Professional Documents

Culture Documents

Service Tax Notification

Service Tax Notification

Uploaded by

SanjayThakkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Tax Notification

Service Tax Notification

Uploaded by

SanjayThakkarCopyright:

Available Formats

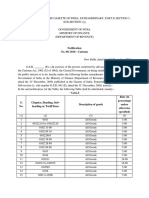

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Notification

No. 9/2014- Service Tax

New Delhi, the 11th July, 2014

G.S.R..... (E). In exercise of the powers conferred by sub-section (1) read with subsection (2) of section 94 of the Finance Act, 1994 (32 of 1994), the Central Government

hereby makes the following rules further to amend the Service Tax Rules, 1994, namely:

1.

(1) These rules may be called the Service Tax (Amendment) Rules, 2014.

(2) Save as otherwise provided in these rules, they shall come into force on the 11th

July, 2014.

2.

In the Service Tax Rules, 1994 (hereinafter referred to as the said rules),

(A) in rule 2, in sub-rule (1), in clause (d), in sub-clause (i),

(a) after item (A), the following item shall be inserted , namely: (AA) in relation to service provided or agreed to be provided by a

recovery agent to a banking company or a financial institution or a nonbanking financial company, the recipient of the service;;

(b) for item (EE),the following item shall be substituted, namely:(EE) in relation to service provided or agreed to be provided by a director

of a company or a body corporate to the said company or the body

corporate, the recipient of such service;;

(B) in rule 6 of the said rules, for sub-rule (2), the following sub-rule shall be

substituted with effect from the 1st October, 2014, namely:(2) Every assessee shall electronically pay the service tax payable by him,

through internet banking:

Provided that the Assistant Commissioner or the Deputy

Commissioner of Central Excise, as the case may be, having jurisdiction,

may for reasons to be recorded in writing, allow the assessee to deposit

the service tax by any mode other than internet banking..

[F.No. 334 /15/2014- TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Note.- The principal notification was published in the Gazette of India, Extraordinary, Part II,

Section 3, Sub-section (i) by notification No. 2/94-ST, dated the 28th June, 1994 vide number

G.S.R. 546 (E), dated the 28th June, 1994 and last amended by notification No.16/2013Service Tax, dated the 22nd November, 2013 vide number G.S.R. 749 (E), dated the 22nd

November, 2013.

You might also like

- Banks Can Not Lend CreditDocument4 pagesBanks Can Not Lend CreditChristian Comunity100% (1)

- Slaves of Sultans: A History of Migration and CommunityDocument8 pagesSlaves of Sultans: A History of Migration and CommunityFrederick Noronha100% (1)

- People V Octa GR 195196 CDDocument2 pagesPeople V Octa GR 195196 CDLester Fiel PanopioNo ratings yet

- Flores V DrilonDocument2 pagesFlores V DrilonansleyNo ratings yet

- BR 921Document30 pagesBR 921Ariel Martinez100% (1)

- 04 Phil. Trust Co. vs. CADocument19 pages04 Phil. Trust Co. vs. CAJulius Geoffrey TangonanNo ratings yet

- Recent and Landmark Case Laws-Book PreviewDocument30 pagesRecent and Landmark Case Laws-Book PreviewprinceNo ratings yet

- Service Tax Notification No.07/2014 Dated 11th July, 2014Document3 pagesService Tax Notification No.07/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Service Tax Notification No.11/2014 Dated 11th July, 2014Document2 pagesService Tax Notification No.11/2014 Dated 11th July, 2014stephin k jNo ratings yet

- in The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)Document9 pagesin The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)shreyansghorawatNo ratings yet

- Explanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedDocument1 pageExplanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedabracadabraNo ratings yet

- Allowance To Transport EmployeesDocument1 pageAllowance To Transport Employeesn1krNo ratings yet

- Services Tax - Series 3Document31 pagesServices Tax - Series 3sb_jainNo ratings yet

- Service Tax Rules 1994Document92 pagesService Tax Rules 1994Rishi DebNo ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- Vide Number G.S.R. 483 (E), Dated The 11: TH THDocument1 pageVide Number G.S.R. 483 (E), Dated The 11: TH THSushant SaxenaNo ratings yet

- GSTNTF55Document7 pagesGSTNTF55JGVNo ratings yet

- Service Tax Exemption in IndiaDocument38 pagesService Tax Exemption in IndiaAnonymous it4wrfEOdNo ratings yet

- 15 of 2007Document9 pages15 of 2007FelicianFernandopulleNo ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Taxguru - In-Govt Notifies Sections 108 109 113 To 122 of FA 2021 Wef 01012022Document5 pagesTaxguru - In-Govt Notifies Sections 108 109 113 To 122 of FA 2021 Wef 01012022Thamil RajendranNo ratings yet

- Bos 60318Document40 pagesBos 60318Subiksha LakshNo ratings yet

- Notification No. 35-2021 - Central TaxDocument4 pagesNotification No. 35-2021 - Central TaxSIR GNo ratings yet

- Central VatDocument6 pagesCentral Vatchethan sogiNo ratings yet

- Act 39 of 2021Document9 pagesAct 39 of 2021Kriti KumarNo ratings yet

- 11 of 2011Document7 pages11 of 2011FelicianFernandopulleNo ratings yet

- 27 Aug 2014 Circular NoDocument3 pages27 Aug 2014 Circular NockzeoNo ratings yet

- Government of India Office of The Assistant Commissioner of Service Tax: Division - IDocument10 pagesGovernment of India Office of The Assistant Commissioner of Service Tax: Division - IadhipdcNo ratings yet

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmNo ratings yet

- Bos 58432Document29 pagesBos 58432Khawaish MittalNo ratings yet

- Service TAx - Notification-Nos-29-to-37Document6 pagesService TAx - Notification-Nos-29-to-37sd naikNo ratings yet

- Tamil Nadu Government Gazette: ExtraordinaryDocument2 pagesTamil Nadu Government Gazette: ExtraordinaryNavya S RadhakrishnanNo ratings yet

- Paper 8: Indirect Tax Laws Statutory Update For May 2022 ExaminationDocument25 pagesPaper 8: Indirect Tax Laws Statutory Update For May 2022 Examinationparam.ginniNo ratings yet

- Central Excise Notification No. 3/2011Document8 pagesCentral Excise Notification No. 3/2011sonia87No ratings yet

- Bos 54534Document12 pagesBos 54534Khawaish MittalNo ratings yet

- THE (With Holding) Rules, 2007: Sales Tax Special ProcedureDocument12 pagesTHE (With Holding) Rules, 2007: Sales Tax Special ProcedureParvez RaeesNo ratings yet

- Final Law Amendment Nov 23Document40 pagesFinal Law Amendment Nov 23Vikash AgarwalNo ratings yet

- Law RTP NOV 23Document60 pagesLaw RTP NOV 23Kartikeya BansalNo ratings yet

- Nov 23 RTP LawDocument22 pagesNov 23 RTP Lawranveersinghkanawat89188No ratings yet

- cs24 2013Document3 pagescs24 2013stephin k jNo ratings yet

- TH TH: Explanation.-For The Purposes of This ClauseDocument4 pagesTH TH: Explanation.-For The Purposes of This ClauseAks SomvanshiNo ratings yet

- HTML File ProcessDocument10 pagesHTML File ProcessSuresh SharmaNo ratings yet

- UntitledDocument22 pagesUntitledShivani KumariNo ratings yet

- st06 2012Document1 pagest06 2012Hardik PatelNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument5 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

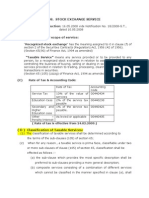

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- 2018FCS - MS27 AP Targetted PDS System AmendmentDocument4 pages2018FCS - MS27 AP Targetted PDS System AmendmentHouse Sites RCPMNo ratings yet

- Restriction On ITC in Case of Diffrence’ GTR 3B Is A Return - CBIC Notifies - Taxguru - inDocument7 pagesRestriction On ITC in Case of Diffrence’ GTR 3B Is A Return - CBIC Notifies - Taxguru - indhananjay12031978No ratings yet

- Corporate and Economic Laws 2023 November 1689591454Document56 pagesCorporate and Economic Laws 2023 November 1689591454mdasifraza3196No ratings yet

- Telecom Regulatory Authority of India NotificationDocument10 pagesTelecom Regulatory Authority of India NotificationVikas DevrajNo ratings yet

- NN 14 2022 EnglishDocument13 pagesNN 14 2022 EnglishManish sharmaNo ratings yet

- GST Amendments: CS - Executive/Professional Ca - Inter/FinalDocument36 pagesGST Amendments: CS - Executive/Professional Ca - Inter/Finalbandaragamini525No ratings yet

- 2019rev MS417Document3 pages2019rev MS417Mallikarjun KanumaNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Document12 pagesIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanNo ratings yet

- TPT RoadDocument13 pagesTPT RoadLakhan PatidarNo ratings yet

- From The GovernmentDocument26 pagesFrom The Governmentamit.a.kekreNo ratings yet

- Notification 14Document11 pagesNotification 14Amol MoreNo ratings yet

- ExnotestDocument4 pagesExnotestaNo ratings yet

- Act39of2013TaxAdmin ADocument28 pagesAct39of2013TaxAdmin Abellydanceafrica9540No ratings yet

- Finance Bill 2011Document23 pagesFinance Bill 2011sherafghan_97No ratings yet

- Service Tax-Point of TaxationDocument1 pageService Tax-Point of TaxationNamrata Parakh MarothiNo ratings yet

- FinanceBill 2011Document39 pagesFinanceBill 2011Shawkat ZafarNo ratings yet

- Relevant Amendments For November 2019 Examination in Paper 6D: Economic LawsDocument28 pagesRelevant Amendments For November 2019 Examination in Paper 6D: Economic LawsJP GuptaNo ratings yet

- Act on Special Measures for the Deregulation of Corporate ActivitiesFrom EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNo ratings yet

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- Imperialism Viewpoints Discussion GuideDocument3 pagesImperialism Viewpoints Discussion Guideapi-199873271No ratings yet

- Oca Vs LopezDocument7 pagesOca Vs LopezAyenGaileNo ratings yet

- PrepositionsDocument3 pagesPrepositionsAsru RojamNo ratings yet

- Forest Hills Golf and Country ClubDocument10 pagesForest Hills Golf and Country ClubGada AbdulcaderNo ratings yet

- AQUINO v. AUREDocument1 pageAQUINO v. AURERNicolo BallesterosNo ratings yet

- Robertson V. Miller.: Ex RelDocument6 pagesRobertson V. Miller.: Ex RelFrance De LunaNo ratings yet

- 2022 - 2023 Sri KDU Secondary School Calendar (SSKDU Secondary) - 21042022Document3 pages2022 - 2023 Sri KDU Secondary School Calendar (SSKDU Secondary) - 21042022maheswaran perumalNo ratings yet

- Intellectual Property CodeDocument5 pagesIntellectual Property CodeMARVIN MYGS MANGUBATNo ratings yet

- Metropolitan Bank and Trust Company Employees UnionDocument1 pageMetropolitan Bank and Trust Company Employees UnionMavic MoralesNo ratings yet

- VICTORY: KVIC Ban Ivory Under PMEGP On Abhishek Kadyan and Sukanya Kadyan ComplaintsDocument7 pagesVICTORY: KVIC Ban Ivory Under PMEGP On Abhishek Kadyan and Sukanya Kadyan ComplaintsAbhishek Kadyan100% (1)

- Signed - Air TransatStatement of Defence (Federal Court) Donaldson v. Swoop Et Al (Action No - T-428-20) PDFDocument2 pagesSigned - Air TransatStatement of Defence (Federal Court) Donaldson v. Swoop Et Al (Action No - T-428-20) PDFCTV VancouverNo ratings yet

- OOB Australian & New Zealand Forces in VietnamDocument9 pagesOOB Australian & New Zealand Forces in VietnamDado HasancevicNo ratings yet

- Extraordinary: Government of GoaDocument5 pagesExtraordinary: Government of Goaalim shaikhNo ratings yet

- Sandeep Kumar v. State of UttarakhandDocument69 pagesSandeep Kumar v. State of UttarakhandSachinNo ratings yet

- Duke Amends 'Black Men in Medicine' ProgramDocument2 pagesDuke Amends 'Black Men in Medicine' ProgramThe College FixNo ratings yet

- Pathbuilder 2e - Kadira WeaponDocument3 pagesPathbuilder 2e - Kadira WeaponLazar MevladNo ratings yet

- Cambridge First CertificateDocument7 pagesCambridge First CertificateIrina Mihai-IonitaNo ratings yet

- Biology Study Material Final2012 13Document157 pagesBiology Study Material Final2012 13Tapas BanerjeeNo ratings yet

- Celia Cruz BiographyDocument3 pagesCelia Cruz BiographyJoaquinNo ratings yet

- Team Code C63: BeforeDocument21 pagesTeam Code C63: Beforesimran yadav100% (1)

- Chapter-Xi: of Improper Admission and Rejection of EvidenceDocument9 pagesChapter-Xi: of Improper Admission and Rejection of EvidenceSachin KumarNo ratings yet

- Rechtbank Gelderland - A.M.P.T. BlokhuisDocument1 pageRechtbank Gelderland - A.M.P.T. Blokhuisopenbaar minNo ratings yet

- Pagibig DigestDocument3 pagesPagibig DigestMaria Mimette AdeaNo ratings yet