Professional Documents

Culture Documents

FAA OU Question Paper 2010 JULY 1

Uploaded by

ratansrikanth0 ratings0% found this document useful (0 votes)

4 views1 pageFAA OU Question Paper 2010 JULY 1

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFAA OU Question Paper 2010 JULY 1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageFAA OU Question Paper 2010 JULY 1

Uploaded by

ratansrikanthFAA OU Question Paper 2010 JULY 1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

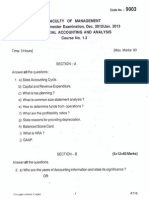

Q.4 QUESTION PAPERS

| MBA FIRST SEMESTER EXAMINATION

JULY - 2010

Time: 3 Hours Max. Marks: 80

| Note: Answer All Questions

PART-A (10 x 2= 20 Marks)

1. (a) Separate entity concept 5 .

(b) Accounting eycle

i} (c) Tax evasion

| (a) LIFO method of inventory valuation

(©) Limitations of ratio analysis

(© Common size income statement

(g) Funds from operations

(h) Sources and uses of cash

(i) Opportunity cost

(i) Features of job costing

PART-B (5 x 12 = 60 Marks)

i 2. (a) Explain how financial accounting, cost accounting, and management accounting information is

: useful to various internal and external users.

! oR

(b) Mr X started his business with a capital of ® 2,50,000 on Ist April 2006. He borrowed & 1,50,000

from a bank and % 50,000 from his friend. During the financial year 2006-07 his revenues and

expenses amounted to % 2,50,000 and ® 1,60,000, respectively. His fixed assets and curtent

assets ate in the proportion of 2:1. If cash in hand is € 80,000 and building is worth ® 2,00,000,

prepare his balance sheet at the end of 31st March 2007 to prove the accounting equation that

: A=CHL,

3. (@)_ Distinguish between capital and revenue items and state their relevance in preparation and

presentation of two financial statements (i., income statement and position statement).

OR

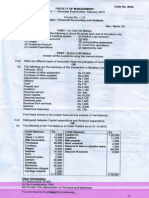

(b) From the following trial balance and additional information supplied by Mr Arun Kumar, a

trader for the year ending 31st March 2008, prepare his final accounts.

Trial Balance

Dr. ‘ Cr.

Particulars @) | Particulars @_

Building 2,80,000 Capital 2,50,000

Furniture 60,000 | Sales 2,65,000

Opening stock Bank loan @ 10% 2,65,000

(1.4.2007) 25,000 interest 1,00,000

| Adver 5,000 Commission 6,000

| Salaries 14,000 | Creditors | 8,000

| Wages 3,000

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Economics JAN 2012 2Document1 pageEconomics JAN 2012 2ratansrikanthNo ratings yet

- Managerial Economics MBA OU Question PaperDocument11 pagesManagerial Economics MBA OU Question Paperratansrikanth75% (4)

- FAA OU Question Paper JAN2014 1Document1 pageFAA OU Question Paper JAN2014 1ratansrikanthNo ratings yet

- Stats MBA 1st YearDocument1 pageStats MBA 1st YearratansrikanthNo ratings yet

- Information Technology - MBA 1st Year 1st SemDocument9 pagesInformation Technology - MBA 1st Year 1st SemratansrikanthNo ratings yet

- Sample JMET PaperDocument15 pagesSample JMET PaperratansrikanthNo ratings yet

- FAA OU Question Paper JAN 2014Document1 pageFAA OU Question Paper JAN 2014ratansrikanthNo ratings yet

- FAA OU Question Paper DEC 2012 JAN 2013 2Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2012 JAN 3Document1 pageFAA OU Question Paper 2012 JAN 3ratansrikanthNo ratings yet

- FAA OU Question Paper 2013 FEB 1Document1 pageFAA OU Question Paper 2013 FEB 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2012 JAN 2Document1 pageFAA OU Question Paper 2012 JAN 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2012 JAN 4Document1 pageFAA OU Question Paper 2012 JAN 4ratansrikanthNo ratings yet

- FAA OU Question Paper DEC 2012 JAN 2013 4Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 4ratansrikanthNo ratings yet

- FAA OU Question Paper DEC 2012 JAN 2013 1Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2011 JAN 2Document1 pageFAA OU Question Paper 2011 JAN 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2013 FEB 2Document1 pageFAA OU Question Paper 2013 FEB 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2011 JAN 3Document1 pageFAA OU Question Paper 2011 JAN 3ratansrikanthNo ratings yet

- FAA OU Question Paper 2011 JAN 1Document1 pageFAA OU Question Paper 2011 JAN 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 JULY 2Document1 pageFAA OU Question Paper 2010 JULY 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2012 JAN 1Document1 pageFAA OU Question Paper 2012 JAN 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 JULY 3Document1 pageFAA OU Question Paper 2010 JULY 3ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 2Document1 pageFAA OU Question Paper 2010 FEB 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 1Document1 pageFAA OU Question Paper 2010 FEB 1ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2012Document1 pageBusiness Law First Semester OU Question Paper 2012ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2014Document1 pageBusiness Law First Semester OU Question Paper 2014ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper LAW 2012 1Document1 pageBusiness Law First Semester OU Question Paper LAW 2012 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 3Document1 pageFAA OU Question Paper 2010 FEB 3ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2011 2Document1 pageBusiness Law First Semester OU Question Paper 2011 2ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2011 1Document1 pageBusiness Law First Semester OU Question Paper 2011 1ratansrikanthNo ratings yet