Professional Documents

Culture Documents

Chap 012

Chap 012

Uploaded by

molango0070 ratings0% found this document useful (0 votes)

13 views23 pagesAdvance Bank Management

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAdvance Bank Management

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views23 pagesChap 012

Chap 012

Uploaded by

molango007Advance Bank Management

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 23

Chapter 12

Managing and Pricing Deposit Services

Fill in the Blank Questions

1. A(n) _________________________ requires the bank to honor withdrawals immediately upon

request.

Answer: demand deposit

2. A(n) _________________________ is an interest bearing checking account and gives the bank

the right to insist on prior notice beore customer withdrawals can be honored.

Answer: !egotiable order o withdrawal (!"#)

$. A(n) _________________________ is a short%maturity deposit which pays a competitive interest

rate. "nly & preauthori'ed drats per month are allowed and only $ o these can be by check.

Answer: money market deposit account

(. _________________________ are designed to attract unds rom customers who wish to set

aside money in anticipation o uture e)penditures or inancial emergencies.

Answer: *hrit deposits

+. _________________________ are the stable base o deposited unds that are not highly sensitive

to movements in market interest rates and tend to remain with a depository institution.

Answer: ,ore deposits

&. -ome people eel that everyone is entitled access to a minimum level o inancial service no

matter their income level. *his issue is called the issue o _________________________.

Answer: basic (lieline) banking

.. _________________________ is a way o pricing deposit services in which the rate or return or

ees charged on the deposit account are based on the cost o oering the service plus a proit

margin.

Answer: ,ost plus pricing

/. #hen inancial institutions tempt customers by paying postage both ways in bank%by%mail

services or by oering ree gits such as teddy bears0 they are practicing ___________.

Answer: nonprice competition

Rose/Hudgins, Bank Management and Financial Services, 8/e 1

Test Bank, Chapter 1 2

1. *he _________________________is the added cost o bringing in new unds.

Answer: marginal cost

12. _________________________ pricing is where the inancial institution sets up a schedule o ees

in which the customer pays a low or no ee i the deposit balance stays above some minimum

level and pays a higher ee i the balance declines below that minimum level.

Answer: ,onditional

11. #hen a customer is charged a i)ed charge per check this is called __________________ pricing.

Answer: lat rate

12. #hen a customer is charged based on the number and kinds o services used0 with the customers

that use a number o services being charged less or having some ees waived0 this is called

__________________ pricing.

Answer: relationship

1$. _________________________ is part o the new technology or processing checks where the

bank takes a picture o the back and the ront o the original check and which can now be

processed as i they were the original.

Answer: ,heck imaging

1(. A(n) _________________________ is a thrit account which carries a i)ed maturity date and

generally carries a i)ed interest rate or that time period.

Answer: time deposit

1+. A(n) _________________________ is a conditional method o pricing deposit services in which

the ees paid by the customer depend mainly on the account balance and volume o activity.

Answer: deposit ee schedule

1&. *he _________________________ was passed in 1111 and speciies the inormation that

institutions must disclose to their customers about deposit accounts.

Answer: *ruth in -avings Act

1.. *he _________________________ must be disclosed to customers based on the ormula o one

plus the interest earned divided by the average account balance ad3usted or an annual $&+ day

year. 4t is the interest rate the customer has actually earned on the account.

Answer: annual percentage yield (A56)

1/. A(n) _________________________ is a retirement plan that institutions can sell which is

designed or sel%employed individuals.

Answer: 7eogh plan

Rose/Hudgins, Bank Management and Financial Services, 8/e $

11. 8eposit institution location is most important to ______%income consumers.

Answer: low

22. _____%income consumers appear to be more inluenced by the si'e o the inancial institution.

Answer: high

21. 9or decades depository institutions oered one type o savings plan. could be opened

with as little as :+ and withdrawal privileges were unlimited.

Answer: 5assbook savings deposits

22. ,8;s allow depositors to switch to a higher interest rate i market rates

rise.

Answer: <ump%up

23. ,8;s permit periodic ad3ustments in promised interest rates.

Answer: -tep%up

24. ,8;s allow the depositor to withdraw some o his or her unds without a

withdrawal penalty.

Answer: =iquid

25. A(n) 0 which was authori'ed by ,ongress in 111.0 allows individuals to

make non%ta)%deductible contributions to a retirement und that can grow ta) ree and also pay no

ta)es on their investment earnings when withdrawn.

Answer: >oth 4>A

26. 8ue to the act that they may be perceived as more risky0 banks generally oer

higher deposit rates than traditional banks.

Answer: virtual

27. are accounts in domestic banking institutions where the ?.-.

*reasury keeps most o their operating unds.

Answer: *reasury *a) and =oan Accounts (**@= accounts)

28. is a process where merchants and utility companies take the

inormation rom a check an individual has 3ust written and electronically debits the individual;s

account instead o sending the check through the regular check clearing process.

Answer: electronic check conversion

Test Bank, Chapter 1 (

29. "n "ctober 2/0 222(0 became the law0 permitting depository institutions to

electronically transer check images instead o the checks themselves.

Answer: ,heck 21

30. *he to the cost plus pricing derives the weighted average cost o all

unds raised and is based on the assumption that it is not the cost o each type o deposit that

matters but rather the weighted average cost o all unds that matters.

Answer: pooled%unds cost approach

True/False Questions

* 9 $1. *he volume o core deposits at ?.-. banks has been growing in recent years relative to

other categories o deposits.

Answer: 9alse

* 9 $2. *he ?.-. *reasury keeps most o its operating unds in **@= deposits0 according to the

te)tbook.

Answer: *rue

* 9 $$. 8eposits owned by commercial banks and held with other banks are called correspondent

deposits.

Answer: *rue

* 9 $(. *he implicit interest rate on checkable deposits equals the dierence between the cost o

supplying deposit services to a customer and the amount o the service charge actually

assessed that customer.

Answer: *rue

* 9 $+. =egally imposed interest%rate ceilings on deposits were irst set in place in the ?nited

-tates ater passage o the <ank Aolding ,ompany Act.

Answer: 9alse

* 9 $&. Bradual phase%out o legal interest%rate ceilings on deposits oered by ?.-. banks was

irst authori'ed by the Blass%-teagall Act.

Answer: 9alse

* 9 $.. *he contention that there are certain banking services (such as small loans or savings and

checking accounts) that every citi'en should have access to is usually called sociali'ed

banking.

Answer: 9alse

Rose/Hudgins, Bank Management and Financial Services, 8/e +

* 9 $/. 8omestic deposits generate legal reserves.

Answer: *rue

* 9 $1. C)cess legal reserves are the source out o which new bank loans are created.

Answer: *rue

* 9 (2. 8emand deposits are among the most volatile and least predictable o a bankDs sources o

unds with the shortest potential maturity.

Answer: *rue

* 9 (1. 4>A and 7eogh deposits have great appeal or bankers principally because they can be

sold bearing relatively low (oten below%market) interest rates.

Answer: 9alse

* 9 (2. 4n general0 the longer the maturity o a deposit0 the lower the yield a inancial institution

must oer to its depositors because o the greater interest%rate risk the bank aces with

longer%term deposits.

Answer: 9alse

* 9 ($. *he availability o a large block o core deposits decreases the duration o a bankDs

liabilities.

Answer: 9alse

* 9 ((. 4nterest%bearing checking accounts0 on average0 tend to generate lower net returns than

regular (noninterest%bearing) checking accounts.

Answer: 9alse

* 9 (+. 5ersonal checking accounts tend to be more proitable than commercial checking

accounts.

Answer: 9alse

* 9 (&. !"# accouts can be held by businesses and individuals and are interest bearing

checking accounts.

Answer: 9alse

* 9 (.. A EE8A is a short term deposit where the bank can oer a competitive interest rate and

which allows up to & preauthori'ed drats per month.

Answer: *rue

Test Bank, Chapter 1 &

* 9 (/. A >oth 4>A allows an individual to accumulate investment earnings ta) ree and also pay

no ta) on their investment earnings when withdrawn provided the ta)payer ollows the

rules on this new account.

Answer: *rue

* 9 (1. ,ompetition tends to raise deposit interest costs.

Answer: *rue

* 9 +2. ,ompetition lowers the e)pected return to a bank rom putting its deposits to work.

Answer: *rue

* 9 +1. A bank has ull control o its deposit prices in the long run.

Answer: 9alse

* 9 +2. !onprice competition or deposits has tended to distort the allocation o scarce resources

in the banking sector.

Answer: *rue

* 9 +$. 8eposits are usually priced separately rom loans and other bank services.

Answer: *rue

* 9 +(. According to recent 9ederal >eserve data no%ee savings accounts are on the decline.

Answer: *rue

* 9 ++. According to recent survey inormation provided by the sta o the 9ederal >eserve

<oard the average level o ees on most types o checking and !"# accounts appear to

have risen.

Answer: *rue

* 9 +&. *he *ruth in -avings Act requires a bank to disclose to its deposit customer the requency

with which interest is compounded on all interest%bearing accounts.

Answer: *rue

* 9 +.. ?nder the *ruth in -avings Act customers must be inormed o the impact o any early

deposit withdrawals on the annual percentage yield they e)pect to receive rom an

interest%bearing deposit.

Answer: *rue

Rose/Hudgins, Bank Management and Financial Services, 8/e .

* 9 +/. *he number one actor households consider in selecting a bank to hold their checking

account is0 according to recent studies cited in this chapter0 low ees and low minimum

balance.

Answer: 9alse

* 9 +1. *he number one actor households consider in choosing a bank to hold their savings

deposits0 according to recent studies cited in this chapter0 is location.

Answer: 9alse

* 9 &2. ,onditionally ree deposits or customers mean that as long as the customers do not go

above a certain level o deposits there are no monthly ees or per transaction charges.

Answer: 9alse

* 9 &1. #hen a bank temporarily oers higher than average interest rates or lower than average

customer ees in order to attract new business they are practicing conditional pricing.

Answer: 9alse

* 9 &2. #eb%centered banks with little or no physical acilities are known as ________ banks

Answer: *rue

* 9 &$. *he total dollar value o checks paid in the ?nited -tates has grown modestly in recent

years.

Answer: 9alse

* 9 &(. *here are still a number o e)isting problems with online bill%paying services which has

limited the growth.

Answer: *rue

* 9 &+. *he depository institutions which tend to have the highest deposit yields are credit

unions.

Answer: 9alse

* 9 &&. ?rban markets are more responsive to deposit interest rates and ees than rural markets.

Answer: 9alse

* 9 &.. >esearch indicates that at least hal o all households and small businesses hold their

primary checking account at a depository institution situated within $ miles o their

location.

Answer: *rue

Test Bank, Chapter 1 /

Multiple Choice Questions

&/. 8eposit accounts whose principal unction is to make payments or purchases o goods and

services are called:

A) 8rats

<) -econd%party payments accounts

,) *hrit deposits

8) *ransaction accounts

C) !one o the above

Answer: 8

&1. 4nterest payments on regular checking accounts were prohibited in the ?nited -tates under terms

o the:

A) Blass%-teagall Act

<) Ec9adden%5epper Act

,) !ational <ank Act

8) Barn%-t. Bermain 8epository 4nstitutions Act

C) !one o the above

Answer: A

.2. Eoney%market deposit accounts (EE8As)0 oering le)ible interest rates0 accessible or

payments purposes0 and designed to compete with share accounts oered by money market

mutual unds0 were authori'ed by the:

A) Blass%-teagall Act

<) 8epository 4nstitutions 8eregulation and Eonetary ,ontrol Act (848E,A)

,) <ank Aolding ,ompany Act

8) Barn%-t.Bermain 8epository 4nstitutions Act

C) !one o the above

Answer: 8

.1. *he stable and predictable base o deposited unds that are not highly sensitive to movements in

market interest rates but tend to remain with the bank are called:

A) *ime deposits

<) ,ore deposits

,) ,onsumer ,8s

8) !ontransaction deposits

C) !one o the above

Answer: <

Rose/Hudgins, Bank Management and Financial Services, 8/e 1

.2. !oegotiable "rders o #ithdrawal (!"#) accounts0 interest%bearing savings accounts that can

be used essentially the same as checking accounts0 were authori'ed by:

A) Blass%-teagall Act

<) 8epository 4nstitutions 8eregulation and Eonetary ,ontrol Act (848E,A)

,) <ank Aolding ,ompany Act

8) Barn%-t. Bermain 8epository 4nstitutions Act

C) !one o the above

Answer: <

.(. A deposit which oers le)ible money market interest rates but is accessible or spending by

writing a limited number o checks or e)ecuting preauthori'ed drats is known as a:

A) 8emand deposit

<) !"# account

,) EE8As

8) *ime deposit

C) !one o the above

Answer: ,

.+. *he types o deposits that will be created by the banking system depend predominantly upon:

A) *he level o interest rates

<) *he state o the economy

,) *he monetary policies o the central bank

8) 5ublic preerence

C) !one o the above.

Answer: 8

.&. *he most proitable deposit or a bank is a:

A) *ime deposit

<) ,ommercial checking account

,) 5ersonal checking account

8) 5assbook savings deposit

C) -pecial checking account

Answer: <

... -ome people eel that individuals are entitled to some minimum level o inancial services no

matter what their income level. *his issue is oten called:

A) =ieline banking

<) 5reerence banking

,) !ondiscriminatory banking

8) =ieboat banking

C) !one o the above

Answer: A

Test Bank, Chapter 1 12

./. *he ormula "perating C)pense per unit o deposit service F Cstimated overhead e)pense F

5lanned proit rom each deposit service unit sold relects what deposit pricing method listed

belowG

A) Earginal cost pricing

<) ,ost plus pricing

,) ,onditional pricing

8) ?pscale target pricing

C) !one o the above.

Answer: <

.1. ?sing deposit ee schedules that vary deposit prices according to the number o transactions0 the

average balance in the deposit account0 and the maturity o the deposit represents what deposit

pricing method listed belowG

A) Earginal cost pricing

<) ,ost plus pricing

,) ,onditional pricing

8) ?pscale target pricing

C) !one o the above.

Answer: ,

/2. *he deposit pricing method that avors large%denomination deposits because services are ree i

the deposit account balance stays above some minimum igure is called:

A) 9ree pricing

<) ,onditionally ree pricing

,) 9lat%rate pricing

8) ?pscale target pricing

C) Earginal cost pricing

Answer: <

/1. *he ederal law that requires ?.-. depository institutions to make greater disclosure o the ees0

interest rates0 and other terms attached to the deposits they sell to the public is called the:

A) ,onsumer ,redit 5rotection Act

<) 9air 5ricing Act

,) ,onsumer 9ull 8isclosure Act

8) *ruth in -avings Act

C) !one o the above.

Answer: 8

Rose/Hudgins, Bank Management and Financial Services, 8/e 11

/2. 8epository institutions selling deposits to the public in the ?nited -tates must quote the

rate o return pledged to the owner o the deposit which relects the customerDs average daily balance kept

in the deposit. *his quoted rate o return is known as the:

A) Annual percentage rate (A5>)

<) Annual percentage yield (A56)

,) 8aily deposit yield (886)

8) 8aily average return (8A>)

C) !one o the above.

Answer: <

/$. According to recent studies cited in this book0 in selecting a bank to hold their checking accounts

household customers rank irst which o the ollowing actorsG

A) -aety

<) Aigh deposit interest rates

,) ,onvenient location

8) Availability o other services

C) =ow ees and low minimum balance.

Answer: ,

/(. According to recent studies cited in this chapter0 in choosing a bank to hold their savings deposits

household customers rank irst which o the ollowing actorsG

A) 9amiliarity

<) 4nterest rate paid

,) *ransactional convenience

8) =ocation

C) 9ees charged.

Answer: A

/+. According to recent studies cited in this chapter0 in choosing a bank to supply their deposits and

other services business irms rank irst which o the ollowing actorsG

A) Huality o inancial advice given

<) 9inancial health o lending institution

,) #hether loans are competitively priced

8) #hether cash management and operations services are provided.

C) Huality o bank oicers.

Answer: <

/&. A inancial institution that charges customers based on the number o services they use and gives

lower deposit ees or waives some ees or a customer that purchases two or more services is

practicing:

A) Earginal cost pricing

<) ,onditional pricing

,) >elationship pricing

8) ?pscale target pricing

C) !one o the above

Answer: ,

Test Bank, Chapter 1 12

Rose/Hudgins, Bank Management and Financial Services, 8/e 1$

/.. A bank determines rom an analysis on its deposits that account processing and other

operating e)penses cost the bank :$.1+ per month. 4t has also determined that its non operating e)penses

on its deposits are :1.$+ per month. *he bank wants to have a proit margin which is 12 percent o

monthly costs. #hat monthly ee should this bank charge on its deposit accountsG

A) :+.$2 per month

<) :$.1+ per month

,) :+./$ per month

8) :+..2 per month

C) !one o the above

Answer: ,

//. A bank determines rom an analysis on its deposits that account processing and other operating

e)penses cost the bank :(.(+ per month. *he bank has also determined that nonoperating

e)penses on deposits are :1.1+ per month. 4t has also decided that it wants a proit o :.(+ on its

deposits. #hat monthly ee should this bank charge on its deposit accountsG

A) :&.2+

<) :+.&2

,) :+.1+

8) :(.(+

C) !one o the above

Answer: A

/1. A customer has a savings deposit or (+ days. 8uring that time they earn :+ in interest and have

an average daily balance o :1222. #hat is the annual percentage yield on this savings accountG

A) 2.+I

<) (.1$I

,) (.2.I

8) (.+I

C) !one o the above

Answer: <

12. A customer has a savings account or one year. 8uring that year they earn :&+.+2 in interest. 9or

1/2 days they have :2222 in the account or the other 1/2 days they have :1222 in the account.

#hat is the annual percentage yield on this savings account.

A) &.++I

<) $.2/I

,) (.$.I

8) /..$I

C) !one o the above

Answer: ,

91.

Test Bank, Chapter 1 1(

4 you deposit :10222 into a certiicate o deposit that quotes you a +.+I A560 how much will you

have at the end o 1 yearG

A) :102+2.22

B) :102++.22

C) :10++2.22

D) :1022+.+2

E) !one o the above.

Answer: <

12. A bank quotes an A56 o /I. A small business that has an account with this bank had :20+22 in

their account or hal the year and :+0222 in their account or the other hal o the year. Aow

much in total interest earnings did this bank make during the yearG

A) :$22

<) :222

,) :(22

8) :1+2

C) !one o the above

Answer: A

1$. ,onditional deposit pricing may involve all o the ollowing actors e)cept:

A) *he level o interest rates

<) *he number o transactions passing through the account

,) *he average balance in the account

8) *he maturity o the account

C) All o the above are used

Answer: A

94. Customers who wish to set aside money in anticipation of future expenditures

or fnancial emergencies put their money in

A) Drafts

B) Second-party payment accounts

C) Thrift Deposits

D) Transaction accounts

E) one of the a!o"e

Answer# C

95. A sa"ings account e"idenced only !y computer entry for which the customer

gets a monthly printout is called#

A) $ass!oo% sa"ings account

B) Statement sa"ings plan

C) egotia!le order of withdrawal

D) &oney mar%et mutual fund

E) one of the a!o"e

Answer# B

Rose/Hudgins, Bank Management and Financial Services, 8/e 1+

96. A traditional sa"ings account where e"idenced !y the entries recorded in a

!oo%let %ept !y the customer is called#

A) $ass!oo% sa"ings account

B) Statement sa"ings plan

C) egotia!le order of withdrawal

D) &oney mar%et mutual fund

E) one of the a!o"e

Answer# A

97. An account at a !an% that carries a fxed maturity date with a fxed interest

rate and which often carries a penalty for early withdrawal of money is called#

A) Demand deposit

B) Transaction deposit

C) Time deposit

D) &oney mar%et mutual deposit

E) one of the a!o"e

Answer# C

98. A time deposit that has a denominations greater than '())*))) and are

generally for wealthy indi"iduals and corporations is %nown as a#

A) egotia!le CD

B) Bump-up CD

C) Step-up CD

D) +i,uid CD

E) one of the a!o"e

Answer# A

99. A time deposit that is non-negotia!le !ut where the promised interest rate

can rise with mar%et interest rates is called a#

A) egotia!le CD

B) Bump-up CD

C) Step-up CD

D) +i,uid CD

E) one of the a!o"e

Answer# B

100.A time deposit that allows for a periodic upward ad-ustment to the promised

rate is called a#

A) egotia!le CD

B) Bump-up CD

C) Step-up CD

D) +i,uid CD

E) one of the a!o"e

Answer# C

Test Bank, Chapter 1 1&

101.A time deposit that allows the depositor to withdraw some of his or her funds

without a withdrawal penalty is called a#

A) egotia!le CD

B) Bump-up CD

C) Step-up CD

D) +i,uid CD

E) one of the a!o"e

Answer# D

102..hat has made /0A and 1eogh accounts more attracti"e to depositors

recently2

A) Allowing the !an% to ha"e 3D/C insurance on these accounts

B) Allowing the fund to grow tax free o"er the life of the fund

C) Allowing the depositor to pay no taxes on in"estment earnings when

withdrawn

D) 0e,uiring !an%s to pay at least 45 on these accounts to depositors

E) /ncreasing 3D/C insurance co"erage to '67)*))) on these accounts

Answer# E

103.The dominant holder of !an% deposits in the 89S9 is#

A) The pri"ate sector

B) State and local go"ernments

C) 3oreign go"ernments

D) Deposits of other !an%s

E) one of the a!o"e

Answer# A

104.The deposit pricing method a!sent of any monthly account maintenance fee

or per-transaction fee is called#

A) 3ree pricing

B) Conditionally free pricing

C) 3lat-rate pricing

D) &arginal cost pricing

E) onprice competition

Answer# A

105.The deposit pricing method that charges a fxed charge per chec% or per

period or !oth is called#

A) 3ree pricing

B) Conditionally free pricing

C) 3lat-rate pricing

D) &arginal cost pricing

E) onprice competition

Answer# C

Rose/Hudgins, Bank Management and Financial Services, 8/e 1.

106.The deposit pricing method that focuses on the added cost of !ringing in new

funds is called#

A) 3ree pricing

B) Conditionally free pricing

C) 3lat-rate pricing

D) &arginal cost pricing

E) onprice competition

Answer# D

107.$rior to Depository /nstitution Deregulation and Control Act :D/D&CA)* !an%s

used 9 This tended to distort the allocation of scarce resources9

A) 3ree pricing

B) Conditionally free pricing

C) 3lat-rate pricing

D) &arginal cost pricing

E) onprice competition

Answer# E

108.A customer has a sa"ings deposit for 4) days9 During that time they earn

'(( and ha"e an a"erage daily !alance of '(7))9 .hat is the annual

percentage yield on this sa"ings account2

A) 9;<5

B) =9<5

C) =975

D) =9;5

E) one of the a!o"e

Answer# C

109.A customer has a sa"ings deposit for (7 days9 During that time they earn

'(7 and ha"e an a"erage daily !alance of '66))9 .hat is the annual

percentage yield on this sa"ings account2

A) 94>5

B) (49<45

C) (497?5

D) (;9?>5

E) one of the a!o"e

Answer# D

110. A !an% determines from an analysis on its deposits that account processing

and other operating expenses cost the !an% '=9(7 per month9 /t has also

determined that its none operating expenses on its deposits are '(947 per

month9 The !an% wants to ha"e a proft margin which is () percent of

monthly costs9 .hat monthly fee should this !an% charge on its deposit

Test Bank, Chapter 1 1/

accounts2

A) '49<> per month

B) '79>) per month

C) '=97; per month

D) '=9(7 per month

E) one of the a!o"e

Answer# A

111. A !an% has '6)) in chec%ing deposits9 /nterest and noninterest costs on

these accounts are =59 This !an% has '=)) in sa"ings and time deposits with

interest and noninterest costs of >59 This !an% has '6)) in e,uity capital

with a cost of 6=59 This !an% as estimated that reser"e re,uirements*

deposit insurance fees and uncollected !alances reduce the amount of money

a"aila!le on chec%ing deposits !y ()5 and on sa"ings and time deposits !y

759 .hat is this !an%@s !efore-tax cost of funds2

A) ((9))5

B) ((9<65

C) ((97)5

D) (69))5

E) one of the a!o"e

Answer# B

112. A !an% has '()) in chec%ing deposits9 /nterest and noninterest costs on

these accounts are >59 This !an% has '4)) in sa"ings and time deposits with

interest and noninterest costs of (659 This !an% has '()) in e,uity capital

with a cost of 6459 This !an% has estimated that reser"e re,uirements*

deposit insurance fees and uncollected !alances reduce the amount of money

a"aila!le on chec%ing deposits !y 6)5 and on sa"ings and time deposits !y

759 .hat is the !an%@s !efore-tax cost of funds2

A) (<9)75

B) (<9675

C) (79<<5

D) (?9(;5

E) one of the a!o"e

Answer# A

113. A !an% has '7)) in chec%ing deposits9 /nterest and noninterest costs on

these accounts are 459 This !an% has '67) in sa"ings and time deposits with

interest and noninterest costs of (=59 This !an% has '67) in e,uity capital

with a cost of 6759 This !an% has estimated that reser"e re,uirements*

deposit insurance fees and uncollected !alances reduce the amount of money

a"aila!le on chec%ing deposits !y (75 and on sa"ings and time deposits !y

=59 .hat is the !an%@s !efore-tax cost of funds2

A) (79))5

B) (69;75

C) (<9=65

Rose/Hudgins, Bank Management and Financial Services, 8/e 11

D) (79;=5

E) one of the a!o"e

Answer# C

114. A !an% expects to raise '<) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '>) million in new money if it pays a deposit rate of >5 and it can

raise '()) million in new money if it pays a deposit rate of >9759 This !an%

expects to earn ?5 on all money that it recei"es in new deposits9 .hat

deposit rate should the !an% oAer on its deposits* if they use the marginal

cost method of determining deposit rates2

A) ;5

B) ;975

C) >5

D) >975

E) one of the a!o"e

Answer# B

115. A !an% expects to raise '<) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '>) million in new money if it pays a deposit rate of >5 and it can

raise '()) million in new money if it pays a deposit rate of >9759 This !an%

expects to earn ?5 on all money that it recei"es in new deposits9 .hat is the

marginal cost of deposits if the !an% raises their deposit rate from ; to ;9752

A) 975

B) ;975

C) >9)5

D) ?975

E) ()975

Answer# C

116. 8nder the Truth in Sa"ings Act* a !an% must inform its customers of the terms

!eing ,uoted on their deposits9 .hich of the following is not one of the terms

listed2

A) +oan rate information

B) Balance computation method

C) Early withdrawal penalty

D) Transaction limitations

E) &inimum !alance re,uirements

Answer# A

117. .hich of these Acts is attempting to address the low sa"ings rate of wor%ers

in the 89S9 !y including an automatic enrollment :Bdefault optionC) in

employees@ retirement accounts2

A) The Economic 0eco"ery Tax Act of (?>(

B) The Tax 0eform Act of (?>4

Test Bank, Chapter 1 22

C) The Tax 0elief Act of (??;

D) The $ension $rotection Act of 6))4

E) one of the a!o"e

Answer# D

118. Business :commercial) transaction accounts are generally more profta!le

than personal chec%ing accounts* according to the text!oo%9 .hich of the

following explain the reasons for this statement#

A) The a"erage siDe of the !usiness transaction is smaller than the personal

transaction

B) +ower interest expenses are associated with commercial deposit

transaction

C) The !an% recei"es more in"esta!le funds in the commercial deposits

transaction

D) A and B

E) B and C

Answer# E

119. A !an% expects to raise '<) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '>) million in new money if it pays a deposit rate of >5 and it can

raise '()) million in new money if it pays a deposit rate of >9759 This !an%

expects to earn ?5 on all money that it recei"es in new deposits9 .hat is the

marginal cost of deposits if this !an% raises their deposit rate from ;975 to

>52

A) 975

B) ;975

C) >9)5

D) ?975

E) ()975

Answer# D

Rose/Hudgins, Bank Management and Financial Services, 8/e 21

120.A !an% expects to raise '<) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '>) million in new money if it pays a deposit rate of >5 and it can

raise '()) million in new money if it pays a deposit rate of >9759 This !an%

expects to earn ?5 on all money that it recei"es in new deposits9 .hat is the

marginal cost of deposits if this !an% raises their deposit rate from >5 to

>9752

A) 975

B) ;975

C) >9)5

D) ?975

E) ()975

Answer# E

121.A !an% expects to raise '6) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '()) million in new money if it pays a deposit rate of >5 and it can

raise '(6) in new money if it pays a deposit rate of >9759 This !an% expects

to earn ?975 on all money that it recei"es in new deposits9 .hat deposit rate

should the !an% oAer on its deposits* if it uses the marginal cost method of

determining deposits rates2

A) ;5

B) ;975

C) >5

D) >975

E) one of the a!o"e

Answer# C

122.A !an% expects to raise '6) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '()) million in new money if it pays a deposit rate of >5 and it can

raise '(6) in new money if it pays a deposit rate of >9759 This !an% expects

to earn ?975 on all money that it recei"es in new deposits9 .hat is the

marginal cost of deposits if this !an% raises their deposit rate from > to >9752

A) ((5

B) >9;75

C) ;9;75

D) ;5

E) 975

Answer# A

123.A !an% expects to raise '6) million in new money if it pays a deposit rate of

;59 /t can raise '4) million in new money if it pays a deposit rate of ;9759 /t

can raise '()) million in new money if it pays a deposit rate of >5 and it can

raise '(6) in new money if it pays a deposit rate of >9759 This !an% expects

to earn ?975 on all money that it recei"es in new deposits9 .hat is the

marginal cost of deposits if this !an% raises their deposit rate from ;975 to

>52

A) ((5

Test Bank, Chapter 1 22

B) >9;75

C) ;9;75

D) ;5

E) 975

Answer# B

Rose/Hudgins, Bank Management and Financial Services, 8/e 2$

You might also like

- FinalsDocument205 pagesFinalsall in one67% (3)

- Test Bank For Financial Markets and Institutions 7th Edition by SaundersDocument7 pagesTest Bank For Financial Markets and Institutions 7th Edition by SaundersKiara Mas100% (1)

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- HRM 5 Units Full Notes 23-1Document41 pagesHRM 5 Units Full Notes 23-1Merlin KNo ratings yet

- Chap 018Document27 pagesChap 018Xeniya Morozova Kurmayeva100% (3)

- Chap 013Document19 pagesChap 013Xeniya Morozova Kurmayeva100% (1)

- Chap 11Document19 pagesChap 11Đại Phú Trần NăngNo ratings yet

- Chap 007Document27 pagesChap 007Xeniya Morozova Kurmayeva100% (6)

- Chap 005Document24 pagesChap 005Xeniya Morozova Kurmayeva88% (16)

- Chap 4Document13 pagesChap 4Mahfuzur RahmanNo ratings yet

- Chapter 15Document5 pagesChapter 15Beltina Ndoni0% (1)

- Chapter 11 PDFDocument18 pagesChapter 11 PDFTedi Saleh100% (1)

- Bank Management and Financial Services 9th Edition Rose Test BankDocument9 pagesBank Management and Financial Services 9th Edition Rose Test Banktestbankloo100% (1)

- Answers To End-of-Chapter Questions - Part 2: SolutionDocument2 pagesAnswers To End-of-Chapter Questions - Part 2: Solutionpakhijuli100% (1)

- Chap 007Document27 pagesChap 007Xeniya Morozova Kurmayeva100% (6)

- Chap 005Document24 pagesChap 005Xeniya Morozova Kurmayeva88% (16)

- Art. 1953 - 1961Document7 pagesArt. 1953 - 1961qwertyNo ratings yet

- Chap 006Document24 pagesChap 006Xeniya Morozova Kurmayeva100% (12)

- Chap 017Document27 pagesChap 017Xeniya Morozova Kurmayeva100% (4)

- Chap015 QuizDocument22 pagesChap015 QuizJuli Yuill-ZiembowiczNo ratings yet

- Chap 010Document16 pagesChap 010Xeniya Morozova KurmayevaNo ratings yet

- CH 1Document15 pagesCH 1awsimms100% (2)

- Chap012 Quiz PDFDocument20 pagesChap012 Quiz PDFLê Chấn PhongNo ratings yet

- Chap 011Document18 pagesChap 011Xeniya Morozova Kurmayeva100% (9)

- Chap 014Document11 pagesChap 014stella0616100% (1)

- Chapter 06Document21 pagesChapter 06saodoingoi_mb37100% (1)

- Test 1Document83 pagesTest 1Cam WolfeNo ratings yet

- Chap011 Quiz PDFDocument18 pagesChap011 Quiz PDFLê Chấn PhongNo ratings yet

- Self-Liquidating Inventory Loan: Rose - Chapter 17 #1Document37 pagesSelf-Liquidating Inventory Loan: Rose - Chapter 17 #1Lê Chấn PhongNo ratings yet

- CH 2Document14 pagesCH 2awsimms100% (1)

- ch18 PDFDocument34 pagesch18 PDFLê Chấn PhongNo ratings yet

- Test Bank For Bank Management and Financial Services 9th Edition by RoseDocument50 pagesTest Bank For Bank Management and Financial Services 9th Edition by RoseAzui VincentNo ratings yet

- TM - Tut 13 - Credit Derivatives - RevisionDocument5 pagesTM - Tut 13 - Credit Derivatives - RevisionTeddy AhBu0% (1)

- Chap 020Document11 pagesChap 020Mitra MallahiNo ratings yet

- Chapter 11 Testbank: StudentDocument71 pagesChapter 11 Testbank: StudentHoan Vu Dao KhacNo ratings yet

- Chapter 7 Practice ProblemsDocument12 pagesChapter 7 Practice ProblemsFarjana Hossain DharaNo ratings yet

- Chap 020Document18 pagesChap 020stella0616No ratings yet

- Quiz I - Commerical Bank ManagementDocument7 pagesQuiz I - Commerical Bank ManagementSohan KhatriNo ratings yet

- Test Bank International Finance MCQ (Word) Chap 10Document38 pagesTest Bank International Finance MCQ (Word) Chap 10Mon LuffyNo ratings yet

- CB Chapter 15 AnswerDocument5 pagesCB Chapter 15 AnswerSim Pei YingNo ratings yet

- TM Tut 13 Credit Derivatives Revision PDFDocument5 pagesTM Tut 13 Credit Derivatives Revision PDFQuynh Ngoc DangNo ratings yet

- QuizDocument26 pagesQuizDung Le100% (1)

- Chapter 2 Economics of Money, Banking, and Fin. MarketsDocument1 pageChapter 2 Economics of Money, Banking, and Fin. Marketsamer_wahNo ratings yet

- Part 1. Questions For Review: Tutorial 1Document25 pagesPart 1. Questions For Review: Tutorial 1TACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- IFI Tutorial 4-8Document19 pagesIFI Tutorial 4-8Ninh Thị Ánh NgọcNo ratings yet

- Chapter12 Managing and Pricing Deposit ServicesDocument12 pagesChapter12 Managing and Pricing Deposit ServicesVisal Chin0% (1)

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenDocument6 pagesRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffNo ratings yet

- Chapter 5 Solutions 6th EditionDocument6 pagesChapter 5 Solutions 6th EditionSarah Martin Edwards50% (2)

- Financial Markets and Institutions Test Bank (021 030)Document10 pagesFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmNo ratings yet

- Tutorial 6 - TRMDocument9 pagesTutorial 6 - TRMHằngg ĐỗNo ratings yet

- Redy For ExamDocument100 pagesRedy For ExamsadNo ratings yet

- Financial Market & Institution WorksheetDocument5 pagesFinancial Market & Institution Worksheetbikilahussen100% (1)

- Chap 12Document23 pagesChap 12MichelleLeeNo ratings yet

- Chapter 5Document18 pagesChapter 5Student 235No ratings yet

- Chap 5Document40 pagesChap 5Minh HoangNo ratings yet

- Chapter 6Document20 pagesChapter 6Federico MagistrelliNo ratings yet

- Chap 004Document18 pagesChap 004Hoài Anh VõNo ratings yet

- NHTM Ch4Document26 pagesNHTM Ch4jnaxx27No ratings yet

- The Management of Capital Fill in The Blank QuestionsDocument16 pagesThe Management of Capital Fill in The Blank Questionsichigo.x introNo ratings yet

- Chap 001Document15 pagesChap 001molango007No ratings yet

- Chap 10 MCQDocument18 pagesChap 10 MCQMichelleLee100% (1)

- Mod08 - 09 10 09Document37 pagesMod08 - 09 10 09Alex100% (1)

- Ch5 Test BankDocument41 pagesCh5 Test BankK59 Le Nhat ThanhNo ratings yet

- Chapter 10 The Investment FunctionDocument18 pagesChapter 10 The Investment FunctionHaris FadžanNo ratings yet

- Chap 011Document18 pagesChap 011Xeniya Morozova Kurmayeva100% (9)

- Chap 010Document16 pagesChap 010Xeniya Morozova KurmayevaNo ratings yet

- CH 1Document15 pagesCH 1awsimms100% (2)

- PPP NguyenDocument9 pagesPPP NguyenMadiha KhanNo ratings yet

- APA Style Citation and ReferenceDocument3 pagesAPA Style Citation and ReferenceXeniya Morozova KurmayevaNo ratings yet

- p1 52Document52 pagesp1 52Xeniya Morozova Kurmayeva67% (3)

- Reading 1 Bank Regulator's LotDocument5 pagesReading 1 Bank Regulator's LotXeniya Morozova KurmayevaNo ratings yet

- A Conceptual Model To Measure Customer S Satisfaction in Electric Power Distribution ServicesDocument22 pagesA Conceptual Model To Measure Customer S Satisfaction in Electric Power Distribution ServicesaggarwalakankshaNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- Employee 1 PayslipDocument6 pagesEmployee 1 PayslipJeric Lagyaban AstrologioNo ratings yet

- Unit 1: The Manager'S Job: ObjectivesDocument18 pagesUnit 1: The Manager'S Job: ObjectivesM.TrangNo ratings yet

- Business Taxation AssignmentDocument7 pagesBusiness Taxation AssignmentThe Social KarkhanaNo ratings yet

- Chapter 1 - General Introduction To Supply Chain and Supply Chain ManagementDocument24 pagesChapter 1 - General Introduction To Supply Chain and Supply Chain ManagementKim Anh ĐặngNo ratings yet

- Entrep-With AnswersDocument2 pagesEntrep-With AnswersMaskter ArcheryNo ratings yet

- Kuliah 12 Creative Marketing PRDocument37 pagesKuliah 12 Creative Marketing PROppie ALmesiNo ratings yet

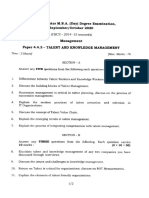

- CBCS 4.4.3 Talent and Knowledge Management 2020Document2 pagesCBCS 4.4.3 Talent and Knowledge Management 2020Uma UmamaheswariNo ratings yet

- Coc Level 1-4Document149 pagesCoc Level 1-4eferem100% (14)

- 601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDocument5 pages601b9f7c3988930021ce6845-1612423290-CHAPTER 2 - BUILDING CUSTOMER LOYALTY THROUGH CUSTOMER SERVICEDomingo VillanuevaNo ratings yet

- Paper15 Revisionary Test PaperDocument59 pagesPaper15 Revisionary Test PaperKumar SAP100% (1)

- Ethics QuijotekaffeeDocument14 pagesEthics QuijotekaffeealbertkNo ratings yet

- Sudden Death of A Ceo: Death and Succession PlanningDocument5 pagesSudden Death of A Ceo: Death and Succession PlanningJohn doeNo ratings yet

- WWW - ILOE.ae WWW - ILOE.aeDocument2 pagesWWW - ILOE.ae WWW - ILOE.aeAfsal JhNo ratings yet

- Unit 1 Issue of DebentureDocument12 pagesUnit 1 Issue of DebentureBhavesh SapkeNo ratings yet

- BNP Paribas Corridor Variance Swaps A Cheaper Way To Buy VolatilityDocument6 pagesBNP Paribas Corridor Variance Swaps A Cheaper Way To Buy VolatilityGaurav VermaNo ratings yet

- A The Interplay of Innovation, Brand, and Marketing Mix VariablesDocument16 pagesA The Interplay of Innovation, Brand, and Marketing Mix VariablesLucimari AcostaNo ratings yet

- Lembar Kerja Ud Buana-1Document20 pagesLembar Kerja Ud Buana-1Akhmad Riza ANo ratings yet

- Emran: Macro Environment Analysis of BangladeshDocument47 pagesEmran: Macro Environment Analysis of BangladeshbappyNo ratings yet

- HDFC Bank 110110Document16 pagesHDFC Bank 110110Raj Kumar MadhavarajNo ratings yet

- Book Solution Economics N Gregory Mankiw Mark P Taylor Questions Answers Chapter 1 34Document160 pagesBook Solution Economics N Gregory Mankiw Mark P Taylor Questions Answers Chapter 1 34Jorge Alfredo HuarachiNo ratings yet

- Assignment - Exam PaperDocument6 pagesAssignment - Exam PaperAsadulla KhanNo ratings yet

- Footwear Industry in NepalDocument76 pagesFootwear Industry in Nepalsubham jaiswalNo ratings yet

- R06 The Time Value of MoneyDocument24 pagesR06 The Time Value of MoneyBảo TrâmNo ratings yet

- Week 3 Case AnalysisDocument3 pagesWeek 3 Case AnalysisGarrett ToddNo ratings yet

- Study of Information Sytems in Eta Engineering Pvt. LTD.: Submitted To: Submitted byDocument12 pagesStudy of Information Sytems in Eta Engineering Pvt. LTD.: Submitted To: Submitted byVivek Raj GuptaNo ratings yet

- Glo MacsDocument4 pagesGlo MacssamiNo ratings yet