '+)0>>)=4?

+4$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is 3ohnson%s reeasureent gain .loss/ for 2((,9 .Assue the ending in7entory #as ac6uired

on *ece!er +1) 2((,$/

A$ '+1)((( gain

8$ '+=)0(( loss

C$ '22)((( gain

*$ '+2)((( gain

?($ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the aount of <erth%s cost of goods sold reeasured in 2$S$ dollars9

A$ ',11)0((

8$ ',?+)0((

C$ ',,?)0((

*$ '>44)0((

12-14

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?1$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the aount of patent aortiDation for 2((, that results fro 3ohnson%s ac6uisition of <erth%s

stoc: on 3anuary 2) 2((,9

A$ '11),,?

8$ '11)>>(

C$ '12)00(

*$ '11)0((

?2$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is <erth%s net incoe for 2((, in 2$S$ dollars .include the reeasureent gain or loss in

<erth%s net incoe/9

A$ '2+,)(((

8$ '22,)(((

C$ '214)0((

*$ '2(2)(((

?+$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the !alance in 3ohnson%s in7estent in foreign su!sidiary account at *ece!er +1) 2((,

.assuing the use of the e6uity ethod/9

A$ '+)+(+)?((

8$ '+)24?)0((

C$ '+)+2+)?((

*$ '+)+1?)0((

12-2(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

@n 3anuary 1) 2((,) Transport Corporation ac6uired >0 percent interest in Steaship

Copany for '+(()((($ Steaship is a "or#egian copany$ The local currency is the

"or#egian :roner ."Hr/$ The ac6uisition resulted in an e&cess of cost-o7er-!oo: 7alue of

'20)((( due solely to a patent ha7ing a reaining life of 0 years$ Transport uses the e6uity

ethod to account for its in7estent$ Steaship%s *ece!er +1) 2((,) trial !alance has !een

translated into 2$S$ dollars) re6uiring a translation ad-ustent de!it of ',)((($ Steaship%s net

incoe translated into 2$S$ dollars is '+0)((($ It declared and paid an "Hr 2()((( di7idend

on 3une 1) 2((,$ Rele7ant e&change rates are as follo#s:

Assue the :roner is the functional currency$

??$ 8ased on the preceding inforation) in the -ournal entry to record the receipt of di7idend

fro Steaship)

A$ In7estent in Steaship Copany #ill !e credited for '+)?0($

8$ Cash #ill !e de!ited for '+)+(($

C$ In7estent in Steaship Copany #ill !e credited for '?)((($

*$ Cash #ill !e de!ited for '+)=(($

?0$ 8ased on the preceding inforation) in the -ournal entry to record parent%s share of

su!sidiary%s translation ad-ustent:

A$ @ther Coprehensi7e Incoe I Translation Ad-ustent #ill !e de!ited for ',)((($

8$ @ther Coprehensi7e Incoe I Translation Ad-ustent #ill !e credited for '=)((($

C$ In7estent in Steaship Copany #ill !e credited for '=)((($

*$ In7estent in Steaship Copany #ill !e de!ited for ',)((($

12-21

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?=$ 8ased on the preceding inforation) #hat aount of translation ad-ustent is re6uired for

increase in differential9

A$ '+)(((

8$ '0)0((

C$ '?)0((

*$ '0)(((

?>$ 8ased on the preceding inforation) in the -ournal entry to record the aortiDation of the

patent for 2((, on the parent%s !oo:s) In7estent in Steaship Copany #ill !e de!ited for:

A$ '0)(((

8$ '0)0((

C$ '?)0((

*$ '+)(((

@n Septe!er +() 2((,) Ailfred Copany sold in7entory to 3ac:son Corporation) its

Canadian su!sidiary$ The goods cost Ailfred '+()((( and #ere sold to 3ac:son for '?()((()

paya!le in Canadian dollars$ The goods are still on hand at the end of the year on *ece!er

+1$ The Canadian dollar .C'/ is the functional currency of the Canadian su!sidiary$ The

e&change rates follo#:

?,$ 8ased on the preceding inforation) at #hat dollar aount is the ending in7entory sho#n

in the trial !alance of the consolidated #or:paper9

A$ '?0)(((

8$ '0()(((

C$ '?()(((

*$ '+0)(((

12-22

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?4$ 8ased on the preceding inforation) #hat aount of unrealiDed intercopany gross profit

is eliinated in preparing the consolidated financial stateents for the year9

A$ '(

8$ '0)(((

C$ '1()(((

*$ '10)(((

0($ 8ased on the preceding inforation) at #hat aount is the in7entory sho#n on the

consolidated !alance sheet for the year9

A$ '?0)(((

8$ '+()(((

C$ '?()(((

*$ '+0)(((

Essay uestions

01$ 8riefly e&plain the follo#ing ters associated #ith accounting for foreign entities:

a/ Functional Currency

!/ Translation

c/ Reeasureent

12-2+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

02$ @n 3anuary 1) 2((,) <ace Copany ac6uired all of the outstanding stoc: of Spin <1C) a

8ritish Copany) for '+0()((($ Spin%s net assets on the date of ac6uisition #ere 20()(((

pounds .J/$ @n 3anuary 1) 2((,) the !oo: and fair 7alues of the Spin%s identifia!le assets and

lia!ilities appro&iated their fair 7alues e&cept for property) plant) and e6uipent and

tradear:s$ The fair 7alue of Spin%s property) plant) and e6uipent e&ceeded its !oo: 7alue

!y '20)((($ The reaining useful life of Spin%s e6uipent at 3anuary 1) 2((,) #as 1( years$

The reainder of the differential #as attri!uta!le to a tradear: ha7ing an estiated useful

life of 0 years$ Spin%s trial !alance on *ece!er +1) 2((,) in pounds) follo#s:

Additional Inforation

1 Spin uses the FIF@ ethod for its in7entory$ The !eginning in7entory #as ac6uired on

*ece!er +1) 2((>) and ending in7entory #as ac6uired on *ece!er 2=) 2((,$ <urchases of

J+(()((( #ere ade e7enly throughout 2((,$

2 Spin ac6uired all of its property) plant) and e6uipent on March 1) 2((=) and uses straight-

line depreciation$

+ Spin%s sales #ere ade e7enly throughout 2((,) and its operating e&penses #ere incurred

e7enly throughout 2((,$

? The di7idends #ere declared and paid on "o7e!er 1) 2((,$

0 <ace%s incoe fro its o#n operations #as '10()((( for 2((,) and its total stoc:holders%

e6uity on 3anuary 1) 2((,) #as '1)((()((($ <ace declared '0()((( of di7idends during 2((,$

= E&change rates #ere as follo#s:

12-2?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Re6uired:

1/ <repare a schedule translating the trial !alance fro 8ritish pounds into 2$S$ dollars$

Assue the pound is the functional currency$

2/ Assue that <ace uses the !asic e6uity ethod$ Record all -ournal entries that relate to its

in7estent in the 8ritish su!sidiary during 2((,$ <ro7ide the necessary docuentation and

support for the aounts in the -ournal entries) including a schedule of the translation

ad-ustent related to the differential$

2/ <repare a schedule that deterines <ace%s consolidated coprehensi7e incoe for 2((,$

?/ Copute <ace%s total consolidated stoc:holders% e6uity at *ece!er +1) 2((,$

0+$ 2se the inforation gi7en in 6uestion 02 to prepare a schedule pro7iding a proof of the

translation ad-ustent$

12-20

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0?$ Refer to the inforation in 6uestion 02$ Assue the 2$S$ dollar is the functional currency)

not the pound$

Re6uired:

1/ <repare a schedule reeasuring the trial !alance fro 8ritish pound into 2$S$ dollars$

2/ Assue that <ace uses the !asic e6uity ethod$ Record all -ournal entries that relate to its

in7estent in the 8ritish su!sidiary during 2((,$ <ro7ide the necessary docuentation and

support for the aounts in the -ournal entries$

+/ <repare a schedule that deterines <ace%s consolidated net incoe for 2((,$

?/ Copute <ace%s total consolidated stoc:holders% e6uity at *ece!er +1) 2((,$

00$ Refer to the inforation in 6uestion 02$ Assue the 2$S$ dollar is the functional currency)

not the pound$ <repare a schedule pro7iding a proof of the reeasureent gain or loss$

Assue that the 8ritish su!sidiary had the follo#ing onetary assets and lia!ilities at 3anuary

1) 2((,:

12-2=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0=$ <arisian Co$ is a French copany located in <aris$ Kan:ee Corp$) located in "e# Kor:

City) ac6uires <arisian Co$ <arisian has the Euro as its local currency and the S#iss Franc as

its functional currency$ Kan:ee has the 2$S$ dollar as its local currency and the 2$S$ dollar as

its functional currency$

Re6uired:

a/ The year-end consolidated financial stateents #ill !e prepared in #hich currency9

!/ E&plain #hich ethod is appropriate to use to use at year-end: Translation or

Reeasureent9

Chapter 12 Multinational Accounting: Issues in Financial Reporting and

Translation of Foreign Entity Stateents Ans#er Hey

Multiple Choice uestions

The !alance in "e#sprint Corp$%s foreign e&change loss account #as '1()((( on *ece!er

+1) 2((,) !efore any necessary year-end ad-ustent relating to the follo#ing:

.1/ "e#sprint had a '10)((( de!it resulting fro the restateent in dollars of the accounts of

its #holly o#ned foreign su!sidiary for the year ended *ece!er +1) 2((,$

.2/ "e#sprint had an account paya!le to an unrelated foreign supplier) paya!le in the

supplier%s local currency unit .1C2/ on 3anuary 10) 2((4$ The 2$S$ dollar5e6ui7alent of the

paya!le #as '0()((( on the *ece!er 1) 2((,) in7oice date and '0+)((( on *ece!er +1)

2((,$

12-2>

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1$ 8ased on the inforation pro7ided) in "e#sprint%s 2((, consolidated incoe stateent)

#hat aount should !e included as foreign e&change loss in coputing net incoe) if the

1C2 is the functional currency and the translation ethod is appropriate9

A$ '2,)(((

!" '1+)(((

C$ '20)(((

*$ ',)(((

AACSB: Analytic

AICPA: Measurement

2$ 8ased on the inforation pro7ided) in "e#sprint%s 2((, consolidated incoe stateent)

#hat aount should !e included as foreign e&change loss in coputing net incoe) if the

2$S$ dollar is the functional currency and the reeasureent ethod is appropriate9

A$ '10)(((

8$ '1()(((

C$ '20)(((

#" '2,)(((

AACSB: Analytic

AICPA: Measurement

12-2,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+$ Infinity Corporation ac6uired ,( percent of the coon stoc: of an Egyptian copany on

3anuary 1) 2((,$ The good#ill associated #ith this ac6uisition #as '1,)+0($ E&change rates at

7arious dates during 2((, follo#:

;ood#ill suffered an ipairent of 2( percent during the year$ If the functional currency is

the Egyptian <ound) ho# uch good#ill ipairent loss should !e reported on Infinity%s

consolidated stateent of incoe for 2((,9

A$ '+)=>(

8$ '+)>((

C" '+)=,(

*$ '+)=4(

AACSB: Analytic

AICPA: Measurement

?$ Infinity Corporation ac6uired ,( percent of the coon stoc: of an Egyptian copany on

3anuary 1) 2((,$ The good#ill associated #ith this ac6uisition #as '1,)+0($ E&change rates at

7arious dates during 2((, follo#:

;ood#ill suffered an ipairent of 2( percent during the year$ If the functional currency is

the 2$S$ dollar) ho# uch good#ill ipairent loss should !e reported on Infinity%s

consolidated stateent of incoe for 2((,9

A$ '+)=,(

!" '+)=>(

C$ '+)=4(

*$ '+)>((

AACSB: Analytic

AICPA: Measurement

12-24

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0$ Sion Copany has t#o foreign su!sidiaries$ @ne is located in France) the other in

England$ Sion has deterined the 2$S$ dollar is the functional currency for the French

su!sidiary) #hile the 8ritish pound is the functional currency for the English su!sidiary$ 8oth

su!sidiaries aintain their !oo:s and records in their respecti7e local currencies$ Ahat

ethods #ill Sion use to con7ert each of the su!sidiary%s financial stateents into 2$S$

dollars9

A$ @ption A

8$ @ption 8

C$ @ption C

#" @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

12-+(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Michigan-!ased 1eo Corporation ac6uired 1(( percent of the coon stoc: of a 8ritish

copany on 3anuary 1) 2((,) for '1)1(()((($ The 8ritish su!sidiary%s net assets aounted to

0(()((( pounds on the date of ac6uisition$ @n 3anuary 1) 2((,) the !oo: 7alues of its

identifia!le assets and lia!ilities appro&iated their fair 7alues$ As a result of an analysis of

functional currency indicators) 1eo deterined that the 8ritish pound #as the functional

currency$ @n *ece!er +1) 2((,) the 8ritish su!sidiary%s ad-usted trial !alance) translated

into 2$S$ dollars) contained '1>)((( ore de!its than credits$ The 8ritish su!sidiary reported

incoe of ++)((( pounds for 2((, and paid a cash di7idend of ,)((( pounds on @cto!er 20)

2((,$ Included on the 8ritish su!sidiary%s incoe stateent #as depreciation e&pense of

+)0(( pounds$ 1eo uses the !asic e6uity ethod of accounting for its in7estent in the 8ritish

su!sidiary and deterined that good#ill in the first year had an ipairent loss of 20 percent

of its initial aount$ E&change rates at 7arious dates during 2((, follo#:

=$ 8ased on the preceding inforation) #hat aount should 1eo record as Bincoe fro

su!sidiaryB !ased on the 8ritish su!sidiary%s reported net incoe9

A" '>2)4+(

8$ '02)0((

C$ '>2)=((

*$ '=4)+((

AACSB: Analytic

AICPA: Measurement

12-+1

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

>$ 8ased on the preceding inforation) the receipt of the di7idend #ill result in a credit to the

in7estent account for:

A$ '1=),((

8$ '1>)=,(

C" '1,)(((

*$ '1>)=((

AACSB: Analytic

AICPA: Measurement

,$ 8ased on the preceding inforation) on 1eo%s consolidated !alance sheet at *ece!er +1)

2((,) #hat aount should !e reported for the good#ill ac6uired on 3anuary 1) 2((,9

A$ '+=),?0

!" '+4)2,=

C$ '+=)4(0

*$ '+=)=(>

AACSB: Analytic

AICPA: Measurement

4$ 8ased on the preceding inforation) in the stoc:holders% e6uity section of 1eo%s

consolidated !alance sheet at *ece!er +1) 2((,) 1eo should report the translation

ad-ustent as a coponent of other coprehensi7e incoe of:

A" '14)??(

8$ '1>)(((

C$ '1,)>,=

*$ '14)+,(

AACSB: Analytic

AICPA: Measurement

12-+2

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1($ Ahich of the follo#ing defines a foreign-!ased entity that uses a functional currency

different fro the local currency9

I$ A 2$S$ su!sidiary in 8ritain aintains its accounting records in pounds sterling) #ith the

a-ority of its transactions denoinated in pounds sterling$

II$ A 2$S$ su!sidiary in <eru conducts 7irtually all of its !usiness in 1atin Aerica) and uses

the 2$S$ dollar as its a-or currency$

A$ I$

!" II$

C$ 8oth I and II$

*$ "either I nor II$

AACSB: Reflective Thinking

AICPA: Gloal

11$ Ahen the local currency of the foreign su!sidiary is the functional currency) a foreign

su!sidiary%s in7entory carried at cost #ould !e con7erted to 2$S$ dollars !y:

A$ translation using historical e&change rates$

8$ reeasureent using historical e&change rates$

C$ reeasureent using the current e&change rate$

#" translation using the current e&change rate$

AACSB: Reflective Thinking

AICPA: Decision Making

12$ Ahen the local currency of the foreign su!sidiary is the functional currency) a foreign

su!sidiary%s incoe stateent accounts #ould !e con7erted to 2$S$ dollars !y:

A$ translation using historical e&change rates$

8$ reeasureent using current e&change rates at the tie of stateent preparation$

C" translation using a7erage e&change rate for the period$

*$ reeasureent using the current e&change rate at the tie of stateent preparation$

AACSB: Reflective Thinking

AICPA: Decision Making

12-++

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1+$ If the restateent ethod for a foreign su!sidiary in7ol7es reeasuring fro the local

currency into the functional currency) then translating fro functional currency to 2$S$

dollars) the functional currency of the su!sidiary is:

I$ 2$S$ dollar$

II$ 1ocal currency unit$

III$ A third country%s currency$

A$ I

!" III

C$ II

*$ Either I or II

AACSB: Reflective Thinking

AICPA: Decision Making

1?$ If the 2$S$ dollar is the currency in #hich the foreign affiliate%s !oo:s and records are

aintained) and the 2$S$ dollar is also the functional currency)

A$ the translation ethod should !e used for restateent$

8$ the reeasureent ethod should !e used for restateent$

C$ either translation or reeasureent could !e used for restateent$

#" no restateent is re6uired$

AACSB: Reflective Thinking

AICPA: Decision Making

10$ All of the follo#ing stoc:holders% e6uity accounts of a foreign su!sidiary are translated at

historical e&change rates e&cept:

A" retained earnings$

8$ coon stoc:$

C$ additional paid-in capital$

*$ preferred stoc:$

AACSB: Reflective Thinking

AICPA: Decision Making

12-+?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1=$ *i7idends of a foreign su!sidiary are translated at:

A$ the a7erage e&change rate for the year$

!" the e&change rate on the date of declaration$

C$ the current e&change rate on the date of preparation of the financial stateent$

*$ the e&change rate on the record date$

AACSB: Reflective Thinking

AICPA: Decision Making

1>$ If the functional currency is the local currency of a foreign su!sidiary) #hat e&change

rates should !e used to translate the ites !elo#) assuing the foreign su!sidiary is in a

country #hich has not e&perienced hyperinflation o7er three years9

A" @ption A

8$ @ption 8

C$ @ption C

*$ @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

12-+0

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

1,$ If the functional currency is the local currency of a foreign su!sidiary) #hat e&change

rates should !e used to translate the ites !elo#) assuing the foreign su!sidiary is in a

country #hich has not e&perienced hyperinflation o7er three years9

A$ @ption A

!" @ption 8

C$ @ption C

*$ @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

14$ Ahich co!ination of accounts and e&change rates is correct for the translation of a

foreign entity%s financial stateents fro the functional currency to 2$S$ dollars9

A$ @ption A

!" @ption 8

C$ @ption C

*$ @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

12-+=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2($ Ahich co!ination of accounts and e&change rates is correct for the reeasureent of a

foreign entity%s financial stateents fro its local currency to 2$S$ dollars9

A$ @ption A

8$ @ption 8

C" @ption C

*$ @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

21$ The assets listed !elo# of a foreign su!sidiary ha7e !een con7erted to 2$S$ dollars at !oth

current and historical e&change rates$ Assuing that the local currency of the foreign

su!sidiary is the functional currency) #hat total aount should appear for these assets on the

2$S$ copany%s consolidated !alance sheet9

A" '=+=)(((

8$ '=?,)(((

C$ '>(,)(((

*$ '4=()(((

AACSB: Analytic

AICPA: Measurement

12-+>

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

22$ The gain or loss on the effecti7e portion of a 2$S$ parent copany%s hedge of a net

in7estent in a foreign entity should !e treated as:

A$ an ad-ustent to the retained earnings account in the stoc:holders% e6uity section of its

!alance sheet$

!" other coprehensi7e incoe$

C$ a translation gain or loss in the coputation of net incoe for the reporting period$

*$ an ad-ustent to a 7aluation account in the asset section of its !alance sheet$

AACSB: Reflective Thinking

AICPA: Decision Making

2+$ *o7er Copany o#ns 4(C of the capital stoc: of a foreign su!sidiary located in Italy$

*o7er%s accountant has -ust translated the accounts of the foreign su!sidiary and deterined

that a de!it translation ad-ustent of ',()((( e&ists$ If *o7er uses the e6uity ethod for its

in7estent) #hat entry should *o7er record in order to recogniDe the translation ad-ustent9

A$ @ption A

8$ @ption 8

C" @ption C

*$ @ption *

AACSB: Analytic

AICPA: Measurement

12-+,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2?$ For each of the ites listed !elo#) state #hether they increase or decrease the !alance in

cuulati7e translation ad-ustents .assuing a credit !alance at the !eginning of the year/

#hen the foreign currency strengthened relati7e to the 2$S$ dollar during the year$

A$ @ption A

!" @ption 8

C$ @ption C

*$ @ption *

AACSB: Reflective Thinking

AICPA: Decision Making

20$ "ichols Copany o#ns 4(C of the capital stoc: of a foreign su!sidiary located in Ireland$

As a result of translating the su!sidiary%s accounts) a de!it of '1=()((( #as needed in the

translation ad-ustents account so that the foreign su!sidiary%s de!its and credits #ere e6ual

in 2$S$ dollars$ Eo# should "ichols report its translation ad-ustents on its consolidated

financial stateents9

A$ As a '1??)((( increase in the stoc:holders% e6uity section of the !alance sheet$

!" As a '1??)((( reduction in consolidated coprehensi7e net incoe$

C$ As a '1=()((( de!it in stoc:holders% e6uity section of the !alance sheet$

*$ As a '1=()((( reduction in consolidated coprehensi7e net incoe$

AACSB: Analytic

AICPA: Decision Making

12-+4

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2=$ 2nder the teporal ethod) #hich of the follo#ing is usually used to translate onetary

aounts to the functional currency9

I$ The current e&change rate

II The historical e&change rate

III$ A7erage e&change rate

A" I

8$ III

C$ II

*$ Either I or II

AACSB: Reflective Thinking

AICPA: Decision Making

Mercury Copany is a su!sidiary of "eptune Copany and is located in FalparaGso) Chile)

#here the currency is the Chilean <eso$ *ata on Mercury%s in7entory and purchases are as

follo#s:

The !eginning in7entory #as ac6uired during the fourth 6uarter of 2((>) and the ending

in7entory #as ac6uired during the fourth 6uarter of 2((,$ <urchases #ere ade e7enly o7er

the year$ E&change rates #ere as follo#s:

12-?(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2>$ Refer the inforation pro7ided a!o7e$ Assuing the 2$S$ dollar is the functional

currency) #hat is the aount of Mercury%s cost of goods sold reeasured in 2$S$ dollars9

A$ '1)=,(

8$ '1)>12

C$ '1)>((

#" '1)=42

AACSB: Analytic

AICPA: Measurement

2,$ 8ased on the preceding inforation) the translation of cost of goods sold for 2((,)

assuing that the Spanish peseta is the functional currency is:

A$ '1)>(($

!" '1)>=($

C$ '1)=,($

*$ '1)=42$

AACSB: Analytic

AICPA: Measurement

12-?1

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

24$ The 8ritish su!sidiary of a 2$S$ copany reported cost of goods sold of >0)((( pounds

.sterling/ for the current year ended *ece!er +1$ The !eginning in7entory #as 1()(((

pounds) and the ending in7entory #as 10)((( pounds$ Spot rates for 7arious dates are as

follo#s:

Assuing the dollar is the functional currency of the 8ritish su!sidiary) the reeasured

aount of cost of goods sold that should appear in the consolidated incoe stateent is:

A$ '1(,)>0($

8$ '112)0(($

C" '11?)20($

*$ '120)>(($

AACSB: Analytic

AICPA: Measurement

+($ The 8ritish su!sidiary of a 2$S$ copany reported cost of goods sold of >0)((( pounds

.sterling/ for the current year ended *ece!er +1$ The !eginning in7entory #as 1()(((

pounds) and the ending in7entory #as 10)((( pounds$ Spot rates for 7arious dates are as

follo#s:

Assuing the pound is the functional currency of the 8ritish su!sidiary) the translated aount

of cost of goods sold that should appear in the consolidated incoe stateent is:

A$ '1(,)>0($

!" '112)0(($

C$ '11?)+(($

*$ '120)>(($

AACSB: Analytic

AICPA: Measurement

12-?2

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Elan) a 2$S$ corporation) copleted the *ece!er +1) 2((,) foreign currency translation of

its >( percent o#ned S#iss su!sidiary%s trial !alance using the current rate ethod$ The

translation resulted in a de!it ad-ustent of '20)((($ The su!sidiary had reported net incoe

of ,(()((( S#iss francs for 2((, and paid di7idends of 0()((( S#iss francs on Septe!er 1)

2((,$ The translation rates for the year #ere:

The 3anuary 1 !alance of the In7estent in the S#iss su!sidiary account #as '1)=(()((($

Elan ac6uired its interest in the S#iss su!sidiary at !oo: 7alue #ith no differential or

good#ill recorded at ac6uisition$

+1$ Elan%s In7estent in S#iss su!sidiary account at *ece!er +1) 2((,) is:

A" '1),,1)(0($

8$ '1)41=)(0($

C$ '1)42+)40($

*$ '2)(01)0(($

AACSB: Analytic

AICPA: Measurement

12-?+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+2$ Elan%s consolidated #or:paper eliinations related to the foreign currency translation

ad-ustent #ill include #hich entry9

A$ @ption A

8$ @ption 8

C$ @ption C

#" @ption *

AACSB: Analytic

AICPA: Decision Making

++$ Seattle) Inc$ o#ns an ,( percent interest in a <ortuguese su!sidiary$ For 2((,) Seattle

reported incoe fro operations of '2$( illion$ The <ortuguese copany%s incoe fro

operations) after foreign currency translation) #as '1$1 illion$ The foreign currency

translation ad-ustent #as '12()((( .credit/$ Consolidated net incoe and consolidated

coprehensi7e incoe for the year are:

A$ @ption A

8$ @ption 8

C$ @ption C

#" @ption *

AACSB: Analytic

AICPA: Re!orting

12-??

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

@n 3anuary 2) 2((,) 3ohnson Copany ac6uired a 1((C interest in the capital stoc: of <erth

Copany for '+)1(()((($ Any e&cess cost o7er !oo: 7alue is attri!uta!le to a patent #ith a

1(-year reaining life$ At the date of ac6uisition) <erth%s !alance sheet contained the

follo#ing inforation:

<erth%s incoe stateent for 2((, is as follo#s:

12-?0

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

The !alance sheet of <erth at *ece!er +1) 2((,) is as follo#s:

<erth declared and paid a di7idend of 2()((( FC2 on @cto!er 1) 2((,$ Spot rates at 7arious

dates for 2((, follo#:

Assue <erth%s re7enues) purchases) operating e&penses) depreciation e&pense) and incoe

ta&es #ere incurred e7enly throughout 2((,$

12-?=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+?$ Refer to the a!o7e inforation$ Assuing the local currency of the country in #hich <erth

Copany is located is the functional currency) #hat are the translated aounts for the ites

!elo# in 2$S$ dollars9

A$ @ption A

8$ @ption 8

C" @ption C

*$ @ption *

AACSB: Analytic

AICPA: Re!orting

+0$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of translation ad-ustents that result fro translating <erth%s trial

!alance into 2$S$ dollars at *ece!er +1) 2((,9

A$ '+4=)0(( de!it

8$ '2,0)((( credit

C" '?(0)((( credit

*$ '?11)((( credit

AACSB: Analytic

AICPA: Decision Making

+=$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of patent aortiDation for 2((, that results fro 3ohnson%s

ac6uisition of <erth%s stoc: on 3anuary 2) 2((,$ Round your ans#er to the nearest dollar$

A$ '11)0((

!" '11),,?

C$ '>)==>

*$ '4)+4?

AACSB: Analytic

AICPA: Measurement

12-?>

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

+>$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the aount of translation ad-ustent that appears on 3ohnson%s consolidated

financial stateents at *ece!er +1) 2((,9

A" '?14)1,? credit

8$ '?1=),,? credit

C$ '?(0),,? de!it

*$ '+4,)0(( credit

AACSB: Analytic

AICPA: Decision Making

+,$ Refer to the a!o7e inforation$ Assuing <erth%s local currency is the functional

currency) #hat is the !alance in 3ohnson%s in7estent in foreign su!sidiary account at

*ece!er +1) 2((,) assuing use of the e6uity ethod9

A$ '+)21=)0((

8$ '+)0=()(((

C" '+)0=,)+((

*$ '+)0>>)=4?

AACSB: Analytic

AICPA: Measurement

+4$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is 3ohnson%s reeasureent gain .loss/ for 2((,9 .Assue the ending in7entory #as ac6uired

on *ece!er +1) 2((,$/

A$ '+1)((( gain

8$ '+=)0(( loss

C$ '22)((( gain

#" '+2)((( gain

AACSB: Analytic

AICPA: Measurement

12-?,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?($ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the aount of <erth%s cost of goods sold reeasured in 2$S$ dollars9

A" ',11)0((

8$ ',?+)0((

C$ ',,?)0((

*$ '>44)0((

AACSB: Analytic

AICPA: Measurement

?1$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the aount of patent aortiDation for 2((, that results fro 3ohnson%s ac6uisition of <erth%s

stoc: on 3anuary 2) 2((,9

A$ '11),,?

8$ '11)>>(

C$ '12)00(

#" '11)0((

AACSB: Analytic

AICPA: Measurement

?2$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is <erth%s net incoe for 2((, in 2$S$ dollars .include the reeasureent gain or loss in

<erth%s net incoe/9

A" '2+,)(((

8$ '22,)(((

C$ '214)0((

*$ '2(2)(((

AACSB: Analytic

AICPA: Re!orting

12-?4

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?+$ Refer to the a!o7e inforation$ Assuing the 2$S$ dollar is the functional currency) #hat

is the !alance in 3ohnson%s in7estent in foreign su!sidiary account at *ece!er +1) 2((,

.assuing the use of the e6uity ethod/9

A$ '+)+(+)?((

!" '+)24?)0((

C$ '+)+2+)?((

*$ '+)+1?)0((

AACSB: Analytic

AICPA: Re!orting

@n 3anuary 1) 2((,) Transport Corporation ac6uired >0 percent interest in Steaship

Copany for '+(()((($ Steaship is a "or#egian copany$ The local currency is the

"or#egian :roner ."Hr/$ The ac6uisition resulted in an e&cess of cost-o7er-!oo: 7alue of

'20)((( due solely to a patent ha7ing a reaining life of 0 years$ Transport uses the e6uity

ethod to account for its in7estent$ Steaship%s *ece!er +1) 2((,) trial !alance has !een

translated into 2$S$ dollars) re6uiring a translation ad-ustent de!it of ',)((($ Steaship%s net

incoe translated into 2$S$ dollars is '+0)((($ It declared and paid an "Hr 2()((( di7idend

on 3une 1) 2((,$ Rele7ant e&change rates are as follo#s:

Assue the :roner is the functional currency$

12-0(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

??$ 8ased on the preceding inforation) in the -ournal entry to record the receipt of di7idend

fro Steaship)

A" In7estent in Steaship Copany #ill !e credited for '+)?0($

8$ Cash #ill !e de!ited for '+)+(($

C$ In7estent in Steaship Copany #ill !e credited for '?)((($

*$ Cash #ill !e de!ited for '+)=(($

AACSB: Analytic

AICPA: Measurement

?0$ 8ased on the preceding inforation) in the -ournal entry to record parent%s share of

su!sidiary%s translation ad-ustent:

A$ @ther Coprehensi7e Incoe I Translation Ad-ustent #ill !e de!ited for ',)((($

8$ @ther Coprehensi7e Incoe I Translation Ad-ustent #ill !e credited for '=)((($

C" In7estent in Steaship Copany #ill !e credited for '=)((($

*$ In7estent in Steaship Copany #ill !e de!ited for ',)((($

AACSB: Analytic

AICPA: Measurement

?=$ 8ased on the preceding inforation) #hat aount of translation ad-ustent is re6uired for

increase in differential9

A$ '+)(((

8$ '0)0((

C" '?)0((

*$ '0)(((

AACSB: Analytic

AICPA: Measurement

12-01

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?>$ 8ased on the preceding inforation) in the -ournal entry to record the aortiDation of the

patent for 2((, on the parent%s !oo:s) In7estent in Steaship Copany #ill !e de!ited for:

A$ '0)(((

!" '0)0((

C$ '?)0((

*$ '+)(((

AACSB: Analytic

AICPA: Measurement

@n Septe!er +() 2((,) Ailfred Copany sold in7entory to 3ac:son Corporation) its

Canadian su!sidiary$ The goods cost Ailfred '+()((( and #ere sold to 3ac:son for '?()((()

paya!le in Canadian dollars$ The goods are still on hand at the end of the year on *ece!er

+1$ The Canadian dollar .C'/ is the functional currency of the Canadian su!sidiary$ The

e&change rates follo#:

?,$ 8ased on the preceding inforation) at #hat dollar aount is the ending in7entory sho#n

in the trial !alance of the consolidated #or:paper9

A" '?0)(((

8$ '0()(((

C$ '?()(((

*$ '+0)(((

AACSB: Analytic

AICPA: Measurement

12-02

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

?4$ 8ased on the preceding inforation) #hat aount of unrealiDed intercopany gross profit

is eliinated in preparing the consolidated financial stateents for the year9

A$ '(

8$ '0)(((

C" '1()(((

*$ '10)(((

AACSB: Analytic

AICPA: Measurement

0($ 8ased on the preceding inforation) at #hat aount is the in7entory sho#n on the

consolidated !alance sheet for the year9

A$ '?0)(((

8$ '+()(((

C$ '?()(((

#" '+0)(((

AACSB: Analytic

AICPA: Measurement

Essay uestions

12-0+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

01$ 8riefly e&plain the follo#ing ters associated #ith accounting for foreign entities:

a/ Functional Currency

!/ Translation

c/ Reeasureent

a/ Functional currency is the currency of the priary econoic en7ironent in #hich the

entity operatesL norally that is the currency of the en7ironent in #hich an entity priarily

generates and recei7es cash$ The functional currency is used to differentiate !et#een t#o

types of foreign operations) those that are self-contained and integrated into a local

en7ironent) and those that are an e&tension of the parent and integrated #ith the parent$

!/ Translation is the ost coon ethod used and is applied #hen the local currency is the

foreign entity%s functional currency$ To translate the financial stateents) the copany #ill

use the current rate) #hich is the e&change rate on the !alance sheet date) to con7ert the local

currency !alance sheet account !alances into 2$S$ dollars$ Any translation ad-ustent that

occurs is a coponent of coprehensi7e incoe$ 8ecause re7enues and e&penses are

assued to occur uniforly o7er the period) re7enues and e&penses on the incoe stateent

are translated using the a7erage rate for the reporting period$

c/ Reeasureent is the restateent of the foreign entity%s financial stateents fro the local

currency that the entity used into the foreign entity%s functional currency$ Reeasureent is

re6uired only #hen the functional currency is different fro the currency used to aintain the

!oo:s and records of the foreign entity$ Monetary assets and lia!ilities are translated at the

current rate$ "on-onetary assets and lia!ilities) including in7entories) are translated at their

historical rates$ The incoe stateent ites other than cost of goods sold is translated at

a7erage rates$ Any resulting ad-ustent is ta:en into current period incoe$

AACSB: Communication

AICPA: Gloal

12-0?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

02$ @n 3anuary 1) 2((,) <ace Copany ac6uired all of the outstanding stoc: of Spin <1C) a

8ritish Copany) for '+0()((($ Spin%s net assets on the date of ac6uisition #ere 20()(((

pounds .J/$ @n 3anuary 1) 2((,) the !oo: and fair 7alues of the Spin%s identifia!le assets and

lia!ilities appro&iated their fair 7alues e&cept for property) plant) and e6uipent and

tradear:s$ The fair 7alue of Spin%s property) plant) and e6uipent e&ceeded its !oo: 7alue

!y '20)((($ The reaining useful life of Spin%s e6uipent at 3anuary 1) 2((,) #as 1( years$

The reainder of the differential #as attri!uta!le to a tradear: ha7ing an estiated useful

life of 0 years$ Spin%s trial !alance on *ece!er +1) 2((,) in pounds) follo#s:

Additional Inforation

1 Spin uses the FIF@ ethod for its in7entory$ The !eginning in7entory #as ac6uired on

*ece!er +1) 2((>) and ending in7entory #as ac6uired on *ece!er 2=) 2((,$ <urchases of

J+(()((( #ere ade e7enly throughout 2((,$

2 Spin ac6uired all of its property) plant) and e6uipent on March 1) 2((=) and uses straight-

line depreciation$

+ Spin%s sales #ere ade e7enly throughout 2((,) and its operating e&penses #ere incurred

e7enly throughout 2((,$

? The di7idends #ere declared and paid on "o7e!er 1) 2((,$

0 <ace%s incoe fro its o#n operations #as '10()((( for 2((,) and its total stoc:holders%

e6uity on 3anuary 1) 2((,) #as '1)((()((($ <ace declared '0()((( of di7idends during 2((,$

= E&change rates #ere as follo#s:

12-00

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

Re6uired:

1/ <repare a schedule translating the trial !alance fro 8ritish pounds into 2$S$ dollars$

Assue the pound is the functional currency$

2/ Assue that <ace uses the !asic e6uity ethod$ Record all -ournal entries that relate to its

in7estent in the 8ritish su!sidiary during 2((,$ <ro7ide the necessary docuentation and

support for the aounts in the -ournal entries) including a schedule of the translation

ad-ustent related to the differential$

2/ <repare a schedule that deterines <ace%s consolidated coprehensi7e incoe for 2((,$

?/ Copute <ace%s total consolidated stoc:holders% e6uity at *ece!er +1) 2((,$

12-0=

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

12-0>

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

12-0,

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

12-04

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

AACSB: Analytic

AICPA: Measurement

12-=(

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0+$ 2se the inforation gi7en in 6uestion 02 to prepare a schedule pro7iding a proof of the

translation ad-ustent$

AACSB: Analytic

AICPA: Measurement

12-=1

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0?$ Refer to the inforation in 6uestion 02$ Assue the 2$S$ dollar is the functional currency)

not the pound$

Re6uired:

1/ <repare a schedule reeasuring the trial !alance fro 8ritish pound into 2$S$ dollars$

2/ Assue that <ace uses the !asic e6uity ethod$ Record all -ournal entries that relate to its

in7estent in the 8ritish su!sidiary during 2((,$ <ro7ide the necessary docuentation and

support for the aounts in the -ournal entries$

+/ <repare a schedule that deterines <ace%s consolidated net incoe for 2((,$

?/ Copute <ace%s total consolidated stoc:holders% e6uity at *ece!er +1) 2((,$

12-=2

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

2/ 3ournal entries for 2((,:

12-=+

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

12-=?

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

AACSB: Analytic

AICPA: Measurement

12-=0

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

00$ Refer to the inforation in 6uestion 02$ Assue the 2$S$ dollar is the functional currency)

not the pound$ <repare a schedule pro7iding a proof of the reeasureent gain or loss$

Assue that the 8ritish su!sidiary had the follo#ing onetary assets and lia!ilities at 3anuary

1) 2((,:

AACSB: Analytic

AICPA: Measurement

12-==

Chapter 12 - Multinational Accounting: Issues in Financial Reporting and Translation of Foreign Entity

Stateents

0=$ <arisian Co$ is a French copany located in <aris$ Kan:ee Corp$) located in "e# Kor:

City) ac6uires <arisian Co$ <arisian has the Euro as its local currency and the S#iss Franc as

its functional currency$ Kan:ee has the 2$S$ dollar as its local currency and the 2$S$ dollar as

its functional currency$

Re6uired:

a/ The year-end consolidated financial stateents #ill !e prepared in #hich currency9

!/ E&plain #hich ethod is appropriate to use to use at year-end: Translation or

Reeasureent9

a/ The consolidated financial stateents #ill !e reported in Kan:ee%s functional currency - the

2$S$ dollar$

!/ <arisian%s financial stateents #ill need to !e reeasured first fro the Euro to the S#iss

Franc$ Then the financial stateents% 7alued in the S#iss Franc #ill !e translated to the 2$S$

dollar$

AACSB: Communication

AICPA: Critical Thinking

12-=>

You might also like

- Advanced Financial Accounting 11th Edition Christensen Test Bank DownloadDocument56 pagesAdvanced Financial Accounting 11th Edition Christensen Test Bank DownloadHeatherRobertstwopa100% (38)

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3Vinh Ngo Nhu57% (7)

- Ifrs PQDocument26 pagesIfrs PQpakhok3No ratings yet

- Advanced Accounting Baker Test Bank - Chap010Document67 pagesAdvanced Accounting Baker Test Bank - Chap010donkazotey50% (2)

- BSBMGT517 Manage Operational Plan Template V1.0619Document14 pagesBSBMGT517 Manage Operational Plan Template V1.0619Edward AndreyNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- Chapter 11 Test Bank PDFDocument29 pagesChapter 11 Test Bank PDFYing LiuNo ratings yet

- Advanced Accounting Baker Test Bank - Chap011Document67 pagesAdvanced Accounting Baker Test Bank - Chap011donkazotey100% (7)

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaNo ratings yet

- Afar01 Joint Arrangements ReviewersDocument13 pagesAfar01 Joint Arrangements ReviewersPam G.No ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Advanced Accounting Baker Test Bank - Chap011Document67 pagesAdvanced Accounting Baker Test Bank - Chap011donkazotey100% (7)

- MDT 2010 Setup Step by StepDocument35 pagesMDT 2010 Setup Step by StepDave ColemanNo ratings yet

- Chapter 10 Translation of Foreign Currency Financial Statements PDFDocument28 pagesChapter 10 Translation of Foreign Currency Financial Statements PDFKim Taehyung91% (23)

- Adfianp - Forex - Quizzer - 2016nDocument9 pagesAdfianp - Forex - Quizzer - 2016nKenneth Bryan Tegerero Tegio100% (1)

- AFAR PracDocument13 pagesAFAR PracTeofel John Alvizo PantaleonNo ratings yet

- Quiz - Corporate LiquidationDocument3 pagesQuiz - Corporate LiquidationJoyce Ann CortezNo ratings yet

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- 8908 - Installment Consignment SalesDocument5 pages8908 - Installment Consignment Salesxara mizpahNo ratings yet

- Home Office and Branch Accounting - FinalsDocument6 pagesHome Office and Branch Accounting - FinalsRaul Carrera Jr.No ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlentravelling67% (9)

- Module 1 Home Office and Branch Accounting General ProceduresDocument4 pagesModule 1 Home Office and Branch Accounting General ProceduresDaenielle EspinozaNo ratings yet

- Forex&Derivative HODocument7 pagesForex&Derivative HOMarielle SidayonNo ratings yet

- Advacc SW HobaDocument6 pagesAdvacc SW HobaMary Dale Joie Bocala100% (1)

- ACC16 - HO 2 Installment Sales 11172014Document7 pagesACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- Home Office, Branches and AgenciesDocument5 pagesHome Office, Branches and AgenciesBryan ReyesNo ratings yet

- FOREX - LectureDocument4 pagesFOREX - LectureJEP WalwalNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Audit of IntangiblesDocument2 pagesAudit of IntangiblesJaycee FabriagNo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Advanced Accounting Baker Test Bank - Chap008Document35 pagesAdvanced Accounting Baker Test Bank - Chap008donkazotey100% (5)

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- Advanced Accounting Baker Test Bank - Chap020Document31 pagesAdvanced Accounting Baker Test Bank - Chap020donkazotey100% (2)

- p2 Foreign CurrencyDocument4 pagesp2 Foreign CurrencyJustine Goes KaizerNo ratings yet

- Derivatives and TranslationDocument3 pagesDerivatives and TranslationVienna Corrine Q. AbucejoNo ratings yet

- Final Examination in Business Combi 2021Document7 pagesFinal Examination in Business Combi 2021Michael BongalontaNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- ACAFA Consignment SalesDocument8 pagesACAFA Consignment SalesMerr Fe PainaganNo ratings yet

- Translation of Foreign Currency StatementDocument5 pagesTranslation of Foreign Currency StatementPea Del Monte AñanaNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- Toaz - Info Quiz On Foreign Transactions PRDocument4 pagesToaz - Info Quiz On Foreign Transactions PRoizys131No ratings yet

- Types of Joint ArrangementsDocument5 pagesTypes of Joint ArrangementsJean Ysrael Marquez100% (2)

- Home Office Questions With AnswersDocument10 pagesHome Office Questions With AnswersDaniel Nichole MerindoNo ratings yet

- 1 Partnership Accounting QuestionnairesDocument11 pages1 Partnership Accounting QuestionnairesShiela MayNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- Audit of InventoryDocument7 pagesAudit of InventoryDianne Antoinette Basallo0% (1)

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Service Concession ArrangementDocument2 pagesService Concession Arrangementkim cheNo ratings yet

- Ch12 Financial Reporting and Translation of Foreign Entity StatementsDocument40 pagesCh12 Financial Reporting and Translation of Foreign Entity StatementsNitinNo ratings yet

- Chapter 12 - Test BankDocument25 pagesChapter 12 - Test Bankgilli1tr100% (1)

- Multiple Choice QuestionsDocument13 pagesMultiple Choice QuestionsnicahNo ratings yet

- Multiple Choice QuestionsDocument10 pagesMultiple Choice QuestionsnicahNo ratings yet

- 2 FKUf RV HDocument8 pages2 FKUf RV HmkcdefNo ratings yet

- Foreign CurrencyDocument6 pagesForeign CurrencyLJ AggabaoNo ratings yet

- Chap011 Multinational Accounting Foreign Currency Transactions and Financial InstrumentsDocument67 pagesChap011 Multinational Accounting Foreign Currency Transactions and Financial InstrumentsLica FalculanNo ratings yet

- Financial Statements Types Presentation Limitations UsersDocument20 pagesFinancial Statements Types Presentation Limitations UsersGemma PalinaNo ratings yet

- cd8cd552db28943f022096d821b9a279 (1)Document12 pagescd8cd552db28943f022096d821b9a279 (1)Azri LunduNo ratings yet

- AFAR - ForexDocument4 pagesAFAR - ForexJoanna Rose DeciarNo ratings yet

- Objective Questions of AccountingDocument8 pagesObjective Questions of Accountingshobhitgoel0% (1)

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QMuhammad SaadNo ratings yet

- AFAR8719 - Foreign Currency Transaction and TranslationDocument5 pagesAFAR8719 - Foreign Currency Transaction and TranslationSid TuazonNo ratings yet

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3chandoraNo ratings yet

- FSW-Cash Flow 070218Document8 pagesFSW-Cash Flow 070218March AthenaNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Advanced Accounting Baker Test Bank - Chap017Document51 pagesAdvanced Accounting Baker Test Bank - Chap017donkazotey100% (2)

- Advanced Accounting Baker Test Bank - Chap020Document31 pagesAdvanced Accounting Baker Test Bank - Chap020donkazotey100% (2)

- Advanced Accounting Baker Test Bank - Chap019Document82 pagesAdvanced Accounting Baker Test Bank - Chap019donkazotey100% (2)

- Advanced Accounting Baker Test Bank - Chap016Document55 pagesAdvanced Accounting Baker Test Bank - Chap016donkazotey93% (14)

- Advanced Accounting Baker Test Bank - Chap014Document34 pagesAdvanced Accounting Baker Test Bank - Chap014donkazotey100% (1)

- Advanced Accounting Baker Test Bank - Chap015Document55 pagesAdvanced Accounting Baker Test Bank - Chap015donkazotey89% (9)

- Advanced Accounting Baker Test Bank - Chap013Document47 pagesAdvanced Accounting Baker Test Bank - Chap013donkazotey100% (2)

- Chapter 07 - Intercompany Inventory TransactionsDocument38 pagesChapter 07 - Intercompany Inventory Transactions_casals100% (8)

- Advanced Accounting Baker Test Bank - Chap009Document57 pagesAdvanced Accounting Baker Test Bank - Chap009donkazotey100% (3)

- Advanced Accounting Baker Test Bank - Chap008Document35 pagesAdvanced Accounting Baker Test Bank - Chap008donkazotey100% (5)

- Chap006-Intercompany Transfers of Services and Non Current AssetsDocument41 pagesChap006-Intercompany Transfers of Services and Non Current Assets_casals100% (4)

- Advanced Accounting Baker Test Bank - Chap003Document37 pagesAdvanced Accounting Baker Test Bank - Chap003donkazoteyNo ratings yet

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- CH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesDocument37 pagesCH 01 - Inter Corporate Acquisitions and Investments in Other EntitiesMerriam Leirose Daganta Cabidog100% (3)

- Advanced Accounting Baker Test Bank - Chap004Document56 pagesAdvanced Accounting Baker Test Bank - Chap004donkazotey90% (10)

- Advanced Accounting Baker Test Bank - Chap002Document36 pagesAdvanced Accounting Baker Test Bank - Chap002donkazotey60% (5)

- Mata Pelajaran Masa Kelas Kehadiran: Hari TarikhDocument9 pagesMata Pelajaran Masa Kelas Kehadiran: Hari TarikhNurul AinNo ratings yet

- IGCSE - Bio - Lesson Plan 3 - Breathing and Gas ExchangeDocument3 pagesIGCSE - Bio - Lesson Plan 3 - Breathing and Gas ExchangeHisokagenNo ratings yet

- SteelHead - Deployment Installation Gui08Document90 pagesSteelHead - Deployment Installation Gui08Partha DashNo ratings yet

- School Management and FinanceDocument7 pagesSchool Management and FinanceCornelioNo ratings yet

- Chemistry Investigatory Project On Setting of Cement: by Siddhant Chhabra Class 12 - ADocument14 pagesChemistry Investigatory Project On Setting of Cement: by Siddhant Chhabra Class 12 - ASIDDHANTNo ratings yet

- Geological Applications of Wireline Logs: A Synopsis of Developments and TrendsDocument18 pagesGeological Applications of Wireline Logs: A Synopsis of Developments and Trendscunin12No ratings yet

- PowerLogic PM800 Series - PM870MGDocument3 pagesPowerLogic PM800 Series - PM870MGEdoardusNo ratings yet

- Sales Cloud Consultant Flashcards - QuizletDocument6 pagesSales Cloud Consultant Flashcards - QuizletSunny SinghNo ratings yet

- Hammer Test (Rebound)Document2 pagesHammer Test (Rebound)Rasya FiezaNo ratings yet

- Beef GuideDocument80 pagesBeef GuideGigiPetrea100% (1)

- CSE Reviewer Part 4Document8 pagesCSE Reviewer Part 4AsukinNo ratings yet

- Identity, Image, ReputationDocument8 pagesIdentity, Image, ReputationMona MicaNo ratings yet

- Soal Report 19Document18 pagesSoal Report 19SULARMANNo ratings yet

- Magnetism and Electromagnetism PDFDocument7 pagesMagnetism and Electromagnetism PDFEng Bahanza100% (1)

- BPPV NCPDocument2 pagesBPPV NCPNiña Mae Marasigan67% (3)

- CRM PresentationDocument20 pagesCRM PresentationPrashant GaykarNo ratings yet

- Chapter 11 - Managing Global Competitive DynamicsDocument9 pagesChapter 11 - Managing Global Competitive DynamicskiarafernandezdNo ratings yet

- BJT Gummel Poon ModelDocument11 pagesBJT Gummel Poon Modelsmar.marshalNo ratings yet