Professional Documents

Culture Documents

Standard Costing, Operational Performance Measures, and The Balanced Scorecard

Uploaded by

Florensia RestianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standard Costing, Operational Performance Measures, and The Balanced Scorecard

Uploaded by

Florensia RestianCopyright:

Available Formats

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

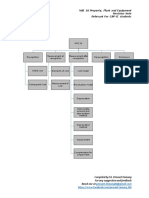

Chapter 10

Standard Costing,

Operational

Performance

Measures, and the

Balanced Scorecard

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

1

Managing Costs

1-3

Standard

cost

Actual

cost

Comparison between

standard and actual

performance

level

Cost

variance

Management by Exception

1-4

Direct

Material

Managers focus on quantities and costs

that exceed standards, a practice known as

management by exception.

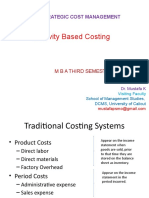

Type of Product Cost

A

m

o

u

n

t

Direct

Labor

Standard

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

2

Setting Standards

1-6

Analysis of

Historical Data

Task

Analysis

Cost

Standards

Participation in Setting Standards

1-7

Accountants, engineers, personnel

administrators, and production managers

combine efforts to set standards based on

experience and expectations.

Perfection versus Practical

Standards: A Behavioral Issue

1-8

Should we use

practical standards

or perfection

standards?

Practical standards

should be set at levels

that are currently

attainable with

reasonable and

efficient effort.

Perfection versus Practical

Standards: A Behavioral Issue

1-9

I agree. Perfection

standards are

unattainable and

therefore discouraging

to most employees.

Use of Standards by

Service Organizations

1-10

Standard cost

analysis may be used

in any organization

with repetitive tasks.

A relationship

between tasks and

output measures

must be established.

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

3

Cost Variance Analysis

1-12

Standard Cost Variances

Quantity Variance Price Variance

The difference between

the actual price and the

standard price

The difference between

the actual quantity and

the standard quantity

A General Model for Variance

Analysis

1-13

Actual Quantity Actual Quantity Standard Quantity

Actual Price Standard Price Standard Price

Price Variance Quantity Variance

Materials price variance Materials quantity variance

Labor rate variance Labor efficiency variance

Variable overhead Variable overhead

spending variance efficiency variance

AQ(AP - SP) SP(AQ - SQ)

AQ = Actual Quantity SP = Standard Price

AP = Actual Price SQ = Standard Quantity

A General Model for Variance

Analysis

1-14

Actual Quantity Actual Quantity Standard Quantity

Actual Price Standard Price Standard Price

Price Variance Quantity Variance

Standard price is the amount that should

have been paid for the resources acquired.

A General Model for Variance

Analysis

1-15

Actual Quantity Actual Quantity Standard Quantity

Actual Price Standard Price Standard Price

Price Variance Quantity Variance

Standard quantity is the quantity that should

have been used.

Standard Costs

1-16

Lets use the concepts

of the general model to

calculate standard cost

variances, starting with

direct material.

Material Variances

1-17

Hanson Inc. has the following direct material

standard to manufacture one Zippy:

1.5 pounds per Zippy at $4.00 per pound

Last week 1,700 pounds of material were

purchased and used to make 1,000 Zippies.

The material cost a total of $6,630.

Zippy

Material Variances

1-18

What is the actual price per pound

paid for the material?

a. $4.00 per pound.

b. $4.10 per pound.

c. $3.90 per pound.

d. $6.63 per pound.

Zippy

Material Variances

1-19

What is the actual price per pound

paid for the material?

a. $4.00 per pound.

b. $4.10 per pound.

c. $3.90 per pound.

d. $6.63 per pound.

AP = $6,630 1,700

lbs.

AP = $3.90 per lb.

Zippy

Material Variances

1-20

Hansons direct-material price variance (MPV)

for the week was:

a. $170 unfavorable.

b. $170 favorable.

c. $800 unfavorable.

d. $800 favorable.

Zippy

Material Variances

1-21

Hansons direct-material price variance (MPV)

for the week was:

a. $170 unfavorable.

b. $170 favorable.

c. $800 unfavorable.

d. $800 favorable.

MPV = AQ(AP - SP)

MPV = 1,700 lbs. ($3.90 -

4.00)

MPV = $170 Favorable

Zippy

Material Variances

1-22

The standard quantity of material that

should have been used to produce

1,000 Zippies is:

a. 1,700 pounds.

b. 1,500 pounds.

c. 2,550 pounds.

d. 2,000 pounds.

Zippy

Material Variances

1-23

The standard quantity of material that

should have been used to produce

1,000 Zippies is:

a. 1,700 pounds.

b. 1,500 pounds.

c. 2,550 pounds.

d. 2,000 pounds.

SQ = 1,000 units 1.5 lbs per unit

SQ = 1,500 lbs

Zippy

Material Variances

1-24

Hansons direct-material quantity variance

(MQV) for the week was:

a. $170 unfavorable.

b. $170 favorable.

c. $800 unfavorable.

d. $800 favorable.

Zippy

Material Variances

1-25

Hansons direct-material quantity variance

(MQV) for the week was:

a. $170 unfavorable.

b. $170 favorable.

c. $800 unfavorable.

d. $800 favorable.

MQV = SP(AQ - SQ)

MQV = $4.00(1,700 lbs - 1,500 lbs)

MQV = $800 unfavorable

Zippy

Material Variances Summary

1-26

Actual Quantity Actual Quantity Standard Quantity

Actual Price Standard Price Standard Price

1,700 lbs. 1,700 lbs. 1,500 lbs.

$3.90 per lb. $4.00 per lb. $4.00 per lb.

$6,630 $ 6,800 $6,000

Price variance

$170 favorable

Quantity variance

$800 unfavorable

Material Variances

1-27

The price variance is

computed on the entire

quantity purchased.

The quantity variance is

computed only on the

quantity used.

Hanson purchased and

used 1,700 pounds.

How are the variances

computed if the amount

purchased differs from

the amount used?

Zippy

Material Variances

1-28

Hanson Inc. has the following material

standard to manufacture one Zippy:

1.5 pounds per Zippy at $4.00 per pound

Last week 2,800 pounds of material were

purchased at a total cost of $10,920, and

1,700 pounds were used to make 1,000

Zippies.

Zippy

Material Variances

1-29

Actual Quantity Actual Quantity

Purchased Purchased

Actual Price Standard Price

2,800 lbs. 2,800 lbs.

$3.90 per lb. $4.00 per lb.

$10,920 $11,200

Price variance

$280 favorable

Price variance increases

because quantity

purchased increases.

Zippy

MPV = AQ(AP - SP)

MPV = 2,800 lbs.

($3.90 - 4.00)

MPV = $280

Favorable

Material Variances

1-30

Actual Quantity

Used Standard Quantity

Standard Price Standard Price

1,700 lbs. 1,500 lbs.

$4.00 per lb. $4.00 per lb.

$6,800 $6,000

Quantity variance

$800 unfavorable

Quantity variance is

unchanged because

actual and standard

quantities are unchanged.

Zippy

MQV = SP(AQ - SQ)

MQV = $4.00(1,700 lbs

- 1,500 lbs)

MQV = $800unfavor.

Isolation of Material Variances

1-31

I need the variances as soon

as possible so that I can

better identify problems

and control costs.

You accountants just dont

understand the problems

we production managers have.

Okay. Ill start computing

the price variance when

material is purchased and

the quantity variance as

soon as material is used.

Standard Costs

1-32

Now lets calculate

standard cost

variances for

direct labor.

Labor Variances

1-33

Hanson Inc. has the following direct labor

standard to manufacture one Zippy:

1.5 standard hours per Zippy at $10.00 per direct

labor hour

Last week 1,550 direct labor hours were

worked at a total labor cost of $15,810 to

make 1,000 Zippies.

Zippy

Labor Variances

1-34

What was Hansons actual rate (AR)

for labor for the week?

a. $10.20 per hour.

b. $10.10 per hour.

c. $9.90 per hour.

d. $9.80 per hour.

Zippy

Labor Variances

1-35

What was Hansons actual rate (AR)

for labor for the week?

a. $10.20 per hour.

b. $10.10 per hour.

c. $9.90 per hour.

d. $9.80 per hour.

Zippy

AR = $15,810 1,550

hours

AR = $10.20 per hour

Labor Variances

1-36

Hansons labor rate variance (LRV)

for the week was:

a. $310 unfavorable.

b. $310 favorable.

c. $300 unfavorable.

d. $300 favorable.

Zippy

Labor Variances

1-37

Hansons labor rate variance (LRV)

for the week was:

a. $310 unfavorable.

b. $310 favorable.

c. $300 unfavorable.

d. $300 favorable.

LRV = AH(AR - SR)

LRV = 1,550 hrs($10.20 - $10.00)

LRV = $310 unfavorable

Zippy

Labor Variances

1-38

The standard hours (SH) of labor that

should have been worked to produce

1,000 Zippies is:

a. 1,550 hours.

b. 1,500 hours.

c. 1,700 hours.

d. 1,800 hours.

Zippy

Labor Variances

1-39

The standard hours (SH) of labor that

should have been worked to produce

1,000 Zippies is:

a. 1,550 hours.

b. 1,500 hours.

c. 1,700 hours.

d. 1,800 hours.

SH = 1,000 units 1.5 hours per unit

SH = 1,500 hours

Zippy

Labor Variances

1-40

Hansons labor efficiency variance (LEV)

for the week was:

a. $510 unfavorable.

b. $510 favorable.

c. $500 unfavorable.

d. $500 favorable.

Zippy

Labor Variances

1-41

Hansons labor efficiency variance (LEV)

for the week was:

a. $510 unfavorable.

b. $510 favorable.

c. $500 unfavorable.

d. $500 favorable.

LEV = SR(AH - SH)

LEV = $10.00(1,550 hrs - 1,500 hrs)

LEV = $500 unfavorable

Zippy

Labor Variances Summary

1-42

Actual Hours Actual Hours Standard Hours

Actual Rate Standard Rate Standard Rate

Rate variance

$310 unfavorable

Efficiency variance

$500 unfavorable

1,550 hours 1,550 hours 1,500 hours

$10.20 per hour $10.00 per hour $10.00 per hour

$15,810 $15,500 $15,000

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

4

Significance of Cost Variances

1-44

1. Size of variance

1. Dollar amount

2. Percentage of standard

2. Recurring variances

3. Trends

4. Controllability

5. Favorable variances

6. Costs and benefits

of investigation

What clues help me

to determine the

variances that I should

investigate?

Statistical Control Chart

1-45

1 2 3 4 5 6 7 8 9

Variance Measurements

Favorable Limit

Unfavorable Limit

Desired Value

Warning signals for investigation

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

5

Behavioral Impact of Standard

Costing

1-47

If I buy cheaper materials, my direct-

materials expenses will be lower than

what is budgeted. Then Ill get my bonus.

But we may lose customers because of

lower quality.

Controllability of Variances

1-48

Direct-Material

Price Variance

Direct-Labor

Rate Variance

Direct-Material

Quantity Variance

Direct-Labor

Efficiency Variance

Interaction among Variances

1-49

I am not responsible for

the unfavorable labor

efficiency variance!

You purchased cheap

material, so it took more

time to process it.

You used too much

time because of poorly

trained workers and

poor supervision.

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

6

Standard Costs and Product

Costing

1-51

Standard material and labor costs

are entered into Work-in-Process

inventory instead of actual costs.

Standard cost variances

are closed directly to

Cost of Goods Sold.

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

7

Advantages of Standard Costing

1-53

Management by

Exception

Stable Product

Costs

Sensible Cost

Comparisons

Advantages

Performance

Evaluation

Employee

Motivation

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

8

Criticisms of Standard Costing

1-55

Not specific

Focus on cost

minimization

Too aggregate,

too late

Disadvantages

Too much focus

on direct-labor

Narrow

definition

Stable production

required

Shorter life

cycles

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

9

Operational Control Measures in Todays

Manufacturing Environment

1-57

Operational Performance Measures in

Todays Manufacturing Environment

1-58

Raw Material &

Scrap Control

Quality

Lead time

Cost of scrap

Total cost

Inventory Control

Average value

Average holding time

Ratio of inventory

value to sales

revenue

Operational Performance Measures in

Todays Manufacturing Environment

1-59

Machine Performance

Availability

Downtime

Maintenance records

Setup time

Product Quality

Warranty claims

Customer complaints

Defective products

Cost of rework

Operational Performance Measures in

Todays Manufacturing Environment

1-60

Production

Manufacturing

cycle time

Velocity

Manufacturing

cycle efficiency

Delivery

% of on-time deliveries

% of orders filled

Delivery cycle time

Operational Performance Measures in

Todays Manufacturing Environment

1-61

Productivity

Aggregate

productivity

Partial productivity

Innovation and

Learning

Percentage of sales

from new products

Cost savings from

process

improvements

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

10

The Balanced Scorecard

1-63

Financial

Learning and Growth

Internal

Operations

Customer

Vision and

Strategy

Copyright 2011 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

Learning

Objective

11

Use of Standard Costs

for Product Costing

1-65

Actual quantity at

standard cost

Raw-material Inventory

Unfavorable Favorable

variance variance

Direct-Material Price Variance

Actual quantity at

actual cost

Account Payable

Use of Standard Costs

for Product Costing

1-66

Unfavorable Favorable

variance variance

Direct-Material Quantity Variance

Standard quantity

at standard price

Work-in-Process Inventory

Actual quantity at

standard cost

Raw-material Inventory

Use of Standard Costs

for Product Costing

1-67

Unfavorable Favorable

variance variance

Direct-Labor Rate Variance

Actual quantity at

actual cost

Wages Payable

Standard quantity

at standard price

Work-in-Process Inventory

Unfavorable Favorable

variance variance

Direct-Labor Efficiency Variance

Use of Standard Costs

for Product Costing

1-68

Unfavorable Favorable

variance variance

Cost of Goods Sold

End of Chapter 10

1-69

Lets set the

standard a

little higher.

You might also like

- Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument64 pagesStandard Costing, Operational Performance Measures, and The Balanced Scorecardtsy0703No ratings yet

- Standard Costing Variances ExplainedDocument45 pagesStandard Costing Variances Explained行歌No ratings yet

- ACC585ARes Chap 10Document69 pagesACC585ARes Chap 10Micha MaaloulyNo ratings yet

- Standard Costs and The Balanced ScorecardDocument32 pagesStandard Costs and The Balanced ScorecardfaheemNo ratings yet

- Lecture 8Document46 pagesLecture 8api-3767414No ratings yet

- Standard CostingDocument101 pagesStandard CostingSana IjazNo ratings yet

- Material and Labor Variances AnalysisDocument22 pagesMaterial and Labor Variances AnalysisC SNo ratings yet

- Chapter 12 - 27-2-2017Document51 pagesChapter 12 - 27-2-2017Shane MoynihanNo ratings yet

- Chap 011 Standard CostingDocument109 pagesChap 011 Standard CostingSpheros Indonesia100% (1)

- Standard Costs and Operating Performance MeasuresDocument108 pagesStandard Costs and Operating Performance MeasuresCharlaign MalacasNo ratings yet

- Hilton 11e Chap010PPTDocument60 pagesHilton 11e Chap010PPTNgọc ĐỗNo ratings yet

- Chapter 7 & 8 Standard costing - A General Model for Variance AnalysisDocument15 pagesChapter 7 & 8 Standard costing - A General Model for Variance AnalysisNitin RajotiaNo ratings yet

- Analyzing Financial - Performance ReportDocument29 pagesAnalyzing Financial - Performance ReportjatimTV webNo ratings yet

- Lecture 18CAs20Document40 pagesLecture 18CAs20mzNo ratings yet

- Standard Costs and The Balanced ScorecardDocument32 pagesStandard Costs and The Balanced Scorecardshule1100% (1)

- Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument69 pagesStandard Costing, Operational Performance Measures, and The Balanced ScorecardAcmad RedhoNo ratings yet

- Flexible Budgets and Performance AnalysisDocument77 pagesFlexible Budgets and Performance AnalysisĐỉnh Kout NamNo ratings yet

- Calculating materials mix and yield variancesDocument9 pagesCalculating materials mix and yield variancesEjaz AhmadNo ratings yet

- Chapter 6 (Variance Analysis)Document57 pagesChapter 6 (Variance Analysis)annur azalillahNo ratings yet

- CH 11Document34 pagesCH 11billybuttonNo ratings yet

- Mas - 6Document2 pagesMas - 6Rosemarie CruzNo ratings yet

- F5 - Material VariancesDocument5 pagesF5 - Material VariancesDCAdamsonNo ratings yet

- Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument73 pagesStandard Costing, Operational Performance Measures, and The Balanced ScorecardQuenn NavalNo ratings yet

- Module 10 Standard Costing and Variance AnalysisDocument47 pagesModule 10 Standard Costing and Variance AnalysisMarjorie NepomucenoNo ratings yet

- 4th (Managerial Accounting)Document20 pages4th (Managerial Accounting)Amara ELprida SaniNo ratings yet

- Materials Mix And Yield Variances ExplainedDocument5 pagesMaterials Mix And Yield Variances ExplainedSamuel AbebawNo ratings yet

- CMA II - Chapter 3, Flexible Budgets & StandardsDocument77 pagesCMA II - Chapter 3, Flexible Budgets & StandardsLakachew Getasew0% (1)

- Accounting Group AssigmnetDocument9 pagesAccounting Group AssigmnetABNETNo ratings yet

- Standard Costing and Variance Analysis: Fall 2007 CrossonDocument20 pagesStandard Costing and Variance Analysis: Fall 2007 CrossonBernard SalongaNo ratings yet

- Standard Costing: A Functional-Based Control ApproachDocument17 pagesStandard Costing: A Functional-Based Control ApproachCaliNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- Standard Costs and Variance AnalysisDocument37 pagesStandard Costs and Variance Analysisromelover79152No ratings yet

- Cost II Chapter FourDocument5 pagesCost II Chapter FourSemiraNo ratings yet

- Sva - Student Copy P1Document101 pagesSva - Student Copy P1Joyce MamokoNo ratings yet

- Standard CostDocument41 pagesStandard CostKate ReyesNo ratings yet

- ACCT 2200 - Chapter 9Document26 pagesACCT 2200 - Chapter 9afsdasdf3qf4341f4asDNo ratings yet

- Standard CostsDocument3 pagesStandard CostspalicpicestepanyaNo ratings yet

- Chap 5Document4 pagesChap 5Himansh KumarNo ratings yet

- Peterson Foods Price and Efficiency VariancesDocument3 pagesPeterson Foods Price and Efficiency VariancesRumaisa HamidNo ratings yet

- Standard Costing & Variance AnalysisDocument43 pagesStandard Costing & Variance Analysis21-51749No ratings yet

- P10-36 Variance Calculation, Analysis, Service Business: Presented By: Tan Shi Xuan 17203097/1 CIA190127Document44 pagesP10-36 Variance Calculation, Analysis, Service Business: Presented By: Tan Shi Xuan 17203097/1 CIA190127Iman NessaNo ratings yet

- Variance Part 1Document4 pagesVariance Part 1Ali Shah 512No ratings yet

- Standard Costs and VariancesDocument103 pagesStandard Costs and VariancesMingmiin TeohNo ratings yet

- Standard Costing and Variance AnalysisDocument26 pagesStandard Costing and Variance AnalysisFidelina CastroNo ratings yet

- Butchers Yield Test GuideDocument4 pagesButchers Yield Test GuideGladys LadromaNo ratings yet

- Synth 1 (STD COSTING)Document11 pagesSynth 1 (STD COSTING)Hassan AdamNo ratings yet

- Standard Costs and Variance Analysis CR - 102Document20 pagesStandard Costs and Variance Analysis CR - 102Princess Corine BurgosNo ratings yet

- Standard CostingDocument6 pagesStandard CostingTariq mahmoodNo ratings yet

- Standard Cost & VarianceDocument26 pagesStandard Cost & VarianceWaqar AhmadNo ratings yet

- Micro Formulas and ConceptsDocument27 pagesMicro Formulas and Conceptsolle.bonnedahlNo ratings yet

- MAF Mixed and Yield Variances (Eng)Document8 pagesMAF Mixed and Yield Variances (Eng)BirukNo ratings yet

- Material Cost Variance Vijay HoodaDocument6 pagesMaterial Cost Variance Vijay HoodaMohit SharmaNo ratings yet

- Problem-1 (Materials, Labor and Variable Overhead Variances)Document3 pagesProblem-1 (Materials, Labor and Variable Overhead Variances)Khim RamosNo ratings yet

- Operational Budgeting and Variance Analysis Topic 5Document17 pagesOperational Budgeting and Variance Analysis Topic 5sv03No ratings yet

- Lesson 5 - Standard Costing and Variance AnalysisDocument24 pagesLesson 5 - Standard Costing and Variance Analysistrixie oriasNo ratings yet

- Economics of Consumer Behaviour: DR.C S ShylajanDocument52 pagesEconomics of Consumer Behaviour: DR.C S ShylajanShifa SharmaNo ratings yet

- Cost Allocation Joint by ProductsDocument31 pagesCost Allocation Joint by ProductsFanie Saphira100% (1)

- A level Economics Revision: Cheeky Revision ShortcutsFrom EverandA level Economics Revision: Cheeky Revision ShortcutsRating: 3 out of 5 stars3/5 (1)

- Low Cost/No Cost Tips for Sustainability in Cultural Heritage: Reduce Your Impact on the PlanetFrom EverandLow Cost/No Cost Tips for Sustainability in Cultural Heritage: Reduce Your Impact on the PlanetNo ratings yet

- Economics for CFA level 1 in just one week: CFA level 1, #4From EverandEconomics for CFA level 1 in just one week: CFA level 1, #4Rating: 4.5 out of 5 stars4.5/5 (2)

- CH 2.palepu - Jw.caDocument18 pagesCH 2.palepu - Jw.caFlorensia RestianNo ratings yet

- Chap 023Document30 pagesChap 023Florensia RestianNo ratings yet

- CH 2.palepu - Jw.caDocument18 pagesCH 2.palepu - Jw.caFathiyah NuramaliyaNo ratings yet

- CH 8.palepu - Jw.caDocument14 pagesCH 8.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 7.palepu - Jw.caDocument13 pagesCH 7.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 8.palepu - Jw.caDocument14 pagesCH 8.palepu - Jw.caFlorensia RestianNo ratings yet

- Chap 022Document76 pagesChap 022Florensia RestianNo ratings yet

- Theory of ConstraintDocument11 pagesTheory of ConstraintFlorensia RestianNo ratings yet

- Income Taxes: IAS 12: IFRS PrimerDocument35 pagesIncome Taxes: IAS 12: IFRS PrimerFlorensia RestianNo ratings yet

- Total Number of Rooms 50.63Document4 pagesTotal Number of Rooms 50.63hanuman2467% (3)

- Insights Into IFRS Overview 2014 15Document101 pagesInsights Into IFRS Overview 2014 15Florensia Restian100% (2)

- CH 7.palepu - Jw.caDocument13 pagesCH 7.palepu - Jw.caFlorensia RestianNo ratings yet

- CH 1.palepu - Jw.caDocument9 pagesCH 1.palepu - Jw.caFlorensia RestianNo ratings yet

- Unitron CorporationDocument8 pagesUnitron CorporationFlorensia RestianNo ratings yet

- Hilton CH 7 Select SolutionsDocument25 pagesHilton CH 7 Select SolutionsHadeeqa Tul Fatima100% (1)

- Timken's Potential Acquisition of Torrington: Valuation and Deal StructureDocument1 pageTimken's Potential Acquisition of Torrington: Valuation and Deal StructureFlorensia RestianNo ratings yet

- Skyview ManorDocument12 pagesSkyview ManorSteffi Dcosta100% (1)

- The Changing Role of Managerial Accounting in A Global Business EnvironmentDocument31 pagesThe Changing Role of Managerial Accounting in A Global Business EnvironmentFlorensia RestianNo ratings yet

- Lehigh Steel Final DocumentDocument6 pagesLehigh Steel Final DocumentSavita SoniNo ratings yet

- Decision Making: Relevant Costs and Benefits: Mcgraw-Hill/IrwinDocument54 pagesDecision Making: Relevant Costs and Benefits: Mcgraw-Hill/IrwinFlorensia RestianNo ratings yet

- Process Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinDocument39 pagesProcess Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinFlorensia RestianNo ratings yet

- Chapter 11 NDocument59 pagesChapter 11 NFlorensia RestianNo ratings yet

- Chapter 13 NDocument62 pagesChapter 13 NFlorensia RestianNo ratings yet

- Chapter 12 NDocument35 pagesChapter 12 NFlorensia RestianNo ratings yet

- Capital Expenditure Decisions: Mcgraw-Hill/IrwinDocument52 pagesCapital Expenditure Decisions: Mcgraw-Hill/IrwinFlorensia RestianNo ratings yet

- Chapter 06 NDocument48 pagesChapter 06 NFlorensia RestianNo ratings yet

- Ch19 Guan CM AiseDocument38 pagesCh19 Guan CM AiseFlorensia RestianNo ratings yet

- Activity-Based Costing and Management: Mcgraw-Hill/IrwinDocument52 pagesActivity-Based Costing and Management: Mcgraw-Hill/IrwinFlorensia RestianNo ratings yet

- Ch21 Guan CM AiseDocument31 pagesCh21 Guan CM AiseFlorensia RestianNo ratings yet

- The Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsDocument2 pagesThe Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsElliot RichardNo ratings yet

- Cost Accounting Prestest 2Document19 pagesCost Accounting Prestest 2aiswiftNo ratings yet

- Quiz CH 2 BBADocument7 pagesQuiz CH 2 BBAYahya KhanNo ratings yet

- ACT 5060 MidtermDocument20 pagesACT 5060 MidtermAarti JNo ratings yet

- Engineer To Order Project Management with SAP and NovecoDocument97 pagesEngineer To Order Project Management with SAP and NovecoSubramanian S (IN)No ratings yet

- Unit 3 - Strategic Performance Measurement111Document130 pagesUnit 3 - Strategic Performance Measurement111Art IslandNo ratings yet

- NAS 16-Property, Plant and EquipmentDocument10 pagesNAS 16-Property, Plant and EquipmentPrashant TamangNo ratings yet

- Total Cost ManagementDocument31 pagesTotal Cost ManagementDinesh Kc50% (2)

- Nature and Scope of Cost Accounting - Dynamic Tutorials and ServicesDocument9 pagesNature and Scope of Cost Accounting - Dynamic Tutorials and Servicesprakashzodpe20130% (1)

- Cost Breakdown TerchaDocument251 pagesCost Breakdown TerchaMohammed GagiNo ratings yet

- Food and Beverage Cost Control ConceptsDocument38 pagesFood and Beverage Cost Control ConceptsAnthony B. AnocheNo ratings yet

- MAS-42G (Standard Costing With GP Variance Analysis)Document14 pagesMAS-42G (Standard Costing With GP Variance Analysis)Bernadette PanicanNo ratings yet

- Replacement-Econ LifeDocument36 pagesReplacement-Econ LifeSHREYANSH SINGHNo ratings yet

- Manual Ceteris ParibusDocument12 pagesManual Ceteris ParibusAbhitej KodaliNo ratings yet

- Maximize Profits Using Limited ResourcesDocument1 pageMaximize Profits Using Limited ResourcesJPNo ratings yet

- CosoldatedDocument11 pagesCosoldatedShafiqNo ratings yet

- C - TS4FI - 2021: Answer: ADocument23 pagesC - TS4FI - 2021: Answer: AThigh100% (2)

- Chapter 4 OverheadsDocument162 pagesChapter 4 OverheadsShalini NayyarNo ratings yet

- CH 1+16th+globalDocument24 pagesCH 1+16th+globalAmina SultangaliyevaNo ratings yet

- 1activity Based Costing-ABCDocument27 pages1activity Based Costing-ABCDr. Mustafa KozhikkalNo ratings yet

- Agribusiness Incubation Centre - Fort-Portal A Concept Note - General Salim Sale PresentationDocument18 pagesAgribusiness Incubation Centre - Fort-Portal A Concept Note - General Salim Sale PresentationBUSIINGENo ratings yet

- Pricing Method and StrategiesDocument11 pagesPricing Method and StrategiesAyushi Chawla100% (1)

- Standard Cost Variances ExplainedDocument17 pagesStandard Cost Variances ExplainedJesselle Marie SalazarNo ratings yet

- Cost Accounting 1 BBA 2020 ManualDocument122 pagesCost Accounting 1 BBA 2020 ManualSangulukani ChirwaNo ratings yet

- AbsorptionDocument29 pagesAbsorptionRavi KatiyarNo ratings yet

- Ojas FR Module 1Document280 pagesOjas FR Module 1AnupNo ratings yet

- Cost Sheet Analysis of Dabur India LtdDocument11 pagesCost Sheet Analysis of Dabur India LtdAjay Abraham Anathanam100% (3)

- The Cost Accounting CycleDocument17 pagesThe Cost Accounting CycleHinazeeshan MalikNo ratings yet

- Audit of Item of Financial StatementDocument20 pagesAudit of Item of Financial StatementKushagra BurmanNo ratings yet

- Q3 Part 2 Problem On Job Order CostingDocument9 pagesQ3 Part 2 Problem On Job Order CostingLadybellereyann A TeguihanonNo ratings yet