Professional Documents

Culture Documents

The Weekly Market Update For The Week of February 16, 2015.

Uploaded by

mike1473Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Weekly Market Update For The Week of February 16, 2015.

Uploaded by

mike1473Copyright:

Available Formats

Presents:

WEEKLY ECONOMIC UPDATE

February 16, 2015

WEEKLY QUOTE

The real problem is

not whether

machines think but

whether men do.

- B.F. Skinner

WEEKLY TIP

One fundamental

rule about consumer

debt: never arrange a

loan that may outlast

the life of whatever

you are buying.

RETAIL SALES DECREASE AGAIN

Recently, economists have worried about a decline in household spending. The 0.8%

fall for retail sales in January affirmed their anxieties. Consumers have certainly

been buying less fuel, but even with gas purchases removed, there was still an 0.2%

retreat. Headline retail sales have now sunk for consecutive months; earlier

Commerce Department data showed an 0.9% falloff in December. 1

HOUSEHOLD SENTIMENT INDEX DECLINES

Did the rough weather blasting much of the nation affect the reading of the latest

University of Michigan consumer sentiment index? Quite possibly. The final January

edition came in at an 11-year high of 98.1, but Februarys initial edition fell to 93.6

and per region, the major declines came in the Midwest and Northeast.1

OIL ENDS THE WEEK WITH A RALLY

Rising 3.1% in a day, WTI crude settled at $52.78 a barrel on the NYMEX Friday.

Over on the COMEX, silver rose 3.6% on the week to $17.29 while gold slipped 0.6%

across five days to $1.227.10.2

S&P 500 CLOSES AT A NEW RECORD HIGH

WEEKLY RIDDLE

I am astonishingly

light, but even the

strongest person in

the world can only

hold me for a few

minutes. What am I?

Last weeks riddle:

What 8-letter name

would be cute and

logical for a house cat

living below the MasonDixon line?

Last weeks answer:

Southpaw.

Thanks to a 2.02% weekly ascent, the index settled at 2,096.99 Friday. Rising crude

prices and signs of economic improvement in the euro area helped. Those factors

also assisted the Dow and Nasdaq: the former gained 1.09% on the week, the latter

3.15%. Friday brought a close of 4,893.84 for the Nasdaq, 18,019.35 for the Dow. 3

THIS WEEK: U.S. stock and bond markets are closed Monday for Presidents Day,

but eyes will be on Europe as Greece formally asks to renegotiate its bailout. On

Tuesday, earnings roll in from MGM Resorts, Goodyear, Medtronic, Waste

Management, Norwegian Cruise Line, Agilent, Fossil, Jack in the Box, and

Bridgestone. Wednesday, Wall Street looks at the minutes from the January Federal

Reserve policy meeting, the latest Producer Price Index, data on January industrial

output, building permits and housing starts and earnings from Fluor, Duke Energy,,

Hilton, Avis Budget Group, SolarCity, Virgin America, Hyatt Hotels, Marathon Oil,

Healthstream, Dennys, Barrick Gold, Marriott and Garmin. The Conference Boards

January index of leading indicators arrives Thursday, plus a new initial claims

report, earnings from Nestle, Wal-Mart, Priceline, Hormel, DirecTV, Boise Cascade,

Clear Channel, Novatel, Noble Energy, Six Flags Entertainment, Newmont Mining,

Public Storage and Nordstrom and for the first time ever, minutes from a

European Central Bank meeting (January 22). Friday sees earnings from Choice

Hotels and Deere.

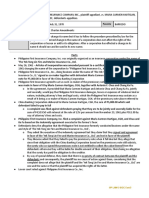

% CHANGE

Y-T-D

1-YR CHG

5-YR AVG

10-YR AVG

DJIA

+1.10

+12.43

+15.68

+6.70

NASDAQ

+3.33

+15.40

+24.83

+13.50

S&P 500

+1.85

+14.60

+19.00

+7.39

REAL YIELD

2/13 RATE

1 YR AGO

5 YRS AGO

10 YRS AGO

10 YR TIPS

0.34%

0.56%

1.46%

1.54%

Sources: online.wsj.com, bigcharts.com, treasury.gov - 2/13/15 4,5,6,7

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do

not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

93224

Please feel free to forward this article to family, friends or colleagues.

If you would like us to add them to our distribution list, please reply with their address.

We will contact them first and request their permission to add them to our list.

Securities and advisory services offered through National Planning Corporation(NPC), Member FINRA/SIPC,

Registered Investment Advisor. FlagStone Retirement Consultants, LLC and NPC are separate and unrelated

companies. FlagStone Retirement Consultants, and NPC are neither endorsed by, retained by, nor affiliated with the

companies here within.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their

affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past

performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services.

If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be

construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither

a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as

such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a priceweighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all

over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard

& Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not

possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange

(the NYSE) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx, and the Pacific Exchange). NYSE Group is a

leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX)

is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with

trading conducted through two divisions the NYMEX Division, home to the energy, platinum, and palladium markets, and the

COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency

fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the

market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past

performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when

originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are

unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other

professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 - tinyurl.com/pfjbxc4 [2/13/15]

2 - proactiveinvestors.com/companies/news/59878/gold-gains-05-to-1227-wti-rises-31-to-5278-59878.html [2/13/15]

3 - markets.on.nytimes.com/research/markets/usmarkets/usmarkets.asp [2/13/15]

4 - markets.wsj.com/us [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F13%2F14&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F13%2F14&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F13%2F14&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F12%2F10&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F12%2F10&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F12%2F10&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F14%2F05&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F14%2F05&x=0&y=0 [2/13/15]

5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F14%2F05&x=0&y=0 [2/13/15]

6 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/13/15]

7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/13/15]

93224

You might also like

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- The Weekly Market Update For The Week of January 26, 2015.Document2 pagesThe Weekly Market Update For The Week of January 26, 2015.mike1473No ratings yet

- The Weekly Economic Update For The Week of February 23, 2015.Document2 pagesThe Weekly Economic Update For The Week of February 23, 2015.mike1473No ratings yet

- The Weekly Ecomonic Update For The Week of April 20, 2015.Document2 pagesThe Weekly Ecomonic Update For The Week of April 20, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of February 2, 2015Document2 pagesThe Weekly Market Update For The Week of February 2, 2015mike1473No ratings yet

- FB 101512Document2 pagesFB 101512mike1473No ratings yet

- Dec 172012Document2 pagesDec 172012mike1473No ratings yet

- The Weekly Market Update For The Week of October 13, 2014.Document2 pagesThe Weekly Market Update For The Week of October 13, 2014.mike1473No ratings yet

- The Weekly Market Update For The Week of May 18, 2015.Document2 pagesThe Weekly Market Update For The Week of May 18, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: Economy Grows 2.8% in Q4Document2 pagesEekly Conomic Pdate: Economy Grows 2.8% in Q4api-118535366No ratings yet

- The Weekly Market Update For The Week of February 9, 2015.Document2 pagesThe Weekly Market Update For The Week of February 9, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of April 13, 2015.Document2 pagesThe Weekly Market Update For The Week of April 13, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of December 8, 2014.Document2 pagesThe Weekly Market Update For The Week of December 8, 2014.mike1473No ratings yet

- The Weekly Market Update For The Week of December 15, 2014.Document2 pagesThe Weekly Market Update For The Week of December 15, 2014.GianaNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Eekly Conomic Pdate: Consumer Sentiment Hits A 4-Year PeakDocument2 pagesEekly Conomic Pdate: Consumer Sentiment Hits A 4-Year Peakapi-118535366No ratings yet

- Weekly Market Update For The Week of Aug 20thDocument3 pagesWeekly Market Update For The Week of Aug 20thmike1473No ratings yet

- The Weekly Market Update For The Week of December 1, 2014.Document2 pagesThe Weekly Market Update For The Week of December 1, 2014.mike1473No ratings yet

- Dec3 Market UpdateDocument2 pagesDec3 Market Updatemike1473No ratings yet

- Weekly Market Update July 22Document3 pagesWeekly Market Update July 22mike1473No ratings yet

- Weekly Market Update For The Week of October 28Document3 pagesWeekly Market Update For The Week of October 28mike1473No ratings yet

- April 15 Weekly Economic UpdateDocument2 pagesApril 15 Weekly Economic UpdateDoug PotashNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Weekly Market Update For The Week of October 14Document3 pagesWeekly Market Update For The Week of October 14mike1473No ratings yet

- Weekly Market Update For The Week of October 21Document2 pagesWeekly Market Update For The Week of October 21mike1473No ratings yet

- Weekly Market Update Forthe Week of September 16Document3 pagesWeekly Market Update Forthe Week of September 16mike1473No ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- 9-18-2012 Weekly Economic UpdateDocument2 pages9-18-2012 Weekly Economic UpdatespectrumfinancialNo ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- March 4 Weekly Economic UpdateDocument2 pagesMarch 4 Weekly Economic UpdateDoug PotashNo ratings yet

- The Weekly Market Update For The Week of November 3, 2014Document2 pagesThe Weekly Market Update For The Week of November 3, 2014mike1473No ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- The Weekly Market Update For The Week of March 2, 2015.Document2 pagesThe Weekly Market Update For The Week of March 2, 2015.mike1473No ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Eekly Conomic Pdate: An Underwhelming Retail Sales ReportDocument2 pagesEekly Conomic Pdate: An Underwhelming Retail Sales Reportapi-118535366No ratings yet

- Weekly Economic UpdateDocument3 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- Weekly Market Update For The Week of October 7Document3 pagesWeekly Market Update For The Week of October 7mike1473No ratings yet

- Eekly Conomic Pdate: Unemployment Down To 8.5%Document2 pagesEekly Conomic Pdate: Unemployment Down To 8.5%api-118535366No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- Eekly Conomic Pdate: 227,000 New Jobs, But Jobless Rate Still at 8.3%Document2 pagesEekly Conomic Pdate: 227,000 New Jobs, But Jobless Rate Still at 8.3%api-118535366No ratings yet

- Weekly Market Update For The Week of September 30thDocument3 pagesWeekly Market Update For The Week of September 30thmike1473No ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument3 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- April 1 Weekly Economic UpdateDocument2 pagesApril 1 Weekly Economic UpdateDoug PotashNo ratings yet

- Eekly Conomic Pdate: Unemployment Down To 8.1%Document2 pagesEekly Conomic Pdate: Unemployment Down To 8.1%api-118535366No ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- The Weekly Market Update For The Week of August 18th.Document2 pagesThe Weekly Market Update For The Week of August 18th.mike1473No ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- The Weekly Market Update For The Week of April 6, 2015.Document2 pagesThe Weekly Market Update For The Week of April 6, 2015.mike1473No ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- The Weekly Market Update For The Week of June 1, 2015.Document2 pagesThe Weekly Market Update For The Week of June 1, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of March 9, 2015.Document2 pagesThe Weekly Market Update For The Week of March 9, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: Facebook Debut Diverts Attention From EuropeDocument2 pagesEekly Conomic Pdate: Facebook Debut Diverts Attention From Europeapi-118535366No ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- The Weekly Market Update For The Week of November 10, 2014.Document2 pagesThe Weekly Market Update For The Week of November 10, 2014.mike1473No ratings yet

- Weekly Economic UpdateDocument2 pagesWeekly Economic UpdateDoug PotashNo ratings yet

- Weekly Market Update June 17thDocument2 pagesWeekly Market Update June 17thmike1473No ratings yet

- The Weekly Market Update For The Week of May 25, 2015.Document2 pagesThe Weekly Market Update For The Week of May 25, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of May 18, 2015.Document2 pagesThe Weekly Market Update For The Week of May 18, 2015.mike1473No ratings yet

- January 2017 Market UpdateDocument5 pagesJanuary 2017 Market Updatemike1473No ratings yet

- The Weekly Market Update For The Week of June 1, 2015.Document2 pagesThe Weekly Market Update For The Week of June 1, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of June 1, 2015.Document2 pagesThe Weekly Market Update For The Week of June 1, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of May 25, 2015.Document2 pagesThe Weekly Market Update For The Week of May 25, 2015.mike1473No ratings yet

- Are Gen Xers Planning For Retirement The Right Way?Document3 pagesAre Gen Xers Planning For Retirement The Right Way?mike1473No ratings yet

- The Weekly Market Update For The Week of March 9, 2015.Document2 pagesThe Weekly Market Update For The Week of March 9, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of April 27, 2015.Document2 pagesThe Weekly Market Update For The Week of April 27, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of May 4, 2015Document2 pagesThe Weekly Market Update For The Week of May 4, 2015mike1473No ratings yet

- The Weekly Market Update For The Week of April 13, 2015.Document2 pagesThe Weekly Market Update For The Week of April 13, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- The Weekly Market Update For The Week of May 4, 2015Document2 pagesThe Weekly Market Update For The Week of May 4, 2015mike1473No ratings yet

- The Weekly Market Update For The Week of April 6, 2015.Document2 pagesThe Weekly Market Update For The Week of April 6, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- The Weekly Market Update For The Week of March 2, 2015.Document2 pagesThe Weekly Market Update For The Week of March 2, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of February 9, 2015.Document2 pagesThe Weekly Market Update For The Week of February 9, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- The Weekly Market Update For The Week of January 19, 2015.Document2 pagesThe Weekly Market Update For The Week of January 19, 2015.mike1473No ratings yet

- The Weekly Market Update For The Week of February 16, 2015.Document2 pagesThe Weekly Market Update For The Week of February 16, 2015.mike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- The Weekly Market Update For The Week of December 8, 2014.Document2 pagesThe Weekly Market Update For The Week of December 8, 2014.mike1473No ratings yet

- Eekly Conomic Pdate: PresentsDocument2 pagesEekly Conomic Pdate: Presentsmike1473No ratings yet

- Nirma - Marketing PresentationDocument22 pagesNirma - Marketing PresentationJayRavasa100% (2)

- Factors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionDocument12 pagesFactors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionYeni Saro ManaluNo ratings yet

- 1610-2311-Executive Summary-EnDocument15 pages1610-2311-Executive Summary-EnKayzha Shafira Ramadhani460 105No ratings yet

- Basics Stats Ti NspireDocument7 pagesBasics Stats Ti NspirePanagiotis SotiropoulosNo ratings yet

- Collection of Solid WasteDocument38 pagesCollection of Solid WasteMuhammad UsmanNo ratings yet

- Surface News - 20130704 - Low Res PDFDocument9 pagesSurface News - 20130704 - Low Res PDFYoko GoldingNo ratings yet

- Scheduled Events in MySQL Load CSV Fileto MysqltabDocument11 pagesScheduled Events in MySQL Load CSV Fileto Mysqltabboil35No ratings yet

- Suggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Document8 pagesSuggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Abdul BasitNo ratings yet

- Organization of Brigada Eskwela Steering and Working CommitteesDocument2 pagesOrganization of Brigada Eskwela Steering and Working CommitteesCherry Lou RiofrirNo ratings yet

- Kolodin Agreement For Discipline by ConsentDocument21 pagesKolodin Agreement For Discipline by ConsentJordan ConradsonNo ratings yet

- Cap. 1Document34 pagesCap. 1Paola Medina GarnicaNo ratings yet

- Order To Cash Cycle Group 1Document4 pagesOrder To Cash Cycle Group 1AswinAniNo ratings yet

- TC 9-237 Welding 1993Document680 pagesTC 9-237 Welding 1993enricoNo ratings yet

- Computer Graphics Mini ProjectDocument25 pagesComputer Graphics Mini ProjectGautam Singh78% (81)

- Ibm v3700 Storeage PDFDocument694 pagesIbm v3700 Storeage PDFJanakackvNo ratings yet

- Resume (Suyash Garg)Document1 pageResume (Suyash Garg)Suyash GargNo ratings yet

- Philippine First Insurance V HartiganDocument3 pagesPhilippine First Insurance V HartiganAlexander Genesis DungcaNo ratings yet

- Statics: Vector Mechanics For EngineersDocument25 pagesStatics: Vector Mechanics For EngineersProkopyo BalagbagNo ratings yet

- Saarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Document8 pagesSaarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Roshan KumarNo ratings yet

- Application Problems 1 Through 3Document5 pagesApplication Problems 1 Through 3api-4072164490% (1)

- Capitol Medical Center, Inc. v. NLRCDocument14 pagesCapitol Medical Center, Inc. v. NLRCFidel Rico NiniNo ratings yet

- San Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintDocument25 pagesSan Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintFindLawNo ratings yet

- TreeSize Professional - Folder Contents of - CDocument1 pageTreeSize Professional - Folder Contents of - CHenrique GilNo ratings yet

- Hood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontDocument3 pagesHood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontHari TejNo ratings yet

- 15.910 Draft SyllabusDocument10 pages15.910 Draft SyllabusSaharNo ratings yet

- Negative Sequence Current in Wind Turbines Type 3 1637954804Document6 pagesNegative Sequence Current in Wind Turbines Type 3 1637954804Chandra R. SirendenNo ratings yet

- Application Form New - Erik WitiandikaDocument6 pagesApplication Form New - Erik Witiandikatimmy lauNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- DataBase Management Systems SlidesDocument64 pagesDataBase Management Systems SlidesMukhesh InturiNo ratings yet

- All About Ignition Coils: Technical InformationDocument15 pagesAll About Ignition Coils: Technical InformationTrương Ngọc ThắngNo ratings yet