Professional Documents

Culture Documents

EXPO14 - Slides Trade Like A Pro

EXPO14 - Slides Trade Like A Pro

Uploaded by

Ray WoolsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EXPO14 - Slides Trade Like A Pro

EXPO14 - Slides Trade Like A Pro

Uploaded by

Ray WoolsonCopyright:

Available Formats

Trade Stocks

Like A Pro

International Traders Expo New York

By Dr. Charles B. Schaap, Jr.

5 TIPS Plus 3 Picks

Tip #1: Use ADX to Trade Power Trends

Tip #2: Use RSI (50/50 Strategy) for Timing the

Trade

Tip #3: Use Dual Timeframes to Gain an Edge

Tip #4: Trade in Sync with the Market (Market

Timing)

Tip #5: Take Profits a the Trend Rises

2014 Charles B. Schaap 2

5 Tips

The information in this lecture is for educational

purposes. No particular stocks, options, futures, mutual

funds, or exchange traded funds are being

recommended. Consult professional investment advice

prior to implementing an investment program. Past

results are not necessarily indicative of future results. Do

not invest with money you cannot afford to lose.

Investing involves potential risks. It should not be

assumed that methods taught will not result in losses.

2014 Charles B. Schaap 3

Disclaimer

2014 Charles B. Schaap 4

Over a 7 month period (15 May to 31 December

2013)

ProSelect Portfolio gained +61%

Realized Gains +43%

Unrealized Gains +18%

Win/Loss Ratio: 3.25/1

Portfolio Summary

2014 Charles B. Schaap 5

2014 Charles B. Schaap 6

TIP #1

Use ADX to Trade Power Trends

2014 Charles B. Schaap 7

New Concepts in Technical Trading Systems, 1978 (Wilder).

Average Directional Movement Index (ADX) was developed by

J. Welles Wilder

ADX is derived from two related indicators, the Positive

Directional Movement Indicator (+DMI) and the Negative

Directional Movement Indicator (-DMI).

Default periods for ADX and DMI is 14

ADXcellencePower Trend Strategies, 2006 (Schaap)

ADXcellence settings: DMI 13, ADX 8

2014 Charles B. Schaap 8

ADX/DMI Indicator

ADX is Nondirectional

ADX measures trend strength

ADX 50 : Very Strong (Power Trend)

ADX 25-50: Strong Trend

ADX 15-25: Weak or No Trend

ADX 15: No trend (Prebreakout)

2014 Charles B. Schaap 9

ADX and Trend Strength

2014 Charles B. Schaap 10

2014 Charles B. Schaap 11

2014 Charles B. Schaap 12

2014 Charles B. Schaap 13

TIP #2

Use RSI for Timing the Entry

2014 Charles B. Schaap 14

New Concepts in Technical Trading Systems, 1978

(Wilder).

Momentum oscillator developed by J. Welles Wilder

Moving average of up closes (price change) vs down

closes (price change)

Default period is 14

The 50/50 Strategy (Technical Analysis of Stocks &

Commodities, March 2004) (Schaap)

RSI with 20 Period setting

Trend Indicator

2014 Charles B. Schaap 15

Relative Strength Index (RSI)

A Rising daily 50 EMA represents institutional buying

Price periodically retraces to the daily 50 EMA

If institutional investors support a stock at the 50 EMA

area, the trend is likely to continue

Buy near the 50 EMA when the price/volume pattern

turns bullish

Stop loss: Sell a stock that violates the 50 EMA on a

bearish price/volume pattern

2014 Charles B. Schaap 16

50/50 Premise

Default RSI = 14 periods

Used as overbought/oversold indicator

17 2014 Charles B. Schaap

Overbought

70

30

Oversold

0

100

Overbought

2014 Charles B. Schaap 18

ProTrend Methodology

(50/50 Strategy)

50

19 2014 Charles B. Schaap

Zone of Price Strength

Zone of Price Weakness

100

0

2014 Charles B. Schaap 20

Two Main Criteria

Price is above a rising 50 EMA

RSI 20 is above the 50 level

2014 Charles B. Schaap 21

50/50 Strategy

Price crosses and closes above the 50 EMA

RSI crosses above the 50 level (or is already above

the 50 level)

Supportive price/volume pattern

Price closes above a Resistance Line

2014 Charles B. Schaap 22

50/50 Strategy Buy Alert

2014 Charles B. Schaap 23

2014 Charles B. Schaap 24

TIP #3

Use Dual Timeframes to

Gain an Edge

2014 Charles B. Schaap 25

Dual Timeframes

Dual Timeframes represents one the major edges

in trading

The Lower timeframe leads the Higher Timeframe

Buy when the higher timeframe trend is STRONG

and the lower timeframe is temporarily WEAK

50/50 Strategy uses weekly/daily charts

Weekly for the bigger picture trend

Daily for timing the entry and risk management

2014 Charles B. Schaap 26

Weekly 10 moving average = Daily 50 moving

average

Weekly 50 moving average = Daily 250 moving

average

Weekly RSI 4 = Daily RSI 20

2014 Charles B. Schaap 27

Weekly/Daily Relationships

2014 Charles B. Schaap 28

2014 Charles B. Schaap 29

2014 Charles B. Schaap 30

2014 Charles B. Schaap 31

TIP #4

Trade in Sync with the Market

2014 Charles B. Schaap 32

Trade in the direction of the institutional money flows

(volume)

Different trade setups work in different market

conditions.

More likely to get stopped out if market conditions are

not supportive

Assess market conditions before entering a trade

Correction:

Leads to the best setups (risk/reward)

Wait for correction to end before buying

Market Trending Up: Consolidating, Retracing, Breaking to

new highs?

2014 Charles B. Schaap 33

Market Conditions

2014 Charles B. Schaap 34

Market Direction

Market Direction determines portfolio positioning

10 January 2014 Email: WARNING OF POTENTIAL

MARKET CORRECTION

Take profits, cut losers, limit buys

27 January 2014 Email: Market in Correction

No new buys, tighten stops

2014 Charles B. Schaap 35

2014 Charles B. Schaap 36

TIP #5

Take Profits as the Trend Rises

2014 Charles B. Schaap 37

Trends move in cycles

Uptrend segment usually has 3 upswings

Intermediate-term retracement will give back profits

Stocks commonly rise 15-25% before entering a

retracement

Capture partial profits at specific targets as price

rises and momentum weakens

Can hold a partial position to let profits run or add

shares back in at the next buy signal

2014 Charles B. Schaap 38

Set Targets and Capture Profits

Example of New Stock Pick

2014 Charles B. Schaap 39

2014 Charles B. Schaap 40

2014 Charles B. Schaap 41

2014 Charles B. Schaap 42

2014 Charles B. Schaap 43

2014 Charles B. Schaap 44

2014 Charles B. Schaap 45

2014 Charles B. Schaap 46

Picks are 10% of the winning equation

Trade management is 90%

PICKS:

UBNT

QIHU

GOMO (IPO)

2014 Charles B. Schaap 47

3 Picks

IPO 2011, makes radios, antennas and network mgmt tools

Qtrly Sales % chg 85%, 3 Yr Sales growth 34%, Qtry EPS change 140%

IPO 2011, Chinese provider of internet security, browsers, online games

EPS%Qtrly 158%, 3 Yr Sales Growth rate 127%

IPO 2013, internet products and applications, focus android smartphones

Qtrly Sales % change 85%, 3 Yr Sales Growth rate 96%

Website:TradeLikeAPro.com

Email: help@tradelikeapro.com

Thank You !

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ARTA MC 2022 05 - Annex A. CSM Questionnaire PDFDocument2 pagesARTA MC 2022 05 - Annex A. CSM Questionnaire PDFBSU Legal Affairs Office0% (1)

- STP Biti'sDocument5 pagesSTP Biti'sVo Ho Uyen NhiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ex ServicemenDocument3 pagesEx Servicemensriprak100% (4)

- Characteristics of A Quality Asylum SystemDocument21 pagesCharacteristics of A Quality Asylum SystemAngel VermasNo ratings yet

- Meidner (1992) - Rise and Fall of The Swedish ModelDocument13 pagesMeidner (1992) - Rise and Fall of The Swedish ModelmarceloscarvalhoNo ratings yet

- Diagnostic Trouble Codes (DTC) : DTC U0100 (Previously U2105) CAN Bus ECM ErrorDocument3 pagesDiagnostic Trouble Codes (DTC) : DTC U0100 (Previously U2105) CAN Bus ECM Errorluis eduardo corzo enriquezNo ratings yet

- The Ultimate Yoga Teacher Training GuideDocument29 pagesThe Ultimate Yoga Teacher Training GuidealiounseydiNo ratings yet

- Risk Inspection Report On Goa Sponge & Power LimitedDocument27 pagesRisk Inspection Report On Goa Sponge & Power LimitedRama Chandra BarikNo ratings yet

- Brosur RoboThinkDocument2 pagesBrosur RoboThinkSarah LNo ratings yet

- 8.urban Design ControlsDocument17 pages8.urban Design ControlsAchu PeterNo ratings yet

- Judicial Activism and Juducial Restraint (Legal Language)Document26 pagesJudicial Activism and Juducial Restraint (Legal Language)Aishani ChakrabortyNo ratings yet

- PAPER MayoraDocument2 pagesPAPER MayoraMasyitha MemesNo ratings yet

- Mirza Kayesh Begg - 250274290 - CompleteReportDocument12 pagesMirza Kayesh Begg - 250274290 - CompleteReportSYEDA MYSHA ALINo ratings yet

- Cpe 442 Introduction To Computer ArchitectureDocument25 pagesCpe 442 Introduction To Computer Architectureعلي سعدهاشمNo ratings yet

- Great Lakes Transport V KRADocument10 pagesGreat Lakes Transport V KRASAMSON OCHIENG ABUOGINo ratings yet

- Seminar 4 & 5 - TelecomsDocument81 pagesSeminar 4 & 5 - TelecomsGible BubuNo ratings yet

- A Resource Guide For Departmental Managers and HR ProfessionalsDocument37 pagesA Resource Guide For Departmental Managers and HR ProfessionalssimasolunkeNo ratings yet

- Chapter 2Document32 pagesChapter 2Lemuel GallegoNo ratings yet

- Gpcdoc Tds Darina R 2Document2 pagesGpcdoc Tds Darina R 2nutchai2538No ratings yet

- MRIDC - VN - 49 - Asst. Manager, Sr. Exectutive, Executive (Civil)Document3 pagesMRIDC - VN - 49 - Asst. Manager, Sr. Exectutive, Executive (Civil)Payal JainNo ratings yet

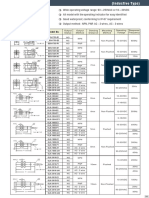

- Outline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodDocument2 pagesOutline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodAgus YohanesNo ratings yet

- Theme Based Safety Discussion (TBT) - Safety in Welding OperationDocument3 pagesTheme Based Safety Discussion (TBT) - Safety in Welding OperationMr. XNo ratings yet

- Training and Development - StudentsDocument201 pagesTraining and Development - StudentsRagiv JalanNo ratings yet

- IDC Service ManualDocument358 pagesIDC Service Manualfourioer100% (1)

- Chief Secretaries of States AddressDocument73 pagesChief Secretaries of States Addressभक्त योगी आदित्यनाथ काNo ratings yet

- Ting Ho, Jr. v. Teng Gui, GR 130115, July 16, 2008, 558 SCRA 421Document1 pageTing Ho, Jr. v. Teng Gui, GR 130115, July 16, 2008, 558 SCRA 421Gia DimayugaNo ratings yet

- 2024년 수특+03강 유형별변형문제.hwpDocument59 pages2024년 수특+03강 유형별변형문제.hwpzhengyujin28No ratings yet

- Types of EthicsDocument5 pagesTypes of EthicsJack mazeNo ratings yet

- Library BduDocument71 pagesLibrary BdushivaNo ratings yet

- KP Group4Document21 pagesKP Group4B17 Santos, Israel C.No ratings yet