Professional Documents

Culture Documents

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 27

Uploaded by

JasmeetOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 27

Uploaded by

JasmeetCopyright:

Available Formats

The Theoretical Framework

11

entity may choose to adjust the initial carrying amount of the recorded asset or liability (e.g.,

within inventories) by the amount deferred in equity, or to keep the amount deferred in

equity and gradually transferring it into P&L in the same periods during which the asset or

liability affects P&L (i.e., when the depreciation expense or cost of sales is recognised). The

choice has to be applied consistently to all such hedges. However, such a basis adjustment

is not permitted where a financial asset or liability (e.g., accounts payable) results from the

hedged forecast transaction.

A hedge of the FX risk of a firm commitment may be accounted for as a fair value hedge or

as a cash flow hedge.

1.3.7 Net Investment Hedge

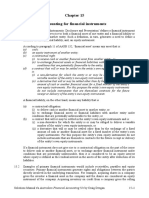

A net investment hedge is a hedge of the foreign currency exposure arising from the reporting

entitys interest in the net assets of a foreign operation. The hedging instrument may be either

a derivative or a non-derivative (e.g., a borrowing denominated in the same currency as the net

investment). Figure 1.4 highlights the accounting treatment of net investment hedges.

The effective portion of the gain or loss on the hedging instrument is recognised in equity.

As the exchange difference arising on the net investment is also recognised in equity,

the objective is to match both exchange rate differences. Gains or losses relating to the

ineffective portion of the hedge are recognised immediately in P&L.

On disposal or liquidation of the foreign operation, the hedge equity balance and the net

investment exchange differences are transferred simultaneously to P&L.

1.3.8 Embedded Derivatives

Sometimes, a derivative is embedded in a financial instrument in combination with a host

contract. The combination of a host contract and an embedded derivative is called hybrid

contract. The embedded derivative causes the contractual cash flows to be modified based

on a specified interest rate, a security price, a commodity price, a foreign exchange rate,

index of prices or rates, or other variables. The principle under IAS 39 is that an embedded

Effective Part

Hedging

Hedging Instrument

Instrument

Changes

Changes in

in fair

fair value

value

Ineffective Part

Equity

When net investment

sold or liquidated

P&L

When net investment

sold or liquidated

Hedged

Hedged Item

Item

Net

Net investment

investment

exchange

exchange differences

differences

Figure 1.4 Accounting for Net Investment Hedge.

Equity

You might also like

- (Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 31Document1 page(Juan Ramirez) Accounting For Atives Advance (BookFi - Org) (1) 31JasmeetNo ratings yet

- CH11Document56 pagesCH11Daniel BermanNo ratings yet

- Hedges of A Net Investment in A Foreign Operation: IFRIC Interpretation 16Document9 pagesHedges of A Net Investment in A Foreign Operation: IFRIC Interpretation 16Tanvir PrantoNo ratings yet

- Fas133 FASB Derivatives Hedge Accounting RulesDocument22 pagesFas133 FASB Derivatives Hedge Accounting Rulesswinki3No ratings yet

- Slide 2 Learning ObjectiveDocument11 pagesSlide 2 Learning ObjectiveHaikal Nur FahreziNo ratings yet

- Investments and AcquisitionsDocument5 pagesInvestments and AcquisitionsBurhan Al MessiNo ratings yet

- Accounting Standard (As) 13Document17 pagesAccounting Standard (As) 13shital_vyas1987No ratings yet

- Accounting For Derivatives - FAS 133 PDFDocument4 pagesAccounting For Derivatives - FAS 133 PDFSayyed Mohammed AshuNo ratings yet

- Differentiation of PFRSDocument3 pagesDifferentiation of PFRSRemie Rose BarcebalNo ratings yet

- Accounting For InvestmentsDocument11 pagesAccounting For Investmentsstarfish85No ratings yet

- As 13Document11 pagesAs 13Avinash YadavNo ratings yet

- Capital MArket MCQDocument11 pagesCapital MArket MCQSoumit DasNo ratings yet

- Deegan5e SM Ch15Document19 pagesDeegan5e SM Ch15Rachel TannerNo ratings yet

- Basic Principles of Hedging: Financial Instruments: Recognition and MeasurementDocument9 pagesBasic Principles of Hedging: Financial Instruments: Recognition and Measurementmrhani_faNo ratings yet

- SM ch18Document50 pagesSM ch18roychanNo ratings yet

- Accounting For InvestmentsDocument17 pagesAccounting For InvestmentsPradeep Gupta100% (1)

- Measures of Financial LeverageDocument15 pagesMeasures of Financial LeverageHeena KauserNo ratings yet

- IFRS 9 DataDocument3 pagesIFRS 9 DataShafaq QureshiNo ratings yet

- Optimal Designation of Hedging Relationships Under FASB Statement 133Document13 pagesOptimal Designation of Hedging Relationships Under FASB Statement 133postscriptNo ratings yet

- Invest MentsDocument12 pagesInvest MentsPembaLamaNo ratings yet

- Plugin Ifrs Investment Funds Issue 1b 686Document0 pagesPlugin Ifrs Investment Funds Issue 1b 686xuhaibimNo ratings yet

- Important:: Emerging Market EtfsDocument4 pagesImportant:: Emerging Market EtfskhotrucNo ratings yet

- Sem 10B HedgeAccounting - Part I (NTUL)Document19 pagesSem 10B HedgeAccounting - Part I (NTUL)Gordon Ong JinjieNo ratings yet

- MNC Chap 11 Trang 316-319 (Tiep Theo Phan Cua Minh Hieu)Document2 pagesMNC Chap 11 Trang 316-319 (Tiep Theo Phan Cua Minh Hieu)PhuongNo ratings yet

- Advanced Accounting Chapter 9 SolutionDocument53 pagesAdvanced Accounting Chapter 9 SolutionTam29100% (10)

- B. Com 5 Sem Advance Financial Accounting 1Document9 pagesB. Com 5 Sem Advance Financial Accounting 1AlankritaNo ratings yet

- References: Paragraph 11ADocument14 pagesReferences: Paragraph 11AMariella AntonioNo ratings yet

- Lesson 2-Hedging Foreign Currency Exchange Rate RiskDocument3 pagesLesson 2-Hedging Foreign Currency Exchange Rate RiskMila Casandra CastañedaNo ratings yet

- Investment Policy StatementDocument14 pagesInvestment Policy StatementHamis Rabiam MagundaNo ratings yet

- Financial Instruement 2Document6 pagesFinancial Instruement 2fawzan4zanNo ratings yet

- Pert 3 - Embeded Derivatives-NewDocument28 pagesPert 3 - Embeded Derivatives-NewGabriel Edson SinagaNo ratings yet

- Gr.1 Report Hedging Foreign CurrencyDocument54 pagesGr.1 Report Hedging Foreign CurrencyJeanette FormenteraNo ratings yet

- Notes: Financial and Corporate Finance Concepts Financial Statements Balance Sheet (Financial Position)Document24 pagesNotes: Financial and Corporate Finance Concepts Financial Statements Balance Sheet (Financial Position)Bhavya ShahNo ratings yet

- Fundamentals of Advanced Accounting 6Th Edition Hoyle Solutions Manual Full Chapter PDFDocument67 pagesFundamentals of Advanced Accounting 6Th Edition Hoyle Solutions Manual Full Chapter PDFDaisyHillyowek100% (11)

- Fundamentals of Advanced Accounting 6th Edition Hoyle Solutions ManualDocument38 pagesFundamentals of Advanced Accounting 6th Edition Hoyle Solutions Manualjeanbarnettxv9v100% (11)

- MaxisDocument2 pagesMaxisYaaga DharsiniNo ratings yet

- Accrued Interest: ArbitrageDocument9 pagesAccrued Interest: ArbitragetarunNo ratings yet

- Hedge AccountingDocument5 pagesHedge Accountingchowchow123No ratings yet

- Financial Instruments (2021)Document17 pagesFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- 69241asb55316 As13Document10 pages69241asb55316 As13cheyam222No ratings yet

- Derivatives As Hedging Instrument in Managing Foreign Currency ExposuresDocument52 pagesDerivatives As Hedging Instrument in Managing Foreign Currency ExposuresCasper John Nanas MuñozNo ratings yet

- Risk and Return NotesDocument21 pagesRisk and Return NotesGrim ReaperNo ratings yet

- Aasc 10Document34 pagesAasc 10Ying LiuNo ratings yet

- Fundamentals of Advanced Accounting 7Th Edition Hoyle Solutions Manual Full Chapter PDFDocument67 pagesFundamentals of Advanced Accounting 7Th Edition Hoyle Solutions Manual Full Chapter PDFDaisyHillyowek100% (13)

- Advanced Accounting 11th Edition Hoyle Solutions Manual Full Chapter PDFDocument67 pagesAdvanced Accounting 11th Edition Hoyle Solutions Manual Full Chapter PDFToniPerryyedo100% (12)

- Chap 012Document134 pagesChap 012dbjnNo ratings yet

- Factsheet For The 6 Schemes Under Winding Up As On August 31, 2021Document17 pagesFactsheet For The 6 Schemes Under Winding Up As On August 31, 2021Ankur SarafNo ratings yet

- Open End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)Document8 pagesOpen End Fund: Buy Securities From DC Receive Return (B) Sales Share To GP Pay Dividend To GP (A)MD Abdur RahmanNo ratings yet

- Assignment No. 2Document4 pagesAssignment No. 2Rizwan NasirNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- IFRS 9 Data (1) - 1Document5 pagesIFRS 9 Data (1) - 1Shafaq ZafarNo ratings yet

- Portfolio Management - Module 1Document15 pagesPortfolio Management - Module 1satyamchoudhary2004No ratings yet

- Arbitrage Pricing TheoryDocument20 pagesArbitrage Pricing TheoryDeepti PantulaNo ratings yet

- Investments Questions For Review of Key Topics: Question 8-1Document85 pagesInvestments Questions For Review of Key Topics: Question 8-1kean ebeoNo ratings yet

- IFRS 9 Part IV Hedging November 2015Document28 pagesIFRS 9 Part IV Hedging November 2015Nicolaus CopernicusNo ratings yet

- Iact-1 Rev FinalsDocument50 pagesIact-1 Rev FinalsmickaNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 89Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 89JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 87Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 87JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 83Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 83JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 85Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 85JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 84Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 84JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 88Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 88JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 90Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 90JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 82Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 82JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 79Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 79JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 76Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 76JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 81Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 81JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 77Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 77JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 80Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 80JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 74Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 74JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 68Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 68JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 75Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 75JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 72Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 72JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 71Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 71JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 65Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 65JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 73Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 73JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 70Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 70JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 67Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 67JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 69Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 69JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 66Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 66JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 62Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 62JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 60Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 60JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 63Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 63JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 64Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 64JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 61Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 61JasmeetNo ratings yet

- Financial Risk Management A Prket and Credit Risk - 2 Edition 59Document1 pageFinancial Risk Management A Prket and Credit Risk - 2 Edition 59JasmeetNo ratings yet