Professional Documents

Culture Documents

Og FM

Uploaded by

Siva KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Og FM

Uploaded by

Siva KumarCopyright:

Available Formats

1

Section A

Objective Type Questions (10*2) 20 Marks

Q1.

(i). The adjustment for time value of money is made through:

a) Interest rate b) Inflation rate c) Growth rate d) None of the above

(ii). Maximization of wealth of shareholders is reflected in:

a) Sales maximization b) No. of shareholders c) Market price of equity shares d) SENSEX

(iii). Capital budgeting decisions are based on:

a) Incremental profits b) Incremental cash flows c) Incremental assets d) Incremental capital

(iv). Which of the following is not a relevant factor in EBIT-EPS analysis of capital structure?

a) Rate of interest on debt b) tax rate c) amount of pref. share capital d) DPS

(v). Permanent working capital:

a) Includes fixed assets c) minimum level of current assets

b) varies with seasonal pattern d) includes equity capital

(vi). Cash budget does not include:

a) Dividend payable b) capital expenditure c) issue of capital d) total sales figure

(vii).Which of the following is not included in cost of inventory?

a) Purchase cost b) transport cost c) import duty d) selling cost

(viii).NPV technique is based on:

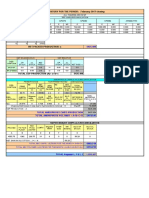

Name of the Program:E-MBA (O&G)

Course Title: Financial Management

This question paper has 5 pages.

2

a) Discounting procedure b) compounding procedure c) average procedure d) None of the above

(ix). ABC analysis is used in :

a) Inventory management. b) Debtors management. c) Accounting policies d) corporate governance

(x). In IRR method, the cash inflows from the project are assumed to be reinvested at the rate equal to:

a) IRR b) risk free rate c) cost of capital d) rate of interest

Section B

Short Questions (Conceptual / Theory) (5*4) 20 Marks

Q2. Define capital structure. Discuss the factors which influence the planning of capital structure?

Q3. What are the important determinants of Working Capital Management?

Q4. What is the relevance of Time value of money in financial decision making?

Q5. What do you understand by Cost of Capital, describe how to calculate the specific cost of Capital ?

Q6. A company is considering taking up of one of two Petroleum Projects :X and Y. Both projects have

the same life, require equal investments of Rs.100 lakhs each and both are estimated to have almost

the same yield. As company is new to this type of infrastructure project the cash flows arising from the

projects cannot be estimated with certainty. An attempt was, therefore, made to use probability to

analyze the pattern of cash flows from either project during the first year of operation. This pattern is

likely to continue during the life of these projects. The results of the analysis are as follows:

PROJECT X PROJECT Y

CASH FLOWS PROBABILITY CASH FLOWS PROBABILITY

12 LACS 0.10 8 LACS 0.10

14 LACS 0.20 12 LACS 0.25

16 LACS 0.40 16 LACS 0.30

18 LACS 0.20 20 LACS 0.25

20 LACS 0.10 24 LACS 0.10

Which Project should the company take up? Show your working to Justify your Answer.

3

Section C

Descriptive Type Analytical Questions (10*3) 30 Marks

Q7 (a) What do you mean by financial leverage? Write the importance and limitations of it.

(b) The capital structure of Microsoft Ltd. is as follows:

Rs. (lakhs)

Equity Share Capital 400

12% Debentures 400

18% Term Loan 1200

(1) Determine the weighted average cost of capital of Microsoft Ltd. It has been paying

dividend at a consistent rate of 20% p.a.

(2) What difference will it make in the weighted average cost of capital if the current market price of

the Rs. 100 equity share is Rs. 160?

Q8. One of the Office of XYZ Ltd. is located in Srinagar. It has received a Quotation for Rs.4400 for

replacing the Heating system. The following information is available:

(i) Currently the Fuel bill for Heating system is Rs. 10,000 p.a.

(ii) The bank provides loan @12%p.a.

(iii) Fuel prices are expected to increase 5% p.a.

(iv) The replacement system will save 10% fuel consumption.

In 6 years time, the firm is expected to shift the office to some other location so it is decided to Evaluate

the proposal for a life of 6 years only. Because of the uncertainties involved, the firm has decided to ignore

any effect of the replacement on the sale value of the building.

The firm requires a risk premium of 2% above interest cost for investment evaluation.

Should the firm accept the offer for replacement?

4

Q9. Following information is related to two machines M and N:

Particulars Machine M Machine N

Cost Rs. 1,12,250 Rs. 1,12,250

Estimated Life 5 Years 5 Years

Estimated Salvage Value Rs. 6,000 Rs. 6,000

Working Capital Required in beginning Rs. 20,000 Rs. 40,000

Annual Income after tax and depreciation: Rs. Rs

Year 1 6750 22,750

Year 2 10,750 18,750

Year 3 14,750 14,750

Year 4 18,750 10,750

Year 5 22,750 6,750

Overhauling charges at the end of third year are Rs. 50,000 on machine M. Depreciation has been charged

at SLM and cost of capital is 10%.

Answer the following question:

A. Which method of project evaluation shall you consider and why?

B. Suggest which machine should be preferred and why?

Section D

Case Study 30 Marks

Q10. XYZ Ltd. plans to extend assets by 50%. To finance the expansions, it is choosing between a

straight 12% debt issue and equity shares. Its balance sheet and profit and loss account are shown below:

Balance Sheet as at 31

st

March 2011

Liabilities Rs. (lakhs) Assets Rs. (lakhs)

11% debentures 40.00

Equity shares of Rs. 10 each 100.00

Retained earnings 60.00 Total assets 200.00

200.00 200.00

5

Contd. (Case study)

P & L Account of XYZ Ltd. for the year ended March 31

st

2011

Particulars Rs. (in lakhs)

Sales 600.00

Total cost (excluding interest) 540.00

Net income before interest and taxes (EBIT) 60.00

Interest on debentures @ 11% 4.40

Income before taxes (EBT) 55.60

Taxes @ 40% 22.24

Profit after tax (PAT) 33.36

Earnings per share (Rs. 33.36/10.00) Rs. 3.336

Market price (7.5 3.336) Rs. 25.02

If XYZ Ltd. finance Rs. 1 crore expansion with debt, the rate of the incremental debt will be 12% and the

price/ earning ratio of the quity shares will be 5 times. If the expansion is financed by equity, the new

shares can be sold at Rs. 12 per share and the price/earning ratio will remain at 7.5 times.

Required :

(i) Assuming that net income before interest and taxes (EBIT) is 10% of sales. Calculate,

Earnings per share at sales levels of Rs. 4 crores, Rs. 8 crores and Rs. 10 crores, when

financing is with (a) equity shares, and (b) debt.

(ii) Using the P/E ratio, calculate the market value per share for each sales level for both the

debt and the equity financing.

(iii) At what level of earnings before interest and taxes (EBIT), after the new capital is

acquired, would earnings per share (EPS) be the same whether new funds are raised by

issuing equity shares or raising debt?

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- INVENTORY FOR THE PERIOD: March 2016 ClosingDocument4 pagesINVENTORY FOR THE PERIOD: March 2016 ClosingSiva KumarNo ratings yet

- Exam Financial ManagementDocument5 pagesExam Financial ManagementMaha MansoorNo ratings yet

- Exam Pattern Questions Marks Total SyllabusDocument55 pagesExam Pattern Questions Marks Total Syllabusrahulnationalite83% (6)

- Investment Planning (Finally Done)Document146 pagesInvestment Planning (Finally Done)api-3814557100% (2)

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- FinancialManagement MB013 QuestionDocument31 pagesFinancialManagement MB013 QuestionAiDLo50% (2)

- Final Project Report Plastic Bottle ManufactureDocument101 pagesFinal Project Report Plastic Bottle Manufactureaskaridumbo82% (33)

- Investment+Planning+Module (1)Document137 pagesInvestment+Planning+Module (1)jayaram_polaris100% (1)

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- II SEMESTER ENDTERM EXAMINATION MARCH 2016Document2 pagesII SEMESTER ENDTERM EXAMINATION MARCH 2016Nithyananda PatelNo ratings yet

- Financial Management Tutorial QuestionsDocument8 pagesFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Use of Statistical Tables PermittedDocument2 pagesUse of Statistical Tables PermittedPAVAN KUMARNo ratings yet

- Indian Institute of TechnologyDocument8 pagesIndian Institute of TechnologySohini RoyNo ratings yet

- SFM 5 PDFDocument4 pagesSFM 5 PDFketulNo ratings yet

- BBS 3rd Year Foundation of Financial Systems Model QuestionDocument8 pagesBBS 3rd Year Foundation of Financial Systems Model QuestionNirajan SilwalNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- GTU Exam - Financial Management QuestionsDocument3 pagesGTU Exam - Financial Management QuestionsMRRYNIMAVATNo ratings yet

- Finance Question Papers Pune UniversityDocument12 pagesFinance Question Papers Pune UniversityJincy GeevargheseNo ratings yet

- TYBFM Sem VI SCF Assignment 2022Document2 pagesTYBFM Sem VI SCF Assignment 2022Varun IngoleNo ratings yet

- CA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comDocument12 pagesCA-Inter-FM-SM-Q-MTP-2-May-2024-castudynotes-comsaurabhNo ratings yet

- Bba - 17ubn05 - 01.02.2022 - FN PDFDocument3 pagesBba - 17ubn05 - 01.02.2022 - FN PDFBdhs HdhdNo ratings yet

- Financial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMDocument6 pagesFinancial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMMatthew HughesNo ratings yet

- GTU MBA Semester II Exam Financial Management QuestionsDocument4 pagesGTU MBA Semester II Exam Financial Management QuestionsVicky ThakkarNo ratings yet

- GTU MBA Semester 2 Financial Management Exam QuestionsDocument3 pagesGTU MBA Semester 2 Financial Management Exam QuestionsAmul PatelNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- SFM - 1Document3 pagesSFM - 1ketulNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- Financial Management-1Document6 pagesFinancial Management-1chelseaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- 2820003Document3 pages2820003ruckhiNo ratings yet

- Objective Questions and Answers of Financial ManagementDocument22 pagesObjective Questions and Answers of Financial ManagementGhulam MustafaNo ratings yet

- 820003Document3 pages820003Minaz VhoraNo ratings yet

- Financial Management 201Document4 pagesFinancial Management 201Avijit DindaNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Financial Management NPV AnalysisDocument8 pagesFinancial Management NPV AnalysisAbid SiddiquiNo ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Case Study - G MuraliDocument7 pagesCase Study - G MuralilakshyamNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceChhabilal KandelNo ratings yet

- Assignments: Program: Mba Ib Semester-IiDocument13 pagesAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNo ratings yet

- Finance II Mid-Term Exam 2020Document4 pagesFinance II Mid-Term Exam 2020Yash KalaNo ratings yet

- Capital Structure: Particulars Company X Company YDocument7 pagesCapital Structure: Particulars Company X Company YAbhishek GavandeNo ratings yet

- RTP Dec 2021 Cap II Group IIDocument106 pagesRTP Dec 2021 Cap II Group IIRoshan KhadkaNo ratings yet

- Executive Post Graduate Diploma in Management Subject: Management Accounting & Analysis Question PaperDocument4 pagesExecutive Post Graduate Diploma in Management Subject: Management Accounting & Analysis Question PaperUpasana vNo ratings yet

- Strategic Corporate Finance Exam 3 Hours Is GivenDocument5 pagesStrategic Corporate Finance Exam 3 Hours Is GivenicaNo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Financial MarketDocument81 pagesFinancial MarketBijay AgrawalNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDocument5 pagesGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385No ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- Financial Management 532635578Document30 pagesFinancial Management 532635578viaan1990No ratings yet

- ABM 801 Financial Management Question BankDocument9 pagesABM 801 Financial Management Question BankneetamoniNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- Capii Financial Management July2015Document14 pagesCapii Financial Management July2015casarokarNo ratings yet

- SSP Pending Jobs SL No Points Responsible Target DateDocument2 pagesSSP Pending Jobs SL No Points Responsible Target DateSiva KumarNo ratings yet

- InventoryDocument4 pagesInventorySiva KumarNo ratings yet

- Daily Production Report December - 2019 (24.12.19)Document51 pagesDaily Production Report December - 2019 (24.12.19)Siva KumarNo ratings yet

- InventoryDocument4 pagesInventorySiva KumarNo ratings yet

- Unit ConversionDocument1 pageUnit ConversionSiva KumarNo ratings yet

- Technical Specifications: 50Hz Powered by Perkins SeriesDocument4 pagesTechnical Specifications: 50Hz Powered by Perkins SeriesSiva KumarNo ratings yet

- Transmitter identification and specificationDocument5 pagesTransmitter identification and specificationSiva KumarNo ratings yet

- FileDocument2 pagesFileSiva KumarNo ratings yet

- Planned Order TemplateDocument1 pagePlanned Order TemplateSiva KumarNo ratings yet

- Insane ProjectDocument220 pagesInsane ProjectsurajphilipsNo ratings yet

- Additional emergency lighting requirementsDocument2 pagesAdditional emergency lighting requirementsSiva KumarNo ratings yet

- AMP Color Testing MethodDocument1 pageAMP Color Testing MethodSiva KumarNo ratings yet

- Storage location-SCM: SL No Department Material Type Storage Location NameDocument3 pagesStorage location-SCM: SL No Department Material Type Storage Location NameSiva KumarNo ratings yet

- SDS For Water Column OverheadDocument11 pagesSDS For Water Column OverheadSiva KumarNo ratings yet

- School FormDocument3 pagesSchool FormSiva KumarNo ratings yet

- Plant Capacity 220 Heater Design DataDocument4 pagesPlant Capacity 220 Heater Design DataSiva KumarNo ratings yet

- Haccp 06 PDFDocument13 pagesHaccp 06 PDFSiva KumarNo ratings yet

- C4054 UIF PR 1010 DB 00001 0 General Process DescriptionDocument64 pagesC4054 UIF PR 1010 DB 00001 0 General Process DescriptionSiva Kumar100% (1)

- 1 Solid State Polymerization of Poly Ethylene Terephthalate I Experimental Study of The Reaction Kinetics and Properties PDFDocument16 pages1 Solid State Polymerization of Poly Ethylene Terephthalate I Experimental Study of The Reaction Kinetics and Properties PDFSiva KumarNo ratings yet

- Pet Polycondensation Side ReactionsDocument6 pagesPet Polycondensation Side ReactionsGeorge MarkasNo ratings yet

- Pet Polycondensation Side ReactionsDocument6 pagesPet Polycondensation Side ReactionsGeorge MarkasNo ratings yet

- C4054 Uif PR 1010 FB 00001 2Document1 pageC4054 Uif PR 1010 FB 00001 2Siva KumarNo ratings yet

- Scan Doc by CamScannerDocument1 pageScan Doc by CamScannerSiva KumarNo ratings yet

- C4054 UIF PR 1010 DB 00001 0 General Process DescriptionDocument64 pagesC4054 UIF PR 1010 DB 00001 0 General Process DescriptionSiva Kumar100% (1)

- Catalyst & Stabilizer Preparation Manual: CPC & STS ProcessesDocument13 pagesCatalyst & Stabilizer Preparation Manual: CPC & STS ProcessesSiva KumarNo ratings yet

- Schedule for Pre-Commissioning FormDocument1 pageSchedule for Pre-Commissioning FormSiva KumarNo ratings yet

- Cutting Defect FormatDocument1 pageCutting Defect FormatSiva KumarNo ratings yet

- DEG TankDocument2 pagesDEG TankSiva KumarNo ratings yet