Professional Documents

Culture Documents

Rev Reg 3-2012 PDF

Uploaded by

Jerdin DinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rev Reg 3-2012 PDF

Uploaded by

Jerdin DinoCopyright:

Available Formats

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

February 20, 2012

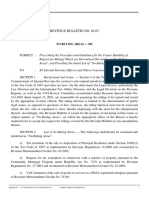

REVENUE REGULATIONS NO. 3-2012

SUBJECT:

Effectivity of Threshold Amounts for Sale of Residential Lot, Sale of House

and Lot, Lease of Residential Unit and Sale or Lease of Goods or Properties or

Performance of Services covered by Section 109 (P), (Q) and (V) of the Tax

Code of 1997, as amended.

TO

All Internal Revenue Officers, Employees and Others Concerned

--------------------------------------------------------------------------------------------------------------------------

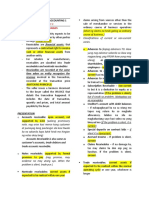

Section 1. BACKGROUND. Sections 109(P), (Q) and (V) of the Tax Code of 1997, as

amended provides that the amounts stated therein shall be adjusted to their present values

using the Consumer Price Index as published by the National Statistics Office (NSO). With

the issuance of Revenue Regulations No. 16-2011 dated October 27, 2011, the threshold

amounts has been adjusted as follows:

Section

Section 109 (P)

Section 109 (P)

Section 109 (Q)

Section 109 (V)

Amount in Pesos

(2005)

1,500,000

2,500,000

10,000

1,500,000

Adjusted threshold

amounts

1,919,500.00

3,199,200.00

12,800.00

1,919,500.00

Section 2. EFFECTIVITY OF ADJUSTED THRESHOLD AMOUNT. The new threshold

amounts shall be made effective for instrument of sale (whether the instrument is

nominated as a deed of absolute sale, deed of conditional sale or otherwise) is executed and

notarized on or after January 1, 2012.

Thus, pertinent portions of Section 4.106-3 of Revenue Regulations No. 16-2005, as

amended by Revenue Regulations No. 16-2011 should properly be worded as follows:

"Section 4.106-3 Sale of Real Properties. Sale of real properties held

primarily for sale to customers or held for lease in the ordinary course of

trade or business of the seller shall be subject to VAT.

Sale of residential lot with gross selling price exceeding P1,919,500.00,

residential house and lot or other residential dwellings with gross selling

price exceeding P3,199,200.00, where the instrument of sale (whether the

instrument is nominated as a deed of absolute sale, deed of conditional sale

or otherwise) is executed and notarized on or after January 1, 2012 and shall

be subject to twelve percent (12%) output VAT.

However, for instruments of sale executed and notarized on or after Nov. 1,

2005 but prior to January 1, 2012, the threshold amounts should

appropriately be P1,500,000 and PP2,500,000 respectively, and excess

thereof shall be subject to ten percent (10%) output VAT, and starting Feb.

1, 2006, to twelve percent (12%) output VAT.

xxx

xxx

xxx"

Moreover, Sections 4.109.-1 (B)(1), (p)(4) of Revenue Regulations No. 16-2005, as

amended by Revenue Regulations No. 16-2011 should properly be worded as follows:

(p)

The following sales of real properties are exempt from VAT, namely:

(4)

Sale of residential lot valued at One Million Nine Hundred

Nineteen Thousand Five Hundred Pesos (P1,919,500.00) and below,

or house & lot and other residential dwellings valued at Three Million

One Hundred Ninety-Nine Thousand Two Hundred Pesos

(P3,199,200.00) and below where the instrument of

sale/transfer/disposition was executed and notarized on or after

January 1, 2012;

However, for instruments executed and notarized on or after Nov.

1, 2005 but prior to January 1, 2012, the threshold amounts should

appropriately be P1,500,000 and P2,500,000 respectively.

Provided, That every three (3) years thereafter, the amounts stated

herein shall be adjusted to its present value using the Consumer Price

Index, as published by the National Statistics Office (NSO); Provided,

further, that such adjustment shall be published through revenue

regulations to be issued not later than March 31 of each year;

xxx

xxx

xxx"

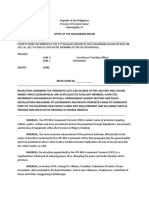

Section 3. REPEALING CLAUSE. - All existing rules and regulations and other

issuances or parts thereof which are inconsistent with the provisions of these Regulations

are hereby modified, amended or revoked accordingly.

Section 4. EFFECTIVITY. - These Regulations shall take effect starting January 1,

2012.

(Original Signed)

CESAR V. PURISIMA

Secretary of Finance

Recommending Approval:

(Original Signed)

KIM S. JACINTO -HENARES

Commissioner of Internal Revenue

You might also like

- Salvation by Peter F. Hamilton - 50 Page FridayDocument50 pagesSalvation by Peter F. Hamilton - 50 Page FridayRandom House Publishing Group50% (2)

- 055 - 1970 - Administrative Law PDFDocument69 pages055 - 1970 - Administrative Law PDFNishant KumarNo ratings yet

- 2017 Coa Aar PDFDocument150 pages2017 Coa Aar PDFJP De La PeñaNo ratings yet

- RR 7-95 Consolidated VATDocument64 pagesRR 7-95 Consolidated VATjankriezlNo ratings yet

- Broke Brothers PetitionDocument22 pagesBroke Brothers PetitionZerohedgeNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- RR 16-2005Document9 pagesRR 16-2005mblopez1No ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- Chapter 18 Language and Regional VariationDocument25 pagesChapter 18 Language and Regional VariationHussain K .Neama100% (1)

- Revenue Regulations No. 16-05: September 1, 2005Document69 pagesRevenue Regulations No. 16-05: September 1, 2005Emil A. MolinaNo ratings yet

- RR 8-98Document3 pagesRR 8-98matinikkiNo ratings yet

- 12.01.13 MOCK - Real Estate Taxation SolutionsDocument4 pages12.01.13 MOCK - Real Estate Taxation SolutionsMiggy Zurita100% (5)

- Exam Booster For Bulgaria Student's BookDocument269 pagesExam Booster For Bulgaria Student's BookNatalia Lesnikova-Byandova100% (1)

- Makati City Draft OrdinanceDocument13 pagesMakati City Draft OrdinanceNick NañgitNo ratings yet

- Rulings2000 DigestDocument21 pagesRulings2000 DigestArriane MartinezNo ratings yet

- Bar Review Lecture - VATDocument71 pagesBar Review Lecture - VATIsagani DionelaNo ratings yet

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- 30.1 Form InstructionsDocument1 page30.1 Form InstructionsNick NañgitNo ratings yet

- GR No. 157594 Toshiba vs. CIRDocument2 pagesGR No. 157594 Toshiba vs. CIRMaryanJunko100% (1)

- 9 - Pre Feasibility Reprot PDFDocument95 pages9 - Pre Feasibility Reprot PDFAchmad Yusaq Faiz FadinNo ratings yet

- VAT ReviewerDocument72 pagesVAT ReviewerJohn Kenneth AcostaNo ratings yet

- RR 13-2018Document20 pagesRR 13-2018Nikka Bianca Remulla-IcallaNo ratings yet

- Rmo 41-1991Document1 pageRmo 41-1991Kobi SaibenNo ratings yet

- RMC 74-99 Treatment of Peza Sales and VatDocument4 pagesRMC 74-99 Treatment of Peza Sales and VatRester John NonatoNo ratings yet

- Bir RR 16-2011Document4 pagesBir RR 16-2011ATTY. R.A.L.C.100% (1)

- D RR No. 16-2011Document4 pagesD RR No. 16-2011Mark DomingoNo ratings yet

- PSR-030: Urging The Secretary of Finance and Commissioner of Internal Revenue To Adjust Anew The Threshold Amounts in NIRCDocument2 pagesPSR-030: Urging The Secretary of Finance and Commissioner of Internal Revenue To Adjust Anew The Threshold Amounts in NIRCRalph RectoNo ratings yet

- Fort Bonifacio v. CIRDocument17 pagesFort Bonifacio v. CIRPaul Joshua SubaNo ratings yet

- Fort Bonifacio Vs CIRDocument6 pagesFort Bonifacio Vs CIRMelo Ponce de LeonNo ratings yet

- RR 16-2005 Amended (Consolidated VAT Regulations)Document83 pagesRR 16-2005 Amended (Consolidated VAT Regulations)Genny JovellanosNo ratings yet

- Cases in Tax ReviewDocument173 pagesCases in Tax ReviewErmawooNo ratings yet

- Provided, That Beginning January 1, 2021, The VAT Exemption Shall Only Apply To Sale of RealDocument7 pagesProvided, That Beginning January 1, 2021, The VAT Exemption Shall Only Apply To Sale of RealzelayneNo ratings yet

- Taxation On Sale of Real PropertiesDocument9 pagesTaxation On Sale of Real PropertiesIsaac CursoNo ratings yet

- RR No. 04-2007Document4 pagesRR No. 04-2007Kristel Anne LiwagNo ratings yet

- RR 4-2007Document23 pagesRR 4-2007arloNo ratings yet

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- Feb 23 Class VATDocument58 pagesFeb 23 Class VATybun100% (1)

- Ab - 103 - Taxation - Personal Income and Corportation TaxesDocument156 pagesAb - 103 - Taxation - Personal Income and Corportation TaxesCalWonkNo ratings yet

- RMC No. 24-2022Document13 pagesRMC No. 24-2022arnulfojr hicoNo ratings yet

- (VAT) in To: Clarifying (RR) No. The The Tax of (TaxDocument13 pages(VAT) in To: Clarifying (RR) No. The The Tax of (TaxShiela Marie Maraon100% (1)

- Tax Alert No. 36 - PWC PhilippinesDocument4 pagesTax Alert No. 36 - PWC PhilippinesbenedickNo ratings yet

- Evat Law Leased of Real PropertyDocument5 pagesEvat Law Leased of Real Propertyenal92No ratings yet

- Fort Bonifacio Vs CirDocument9 pagesFort Bonifacio Vs CirPJr MilleteNo ratings yet

- Revenue Bulletin No. 01-03Document4 pagesRevenue Bulletin No. 01-03MMNo ratings yet

- RR No. 4-07Document24 pagesRR No. 4-07LRBNo ratings yet

- Tax UpdatesDocument19 pagesTax UpdatesYeoh MaeNo ratings yet

- Chamber of Real Estate and Builders' Association v. RomuloDocument19 pagesChamber of Real Estate and Builders' Association v. RomuloNxxxNo ratings yet

- Fort Bonifacio Development Corp. v. CIR Et Al. G.R. No. 158885 Oct. 2 2009Document9 pagesFort Bonifacio Development Corp. v. CIR Et Al. G.R. No. 158885 Oct. 2 2009Orlhee Mar MegarbioNo ratings yet

- Bir Revenue Regulations No. 4-2007Document22 pagesBir Revenue Regulations No. 4-2007hirohonmaNo ratings yet

- 43677RMO 3-2009 - Suspension GroundsDocument29 pages43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjNo ratings yet

- Rmo 3-2009Document29 pagesRmo 3-2009sheena100% (2)

- 583 Scra 168Document19 pages583 Scra 168Chanel GarciaNo ratings yet

- Revenue Regulation 2-99Document5 pagesRevenue Regulation 2-99Joanna MandapNo ratings yet

- Tax Law1Document56 pagesTax Law1hadihadihaNo ratings yet

- Ra 9480 PDFDocument9 pagesRa 9480 PDFMïë Jüŕ EťhNo ratings yet

- Revenue Bulletin No. 1-2003 No Ruling AreasDocument3 pagesRevenue Bulletin No. 1-2003 No Ruling AreasArianne CyrilNo ratings yet

- Fort Bonifacio Development Corporation v. Commissioner of Internal RevenueDocument7 pagesFort Bonifacio Development Corporation v. Commissioner of Internal RevenuemarsdetorresNo ratings yet

- CREBA Vs RomuloDocument19 pagesCREBA Vs RomuloVincent OngNo ratings yet

- RR 14-2005-VatDocument68 pagesRR 14-2005-VatEmil A. MolinaNo ratings yet

- Chamber vs. Romulo 614 SCRA 605 2010Document17 pagesChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroNo ratings yet

- Rev. Regs. 16-2005Document55 pagesRev. Regs. 16-2005makimillianNo ratings yet

- GR 179115Document19 pagesGR 179115MelgenNo ratings yet

- Revenue Regulation No. 16-05Document62 pagesRevenue Regulation No. 16-05Raymond Atanacio100% (2)

- Excise Duty-1Document11 pagesExcise Duty-1AftabKhanNo ratings yet

- 2001 Bir RulingsDocument12 pages2001 Bir RulingsSarah Jeane CardonaNo ratings yet

- RR No. 13-2018 (VAT Refund)Document23 pagesRR No. 13-2018 (VAT Refund)Hailin QuintosNo ratings yet

- Sagum V CaDocument9 pagesSagum V CaNick NañgitNo ratings yet

- Dti Department Administrative Order No 10-08 Series of 2010Document12 pagesDti Department Administrative Order No 10-08 Series of 2010Nick NañgitNo ratings yet

- GR 193301 Mindanao Geothermal V CirDocument34 pagesGR 193301 Mindanao Geothermal V CirNick NañgitNo ratings yet

- Dti Department Administrative Order No 10-01 Series of 2010 Part 1Document8 pagesDti Department Administrative Order No 10-01 Series of 2010 Part 1Nick NañgitNo ratings yet

- GR 169899 Philacor V CirDocument14 pagesGR 169899 Philacor V CirNick NañgitNo ratings yet

- 2017 Pto Isabela Annual Report of AccomplishmentDocument37 pages2017 Pto Isabela Annual Report of AccomplishmentAngelica Aquino GasmenNo ratings yet

- AISA CP Handbook 2016Document83 pagesAISA CP Handbook 2016Rhea EscleoNo ratings yet

- Twenty Thousand Leagues Under These AsDocument275 pagesTwenty Thousand Leagues Under These AsrivieryNo ratings yet

- Unit 6 - Black FeminismDocument3 pagesUnit 6 - Black FeminismAkash SinghNo ratings yet

- Workung CapitalDocument96 pagesWorkung CapitalSanju ReddyNo ratings yet

- December, 2022 12152022Document5 pagesDecember, 2022 12152022doraNo ratings yet

- 02 - Measuring The Cost of LivingDocument38 pages02 - Measuring The Cost of LivingClaudia Edeline100% (2)

- The Subjunctive in A Single Concept Ruiz CampilloDocument57 pagesThe Subjunctive in A Single Concept Ruiz CampilloJuanjoMalNo ratings yet

- Ms Nieuw Amsterdam Itineraries 2019Document6 pagesMs Nieuw Amsterdam Itineraries 2019Janella Mae JasarenoNo ratings yet

- Nægling - Wikipedia, The Free EncyclopediaDocument2 pagesNægling - Wikipedia, The Free EncyclopediaKuro ZyboniacchiNo ratings yet

- Using Self-Determination Theory To Explain Sport PDocument4 pagesUsing Self-Determination Theory To Explain Sport PPaulNo ratings yet

- NDCP 'S ChallengeDocument19 pagesNDCP 'S ChallengeRj BawitNo ratings yet

- Unit 5 World Trade Organization: StructureDocument0 pagesUnit 5 World Trade Organization: StructureJohn ArthurNo ratings yet

- Isaiah Study Guide For Book by BookDocument97 pagesIsaiah Study Guide For Book by BookPaul BlackhamNo ratings yet

- ESPDocument6 pagesESPFhifi NovitasariNo ratings yet

- Intacc 1 Notes Part 3Document17 pagesIntacc 1 Notes Part 3Crizelda BauyonNo ratings yet

- MIUI Global DebloaterDocument2 pagesMIUI Global DebloaterJhon CuidadosNo ratings yet

- Extra Reading03Document3 pagesExtra Reading03Marcelo SilvaNo ratings yet

- Brightmile Weekly Status Report - 8-9-2021 To 8-15-2021Document3 pagesBrightmile Weekly Status Report - 8-9-2021 To 8-15-2021TFBright MileNo ratings yet

- 242833882 Lesson 2 Vowels Part 1 अ a and आ Aa Learning Hindi PDFDocument6 pages242833882 Lesson 2 Vowels Part 1 अ a and आ Aa Learning Hindi PDFsantoshNo ratings yet

- Resolution No To NpaDocument5 pagesResolution No To NpaDolores PulisNo ratings yet

- Discpline and Ideas in Social Sciences: GradeDocument17 pagesDiscpline and Ideas in Social Sciences: GradeJ-Ann FloresNo ratings yet

- 12 Verb Tenses Functions or UsagesDocument11 pages12 Verb Tenses Functions or UsagesHal FianNo ratings yet