Professional Documents

Culture Documents

FAA OU Question Paper 2010 JULY 3

Uploaded by

ratansrikanth0 ratings0% found this document useful (0 votes)

3 views1 pageFAA OU Question Paper 2010 JULY 3

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFAA OU Question Paper 2010 JULY 3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageFAA OU Question Paper 2010 JULY 3

Uploaded by

ratansrikanthFAA OU Question Paper 2010 JULY 3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

‘aac a aaa ca ek tee ns

Q.6 QUESTION PAPERS

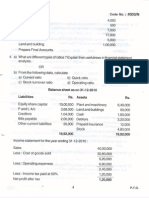

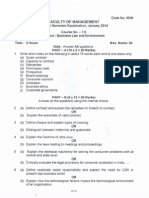

Liabilities 2007 2008 | Assets 2007 2008

2) ® ® ®

| Equity share capital | 3,00,.000 | 4,00,000 | Goodwill 1,00,000 85,000

2% redeemable 1,50,000 | 1,00,000 | Plant 1,25,000 | 1,40,000

debentures Buildings. 2,24,000 | 2,06,000

General reserve 40,000 50,000 | Long-term

| P and L account 30,000 48,000 | investments 25,000 35,000

Sundry creditors 24,000 30,000 | Stock . 40,000 65,000

Outstanding 5,000 3,000 | Debtors 20}000 30,000

i expenses Preliminary

expenses 5,000 3,000

Cash 10,000 67,000

549,000 _| 631,000 549,000 | 631,000

respectively.

by-products.

OR

ending 31 March 2008.

During the year 2008 depreciation of & 12,500 and & 18,000 were provided on plant and buildings,

6. (a) Distinguish between joint and by-products and discuss any two methods of accounting for

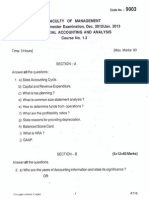

(b) The following data have been extracted from the books of Suguna Industries Ltd for the year

®@. ®)

Opening stock of raw material 25,000 | Depreciation on equipment

Factory 10,000

Purchase of raw material Closing 85,000 Office 2,000

stock of raw material 40,000 | Salaries: Office 2,500

! Carriage inward 5,000 Salesmen 2,000

: Direct wages 75,000 | Other factory expenses 5,700

: Indirect wages 10,000 | Baddebts written off 2,000

i Other direct charges 15,000 | Advertising expenses 3,000

Rent and rates: Carriage outward 1,500

Factory 5,000 | Manager's remuneration 12,000

Office 1,000 . | Sales 2,60,00

Income-tax paid 10,000

a statement showing the following:

(i) Prime cost

) Factory cost

(ii) Cost of production

| (iv) Cost of sales

(v) Net of profit.

‘The manager has the overall charge of the company and his remuneration is to be allocated at € 4,000 to

the factory; € 3,000 to the office; and & 5,000 to the selling operations. From the above particulars prepare

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Economics JAN 2012 2Document1 pageEconomics JAN 2012 2ratansrikanthNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Managerial Economics MBA OU Question PaperDocument11 pagesManagerial Economics MBA OU Question Paperratansrikanth75% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- FAA OU Question Paper JAN2014 1Document1 pageFAA OU Question Paper JAN2014 1ratansrikanthNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Stats MBA 1st YearDocument1 pageStats MBA 1st YearratansrikanthNo ratings yet

- Information Technology - MBA 1st Year 1st SemDocument9 pagesInformation Technology - MBA 1st Year 1st SemratansrikanthNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sample JMET PaperDocument15 pagesSample JMET PaperratansrikanthNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- FAA OU Question Paper JAN 2014Document1 pageFAA OU Question Paper JAN 2014ratansrikanthNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- FAA OU Question Paper DEC 2012 JAN 2013 2Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 2ratansrikanthNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- FAA OU Question Paper 2012 JAN 3Document1 pageFAA OU Question Paper 2012 JAN 3ratansrikanthNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- FAA OU Question Paper 2013 FEB 1Document1 pageFAA OU Question Paper 2013 FEB 1ratansrikanthNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- FAA OU Question Paper 2012 JAN 2Document1 pageFAA OU Question Paper 2012 JAN 2ratansrikanthNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- FAA OU Question Paper 2012 JAN 4Document1 pageFAA OU Question Paper 2012 JAN 4ratansrikanthNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- FAA OU Question Paper DEC 2012 JAN 2013 4Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 4ratansrikanthNo ratings yet

- FAA OU Question Paper DEC 2012 JAN 2013 1Document1 pageFAA OU Question Paper DEC 2012 JAN 2013 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2011 JAN 2Document1 pageFAA OU Question Paper 2011 JAN 2ratansrikanthNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- FAA OU Question Paper 2013 FEB 2Document1 pageFAA OU Question Paper 2013 FEB 2ratansrikanthNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- FAA OU Question Paper 2011 JAN 3Document1 pageFAA OU Question Paper 2011 JAN 3ratansrikanthNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- FAA OU Question Paper 2011 JAN 1Document1 pageFAA OU Question Paper 2011 JAN 1ratansrikanthNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FAA OU Question Paper 2010 JULY 1Document1 pageFAA OU Question Paper 2010 JULY 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2012 JAN 1Document1 pageFAA OU Question Paper 2012 JAN 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 JULY 2Document1 pageFAA OU Question Paper 2010 JULY 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 2Document1 pageFAA OU Question Paper 2010 FEB 2ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 1Document1 pageFAA OU Question Paper 2010 FEB 1ratansrikanthNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Business Law First Semester OU Question Paper 2012Document1 pageBusiness Law First Semester OU Question Paper 2012ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2014Document1 pageBusiness Law First Semester OU Question Paper 2014ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper LAW 2012 1Document1 pageBusiness Law First Semester OU Question Paper LAW 2012 1ratansrikanthNo ratings yet

- FAA OU Question Paper 2010 FEB 3Document1 pageFAA OU Question Paper 2010 FEB 3ratansrikanthNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Business Law First Semester OU Question Paper 2011 2Document1 pageBusiness Law First Semester OU Question Paper 2011 2ratansrikanthNo ratings yet

- Business Law First Semester OU Question Paper 2011 1Document1 pageBusiness Law First Semester OU Question Paper 2011 1ratansrikanthNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)