Professional Documents

Culture Documents

HUL Key Financial Ratios

Uploaded by

swatiknoldusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HUL Key Financial Ratios

Uploaded by

swatiknoldusCopyright:

Available Formats

HUL

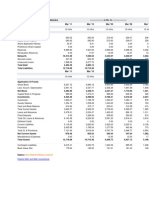

Key Financial Ratios of Hindustan Unilever

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio Post Tax

Management Efficiency Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

Profit & Loss Account Ratios

Material Cost Composition

Imported Composition of Raw Materials Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit

Mar

'14

Mar '13

Mar '12

Mar '11

Mar

1.00

13.00

20.69

129.56

-60.89

1.00

18.50

18.51

119.36

-60.89

1.00

7.50

15.23

102.32

-60.92

1.00

6.50

12.40

91.39

-60.98

1

6

12

81

10

60

15.97

14.71

15.04

13.61

13.61

13.50

13.50

147.56

118.01

111.03

15.15

15.15

147.56

15.51

14.26

14.59

12.96

12.96

14.37

14.37

163.59

141.98

119.23

12.37

12.37

163.59

14.88

13.72

13.89

12.46

12.46

12.01

12.01

95.40

76.61

73.23

16.25

16.25

95.40

13.57

12.28

12.45

11.59

11.59

11.52

11.52

102.66

86.70

78.93

12.32

12.32

102.66

15

14

14

12

12

12

12

106

85

81

11

11

106

0.74

0.44

---

0.76

0.45

---

0.83

0.46

---

0.86

0.46

---

0

0

134.21

-141.45

115.57

173.94

-183.33

161.35

2,702.74

-2,878.75

2,347.49

11,376.83

-12,296.96

10,529.42

395

10.20

33.96

10.20

6.77

8.61

9.42

---36.35

10.21

34.13

10.21

6.73

9.78

8.34

---38.69

8.79

27.27

8.79

6.26

6.35

7.17

---25.37

7.02

24.34

7.02

5.65

7.52

7.53

---24.09

8

29

8

5

7

7

51

32

-22

52.18

8.07

-1.95

52.82

10.59

-2.53

52.90

12.53

-2.24

53.28

19.13

-7.23

50

18

18

7

72.69

105.35

60.22

61.17

64

421

342

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

Earnings Per Share

Book Value

68.10

22.74

27.91

--

99.18

-25.45

-16.81

--

55.70

37.00

41.92

--

55.82

32.81

39.20

--

59

32

38

Mar

'14

Mar '13

Mar '12

Mar '11

Mar

17.88

15.15

17.56

12.37

12.45

16.25

10.68

12.32

10

11

You might also like

- Ratio AnalysisDocument2 pagesRatio AnalysisAnkush SharmaNo ratings yet

- Key Financial Ratios of HT Media: Print/Copy To ExcelDocument2 pagesKey Financial Ratios of HT Media: Print/Copy To ExcelRahul ShuklaNo ratings yet

- Investment Valuation Ratios Profit and Loss Account RatiosDocument1 pageInvestment Valuation Ratios Profit and Loss Account RatiosAshu158No ratings yet

- Key Financial Ratios Jindal Steel & PowerDocument2 pagesKey Financial Ratios Jindal Steel & PowerDivyesh BavisiNo ratings yet

- IDBI Bank key financial ratiosDocument6 pagesIDBI Bank key financial ratiosSunil ShawNo ratings yet

- Ub RatiosDocument1 pageUb RatiosKelly WilkersonNo ratings yet

- Key Financial Ratios AnalysisDocument6 pagesKey Financial Ratios AnalysisbanilbNo ratings yet

- Mar '13 Mar '12 Mar '11 Mar '10 Mar '09Document2 pagesMar '13 Mar '12 Mar '11 Mar '10 Mar '09Chiranjit BardhanNo ratings yet

- Find the Right Mutual Fund with Our Ratio Analysis ToolDocument2 pagesFind the Right Mutual Fund with Our Ratio Analysis Toolअंजनी श्रीवास्तवNo ratings yet

- Investment Valuation RatiosDocument2 pagesInvestment Valuation RatiosVikizz AgNo ratings yet

- Healthcare Deal Multiples (Select Transactions) - Part 1Document10 pagesHealthcare Deal Multiples (Select Transactions) - Part 1Reevolv Advisory Services Private LimitedNo ratings yet

- Summary of RatiosDocument4 pagesSummary of RatiosKalpak DeNo ratings yet

- Financial Ratio Analysis FormulasDocument4 pagesFinancial Ratio Analysis FormulasVaishali Jhaveri100% (1)

- Ambuja Cements: Standalone Balance SheetDocument12 pagesAmbuja Cements: Standalone Balance SheetcharujagwaniNo ratings yet

- Super Revised Valuation RatioDocument4 pagesSuper Revised Valuation RatioAnne GunhooNo ratings yet

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- Bank Ratio Analysis Sample RatiosDocument4 pagesBank Ratio Analysis Sample Ratiosmicrolab777No ratings yet

- Key Financial Ratios GuideDocument25 pagesKey Financial Ratios GuideGaurav HiraniNo ratings yet

- Explore Mah and Mah Connections: Dion Global Solutions LimitedDocument4 pagesExplore Mah and Mah Connections: Dion Global Solutions LimitedSwati SinghNo ratings yet

- Ratios - Maruti 2017-18Document6 pagesRatios - Maruti 2017-18chandel08No ratings yet

- Class of AccountsDocument5 pagesClass of AccountssalynnaNo ratings yet

- Ratio Analysis Formula Liquidity Ratios Location RatioDocument4 pagesRatio Analysis Formula Liquidity Ratios Location RatioSreenivas Badiginchala100% (1)

- Understanding Financial StatementsDocument53 pagesUnderstanding Financial StatementsRyanNo ratings yet

- Understanding Financial StatementsDocument60 pagesUnderstanding Financial StatementsAnonymous nD4Kwh100% (1)

- Fsa 1Document26 pagesFsa 1Nabanita GhoshNo ratings yet

- Balance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Document5 pagesBalance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Raj ChauhanNo ratings yet

- Ratio Analysis FormulaDocument2 pagesRatio Analysis FormulaAyuHussNo ratings yet

- Key Financial Ratios BreakdownDocument25 pagesKey Financial Ratios Breakdownwinnerme100% (1)

- Classification of Ratios Type Standard Norm For Investors For Company Profitability RATIOS: (Expressed in %)Document12 pagesClassification of Ratios Type Standard Norm For Investors For Company Profitability RATIOS: (Expressed in %)parivesh16No ratings yet

- Financial Statement Analysis Ratios GuideDocument13 pagesFinancial Statement Analysis Ratios Guidesunilsims2No ratings yet

- Bank Financial Statements and Performance MetricsDocument107 pagesBank Financial Statements and Performance MetricsNur AlamNo ratings yet

- Analysing & Interpreting Financial StatementsDocument7 pagesAnalysing & Interpreting Financial StatementsmiraaloabiNo ratings yet

- Corfin Tutorial Cfa Research Preparation 1Document14 pagesCorfin Tutorial Cfa Research Preparation 1Felia RizkitaNo ratings yet

- Financial RatiosDocument5 pagesFinancial RatioszarimanufacturingNo ratings yet

- K P I T Cummins Infosystems Limited: Financials (Standalone)Document8 pagesK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajNo ratings yet

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- S. No. Ratios: Liqudity MeasurementDocument5 pagesS. No. Ratios: Liqudity MeasurementRameshkundar KumarNo ratings yet

- Ratio AnalysisDocument1 pageRatio AnalysisArun KumarNo ratings yet

- MoneyControl Share Ratios GuideDocument1 pageMoneyControl Share Ratios GuideRajeshNo ratings yet

- SL No Description A Liquidity RatiosDocument10 pagesSL No Description A Liquidity RatiosAshish SharmaNo ratings yet

- CMA FormulaDocument4 pagesCMA FormulaKanniha SuryavanshiNo ratings yet

- Financial Control and Ratio AnalysisDocument28 pagesFinancial Control and Ratio Analysismalavika100% (1)

- Ratio AnalysisDocument113 pagesRatio AnalysisNAMAN SRIVASTAV100% (1)

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- Understanding Financial RatiosDocument3 pagesUnderstanding Financial Ratiospv12356No ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Working Group AM2 Accounts ProjectDocument6 pagesWorking Group AM2 Accounts Projectadharsh veeraNo ratings yet

- Financial Ratio Analysis With FormulasDocument3 pagesFinancial Ratio Analysis With FormulasLalit Bom Malla100% (1)

- Financial Ratios Explanation: Icap Group S.ADocument15 pagesFinancial Ratios Explanation: Icap Group S.Asteven_c22003No ratings yet

- RASIO KEUANGANDocument3 pagesRASIO KEUANGANnadhifarahmaNo ratings yet

- Analyzing The Financial StatementsDocument30 pagesAnalyzing The Financial StatementsIshan Gupta100% (1)

- Financial Statement Analysis of Banking Sector RatiosDocument34 pagesFinancial Statement Analysis of Banking Sector RatiosMavara SiddiquiNo ratings yet

- Current Ratio Current Assets / Current LiabilitiesDocument6 pagesCurrent Ratio Current Assets / Current LiabilitiesAnkush ShindeNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- HUL Income StatementDocument1 pageHUL Income StatementswatiknoldusNo ratings yet

- HUL Key Financial RatiosDocument2 pagesHUL Key Financial RatiosswatiknoldusNo ratings yet

- HUL Key Financial RatiosDocument2 pagesHUL Key Financial RatiosswatiknoldusNo ratings yet

- SsDocument1 pageSsswatiknoldusNo ratings yet