Professional Documents

Culture Documents

01 S&D - Closing The European Tax Gap 4

Uploaded by

Dimitris ArgyriouOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 S&D - Closing The European Tax Gap 4

Uploaded by

Dimitris ArgyriouCopyright:

Available Formats

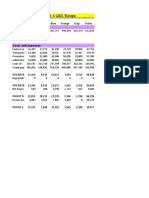

As shown in the table below, there is no clear relation between the level of taxes and the level of tax

evasion in the European Union member states:

Taxburden

2009

%

Sizeof

Shadow

Economy

Euro'm

Taxlostasa

resultof

Shadow

Economy

Euro'm

Country

GDP2009

Euro'm

Sizeof

Shadow

Economy

%

Austria

284,000

9.7

42.7

27,548

11,763

Belgium

353,000

21.9

43.5

77,307

33,629

Bulgaria

36,000

35.3

28.9

12,708

3,673

Cyprus

17,000

28.0

35.1

4,760

1,671

CzechRepublic

145,000

18.4

34.5

26,680

9,205

Denmark

234,000

17.7

48.1

41,418

19,922

Estonia

15,000

31.2

35.9

4,680

1,680

Finland

180,000

17.7

43.1

31,860

13,732

France

1,933,000

15.0

41.6

289,950

120,619

Germany

2,499,000

16.0

39.7

399,840

158,736

230,000

27.5

30.3

63,250

19,165

Greece

Hungary

98,000

24.4

39.5

23,912

9,445

Ireland

156,000

15.8

28.2

24,648

6,951

Italy

1,549,000

27.0

43.1

418,230

180,257

Latvia

18,000

29.2

26.6

5,256

1,398

Lithuania

27,000

32.0

29.3

8,640

2,532

Luxembourg

42,000

9.7

37.1

4,074

1,511

6,200

27.2

34.2

1,686

577

Netherlands

591,000

13.2

38.2

78,012

29,801

Poland

354,000

27.2

31.8

96,288

30,620

Portugal

173,000

23.0

31.0

39,790

12,335

Romania

122,000

32.6

27.0

39,772

10,738

Slovakia

66,000

18.1

28.8

11,946

3,440

Slovenia

36,000

26.2

37.6

9,432

3,546

Malta

Spain

Sweden

United

Kingdom

Total

or

unweighted

average

1,063,000

22.5

30.4

239,175

72,709

347,000

18.8

46.9

65,236

30,596

1,697,000

12.5

34.9

212,125

74,032

12,271,200

22.1

35.9

2,258,223

864,282

You might also like

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeFrom EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeNo ratings yet

- What Is Average Salary in EUDocument4 pagesWhat Is Average Salary in EUMy Visa Online Immigration InvestNo ratings yet

- Property Tax Rates in High-Income NationsDocument1 pageProperty Tax Rates in High-Income NationsDimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2011 - Booklet 37Document1 pageTaxation Trends in The European Union - 2011 - Booklet 37Dimitris ArgyriouNo ratings yet

- The Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011Document4 pagesThe Overall tax-to-GDP Ratio in The EU27 Up To 38.8% of GDP in 2011pissiqtzaNo ratings yet

- 01 IMF - Taxing Immovable Property - 2013 38Document1 page01 IMF - Taxing Immovable Property - 2013 38Dimitris ArgyriouNo ratings yet

- EU27 tax-to-GDP ratio up to 38.8% in 2011Document5 pagesEU27 tax-to-GDP ratio up to 38.8% in 2011WISDOM your outside perspective pillarNo ratings yet

- Ireland: Developments in The Member StatesDocument4 pagesIreland: Developments in The Member StatesBogdan PetreNo ratings yet

- Salaries in EUDocument1 pageSalaries in EUsidharthmittalNo ratings yet

- GDP Per Capita 2006, EU, by RegionDocument9 pagesGDP Per Capita 2006, EU, by RegionPJPeguyNo ratings yet

- Taxation Trends in The European Union - 2012 61Document1 pageTaxation Trends in The European Union - 2012 61d05registerNo ratings yet

- Nama 10 PP Page SpreadsheetDocument7 pagesNama 10 PP Page SpreadsheetOvidiu DascaluNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Chart Title Source Dataset Dataset Metadata and Download List of Available Indicators Extraction DateDocument17 pagesChart Title Source Dataset Dataset Metadata and Download List of Available Indicators Extraction DateciojaijocawjilNo ratings yet

- Taxe Și Impozite (% PIB)Document6 pagesTaxe Și Impozite (% PIB)dlavinutzzaNo ratings yet

- Vat Gap Factsheet 2017Document2 pagesVat Gap Factsheet 2017shtefanandreiNo ratings yet

- Ucb (Report)Document3 pagesUcb (Report)Shruti VasudevaNo ratings yet

- Economia Subterana in Europa PDFDocument112 pagesEconomia Subterana in Europa PDFFlorin Marius PopaNo ratings yet

- Annual enterprise statistics by size and sectorDocument12 pagesAnnual enterprise statistics by size and sectorCatalin T.No ratings yet

- Work-related deaths and injuries in EU countriesDocument4 pagesWork-related deaths and injuries in EU countriesLi YuNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- WEO DataDocument24 pagesWEO DataDana CăpățînăNo ratings yet

- ANEXOIDocument20 pagesANEXOIVir PirolaNo ratings yet

- Eu StatsDocument2 pagesEu StatsOKCHRNo ratings yet

- Clasificare Dupa Categoria de StruguriDocument2 pagesClasificare Dupa Categoria de StruguriElena BadeaNo ratings yet

- Cushman: DNA of Real Estate 2014 Q2Document5 pagesCushman: DNA of Real Estate 2014 Q2vdmaraNo ratings yet

- Fiscal PolicycesifoDocument38 pagesFiscal PolicycesifoHotIce05No ratings yet

- Yearbook: Facts and Figures On Ptws in EuropeDocument47 pagesYearbook: Facts and Figures On Ptws in EuropeChristianFelberNo ratings yet

- TASK 1-22-23 StatementDocument4 pagesTASK 1-22-23 StatementPablo Martínez BordiuNo ratings yet

- 95-2010 - en - JournDocument5 pages95-2010 - en - Journjohn_miller3043No ratings yet

- Tarifhist Estbel STDocument1 pageTarifhist Estbel STAnonymous Yrx9mKmiNo ratings yet

- Career CommissionDocument3 pagesCareer CommissionElvin ShllakuNo ratings yet

- Cars 2018 Production By-CountryDocument1 pageCars 2018 Production By-CountryChris DODGERSNo ratings yet

- Bulgaria: Investment Climate and Business OpportunitiesDocument18 pagesBulgaria: Investment Climate and Business OpportunitiesrosariohoyosNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Klabin Webcast 20101 Q10Document10 pagesKlabin Webcast 20101 Q10Klabin_RINo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Fact Sheet Qu1 2006Document8 pagesFact Sheet Qu1 2006javierdb2012No ratings yet

- Government Revenue and Expenditure: Table A - Summary TableDocument5 pagesGovernment Revenue and Expenditure: Table A - Summary TableOana PuiuNo ratings yet

- Excise Duties-Part I Alcohol enDocument33 pagesExcise Duties-Part I Alcohol enscribd01No ratings yet

- Clasificatie FunctionalaDocument18 pagesClasificatie FunctionalaDiana ANo ratings yet

- Tax Revenues Per GDPDocument8 pagesTax Revenues Per GDPizforever1287557No ratings yet

- Taxation Trends in EU in 2010Document42 pagesTaxation Trends in EU in 2010Tatiana TurcanNo ratings yet

- Scorecard Hotel El VallecitoDocument9 pagesScorecard Hotel El VallecitoJuan JiménezNo ratings yet

- All Vehicles 2010 ProvisionalDocument1 pageAll Vehicles 2010 ProvisionalMichael Rafael YumangNo ratings yet

- NRG CHP Cpfe Custom 6300978 Page SpreadsheetDocument8 pagesNRG CHP Cpfe Custom 6300978 Page SpreadsheetJad ZoghaibNo ratings yet

- Tata Tea Limited - Brand ValuationDocument37 pagesTata Tea Limited - Brand ValuationKunal MehtaNo ratings yet

- PRPC 2111 FinalDocument5 pagesPRPC 2111 FinalWohlenberg MonicaNo ratings yet

- Profit and Loss Statement, K USD, Europe: Sales RevenueDocument1 pageProfit and Loss Statement, K USD, Europe: Sales Revenueronit brahmaNo ratings yet

- Third-Quarter Report To 30 September 2003Document21 pagesThird-Quarter Report To 30 September 2003dds70No ratings yet

- Date Comisia Europeana AMECO 1Document20 pagesDate Comisia Europeana AMECO 1Dorina BouthNo ratings yet

- GDP per capita growth across CEE countries 2009-2019Document11 pagesGDP per capita growth across CEE countries 2009-2019Mazlan NorinahNo ratings yet

- GPI cap production Technology Comparison and AnalysisDocument54 pagesGPI cap production Technology Comparison and AnalysisNarayana MugalurNo ratings yet

- Chart Title Source Dataset Dataset Metadata and Download List of Available Indicators Extraction DateDocument15 pagesChart Title Source Dataset Dataset Metadata and Download List of Available Indicators Extraction DateciojaijocawjilNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Eu 2015 Tax ReformsDocument132 pagesEu 2015 Tax ReformsE. S.No ratings yet

- 01 IMF - Taxing Immovable Property - 2013 21Document1 page01 IMF - Taxing Immovable Property - 2013 21Dimitris ArgyriouNo ratings yet

- Iban enDocument2 pagesIban enPeter ChristopherNo ratings yet

- Hungary Midterm BudgetDocument2 pagesHungary Midterm BudgetbodnartiNo ratings yet

- Raport Trimestrial RestructurareDocument20 pagesRaport Trimestrial RestructurareIndraNo ratings yet

- Taxation Trends in The European Union - 2012 39Document1 pageTaxation Trends in The European Union - 2012 39Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 42Document1 pageTaxation Trends in The European Union - 2012 42Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 44Document1 pageTaxation Trends in The European Union - 2012 44Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 45Document1 pageTaxation Trends in The European Union - 2012 45Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 40Document1 pageTaxation Trends in The European Union - 2012 40Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 35Document1 pageTaxation Trends in The European Union - 2012 35Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 41Document1 pageTaxation Trends in The European Union - 2012 41Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 37Document1 pageTaxation Trends in The European Union - 2012 37Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 33Document1 pageTaxation Trends in The European Union - 2012 33Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 38Document1 pageTaxation Trends in The European Union - 2012 38Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 29Document1 pageTaxation Trends in The European Union - 2012 29Dimitris ArgyriouNo ratings yet

- Top Personal Income Tax Rates 1995-2012Document1 pageTop Personal Income Tax Rates 1995-2012Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 30Document1 pageTaxation Trends in The European Union - 2012 30Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 27Document1 pageTaxation Trends in The European Union - 2012 27Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 31Document1 pageTaxation Trends in The European Union - 2012 31Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 26Document1 pageTaxation Trends in The European Union - 2012 26Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 25Document1 pageTaxation Trends in The European Union - 2012 25Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 28Document1 pageTaxation Trends in The European Union - 2012 28Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 7Document1 pageTaxation Trends in The European Union - 2012 7Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 23Document1 pageTaxation Trends in The European Union - 2012 23Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 8Document1 pageTaxation Trends in The European Union - 2012 8Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 4Document1 pageTaxation Trends in The European Union - 2012 4Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 10Document1 pageTaxation Trends in The European Union - 2012 10Dimitris ArgyriouNo ratings yet

- Revenue Structure by Level of GovernmentDocument1 pageRevenue Structure by Level of GovernmentDimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 6Document1 pageTaxation Trends in The European Union - 2012 6Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 5Document1 pageTaxation Trends in The European Union - 2012 5Dimitris ArgyriouNo ratings yet

- Taxation Trends in The European Union - 2012 3Document1 pageTaxation Trends in The European Union - 2012 3Dimitris ArgyriouNo ratings yet