Professional Documents

Culture Documents

Question 1

Uploaded by

Joanna SimmonsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 1

Uploaded by

Joanna SimmonsCopyright:

Available Formats

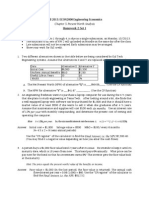

Question 1 Three different alternatives shown in the table below are being considered by Kal Tech

Engineering systems. Assume that alternatives X and Z are replaced at the end of their lives

(replaceability assumption). The NPW of alternative X is ____________.

Data

Alternative X

Alternative Y

Alternative Z

Initial Cost

$6,000

$1,000

$1,500

Uniform Annual Benefits

$810

$125

$ 230

Useful Life in Years

20

Infinite

10

MARR

12%

$5

$53.4

$49.89

$84.5

Question 2 A sum of $25,000 is deposited into a savings account, which pays 8% interest compounded

semiannually. Equal annual withdrawals are to be made from the account, beginning 1 year from now and

continuing forever. The maximum amount that can be withdrawn at the end of each year is

approximately equal to ____________.

$2,250

$2,000

$2,300

$2,040

Question 3 Four different alternative designs as shown in table below are available for a public interest

project. Determine using the capitalized cost approach which alternative is the most desirable one. MARR

=5%

Alternative X

Alternative Y

Alternative Z

Do Nothing

Initial Cost

$10M

$28M

$5M

0

Benefit/Year

$1M

$1.8M

$1M

0

Life in Years

15

30

10

0

Alternative X

Alternative Y

Alternative Z

Do nothing

Question 4 A federal government contractor is considering buying a software package at a cost of

$450,000. The software company will charge an annual maintenance fee of $25,000 payable at the

beginning each year including the very first year. The contracting company is bidding on a four-year

government contract. The present worth of the software that should be included in the bid at an interest

rate of 20% is ______.

$550,000

$517,346

$509,050

$527,650

Question 5 A bridge in a metropolitan area is being considered at a cost of $120M. The annual

maintenance cost is estimated to be $100K. A major renovation at a cost of $50M is required every 100

years. What is the capitalized cost of the bridge at an interest rate of 5%?

$122M

$12.38M

$122.38M

$12M

You might also like

- 007session Chapter7solutions20100916180648Document2 pages007session Chapter7solutions20100916180648Samar GulatiNo ratings yet

- Managemnt AssigmnetDocument19 pagesManagemnt AssigmnetSAMUEL DEBEBENo ratings yet

- CE 366 Exam 3 Review - SDocument7 pagesCE 366 Exam 3 Review - SShaunak TripathiNo ratings yet

- ISE211 Chapter4SSand5FallDocument37 pagesISE211 Chapter4SSand5FallV GozeNo ratings yet

- Week 7 Quiz SolutionsDocument12 pagesWeek 7 Quiz SolutionsMehwish Pervaiz100% (1)

- APS 1002 Financial Engineering Midterm QuestionsDocument3 pagesAPS 1002 Financial Engineering Midterm QuestionsMert Ertuğrul SayınNo ratings yet

- MGT410 Take Home Final 1 - Fall2010Document10 pagesMGT410 Take Home Final 1 - Fall2010Belinda Elois ToNo ratings yet

- Final Exam A Qms 102 Fall 2010Document18 pagesFinal Exam A Qms 102 Fall 2010sahilbhayanaNo ratings yet

- Ôn Tập Cuối Kỳ - Trắc NghiệmDocument35 pagesÔn Tập Cuối Kỳ - Trắc Nghiệmthaoluhan456No ratings yet

- Chapter 4 Present Worth AnalysisDocument34 pagesChapter 4 Present Worth AnalysisShudipto PodderNo ratings yet

- Answer All The Following QuestionsDocument3 pagesAnswer All The Following QuestionsMohamed RaheemNo ratings yet

- Cost analysis and evaluation of satellite communication system capacity expansionDocument7 pagesCost analysis and evaluation of satellite communication system capacity expansionbrugelionNo ratings yet

- SDF SDFDF 32 SDFDSF SDFDSFDocument2 pagesSDF SDFDF 32 SDFDSF SDFDSFDineshan PNo ratings yet

- Using Excel Solver to Optimize Investment ProblemsDocument5 pagesUsing Excel Solver to Optimize Investment ProblemsRavi PrakashNo ratings yet

- Math 540 Week 11 Final ExamDocument9 pagesMath 540 Week 11 Final ExamGaryoFrobonNo ratings yet

- Week 6 Quiz SolutionsDocument12 pagesWeek 6 Quiz SolutionsMehwish Pervaiz100% (1)

- 18e Key Question Answers CH 7Document2 pages18e Key Question Answers CH 7AbdullahMughalNo ratings yet

- Sample Paper MS PDFDocument8 pagesSample Paper MS PDFImad BaberNo ratings yet

- ENGR301 Exam Practice Questions2 Winter 2013Document1 pageENGR301 Exam Practice Questions2 Winter 2013Jonathan RuizNo ratings yet

- Worksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedDocument10 pagesWorksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedkalNo ratings yet

- IE54500 - Problem Set 1: 1. AffordabilityDocument4 pagesIE54500 - Problem Set 1: 1. AffordabilityMNo ratings yet

- Quantitative Methods Assignment guideDocument8 pagesQuantitative Methods Assignment guideSyed OsamaNo ratings yet

- Seem 2440A/B - Engineering Economics First Term (2011 - 2012)Document3 pagesSeem 2440A/B - Engineering Economics First Term (2011 - 2012)Sun KelvinNo ratings yet

- ps1 - MicroeconomicsDocument10 pagesps1 - MicroeconomicsLEENNo ratings yet

- IE 360 Engineering Economic Analysis Sample TestDocument11 pagesIE 360 Engineering Economic Analysis Sample TestjohnhenryyambaoNo ratings yet

- Using Excel Solver in Optimization Problems: November 2014Document9 pagesUsing Excel Solver in Optimization Problems: November 2014Chandrabali SahaNo ratings yet

- Week 5 - Present Worth, Annual Worth and Payback Period Analysis SlidesDocument45 pagesWeek 5 - Present Worth, Annual Worth and Payback Period Analysis SlidesDavid Liu GeoPro ConsultingNo ratings yet

- Math Grade 7Document20 pagesMath Grade 7gcimorelliNo ratings yet

- ECON 208 Midterm 2013FDocument12 pagesECON 208 Midterm 2013Fexamkiller100% (1)

- Bab 9Document26 pagesBab 9Saravanan MathiNo ratings yet

- Micro Key Questions With AnswersDocument44 pagesMicro Key Questions With AnswersIanthae Ivy Lubrin DumpitNo ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- CH 12Document59 pagesCH 12Jean100% (1)

- 2012Document9 pages2012Akshay JainNo ratings yet

- Chapter6 PDFDocument54 pagesChapter6 PDFI am SmoothieNo ratings yet

- HW 2Document2 pagesHW 2urbuddy542No ratings yet

- DECISION TREE - Worked ExampleDocument2 pagesDECISION TREE - Worked ExampleRavi JaiswalNo ratings yet

- Linear Optimization Models in Finance: BY CHIRAYU K TRIVEDI (207943087) & ALANNA ELBAUM (206459119)Document29 pagesLinear Optimization Models in Finance: BY CHIRAYU K TRIVEDI (207943087) & ALANNA ELBAUM (206459119)Muneéb IrfanNo ratings yet

- FNCE-611 Wharton Waiver Exam Guide16Document21 pagesFNCE-611 Wharton Waiver Exam Guide16merag76668No ratings yet

- Reading 7: Alternatives and Structuring Assumptions: (File016r Reference Only)Document13 pagesReading 7: Alternatives and Structuring Assumptions: (File016r Reference Only)Toni HornsbyNo ratings yet

- ECN801 - F2009 Final ExamDocument3 pagesECN801 - F2009 Final ExamDSFS DSFSDFDSF NNo ratings yet

- PAN African e Network Project: Operations Research and Linear Programming TechniquesDocument75 pagesPAN African e Network Project: Operations Research and Linear Programming TechniqueswesterNo ratings yet

- Accounting Textbook Solutions - 4Document19 pagesAccounting Textbook Solutions - 4acc-expertNo ratings yet

- Econ 4351 - Practice Exam - Midterm IDocument7 pagesEcon 4351 - Practice Exam - Midterm IAdam RenfroNo ratings yet

- Assignment #2 Due: April 8 by 1:15 PM Central Standard TimeDocument4 pagesAssignment #2 Due: April 8 by 1:15 PM Central Standard TimeAndrew SohnNo ratings yet

- Exam 3 Study Guide 2022-1Document6 pagesExam 3 Study Guide 2022-1Joel HaroNo ratings yet

- CEE 307 Engineering Economics HWDocument4 pagesCEE 307 Engineering Economics HWansarvaliNo ratings yet

- MBA Mid-Term Exam SolutionsDocument16 pagesMBA Mid-Term Exam SolutionsSomera Abdul QadirNo ratings yet

- MP1 - Engineering EconomyDocument7 pagesMP1 - Engineering EconomyNeill TeodoroNo ratings yet

- Assignment+3 FFM 2014 SampleMidtermDocument15 pagesAssignment+3 FFM 2014 SampleMidtermAlbertoManca0% (1)

- Mgea02 TT1 2011F CDocument9 pagesMgea02 TT1 2011F CexamkillerNo ratings yet

- Assignment 12-2 Zero-Based Budgeting DirectionsDocument5 pagesAssignment 12-2 Zero-Based Budgeting DirectionsMohaddisa 2948-FE/BSECO/F16No ratings yet

- CEE 307 Engineering Economics HWDocument4 pagesCEE 307 Engineering Economics HWAnonymous UP5RC6JpGNo ratings yet

- Chapter 1 Making Economic Decisions: References: Solution: Identifying All Feasible Alternatives For A Given ProjectDocument23 pagesChapter 1 Making Economic Decisions: References: Solution: Identifying All Feasible Alternatives For A Given ProjectAngel NapitupuluNo ratings yet

- Problem Set 8Document7 pagesProblem Set 8miltonrmoreira0% (1)

- Midterm 2021Document10 pagesMidterm 2021miguelNo ratings yet

- BA 502 Sample Final Exam SolutionsDocument8 pagesBA 502 Sample Final Exam SolutionsverarenNo ratings yet

- Senior Design Project Description - Koyo Bearings1Document2 pagesSenior Design Project Description - Koyo Bearings1Joanna SimmonsNo ratings yet

- Jae TextDocument1 pageJae TextJoanna SimmonsNo ratings yet

- Eeoc QuestionsDocument2 pagesEeoc QuestionsJoanna SimmonsNo ratings yet

- 1Document5 pages1Joanna SimmonsNo ratings yet

- Lab 1Document3 pagesLab 1Joanna SimmonsNo ratings yet

- Summer List 4-28Document14 pagesSummer List 4-28Joanna SimmonsNo ratings yet

- Lab Report FormatDocument1 pageLab Report FormatJoanna SimmonsNo ratings yet

- Strain Gage Mounting Surface Preparation Bonding SolderingDocument2 pagesStrain Gage Mounting Surface Preparation Bonding SolderingJoanna SimmonsNo ratings yet

- Template For Lab ReportDocument9 pagesTemplate For Lab ReportJoanna SimmonsNo ratings yet

- Measure Strain and Determine Young's Modulus Using a Strain GageDocument3 pagesMeasure Strain and Determine Young's Modulus Using a Strain GageJoanna SimmonsNo ratings yet

- M-L/NE ACCESSORIES Student Instruction Bulletin Strain Gage InstallationsDocument10 pagesM-L/NE ACCESSORIES Student Instruction Bulletin Strain Gage InstallationsJoanna SimmonsNo ratings yet

- Chapter 7Document7 pagesChapter 7Joanna SimmonsNo ratings yet

- #2 Introduction To Business - Information AcquisitionDocument2 pages#2 Introduction To Business - Information AcquisitionJoanna SimmonsNo ratings yet

- SamplePaperASME MSECDocument10 pagesSamplePaperASME MSECJoanna SimmonsNo ratings yet

- Template For Lab ReportDocument9 pagesTemplate For Lab ReportJoanna SimmonsNo ratings yet

- Do You Like Giving Your Opinions? Are You Comfortable Talking in Groups? We Want You To Be in One of Our Discussion Groups!Document1 pageDo You Like Giving Your Opinions? Are You Comfortable Talking in Groups? We Want You To Be in One of Our Discussion Groups!Joanna SimmonsNo ratings yet

- VPN Instructions For Vista and Windows 7Document3 pagesVPN Instructions For Vista and Windows 7Joanna SimmonsNo ratings yet

- Transformations in TRIP-assisted Steels: Microstructure and PropertiesDocument191 pagesTransformations in TRIP-assisted Steels: Microstructure and PropertiesJoanna SimmonsNo ratings yet

- Scholarship Contest: Uecu'S Student MembersDocument2 pagesScholarship Contest: Uecu'S Student MembersJoanna SimmonsNo ratings yet

- Statistics J703: Introduction To Statistical Theory II Spring 2011Document3 pagesStatistics J703: Introduction To Statistical Theory II Spring 2011Joanna SimmonsNo ratings yet

- Statistics J703: Introduction To Statistical Theory II Spring 2011Document3 pagesStatistics J703: Introduction To Statistical Theory II Spring 2011Joanna SimmonsNo ratings yet

- Kline-Mcclintock Method of Experimental UncertaintyDocument2 pagesKline-Mcclintock Method of Experimental UncertaintycrazzyrajNo ratings yet

- Statistics J703: Introduction To Statistical Theory II Spring 2011Document3 pagesStatistics J703: Introduction To Statistical Theory II Spring 2011Joanna SimmonsNo ratings yet

- The Earth, Bible, and HumansDocument12 pagesThe Earth, Bible, and HumansAJ McNerney100% (21)

- O. Smith Water Products Company: IndustryDocument9 pagesO. Smith Water Products Company: IndustryJoanna SimmonsNo ratings yet

- Black History MonthDocument13 pagesBlack History MonthJoanna SimmonsNo ratings yet