Professional Documents

Culture Documents

DCF Slides v01

Uploaded by

John DCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCF Slides v01

Uploaded by

John DCopyright:

Available Formats

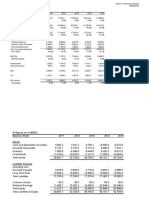

Discounted Cash Flow

10 Year Projections

2014

Sales

2015

2016

Projected Year Ending January 31, (a)

2017

2018

2019

2020

WACC: based on average unlevered betas of comparable companies

2021

2022

2023

$4,056.1 $4,347.3 $4,671.6 $5,033.2 $5,436.8 $5,872.9 $6,285.1 $6,663.5 $6,998.0 $7,279.3

EBITDA

Less: depreciation

Less: amortization

EBIT

Less: taxes @

34.6%

Tax-effected EBIT

916.7 1,060.7 1,224.0 1,409.3

(176.1) (203.5) (235.5) (271.1)

(4.4)

(4.4)

(4.2)

(4.2)

736.2

852.9

984.3 1,133.9

(254.7) (295.1) (340.6) (392.3)

481.4

557.8

643.7

741.6

1,620.2

(311.0)

(4.2)

1,305.0

(451.5)

853.5

1,538.7 1,615.3 1,679.2 1,728.5 1,761.6

(311.0) (315.8) (320.5) (325.3) (330.1)

(4.2)

(4.2)

(4.2)

(4.2)

(4.2)

1,223.5 1,295.3 1,354.5 1,399.0 1,427.3

(423.3) (448.2) (468.6) (484.1) (493.9)

800.2

847.1

885.8

914.9

933.5

Plus: depreciation

176.1

Plus: amortization

4.4

Less: capital expenditures

(230.0)

Less: additions to definite life intangibles

0.0

+ / - Changes in working capital

(95.3)

+ / - Changes in other assets and liabilities 0.0

203.5

4.4

(260.8)

0.0

(131.2)

0.0

235.5

4.2

(280.3)

0.0

(144.8)

0.0

271.1

4.2

(302.0)

0.0

(159.8)

0.0

311.0

4.2

(326.2)

0.0

(176.5)

0.0

311.0

4.2

(326.2)

0.0

(176.5)

0.0

315.8

4.2

(331.2)

0.0

(156.5)

0.0

320.5

4.2

(336.2)

0.0

(136.5)

0.0

325.3

4.2

(341.2)

0.0

(116.5)

0.0

330.1

4.2

(346.2)

0.0

(96.5)

0.0

Unlevered free cash flow

Unlevered free cash flow growth rate

$373.6

11.0%

$458.3

22.7%

$555.1

21.1%

$665.9

20.0%

$612.6

(8.0%)

$679.3

10.9%

$737.8

8.6%

$786.7

6.6%

$825.0

4.9%

$336.7

Unleveraged Beta

Leveraged Beta

Marginal Tax Rate

1.086

1.159

34.6%

1.102

1.176

34.6%

1.131

1.207

34.6%

3.9%

4.4%

4.8%

5.3%

5.8%

66.1%

65.7%

65.2%

64.7%

64.3%

67.3%

66.8%

66.4%

65.9%

65.4%

WACC

Cost of Debt (after Tax)

Cost of Equity

WACC

3.92%

10.52%

9.91%

WACC

3.92%

10.73%

10.09%

WACC: based on the Tiffany & Co. beta

Unleveraged Beta

Leveraged Beta

Marginal Tax Rate

Terminal

Terminal

value

value

asas

a%

a of

% of

enterprise

EV

value

9.5x

10.0x

10.5x

4.3%

4.8%

5.3%

5.8%

6.3%

3.92%

10.40%

9.80%

WACC: Based on median unlevered betas of comparable companies

Unleveraged Beta

Leveraged Beta

Marginal Tax Rate

Implied perpetuity growth rate

9.5x

10.0x

10.5x

4.1%

4.6%

5.1%

5.6%

6.0%

Cost of Debt (after Tax)

Cost of Equity

68.3%

67.9%

67.4%

67.0%

66.5%

Cost of Debt (after Tax)

Cost of Equity

Value per diluted share (e)

9.5x

10.0x

10.5x

$78.95

75.82

72.83

69.98

67.26

$81.81

78.55

75.44

72.48

69.64

$84.67

81.29

78.05

74.97

72.03

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocument5 pagesHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossNo ratings yet

- BVADocument15 pagesBVAJasonNo ratings yet

- Inputs From Income Statement:: Total RevenueDocument6 pagesInputs From Income Statement:: Total RevenuecarminatNo ratings yet

- Financial Accounting 2020 June - July Exam Question PaperDocument16 pagesFinancial Accounting 2020 June - July Exam Question PaperLaston Milanzi50% (2)

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- The Coca Cola Company Financial Risk AssessmentDocument6 pagesThe Coca Cola Company Financial Risk AssessmentAshmit RoyNo ratings yet

- Name of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementDocument6 pagesName of The company-JSW STEEL LTD Financial Analysis Financial Statements 1) Income StatementzaniNo ratings yet

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- DataDocument3 pagesDataDinoNo ratings yet

- TotalEnergies Financial Data BloombergDocument48 pagesTotalEnergies Financial Data BloombergShardul MudeNo ratings yet

- Consolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Document4 pagesConsolidated Statements of Income and Other Comprehensive Income (In Million Rupiah) Description 2021 2020 2019 2018 2017Ferial FerniawanNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- Pag BankDocument24 pagesPag Bankandre.torresNo ratings yet

- Olam International Limited: Management Discussion and AnalysisDocument22 pagesOlam International Limited: Management Discussion and Analysisashokdb2kNo ratings yet

- DCF Valuation Pre Merger Southern Union CompanyDocument20 pagesDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNo ratings yet

- FSADocument4 pagesFSAAreeba AslamNo ratings yet

- 10 Years Record On Financial PerformanceDocument1 page10 Years Record On Financial PerformanceAditya ChughNo ratings yet

- Income Statement FormatDocument24 pagesIncome Statement FormatTrisha Mae AbocNo ratings yet

- BSRM PresentationDocument4 pagesBSRM PresentationMostafa Noman DeepNo ratings yet

- Milestone Three Consolidated Financials Final Paper - Workbook...Document19 pagesMilestone Three Consolidated Financials Final Paper - Workbook...Ishan MishraNo ratings yet

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- 1Q23 Supporting SpreadsheetDocument22 pages1Q23 Supporting SpreadsheetJamilly PaivaNo ratings yet

- Case RockboromachinetoolscorporationDocument10 pagesCase RockboromachinetoolscorporationPatcharanan SattayapongNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Ten Year Financial Summary PDFDocument2 pagesTen Year Financial Summary PDFTushar GoelNo ratings yet

- Business Valuation - ROTIDocument21 pagesBusiness Valuation - ROTITEDY TEDYNo ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- The Analyst Exchange 374407768.xlsx, Income Statement1 Of: On - LineDocument49 pagesThe Analyst Exchange 374407768.xlsx, Income Statement1 Of: On - LinePratik ChavhanNo ratings yet

- Uts Comprehensive Case PT WikaDocument7 pagesUts Comprehensive Case PT WikaFerial FerniawanNo ratings yet

- PGP Heritage Doll ExcelDocument5 pagesPGP Heritage Doll ExcelPGP37 392 Abhishek SinghNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- HABT Model 5Document20 pagesHABT Model 5Naman PriyadarshiNo ratings yet

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394No ratings yet

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- Ashok Leyland LTD (AL IN) - Adj HighlightsDocument184 pagesAshok Leyland LTD (AL IN) - Adj Highlightsनिशांत मित्तलNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- Wall Street Prep Financial Modeling Quick Lesson DCF1Document18 pagesWall Street Prep Financial Modeling Quick Lesson DCF1NuominNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- NHDC-Solution-xls Analisis VPN TIR NHDCDocument4 pagesNHDC-Solution-xls Analisis VPN TIR NHDCDaniel Infante0% (1)

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Bosch 1qcy2014ru 290414Document12 pagesBosch 1qcy2014ru 290414Tirthajit SinhaNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- UAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDocument9 pagesUAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDinda AzzahraNo ratings yet

- BIOCON Ratio AnalysisDocument3 pagesBIOCON Ratio AnalysisVinuNo ratings yet

- AnandamDocument12 pagesAnandamNarinderNo ratings yet