Professional Documents

Culture Documents

Principles of Taxation

Principles of Taxation

Uploaded by

Vinay Sahu0 ratings0% found this document useful (0 votes)

10 views2 pagesfile

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfile

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesPrinciples of Taxation

Principles of Taxation

Uploaded by

Vinay Sahufile

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

PRINCIPLES OF TAXATION (SEMESTER - V)

Module-I: Historical Perspective and Introduction

Unit-1: Taxation in Ancient World and India in Particular

Unit-2: Meaning of Tax

a.

Types of Tax

b.

Difference between Direct Tax and Indirect Tax

c.

Difference between Tax and Fee

d.

Characteristics of Tax and Fee

Unit-3: Canons of Taxation and Characteristics of a Good Tax System

Unit-4: Taxation under the Indian Constitution

Unit-5: Ability to Pay

Module-II: General Perspective

Unit-1: Important Definitions

a. Previous Year

g. Agricultural Income

b. Assessment Year

h. Average Rate of Income Tax

c. Income Tax

i. Business

d. Assessee

j. Capital Asset

e. Person

k. Company

f. Total Income

Unit-2: Residential Status of Assessee

Unit-3: Scope of Total Income

Unit-4: Income Exempt from Tax

Unit-5: Concept of Advance Tax

Module-III: Income from Salaries

Unit-1: Meaning and Characteristics of Salary

Unit-2: Relationship of Employer and Employee

Unit-3: Income from Office not amounting to Employment

Unit-4: Incomes Forming Part of Salary

(a. Basic Salary b. Fees, Comission and Bonus c. Taxable Value of Allowances d. Taxable Value

of Perquisites e. Retirement Benefit)

Unit-5: Deductions from Gross Salary (Section 16)

Unit-6: Computation of Income from Salary

Module-IV: Income from House Property

Unit-1: Basis of Charge (Section 22)

Applicability of Section 22 (Buildings or lands appurtenant thereto, Ownership of

house property, Property used for own business or profession, Rental income of a

dealer in house property, House property in a foreign country)

Unit-2: Property Income Exempt from Tax

Unit-3: Computation of Income from Let Out House Property

(Determination of annual value, Gross annual value, Deductions under section 24)

Unit-4: Computation of Income from Self Occupied House Property

Unit-5: Deduction from Income from House Property

Module-V: Income from Profit and Gains of Business or Profession

Unit-1: Concept of Profit and Gains

Unit-2: scope of Section 28 (Basis of Charge)

Unit-3: Business, Profession and Vocation

Unit-4: Method of Accounting

Unit-5: Different Deductions under This Head

a. Schemes of Business Deductions

b. Specific Deductions under this Act

c. Deductions under sections 30 & 31

Unit-6: Depreciation

Module-VII: Tax Avoidance, Tax Evasion and Tax Planning

Unit-1: Basic Concept of Tax Avoidance, Tax Evasion and Tax Planning

Unit-2: Reason of Tax Avoidance, Tax Evasion

Unit-3: Distinction between Tax Avoidance and Tax Evasion

Unit-4: Recommendation of Wanchoo Committee to Fight Tax Evasion

Unit-5: Effect of Tax Avoidance and Tax Evasion

Module-VIII: Indirect Tax

Unit-1: Service Tax

Unit-2: Excise Duty

Unit-3: Custom Duty

Unit-4: Sale Tax

You might also like

- HMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013Document6 pagesHMRC Specialist Investigations Offshore Coordination Unit Letter, Oct. 2013punktlichNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDispatch TeamNo ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Cir v. BpiDocument1 pageCir v. BpiluckyNo ratings yet

- SalesInvoice 2022Document1 pageSalesInvoice 2022Gopal BiswasNo ratings yet

- Net and Gross Income Activities Worksheet 1Document2 pagesNet and Gross Income Activities Worksheet 1John Philip ReyesNo ratings yet

- InvoiceDocument1 pageInvoiceHemant YadavNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

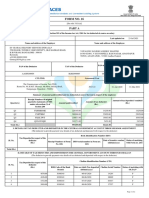

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax NotesMaruSalvatierra100% (1)

- DLF Camellias Price List: RebatesDocument5 pagesDLF Camellias Price List: RebatesAchint VermaNo ratings yet

- Tnvat Form WW Fy 15-16Document30 pagesTnvat Form WW Fy 15-16samaadhuNo ratings yet

- Section-II - Instructions To BidderDocument18 pagesSection-II - Instructions To BidderYohannes GebreNo ratings yet

- Chapter Xxi.cDocument12 pagesChapter Xxi.cdakshbajajNo ratings yet

- Republic Act No. 10142 An Act Providing For The Rehabilitation or Liquidation of Financially Distressed Enterprises and IndividualsDocument7 pagesRepublic Act No. 10142 An Act Providing For The Rehabilitation or Liquidation of Financially Distressed Enterprises and IndividualselmersgluethebombNo ratings yet

- Highlights of Annual Supplement 2013-14 Announced by Minister For Commerce, Industry & Textiles Shri Anand SharmaDocument15 pagesHighlights of Annual Supplement 2013-14 Announced by Minister For Commerce, Industry & Textiles Shri Anand Sharmapatelpratik1972No ratings yet

- 2 Concept Note FormDocument7 pages2 Concept Note Formmajmun1976No ratings yet

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniNo ratings yet

- Form 15g Blank1Document2 pagesForm 15g Blank1Rasesh ShahNo ratings yet

- Revenue RegulationsDocument13 pagesRevenue RegulationsErika AvedilloNo ratings yet

- Guidance Manual FinalDocument27 pagesGuidance Manual FinalrosdobNo ratings yet

- Notes in VATDocument6 pagesNotes in VATJuris GempisNo ratings yet

- Form No 15HDocument2 pagesForm No 15HPrajesh SrivastavaNo ratings yet

- ch02 AccountingDocument24 pagesch02 AccountingDebbie Cangco Dulatre-SupnetNo ratings yet

- Sem-V Principle of Taxation LawDocument3 pagesSem-V Principle of Taxation LawAnantHimanshuEkkaNo ratings yet

- Sem-V Principle of Taxation Law PDFDocument3 pagesSem-V Principle of Taxation Law PDFAnantHimanshuEkkaNo ratings yet

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaDocument14 pagesMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohNo ratings yet

- Note On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial JurisdictionDocument15 pagesNote On Import and Export of Services A.R. Krishnan 1. Situs of Taxation Territorial Jurisdictionjain2007gauravNo ratings yet

- Special Economic ZonesDocument9 pagesSpecial Economic ZonesSri Harsha KothapalliNo ratings yet

- Principle of Taxation LawDocument3 pagesPrinciple of Taxation Lawyogasri gNo ratings yet

- Course Syllabus in Auditing Theory ReviewDocument8 pagesCourse Syllabus in Auditing Theory ReviewAngel OmlasNo ratings yet

- Taxation and Legal Aspects Outline 1.legal Ownership: Registering A BusinessDocument10 pagesTaxation and Legal Aspects Outline 1.legal Ownership: Registering A BusinessGiselle Esguerra ManansalaNo ratings yet

- Chapter 8 HKAS 16 Property, Plant and Equipment: 1. ObjectivesDocument29 pagesChapter 8 HKAS 16 Property, Plant and Equipment: 1. Objectivessamuel_dwumfourNo ratings yet

- $e ., - .22 - May, 2al9: of Af of 42Document12 pages$e ., - .22 - May, 2al9: of Af of 42Ekansh AroraNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document11 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)ziabuttNo ratings yet

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawChoudhary Shadab phalwan100% (1)

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawNaveen SihareNo ratings yet

- D Package Scheme of Incentives-2007Document7 pagesD Package Scheme of Incentives-2007banavaram1No ratings yet

- Karpagam Institute of Technology Mca Continuous Assessment Internal Test-IDocument5 pagesKarpagam Institute of Technology Mca Continuous Assessment Internal Test-IanglrNo ratings yet

- Property Return Form 2013Document4 pagesProperty Return Form 2013Shashank RaiNo ratings yet

- Project Quality DetailDocument18 pagesProject Quality DetailAjay MalikNo ratings yet

- Auditors, Advocates, Taxation & Company Law AdvisorsDocument3 pagesAuditors, Advocates, Taxation & Company Law AdvisorsHussain MehmoodNo ratings yet

- Chapter 2 MathDocument4 pagesChapter 2 MathfuriousTaherNo ratings yet

- Master MDA Guidelines MDA 2013Document17 pagesMaster MDA Guidelines MDA 2013sukritgoelNo ratings yet

- All About Taxes TallyDocument411 pagesAll About Taxes Tallyvenkat6299No ratings yet

- ICA/JA-1: WWW - Mida.gov - MyDocument17 pagesICA/JA-1: WWW - Mida.gov - MyJason LimNo ratings yet

- Taxation System in IndiaDocument13 pagesTaxation System in IndiaTahsin SanjidaNo ratings yet

- Form No. 15G: Area Code AO Type Range Code Ao NoDocument2 pagesForm No. 15G: Area Code AO Type Range Code Ao NoRanjan ManoNo ratings yet

- MD070 - Form Personalization For AP Tax Clasification Code LOVDocument4 pagesMD070 - Form Personalization For AP Tax Clasification Code LOVrodolfocalvilloNo ratings yet

- India and Foreign TradeDocument6 pagesIndia and Foreign TradeNirmalrahul_1990No ratings yet

- Government of Jammu & Kashmir Office of The Executive Engineer Sewerage & Drainage Division (1St) Srinagar Notice Inviting TendersDocument5 pagesGovernment of Jammu & Kashmir Office of The Executive Engineer Sewerage & Drainage Division (1St) Srinagar Notice Inviting TendersNaveed ZazNo ratings yet

- Premier Travel InnDocument38 pagesPremier Travel InnrehanbtariqNo ratings yet

- Probably For Developer) : Formats To Be UsedDocument21 pagesProbably For Developer) : Formats To Be UsedSavoir PenNo ratings yet

- Bangko Sentral Are Considered Export Sales Subject To Zero-Rated VATDocument3 pagesBangko Sentral Are Considered Export Sales Subject To Zero-Rated VATharrietlouNo ratings yet

- Industrial Inventory FunctionalDocument6 pagesIndustrial Inventory FunctionalPrasad KaruturiNo ratings yet

- Tax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F StudentsDocument10 pagesTax Depreciation, Amortisation, Pre-Commencement Expenditure ICAP F Studentssohail merchantNo ratings yet

- Cir Vs Sony Philippines Inc (GR 178697 November 17 2010)Document11 pagesCir Vs Sony Philippines Inc (GR 178697 November 17 2010)Brian BaldwinNo ratings yet

- Special Economic ZoneDocument4 pagesSpecial Economic ZoneanianirudhkhatriNo ratings yet

- Final - Asset Accounting ProcedureDocument38 pagesFinal - Asset Accounting ProcedureSonianNareshNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationLove Lee Hallarsis Fabicon86% (7)

- JULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallyDocument8 pagesJULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallySeemaNaikNo ratings yet

- Sfurthi ApplicationDocument7 pagesSfurthi ApplicationBalamurali BalasundaramNo ratings yet

- Unit V CompletedDocument12 pagesUnit V Completedsahadeva18No ratings yet

- Ch24 Full Disclosure in Financial ReportingDocument31 pagesCh24 Full Disclosure in Financial ReportingAries BautistaNo ratings yet

- ANF21Document6 pagesANF21Vinod SubramaniamNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Delayed JusticeDocument29 pagesDelayed JusticeVinay SahuNo ratings yet

- Constituent Assembly of India Debates (Proceedings) - : Tuesday, 27th January 1948Document56 pagesConstituent Assembly of India Debates (Proceedings) - : Tuesday, 27th January 1948Vinay SahuNo ratings yet

- Grudge Informer ExerciseDocument2 pagesGrudge Informer ExerciseVinay Sahu0% (1)

- Issue6 PDFDocument21 pagesIssue6 PDFVinay SahuNo ratings yet

- List of Moot Court Cases For Semester II (B) - Family Law - IDocument2 pagesList of Moot Court Cases For Semester II (B) - Family Law - IVinay SahuNo ratings yet

- Corporate Law II Jan April 2015 SlybussDocument4 pagesCorporate Law II Jan April 2015 SlybussVinay SahuNo ratings yet

- Sanjay Satyanarayan Bang PDFDocument34 pagesSanjay Satyanarayan Bang PDFarshadtabassumNo ratings yet

- Positive ThinkingDocument3 pagesPositive ThinkingVinay SahuNo ratings yet

- New Land Acquisition Act 2013: Ensuring Inclusive Growth in IndiaDocument3 pagesNew Land Acquisition Act 2013: Ensuring Inclusive Growth in IndiaVinay SahuNo ratings yet

- Sociology. Punishment TheoriesDocument10 pagesSociology. Punishment TheoriesVinay SahuNo ratings yet

- Judicial Activism and Its Significance in Protecting The Rights of Prisoners in IndiaDocument2 pagesJudicial Activism and Its Significance in Protecting The Rights of Prisoners in IndiaVinay SahuNo ratings yet

- Compensatory Discrimination Hons. Prof - Anirudh PrasadDocument9 pagesCompensatory Discrimination Hons. Prof - Anirudh PrasadVinay SahuNo ratings yet

- English Project Sem2Document14 pagesEnglish Project Sem2Vinay SahuNo ratings yet

- Abstract On Judicial Activism & PILDocument1 pageAbstract On Judicial Activism & PILVinay SahuNo ratings yet

- IsavasyaDocument2 pagesIsavasyaVinay SahuNo ratings yet

- Economics ProjectDocument26 pagesEconomics ProjectVinay SahuNo ratings yet

- DT Handwritten Concept Notes (Part I) May 22 ExamsDocument230 pagesDT Handwritten Concept Notes (Part I) May 22 ExamsFamily AccountNo ratings yet

- What Is SGST, CGST, IGST and UTGSTDocument17 pagesWhat Is SGST, CGST, IGST and UTGSTCA Naveen Kumar BalanNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Asia Amalgamated Holdings Corporation Financials - RobotDoughDocument6 pagesAsia Amalgamated Holdings Corporation Financials - RobotDoughKeith LameraNo ratings yet

- PATELDocument1 pagePATELRJ MechNo ratings yet

- Radhay Krishna Enterprises BillDocument1 pageRadhay Krishna Enterprises Billkrishparjapat2008No ratings yet

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- Act Invoice-MAY 2023Document4 pagesAct Invoice-MAY 2023Shiva Kant VermaNo ratings yet

- Uncollected Social Security and Medicare Tax On WagesDocument2 pagesUncollected Social Security and Medicare Tax On Wagesnujahm1639No ratings yet

- Mumbai TicketDocument1 pageMumbai Ticketkapil chavanNo ratings yet

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoNo ratings yet

- April 2021 PAYSLIPDocument1 pageApril 2021 PAYSLIPPuja ParekhNo ratings yet

- LKNS13014B 26Q Q1 2016-17Document15 pagesLKNS13014B 26Q Q1 2016-17Shoaib Ikram HayatiNo ratings yet

- Query Results - 1Document13 pagesQuery Results - 1arnoldvkNo ratings yet

- Wall Street Courier Services, Inc. PayslipDocument1 pageWall Street Courier Services, Inc. PayslipAimee TorresNo ratings yet

- Question TAX GMDocument7 pagesQuestion TAX GMAshutosh Kr. Sahuwala 7bNo ratings yet

- Presentation FdsDocument7 pagesPresentation FdsSam Smith - 252No ratings yet

- Ticket InvoiceDocument1 pageTicket InvoiceCoastal RomanceNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Minda Kyoraku LTD - 380 - 30-12-2021Document1 pageMinda Kyoraku LTD - 380 - 30-12-2021Pragnesh PrajapatiNo ratings yet

- PPH Pasal 26 EnglishDocument4 pagesPPH Pasal 26 Englishmarlina elisabethNo ratings yet