Professional Documents

Culture Documents

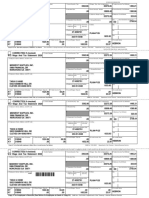

Tax Memo 1

Uploaded by

Zachary Williams0 ratings0% found this document useful (0 votes)

43 views1 pageTax Memo

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax Memo

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views1 pageTax Memo 1

Uploaded by

Zachary WilliamsTax Memo

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

October 9, 2014

Tax File Memorandum

From: Zachary Williams

Subject: Tax Memo 1

Facts:

Mr. Tardy, our newest client, having recently lost his job, has begun his

dream career of teaching employees better time-management skills. During 2013

and 2014, Mr. Tardy has incurred a net loss with his new career. Mr. Tardy is

convinced he can make his business a profitable one in the coming years. Mr. Tardy

wishes to declare his career a profit-seeking venture in order to deduct the full

amount of expenses. With this only being his second year of business, however, he

does not meet the 3 out of 5 year test (IRS Publication 535 (2013), p. 5).

Issue and Conclusion: Is there a way to give Mr. Tardy some protection and allow

him to deduct the losses in 2014 without worrying immediately about the IRS

disallowing his excess losses as a hobby?

1. Is there some way that Mr. Tardy can be presumed to be engaged in a forprofit activity until the three-for-five year rule is met?

2. If there is, what must be done to get this protection?

Yes.

Analysis: 1) Mr. Tardy can be presumed to be engaged in a for-profit activity until

the three-for-five year rule is met. According to IRS Publication 535, if an entity does

not 3 (or 2) years of profitable activity, the entity can elect to have this rule apply

only after the 5th (or 7th) year (P. 5, Not-for-Profit Activities). By doing this, the IRS

will not immediately question whether or not it is a profit-seeking activity or hobby.

Also, the IRS will not limit the deductions.

2) In order to get this protection, Mr. Tardy must file a Form 5213 with the IRS.

This form must be filed within 3 years of the due date of the return, for the year in

which the activity was carried on.

Final Conclusion: If Mr. Tardy believes he can make his career a profitable venture,

we can file a Form 5213 with the IRS. This form will allow Mr. Tardy to wait until year

5 (or 7) to determine whether or not the venture meets the three-for-five rule. This

form must be filed within 3 years of the activity in question, meaning it must be

filed by 2017, at the latest.

You might also like

- Last Minute Tax TipsDocument2 pagesLast Minute Tax TipsIncome Solutions Wealth ManagementNo ratings yet

- A Simple Guide To Resolve Your Rejected GST Registration ApplicationDocument6 pagesA Simple Guide To Resolve Your Rejected GST Registration ApplicationRam ADCANo ratings yet

- E-Book On GST Late FeesDocument19 pagesE-Book On GST Late FeesSourav ThakyalNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- Example of Opinion Letter To ClientDocument4 pagesExample of Opinion Letter To ClientFatin NabilaNo ratings yet

- SkripDocument1 pageSkripAmir RadziNo ratings yet

- Issues of Compliance in GSTDocument8 pagesIssues of Compliance in GSTMahiya Ahmad100% (1)

- GST ReturnsDocument3 pagesGST ReturnsLopamudracsNo ratings yet

- Malaysia Incorp ChecklistDocument5 pagesMalaysia Incorp Checklistku.hariamuNo ratings yet

- Guide To GST RegistrationDocument14 pagesGuide To GST RegistrationJorge DotelNo ratings yet

- Guide To GST Registration Ask Your ProfessionalDocument15 pagesGuide To GST Registration Ask Your ProfessionalAmisha khandelwalNo ratings yet

- Ben Fits of It FilingDocument3 pagesBen Fits of It Filingptnagarjuna55No ratings yet

- How To Register A Sole Proprietor Business in The PhilippinesDocument2 pagesHow To Register A Sole Proprietor Business in The PhilippinesAngellaine BulanadiNo ratings yet

- Unit 4.2 Income TaxDocument5 pagesUnit 4.2 Income TaxSAMIR AHMEDNo ratings yet

- ISA Agreement SharpenerDocument7 pagesISA Agreement SharpenerGurjeet kaur RanaNo ratings yet

- Campany LawDocument5 pagesCampany LawSubashini A 21PBA021No ratings yet

- Affidavit Cancellation 2v2018Document7 pagesAffidavit Cancellation 2v2018Francis A SalvadorNo ratings yet

- Basic and Special PermitsDocument4 pagesBasic and Special PermitsJericho MarceloNo ratings yet

- The Payment of Gratuity ActDocument25 pagesThe Payment of Gratuity ActRh SamsserNo ratings yet

- Boredprogrammers Internship Questions: Anyone Can Work Without The "Company of Commencement"?Document2 pagesBoredprogrammers Internship Questions: Anyone Can Work Without The "Company of Commencement"?Joy BoseNo ratings yet

- Changes in ITR AY 20-21 by Dr. CA Abhishek MuraliDocument18 pagesChanges in ITR AY 20-21 by Dr. CA Abhishek MuraliRanga AmarNo ratings yet

- Www-Besttaxinfo-InDocument8 pagesWww-Besttaxinfo-Insukantabera215No ratings yet

- Return of Income - FaqsDocument4 pagesReturn of Income - FaqsSushil PrajapatiNo ratings yet

- End-of-the-Year Money MovesDocument3 pagesEnd-of-the-Year Money MovesDoug PotashNo ratings yet

- Presentation FdsDocument7 pagesPresentation FdsSam Smith - 252No ratings yet

- Income Tax Quick NotesDocument75 pagesIncome Tax Quick NotesBasavaraju K RNo ratings yet

- Legal Requirements For Starting A Business in The PhilippinesDocument4 pagesLegal Requirements For Starting A Business in The PhilippinesJobena Rose Serdena50% (2)

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- GST Registration in India: Practical Guide OnDocument28 pagesGST Registration in India: Practical Guide OnSiddhesh jadhavNo ratings yet

- Business Cessation Form IR315Document2 pagesBusiness Cessation Form IR315Charlotte's WangNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- Al Guru FinalDocument3 pagesAl Guru FinalAnonymous BRc1Ld5No ratings yet

- Registration in Continuation With Class NotesDocument5 pagesRegistration in Continuation With Class NotesRahul KumarNo ratings yet

- Form 15G & 15H: Save Tds On Interest On FdsDocument6 pagesForm 15G & 15H: Save Tds On Interest On FdsShreekumarNo ratings yet

- Taxation General RulesDocument7 pagesTaxation General RulesAnurag BhardwajNo ratings yet

- Procedures of Partnership FirmDocument2 pagesProcedures of Partnership FirmUnimarks Legal Solutions100% (1)

- Interview 3. Direct TaxDocument14 pagesInterview 3. Direct TaxNiladri SahaNo ratings yet

- GST Registration in IndiaDocument24 pagesGST Registration in IndiaVijai AnandNo ratings yet

- Pre Employment RequirementsDocument14 pagesPre Employment Requirementsqqutty pioNo ratings yet

- HCL Technologies - IncDocument1 pageHCL Technologies - IncjaganbecsNo ratings yet

- End of Service Custom ReportDocument1 pageEnd of Service Custom ReportMuhammad NaveedNo ratings yet

- We've Reported Global 4 Temps Limited To The Pensions RegulatorDocument2 pagesWe've Reported Global 4 Temps Limited To The Pensions Regulatorantohiremus4No ratings yet

- Step-By-Step Sole Proprietor Business RegistrationDocument4 pagesStep-By-Step Sole Proprietor Business Registrationjen mikeNo ratings yet

- What Is PPF and PF?Document3 pagesWhat Is PPF and PF?nonyaNo ratings yet

- India Entry For SMEDocument4 pagesIndia Entry For SMEGaurav VashisthaNo ratings yet

- Business Law and Regulations Rhin FrancineDocument207 pagesBusiness Law and Regulations Rhin FrancineShiela MarieNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 4Document8 pagesINCOME TAX AND GST. JURAZ-Module 4TERZO IncNo ratings yet

- 8 Types of Companies in MalaysiaDocument9 pages8 Types of Companies in MalaysiaYingfang HuangNo ratings yet

- Financial Considerations For 2014Document3 pagesFinancial Considerations For 2014Doug PotashNo ratings yet

- Bussiness ReportDocument2 pagesBussiness ReportSadie LeeisNo ratings yet

- fw4 DFTDocument5 pagesfw4 DFTCNBC.comNo ratings yet

- How To Close BusinessDocument5 pagesHow To Close BusinessJose Gabriel PesebreNo ratings yet

- ss4 PDFDocument4 pagesss4 PDFKeith Muhammad: Bey100% (2)

- Return of Income & Itr FormsDocument11 pagesReturn of Income & Itr FormsJohanNo ratings yet

- Leave Travel AllowanceDocument12 pagesLeave Travel AllowanceRahul SinghNo ratings yet

- Ir744 PDFDocument4 pagesIr744 PDFAnonymous RCSnYul44lNo ratings yet

- Pag Ibig 1Document2 pagesPag Ibig 1Fervi Louie Jalop Bongco0% (1)

- Jaime SerranoDocument3 pagesJaime SerranoMichelle ChrisNo ratings yet

- Weisbrich Essay Peer ReviewDocument6 pagesWeisbrich Essay Peer Reviewapi-302932395No ratings yet

- 2009 Form 990 For Harvard Management CompanyDocument55 pages2009 Form 990 For Harvard Management CompanyresponsibleharvardNo ratings yet

- Baixareu - Odeio - Cozinhar - 384730.zip - Uploadbox - SpaceDocument8 pagesBaixareu - Odeio - Cozinhar - 384730.zip - Uploadbox - SpaceJamile NascimentoNo ratings yet

- Jonah Bey Notes IIDocument1 pageJonah Bey Notes IINoah Body96% (24)

- 1 PDFDocument1 page1 PDFbrendon williamsNo ratings yet

- PDCFDocument51 pagesPDCFreutersdotcomNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateJayaprakash Vayakkoth Madham100% (3)

- John Fuji Age 37 Moved From California To Washington in PDFDocument1 pageJohn Fuji Age 37 Moved From California To Washington in PDFhassan taimourNo ratings yet

- AASHTO Guide For Design of Pavement StructuresDocument93 pagesAASHTO Guide For Design of Pavement StructuresErikson Soto33% (3)

- US Internal Revenue Service: I1040 - 2004Document128 pagesUS Internal Revenue Service: I1040 - 2004IRS100% (1)

- REVLONDocument20 pagesREVLONUrika RufinNo ratings yet

- The Great Depression Scavenger HuntDocument2 pagesThe Great Depression Scavenger Huntvickiajones60% (5)

- Gov. Rick Perry 2007 TaxesDocument60 pagesGov. Rick Perry 2007 TaxesHouston ChronicleNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Lownds CFPB 3 of 3Document1,704 pagesLownds CFPB 3 of 3Judicial Watch, Inc.No ratings yet

- Solved As Discussed in Chapter 3 The Irs Carefully Scrutinizes Transactions PDFDocument1 pageSolved As Discussed in Chapter 3 The Irs Carefully Scrutinizes Transactions PDFAnbu jaromiaNo ratings yet

- Multiple Choice Questions 1 Employers Pay A Maximum Federal Unemployment TaxDocument1 pageMultiple Choice Questions 1 Employers Pay A Maximum Federal Unemployment TaxTaimour HassanNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- Global Trend Alert. Stan WeinsteinDocument30 pagesGlobal Trend Alert. Stan WeinsteinMARIANO7363100% (3)

- Salary Payment PolicyDocument2 pagesSalary Payment PolicypavaniNo ratings yet

- Top 100 Contractors Report Fiscal Year 2016Document152 pagesTop 100 Contractors Report Fiscal Year 2016nbharat9No ratings yet

- Membership List: Russell Microcap® IndexDocument17 pagesMembership List: Russell Microcap® IndexCathyNo ratings yet

- 2019 It-511 Individual Income Tax Booklet PDFDocument52 pages2019 It-511 Individual Income Tax Booklet PDFvinayak ShedgeNo ratings yet

- STOCK TO STUDY: Fastenal Co. - Tightening Up Its Growth Strategy? (P. 19)Document6 pagesSTOCK TO STUDY: Fastenal Co. - Tightening Up Its Growth Strategy? (P. 19)nunov_144376No ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- International Business Strategy ReportDocument55 pagesInternational Business Strategy ReportTrần Anh KhoaNo ratings yet

- "Alphabet Soup": New Deal Programs in The 1930SDocument11 pages"Alphabet Soup": New Deal Programs in The 1930SJack ReddingNo ratings yet

- Camden / Charlton Board of Realtors - REALTOR CONTACTS: Office Name TitleDocument15 pagesCamden / Charlton Board of Realtors - REALTOR CONTACTS: Office Name TitleDo Ngoc MinhNo ratings yet

- EIN Numbers 1Document15 pagesEIN Numbers 1sc100% (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldFrom EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldRating: 3.5 out of 5 stars3.5/5 (129)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningFrom EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningRating: 5 out of 5 stars5/5 (3)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Phil Gordon's Little Blue Book: More Lessons and Hand Analysis in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Blue Book: More Lessons and Hand Analysis in No Limit Texas Hold'emRating: 4.5 out of 5 stars4.5/5 (7)

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerFrom EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerRating: 5 out of 5 stars5/5 (49)

- The Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesFrom EverandThe Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesNo ratings yet

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Phil Gordon's Little Gold Book: Advanced Lessons for Mastering Poker 2.0From EverandPhil Gordon's Little Gold Book: Advanced Lessons for Mastering Poker 2.0Rating: 3.5 out of 5 stars3.5/5 (6)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emRating: 4 out of 5 stars4/5 (64)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Poker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsFrom EverandPoker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsRating: 4 out of 5 stars4/5 (7)

- POKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)From EverandPOKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)No ratings yet