Professional Documents

Culture Documents

Working of Stock Exchange

Working of Stock Exchange

Uploaded by

profvishal0 ratings0% found this document useful (0 votes)

14 views112 pagesse wORKING

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentse wORKING

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views112 pagesWorking of Stock Exchange

Working of Stock Exchange

Uploaded by

profvishalse wORKING

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 112

Introduction

Of all the modern service institutions, stock exchanges are

perhaps the most crucial agents and facilitators of

entrepreneurial progress. After the industrial revolution, as the

size of business enterprises grew, it was no longer possible for

proprietors or partnerships to raise colossal amount of money

required for undertaking large entrepreneurial ventures. Such

huge requirement of capital could only be met by the

participation of a very large number of investors their numbers

running into hundreds, thousands and even millions, depending

on the size of business venture.

!n general, small time proprietors, or partners of a proprietary or

partnership firm, are likely to find it rather difficult to get out of

their business should they for some reason wish to do so. "his is

so because it is not always possible to find buyers for an entire

business or a part of business, #ust when one wishes to sell it.

Similarly, it is not easy for someone with savings, especially

with a small amount of savings, to readily find an appropriate

business opportunity, or a part thereof, for investment. "hese

problems will be even more magnified in large proprietorships

and partnerships. $obody would like to invest in such

partnerships in the first place, since once invested, their savings

would be very difficult to convert into cash. And most people

have lots of reasons, such as better investment opportunity,

marriage, education, death, health and so on for wanting to

convert their savings into cash. %learly then, big enterprises will

be able to raise capital from the public at large only if there were

some mechanism by which the investors could purchase or sell

their share of business as ands they wished to do so. "his

implies that ownership in business has to be &broken up' into a

lager number of small units, such that each unit may be

independently ( easily bought and sold without hampering the

business activity as such. Also, such breaking of business

ownership would help mobilize small savings in the economy

into entrepreneurial ventures.

"his end is achieved in a modern business through the

mechanism of shares.

What is a share?

A share represents the smallest recognized fraction of ownership

in a publicly held business. )ach such fraction of ownership is

represented in the form of a certificate known as a share

certificate. "he breaking up of total ownership of a business

into small fragments, each fragment represented by a share

certificate, enables them to be easily bought and sold.

What is a stock exchange?

The institution where this buying and selling of shares

essentially takes place is the Stock Exchange.

!n the absence of stock exchanges, ie. !nstitutions where small

chunks of businesses could be traded, there would be no modern

business in the form of publicly held companies. "oday, owing

to the stock exchanges, one can be part owners of one company

today and another company tomorrow one can be part owners

in several companies at the same time one can be part owner in

a company hundreds or thousands of miles away one can be all

of these things. "hus by enabling the convertibility of ownership

in the product market into financial assets, namely shares, stock

exchanges bring together buyers and sellers *or their

representatives+ of fractional ownerships of companies. And for

that very reason, activities relating to stock exchanges are also

appropriately enough, known as stock market or security

market. Also a stock exchange is distinguished by a specific

locality and characteristics of its own, mostly a stock exchange

is also distinguished by a physical location and characteristics of

its own. !n fact, according to ,.".-arekh, the earliest location of

the .ombay Stock )xchange, which for a long period was

known as &the native share and stock brokers/ association', was

probably under a tree around 01234

"he stock exchanges are the exclusive centers for the trading of

securities. "he regulatory framework encourages this by

virtually banning trading of securities outside exchanges. 5ntil

recently, the area of operation6 #urisdiction of exchange was

specified at the time of its recognition, which in effect precluded

competition among the exchanges. "hese are called regional

exchanges. !n order to provide an opportunity to investors to

invest6 trade in the securities of local companies, it is mandatory

foe the companies, wishing to list their securities, to list on the

regional stock exchange nearest to their registered office.

Characteristics of Stock Exchanges in India

"raditionally, a stock exchange has been an association of

individual members called member brokers *or simply

members or brokers+, formed for the express purpose of

regulating and facilitating buying and selling of securities

by the public and institution at large.

A stock exchange in !ndia operates with due recognition

from the government under the Securities and %ontracts

*7egulations+ Act, 089:. the member brokers are

essentially the middlemen who carry out the desired

transactions in securities on behalf of the public*for a

commission+ or on their own behalf. $ew membership to a

Stock )xchange is through election by the governing

board of that stock exchange.

At present, there are ;< stock exchanges in !ndia, the

largest among them being the .ombay Stock )xchange.

.S) alone accounts for over 13= of the total volume of

transactions in shares.

"ypically, a stock exchange is governed by a board

consisting of directors largely elected by the member

brokers, and a few nominated by the government.

>overnment nominee include representatives of the

ministry of finance, as well as some public representatives,

who are expected to safeguard the public interest in the

functioning of the exchanges. A president, who is an

elected member, usually nominated by the government

from among the elected members, heads the board. "he

executive director, who is usually appointed by the by the

stock exchange with the government approval is the

operational chief of the stock exchange. ,is duty is to

ensure that the day to day operations the Stock )xchange

are carried out in accordance with the various rules and

regulations governing its functioning.

"he overall development and regulation of the securities

market has been entrusted to the Securities and )xchange

.oard of !ndia *S).!+ by an act of parliament in 088;.

All companies wishing to raise capital from the public are

required to list their securities on at least one stock

exchange. "hus, all ordinary shares, preference shares and

debentures of the publicly held companies are listed in the

stock exchange.

Exchange management

?ade some attempts in this direction, but this did not materially

alter the situation. !n view of the less than satisfactory quality, of

administration of broker@managed exchanges, the finance

minister in march ;330 proposed demutualisation of exchanges

by which ownership, management and trading membership

would be segregated from each other. "he regulators are

working towards implementing this. Of the ;< stock exchanges

in !ndia, two stock exchanges viz., O"%)! and $S) are already

demutualised. .oard of directors, which do not include trading

members, manages these. "heses are purest form of

demutualised exchanges, where ownership, management and

trading are in the hands of three sets of people. "he concept of

demutualisation completely eliminates any conflict of interest

and helps the exchange to pursue market efficiency and

investors interest aggressively.

ole of SE!I

"he S).!, that is, the Securities and the )xchange .oard of

!ndia, is the national regulatory body for the securities market,

set up under the securities and )xchange .oard of !ndia act,

088;, to &protect the interest of investors in securities and to

promote the development of, and to regulate the securities

market and for matters connected therewith and incidental too.'

S).! has its head office in ?umbai and it has now set up

regional offices in the metropolitan cities of Aolkata, Belhi, and

%hennai. "he .oard of S).! comprises a %hairman, two

members from the central government representing the

ministries of finance and law, one member from the 7eserve

.ank of !ndia and two other members appointed by the central

government.

As per the S).! act, 088;, the power and functions of the .oard

encompass the regulation of Stock )xchanges and other

securities markets registration and regulation of the working

stock brokers, sub@brokers, bankers to an issue *a public offer of

capital+, trustees of trust deeds, registrars to an issues, merchant

bankers, under writers, portfolio managers, investment advisors

and such other intermediaries who may be associated with the

stock market in any way registration and regulations of mutual

funds promotion and regulation of self@ regulatory

organizations prohibiting Craudulent and unfair trade practices

and insider trading in securities markets regulating substantial

acquisition of shares and takeover of companies calling for

information from,undertking inspection, conducting inquiries

and audits of stock exchanges, intermediaries and self@

regulatory organizations of the securities market performing

such functions and exercising such powers as contained in the

provisions of the %apital !ssues *%ontrol+ Act,08D2 and the

Securities %ontracts *7egulation+ Act, 089:, levying various

fees and other charges, conducting necessary research for above

purposes and performing such other functions as may be

prescribes from time to time.

S).! as the watchdog of the industry has an important and

crucial role in the market in ensuring that the market participants

perform their duties in accordance with the regulatory norms.

"he Stock )xchange as a responsible Self 7egulatory

Organization *S7O+ function to regulate the market and its

prices as per the prevalent regulations. S).! and the )xchange

play complimentary roles to enhance the investor protection and

the overall quality of the market.

"embership

"he trading platform of a stock exchange is accessible only to

brokers. "he broker enters into trades in exchanges either on his

own account or on behalf of clients. "he clients may place their

order with them directly or a sub@broker indirectly. A broker is

admitted to the membership of an exchange in terms of the

provisions of the S%7A, the S).! act 088;, the rules, circulars,

notifications, guidelines, etc. prescribed there under and the

byelaws, rules and regulations of the concerned exchange. $o

stockbroker or sub@broker is allowed to buy, sell or deal in

securities, unless he or she holds a certificate of registration

granted by S).!. A broker6sub@broker compiles with the code of

conduct prescribed by S).!.

"he stock exchanges are free to stipulate stricter requirements

for its members than those stipulated by S).!. "he minimum

standards stipulated by $S) for membership are in excess of the

minimum norms laid down by S).!. "he standards for

admission of members laid down by $S) stress on factors, such

as, corporate structure, capital adequacy, track record, education,

experience, etc. and reflect the conscious endeavors to ensure

quality broking services.

#isting

Eisting means formal admission of a security to the trading

platform of a stock exchange, invariably evidenced by a listing

agreement between the issuer of the security and the stock

exchange. Eisting of securities on !ndian Stock )xchanges is

essentially governed by the provisions in the companies act,

089:, S%7A, S%77, rules, bye@laws and regulations of the

concerned stock exchange, the listing agreement entered into by

the issuer and the stock exchange and the circulars6 guidelines

issued by central government and S).!.

Index ser$ices

Stock index uses a set of stocks that are representative of the

whole market, or a specified sector to measure the change in

overall behavior of the markets or sector over a period of time.

!ndia !ndex Services ( -roducts Eimited *!!SE+, promoted by

$S) and %7!S!E, is the only specialized organization in the

country to provide stock index services.

Trading "echanism

All stock exchanges in !ndia follow screen@based trading

system. $S) was the first stock exchange in the country to

provide nation@wide order@driven, screen@based trading system.

$S) model was gradually emulated by all other stock

exchanges in the country. "he trading system at $S) known as

the $ational )xchange for Automated "rading *$)A"+ system is

an anonymous order@driven system and operates on a strict

price6time priority. !t enables members from across the countries

to trade simultaneously with enormous ease and efficiency.

$)A" has lent considerable depth in the market by enabling

large number of members all over the country to trade

simultaneously and consequently narrowed the spreads

significantly. A single consolidated order book for each stock

displays, on a real time basis, buy and sell orders originating

from all over the country. "he bookstores only limit orders,

which are orders to buy or sell shares at a stated quantity and

stated price. "he limit order is executed only if the price

quantity conditions match. "hus, the $)A" system provides an

open electronic consolidated limit order book *O)%EO.+. "he

trading system provides tremendous flexibility to the users in

terms of kinds of orders that can be placed on the system.

Several time@related *>ood@"ill@%ancelled, >ood@"ill@Bay,

!mmediate@or@%ancel+, price related *buy6sell limit and stop@loss

orders+ or volume related *All@or@$one, ?inimum Cill, etc.+

conditions van be easily built into an order. Orders are sorted

and match automatically by the computer keeping the system

transparent, ob#ective and fair. "he trading system also provides

complete market information on@line, which is updated on real

time basis. "he trading platform of the %? segment of $S) is

accessed not only from the computer terminals from the

premises of brokers spread over D;3 cities, but also from the

personal computers in the homes of investors through the

internet and from the hand@held devices through FA-. "he

trading platform of .S) is also accessible from D33 cities.

!nternet trading is available on $S) and .S), as of now. S).!

has approved the use of !nternet as an order routing system, for

communicating clients/ orders to the exchanges through brokers.

S).!@ registered brokers can introduce internet@based trading

after obtaining permission from the respective Stock )xchanges.

S).! has stipulated the minimum conditions to be fulfilled by

trading members to start internet@based trading and services.

$S) was the first exchange in the country to provide web@based

access to investors to trade directly on the exchange. !t launched

!nternet trading in Cebruary ;333. !t was followed by the launch

of !nternet trading by .S) in ?arch ;330. "he orders

originating from the personal computers *-%s+ of investors are

routed through the !nternet tot eh trading terminals of the

designated brokers with whom they have relations and further to

the exchange of trade execution. Soon after these orders get

matched and result into trades, the investors get confirmation

about them on their -%s through the same !nternet routes.

S).! approved trading through wireless medium or FA-

platform. $S) is the only exchange to provide access to its

order book through the hand held devices, which use FA-

technology. "his serves primarily retail investors who are

mobile and want to trade from any place when the market prices

for st3ocks of their choice are attractive.

%emat Trading

A depository holds securities in dematerialized form. !t

maintains ownership records of securities in a book entry form

and also effects transfer of ownership through book entry. S).!

has introduced some degree of compulsion in trading and

settlement of securities in dematerialized form. Fhile the

investors have a right to hold securities in either physical or

demat form, S).! has mandated compulsory trading and

settlement of securities in dematerialized form. "his was

initially introduced for institutional investors and was later

extended to all investors. Starting with 0; scrips on Ganuary 09,

0881, all investors are required to mandatorily trade in

dematerialized form in respect of ;,<<9 securities as at end@

Gune, ;330.

Since the introduction of the depository system,

dematerialization has progressed at a fast pace and has gained

acceptance among the participants in the market. All actively

traded scrips are held, traded and settled in demat form. "he

details of progress in dematerialization in two depositories, viz.,

$SBE and %BSE., are presented as belowH

!n a S).! working paper titled IBematerializationH A Silent

7evolution in the !ndian %apital ?arket/ released in April ;333,

it has been observed that !ndia has achieved a very high level of

dematerialization in less than three years/ time, and currently

more than 88=of trades settle in demand form. %ompetition and

regulatory developments facilitated reduction in custodial

charges and improvements in qualities of service standards. The

paper obser$es that one imminent and apparent immediate

benefit of competition between the two depositories is fall in

settlement and other charges. Competition has been dri$ing

impro$ement in ser$ice standards. Bepository facility has

effected changes in stock market microstructure. .readth and

depth of investment culture has further got extended to interior

areas of the country faster. )xplicit transaction cost has been

falling due to dematerialization. Bematerialization substantially

contributed to the increased growth in the turnover.

Bematerialization growth in !ndia is the quickest among all

emerging markets and also among developed markets excepting

for the 5.A and ,ong Aong.

I&T'%(CTI'&

"he Stock )xchange, ?umbai, popularly known as J.S)J was

established in 0129 as J"he $ative Share and Stock .rokers

AssociationJ, as a voluntary non@profit making association. !t

has evolved over the years into its present status as the premier

Stock )xchange in the country. !t may be noted that the Stock

)xchanges is the oldest one in Asia, even older than the "okyo

Stock )xchange, which was founded in 0121.

"he )xchange, while providing an efficient and transparent

market for trading in securities, upholds the interests of the

investors and ensures redressal of their grievances, whether

against the companies or its own member@brokers. !t also strives

to educate and enlighten the investors by making available

necessary informative inputs and conducting investor education

programmes.

A >overning .oard comprising of 8 elected directors *one third

of them retire every year by rotation+, two S).! nominees, a

7eserve .ank of !ndia nominee, six public representatives and

an )xecutive Birector is the apex body, which decides the

policies and regulates the affairs of the )xchange.

"he )xecutive Birector as the %hief )xecutive Officer is

responsible for the day@to@day administration of the )xchange.

"he average daily turnover of the )xchange during the year

;333@;330 *April@?arch+, was 7s.<81D.08 crores and average

number of daily trades was 9.:8 lakhs. ,owever, the average

daily turnover of the )xchange during the year ;330@ ;33; has

declined to 7s. 0;DD.03 crores and number of average daily

trades during the period to 9.02 lakhs. "he ban on all deferral

products like .E)SS and AE.? in the !ndian capital ?arkets

by S).! w.e.f. Guly ;, ;330, abolition of account period

settlements, introduction of %ompulsory 7olling Settlements in

all scrips traded on the )xchanges w.e.f. Becember <0, ;330,

etc. have adversely impacted the liquidity and consequently

there is a considerable decline in the daily turnover at the

)xchange.

C)*IT)# #ISTE% )&% ")+ET C)*IT)#I,)TI'&.

"he Stock )xchange, .ombay *.S)+ is the premier Stock

)xchange in !ndia. "he .S) accounted for D: per cent of listed

companies on an all !ndia basis as on <0st ?arch 088D. !t

ranked first in terms of the number of listed companies and

stock issues listed. "he capital listed in the .S) as on <0st

?arch 088D accounted for 93= of the overall capital listed on

all the stock exchanges. !ts share of the market capitalization

was around 2D= as on the same date. "he paid@up capital of

equity, debentures6bonds and preference were 2<=, <0=, DD=

respectively of the overall capital listed on all the Stock

)xchanges as on the same date.

On the .S), the Steel Authority of !ndia had the largest market

capitalization of 7s.08, 831 crores as on the <0st ?arch, 088D

followed by the State .ank of !ndia with the market

capitalization of 7s.0:, 23; crores and ?ahanagar "elephone

$igam Eimited with the market capitalization of 7s.00, 233

crores.

!SE SE&SE-

"he !SE SE&SE-, short form of Sensitive !ndex, first

compiled in 081: is a &market %apitalization@Feighted' index

of <3 component stocks representing a sample of large, well@

established and financially sound companies. "he index is

widely reported in both, the domestic international, print

electronic media and is widely used to measure the used to

measure the performance of the !ndian stock markets.

"he .S) S)$S)K is the benchmark index of the !ndian capital

market and one, which has the longest social memory. !n fact

the SE&SE- is considered to be the pulse of the !ndian stock

markets. !t is the oldest index in !ndia and has acquired a unique

place in collective consciousness of the investors. Curther, as the

oldest index of the !ndian Stock ?arket, it provides time series

data over a fairly long period of time. Small wonder that the

SE&SE- has over the years has become one of the most

prominent brands of the %ountry.

'b.ecti$es of SE&SE-

"he !SE SE&SE- is the benchmark index with wide

acceptance among individual investors, institutional investors,

foreign investors, foreign investors and fund managers. "he

ob#ectives of the index areH

To measure market mo$ements

>iven its long history and its wide acceptance, no other

index matches the !SE

SE&ES- in the reflecting market movements and

sentiments. SE&SE- is widely

used to describe the mood in the !ndian stock markets.

!enchmark for funds performance

"he inclusion of blue chip companies and the wide and

balanced industry 7epresentation in the SE&SE-

makes it the ideal benchmark for fund managers to compare

the performance of their funds.

/or index based deri$ati$es products

!nstitutional investors, money managers and small investors,

all refer to the !SE

SE&SE- for their specific purposes. "he !SE SE&SE- is

in effect the proxy for

the !ndian stock markets. Since SE&SE- comprises of the

leading companies in

all the significant sectors in the economy, we believe that it

will be the most liquid

contract in the !ndian market and will garner a predominant

market share.

Companies represented in the SE&SE-

Company name Sector

0)s on 12.34.315

,industan lever C?%>

7eliance limited %hemicals and

petrochemicals

!nfosys technologies !nformation technology

7eliance petroleum Oil and gas

!"% C?%>

State bank of !ndia Cinance

?"$E "elecom

Satyam computers !nformation technology

Lee telefilms ?edia

7anbaxy labs ,ealthcare

!%!%! Cinance

Earsen ( toubro Biversified

%ipla ,ealthcare

,indalco ?etals and mining

,-%E ?etal and mining

"!S%O ?etal and mining

$estle C?%>

Trading System

"ill $ow, buyers and sellers used to negotiate face@to@face on

the trading floor over a security until agreement was reached

and a deal was struck in the open outcry system of trading, that

used to take place in the trading ring. "he transaction details of

the account period *called settlement period+ were submitted for

settlement by members after each trading session.

"he computerized settlement system initiated the netting and

clearing process by providing on a daily basis statements for

each member, showing matched and unmatched transactions.

Settlement processing involves computation of each memberMs

net position in each security, after taking into account all

transactions for the member during the settlement period, which

is 03 working days for group MAM securities and 9 working days

for group M.M securities.

"rading is done by members and their authorized assistants from

their "rader Fork Stations *"FS+ in their offices, through the

.S) On@Eine "rading *.OE"+ system. .OE" system has

replaced the open outcry system of trading. .OE" system

accepts two@way quotations from #obbers, market and limit

orders from client@brokers and matches them according to the

matching logic specified in the .usiness 7equirement

Specifications *.7S+ document for this system.

"he matching logic for the %arry@Corward System as in the case

of the regular trading system is quote driven with the order book

functioning as an Jauxiliary #obberJ.

T)%I&6

T)%I&6

"he )xchange, which had an open outcry trading system, had

switched over to a fully automated computerized mode of

trading known as .OE" *.S) on Eine "rading+ System.

"hrough the .OE" system the members now enter orders from

"rader Fork Stations *"FSs+ installed in their offices instead of

assembling in the trading ring. "his system, which was initially

both order and quote driven, was commissioned on ?arch 0D,

0889. ,owever, the facility of placing of quotes has been

removed w.e.f., August 0<, ;330 in view of lack of market

interest and to improve system@matching efficiency. "he system,

which is now only order driven, facilitates more efficient

processing, automatic order matching and faster execution of

orders in a transparent manner.

)arlier, the members of the )xchange were permitted to open

trading terminals only in ?umbai. ,owever, in October 088:,

the )xchange obtained permission from S).! for expansion of

its .OE" network to locations outside ?umbai. !n terms of the

permission granted by S).! and certain modifications

announced later, the members of the )xchange are now free to

install their trading terminals at any place in the country. Shri -.

%hidambaram inaugurated the expansion of .OE" network the

then Cinance ?inister, >overnment of !ndia on August <0, 0882.

!n order to expand the reach of .OE" network to centers outside

?umbai and support the smaller 7egional Stock )xchanges, the

)xchange has, as on ?arch <0, ;33;, admitted subsidiary

companies formed by 0< 7egional Stock )xchanges as its

members. "he members of these 7egional Stock )xchanges

work as sub@brokers of the member@brokers of the )xchange.

"he ob#ectives of granting membership to the subsidiary

companies formed by the 7egional Stock )xchanges were to

reach out to investors in these centers via the members of these

7egional )xchanges and provide the investors in these areas

access to the trading facilities in all scrips listed on the

)xchange.

"rading on the .OE" System is conducted from ?onday to

Criday between 8H99 a.m. and <H<3 p.m. "he scrips traded on the

)xchange have been classified into MAM, M.0M, M.;M, MCM and MLM

groups. "he number of scrips listed on the )xchange under MAM,

M.0 M, M.;M and MLM groups, which represent the equity segment, as

on ?arch <0, ;33; was 02<, 9:3,08<3 and <3DD respectively.

"he MCM group represents the debt market *fixed income

securities+ segment wherein 2D1 securities were listed as on

?arch <0, ;33;. "he MLM group was introduced by the )xchange

in Guly 0888 and covers the companies which have failed to

comply with listing requirements and6or failed to resolve

investor complaints or have not made the required arrangements

with both the Bepositories, viz., %entral Bepository Services *!+

Etd. *%BSE+ and $ational Security Bepository Etd. *$SBE+ for

dematerialization of their securities by the specified date, i.e.,

September <3, ;330. %ompanies in JLJ group numbered <3DD as

on ?arch <0, ;33;. Of these, 0D;8 companies were in JLJ

group for not complying with the provisions of the Eisting

Agreement and6or pending investor complaints and the balance

0:09 companies were on account of not making arrangements

for dematerialization of their securities with both the

Bepositories. 0:09 companies have been put in JLJ group as a

temporary measure till they make arrangements for

dematerialization of their securities. Once they finalize the

arrangements for dematerialization of their securities, trading

and settlement in their scrips would be shifted to their respective

erstwhile groups.

"he )xchange has also the facility to trade in J%J group which

covers the odd lot securities in MAM, M.0M, M.;M and MLM groups and

7ights renunciations in all the groups of scrips in the equity

segment. "he )xchange, thus, provides a facility to market

participants of on@line trading in odd lots of securities and

7ights renunciations. "he facility of trading in odd lots of

securities not only offers an exit route to investors to dispose of

their odd lots of securities but also provides them an opportunity

to consolidate their securities into market lots.

"he M%M group can also be used by investors for selling upto 933

shares in physical form in respect of scrips of companies where

trades are to be compulsorily settled by all investors in demat

mode. "his scheme of selling physical shares in compulsory

demat scrips is called as )xit 7oute Scheme.

Fith effect from Becember <0, ;330, trading in all securities

listed in equity segment of the )xchange takes place in one

market segment, viz., %ompulsory 7olling Settlement Segment.

*ermitted Securities

"he )xchange has since decided to permit trading in the

securities of the companies listed on other Stock )xchanges

under J -ermitted SecuritiesJ category which meet the relevant

norms specified by the )xchange. Accordingly, to begin with the

)xchange has permitted trading in scrips of five companies

listed on other Stock )xchanges w.e.f. April ;;, ;33;6

Computation of closing price of scrips in the Cash Segment7

"he closing prices of scrips are computed on the basis of

weighted average price of all trades in the last 09 minutes of the

continuous trading session. ,owever, if there is no trade during

the last 09 minutes, then the last traded price in the continuous

trading session is taken as the official closing price.

)5 Compulsory olling Segment 0CS57

Compulsory olling Settlement 0CS5 Segment7

Fith a view to introduce the best international trading practices

and to achieve higher settlement efficiency, as mandated by

S).!, trades in all the equity shares listed on the )xchange in

%7S Segment were to be settled on "N9 basis w.e.f. Becember

<0, ;330. S).! has further directed the Stock )xchanges that

trades in all scrips w.e..f. April 0, ;33; should be settled on "N<

basis. Accordingly, all transactions in all groups of securities in

the equity segment and fixed income securities listed on the

)xchange are settled on "N< basis w.e.f. April 0, ;33;

5nder a rolling settlement environment, the trades done on a

particular day are settled after a given number of business days

rather than settling all trades done during a period at the end of

an Maccount periodM. A "N< settlement cycle means that the final

settlement of transactions done on " or trade day by exchange of

monies and securities, occurs on fifth business day after the

trade day.

"he transactions in securities of companies which have made

arrangements for dematerialization of their securities by the

stipulated date are settled only in Bemat mode on "N< on net

basis, i.e., buy and sale positions in the same scrip are netted and

the net quantity is to be settled. ,owever, transactions in

securities of companies, which have failed to make

arrangements for dematerialization of their securities or 6are in

JLJ group, are settled only on trade to trade basis on "N< i.e.,

the transactions are settled on a gross basis and the facility of

netting of buy and sale transactions in a scrip is not available.

Cor example, if one buys and sells 033 shares of a company on

the same day which is on trade to trade basis, the two positions

will not be netted and he will have to first deliver 033 shares at

the time of pay@in of securities and then receive 033 shares at

the time of pay@out of securities on the same day. "hus, if one

fails to deliver the securities sold at the time of pay@in, it will be

treated as a shortage and the position will be auctioned6 closed@

out.

!n other words, the transactions in scrips of companies which

are in compulsory demat are settled in demat mode on "N< on

netting basis and the transactions in scrips of companies, which

have not made arrangements for dematerialization of their

securities by the stipulated date or are in JLJ group for other

reasons, are settled on trade to trade basis on "N< either in

demat mode or in physical mode.

"he settlement of transactions in MCM group securities

representing Cixed !ncome Securities is also on 7olling

Settlement %ycle of "N< basis.

"he following tables summarizes the steps in the trading and

settlement cycle for scrips under %7SH

BAO A%"!P!"O

"rading on .OE" and daily downloading of statements

showing details of transactions and margins at the end of each

trading day.

:A62A entry by the member@brokers.

"N0

%onfirmation of :A62A data by the %ustodians. Bownloading

of securities and funds obligation statement by members.

"N<

-ay@in of funds and securities by 00H33 a.m. and pay@out of

funds and securities by ;H33 p.m

"ND

Auction on .OE".

"N9

Auction pay@in and pay@out.

Q :A62A H A mechanism whereby the obligation of settling the

transactions done by a member@broker on behalf of a client is

passed on to a custodian based on his confirmation.

"hus, the pay@in and pay@out of funds and securities takes places

on the <rd working day of the execution of the trade.

"he !nformation Systems Bepartment of the )xchange generates

the following statements, which can be downloaded by the

members in their back offices on a daily basis.

Statements giving details of the daily transactions entered into

by the members.

Statements giving details of margins payable by the members in

respect of the trades executed by them.

"he settlement of the trades *money and securities+ done by a

member on his own account or on behalf of his individual,

corporate or institutional clients may be either through the

member himself or through a S).! registered %ustodian

appointed by him or the respective client. !n case the

delivery6payment is to be given or taken by a registered

%ustodian, he has to confirm the trade done by a member on the

.OE" System through :A@2A entry. Cor this purpose, the

%ustodians have been given connectivity to .OE" System and

have also been admitted as members of the %learing ,ouse. !n

case a transaction is not confirmed by a registered %ustodian,

the liability for pay@in of funds or securities in respect of the

same devolves on the concerned member.

"he introduction of settlement on "N< basis has resulted in

reduction in settlement risk, provided early receipt of securities

and monies to buyers and sellers respectively and brought

!ndian %apital ?arkets at the international standard of

settlements

Settlement

Pay-in and Pay-out for 'A', 'B1', 'B2', 'C', "F" & 'Z' group of

securities

As discussed earlier, the trades done by members in all the

securities in %7S are now settled by payment of money and

delivery of securities on "N< basis. All deliveries of securities

are required to be routed through the %learing ,ouse, except for

certain off@market transactions which, although are required to

be reported to the )xchange, may be settled directly between the

members concerned.

"he %learing ,ouse is an independent company promoted

#ointly by .ank of !ndia and Stock )xchange, ?umbai for

handling the clearing and settlement operations of funds and

securities on behalf of the )xchange. Cor this purpose, the

%learing ( Settlement Bept. of the )xchange liaises with the

%learing ,ouse on a day to day basis.

"he !nformation Systems Bepartment *!SB+ of the )xchange

generates Belivery and 7eceive Orders for transactions done by

the members in A, .0, .; and C group scrips after netting

purchase and sale transactions in each scrip whereas Belivery

and 7eceive Orders for J%J and JLJ group scrips are generated

on trade to trade basis, i.e., without netting of purchase and sale

transactions in a scrip.

"he Belivery Orders provide information like scrip, quantity

and the name of the receiving member to whom the securities

are to be delivered through the %learing ,ouse. "he ?oney

Statement provides scrip wise6item wise details of

payments6receipts for the settlement. "he Belivery67eceive

Orders and money statements can be downloaded by the

members in their back offices

"he bank accounts of members maintained with the eight

clearing banks, viz., .ank of !ndia, ,BC% .ank Etd., >lobal

"rust .ank Etd., Standard %hartered .ank, %enturion .ank Etd.,

5"! .ank Etd., !%!%! .ank Etd., and !ndusind .ank Etd., are

directly debited through computerized posting for their

settlement and margin obligations and credited with receivables

on accounts of pay@out dues and refund of margins.

"he securities, as per the Belivery Orders issued by the

)xchange, are required to be delivered by the members in the

%learing ,ouse on the day designated for securities pay@in, i.e.,

on "N< day. !n case of the physical securities, the members have

to deliver the securities in special closed pouches *supplied by

the )xchange+ along with the relevant details *distinctive

numbers, scrip code, quantity, and receiving member+ on a

floppy. "he data submitted by the members on floppies is

matched against the master file data on the %learing ,ouse

computer systems. !f there are no discrepancies, then a scroll

number is generated by the %learing ,ouse and a scroll slip is

issued. "he members can then submit the securities at the

receiving counter in the %learing ,ouse

)uto %.'. facility7

!nstead of issuing Belivery Out instructions for their delivery

obligations in a settlement 6auction, a facility has been made

available to the members of automatically generating Belivery@

Out *B.O.+ instructions on their behalf from their %? -ool A6cs

by the %learing ,ouse w.e.f., August 03, ;333. "his Auto B.O.

facility is available for %7S *$ormal ( Auction+ and for trade@

to@trade settlements. "his facility is, however, not available for

delivery of non@pari passu shares and shares having multiple

!S!$s. "he members wishing to avail of this facility have to

submit an authority letter to the %learing ,ouse. "his Auto B.O

facility is currently available only for %learing ?ember *%?+

-ool accounts6-rincipal Accounts maintained by the members

with $ational Securities Bepository Etd. *$SBE+ and %entral

Bepositories Services Etd. *%BSE+

%emat pay8in7

"he members can effect demat pay@in either through %entral

Bepository Services *!+ Etd. *%BSE+ or $ational Securities

Bepository Etd. *$SBE+. !n case of $SBE, the members are

required to give instructions to their Bepository -articipant *B-+

specifying settlement no., settlement type, effective pay@in date,

quantity, etc. "he securities are transferred to the -ool Account.

"he members are required to give delivery@out instructions so

that the securities are considered for pay@in.

As regards %BSE, the members give pay@in instructions to their

B-. "he securities are transferred to %learing ?ember *%?+

-rincipal Account. "he members are required to give

confirmation to their B-, so that securities are processed towards

pay@in obligations. Alternatively, members may also effect pay@

in from clientsM beneficiary accounts for which member are

required to do break@up on the front@end software to generate

obligation and settlement !B.

"he %learing ,ouse arranges and tallies the securities received

against the receiving member wise report generated on the -ay@

in day. Once this reconciliation is complete, the bank accounts

of members with seven clearing banks having pay@in positions

are debited on the scheduled pay@in day. "his procedure is called

Cunds -ay@in. !n case of the demat securities, the securities are

credited in the -ool Account of the members or the %lient

Accounts as per the client details submitted by the members. !n

case of -hysical securities, the 7eceiving ?embers collect

securities from the %learing ,ouse on the payout day and the

accounts of the members having payout are credited on Criday.

"his is referred to as -ayout. !n case of the 7olling Settlements,

pay@in and payout of both funds and securities is on the same

day, in case of Feekly settlements, pay@in of funds and

securities is on "hursday and payout is on Criday.

"he auction is conducted for those securities which members

fail to deliver6short deliver during the -ay@in. !n case the

securities are not received in an auction, the positions are closed

out as per the closeout rate fixed by the )xchange in accordance

with the prescribed rules. "he close out rate is calculated as the

highest rate of the scrip recorded in the settlement in which the

trade was executed and in the subsequent settlement upto the

day prior to the day of auction, or ;3= above the closing price

on the day prior to the day of auction, whichever is higher.

,owever, in case of close@out for shares under ob#ection or

traded in J%J group, 03= instead of ;3= above the closing price

on the day prior to the day of auction and the highest price

recorded in the settlement in which trade took place upto a day

prior to auction is considered.

"he )xchange has strictly adhered to the settlement schedules

for various groups of securities and there has been no case of

clubbing of settlements or postponement of pay@in and pay@out

during the last six years.

"he )xchange is also maintaining a database of fake6forged,

stolen, lost and duplicate securities with the %learing ,ouse so

that distinctive numbers submitted by members on delivery may

be matched against the database to weed out bad paper from

circulation at the time of introduction of such securities in the

market. "his database has also been made available to the

members so that delivering and receiving members can check

the entry of fake, forged and stolen shares in the market

S9'T)6ES )&% '!:ECTI'&S

Shortages & consequent actions

"he members download Belivery67eceive Orders based on their

netted positions for transactions entered into by them during a

settlement in MAM, M.0M, M.;M, and MCM group scrips and on trade to

trade basis, i.e., without netting buy and sell transactions in

scrips in J%J ( MLM groups and scrips in .0 and .; groups which

have been put on trade to trade basis as a surveillance measure.

"he seller members have to deliver the shares in the %learing

,ouse as per the Belivery Orders downloaded. !f a seller

member is unable to deliver the shares on the -ay@in day for any

reason, his bank account is debited at the standard rate *which is

equal to the closing price of the scrip on the day of trading+

fixed by the )xchange for the quantity of shares short delivered.

"he %learing ,ouse arrives at the shortages in delivery of

various scrips by members on the basis of their delivery

obligations and actual delivery.

"he members can download the statement of shortages on "N<

in 7olling Settlements. After downloading the shortage details,

the members are expected to verify the same and report

discrepancy , if any, to the %learing ,ouse by 0H33 p.m. !f no

discrepancy is reported within the stipulated time, the %learing

,ouse assumes that the shortage of a member is in order and

proceeds to auction the same. ,owever, in M%M group, i.e., Odd

Eot segment the members are themselves required to report the

shortages to the %learing ,ouse.

"he )xchange issues an Auction "ender $otice to the members

informing them about the names of the scrips, quantity slated for

auction and the date and time of the auction session on the

.OE". "he auction for the undelivered quantities is conducted

on "ND for all the scrips under compulsory 7olling Settlements.

"he auction offers received in batch mode are electronically

matched with the auction quantities so as to award the Mbest

priceM. "he members who participate in the auction session can

download the Belivery Orders on the same day, if their offers

are accepted. "he members are required to deliver the shares in

the %learing ,ouse on the auction -ay@in day, i.e, "N9. -ay@Out

of auction shares and funds is also done on the same day, i.e.,

"N9. "he various auction sessions relating to shortages, and bad

deliveries are now conducted during normal trading hours on

.OE". "hus, it is possible to schedule multiple auction sessions

on a single trading day.

!n auction, the highest offer price is allowed upto the close@out

rate and the lowest offer price can be ;3= below the closing

price on a day prior to day of auction. A member who has failed

to deliver the securities of a particular company on the pay@in

day is not allowed to offer the same in auction. ,e can,

however, participate in auction of other scrips.

!n case no offers are received in auction for a particular scrip,

the sale transaction is closed@out at a close@out price, determined

by higher of the followingH@

@ ,ighest price recorded in the scrip from the settlement in

which the transaction took place upto a day prior to the day of

the auction.

O7

@ ;3= above the closing price on a day prior to the day of

auction.

,owever, in case of the close@out of the shares under ob#ection

and shortages in J%J or JLJ group, 03= above the closing prices

of the scrips on the pay@out day of the respective settlement are

considered instead of ;3=.

Curther, if the auction price6close@out price of a scrip is higher

than the standard price of the scrip in the settlement in which the

transaction was done, the difference is recovered from the seller

who failed to deliver the scrip. ,owever, in case, auction6 close@

out price is lower than standard price, the difference is not given

to the seller but is credited by the )xchange to the %ustomers

-rotection Cund. "his is to ensure that the seller does not benefit

from his failure to meet his delivery obligation. Curther, if the

offeror member fails to deliver the shares offered in auction,

then the transactions is closed@out as per the normal procedure

and the original selling member pays the difference below the

standard rate and offer rate and the offeror member pays the

difference between the offer rate and close@out rate.

Self )uction

As has been discussed in the earlier paragraphs, the Belivery

and 7eceive Orders are issued to the members after netting off

their purchase and sale transactions in scrips where netting of

purchase and sale positions is permitted. !t is likely in some

circumstances that a selling client of a member has failed to

deliver the shares to him. ,owever, this did not result in a

memberMs failure to deliver the shares to the %learing ,ouse as

there was a purchase transaction of some other buying client of

the member in the same scrip and the same was netted off for

the purpose of settlement. ,owever, in such a case, the member

would require shares so that he can deliver the same to his

buying client, which otherwise would have taken place from the

delivery of shares by the seller. "o provide shares to the

members, so that they are in a position to deliver them to their

buying clients in case of internal shortages, the members have

been given an option to submit floppies for conducting self@

auction *i.e., as if they have defaulted in delivery of shares to the

%learing ,ouse+. Such floppies are to be given to the %learing

,ouse on the pay@in day. "he internal shortages reported by the

members are clubbed with the normal shortages in a settlement

and the %learing ,ouse for the combined shortages conducts the

auction. A member after getting delivery of shares from the

%learing ,ouse in self@auction credits the shares to the

.eneficiary account of his client or hand over the same to him in

case securities received are in physical form and debits his seller

client with the amount of difference, if any, between the auction

price and original sale price

!5 'b.ections

Fhen receiving members collect the physical securities from

the %learing ,ouse on the -ayout day, the same are required to

be checked by them for good delivery as per the norms

prescribed by the S).! in this regard. !f the receiving member

does not consider the securities good delivery, he has to obtain

an arbitration award from the arbitrators and submit the

securities in the %learing ,ouse on the following day of the

-ay@Out *"ND+. "he %learing ,ouse returns these securities to

the delivering members on the same day, i.e., *"ND+. !f a

delivering members feels that arbitration awards obtained

against him is incorrect, he is required to obtain arbitration

award for invalid ob#ection from the members of the Arbitration

7eview %ommittee. "he delivering members are required to

rectify6replace the ob#ections and return the shares to the

%learing ,ouse on next day *"N9+ to have the entry against

them removed. "he rectified securities are delivered by the

%learing ,ouse to the buyer members on the same day *"N9+.

"he buyer members, if they are not satisfied with the

rectification, are required to obtain arbitration awards for invalid

rectification from the .ad Belivery %ell on "N: day and submit

the shares to the %learing ,ouse on the same day.

!f a member fails to rectify6replace the ob#ections then the same

are closed@out. "his is known as JOb#ection %ycleJ and the

entire process takes < days.

The following table summari;es the acti$ities in$ol$ed in the

*atawat 'b.ection Cycle of CS.

BAO A%"!P!"O

" N < -ay@out of securities of 7olling Settlement

" N D -atawat Arbitration session H

Arbitration awards to be obtained from officials of the .ad

Belivery %ell.

Securities under ob#ection to be submitted in the %learing

,ouse

Arbitration awards for invalid ob#ection to be obtained from

members of the Arbitration 7eview %ommittee

" N 9

?embers and institutions to submit rectified securities,

confirmation forms and invalid ob#ections in the clearing house

7ectified securities delivered to the receiving members

" N :

Arbitration Awards for invalid rectification to be obtained from

officials of the .ad Belivery %ell

Securities to be lodged with the clearing house

"he un@rectified and invalid rectification of securities are

directly closed@out by the %learing ,ouse instead of first

inviting the auction offers for the same.

"he shares in physical form returned under ob#ection to the

%learing ,ouse are required to be accompanied by an arbitration

award *%hukada+ except in certain cases where the receiving

members are permitted to submit securities to the %learing

,ouse without J%hukadaJ.

"hese cases are as followsH

"ransfer Beed is out of date.

%heques for the dividend ad#ustment for new shares where

distinctive numbers are given in the )xchange $otice is not

enclosed.

Stamp of the 7egistrar of %ompanies is missing.

Betails like Bistinctive $umbers, "ransferorsM $ames, etc. are

not filled, in the "ransfer Beeds.

Belivering brokerMs stamp on the reverse of the "ransfer Beed is

missing.

Fitness stamp or signature on "ransfer Beed is missing.

Signature of the transferor is missing.

Beath %ertificate *in cases where one or more of the transferors

are deceased+ is missing.

A penalty at the rate of 7s.0336@ per Belivery Order is levied on

the delivering member for delivering shares, which are not in

order. !n the event a receiving member misuses the facility of

submitting shares under ob#ection without J%hukadaJ, a penalty

of 7s.9336@ per case is charged and the penalty of 7s.0336@ per

Belivery Order levied on the delivering member is refunded to

him by debiting the receiving memberMs account

Close 'ut7

"here are cases when no offer for particular scrip is received in

an auction or when members who offer the scrips in auction, fail

to deliver the same. !n the former case, the original seller

memberMs account is debited and the buyer memberMs account is

credited at the closeout rate. !n the latter case, the offeror

memberMs account is debited and the buyer memberMs account is

credited at the close@out rate. "he closeout rates for closing the

positions in different segments are as underH

/or <)< = <!1< = <!>< = <,<? <olling demat< and </< group

"he closeout rate is higher of the following ratesH

"he highest rate of the scrip from the first day *trading day in

case of 7olling demat segment+ to the day prior to the day on

which the auction is conducted for the respective settlement.

;3= above the closing rate as on the day prior to the day of

auction of the respective settlement.

/or <C< group segment

"he close@out rate is higher of the following rates H

"he highest rate of the scrip from the first day to the day prior

to the day of auction of MAM, M.0M, M.;, and MLM group segment of

the respective settlements or

03= above the closing rate as on the day prior to the day of

auction of MAM, M.0M, M.;, and MLM group or

"ransaction price.

!n the M%M group, i.e., Odd Eot Segment, no auction session is

conducted. "he shortages are directly closed out.

Close 'ut7

"here are cases when no offer for particular scrip is received in

an auction or when members who offer the scrips in auction, fail

to deliver the same. !n the former case, the original seller

memberMs account is debited and the buyer memberMs account is

credited at the closeout rate. !n the latter case, the offeror

memberMs account is debited and the buyer memberMs account is

credited at the close@out rate. "he closeout rates for closing the

positions in different segments are as underH

/or <)< = <!1< = <!>< = <,<? <olling demat< and </< group

"he closeout rate is higher of the following ratesH

"he highest rate of the scrip from the first day *trading day in

case of 7olling demat segment+ to the day prior to the day on

which the auction is conducted for the respective settlement.

;3= above the closing rate as on the day prior to the day of

auction of the respective settlement.

/or <C< group segment

"he close@out rate is higher of the following rates H

"he highest rate of the scrip from the first day to the day prior

to the day of auction of MAM, M.0M, M.;, and MLM group segment of

the respective settlements or

03= above the closing rate as on the day prior to the day of

auction of MAM, M.0M, M.;, and MLM group or

"ransaction price.

!n the M%M group, i.e., Odd Eot Segment, no auction session is

conducted. "he shortages are directly closed out.

!)S+ET T)%I&6 S@STE"

"he )xchange has commenced trading in the Berivatives

Segment with effect from Gune 8, ;333 to, enable the investors

to hedge their risks. !nitially, the facility of trading in the

Berivatives Segment has been confined to !ndex Cutures.

Subsequently, the )xchange has since introduced the index

options and options ( futures in select individual stocks. "he

investors in cash market had felt a need to limit their risk

exposure in the market to movement in Sensex.

Fith a view to provide investors with this facility of creating

Sensex linked portfolios and also to create a linkage of market

prices of the underlying securities of Sensex in the %ash

Segment and Cutures on Sensex, the )xchange has provided the

facility of .asket "rading System on .OE". !n .asket "rading

System, the investors are able to buy6 sell all <3 scrips of Sensex

in the proportion of their respective weights in the Sensex, in

one go. "he investors need not calculate the quantity of Sensex

scrips to be bought or sold for creating Sensex linked portfolios

and this function is performed by the system. "he investors are

also allowed to create their own baskets by deleting certain

scrips from the Sensex basket of <3 scrips.

Curther, the .asket "rading System provides the arbitrageurs an

opportunity to take advantage of price differences in the

underlying securities of Sensex and Cutures on the Sensex by

simultaneous buying and selling of baskets covering the Sensex

scrips and Sensex Cutures. "his is expected to have balancing

impact on the prices in both cash and futures markets.

"he .asket "rading System would, thus, meet the needs of

investors and also boost the volumes and depth in cash and

futures markets.

"he .asket "rading System has been implemented by the

)xchange w.e.f. ?onday, the 0Dth August ;333. "he trades

executed under the .asket "rading System are sub#ect to intra@

day trading6gross exposure limits and daily margins as are

applicable to normal trades.. "o participate in this system the

member indicates number of Sensex basket*s+ to be bought or

sold, where the value of one Sensex basket is arrived at by the

system by multiplying 7s.93 to prevailing Sensex.

SETT#E"E&T S@STE"

Securities traded on .S) are classified into three groups,

namely, specified shares or MAM group and non@specified

securities that are sub@divided into M.0M and M.;M groups.

-resently, equity shares of thirty@two companies are classified as

specified shares. "hese companies typically have a large capital

base with widespread shareholding, a steady dividend, good

growth record and a large volume of business in the secondary

market. %ontracts in this group are allowed to be carried over to

subsequent settlements upto a maximum permissible period of

29 days.

D89 relatively liquid securities are placed in a category called

M.0M group. "he remaining securities@about 9133 as on ?ay <0,

088: are placed in the M.;M group. All newly listed securities are

placed in the M.;M group.

Settlement of transactions is done on an MAccount -eriodM basis.

"he period is a calendar week in the case of MAM and M.0M groups

and 0D calendar days in the case of M.;M group Buring an

account period, buy or sell positions in a particular security can

be either squared up by entering into contra transactions or can

be further accumulated by entering into more buy or sell

transactions.

Clearing System

"he %learing ,ouse of the )xchange handles the share and the

money parts of the settlement process in the case of MAM and M.0M

groups. "he %learing ,ouse handles only the money part of M.;M

group while securities are physically exchanged between the

brokers.

'pportunities a$ailable for foreign in$estors

0. Birect investmentH

Coreign %ompanies are now permitted to have a ma#ority

stake in their !ndian affiliates except in a few restricted

industries. !n certain specific industries, foreigners can even

have holding upto 033 per cent.

;. !nvestment through Stock )xchangesH

Coreign !nstitutional !nvestors *C!!+ upon registration with the

Securities and )xchange .oard of !ndia *S).!+ and the

7eserve .ank of !ndia *7.!+ are allowed to operate in !ndian

Stock )xchanges sub#ect to the guidelines issued for the

purpose by S).!.

!mportant requirements under the guidelines are as underH

!. -ortfolio investment in primary or secondary markets will

be sub#ect to a ceiling of ;D per cent of issued share capital

for the total holding of all registered C!!s in any one

company. "he holding of a single C!! in any one company is

sub#ect to a ceiling of 9 per cent of the total issued capital.

,owever, in applying the ceiling of ;D percent the following

are excludedH

Coreign investment under a financial collaboration

*BC!+, which is, permitted upto 90 per cent in all

priority areas.

!nvestment by C!!s through following alternative routes

Offshore Single67egional funds, >B7Ms and )uro

convertibles.

!!. Bisinvestments will be allowed only through a broker of

a Stock )xchange.

!!!. A registered C!! is required to buy or sell only for

delivery. !t should not offset a deal. !t is also not

allowed to sell short.

<. !nvestment in )uro !ssues6?utual Cunds Cloated OverseasH

Coreign investors can invest in )uro issues of !ndian

companies and in !ndia@specific funds floated abroad.

D. .roking .usinessH

Coreign brokers upon registration with the S).! are now

allowed to route the business of registered C!!s. >uideline for

the purpose have been issued by S).!. ,owever, foreign

brokers at present are not allowed membership in !ndia Stock

)xchanges.

9. Asset ?anagement %ompanies6?erchant .ankingH

Coreign -articipation in Asset ?anagement %ompanies and

?erchant .anking %ompanies is permitted.

T)&S/E '/ 'W&ES9I*

"ransfer of ownership of securities in effected through a date

stamped transfer@deed, which is signed, by the buyer and the

seller. "he duly executed transfer@deed along with the share

certificate has to be lodged with the company for change in the

ownership. A nominal duty becomes payable in the form of

stamps to be affixed on the transfer@deeds. "ransfer@deeds

remain valid for twelve months or the next book closure

following the stamped date whichever occurs later.

S)/E6()%S

0. ?argins are collected from the brokers on buying and

selling positions at the end of the day. "he total

outstanding position is further sub#ect to capital adequacy

norms laid down from time to time.

;. A comprehensive insurance cover for the )xchange and

the members is about to be put in place.

<. >uaranteeing trades is the cornerstone of a mature clearing

and settlement process. .S) is in the process of

establishing a %learing %orporation that will guarantee

trades.

D. %ompanies are required to publish half@yearly unaudited

results and other price sensitive information. "his imparts

greater transparency to the stock market operations.

9. !nsider "rading 7egulations have been laid down and a

M"ake@OverM code has been created.

)!IT)TI'& ")C9I&E@

"here exists three level arbitration machinery. "he first two

levels, which are ad#udicated by member brokers, comprise of a

two@member bench and a full bench that is to comprise of at

least sixteen members respectively. "he highest arbitrator in the

)xchange is the >overning .oard. Bisputes unresolved in the

)xchange are taken to the %ourt of Eaw.

C(ST'"E *'TECTI'& /(&%

"he ob#ective of this fund is to provide insurance to investors in

case of default by a member. "he investor is indemnified from

default to the extent of 7s.0, 33,333. "he corpus of the fund is

created by depositing ;.9= of the listing fees and a levy on

turnover at the rate or 7e.0 for 7s. 0 million of turnover. !t is

further augmented by 93= of the interest accrued on 0= of the

issue amount which is deposited by companies at the time of

their public and rights issues for a three month period as a

safeguard against non@refund of excess subscription.

6IEA)&CE E%ESS)#

"he !nvestorMs Services %ell redresses investorsM grievances

against listed companies and stockbrokers. ,owever, the

)xchange does not have power to take penal action against

listed companies, except delisting for specified periods.

%ISCI*#I&)@ )CTI'&

"he )xchange has an eight member Bisciplinary Action

%ommittee *BA%+ which decides on punitive action in

disciplinary cases referred to it by the Surveillance and

inspection departments of the )xchange Administration.

I&%ICES

"he )xchange compiles four indices, which are based on market

capitalization. "he first index to be compiled was the .S)

Sensitive !ndex with 0821@28 as the base year. !t comprises of

equity shares of <3 companies from both specified and non@

specified securities groups. "he companies have been selected

on the basis of market activity. Subsequently, a more broad

based index, .S) $ational !ndex with 081<@1D as base year,

was compiled. "his index is made up of 033 scrips, 81 of which

are quoted on .ombay. "his index also includes prices on the

other ma#or stock exchanges of Belhi, %alcutta, Ahmedabad and

?adras. !f scrip is actively quoted on more than one )xchange

the average price of the scrip is used in the compilation of the

index.

!t was felt that the sensitive index@the most popular indicator of

market movement@had become oversensitive to a handful of

scrips. Fith divestment of -ublic Sector 5nit *-S5+ equity by

government and a sharp increase in the number of companies

listed over the last few years, it was felt that a new index, which

is more representative of the recent changes and is more

balanced is necessary. "he .S)@;33, which was introduced in

?ay 088D, consists of equity shares of ;33 companies, which

have been selected on the basis of market capitalization, volume

of turnover and strength of the companiesM fundamentals. 0818@

83 has been chosen as the base year for .S)@;33.

As the presence of the foreign investors grew, a need was felt to

express the index values by taking into account the 7upee@

Bollar conversion rate. %onsequently, dividing the current

7upee market value by 7upee@Bollar modifies the .S)@;33

conversion rate in the base year. "his index, which indicates the

movement of the market in dollar values, is called the Bollex.

%ISC#'S(E B #ISTI&6 &'"S

%ompanies who wish to raise money from capital market follow

guidelines relating to disclosure, laid down by the Securities and

)xchange .oard of !ndia. Some of the disclosure norms areH

Betails of other income if it constitutes more than ten

percent of total income.

All adverse event affecting the operations of the company.

Any change in key managerial personnel.

7isk factors specific to the pro#ect and those which are

external to the company.

"he listing requirements with the )xchange call for further

disclosure by companies to promote public confidence.

!mportant disclosures areH

"he company is required to furnish unaudited half@yearly

financial results in the prescribed -erforma.

"he company must explain to the Stock )xchange any

large variation between audited and unaudited results in

respect of any item.

Fhen any person or an institution acquires or agrees to

acquire any security of a company which would result in

his holding five percent or more of the voting capital of the

company, including the existing holding the )xchange

must be notified within two days of such acquisition by the

company or by authorized intermediary or by the acquirer.

Any take@over offer made either voluntarily or

compulsorily to a company requires a public

announcement by both the offeror and the offeree

company.

Computeri;ed Trading

.S) computerized its trading and settlement activities by

following a three@phased approach.

*hase I7 "he primary ob#ective of this phase was the real time

dissemination of price data through the Bisplay !nformation

Briver System *B!BS+. B!BS was commissioned in $ovember

088; to disseminate bids, offers, actual rates of transactions and

indices on a real time basis.

*hase II7 !n 088D, settlement related daily transactions inputs

and outputs were uploaded and downloaded from the "FS in

the brokers/ offices.

*hase III7 %ommissioned on ?arch 0D, 0889. Although, screen

based trading started with 101 scrips, by the 23th day of its

commissioning, all scrips@exceeding 9333 had been put on the

.OE" system. "he .OE" system was commissioned with the

,imalya A 03,333 central trading computer hardware. Since

then the hardware has been upgraded to the ,imalya A ;3,333

system. "he system provides for a response time of two seconds

and can handle more than two hundred thousand trades in a day.

Stock Market Indicators

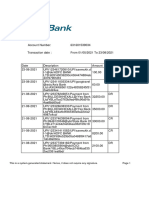

1991-

92

(Apr.M

ar)

1992-

93

(Apr.M

ar)

1993-

94

(Apr.M

ar)

1994-

95

(Apr.M

ar)

1995-

96

(Apr.M

ar)

No. of

Listed

o!panies

2061 2861 3585 4702 5603

Market apita"i#ation

(In

$s.%i""ion)

3059.8

7

1881.4

6

3680.7

1

4354.8

1

5264.7

6

(In &S '

%i""ion)

97.13 59.72 116.85 138.37 153.27

Ann(a" )(rno*er

(In

$s.%i""ion)

717.77 456.96 836.29 677.49 500.64

(In &S '

%i""ion)

22.78 14.50 26.55 21.51 14.57

+e"ocit, 0.23 0.24 0.24 0.16 0.10

A*era-e .ai", )(rno*er

(In

$s.%i""ion)

3.32 2.38 3.84 1.78 2.16

(In &S '

%i""ion)

0.10 0.07 0.12 0.06 0.06

No. of

S/ares

)raded

(In Mi""ion

Nos.)

6,35,51

5

3,50,31

3

7,42,79

2

1,07,24

.8

7,71,85

0

A*era-e

N(!0er of

.ai", .ea"s

75,000 65,535 63,786 85,010 73,855

%S1 4285.0 2280.5 3778.9 3260.9 3366.6

Sensiti*e

Inde2

(3ear 1nd)

0 2 9 5 1

%S1

Nationa"

Inde2

(3ear 1nd)

1967.7

1

1021.4

0

1829.5

3

1605.5

7

1549.2

5

%S1 2444

(3ear 1nd)

585.19 234.35 450.07 365.97 345.40

.o""e2 (3ear

1nd)

261.25 124.89 238.86 194.67 168.54

No. of

$e-istered

5""s

- - 145 308 366

5"" Net in*est!ent

(In $s.

%i""ion)

- - 29.85 21.24 31.63

(In &S '

%i""ion)

- - 0.95 0.67 0.92

No. of

Me!0ers

(3ear 1nd)

558 558 628 636 641

No. of

orporate

Me!0ers

(3ear 1nd)

4 4 4 26 63

/uture %e$elopments

!n 0889, the -resident of !ndia promulgated an Ordinance,

which allowed for establishment of depositories.

.S) in collaboration with .ank of !ndia *.O!+ will shortly

establish a depository. .S) has applied for permission from

S).! to expand .OE" to other centres. )xpansion of .OE"

would bring more investors into the ambit of the capital market

and consequently add depth to it.

I&T'%(CTI'&

"he $ational Stock )xchange *$S)+ is !ndiaMs leading stock

exchange covering around D33 cities and towns all over !ndia.

$S) introduced for the first time in !ndia, fully automated

screen based trading. !t provides a modern, fully computerized

trading system designed to offer investors across the length and

breadth of the country a safe and easy way to invest or liquidate

investments in securities.

Sponsored by the industrial development bank of !ndia, the $S)

has been co@sponsored by other development6 public finance

institutions, E!%, >!%, banks and other financial institutions

such as S.! %apital ?arket, Stockholding corporation,

!nfrastructure leasing and finance and so on. !ndia has had a

history of stock exchanges limited in their operating #urisdiction

to the cities in which they were set up.

$S) started equity trading on $ovember <, 088D and within a

short span of 0 year became the largest exchange in !ndia in

terms of volumes transacted. "rading volumes in the equity

segment have grown rapidly with average daily turnover

increasing from 7s.2 crores in $ovember 088D to 7s.:282

crores in Cebruary ;330 with an average of 8.: lakh trades on a

daily basis. Buring the year ;333@;330, $S) reported a turnover

of 7s.0<, <8,903 crores in the equities segment accounting for

D9= of the total market.

"he $S) represented an attempt to overcome the fragmentation

of regional markets by providing a screen@based system, which

transcends geographical barriers. ,aving operationalised both

the debt and equity markets, the $S) is planning for a derivative

market, which will provide futures and options in equity. !ts

main ob#ectives has been to set up comprehensive facilities for

the entire range of securities under a single umbrella, namely,

"o set up a nation wide trading facility for equities, debt

instruments and

hybrids

"o ensure equal access to investors across the country