Professional Documents

Culture Documents

Steps To Purchase A Manager's Check

Steps To Purchase A Manager's Check

Uploaded by

Sannie RemotinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steps To Purchase A Manager's Check

Steps To Purchase A Manager's Check

Uploaded by

Sannie RemotinCopyright:

Available Formats

What is MC

It is a check issued by the bank against its own account, and is signed by a manager and maybe

another officer. Compare that with a regular check which is issued by persons/corporations against

their account with the bank.

Banks will charge for the service. Fees will vary from bank to bank.

Generally you must be an accountholder to be able to buy a manager's check, but a bank may sell you

one even if you are not, if you are properly identified, introduced, referred, or otherwise known to the

bank. They do not want their checks to be used for fraudulent or illegal transactions, which is why

they want to know who their customers are.

Difference Between MC and Personal/Customer Check

Regular checks are subject to rejections if no enough balance is available. Manager's checks,

however, are guaranteed (i.e., your bank guarantees that funds will be automatically available upon

demand or presentation of the MC). It is considered as good as cash.

If the manager's checque get's lost, you lose you money unless you report it to the bank and ask for

a replacement, wherein some banks asks for affidavit of lose and other legal papers. A personal

cheque when it get's lost you just report it to the bank and they will cancel that serial number so the

checque would not be honored anymore.

Steps to Purchase a Managers Check

1. Proceed to the bank where you hold an account.

2. In the bank, ask for a form to purchase a managers check. Fill in the form. Double or triple

check the information youve written on the form.

3. After you fill in the form, queue in the line and present the form, your ATM card or passbook, valid

IDs and the managers check fee.

4. The bank will hand over the managers check to you. Double check that the name, amount (in

words and number), date and signatories are all correct.

Notes:

The fee to purchase a managers check varies from bank to bank. You may try and ask for the fee

to be waived if youre a VIP customer.

A managers check will no longer be valid after 6 months of issuance date.

If you lose the managers check, file for an affidavit of loss, report it to the bank and ask for a

replacement subject to fees.

To cancel the managers check, you need to return the original check to the issuing bank with your

valid IDs. Make sure that the person who purchased the MC is the same person who returns the

original check for cancellation.

Managers Check Fee of Some Banks as of 14 May 2012:

BDO: Php 30

BPI or BPI Family: Php 50

China Bank: Php 30

HSBC: Php 100

Maybank: Php 31.50

You might also like

- FABM2 Module 07 (Q1-W8-9)Document9 pagesFABM2 Module 07 (Q1-W8-9)Christian ZebuaNo ratings yet

- Types of Cheque PDFDocument5 pagesTypes of Cheque PDFRicha Nandy0% (1)

- Chap-4 Departmentalization of NBPDocument25 pagesChap-4 Departmentalization of NBP✬ SHANZA MALIK ✬No ratings yet

- Main Area of Focus For Audit of "Cash and Cash Equivalents"Document3 pagesMain Area of Focus For Audit of "Cash and Cash Equivalents"Mohit SainiNo ratings yet

- Chapter 13 BankingDocument5 pagesChapter 13 BankingdragongskdbsNo ratings yet

- Banking Chapter FourDocument13 pagesBanking Chapter FourfikremariamNo ratings yet

- Acca Fundamentals of Accounting (FA1)Document24 pagesAcca Fundamentals of Accounting (FA1)Paredes FlozerenziNo ratings yet

- Paying BankerDocument2 pagesPaying BankerwubeNo ratings yet

- RemittanceDocument21 pagesRemittancemuhammad arifNo ratings yet

- BankingDocument14 pagesBankingFahmi AbdullaNo ratings yet

- Make Una Accept An 1Document1 pageMake Una Accept An 1Private NetworkNo ratings yet

- Unit 2 LPBDocument9 pagesUnit 2 LPBVeena ReddyNo ratings yet

- Cheque Objectives: Unit - V Chapter - IXDocument14 pagesCheque Objectives: Unit - V Chapter - IXritika sharmaNo ratings yet

- TPB - Module 4 - Reference MaterialDocument8 pagesTPB - Module 4 - Reference MaterialSupreethaNo ratings yet

- Cheque: What Is It?: Cheque Statistics Cheque Cheque ChequeDocument13 pagesCheque: What Is It?: Cheque Statistics Cheque Cheque ChequeMAdhuNo ratings yet

- Linkedin: Main Content Starts BelowDocument8 pagesLinkedin: Main Content Starts BelowBryce BihagNo ratings yet

- Lession 4 Op& CLDocument11 pagesLession 4 Op& CLNirbhay SaxenaNo ratings yet

- Account Opening Department: Types of AccountsDocument24 pagesAccount Opening Department: Types of AccountsHammad AhmadNo ratings yet

- Banking CH 5Document22 pagesBanking CH 5Bicaaqaa M. AbdiisaaNo ratings yet

- 42 Banking CorrespondenceDocument11 pages42 Banking Correspondencepallab1983No ratings yet

- MC IV UnitDocument17 pagesMC IV UnitABINAYANo ratings yet

- Banking Operations: Cheques & EndorsementsDocument12 pagesBanking Operations: Cheques & EndorsementsSharath SaunshiNo ratings yet

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- Las 8 Bank AccountsDocument8 pagesLas 8 Bank AccountsCharlyn CastroNo ratings yet

- Unit - II Banking Law & Practices FullDocument39 pagesUnit - II Banking Law & Practices FulllittlemagicpkNo ratings yet

- Chapter - 5 (Others Services of Bank)Document8 pagesChapter - 5 (Others Services of Bank)kritik deswalNo ratings yet

- Project On ChequeDocument19 pagesProject On Chequesonyprabhakar76No ratings yet

- Audit Program - CashDocument2 pagesAudit Program - CashKris Van HalenNo ratings yet

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- 4.account Opening RequirmentsDocument16 pages4.account Opening RequirmentsTaonga Jean BandaNo ratings yet

- Fabm2 Quarter 2 Module 1Document51 pagesFabm2 Quarter 2 Module 1princesselainevilbar676No ratings yet

- Customers Account With BankerDocument11 pagesCustomers Account With Bankerrkrakib073No ratings yet

- 17-Banking Services ProceduresDocument37 pages17-Banking Services ProceduresjayNo ratings yet

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarNo ratings yet

- Chapter 5 A ServicesDocument15 pagesChapter 5 A ServicesSeid KassawNo ratings yet

- Ebl OriginalDocument18 pagesEbl OriginalPushpa BaruaNo ratings yet

- What Are Cheques ReportDocument7 pagesWhat Are Cheques ReportROMMIL BALLENOSNo ratings yet

- Swastika 4Document9 pagesSwastika 4Yaman BhattaraiNo ratings yet

- Audit Cash CycleDocument13 pagesAudit Cash CycleNik Nurul Ain Ehzani100% (3)

- FABM2 - Q1 - v1 Page 133 139Document7 pagesFABM2 - Q1 - v1 Page 133 139Kate thilyNo ratings yet

- Departments of The NBP: Cash DepartmentDocument7 pagesDepartments of The NBP: Cash DepartmentZahid HussainNo ratings yet

- Intermidiate FA I ChapterDocument28 pagesIntermidiate FA I Chapteryiberta69No ratings yet

- Deficiency of Service in Banks (India)Document10 pagesDeficiency of Service in Banks (India)Parveen Kumar0% (1)

- Watch Your Savings GrowDocument14 pagesWatch Your Savings GrowpratikjaiNo ratings yet

- Reasons For Overdrafts: Types of Corporate Finance Short Term Bank OverdraftDocument8 pagesReasons For Overdrafts: Types of Corporate Finance Short Term Bank OverdraftAshfaque KhanNo ratings yet

- ChequesDocument3 pagesChequesmariyanaalharthiNo ratings yet

- Cheesy Company Test Plan SolutionDocument1 pageCheesy Company Test Plan SolutionAnnamae TeoxonNo ratings yet

- Chapter Five CashDocument9 pagesChapter Five CashDawit TesfayeNo ratings yet

- Chap 4Document28 pagesChap 4অঝর শ্রাবনNo ratings yet

- Retail Banking AssignmentDocument8 pagesRetail Banking Assignmentzubin pahujaNo ratings yet

- Journal 07Document1 pageJournal 07abdullah abu saifNo ratings yet

- Types of Cheque and Types of Corss ChequesDocument8 pagesTypes of Cheque and Types of Corss Chequesprahalakash Reg 113No ratings yet

- Banking LawDocument12 pagesBanking LawArockia AmalanNo ratings yet

- Activities Perform During Internship: Special Category of AccountDocument3 pagesActivities Perform During Internship: Special Category of AccountChoudheryShahzadNo ratings yet

- Chapter # 5: DepartmentalizationDocument24 pagesChapter # 5: Departmentalizationanon_248950009No ratings yet

- Kokan BankDocument20 pagesKokan BankramshaNo ratings yet

- General BankingDocument32 pagesGeneral BankingTaanzim JhumuNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Endorsement LetterDocument1 pageEndorsement LetterSannie RemotinNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument96 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledSannie RemotinNo ratings yet

- RULE 132 Rules of Court - Presentation of EvidenceDocument26 pagesRULE 132 Rules of Court - Presentation of EvidenceSannie RemotinNo ratings yet

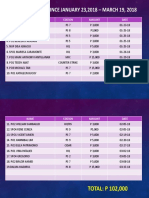

- Assistance Given Since January 23,2018 - March 19, 2018: Name Station Amount DateDocument2 pagesAssistance Given Since January 23,2018 - March 19, 2018: Name Station Amount DateSannie RemotinNo ratings yet

- Books Used by TopnotchersDocument2 pagesBooks Used by TopnotchersSannie RemotinNo ratings yet

- Books Used by TopnotchersDocument2 pagesBooks Used by TopnotchersSannie RemotinNo ratings yet

- Andrew S. Enriquez 0997-663-1077 Sales Representative: Down PaymentDocument1 pageAndrew S. Enriquez 0997-663-1077 Sales Representative: Down PaymentSannie RemotinNo ratings yet

- Zamboanga Adventist CenterDocument3 pagesZamboanga Adventist CenterSannie RemotinNo ratings yet

- Lim Tong Lim, Petitioner, vs. Philippine Fishing Gear INDUSTRIES, INC., RespondentDocument38 pagesLim Tong Lim, Petitioner, vs. Philippine Fishing Gear INDUSTRIES, INC., RespondentSannie RemotinNo ratings yet

- Petition For Review From The Regional Trial Courts To The Court of AppealsDocument13 pagesPetition For Review From The Regional Trial Courts To The Court of AppealsSannie RemotinNo ratings yet

- How To Write A Rhyming PoemDocument71 pagesHow To Write A Rhyming PoemSannie RemotinNo ratings yet

- Lim Tong Lim, Petitioner, vs. Philippine Fishing Gear INDUSTRIES, INC., RespondentDocument38 pagesLim Tong Lim, Petitioner, vs. Philippine Fishing Gear INDUSTRIES, INC., RespondentSannie RemotinNo ratings yet