Professional Documents

Culture Documents

Porter'S 5 Forces Model

Uploaded by

sajal30Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Porter'S 5 Forces Model

Uploaded by

sajal30Copyright:

Available Formats

1

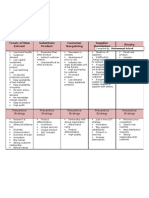

PORTERS 5 FORCES

MODEL

2

3

4

RETAILING INDUSTRY

5

THREAT OF NEW ENTRANTS

Independent retailers decreased.

Chain stores

Centralized buying competitive advantage

THREAT OF SUBSTITUTES

Deal with various products.

Chances of shifting is high.

POWER OF SUPPLIERS

Historically, exploit the relationship.

Less power

POWER OF BUYERS

Lower bargaining power

High quality products retailers honest

RIVARLY AMONG EXISTING FIRMS WITHIN AN INDUSTRY

Cut throat Competition

Reduce frequent fliers, memberships, loyalty cards, etc..

TELECOMMUNICATION

INDUSTRY

6

7

THREAT OF NEW ENTRANTS

Ownership of a telecom license

Finance

THREAT OF SUBSTITUTES

Cable TV direct lines, broadband services

POWER OF SUPPLIERS

Less power

Talented managers & engineers

POWER OF BUYERS

Increased choice high bargaining power

Switching costs individual & large business

customers.

RIVARLY AMONG EXISTING FIRMS WITHIN AN INDUSTRY

Usage of phone, competition is high

Price

Value added services

Profitability low

8

Airline Industry

9

THREAT OF NEW ENTRANTS

Saturated Market

Brand Name & Recognition

THREAT OF SUBSTITUTES

Time, Money

Personal References & convenience

POWER OF SUPPLIERS

Dominated Boeing & Airbus

Not much of difference.

POWER OF BUYERS

Low bargaining

Consider Service of airline too.

RIVARLY AMONG EXISTING FIRMS WITHIN AN INDUSTRY

High competition

Cut throat competition

Low Profitability

10

Pharma Industry

11

THREAT OF NEW ENTRANTS

Very low barriers to entry

Government policies supportive

Entry price regulation exists

Economies of scale exist

Proprietary technology

Product existence

THREATS OF SUBSTITUTES

No substitutes for the medicines

Biotechnology is a threat to synthetic pharma products

POWER OF SUPPLIERS

Volume benefits occur

Inputs standard, available locally

Numerous suppliers-switching cost low

Suppliers can go for forward integration

Raw material cost constitute more than 50% of the total

expenses

POWER OF BUYERS

End consumers do not have bargaining power

Brand identity exists but is in the hands of Influencer (Doctors)

Price Sensitivity is less

Highly fragmented market, so buyer concentration v/s industry

is low

RIVARLY AMONG EXISTING FIRMS WITHIN AN INDUSTRY

Industry Competition

Highly competitive.

Top five players have mere 18% market share

18% market share

Lower fixed cost and high working capital

Indian Automobile Industry

12

13

THREAT OF NEW ENTRANTS

Substantial entry

New company requires high capital.

Achieving minimum efficient scale is prohibitive

Enter through strategic partnership, buying, merging

Domestic market works well locally than globally

THREAT OF SUBSTITUTES

Fairly mild

Other forms of transportation available

POWER OF SUPPLIERS

the power axis is tipped in industry

Powerful buyers dictate their terms to supplier

POWER OF BUYERS

The power axis is tipped in the consumers favor

Low switching costs from among competing brands.

RIVARLY AMONG EXISTING FIRMS WITHIN AN INDUSTRY

Intense due to the entry of foreign companies

Rivalry - high with any product being matched in a few months by the competitors

Technical capabilities

Collaboration with international players

THANK YOU

14

You might also like

- Porter 5 F ModelDocument7 pagesPorter 5 F Modelsaurabhtiwari2102No ratings yet

- Porters Five Forces - TKIMDocument13 pagesPorters Five Forces - TKIMHuhyhuthut HutNo ratings yet

- Unit II Competitve AdvantageDocument147 pagesUnit II Competitve Advantagejul123456No ratings yet

- Porter's Five Forces Model Is An Analysis Tool That Uses Five Industry Forces ToDocument4 pagesPorter's Five Forces Model Is An Analysis Tool That Uses Five Industry Forces ToAanchal MahajanNo ratings yet

- Porter's Five Forces ModelDocument9 pagesPorter's Five Forces ModelSahrish IqbalNo ratings yet

- Five Forces ModelDocument11 pagesFive Forces ModelNicole ConcepcionNo ratings yet

- Porter's Five Forces and SWOT: Retail IndustryDocument38 pagesPorter's Five Forces and SWOT: Retail Industrynikhil kunchikorveNo ratings yet

- Business Policy & Strategy Management Bargaining Power of BuyersDocument32 pagesBusiness Policy & Strategy Management Bargaining Power of BuyersMidsy De la CruzNo ratings yet

- Analysis of Consumer Electronics Industry With Porter's FiveDocument11 pagesAnalysis of Consumer Electronics Industry With Porter's FiveNiraj KumarNo ratings yet

- External Analysis Industry Structure: Session 3Document40 pagesExternal Analysis Industry Structure: Session 3Moidin AfsanNo ratings yet

- Session3 IndustryanalysisDocument40 pagesSession3 IndustryanalysisBhargav D.S.No ratings yet

- 5 PortarDocument37 pages5 Portartanmoy2000No ratings yet

- Porter's Five Forces ModelDocument34 pagesPorter's Five Forces ModelAthulyaNo ratings yet

- The Five Competitive Forces That Shape StrategyDocument10 pagesThe Five Competitive Forces That Shape StrategyDuong Do100% (1)

- Strategic Elements of Competitive Advantage: Warren J. Keegan Mark C. GreenDocument38 pagesStrategic Elements of Competitive Advantage: Warren J. Keegan Mark C. GreenPitoyo MarbunNo ratings yet

- Competitor Analysis1Document15 pagesCompetitor Analysis1malatheshNo ratings yet

- Chapter 8 - Porter, Industry AnalysisDocument6 pagesChapter 8 - Porter, Industry AnalysisNathalie ChahrourNo ratings yet

- The Case of Pro Profitless PCDocument11 pagesThe Case of Pro Profitless PCShubham AgnihotriNo ratings yet

- 00 Porters Five Force Model of Industry AnalysisDocument15 pages00 Porters Five Force Model of Industry Analysisvinit_shah90No ratings yet

- Porter's Five Force ModelDocument32 pagesPorter's Five Force Modelkregson04No ratings yet

- Business Level Strategies: - Rutika SainiDocument22 pagesBusiness Level Strategies: - Rutika Sainidivyansh varshneyNo ratings yet

- Industry Analysis and VRIODocument6 pagesIndustry Analysis and VRIOAravind ShankarNo ratings yet

- Cirque Du SoleilDocument1 pageCirque Du SoleilalexgiioNo ratings yet

- International Marketing: Course 3Document45 pagesInternational Marketing: Course 3Diana DmNo ratings yet

- Strategic Sourcing: Dr. Kunal GhoshDocument72 pagesStrategic Sourcing: Dr. Kunal GhoshPankaj VishwakarmaNo ratings yet

- Environmental ScanningDocument14 pagesEnvironmental Scanningthabithadube844No ratings yet

- 71 Competitive Environment - Porter's 5 ForcesDocument19 pages71 Competitive Environment - Porter's 5 ForcesGeorge ButlerNo ratings yet

- Porter's Five Forces of Competitive AnalysisDocument34 pagesPorter's Five Forces of Competitive AnalysisShelly SinghalNo ratings yet

- The Five Competitive Forces That Shape Strategy: - Manish Kumar - 428Document14 pagesThe Five Competitive Forces That Shape Strategy: - Manish Kumar - 428manishkpratapNo ratings yet

- Evaluating A Firms External Environment: Session 2Document35 pagesEvaluating A Firms External Environment: Session 2Ni Ni BobokhidzeNo ratings yet

- Presentation For StrategyDocument10 pagesPresentation For StrategynidhishvNo ratings yet

- Disposable Diaper Industry: Case AnalysisDocument8 pagesDisposable Diaper Industry: Case AnalysisaabfjabfuagfuegbfNo ratings yet

- 5 ForcesDocument2 pages5 ForcesNakulParuthiNo ratings yet

- Porter's Five Forces: Barriers To EntryDocument2 pagesPorter's Five Forces: Barriers To EntryJohn FaustorillaNo ratings yet

- Analysis of Consumer Electronics Industry With Porter S FiveDocument11 pagesAnalysis of Consumer Electronics Industry With Porter S FiveGREAT Alikhan0% (1)

- Porter's Five Forces: of Competitive AnalysisDocument27 pagesPorter's Five Forces: of Competitive AnalysisMuskan KaurNo ratings yet

- Role of I-T in Porters ModelDocument33 pagesRole of I-T in Porters ModelRohit1974No ratings yet

- Customers: - Suppliers - CompetitorsDocument32 pagesCustomers: - Suppliers - CompetitorsanashussainNo ratings yet

- Remote Environment: - Concern The Nature and Direction of Economy in Which A Firm Operates - Types of FactorsDocument27 pagesRemote Environment: - Concern The Nature and Direction of Economy in Which A Firm Operates - Types of FactorsNiranjan MundariNo ratings yet

- Monsanto Case AnalysisDocument7 pagesMonsanto Case AnalysisMuhammad Daniala SyuhadaNo ratings yet

- CHP. 9 Competitive Strategy in Fragmented IndustriesDocument36 pagesCHP. 9 Competitive Strategy in Fragmented IndustriesNur AsniNo ratings yet

- (Unit 2) Porter's Five Forces ExamplesDocument5 pages(Unit 2) Porter's Five Forces ExamplesShreya GoyalNo ratings yet

- Session 3 Strategic PositionDocument69 pagesSession 3 Strategic PositionArnold DsouzaNo ratings yet

- 5 Forces OverviewDocument1 page5 Forces OverviewRohail AmjadNo ratings yet

- Porter's Five Forces ModelDocument17 pagesPorter's Five Forces ModelGitanjali gitanjaliNo ratings yet

- Porter's Five Force AnalysisDocument24 pagesPorter's Five Force AnalysisAman Oza R100% (1)

- Final Presentation - Poters Five ForcesDocument41 pagesFinal Presentation - Poters Five ForcesgawadesxNo ratings yet

- Porter's Five Forces and SWOT: Retail IndustryDocument38 pagesPorter's Five Forces and SWOT: Retail Industryvintosh_pNo ratings yet

- What Is An Industry?Document16 pagesWhat Is An Industry?North East University Business ClubNo ratings yet

- Group 6 - KDADocument15 pagesGroup 6 - KDARavitejaAsodiNo ratings yet

- Lecture 2 SMDocument58 pagesLecture 2 SMadil azmiNo ratings yet

- Topic 3Document36 pagesTopic 3Patrick John LumutanNo ratings yet

- 5 ForcesDocument17 pages5 Forcesirfan julNo ratings yet

- Porter AnalysisDocument6 pagesPorter AnalysisSahil0111No ratings yet

- Business and Strategy AnalysisDocument52 pagesBusiness and Strategy Analysisआयुष आर्यनNo ratings yet

- Industry Analysis: The FundamentalsDocument18 pagesIndustry Analysis: The FundamentalsRahul RastogiNo ratings yet

- Structure of A Competitive IndustryDocument12 pagesStructure of A Competitive Industrypremald100% (5)

- SWOT AnalysisDocument3 pagesSWOT AnalysisGuest HouseNo ratings yet

- 2 - ACS - 2021-22 - Recap - Industry Structure AnalysisDocument13 pages2 - ACS - 2021-22 - Recap - Industry Structure AnalysisAakash VermaNo ratings yet

- CUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESFrom EverandCUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESNo ratings yet

- DerivativesDocument36 pagesDerivativessajal30100% (1)

- FM - Chapter 3Document6 pagesFM - Chapter 3sajal30No ratings yet

- 50 Business Ideas PDFDocument53 pages50 Business Ideas PDFSuman Adak33% (3)

- Various Modes of Electronic Funds Transfers in India - NEFT, RTGS and IMPSDocument4 pagesVarious Modes of Electronic Funds Transfers in India - NEFT, RTGS and IMPSsajal30No ratings yet

- Retailbanking 130715232230 Phpapp02Document55 pagesRetailbanking 130715232230 Phpapp02Prateek JainNo ratings yet

- Chapter 4Document25 pagesChapter 4sajal30No ratings yet

- Erp - Sap N BaanDocument36 pagesErp - Sap N BaanShivangi Srivastava100% (2)

- Ba7301 Enterprise Resource Planning PDFDocument100 pagesBa7301 Enterprise Resource Planning PDFsajal30100% (2)

- 7 - 24575 - EA311 - 2012 - 1 - 2 - 1 - Introduction toHRMDocument8 pages7 - 24575 - EA311 - 2012 - 1 - 2 - 1 - Introduction toHRMsajal30No ratings yet

- 7 - 24575 - EA311 - 2012 - 1 - 2 - 1 - Introduction toHRMDocument8 pages7 - 24575 - EA311 - 2012 - 1 - 2 - 1 - Introduction toHRMsajal30No ratings yet

- Transcript Sun Pharma - Ranbaxy Merger Conference CallDocument27 pagesTranscript Sun Pharma - Ranbaxy Merger Conference Callsajal30No ratings yet