Professional Documents

Culture Documents

Monopoly and Monopsony

Monopoly and Monopsony

Uploaded by

RajatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monopoly and Monopsony

Monopoly and Monopsony

Uploaded by

RajatCopyright:

Available Formats

1 Multi-Plant Firm

14.01 Principles of Microeconomics, Fall 2007

Chia-Hui Chen

November 9, 2007

Lecture 23

Monopoly and Monopsony

Outline

1. Chap 10: Multi-Plant Firm

2. Chap 10: Social Cost of Monopoly Power

3. Chap 10: Price Regulation

4. Chap 10: Monopsony

Multi-Plant Firm

How does a monopolist allocate production between plants?

Suppose the rm produces quantity Q1 with cost C1 (Q1 ) for plant 1, and quan

tity Q2 with cost C2 (Q2 ) for plant 2. The total quantity is

QT = Q1 + Q2 .

And the prot is

= QT P (QT ) C1 (Q1 ) C2 (Q2 ) = (Q1 + Q2 )P (Q1 + Q2 ) C1 (Q1 ) C2 (Q2 ).

To solve, use the rst order constraint:

d

dP (Q1 + Q2 )

dC1

= P (Q1 + Q2 ) + (Q1 + Q2 )

= 0,

dQ1

dQ1

dQ1

Since

P (QT ) + QT

dP (QT )

dP (QT )

= P (QT ) + QT

= M R(QT ),

dQ1

dQT

M R(QT ) = M C1 (Q1 ).

Similarly,

M R(QT ) = M C2 (Q2 ).

Thus,

M R(QT ) = M C1 (Q1 ) = M C2 (Q2 ).

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

2 Social Cost of Monopoly Power

Social Cost of Monopoly Power

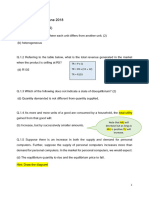

Firstly, compare the producer and consumer surplus in a competitive market and

a monopolistic market. In the competitive market, the quantity is determined

by

M C = AR,

while in the monopolistic market, the quantity is determined by

MC = MR

(see Figure 1). Therefore, in going from a perfectly competitive market to a

10

PM

PC

MR

D=AR

MR

MC

B

C

QM Q

C

3

5

Q

10

Figure 1: Consumer and Producer Surplus in Monopolist Market.

monopolistic market, the change of consumer surplus and producer surplus are,

respectively,

CS = (A + B),

and

P S = A C.

The deadweight loss is

DW L = B + C.

In fact, social cost should not only include the deadweight loss but also rent seek

ing. The rm might spend to gain monopoly power by lobbying the government

and building excess capacity to threaten opponents.

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

3 Price Regulation

Price Regulation

In perfectly competitive markets, price regulation causes deadweight loss, but

in monopoly, price regulation might improve eciently. Now we discuss four

possible price regulations in monopolistic markets. P1 , P2 , P3 , P4 are:

P1 (PC , PM );

P2 = PC ;

P3 (P0 , PC );

P4 < P0 .

10

MC

PM

AC

PC

P0

MR

D=AR

QM Q

C

3

5

Q

10

Figure 2: Comparing Competitive and Monopolist Market.

Price between the competitive market price and monopolist market price.

Suppose the price ceiling is P1 . The new corresponding AR and M R

curves are shown in Figure 3. Given the new M R curve, the equilibrium

quantity will be Q1 .

Q1 (QM , QC ).

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

3 Price Regulation

10

9

8

7

MC

6

5

4

P

MP

P 1

C

MR

3

2

1

0

Q Q1Q

M

C

3

AR

5

Q

10

Figure 3: Price between the Competitive Market Price and Monopolist Market

Price.

Price equal to the competitive market price. The new corresponding M R

and AR curves are shown in Figure 4. In this case the equlibrium price

and quantity are as same as those of the competitive market.

Price between the competitive market price and the lowest average cost.

Suppose the price ceiling is P3 . The new corresponding M R and AR

curves are shown in Figure 5. The equilibrium quantity will be Q3 .

Q3 (QC , Q0 ).

The new bold line describes the relation between price and quantity.

Price lower than the lowest average cost. The rms revenue is not enough

for the cost, thus it will quit the market. There is no production.

The analysis shows that if the government sets the price ceiling equal to P2 , the

outcome is the same as in a competitive market, and there is no deadweight

loss.

Natural monopoly. In a natural monopoly, a rm can produce the entire

output of the industry and the cost is lower than what it would be if there

were other rms. Natural monopoly arises when there are large economies

of scale (see Figure 6). If the market is unregulated, the price will be PM

and the quantity will be QM . To improve eciency, the government can

regulate the price. If the price is regulated to be PC , the rm cannot cover

the average cost and will go out of business. PR is the lowest price that

the government can set so that the monopolist will stay in the market.

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

3 Price Regulation

10

9

8

7

MC

6

5

PC

MR

3

2

AR

1

0

QC

4

5

Q

10

Figure 4: Price Equal to the Competitive Market Price.

10

MC

6

5

4

3

AC

PCP

P0 3 MR

2

1

0

Q AR

QC 3

4

5

Q

10

Figure 5: Price between the Competitive Market Price and the lowest Average

Cost.

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

4 Monopsony

10

PM

P

AC

MC

Q MRQR

M

3

Q AR

C

5

Q

10

Figure 6: Regulating the Price of a Natural Monopoly.

Monopsony

Monopsony refers to a market with only one buyer. In this market, the buyer

will maximize its prot, which is the dierence of value and expenditure:

max (Q) = V (Q) E(Q).

When the prot is maximized,

d

(V (Q) E(Q) = 0.

dQ

Thus

M V = M E,

namely, the marginal value (additional benet form buying one more unit of

goods) is equal to the marginal expenditure (addtional cost of buying one more

unit of goods).

Cite as: Chia-Hui Chen, course materials for 14.01 Principles of Microeconomics, Fall 2007. MIT

OpenCourseWare (http://ocw.mit.edu), Massachusetts Institute of Technology. Downloaded on [DD Month

YYYY].

You might also like

- Solutions PepallDocument48 pagesSolutions PepallJoseph Guen67% (6)

- Mid Term Business Economy - Ayustina GiustiDocument9 pagesMid Term Business Economy - Ayustina GiustiAyustina Giusti100% (1)

- Exercises Part6Document14 pagesExercises Part6Inder Mohan0% (1)

- Supply Chain Strategy at TCL MultimediaDocument7 pagesSupply Chain Strategy at TCL MultimediaWaqas AhmedNo ratings yet

- ME Tutorial 14Document2 pagesME Tutorial 14Tamanna SinghNo ratings yet

- Microeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth EditionDocument56 pagesMicroeconomics: by Robert S. Pindyck Daniel Rubinfeld Ninth Editiongerald100% (1)

- Ch08 SolutionsDocument8 pagesCh08 SolutionsOng Wei LingNo ratings yet

- EC1301 Post Lecture Quiz 5Document7 pagesEC1301 Post Lecture Quiz 5Liu XinchengNo ratings yet

- Uniqlo Group PresentationDocument11 pagesUniqlo Group PresentationmanuelsalgadoNo ratings yet

- Buyers' Cartels An Empirical Study of Prevalence and Economic CharacteristicsDocument48 pagesBuyers' Cartels An Empirical Study of Prevalence and Economic CharacteristicsmgNo ratings yet

- Bài tập làm thêmDocument2 pagesBài tập làm thêmNguyễn Phương ThảoNo ratings yet

- 3.1.1. Basic Concepts of Perfect CompetitionDocument9 pages3.1.1. Basic Concepts of Perfect Competitiontegegn mogessieNo ratings yet

- Pricing With Market Power: (A) Group 1. (B) Group 2. (C) Total MarketDocument5 pagesPricing With Market Power: (A) Group 1. (B) Group 2. (C) Total MarketMohammad SaifullahNo ratings yet

- Monopoly: I. What Is A Monopoly Market?Document6 pagesMonopoly: I. What Is A Monopoly Market?Asaa mjakaNo ratings yet

- Notes9 Monopoly PDFDocument28 pagesNotes9 Monopoly PDFsukandeNo ratings yet

- MIT14 01F18 Pset5Document5 pagesMIT14 01F18 Pset5Lucifer MorningstarNo ratings yet

- Unit 8 MonopolyDocument24 pagesUnit 8 MonopolyRanjeet KumarNo ratings yet

- Worksheet - ME 2022Document3 pagesWorksheet - ME 2022kibebew shenkuteNo ratings yet

- Econ 2001 Midsemester Marathon: EquationsDocument3 pagesEcon 2001 Midsemester Marathon: Equationssandrae brownNo ratings yet

- Chapter Onemonopoly MonopolyDocument16 pagesChapter Onemonopoly Monopolyvillaarbaminch0% (1)

- Perfect CompetitionDocument15 pagesPerfect CompetitionFabian MtiroNo ratings yet

- Musgrave, Curves: Musgrave FF.) Musgrave Musgrave (1989, FF.), (Hyman 1996) - Musgrave'sDocument6 pagesMusgrave, Curves: Musgrave FF.) Musgrave Musgrave (1989, FF.), (Hyman 1996) - Musgrave'sSalah MuhammedNo ratings yet

- Economics 121: Zvika NeemanDocument26 pagesEconomics 121: Zvika NeemanMatteo GodiNo ratings yet

- EconDocument4 pagesEconKianna SabalaNo ratings yet

- T Note 8 MonopolyDocument7 pagesT Note 8 MonopolyBella NovitasariNo ratings yet

- Principles of MicroeconomicsDocument10 pagesPrinciples of MicroeconomicsAnand AryaNo ratings yet

- A Two-Level Optimization Problem For Analysis of Market Bidding Strategies Weber, OverbyeDocument6 pagesA Two-Level Optimization Problem For Analysis of Market Bidding Strategies Weber, OverbyehoseinkhazaeiNo ratings yet

- Workshop 4 Perfect Competition Solutions-2Document15 pagesWorkshop 4 Perfect Competition Solutions-2GiovanniNico33No ratings yet

- Energy Economics (Peter M. Schwarz) (Z-Lib - Org) - Pages-69-75Document7 pagesEnergy Economics (Peter M. Schwarz) (Z-Lib - Org) - Pages-69-75ilia movasatianNo ratings yet

- Lesson: 9.0 Aims and ObjectivesDocument7 pagesLesson: 9.0 Aims and ObjectivesDr.B.ThayumanavarNo ratings yet

- Some Important Questions For The Paper Managerial Economics'Document3 pagesSome Important Questions For The Paper Managerial Economics'Amit VshneyarNo ratings yet

- EC3099 - Industrial Economics - 2007 Exam - Zone-ADocument4 pagesEC3099 - Industrial Economics - 2007 Exam - Zone-AAishwarya PotdarNo ratings yet

- Assignment Econ 2021Document4 pagesAssignment Econ 2021bashatigabuNo ratings yet

- Test QuestionsDocument7 pagesTest QuestionsArjun AryalNo ratings yet

- Micro 2021 Syllabus W5 SkillsDocument5 pagesMicro 2021 Syllabus W5 SkillsVe DekNo ratings yet

- Memo Exam Jun 2017Document11 pagesMemo Exam Jun 2017Nathan VieningsNo ratings yet

- Cournot Model With Entry NewDocument8 pagesCournot Model With Entry NewhashimNo ratings yet

- Introduction To MicroeconomicsDocument5 pagesIntroduction To MicroeconomicscyrusNo ratings yet

- Recitation 9Document10 pagesRecitation 9Zilhayati RamadhaniNo ratings yet

- N5 OligopolyDocument11 pagesN5 OligopolyMuhammad RajaNo ratings yet

- Week 2 SolutionsDocument6 pagesWeek 2 SolutionsAnton BochkovNo ratings yet

- Tutorial Sheet 1Document2 pagesTutorial Sheet 1Samar EissaNo ratings yet

- Microeconomics Chapter 6 Calculating ExercisesDocument10 pagesMicroeconomics Chapter 6 Calculating ExercisesNguyen Bich NgocNo ratings yet

- Game TheoryDocument49 pagesGame TheoryKocic BalicevacNo ratings yet

- Characteristics Characteristics Characteristics CharacteristicsDocument6 pagesCharacteristics Characteristics Characteristics CharacteristicsCecilia RanaNo ratings yet

- Tutorial 8 - SchemeDocument7 pagesTutorial 8 - SchemeTeo ShengNo ratings yet

- Economics Questions 25 June 2023Document17 pagesEconomics Questions 25 June 2023Samuel NgodaNo ratings yet

- Economics ExamDocument15 pagesEconomics ExamИСЛАМБЕК СЕРІКҰЛЫNo ratings yet

- Theory of The FirmDocument56 pagesTheory of The FirmoogafelixNo ratings yet

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- Cournot Duopoly ModelDocument4 pagesCournot Duopoly ModelUtkarsh MishraNo ratings yet

- Exam 2 - Answer Key PDFDocument6 pagesExam 2 - Answer Key PDFMarjser Planta SagarinoNo ratings yet

- Firm Heterogeneity, Endogenous Markups, and Factor EndowmentsDocument24 pagesFirm Heterogeneity, Endogenous Markups, and Factor EndowmentsHector Perez SaizNo ratings yet

- 1NA050 - Cost Theory and Market Analysis. Autumn 2019Document4 pages1NA050 - Cost Theory and Market Analysis. Autumn 2019George Von ZarovichNo ratings yet

- Seminar 3 - SolutionsDocument13 pagesSeminar 3 - SolutionsDavidBudinasNo ratings yet

- Problem Set 7Document1 pageProblem Set 7Bill BillsonNo ratings yet

- Memo Exam Jun 2018Document12 pagesMemo Exam Jun 2018Nathan VieningsNo ratings yet

- Chapter5 Monopol Dominant DWLDocument90 pagesChapter5 Monopol Dominant DWLAbdulkadir KuçarNo ratings yet

- AnswerDocument6 pagesAnswerAinin Sofea FoziNo ratings yet

- Econ Report ScriptDocument8 pagesEcon Report ScriptEun HaeNo ratings yet

- Eco135 Final Gülra KarabiyikDocument5 pagesEco135 Final Gülra KarabiyikgülraNo ratings yet

- Pricing and Price Regulation: An Economic Theory for Public Enterprises and Public UtilitiesFrom EverandPricing and Price Regulation: An Economic Theory for Public Enterprises and Public UtilitiesNo ratings yet

- EU China Energy Magazine 2023 March Issue: 2023, #2From EverandEU China Energy Magazine 2023 March Issue: 2023, #2No ratings yet

- VIII. Privacy - GLBA Gramm-Leach-Bliley Act (Privacy of Consumer Financial Information)Document31 pagesVIII. Privacy - GLBA Gramm-Leach-Bliley Act (Privacy of Consumer Financial Information)Anil AppayannaNo ratings yet

- Managing Global ExpansionDocument5 pagesManaging Global Expansionlaszlobock100% (1)

- Strat 15finalDocument153 pagesStrat 15finalKowshik ChakrabortyNo ratings yet

- Munjal Kiriu IndustriesDocument15 pagesMunjal Kiriu IndustriesSubhash BajajNo ratings yet

- IMC-Creative Strategy P&DDocument17 pagesIMC-Creative Strategy P&Dazazelavey100% (1)

- Principles of Business Economics Joseph G. NellisDocument134 pagesPrinciples of Business Economics Joseph G. Nellisankur_555in3810No ratings yet

- Product PortfolioDocument83 pagesProduct PortfoliosteveNo ratings yet

- AP Economics Chapter 29 VocabularyDocument2 pagesAP Economics Chapter 29 VocabularyKevin WangNo ratings yet

- Review of Related LiteratureDocument18 pagesReview of Related LiteratureKaela EuniceNo ratings yet

- ABC Board PricesDocument64 pagesABC Board PricesAndrew K. HyderNo ratings yet

- Marketing Quiz 2Document2 pagesMarketing Quiz 2Alex AsherNo ratings yet

- Physical EvidenceDocument23 pagesPhysical EvidenceMohsin ParkarNo ratings yet

- Repot BernasDocument3 pagesRepot BernasNur Fatin AwanisNo ratings yet

- GroupOn FinalDocument27 pagesGroupOn FinalAndrew NeuberNo ratings yet

- Apurva Madiraju CBA Exam Apurva Madiraju 71310044 296Document8 pagesApurva Madiraju CBA Exam Apurva Madiraju 71310044 296sonalzNo ratings yet

- Invoice OD110503281128278000 PDFDocument1 pageInvoice OD110503281128278000 PDFSandeep KumarNo ratings yet

- Module 5 NotesDocument20 pagesModule 5 NotesHarshith AgarwalNo ratings yet

- Britannia CaseDocument2 pagesBritannia CaseAbhiMisraNo ratings yet

- WhirlpoolDocument18 pagesWhirlpoolAmin FarooqNo ratings yet

- Questionnaire For BIDocument4 pagesQuestionnaire For BILovely Akhil SaiNo ratings yet

- 15 Brand Analysis On Laptop Computers Dhaka University Students' PerspectiveDocument18 pages15 Brand Analysis On Laptop Computers Dhaka University Students' PerspectiveHariNo ratings yet

- Boult Audio International Expansion Case Study - Gaurav DharDocument2 pagesBoult Audio International Expansion Case Study - Gaurav DharGaurav DharNo ratings yet

- Pob SyllabusDocument22 pagesPob SyllabusJahvaine Kerr50% (2)

- IB Economics-Internal Assessment Cover SheetDocument8 pagesIB Economics-Internal Assessment Cover SheetJacob AronovitzNo ratings yet

- Complaint LetterDocument13 pagesComplaint LetteragungokeNo ratings yet

- Case Study On Lakme Reinvent Marketing StrategyDocument26 pagesCase Study On Lakme Reinvent Marketing StrategyVasudha97No ratings yet

- Profile Intramega GlobalDocument25 pagesProfile Intramega GlobalIwan Budi SasongkoNo ratings yet