Professional Documents

Culture Documents

Standard Chartered Bank, Bangladesh

Standard Chartered Bank, Bangladesh

Uploaded by

Shamsuddin AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standard Chartered Bank, Bangladesh

Standard Chartered Bank, Bangladesh

Uploaded by

Shamsuddin AhmedCopyright:

Available Formats

Report On

TRANSACTION

BANKING

IN STANDARD CHARTERED

BANK BANGLADESH

A Descriptive Analysis

Table of Contents

CHAPTER-1

INTRODUCTION

1.1 ORIGIN OF THE REPORT

1.2 SCOPE

1.3 METHODOLOGY & SOURCE OF INFORMATION

1.4 LIMITATIONS

1.5 BANKING INDUSTRY OVRVI!

CHAPTER-2

STANDARD C"ARTRD BANK

2.1 ETHICS OF STANDARD CHARTERED BANK

2.2 STANDARD CHARTERED BANK IN BANGLADESH

2.3 PERFORMANCE AND GROWTH

2.4 ACTIVITIES OF STANDARD CHARTERED BANK

2.5 SWOT ANALYSIS OF STANDARD CHARTERED BANK

CHAPTER-3

C#INT R#ATIONS"I$S $RODUCTS

3.1 TRANSACTION BANKING

3.2 TRADE SERVICE

3.3 CUSTODY

3.4 LANDING

CHAPTER-4

A DSCRI$TIV ANA#YSIS O% TRANSACTION

BANKING

4.1 INTRODUCTION

4.2 CASH MANAGEMENT SERVICES

4.3 ACCOUNTS SERVICES

4.4 E-BANKING

4.5 NATIONAL COLLECTION SERVICES-NCS

4. OPSPAY

4.! PREMIUM SERVICE-BANKING

4." PAYMENTS PLUS

4.# TRADE REPORTS

4.1$ WEB BANK

4.11 CHE%WRITER

4.12 BILLSPAY

4.13 CONCLUSION & RECOMMENDATION

4.15 BIBILIOGRAPHY

________________________________________________________Acknowledgement

At the very outset, I would like to take this opportunity to express my gratitude to my

internship supervisor, Mirza Aminur Rahman for his continuous inspiration, supervision

and patience. Without his guidance and support it would not have been possible to come

this far.

I would also like to thank Nasreen Rehman for her continuous support, inspiration and

giving me the opportunity to deal with different corporate clients.

The managers of various companies have extended their kind cooperation by sharing

information much needed for this report - for this I am ever grateful.

My sincerest thanks go to the others who were involved and helped directly and

indirectly in preparing this report as well as Faculties of Business Studies University of

Dhaka for all the support as well as giving me the opportunity to prepare this report as a

part of my BBA program.

EXECUTIVE SUMMARY

anking service in Bangladesh is characterized as a highly competitive and highly

regulated sector. With a good number of banks already in operation and a few more in the

pipeline, the market is becoming increasingly competitive by the day.

With the global slowdown in the face of rising competition, the commercial banks are

constantly looking for ways to develop their market and product offers to remain ahead of

others. A significant amount of regulation by Bangladesh Bank prevents the scope of

introducing newer products into the market and thereby restricts a banks ability to

outperform others with a diversified product range.

However, recent trends have shown banks shifting away from vanilla products (basic

products) towards higher value added products that are highly structured, to meet the

needs of the clients.

Standard Chartered Bank is the oldest multinational bank operating in Bangladesh. It has,

over the years, created one of the largest networks among all the foreign banks in

Bangladesh. Although a trendsetter in offering a various range of products in the market,

the product offers of Standard Chartered Bank are quickly imitated by competitors.

Substitutes offered by other commercial banks make their way into the market and

thereby eat a portion of the margin.

B

This report takes a look at the current product offer of the Transaction Banking at

Standard Chartered Bank alongside with a look at the untapped opportunities that lie

ahead for the bank to take advantage of Know Your Customer (KYC) project.

An earnest attempt has been made to analyze the Transaction Banking products that drive

competitor banks.

An idea of the current portfolio structure of nationalized, private and other foreign

commercial banks has helped to generate ideas regarding the areas that Standard

Chartered itself can explore into.

Having established itself as the leading foreign commercial bank in Bangladesh is not by

itself sufficient unless a hearty attempt is made to sustain this position. Amidst an age of

regulation and intense competition, diversification of the corporate products in a way that

helps to increase the wallet share of the bank and thereby achieve growth is undoubtedly

very desirable.

Based on above, this report looks in depth towards the opportunity for Transaction

Banking.

PART-1

INTRODUCTION

1.1 Origin of the Paper

This report is an Internship Report prepared as a requirement for the

completion of the BBA Program of the Department of Finance & Banking,

Uniersit! of Dhaka" The primar! goal of internship is to proide an on the

#o$ e%posure to the student and an opportunit! for translation of theoretical

conceptions in real life situation" &tudents are placed in enterprises,

organi'ations, research institutions as (ell as deelopment pro#ects" The

program coers a period of ) months of organi'ational attachment"

After the completion of BBA program, I, *d" *ohin Uddinof BBA +

th

Batch,

(as placed in &tandard ,hartered Bank, Bangladesh for the internship

program under the guidance of m! facult! adisor A"-"*" .uma!un *orshed"

The duration of m! organi'ational attachment (as, $! polic!/ ) months,

starting from *a! 01, 0221 to 3ul! 01, 0221" As a requirement for the

completion of the program I needed to su$mit this report, (hich (ould

include an oerie( of the organi'ation I (as attached (ith and ela$oration

of the pro#ect I (as supposed to conduct during the internship period"

I (as placed in the Transaction Banking of the Bank, under the direct

superision of *ir'a Aminur Rahmah, the head Transaction Banking of

&tandard ,hartered Bank Bangladesh"

1.2 S&'()*

The scope of this report is limited to the oerall descriptions of the $ank, its

serices, its position in the industr!, and its competitie adantage" The

scope is also defined $! the organi'ational set4up, functions, and

performances"

1.3 M)+,'-'.'/0 & S'12&) '3 I43'256+7'4

In the organi'ation part, much information has $een collected from different

pu$lished articles, #ournals, $rochures, (e$ sites and preious internship

report" All the information incorporated in this report has $een collected $oth

from the primar! sources and as (ell as from the secondar! sources"

$r&'ar( So)r*e of Infor'at&on

Discussion (ith officials of &,B

Face to face and telephone conersations (ith customers

Data from the compan!5s documents and &,B5s computeri'ed

information s!stem

Se*on+ar( So)r*es of Data

Preious reports and #ournals releant to the $anking industr!

6ther pu$lished documents of Bangladesh Bank

Releant &,B paper and pu$lished documents

1.4 L757+6+7'48*

Past and present financial information that are confidential could not $e

accuratel! o$tained" Alike all other $anking institutions, &,B is also er!

conseratie and strict in proiding financial information" In such cases, I

hae relied upon certain assumptions, (hich are onl! amateur estimates" As

man! of the anal!sis on the o$tained data are $ased on m! sole

interpretation, there ma! $e some $iases, as lack of kno(ledge and depth of

understanding might hae hindered m! a$ilit! to produce an a$solutel!

authentic and meaningful report"

Time constraint (as another limitation restricting this report to $e a more

detailed and anal!tical one" *! superisors are $us! all the time and it (as

reall! difficult to get hold of some of their time"

1.5 Banking Industry-Overview

The Banking Industry is Bangladesh is one characterized by strict regulations and

monitoring from the central governing body, the Bangladesh Bank. The chief concern is

that currently there are far too many banks for the market to sustain. As a result, the

market will only accommodate only those banks that can transpire as the most

competitive and profitable ones in the future.

Currently, the major financial institutions under the banking system include:

Bangladesh Bank

Commercial Banks

Islamic Banks

Leasing Companies

Finance Companies

Of these, there are four nationalized commercial banks (NCB), 5 specialized banks, 11

foreign banks, 26 domestic private banks and 4 Islamic Banks currently operating in

Bangladesh.

Figure: 1

All local banks must maintain a 4% Cash Reserve Requirement (CRR), which is non-

interest bearing and a 16% Secondary Liquidity Requirement (SLR). With the

liberalization of markets, competition among the banking products and financial services

Scheduled Banks in Bangladesh

PCB

549

FCB

2$9

NCB

"9

I8. 657 &

"9

S()&7 6. 7 :)-

1$9

seems to be growing more intense each day. In addition, the banking products offered in

Bangladesh are fairly homogeneous in nature due to the tight regulations imposed by the

central bank.

Competing through differentiation is increasingly difficult and other banks quickly

duplicate any innovative banking service.

PART-2

STANDARD CHARTERED BANK

2.1 E+,7&8 O3 S+64-62- C,62+)2)- B64;

Standard Chartered reputation is critical to being the world's leading emerging markets

bank. The preservation and enhancement of that reputation depends upon our businesses

operating to the highest standards of ethical conduct.

We face a particular challenge to uphold consistent standards of conduct while at the

same time respecting the culture and varying business customs of all the countries in

which we operate.

The principles that govern the behaviour of our business and employees are reflected in a

Group Code of Conduct. The Group Code of Conduct is a practical working document

which guides employees through the many difficult conduct issues which confront them

on a daily basis. Complying with each element of the Code will not always be easy but

we recognise that we will be judged not just by what is set out in the Code but on how

this is reflected in our day to day activities and the behaviour of all of you.

2.2 S+64-62- C,62+)2)- B64; 74 B64/.6-)8,

The Chartered Bank started operating in Bangladesh in 1948, opening a branch in

Chittagong. The branch was opened mainly to facilitate the post-war reestablishment and

expansion of South and Southeast Asia. The Chartered Bank opened another branch in

Dhaka in 1966, where it is still headquartered. After the merger of the Chartered Bank

with the Standard Bank in 1969, the Standard Chartered Bank took up a program of

expansion. It increasingly invested in people; technology and premises as its business

grew in relation to the country's economy. In 1993, there was an organizational re-

structuring, which led to a substantial expansion of the Bank's business.

BANGLADESH (BD)

Currency Bangladesh Taa (BDT)

Main offices/branches Address! 1

st

"loor # $%& Transa'tional Baning#

Hadi (ansion# )# Dil*sha $+A#

Dhaa

(ain tele! (,--. ) ) /00.1-1

Total n*12er of 2ran'hes! 1-

In Country Partner Banks 3ttara Ban Ltd.# National Ban Ltd.# &"&$ Ban Ltd.#

Sonali Ban % Agrani Ban

Country business coverage Standard $hartered Bangladesh 'o4ers 2*siness

thro*gho*t si5 1a6or 'ities in'l*ding (a6or

Presen'e in $apital Dhaa % Port $it7 $hittagong.

Contact numbers Standard $hartered Sales!Tele! (,--. )) /089/.:#

/08.19) "a5! (,--. ))

/08)9)/ # /0:1/:0

Prod*'t ! Tele! (,--. )) /089/11# :18/10:

"a5! (,--. )) /08)9)/ # /0:1/:0

Sol*tions Deli4er7! Tele! (,--. )) :18/10:

"a5! (,--. )) /08)9)/ # /0:1/:0

0") Performance and -ro(th

The change in strategy, performance and growth, adapted by Standard Chartered Bank is

clearly evident in the following comparison between its performance in 1995 to that in

2002.

Figure 2

Revenue Mix in 1995

1,,5

Lack of revenue momentum

Over layered organization

Weak risk control environment

Basic product ofering- vanilla

product

High cost structure

-..-

Revenue driven target/goal

Revenue diversication !

sustaina"ility

#trong risk management culture

in place

Higher value-added $

customized product

%ost eficiency

Revenue Mix in 2002

Str*'t*re

Prod*'ts

);

D$(

);

Sales

18;

B+S

(anage

1ent

));

Trading

<;

$ash

1<; Lending

18;

Trade

)<;

Sales

8;

B+S

(anage 1ent 0;

Trading

:;

$ash

19;

Lending

90;

Trade

9<;

All the foreign banks combined hold 9% in deposits as compared to 29% by private

commercial banks and 62% by nationalized commercial banks.

The comparative performance (holding market share) of Standard Chartered Bank in

terms of deposit and advance are presented separately in the following figures:

Figure 3- Source: Scheduled Bank Statistics, Bangladesh Bank, Oct-Dec 2002

From the above figure we see that of the 9% held by foreign banks in total deposits, SCB

alone commands 40% of the deposits.

Figure 4- Source: Scheduled Bank Statistics, Bangladesh Bank, Oct- Dec 2002

In terms of advances made, Standard Chartered Bank holds the leading position among

the foreign banks with a market share of approximately 35%.

Ttal Depsits in !"Bs

S$B

<.;

$A&

19;

HSB$

1);

A(E=

).;

$&T&BAN>

1.;

Others

0;

Advances #ade $y !"Bs

S$B

90;

$A&

10;

HSB$

19;

A(E=

11;

$&T&BAN>

).;

OTHE?S

8;

.! "ctivities of Standard Chartered #ank

Corporate Ban/&n0 Gro)p

Standard Chartered Bank offers it local customers wide variety of financial services. All

the accounts of corporate clients, which mainly comprises the top local and multinational

companies operating in Bangladesh, are assigned to Relationship managers who maintain

regular and close contact to cater top their needs.

The objective of this department is to maintain a thorough knowledge of the clients

business and to develop positive relations with them. This is maintained through

interactions to offer timely advice in a n increasingly competitive business environment.

The expertise of the Institutional Banking and Treasury groups is also available whenever

required. The unique Offshore Banking Unit (OBU) in Savar provides a full range of

facilities to overseas investors. The Corporate Banking Group in Bangladesh has

displayed a spirit of community involvement by working with NGOs to underwrite soft

loans. Standard Chartered offers its corporate customers a wide variety of lending needs

that are catered with skilled and responsive attention. They provide project finance and

investment consultancy, syndicated loans, bonds and guarantees and local and

international treasury products.

Trade finance

The trade finance of standard Chartered bank takes care of the commercial activity

related issues, particularly those related to import and export finance services. Some of

the services are:

Trade finance facilities including counseling, confirming export L/C and issuing of

import L/Cs, backed by its international branch and correspondent loan network.

Bond and Guarantees

Project finance opportunities for import substitution and export oriented projects

Treasury

The foreign exchange and money market operation of the Standard Chartered Bank in the

world is extensive. Exotic currencies happen to be one of its special areas of strength. A

24-hr service is provided to customers in Bangladesh through the Banks network of

dealing centers placed in the principal areas of the world. The Banks treasury specializes

in offering solutions to those who wish to manage interest rate and currency exposure s

that result from trade, investment and financing activities of other dynamic economies of

the region.

Institutional Banking Group

The IBG of Standard Chartered Bank offers a wide variety of products and services to

banks and financial institutions. It has global links with leading bank institutions and

agency arrangements through its network of offices in 40 countries. The Bank offers a

full range of clearing, payment collection and import-export handling services. The bank

offers foreign missions, voluntary organizations, consultants, airlines, shipping lines and

their personnel, the following services:

Current accounts in both Taka and other major foreign currencies and Convertible Taka

accounts.

Consumer Banking

Superior retail banking services comprising of a wide range of deposit and loan products

are offered by Standard Chartered Bank to its individual customers. The consumer

banking division constantly faces challenges and meets them by developing new products

and services to fulfill the specific requirements of local TU. The Bank offers a 24-hour

service in Bangladesh through its Money-link ATM Network and Phone-link Phone

banking Services.

Custodial services: The Equitor

Headquartered in Singapore, Standard Chartered equitor fulfils the groups strategic

commitment to the provision of custodial service in Asia. The equitors customers are

primarily foreign global custodians and broker/dealers requiring cross-border information

as well as sub-custodian services. Standard Chartered Bank, Bangladesh is responsible

for the planning in Bangladesh, but the overall management of the custody business is

based in Equitors international business strategy.

SUPPORT SERVICES

Operations

Operations are the part of the support division that helps to run the businesses of the bank

in a smooth and controlled manner. Since it helps mainly in processing the works of the

business units, any mistakes made can be easily detected and on time. Following are the

main functions of the operations department:

Central operations deals with the closing and opening of accounts and other payment and

account related processing of the Personal Banking division. Treasury operations help to

deal with the processing works of the treasury division. Loan Administration Unit (LAU)

deals with the processing of the Corporate Banking division.

Operations also have a department that deals with internal projects that arises from the

need to deal with certain problems or to make certain changes. Following are some

examples of projects being dealt with presently:

Finance, Administration and Risk Management

The support department performs the following activities:

Administration, audit and back office operation

Taking care of taxation and financial control of the Bank

Keeping track of overall credit operation

Information Technology Center

This department is instrumental in the running of all the computerized operations of the

bank. They help in the implementation and generation of computerized reports. Another

duty of the department is to maintain communication with the rest of the world.

Human Resource Department

This department manages recruitment, training and career progression plan. Standard

Chartered Bank highlights the importance of developing its people to create a culture of

customer service, innovation, teamwork and professional excellence.

Legal and compliance

In the UK, Standard Chartered Bank is regulated by the Bank of England, while in

Bangladesh local banking laws regulate it and rules set by the Ministry of Finance and

Bangladesh Bank. The local restriction involves a licence from Bangladesh Bank to

operate banking business in Bangladesh. Standard Chartered Bank complies by the rules

and regulations seriously. It also encourages its staff to conform to an internal culture of

ethical behavior and sensitivities to the culture and religion of the country. There is a

mandatory training on Company Code of Conduct for all staff members.

Some of the key areas that the Legal & Compliance department has to take care of are:

any kind of legal issues, to advise the CEO regarding all matters and the management on

legal and regulatory issues, correspond regulatory compliance issues to MESA Regional

Head of Compliance, and supervise internal control (e.g. internal audit).

External Affairs

This department deals with advertising, public relations, promotions, partial marketing

which involves disseminating new products and services to customers and above all

ensuring service quality.

Credit

The credit department approves the loans of Corporate Banking division. The approval is

mainly based on the risk analysis of the corporate clients done by the Corporate Banking

division.

PART-3

CLIENT RELATIONSHIPS PRODUCTS

Client relationships provides transaction banking, cash management, custody and trade

finance services through their strong market networks in Asia, Africa, the Middle East

and Latin America. They provide a bridge to these markets for clients from the U.S and

Europe. The services provided are integrated, superior cross-border and local services

that enable efficient transaction processing, with reliable financial information.

3.1 Transaction Banking

Cash Management Service

The cash management service provides total solutions to improve cash flows. Standard

Chartered is highly recognized as a leading cash management supplier across the

emerging markets. Cash Management Services cover local and cross border payments,

collections, information management, account services and liquidity management for

both corporate and institutional customers.

With Standard Chartered's Cash Management Services, customers always know where

their money is. Customers can manage their company's total financial position right from

their desktop computer. They will also be able to take advantage of SCBs outstanding

range of payment, collection, liquidity and investment services and receive reports

detailing when and where cash has been moving.

Clearing Services

With increasing business globalization, your banking network may not have sufficient

reach. You may not want to put in the extra infrastructure or resources to expand your

network but still want to ensure your clients transactions are serviced efficiently.

Clearing is one of the important services in which your bank would need support to

facilitate your clients smooth international trade and cross-border transactions.

3.2 T

Standard Chartered possesses 140 years of experience in Trade Finance. SCBs broad

international customer base, professional insight and knowledge of the risks and rewards

of international trade earned the bank a unique position in the industry. The bank offers

world-class support across the worldwide buyer chain to minimize overall cost, maximize

buyer base, and shorten administrative processes.

To enable customers to capture global opportunities, it has a presence in over 40

countries, in addition to the extensive network of overseas banking partners and

correspondents.

Standard Chartered has a wide array of financing tools to ease your cash flow burden and

help you grow your business.

Receivables Services

It gives you the financial security to explore new markets overseas or grow your business

locally, reducing your risk and cost.

Import Services

Instead of paying for your imports immediately, Standard Chartered is able to offer you

import financing, to finance a drawing under an Import Letter of Credit or Import Bill for

Collection, giving you time for the goods to be cleared and resold.

Export Services

Do you need extra cash for manufacturing or purchasing the goods to fulfill your export

order? Do you want to turn the goods into cash as soon as you have them shipped out?

Standard Chartered offers you the opportunity to obtain pre-shipment and post-shipment

financing. You can now trade with the added confidence of our financial help.

)") CUSTODY

Standard Chartered Custody and Clearing Services' combination of local market

expertise, with the security offered by being an integral part of one of the world's leading

international banks has garnered an impressive client base which includes leading North

American, European and Asian institutions.

Standard Chartered keeps its custody and clearing clients regularly informed of

developments relating to securities market infrastructure and custody in Asia through a

market information website. This information is available to clients with a registered

login name and password. Clients are offered a customized and comprehensive range of

products and services, which include:

- Custodial services

- Brokerage, clearing and settlement services

- Securities lending

- Foreign Exchange

- Transfer agent for institutionsal debt and equity offerings

- Delivery, receipt, settlement, registration and physical safe custody of securities

9.< LENDING

To support the local and international business, Standard Chartered offers various

services to help with:

- Loan Structure and Syndication

- Loan facilities.

Loan Structure and Syndication

Our leadership in loan syndication stems from ability to forge strong relationships not

only with borrowers but also with bank investors. Because we understand our syndicate

partners' asset criteria, we help borrowers meet substantial financing needs by enabling

them to reach the banks most interested in lending to their particular industry, geographic

location and structure through syndicated debt offerings. Our syndication capabilities are

complemented by our own capital strength and by industry teams who bring specialized

knowledge to the structure of a transaction.

Loan facilities

To enhance the ability to meet financial obligations and operate effectively, SCB offers

assistance in the form of working capital loans, overdrafts, term loans (including real

estate loans and other secured debt), backstops and revolvers. SCB works closely with

clients to understand the dynamics of the business so that the bank can anticipate and

serve short-term and long-term funding needs in the most efficient manner, drawing from

the full range of global resources and capabilities.

Modern banking operations touch almost every sphere of economic activity. Bank credit

is a catalyst for bringing about economic development. Without adequate finance there

can be no growth or maintenance of a stable output.

There are some standard loan facilities provided by the corporate division of Standard

Chartered. These are:

- Seasonal Loan

- Term Loan

- Permanent Working Capital Loan (Asset-based Lending)

SEASONAL LOAN-

A seasonal loan is generally defined as a short term, self-liquidating loan. Which means

that the funds advanced on a short-term basis are repaid in full when the assets

purchased by the funds are converted to cash. Overdraft, Import Loan, !port Loan, L"#

$%achinery&, L"# $'aw %aterials& , (uarantees etc. are seasonal loans provided by the

local corporate division to different customers.

O@E?D?A"TS

An overdraft facility is a revolving borrowing facility repayable on demand, made

available concerning a current account. Where permitted by law, a customer can

overdraw his current account when any entry is debited to the account for more than the

available credit balance on overdraw. Once the limit is utilized, interest will be charged

on outstanding utilization on a daily basis.

Overdrafts are flexible for borrowing intended to finance day to day cash flow

requirements generated to normal business activity. They are not intended for the

financing of long term borrowing requirements for which more appropriate credit lines

are available.

Overdraft facilities are uncommitted. The bank has the right to cancel the facility and

demand repayment without prior written notice to the customer.

The typical tenor of an overdraft is one day. However, the Bank may agree to make

overdraft facilities available for longer periods (maximum one year), with annual

review/renewal and subject to the Banks discretion to suspend/cancel the facility.

Letter of Credit (LC)

When any company needs to import raw materials from abroad then L/C is required.

Because they are unknown to foreign supplier. The Importer Company must open L/C in

any bank. Then the bank will contact with other bank, which is situated in supplier

country. When the bank give financial guarantees to foreign bank through L/C

application the foreign bank supplier will send raw material within a time period. Our

bank will charge a specific amount for L/C, which is non-funded financing.

L/C is not only for import but also for local transaction. When any company collect raw

material from local supplier on credit then L/C is required.

Revolving Loan (RL)

Revolving Loan is a contract between a borrower and Standard Chartered Bank (SCB)

whereby SCB provides the borrower with a certain amount of currency, for a period more

than one year and up to 5 years.

SCB gives the facility of loan to buy the raw material or other trade related products at a

specific interest rate. When a manufacturing company does not have the working capital

to bear the operating cost, they can collect this money from SCB at a specific interest rate

to be repaid after 90/120/150 days. And it will be treated as Revolving Loan.

Loan Against Trust Receipt (LATR)

Advances allowed for retirement of shipping documents and release of goods imported

through L/C falls under this head. The goods are handed over to the importer under trust

with the arrangement that sale proceeds should be deposited to liquidate the advances

within import and known as post- import finance and falls under the category

Commercial Lending.

Guarantee

According to the contract act 1872, Guarantee can be defined as a contract to perform the

promise or discharge of liability of a third person in case of his default. The person in

respite, of whose default the guarantee is given is called principal debtor and the person

to whom the guarantee is given is called the creditor. It is an irrevocable undertaking to

pay in case of a certain eventually/contingency.

2.5 )WO* Analysis of )tandard #hartered +an,

*he )WO* analysis comprises of the organi-ation.s internal strength and

wea,nesses and e!ternal opportunities and threats. )WO* analysis gives an

organi-ation an insight of what they can do in future and how they can compete

with their e!isting competitors.

Strengths!

For more than 11 !ears in Bangladesh, &,B is kno(n to $ear the

Banking 7%perience that proides it the strength of $eing the market

leader in the foreign $anking sector" Unlike an! other multinational

$ank in Bangladesh, the long4term success of &,B is attri$uted to this

strength of &,B (hereas the long4term success of a $ank heail!

depends on its reputation (hile dealing (ith er! sensitie commodit!

like mone!"

The first $ank in Bangladesh to issue *one! link 8AT*9 card is &,B" B!

gra$$ing the opportunit! that e%ists in the market &,B, as the market

leader, sho(ed the most su$stantial corporate strength among the

foreign $anks"

&,B has a $ulk of qualified, e%perienced and dedicated human

resources"

&,B is the onl! one among the foreign $anks that has $een a$le to

utili'e its e%tensie marketing efforts in order to capture a (ide

customer $ase at a er! short time"

&,B5s dedication is supreme in proiding the $est phone $anking

serices in to(n" It is also keen to proide unmatched and instant 0:

hour $anking serice and has recentl! opened the ,all ,entre at ;otus

<amal To(er in =ikun#o, Dhaka"

In order to e%ude innoatieness and creatieness, &,B tries its $est

to come up (ith customers5 $anking pro$lems and sole them"

Another recent step taken $! them is starting the 7ening Banking

serice, (hich (ill $e open from + pm to > pm in the eening" The

customer, (ho has to keep his transactions stopped for ?> hours until

the ne%t $anking hour arries, (ill $e $enefited, as this (ill reduce the

lag and hassle associated (ith it"

Aeanesses!

Banks, (ho are offering $etter prospects, no( en#o!s customers

s(itching to them as &,B offers lo( deposit rates and has set the

minimum $alances too high" Furthermore, long (aiting cues, moderate

customer serice, non4functioning AT* machines and outrageousl!

high charges lead to &,B $eing noted for these (eaknesses as (ell" As

a result, a large amount of customers hae ceased transactions (ith

the $ank" *an! customers5 accounts hae $ecome oerdra(n due to

fees that hae $een charged $! the $ank5s computer s!stem for as

long as three !ears $ecause the! hae either simpl! not cared to close

their accounts, or thought that the! hae $een closed automaticall!"

The $anking industr! is no( e%periencing the contractual emplo!ment

feer that has started up and &,B has also fallen pre! to it" &elf4

interest of the emplo!ees are actuall! hindering their performance

$ecause &,B is emplo!ing indiiduals from other agencies and giing

them tough targets to reach and there$! not giing them the full

$enefits of a permanent emplo!ee" For e%ample, man! accounts are

opened $! Direct &ales 7%ecuties $! luring customers (ith loans,

(hich the! ultimatel! do not receie, and also opening accounts for

customers (ho can hardl! maintain the account and do not een pa!

the minimum opening amount" 7en though &,B is getting $enefited

in the short run, the implications are long run losses"

During the last ?2 !ears the $anking industr! has $ecome considera$l!

monopolistic and hence &,B is starting to lose its market share to its

rials due to lo( $arriers to entr!, and the local $anks5 increasing

aggressieness

&,B is also facing pro$lem in its s!stem of collection and dis$ursement

of cash" *an! customers do not $ear the proper kno(ledge as to the

process of depositing and (ithdra(ing mone!" The $ank does not take

man! steps to assist them either" The s!stem of (ithdra(al and

deposit ma! $e ne( and different from the s!stem the customers hae

come across at local $ank" *an! of these customers or people the!

send to the $ank on their $ehalf, are not educated and hence the! face

difficult! in the s!stem of deposit or (ithdra(al" For instance, since the

s!stem of deposit is not that iid, customer often drop the counterfoil

of the deposit slip (ith the main cop! into the slip $o%" ,onsequentl!,

in man! such cases it happened that a smart clerk picked up $oth the

papers and took the mone!" Then there (ere no documents left for the

$ank or the customer to proe that he@she deposited the mone!"

Because the (a! &,B makes charges to accounts cannot $e properl!

e%plained, man! customers $eliee and complain a$out the unethical

$anking of &,B"

Ahile dealing (ith its customers4 especiall! in ,onsumer Banking, &,B

emphasi'es more on short4term profits than focusing on the

maintenance of a long4term health! relationship (ith them" This

suffering of &,B from m!opia4 i"e" shortsightedness leads it to pursue

strategies in such a m!opic manner, and so in the long run, it ma!

undergo seere losses" Another (eakness of the $ank that can $e

sighted as (ell is Poor coordination and communication $et(een the

head office and $ranches" As the head office undertakes man!

pro#ects, the actiities are hampered due to some actiities of the

$ranches" 7en after the head office5s carefull! thought out action plan

for a pro#ect, the! still face pro$lems in e%ecuting $ecause the

$ranches are not (ell a(are of such a pro#ect and therefore, their

actions do not compl! (ith (hat is required for the ultimate success of

the pro#ect"

Opport*nities!

&tandard ,hartered Bank (as approed of the permission to start

Islami Banking from The -oernment of Bangladesh" The $ank no(

has a (hole ne( prospect opening up and also the opportunit! to

introduce a (ide arra! of Islami Banking products" It also has the

prospect of e%panding its customer $ase" The countr!5s gro(ing

population is graduall! and increasingl! learning to adapt to and use

the $anking serice" As the $ulk of our population is middle class, and

*uslim, different t!pes of Islami Banking products (ill hae a er!

large and easil! pregna$le market"

&,B has rigorous credit screening polic! and it is oer conseratie" B!

freeing their credit screening polic! a little, the! ma! $e a$le to pursue

man! opportunist $usiness entures" &,B also has a good consumer

$ase that maintains seeral accounts at once" &,B has the opportunit!

to keep these customers $! reducing its current fees and charges and

positioning attractiel! in middle class segment"

*ore Branches around Dhaka speciall! and all oer Bangladesh (ill

ena$le &,B to capture more market share, and hold a stronger

competition against local $anks"

B! offering more attractie interest rates, and lo(ering the minimum

$alances eligi$le for interest, the $ank can attract a lot of the old

customers (ho hae stre(n a(a! to other $anks as (ell as ne(

customers"

Threats!

Increased competition $! other foreign $anks is a threat to &,B" At

present .&B, and ,ITI ,orp are posing significant threats to &,B

regarding retail and $usiness $anking respectiel!" Furthermore, the

ne( comers in priate sector such as Prime Bank, Dutch Bangla Bank,

7BI* Bank, BRA, Bank, &outheast Bank, *ercantile Bank, &ocial

Inestment Bank, Islami Bank and Bank Asia are also coming up (ith

er! competitie products" Aith customers shifting to these $anks,

&,B5s profits, as (ell as market share is falling, and it faces the threat

of $eing (iped out $! competition"

In toda!5s econom!, su$stantial amount of saings is remaining idle"

,urrentl! foreign direct inestment in the countr! is er! lo(" These

economic situations of the countr! indicate political threats"

A DESCRIPTIVE ANALYSIS

OF TRANSACTION

BANKING

4.1 Introduction

As part of &tandard ,harteredCs glo$al transaction solutions to ,orporates

and Institutions, (e proide ,ash *anagement, &ecurities &erices and Trade

&erices through our strong market net(orks in Asia, Africa, the *iddle 7ast

and ;atin America" Ae also proide a $ridge to these markets for clients from

the U"& and 7urope"

The! are committed to proiding !ou (ith

Integrated, superior cross4$order and local serices

7fficient transaction processing

Relia$le financial information

Innoatie products

Aorld4class clearing serices

thus ensuring a full suite of transactional products for !our needs"

It5s ,ash *anagement &erices coer local and cross $order Pa!ments,

,ollections, Information *anagement, Account &erices and ;iquidit!

*anagement for $oth corporate and institutional customers"

1.- Cas2 3ana0e'ent Ser4&*es5

Cas2 3ana0e'ent for Corporat&ons5

Colle*t&ons Ser4&*es

,omprehensie receia$les management solution4

&tandard ,hartered understands that operating and sustaining a profita$le $usiness

these da!s is e%tremel! tough" In an enironment of constant changes and

uncertainties, most $usinesses face challenges of costs and efficienc!" <e! concerns

include/

Receia$les *anagement D ensuring receia$les are collected in an efficient and

timel! manner to optimise utilisation of funds"

Risk *anagement D ensuring effectie management of de$tors to eliminate risk of

returns and losses caused $! defaulters and dela!ed pa!ments"

Inentor! *anagement 4 ensuring efficient and quick turnaround of inentor! to

ma%imise returns"

,ost *anagement D reducing interest costs through optimal utilisation of funds"

6ur &olution

The &tandard ,hartered ,ollections &olution leerages the Bank5s e%tensie regional

kno(ledge and (idespread $ranch net(ork across our ke! markets to speciall! tailor

solutions for !our regional and local collection needs"

This ,ollections &olution, deliered through a standardised international platform,

has the fle%i$ilit! to cater to !our local needs, thus ena$ling !ou to meet !our

o$#ecties of reducing costs and increasing efficienc! and profita$ilit! through $etter

receia$les and risk management" The ke! components of our solution include the

follo(ing/

7%tensie ,learing =et(ork

-uaranteed ,redit

,omprehensie *I&

&!stem Integration

6utsourcing of ,ollection

#&6)&+&t( 3ana0e'ent

&olutions for efficient management of !our funds

A corporate treasurer5s main challenge often reoles round ensuring that the

compan!5s cash resources are utilised to its ma%imum adantage" Eou need a partner

$ank that can help !ou/

*a%imise interest income on surplus $alancesF minimise interest e%pense on deficit

$alances for domestic, regional and glo$al accounts

*inimise FB conersion for cross4currenc! cash concentration

,ustomise liquidit! management solutions for different entities in different countries

,entralise information management of consolidated account $alances

6ur &olution

Aith our glo$al e%perience and on4the4ground market kno(ledge, &tandard

,hartered (ill help !ou define an oerall cash management strateg! (hich

incorporates a liquidit! management solution that $est meets !our needs" ,lick here

for an illustration of our propositions"

Ke( %eat)res

Based on !our needs and the regulator! enironment that !ou are in, !ou can choose

an! of the follo(ing features/

Ph!sical &(eeping

=otional Pooling

Interest Reallocation

Inestment

$a('ents Ser4&*es

-lo$al pa!ments solution for efficient transaction processing

;ooking to outsource !our pa!ments to ena$le/

: 7fficient processing of all !our pa!a$les in the most cost effectie (a!

1 &traight through processing $oth at !our end as (ell as !our $ankCs $ack4end

+ 7fficient pa!a$les reconciliation (ith minimal effort and dela!

G Huick approal of pa!ments from an! location

> *inimum hindrance to automation due to local language difficulties

,entralised management of pa!a$les across departments, su$sidiaries and countries

6ur &olution

&tandard ,harteredCs &traight Through &erices 8&T&9 Pa!ments &olution can $e

tailored to the different pa!ment needs of companies, (hateer industr!, si'e or

countr! !ou ma! $e in" Aith a comprehensie 7nd4to4end Pa!ment Processing ,!cle,

&T& allo(s companies to process a ariet! of pa!ment t!pes, (hether the! $e

domestic or international, local or central in different countries, all in a single s!stem

file" To realise the $enefits of &T&, please contact !our local Relationship *anager or

,ash *anagement representatie"

Cas2 3ana0e'ent for %&nan*&al Inst&t)t&on5

Clear&n0 Ser4&*es

*aking the right connections for financial institutions4

Aith increasing $usiness glo$alisation, !our $anking net(ork ma! not hae sufficient

reach" Eou ma! not (ant to put in the e%tra infrastructure or resources to e%pand

!our net(ork $ut still (ant to ensure !our clients5 transactions are sericed

efficientl!" ,learing is one of the important serices in (hich !our $ank (ould need

support to facilitate !our clients5 smooth international trade and cross4$order

transactions"

It5s &olution

&tandard ,hartered5s international net(ork and multi4currenc! capa$ilities are (ell

placed to proide !ou (ith a seamless serice for all !our clearing requirements

(orld(ide" 6ur net(ork e%tends across Africa, the *iddle 7ast, &outh Asia, ;atin

America, the U&A and the U<" Eou can count on our oer ?12 !ears of on4the4ground

e%perience to tailor a clearing solution that meets !our needs" &tandard ,hartered is

a correspondent $anking partner !ou can trust to make this potentiall! complicated

process much easier for !ou" ,lick here to ie( our international net(ork"

&tandard ,hartered offers IBest in ,lassJ technolog! and processes in our clearing

serices (hereer !ou are, in (hicheer countr! !ou do $usiness and in (hateer

currenc!/

7merging *arkets 4 Asia4Pacific, &outh Asia, the *iddle 7ast and Africa

U&D

7uro 4 includes &terling

Ae tailor clearing solutions to address !our specific needs (hether in one or multiple

countries, or to complement our other serices"

Cont&n)o)s #&n/e+ Settle'ent

,ontinuous ;inked &ettlement 8,;&9 is the ne( priate sector response to increasing

regulator! pressure to reduce foreign e%change settlement risk e%posures" The

initiatie has $een lie since the end of 0220 and is endorsed $! the -?2 central

$anks and lead regulators" The primar! o$#ecties of ,;& are to eliminate the

inherent settlement risk from the current foreign currenc! settlement processes and

to proide a mechanism for containing an! s!stemic risk arising from the failure of a

ma#or market participant"

&tandard ,hartered at the forefront4

&tandard ,hartered Bank has $een deepl! committed to this industr! initiatie since

its inception in ?KKG and holds full shareholder status in the ne( Bank" &tandard

,hartered operates as a full &ettlement *em$er (ithin ,;&B and e%tends

comprehensie Third Part! serices to our customers, ena$ling them to take full

adantage of the settlement risk $enefits associated (ith FB settlement through ,;&"

Aith &tandard ,hartered5s ,ash *anagement serices, !ou5ll al(a!s kno(

!our e%act financial position" Eou hae the fle%i$ilit! to manage !our

compan!5s complete financial position directl! from !our computer

(orkstation" Eou (ill also $e a$le to take adantage of our outstanding range

of Pa!ments, ,ollections, ;iquidit! and Inestment &erices and receie

comprehensie reports detailing !our transactions" Aith &tandard ,hartered,

!ou hae eer!thing it takes to manage !our cash flo( more accuratel!"

&tandard ,hartered, esta$lished since ?K:>, is highl! reputa$le in proiding

fle%i$le and innoatie financial serices solutions" Ae adopt a proactie

approach in tailoring customised packages to meet our customersC eer4

changing needs" Ae appl! state4of4the4art technolog! to automate our dail!

operations and electronic delier! s!stem has $een put in place to ensure

that transactions are handled s(iftl! and efficientl!" 6ur dedicated ,ustomer

&erice ,entres are staffed (ith e%perienced ,ash Products &pecialists to

ensure that all our customers are (ell sered"

&tandard ,hartered full! understands the importance of time, conenience

and efficienc! to the success of !our $usiness" Ae make eas! the comple%

financial (orld for !ou and help !ou ma%imise eer! opportunit!"

Aith oer ?:2 !ears of e%perience in trade finance and an e%tensie

international $ranch net(ork, &tandard ,hartered is committed to help !ou

succeed in eer! competitie enironment" To keep pace (ith !our changing

needs, (e constantl! reie( our comprehensie products and serices,

ensuring that a full range of fle%i$le and innoatie serices is al(a!s

aaila$le for !ou (hereer !ou trade"

&tandard ,hartered is highl! recognised as a leading cash management

supplier across the emerging markets" 6ur ,ash *anagement &erices coer

local and cross $order pa!ments, collections, information management,

account serices and liquidit! management for $oth corporate and

institutional customers"

T2e( *an 2elp (o)5

manage the aaila$ilit! of !our funds efficientl!

monitor and control the moement of funds

settle pa!ments to !our suppliers in a timel! and cost4effectie

manner"

capture eer! inestment opportunit! to increase !our income

<.9 A''o*nts Ser4i'es

In Bangladesh, &tandard ,hartered customers hae access to a ?>4$ranch,

+4cit!, -57AT3 $anking net(ork" ,ustomers can operate their accounts

through an! of our full! automated offices in Dhaka, ,hittagong, &!lhet,

Bogra, <hulna and =ara!angan#" The! can perform ,ash deposits and

(ithdra(als, ,heque Deposits, Fund Transfers, make transactional queries,

gie cheque $ook requisitions, ask for account statement and pa! utilit! $ills"

At &tandard ,hartered, (e proide a (ide range of account serices for our

,orporate ,ustomers" 6ur ,orporate Accounts are managed $! dedicated

A**o)nt Relat&ons2&p 3ana0ers8 (ho maintain regular and close contact

(ith our clients in order to understand their requirements and serice them

$etter"

!e offer t2e follo9&n0 t(pes of a**o)nts to o)r *orporate

*l&ents5

C)rrent A**o)nts:These are checking Taka accounts through (hich

funds can $e freel! deposited and (ithdra(n" ,orporates t!picall! use

them for most of their transactional requirements (hich includes

collections as (ell as pa!ments" ,ollections ma! $e in the form of cash,

cheques, pa!4orders@demand drafts and een in(ard remittances from

a$road" &imilarl!, pa!ments ma! $e in the form of cash, cheques and

other aaila$le mechanisms"

S2ort Ter' Depos&ts ;STD<:These are similar to current accounts in

operation accept that the! do not hae checking facilities and the! earn

interest, (hich is calculated on a dail! $alance $asis and credited at

periodic interals" The &TD account is a useful mechanism to earn interest

on idle funds for companies that can not commit fund for longer period of

times in Fi%ed Deposits"

%&=e+ Depos&t A**o)nts: Fi%ed Deposits are for ar!ing tenorsF current

offerings range from ? month to 1 !ears and the interest rate also ar!

correspondingl!" Fi%ed deposit accounts can not $e used for transactional

purposes and interest can onl! $e earned upon the maturit! of the

deposit"

Sa4&n0s A**o)nts: These accounts are mainl! aimed at the indiidual

and are usuall! offered for ,orporate emplo!ees" .o(eer, ,orporate

Proident Fund accounts, -ratuit! Funds, etc" can also use such accounts,

proiding statutor! appropriate approals are held"

Con4ert&ble A**o)nts: The ,onerti$le Account is a checking current

account (ith $alances denominated in Taka" Pa!ments or (ithdra(als

from this account can $e made in $oth Taka and Foreign ,urrenciesF

ho(eer funds deposited must hae a foreign currenc! source" &trict

7%change ,ontrol Regulations goern the opening and operation of

,onerti$le Accounts and it is adisa$le to discuss these in detail (ith the

Bank $efore opening such accounts"

%ore&0n C)rren*( A**o)nts: In addition to the arious local currenc!

accounts, there are t(o t!pes of Foreign ,urrenc! accounts aaila$le/ a

U&D@-BP checking ,urrent Account or a U&D@-BP Fi%ed Deposit (hich is

also called a =on4resident Foreign ,urrenc! Deposit 8 =F,D9 and (hich

earn attractie interest rates" &trict 7%change ,ontrol Regulations goern

the opening and operation of Foreign ,urrenc! Accounts and it is

adisa$le to discuss these in detail (ith the Bank $efore opening such

accounts"

1.1 e7Ban/&n0

e4Banking proides !ou (ith a full range of reporting capa$ilities, and a

comprehensie range of transaction initiation options" Ahether it is cash or

trade related, the user4friendl! e4Banking customer (orkstation (ill proide

!ou (ith a secure, relia$le and effectie link $et(een !ou and !our accounts

an!(here across the &tandard ,hartered net(ork (ith more than 122 offices

in more than 12 countries"

6nce !ou hae defined !our required reporting data into the s!stem, !ou can

displa! it on the e4Banking (orkstation or print it" The em$edded report

generator ena$les !ou to customise report formats to suit !our particular

requirements" e4Banking also incorporates an Ieents schedulerJ (hich

automaticall! e%ecutes tasks for !ou" *oreoer, e4Banking offers Data

7%port@Import capa$ilit! to@from other (idel! used Aindo(s4$ased soft(are

8e"g" te%t, *& 7%cel, *& Access etc"9"

T2e follo9&n0 are t2e /e( feat)res of e7Ban/&n05

Cas2 Report&n0>

Aith e4Banking, !ou not onl! receie access to !our accounts throughout the

Bank5s net(ork, !ou also receie information a$out moements through !our

accounts (ith other $anks ia the &AIFT multi4$ank reporting capa$ilit!" The

user friendl! design of e4Banking ena$les !ou to ie( !our account details

quickl! and easil! D account $alance details, statements, and histor!

information are all aaila$le at the touch of a $utton"

Cas2 In&t&at&on>

Eou receie a full range of domestic and cross4$order transaction initiation

capa$ilities through e4Banking, including electronic funds transfer as (ell as

paper $ased pa!ment options such as drafts" e4Banking simplifies the cash

input initiation process $! proiding !ou (ith features that improe accurac!

and efficienc!" These include templates for commonl! used transactionsF

Ilook4upJ ta$les for frequentl! used information such as $ank, $eneficiar!

and account detailsF and a Icreate from preiousJ capa$ilit! that allo(s !ou

to select one of !our earlier instructions as a template for !our current input"

Tra+e In&t&at&on>

e4Banking proides !ou (ith a full range of trade transaction capa$ilities

including, ;, applications, issue, amendments, funds (ithdra(als, import

collections and reim$ursement authori'ations"

Se*)r&t( ? Control>

Ahen making financial transactions electronicall!, strict securit! is of the

utmost importance, !ou need to hae the right safeguards in place to preent

people (ithout access rights from tampering (ith the s!stem" &tandard

,hartered5s e4Banking includes a series of features such as User

A)t2or&@at&on8 $ass9or+ $rote*t&on8 A)t2ent&*at&on ? n*r(pt&on an+

Tra*/&n0 transa*t&ons t2ro)02 an A)+&t Tra&l to ensure data integrit!

and meet !our securit! needs D all in line (ith industr!4recogni'ed

standards"

4.5 N6+7'46. C'..)&+7'4 S)2<7&)8-NCS

In toda!5s $usiness climate, it is more important than eer to turn !our

receia$les into funds !ou can actuall! use" &tandard ,hartered5s Nat&onal

Colle*t&on Ser4&*es ;NCS< is designed to help corporates (ith receia$le

collection requirements across Bangladesh" It proides faster funds

aaila$ilit! in a cost4effectie manner and improe the compan!5s liquidit!"

=,& offers a centralised s!stem (here !ou can maintain a single

concentration account (ith &tandard ,hartered for all !our countr!(ide

collections"

Co'pre2ens&4e *o4era0e>

Eou ma! deposit cheques at our ,orrespondent Bank $ranches 8currentl! +)

locations9 in addition to the eighteen 8?>9 &tandard ,hartered $ranches in

Dhaka, ,hittagong, &!lhet, =ara!angan#, <hulna, and Bogra"

C2e6)e $&*/ )p>

Alternatiel!, (e can arrange for a courier to collect the cheques from !our

offices at pre4agreed times" Ae hae dedicated support at each location (ho

(ill maintain close contact (ith !our offices, dealers and distri$utors" The!

(ill collect cheques from these places and deposit them at our correspondent

$ank $ranches"

I'pro4e (o)r *as2 flo9>

Eour single concentration account in &tandard ,hartered is credited on a pre4

agreed alue date for locations (here local clearing e%ists" &o there is no

more guessing (hen funds (ill $ecome aaila$le for !our use" *oreoer, for

non4clearing locations, (e ensure funds are realised in the shortest possi$le

time" &ince =,& quickens the speed of collections compared to the normal

clearing@collection process, !ou can take the adantage of inestment

opportunities D or reduce !our $orro(ing costs D instead of (aiting"

S&'pl&f( re*on*&l&at&on an+ re+)*e &+le balan*es>

=ational ,ollection &erices is designed in such a (a! that all funds for

collection flo( into !our concentration account" There is no need for multiple

local accounts (ith idle $alances, and there is no need to handle multiple,

time4consuming reconciliation tasks"

Re*e&4e better &nfor'at&on>

Eour a$ilit! to manage !our $usiness effectiel! is dependent on the qualit!

and timeliness of the information !ou receie" Eou (ill promptl! receie

deposit ackno(ledgements and !our &tandard ,hartered ,oncentration

Account (ill $e credited on the pre4agreed date 8$ased on the cheque t!pe

!ou hae deposited at the designated $ranches9" Eou can also receie a

comprehensie statement, detailing the deposits made at each of the

designated $ranches and the funds due from them"

=ational ,ollection &erices proides a ariet! of informatie and timel!

reports to make sure !ou kno( (hat funds are $eing collected, (hen, and

ho( D to help !ou make the most effectie decisions regarding !our

compan!5s finances" 6ur informatie reports (ill

.elp !ou $etter plan !our cash flo(s

&upport !our customer credit control process

.elp !ou to reconcile !our receia$les quickl! and efficientl!

In short, =ational ,ollection &erices is a simple and relia$le solution to !our

countr!(ide receia$le collection requirements"

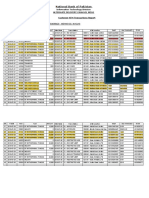

ADLA=TA-7 6F =,&

Sl

No

T2r) NCS !&t2o)t NCS

? The! are charging "?2M (ith a

minimum processing fee of BDT ?22 for

processing an! deposit 8including cash,

cheques, DDs,P6s9 through =,&

"01M (ith minimum BDT )22 and

ma%imum BDT ?,122 charges for

processing an! collection cheques"

0 =o return charges in =,& Return charges of BDT ?22 for an!

dishonored collection cheque"

) A fle%i$ilit! of haing the net(ork

,oerage at 12 ,orr$ank ;ocations and

+ &,B locations" ,ustomer can deposit

,ash, an! kind of instrument in these

$ranches" -uaranteed credit if the

cheque is dra(n on clearing area and

faster collection 8ma%imum ? (eek9 if

the cheque is dra(n on non4clearing

locations"

There is no such arrangement

e%ists, an! cheques dra(n on

outside &,B $ranches sent for

collection and usuall! it takes 0@)

(eeks to realise the cheque"

: A pre4agreed credit4structure is gien in

=,&" For cheques deposited in an!

clearing location (e are crediting the

=N*; (ith a pre4agreed turnaround

time" For &,B it is ne%t da! and , in

,orr $ank clearing locations it is Da! )"

If the cheques sent for collection

normall! there is a$solutel! no

guaranteed turnaround time" It

ma! een take months to realise

the cheque"

1 A comprehensie *I& proided for all

the transactions through =,&" Ae do

hae separate reports for ,heques &

,ash sho(ing respectie deposit

locations, consolidated total for a

particular location and also depositor5s

name"

=o such *I& aaila$le in normal

procedure"

+ Ae do hae return reports sho(ing all

the details including Return Reason,

Return Date, indiidual ,heque

Amount, ,heque num$er, ,heque

Date, Dra(ee $ank5s name so that the

cheque can $e easil! marked and

=o such *I& is aaila$le"

reconciled"

G Ae do hae a separate report called list

of Relaised transaction sho(ing details

of honored@dishonored collection

cheques"

=o such *I& is aaila$le"

> Ae do hae comprehensie charges

report sho(ing complete $reak4up

including indiidual deposit5s $reak4up

of charges leied in a particular month"

=o such *I& is aaila$le"

K ,ash flo( forecast & Reconciliation

report for easier reconciliation purpose"

=o such *I& is aaila$le"

?2 Dedicated customer serice support" =o such dedicated serice"

??" All in all a single point collection

solution for =e( Nealand *ilk products

8BD9 ;td"

There is not customi'ed dedicated

serice for an! specific customer"

4. O(8(60

&tandard ,hartered is proud to present O$S$AY, a serice for our ,orporate

,ustomers (hich offers automated $ulk transfer 8e"g" salar!9 processing

from their corporate accounts" This (ill result in reduced errors and an

oerall improement in !our salar! pa!ment processing"

O$S$AY processes !our &taff &alar! Pa!ment $! do(nloading !our pa!ment

instructions in the form of a Flopp! Diskette" The serice ensures that

appropriate narration is proided for all indiidual account credits 8i"e" salar!

for the month of %%%%%9 in account statements"

This serice has the follo(ing $enefits,

T&'e7eff&*&ent5 Ae can act on !our instructions on the same (orking da!

if the Diskette containing the information reaches our concerned

department $efore ??"22 a"m"

rror7%ree5 As the instructions (ill $e do(nloaded directl! from the

Flopp! Diskette, O$S$AY eliminates manual entries and minimi'es the

possi$ilities of an! errors"

Val)e7+ate5 Funds transferred through this serice are immediatel!

aaila$le at all our $ranches and AT*s

All !ou need to do is send us the salar! transfer instruction in an 7%cel File

that should contain the follo(ing information/

Full Account =o" Account =ame & &alar! Amount

The diskette should $e accompanied $! a (ritten authori'ation, (hich (ill $e

used to alidate the soft4cop! details"

The com$ined net(ork of &tandard ,hartered Bank 8?> $ranches, 01 AT*s9

and a hundred4!ear old heritage in Bangladesh places us in a unique position

to support !our $anking needs" 6ur $ranch net(ork no( coers Dhaka,

=ara!angan#, ,hittagong, &!lhet, Bogra, and <hulna, (hich are linked

through on4line4Banking serices ena$ling !ou to operate !our account of

from an! one of our $ranches or 0:4hour AT*s"

6ur offer includes a ast range of financial products and serices

complemented $! a designated Relationship *anager to manage !our

requirements (ith personali'ed care"

4.! P2)5715 S)2<7&)-B64;74/

$re'&)' Ser4&*e7Ban/&n0 offers !ou a choice of serice improements

(hich can $e tailored to !our indiidual $usiness needs" These serice

enhancements collectiel! allo( !ou to manage !our $usiness finances and

cash resources more effectiel! and conenientl!" It comprises of the

follo(ing si% modulesO

Co)r&er

The Bank (ill proide !ou (ith the conenience and securit! of a dail! courier

pick4up and delier! serice at !our premises for !our routine4Banking

transactions" The serice is aaila$le for non4cash transactions like cheque

deposits, trade finance documents, pa!ment instructions, statements and

cheque $ook requests"

A)to7%a= Reports

A comprehensie Dail! Account &tatement coering detailed transaction

information (ill $e made aaila$le to customers ia fa% eer! morning" It (ill

contain complete transaction details up to the close of $usiness of the

preious da! to facilitate $etter financial management of !our precious cash

resources"

"otl&ne ;A S&n0le $o&nt of Conta*t<

This facilit! proides !ou (ith a single (indo( into the $ank for all !our

transactional $anking enquir!" Premium &erice4Banking customers (ill hae

access $! fa% or $! phone to an e%clusie ,orporate &erice Unit 8,&U9 in

the Bank5s 6ffice at Dhaka, Bangladesh" Dedicated personnel are aaila$le to

handle a full range of transactional $anking enquir! relating to $alances,

account statements, cheque pa!ment status and other transactions"

In9ar+ Re'&ttan*e Infor'at&on Ser4&*e

The $ank (ill pro4actiel! proide !ou (ith a fa% report detailing all In(ard

&AIFT pa!ment messages receied $! the Bank for !our accounts (ith us"

For the first time !ou (ill get to kno( a$out the receipt of such remittances

een $efore the! are processed in the $ank" These messages (ill proide !ou

(ith complete remittance details including amount and remitter information"

=press $a('ents

In case !ou miss our dail! courier or urgentl! need to send a tele% or draft,

(e offer !ou an alternatieF initiate !our request for a pa!ment ia !our fa%

machine" Ahat is more, for Premium &erice4Banking customers, the Bank

commits to initiate remittance transactions for tele%@&AIFT transfer

instructions receied $! ?/22 p"m" For pa! orders, the cut off time for

Premium &erice4Banking customers has $een e%tended to )/)2 p"m"

%ore&0n =*2an0e ? 3one( 3ar/et Infor'at&on

The Bank (ill arrange to proide information on Foreign 7%change and *one!

*arket rates on a dail! $asis $! fa%" 6ur Dail! Treasur! =e(s proides

information on Foreign 7%change rates, ke! stock, $ond, and interest rate

indices, highlights from international financial markets and information on

technical chart points"

In addition, the Bank (ill proide (ith a clear and concise market

commentar!, in the form of a Aeekl! Treasur! =e(sletter, (hich coers the

ma#or financial eents of the (eek and proides information on moements

in ma#or currencies, stock indices, commodities and U&D *one! *arket

rates"

4." P605)4+8 P.18

!2at &s $a('ents $l)sA

Pa!ments Plus is a user friendl! soft(are (hich is offered to corporate

customers of &tandard ,hartered Bank to facilitate the pa!ments that the!

(ish to make through its electronic platform, e4Banking"

Ahat Pa!ments Plus essentiall! does is create a $ridge $et(een the

customer5s o(n accounts pa!a$le s!stem and &tandard ,hartered5s e4

Banking" T!picall! the customer has to maintain a data$ase from (hich

pa!ments are periodicall! made"

For customers (ho are alread! used to the conenience of sending

instructions electronicall! through &tandard ,hartered5s e4Banking, t!ping in

the required information into the e4Banking template creates an additional

leel of (ork"

This is (here Pa!ments Plus comes in" $! utili'ing this soft(are the process

of t!ping in all the requited information $ecomes #ust a single click of the

mouse $utton" If the accounts pa!a$le s!stem is maintained in a simple pre4

determined format 8t!picall! in *& 7%cel file9, then Pa!ments Plus uploads

the information from the file to e4Banking"

Thus sending pa!ment instructions to &tandard ,hartered Bank $ecomes a

one4step process

!2at $a('ents $l)s 'eans for (o)A

6utsourcing of domestic account pa!a$les to the $ank

Integration of e4Banking (ith account pa!a$le s!stems

A$ilit! to process $ulk transactions

&upports internal transfers, pa! orders and demand drafts dra(n on

other $anks

Tan0&ble benef&ts (o) 0et b( )s&n0 $a('ents $l)s

Increased efficienc!

-reater control

7nhanced securit!

Improed endor relations

;o(er all4in4all cos

4.# T26-) R)('2+8

At &tandard ,hartered, (e understand ho( important it is to sta! informed

of !our trade commitment at all times" 6ur innoatie information serice

no( ena$les !ou to get an up4to date and eas! Dto read summar! of !our

outstandings for !our Import, 7%port and &hipping -uarantee positions"

Eou get the follo(ing $enefits from our Trade Reports

*onitor !our outstandings at a glance

Take control of !our $ills status and cash flo(

6ptimall! utili'e !our trade credit facilities

Proactiel! act on pro$lems relating to unaccepted or unpaid $ills

,ontrol oer the e%pir! dates for import and e%port ;etters of ,redit

Its range of Trade Reports

Trade Reports puts !ou in control of !our trade outstandings D and gies !ou

all the information !ou need to effectiel! manage !our compan!5s trade

$usiness" Eou can choose the leel of reporting that $est meets !our

compan! needs, and !ou can change this selection as !our $usiness gro(s"

Ae offer si% t!pes of report categories

1. Tra+e O)tstan+&n0s Report summari'ing all !our trade finance

outstandings in the report"

-. =port Tra+e 3at)r&t( Report includes the follo(ing information/

=port #etters of Cre+&t Report details une%pired e%port letters of

credit transactions

=port Dra9&n0sBB&lls Report details !our outstanding e%port

dra(ings@$ills transactions

C. I'port Tra+e 3at)r&t( Report includes the follo(ing information/

I'port #etters of Cre+&ts Report details !our outstanding import

letters of credit transactions

Tr)st Re*e&pts 3at)r&t( Report details !our outstanding trust

receipt transactions

A**eptan*es Report details !our outstanding acceptances and their

maturities

1. G)arantee Report details !our outstanding from cop! document

endorsement for air, sea and road, Bid Bond and Performance Bond

issuance"

All reports can $e deliered $! fa%, mail, or held for collection" The! can $e

deliered on a dail!, (eekl!, fortnightl!, monthl! $asis or on demand"

1.1. !eb Ban/

Intro+)*t&on>

Ae$ Bank can significantl! enhance the $ank5s serice to !ou and (ill pla! a

piotal role in the future of !our $usiness" 6ur ,orporate and Institutional

(e$4site offers !ou comprehensie information on !our accounts and a

num$er of alue4added features"

The onl! thing that !ou need is an access to the internet and !ou (ill $e a$le

to use Ae$ Bank from an!(here in the (orld" As a Ae$ Bank customer !ou

(ill $e gien a specific user ID and a confidential pass(ord" Eou can then

ie( the follo(ing information online/

Cash Account Statement

Cash Account Balances

Cash Balance History

Eou can also sae these information as .T*;, PDF or te%t format and take

printout"

In addition !ou (ill $e a$le to find a comprehensie range of information a$out &tandard ,hartered Bank,

its serices and (orld4(ide net(ork" A ma#or adantage of Ae$ Bank is the user can access this (e$4site

from an! location through an internet connection onl!"

Balan*es an+

3essa0e

Center on

!eb ban/

Se*)r&t(>

In order to meet the rigorous industr! standard of transactional securit!, (e hae

adopted the operational and technolog! frame(ork of Identrus -lo$al Pu$lic <e!

Infrastructure" Ae hae achieed the status of Identrus -lo$al ,ertified Authorit! in

022?"

4.11 C,)=>27+)2

!2at &s C2e6!r&terA

,heqAriter is an user4friendl! soft(are deeloped and o(ned $! &tandard

,hartered -roup, (hich is offered to corporate customers to facilitate the

preparation, printing, and recording of &tandard ,hartered cheques"

,heqAriter also proides different t!pes of *I& for a $etter control on !our

cheque pa!ments"

The Bank (ill suppl! the cheque printing stationar! as and (hen requested

$! the customer" This is a pre4printed A:4si'e cheque form (ith t(o sections

separated $! a perforation" The top part is the counter foil of the cheque that

can $e used as a paper4record of the transaction and can also eidence the

pa!ee5s receipt" The $ottom part is the cheque that contains all regular input

fields of a conentional cheque leaf" An optional IAccount Pa!ee 6nl!J

marking for crossed cheques can $e printed on the cheque leaf $!

,heqAriter"

!2at are &ts feat)resA

,ustomisation of cheque leaes (ith customer logosF

Data storage for a complete histor! of all cheque pa!mentsF

,ontrols against t!ping errorsF

Ro$ust oerall securit!F and

Professional counterfoils, (hich can $e used $oth for recording

purposes as (ell as receipts"

!2at are t2e 2ar+9are re6)&re'ents for C2e6!r&terA

,heqAriter can $e operated from either a single personal computer or from a

net(ork of multiple computers" .ard(are requirements for installation of

,heqAriter are/

?22M IB* compati$le personal computer operating under *& Aindo(s

K1 and a$oeF

:>+ processor 8minimum9F

?+ *B RA*F

?":: *B )"1J Disk Drie

.ard Disk drie (ith 01*B free space"

"o9 *an (o) benef&t fro' C2e6!r&terA

,heqAriter

allo(s !ou to customise !our cheques (ith compan! details, logo and

counterfoilF

saes time $! automating the cheque preparationF

maintains a histor! of all cheque pa!ments and can proide a (ide

range of information e%traction capa$ilities through arious reportsF

has the a$ilit! to interface (ith other applicationsF

proides full audit trail of all transactions"

Se*)r&t(>

Access to #heqWriter can be parameteri-ed through user I/s and passwords. 0sers can also be

assigned with different access levels to avoid unauthori-ed use of #heqWriter.

4.12 B7..8(60

Ae are pleased to introduce Billspa!, the most conenient (a! to settle !our

monthl! utilit! $ills" Billspa! (ill not onl! proide conenience $ut also allo(

fle%i$ilit! to pa! !our $ills as and (hen !ou choose" 6nce !ou sign up for our

serices !ou (ill no longer hae to go out of !our (a! to pa! $ills for

electricit!, mo$ile phones, internet, etc", eer! month" Billspa! proides one4

stop pa!ment solution (here (e (ill de$it !our account to pa! !our $ills"

,hoose A)to B&llspa( to outsource !our utilit! pa!ments to the $ank" The

$ank (ill collect !our $ills directl! from the $illing compan! and de$it !our

account to pa! them according to their $illing c!cle" All !ou hae to do is sign

up once and completel! forget a$out !our $illsP (e (ill take care of them"

And if !ou5re not comforta$le (ith pa!ing in a date deter&mined $! the $illing

compan!, (e hae B&llspa( Re0)lar for !ou" Eou can send !our $ills to our

$ank at an! da! of the month $! a messenger and (e (ill pa! off !our $ills

and stamp IPAIDJ on !our receipts"

6r simpl! choose B&llspa( =press to en#o! the $enefits of $oth the serices

mentioned a$oe" Eou decide (hen to pa! and (e5ll send in our people to

collect !our $ills from !our premise8s9" Ae (ill pa! off these $ills, stamp

IPAIDJ and send them $ack to !our office"

To sign up for Auto Billspa! !ou hae to gie us detailed $illing information"

Information like meter num$er 8for pa!ment of electricit! $ills9, $illing

compan!5s name, $illing date 8for pa!ment of mo$ile phone $ills9, customer5s

name and signature should $e gien at the time of sign up" Eou should also

proide a cop! of the releant $ill statement8s9"

To en#o! Billspa! Regular or Billspa! 7%press all !ou need to do is accept our

$anking serice proposal customi'ed to(ards !our requirement

Interns2&p Report on

TRANSACTION BANKING

IN STANDARD CHARTERED BANK

BANGLADESH

A Descriptive Analysis

S)b'&tte+ to

* Aminul .uque

.ead of .uman Resources

&tandard ,hartered Bank

0 Dilkusha ,@A, Dhaka4?222

S)b'&tte+ b(

*d" *ohin Uddin

Department of Finance & Banking

ID4+4?)0, &ec"4B

Facult! of Business &tudies

Uniersit! of Dhaka

You might also like

- Corporate CreditDocument69 pagesCorporate CreditAshish chanchlani100% (1)

- Engine Leasing MarketDocument26 pagesEngine Leasing MarketavianovaNo ratings yet

- People Vs Concepcion (Case Digest 44 Phil)Document1 pagePeople Vs Concepcion (Case Digest 44 Phil)Lemuel Angelo M. EleccionNo ratings yet

- RBS Guide To International Trade PDFDocument60 pagesRBS Guide To International Trade PDFJayakumar Sankaran100% (1)