Professional Documents

Culture Documents

Nizwa Bank Investment Structure 05062011

Uploaded by

mfaisalidreisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nizwa Bank Investment Structure 05062011

Uploaded by

mfaisalidreisCopyright:

Available Formats

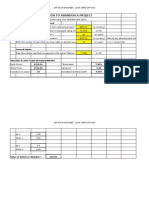

PROPOSED INVESTMENT STRUCTURE - NIZWA BANK

GLOREI -50%

RO 5,000,000 cash (50%

ownership in SPV)

SPV (LLC) - Capital RO 10,000,000

(6.66% interest in Nizwa Bank)

SHEIK SALIM - 50%

RO 5,000,000 cash (50%

ownership in SPV)

10,000,000

shares

RO 10,000,000

investment

NIZWA BANK

(150 mn

shares)

Notes:

- The essence/ objective of the structure is to gain 6.66% equity interest in Nizwa Bank by forming an SPV

- The SPV will be capitalized by RO 10,000,000 whereby Glorei and Sheik Salim potentially injects RO 5,000,000 cash each in the SPV.

- The ownership in the SPV will be 50% for both Glorei and Sheik Salim

- RO 10,000,000 cash in the SPV will be used to acquire 10,000,000 shares in Nizwa Bank which equates to 6.66% holding in Nizwa Bank

- Incase if the equity is partly offered in-kind, the other partner will compensate and inject cash for shares acquisition and the shareholding in the SPV will change accordingly.

- The proposed structure is subject to approval by the Board.

PROPOSED INVESTMENT STRUCTURE - NIZWA BANK

GLOREI

RO 5,000000 cash

(55% ownership in

SPV)

SPV (LLC) - Capital RO 9,080,000

(3.33% interest in Nizwa Bank)

SHEIK SAIF (PIPE FACTORY)

In -kind 51% Holding in Pipe

Factory (RO 4,080,000) - (45%

ownership in SPV)

RO 5,000000

investment

5,000,000

shares

NIZWA BANK

(150 mn

shares)

Notes:

- The essence/ objective of the structure is to gain 3.33% interest in Nizwa Bank by forming an SPV

- The SPV will be capitalized by RO 5,000,000 in cash by Glorei and in-kind contribution by Sheik Saif Al Maskeri (51% shares of the pipe factory).

- Total book value of pipe factory is RO 8,000,000

- RO 5,000,000 cash in the SPV will be used to acquire 5,000,000 shares in Nizwa Bank

- The ownership in the SPV will be 55% and 45% by Glorei and Sheik Saif Al Maskeri respectively

- The proposed structure is subject to approval by the Boards of each Company

You might also like

- Faysal Bank ReportDocument4 pagesFaysal Bank Reportadnan_akram300No ratings yet

- BB QuestionsDocument2 pagesBB QuestionsHari NaamNo ratings yet

- Questions Baesd On WaccDocument1 pageQuestions Baesd On WaccRohit ShrivastavNo ratings yet

- 4 January 2016Document1 page4 January 2016Ady HasbullahNo ratings yet

- APFL/Bank Investment/2017/01 27-May-2017Document1 pageAPFL/Bank Investment/2017/01 27-May-2017ASM LikhonNo ratings yet

- FM AssignmentDocument3 pagesFM Assignmentdua tanveerNo ratings yet

- Allied Bank of Pakistan PrivatizationDocument14 pagesAllied Bank of Pakistan Privatizationnadeemmumtaz44No ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument16 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Lucky LankaDocument7 pagesLucky LankaRandora Lk100% (1)

- SBC - Announcement On Incorporation of New SubsidiaresDocument3 pagesSBC - Announcement On Incorporation of New SubsidiarestôqüêZzNo ratings yet

- Privatization of HBLDocument10 pagesPrivatization of HBLUmair HassanNo ratings yet

- Saudi Arabia Fertilizers CompanyDocument26 pagesSaudi Arabia Fertilizers CompanybskadyanNo ratings yet

- Sipchem Gih251008Document44 pagesSipchem Gih251008maitaniNo ratings yet

- UT Notification - Replacement Prop IslamicDocument5 pagesUT Notification - Replacement Prop IslamicJohn altaNo ratings yet

- SEBI Board Meeting 28:09:2021Document9 pagesSEBI Board Meeting 28:09:2021PRATIM MAJUMDERNo ratings yet

- Mini Case of Cost of CapitalDocument13 pagesMini Case of Cost of Capitalpoooja2850% (4)

- SFK Writeup April 12 2010Document11 pagesSFK Writeup April 12 2010toptickNo ratings yet

- CIMB Islamic Sukuk Fund PerformanceDocument2 pagesCIMB Islamic Sukuk Fund PerformanceAbdul-Wahab Abdul-HamidNo ratings yet

- TNLHB Acquires Sarawak Logistics Firm for RM3MDocument3 pagesTNLHB Acquires Sarawak Logistics Firm for RM3Mnickong53No ratings yet

- Buy Back of Shares: Creative MembersDocument30 pagesBuy Back of Shares: Creative Membersjayesh_goradiaNo ratings yet

- Daily Derivatives Snapshot: Nifty Futures, Options OI & Pivot PointsDocument3 pagesDaily Derivatives Snapshot: Nifty Futures, Options OI & Pivot Pointschoni singhNo ratings yet

- Roadmap To A Deposit-Taking Franchise Through Acquisition of 39.76% Stake in OakNorth Bank, A Licensed UK Bank (Company Update)Document26 pagesRoadmap To A Deposit-Taking Franchise Through Acquisition of 39.76% Stake in OakNorth Bank, A Licensed UK Bank (Company Update)Shyam SunderNo ratings yet

- News Release 22-07-2015Document3 pagesNews Release 22-07-2015IRL MiningNo ratings yet

- Sona Petroleum Fact Sheet SPACs (Final) 8 MayDocument5 pagesSona Petroleum Fact Sheet SPACs (Final) 8 MaymuthukjNo ratings yet

- Market Pulse - 08 December 2010Document4 pagesMarket Pulse - 08 December 2010prashant_karnNo ratings yet

- Act Providing 1989 Charter Al-Amanah Islamic Investment Bank PhilippinesDocument16 pagesAct Providing 1989 Charter Al-Amanah Islamic Investment Bank PhilippinesIsmael AlipuddinNo ratings yet

- Unit 4Document2 pagesUnit 4Sweta YadavNo ratings yet

- KFCDocument208 pagesKFCAsHiya MiZuki50% (2)

- Bakry Business PlanDocument18 pagesBakry Business Planfaisaltarar2007No ratings yet

- VS An20170515a1 1Document18 pagesVS An20170515a1 1Aziema binti OTHMANNo ratings yet

- Abridged Prospectus - 06-04-2010 FinalDocument60 pagesAbridged Prospectus - 06-04-2010 FinalZaid JavaidNo ratings yet

- Main Aims For The Central Bank of IndusDocument2 pagesMain Aims For The Central Bank of IndusKanishq BawejaNo ratings yet

- SYNOPSIS of MGTDocument8 pagesSYNOPSIS of MGTShishir SinghNo ratings yet

- Sterling Bank PLC and Equitorial Trust Bank LTD Merger: The Business CaseDocument23 pagesSterling Bank PLC and Equitorial Trust Bank LTD Merger: The Business CaseSterling Bank PLCNo ratings yet

- SGX-Listed Sapphire Sells Entire PRC Steel-Making Business for S$70 Million and Gain on Divestment; Proceeds Will Be Used To Support Resource Business and Chart New Direction in Value-Added Engineering ServicesDocument2 pagesSGX-Listed Sapphire Sells Entire PRC Steel-Making Business for S$70 Million and Gain on Divestment; Proceeds Will Be Used To Support Resource Business and Chart New Direction in Value-Added Engineering ServicesWeR1 Consultants Pte LtdNo ratings yet

- Company History - IFB IndustriesDocument4 pagesCompany History - IFB IndustriesDebanil MajumderNo ratings yet

- Prospectus enDocument241 pagesProspectus enNasar MahboobNo ratings yet

- Gaurav DiwakarDocument30 pagesGaurav DiwakarMayank jainNo ratings yet

- Bank Nizwa Summary Prospectus (English)Document13 pagesBank Nizwa Summary Prospectus (English)Mwangu KibikeNo ratings yet

- Module 2 Private Equity Worksheet AAfEEJESvQDocument8 pagesModule 2 Private Equity Worksheet AAfEEJESvQNAMAN JAINNo ratings yet

- VNJ2 XOe QLPW UK63 WVC YeDocument6 pagesVNJ2 XOe QLPW UK63 WVC Yeyansen guyNo ratings yet

- Jhuma Krishi Farm - Business Plan & Projected DetailsDocument21 pagesJhuma Krishi Farm - Business Plan & Projected DetailsSujan BhattaraiNo ratings yet

- Operational PlanDocument6 pagesOperational Planpowerpoint_1234No ratings yet

- Content 8 September 2011Document1 pageContent 8 September 2011laleye_olumideNo ratings yet

- Daily Derivatives: September 9, 2015Document3 pagesDaily Derivatives: September 9, 2015choni singhNo ratings yet

- 14 Working Capital Management 2020Document6 pages14 Working Capital Management 2020JemNo ratings yet

- POL Oilfields PotentialDocument23 pagesPOL Oilfields PotentialMuhammad Ali KhanNo ratings yet

- ALM Presentation 02-12-2013Document27 pagesALM Presentation 02-12-2013Cvijet IslamaNo ratings yet

- Final Exam Summer 2021 financial managementDocument4 pagesFinal Exam Summer 2021 financial managementAhmed Khan WarsiNo ratings yet

- IPO Fact Sheet - Accordia Golf Trust 140723Document4 pagesIPO Fact Sheet - Accordia Golf Trust 140723Invest StockNo ratings yet

- Financial Management Project AnalysisDocument4 pagesFinancial Management Project Analysispalak2407No ratings yet

- Islamic Finance in Malaysia - Evolution & Current Development - MIFCDocument12 pagesIslamic Finance in Malaysia - Evolution & Current Development - MIFCmohammedzaidiNo ratings yet

- Business Plan OF: "Appss Export House"Document26 pagesBusiness Plan OF: "Appss Export House"aniketsethiNo ratings yet

- Nifty Daily Outlook 21 June Equity Research LabDocument8 pagesNifty Daily Outlook 21 June Equity Research Labram sahuNo ratings yet

- 9 April 2015Document1 page9 April 2015Ady HasbullahNo ratings yet

- MOSt Market Outlook 14 TH February 2024Document10 pagesMOSt Market Outlook 14 TH February 2024Sandeep JaiswalNo ratings yet

- Introduction To Pool Management: by Mujeeb BeigDocument25 pagesIntroduction To Pool Management: by Mujeeb Beigjajaja hfieieNo ratings yet

- Cost of Capital - 114722Document2 pagesCost of Capital - 114722lender kent alicanteNo ratings yet

- Memorandum of Understanding (TAMMEER INVESTMENT)Document6 pagesMemorandum of Understanding (TAMMEER INVESTMENT)mfaisalidreisNo ratings yet

- MOU With Oman Arab BankDocument3 pagesMOU With Oman Arab BankmfaisalidreisNo ratings yet

- N293Document87 pagesN293mfaisalidreisNo ratings yet

- Consolidated Statement of Profitability For The Year 2014Document1 pageConsolidated Statement of Profitability For The Year 2014mfaisalidreisNo ratings yet

- Sale and Lease Back of Income Generating Properties: Al Khuwair & Maktabi 1Document2 pagesSale and Lease Back of Income Generating Properties: Al Khuwair & Maktabi 1mfaisalidreisNo ratings yet

- Muscat Hills LetterDocument1 pageMuscat Hills LettermfaisalidreisNo ratings yet

- Accident Report For Mercedes E300 AmgDocument1 pageAccident Report For Mercedes E300 AmgmfaisalidreisNo ratings yet

- ListDocument1 pageListmfaisalidreisNo ratings yet

- Confirmation Letters FormDocument20 pagesConfirmation Letters FormmfaisalidreisNo ratings yet

- 254Document48 pages254mfaisalidreisNo ratings yet

- Nizwa Bank Investment StructureDocument1 pageNizwa Bank Investment StructuremfaisalidreisNo ratings yet

- Muscat Hills LandDocument4 pagesMuscat Hills LandmfaisalidreisNo ratings yet

- Valuing An Option To Abandon A Project: Inputs Relating The Underlying AssetDocument4 pagesValuing An Option To Abandon A Project: Inputs Relating The Underlying Assetapi-3763138No ratings yet

- Doc1 90Document1 pageDoc1 90mfaisalidreisNo ratings yet

- Firewall IssuesDocument2 pagesFirewall IssuesmfaisalidreisNo ratings yet

- Financial Affairs Executive Committee Terms of Reference: PurposeDocument2 pagesFinancial Affairs Executive Committee Terms of Reference: PurposemfaisalidreisNo ratings yet

- Real Estate Development ProcessDocument2 pagesReal Estate Development ProcessmfaisalidreisNo ratings yet

- It Risk Assesment TemplateDocument22 pagesIt Risk Assesment TemplatekenptyNo ratings yet

- Stock Risk Return Analysis and ForecastingDocument6 pagesStock Risk Return Analysis and Forecastingsumon finNo ratings yet

- Betas Damodaran EspanolDocument6 pagesBetas Damodaran Espanolmanuelfloresl_473351No ratings yet

- Invitation Letter for Friend's Family Visiting BaliDocument2 pagesInvitation Letter for Friend's Family Visiting BalimfaisalidreisNo ratings yet

- Types of Credit Cards: VISA, MASTERCARD, JCBDocument1 pageTypes of Credit Cards: VISA, MASTERCARD, JCBmfaisalidreisNo ratings yet

- JD Additional Finance ResponsibilitiesDocument3 pagesJD Additional Finance ResponsibilitiesmfaisalidreisNo ratings yet

- Saudi Chartbook Feb 2012Document14 pagesSaudi Chartbook Feb 2012mfaisalidreisNo ratings yet

- Type of Credit Card: Visa JCB Card Holder's Name: Credit Card Number: Exp Date: Issuing BankDocument1 pageType of Credit Card: Visa JCB Card Holder's Name: Credit Card Number: Exp Date: Issuing BankmfaisalidreisNo ratings yet

- Gold and Silver Club EbookDocument22 pagesGold and Silver Club Ebookmfaisalidreis100% (1)

- BetawaccDocument1 pageBetawaccwelcome2jungleNo ratings yet

- OAB Virtual GCC Portfolio 20-2-2012Document3 pagesOAB Virtual GCC Portfolio 20-2-2012mfaisalidreisNo ratings yet

- NBK Capital - MENA in Focus 6-2-2012Document17 pagesNBK Capital - MENA in Focus 6-2-2012mfaisalidreisNo ratings yet