Professional Documents

Culture Documents

Bond and Sinking Fund

Bond and Sinking Fund

Uploaded by

Joelius EndryawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond and Sinking Fund

Bond and Sinking Fund

Uploaded by

Joelius EndryawanCopyright:

Available Formats

15 - 1

Bonds

15

& SF

Chapter 15

McGraw-Hill Ryerson

Bonds

Learning Objectives

15

& SF

After completing this chapter, you will be able to:

Calculate

LO 1.

the market price of a bond on any date

LO 2.

the yield to maturity of a bond on any

interest payment

date

McGraw-Hill Ryerson

15 - 2

15 - 3

Bonds

15

& SF

fixed Income investments

McGraw-Hill Ryerson

Bonds

15

& SF

15 - 4

Basic Concepts & Definitions of

MainCharacteristics

Characteristics

Main

Face Value (or denomination)

the principal amount that the issuer is

required to pay to the bond holder on

the maturity date

Coupon

interest rate paid on face value

rate normally fixed for life of bond

paid semiannually

McGraw-Hill Ryerson

Bonds

15

& SF

15 - 5

Basic Concepts & Definitions of

MainCharacteristics

Characteristics

Main

a bond is basically a loan used to raise funds for the

organization or institution, e.g. CSBs, Municipalities

the issue date is the date on which the loan was made

and on which interest starts to accrue

are fixed Income investments i.e. they have a fixed interest

rate or coupon payable on the principal amount

borrower is required to make periodic payments of interest only

McGraw-Hill Ryerson

Bonds

15

& SF

15 - 6

Basic Concepts & Definitions of

MainCharacteristics

Characteristics

Main

issued with maturities ranging from 2

on the maturity

the

McGraw-Hill Ryerson

to 30 years

date of the bond,

full principal amount is repaid

along with the final interest payment

15 - 7

Bonds

15

& SF

Do Canada Savings Bonds have exactly the

same characteristics as Marketable Bonds?

CanadaSavings

Savings

Canada

Bonds

Bonds

Youcan

cancash

cashin

inaaCSB

CSB

You

beforeits

itsscheduled

scheduled

before

maturitydate

dateand

and

maturity

receivethe

the

receive

fullface

facevalue

value

full

plusaccrued

accrued

plus

interest

interest

McGraw-Hill Ryerson

Marketable

Marketable

Bonds

Bonds

Youcannot

cannotdo

dothis

this

You

withaaM

MBB

with

If you

you want

want to

to cash

cash in

in before

before

If

matures, you

you must

must do

do

itit matures,

this through

through an

an investment

investment

this

dealer in

in the

the bond

bond market

market

dealer

Bonds

15

& SF

Effectsof

ofInterest

InterestRate

Rate

Effects

Changeson

onBond

BondPrices

Prices

Changes

IfIfthe

themarket

marketrate

ratefalls

falls

below

belowthe

thecoupon

couponrate,

rate,

the

thebonds

bondsprice

pricerises

rises

above

aboveits

itsface

facevalue

value

15 - 8

Bond

Bond

Price

Price

Coupon

Coupon

Rate

Rate

Market

Market

Rate

Rate

Face

Face

Value

Value

themarket

marketrate

raterises

rises

IfIfthe

Coupon

Coupon

above

the

coupon

rate,

above the coupon rate,

Rate

Rate

thebonds

bondsprice

pricefalls

falls

the

belowits

itsface

facevalue

value

below

Market

Market

Rate

Rate

Face

Face

Value

Value

McGraw-Hill Ryerson

Bond

Bond

Price

Price

Bonds

Effectsof

ofInterest

InterestRate

Rate

Effects

Changeson

onBond

BondPrices

Prices

Changes

15

& SF

Fair Market

Value of a Bond

Formula

Formula

15 - 9

Present Value of the

Interest Payments

Bond Price = b(FV)

1 (1 + i)- n

i

Present Value of

the Face Value

+ FV(1 + i)- n

2b==coupon

couponrate

rate(compounded

(compoundedsemiannually)

semiannually)

2b

FV==Face

FaceValue

Valueof

ofthe

thebond

bond

FV

Example

McGraw-Hill Ryerson

15 - 10

Bonds

15

A $5,000 face value bond has a coupon rate

of 6.6% and a maturity date of March 1, 2018.

LO 1.

Interest is paid semi-annually. On September 1,

2002, the prevailing interest rate on long-term bonds abruptly

rose from 6% to 6.2% compounded semi-annually.

What were the bond's prices before and after the interest rate

FV = 5000change?

b = 6.6%/2

& SF

September 1, 2002 = interest payment date

15.5 years remain until maturity

15.5 ** 22 == 31

31

nn == 15.5

The semi-annual

semi-annual interest

interest paid

paid on

on the

the bond

bond isis

The

b(FV) == 0.033

0.033 ($5,000)

($5,000) == $165

$165

b(FV)

Calculation

McGraw-Hill Ryerson

15 - 11

Bonds

15

& SF

$5,000face

facevalue

value

AA$5,000

bondhas

hasaacoupon

couponrate

rate

bond

6.6%and

andaa

ofof6.6%

maturitydate

dateofofMarch

March

maturity

2018.

1,1,2018.

Interestisis

Interest

paidsemi-annually.

semi-annually.On

On

paid

September1,1,2002,

2002,the

the

September

prevailinginterest

interestrate

rate

prevailing

onlong-term

long-termbonds

bonds

on

abruptly

abruptly

rosefrom

from6%

6%toto6.2%

6.2%

rose

compoundedsemisemicompounded

annually.What

Whatwere

werethe

the

annually.

bond'sprices

pricesbefore

beforeand

and

bond's

afterthe

theinterest

interestrate

rate

after

change?

McGraw-Hill Ryerson

Calculate the bond price before

the market rate increase.

PV =

-5300.01

165

31

5000

$5,300.01isisthe

thebond

bondprice

price

$5,300.01

beforethe

therate

rateincrease

increase

before

15 - 12

Bonds

15

& SF

$5,000face

facevalue

value

AA$5,000

bondhas

hasaacoupon

couponrate

rate

bond

6.6%and

andaa

ofof6.6%

maturitydate

dateofofMarch

March

maturity

2018.

1,1,2018.

Interestisis

Interest

paidsemi-annually.

semi-annually.On

On

paid

September1,1,2002,

2002,the

the

September

prevailinginterest

interestrate

rate

prevailing

onlong-term

long-termbonds

bonds

on

abruptly

abruptly

rosefrom

from6%

6%toto6.2%

6.2%

rose

compoundedsemisemicompounded

annually.What

Whatwere

werethe

the

annually.

bond'sprices

pricesbefore

beforeand

and

bond's

afterthe

theinterest

interestrate

rate

after

change?

McGraw-Hill Ryerson

Calculate the bond price after

the market rate increase.

PV =

-5197.38

6.2

$5,197.38 is

is the

the bond

bond price

price

$5,197.38

after the

the rate

rate

after

increase

increase

Bond price decreased by

$5,300.01 5,197.38

$128.51

== $128.51

Bonds

15

& SF

LO 2.

Calculatingthe

the

Calculating

Yield-tto-Maturity

o-Maturityof

ofaa

YieldBond

Bond

The bonds yield-to-maturity is the

discount rate that makes the

combined

PV of all remaining interest payments

and the Face Value

equal to

the bonds Market Value

McGraw-Hill Ryerson

15 - 13

Bonds

Calculatingthe

theYieldYield-tto-Maturity

o-Maturity

Calculating

ofaaBond

Bond

of

15

& SF

15 - 14

A $1,000 face value Province of Manitoba bond, bearing

interest at 5.8% payable semiannually, has 11 years

remaining until maturity. What is the bonds yield to

maturity (YTM) at its current market price of $972?

I/Y

P/Y ==

2

22

972

6.1542

PMT==

PMT

1000*5.8%/2

1000*5.8%/2

29

1000

Thebonds

bondsYTM

YTMisis6.154%

6.154%

The

McGraw-Hill Ryerson

Bonds

PricingaaBond

Bond

Pricing

between

between

InterestPayment

PaymentDates

Dates

Interest

15

& SF

A $1,000, 20 year, 6% coupon bond was issued on

August 15, 2000. It was sold on Nov 3, 2002 to yield

the purchaser 6.5% compounded semiannually until

maturity. At what price did the bond sell?

Calculatethe

thePV

PVof

ofthe

theremaining

remaining

Calculate

paymentson

onthe

thepreceding

precedinginterest

interest

payments

paymentdate.

date.

payment

Calculatethe

theFV

FVof

ofthe

theStep

Step11result

resulton

on

Calculate

thedate

dateof

ofsale.

sale.

the

McGraw-Hill Ryerson

15 - 15

Bonds

PricingaaBond

Bondbetween

between

Pricing

InterestPayment

PaymentDates

Dates

Interest

15

& SF

15 - 16

A $1,000, 20 year, 6% coupon bond was issued

on August 15, 2000. It was sold on Nov 3, 2002 to yield

the purchaser 6.5% compounded semiannually until

maturity. At what price did the bond sell?

Most

Most

recent

recent

interest

interest

payment

payment

date is

is

date

August 15,

15,

August

2002

2002

McGraw-Hill Ryerson

P/V ==

P/Y

-947.40

2

36

30

6.5

1000

PMT==

PMT

1000*6.0%/2

1000*6.0%/2

OnAugust

August15,

15,2002,

2002,the

thebonds

bondsvalue

valueisis

On

$947.40

$947.40

Bonds

15

& SF

PricingaaBond

Bondbetween

between

Pricing

InterestPayment

PaymentDates

Dates

Interest

15 - 17

A $1,000, 20 year, 6% coupon bond was issued

on August 15, 2000. It was sold on Nov 3, 2002 to yield

the purchaser 6.5% compounded semiannually until

maturity. At what price did the bond sell?

P/V

P/Y ==

-947.402

Calculate the FV of $947.40 on Nov.3, 2002

Weneed

needto

tofind:

find:

We

a)##of

ofdays

daysbetween

betweeninterest

interestpayment

paymentdates,

dates, and

and

a)

b)##of

ofdays

daysfrom

fromAug.15

Aug.15totoNov.3

Nov.3

b)

McGraw-Hill Ryerson

Bonds

15

& SF

Using

15 - 18

Texas Instruments

BAII PLUS

2nd

Date 08.1502

Calculate

the time from

Aug.

15th to Nov. 3rd

DBD = 80

2nd

Date

Enter

11.0302

Enter

02.1503

Enter

CPT

CPT

the time from

Aug. 15th,2002 to

Feb. 15th,2003

DBD = 184

McGraw-Hill Ryerson

Days Between

Between Dates

Dates

Days

Bonds

15

& SF

PricingaaBond

Bondbetween

between

Pricing

InterestPayment

PaymentDates

Dates

Interest

15 - 19

A $1,000, 20 year, 6% coupon bond was issued

on August 15, 2000. It was sold on Nov 3, 2002 to yield

the purchaser 6.5% compounded semiannually until

maturity. At what price did the bond sell?

FV=

P/Y =

.4348

960.67

.43482

N == 80/184

80/184

N

947.40

Thebond

bondsold

soldfor

for$960.67

$960.67on

onNov.3,

Nov.3,2002

2002

The

McGraw-Hill Ryerson

Bonds

15

15 - 20

& SF

Click here:

here: http://www.finpipe.com/fixed.htm

Click

Thissite

siteprovides

providescomplete

completedetails

detailson

onhow

howbonds

bondsfunction.

function.

This

Justclick

clickon

onthe

theareas

areasthat

thatthe

thesite

siteprovides

providesfor

forinformation.

information.

Just

McGraw-Hill Ryerson

Bonds

15

15 - 21

& SF

This completes Chapter 15

McGraw-Hill Ryerson

You might also like

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- 72 08 NAV Part 1 Revenue AfterDocument80 pages72 08 NAV Part 1 Revenue Aftermerag76668No ratings yet

- Jerome4 15Document21 pagesJerome4 15Bito ScereNo ratings yet

- Jerome4 15Document21 pagesJerome4 15Harinda GayatriNo ratings yet

- Bond Valuation: Bond Analysis: Returns & Systematic RiskDocument50 pagesBond Valuation: Bond Analysis: Returns & Systematic RiskSamad KhanNo ratings yet

- BondDocument4 pagesBondShelly SinghalNo ratings yet

- Bond Valuation & Yields - Part IIDocument27 pagesBond Valuation & Yields - Part IIIkra MemonNo ratings yet

- Chapter 11 Bond Prices and YieldsDocument36 pagesChapter 11 Bond Prices and Yieldssharktale2828No ratings yet

- Bond MarketDocument35 pagesBond MarketBhupendra MoreNo ratings yet

- Booth Cleary 2nd Edition Chapter 6 - Bond Valuation and Interest RatesDocument93 pagesBooth Cleary 2nd Edition Chapter 6 - Bond Valuation and Interest RatesQurat.ul.ain MumtazNo ratings yet

- Bond Yields DurationDocument18 pagesBond Yields DurationKaranbir Singh RandhawaNo ratings yet

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- Bond Prices and Yields: InvestmentsDocument35 pagesBond Prices and Yields: InvestmentsPritika PriyaNo ratings yet

- Commerce 308: Introduction To Finance: Bond Valuation & Interest RatesDocument47 pagesCommerce 308: Introduction To Finance: Bond Valuation & Interest RatesPamela Santos100% (1)

- Week 7 - Debt Financing Part 1 - Sem 2 2022-23Document42 pagesWeek 7 - Debt Financing Part 1 - Sem 2 2022-23AnselmNo ratings yet

- Bonds, Bond Valuation, Interest Rates - Session 7 - 8Document19 pagesBonds, Bond Valuation, Interest Rates - Session 7 - 8anon_974035635No ratings yet

- Bloomberg Professional For Bond Pricing & Yield To MaturityDocument5 pagesBloomberg Professional For Bond Pricing & Yield To Maturityjujonet100% (1)

- CH 7Document9 pagesCH 7Nowshin NaylaNo ratings yet

- Bond ValuationDocument29 pagesBond ValuationNida MusheerNo ratings yet

- Chapter 6 Lecture Notes STUDENTS SEPT 2023Document20 pagesChapter 6 Lecture Notes STUDENTS SEPT 2023evelyngoveaNo ratings yet

- What Is Yield To Maturity (YTM) ?Document5 pagesWhat Is Yield To Maturity (YTM) ?Niño Rey LopezNo ratings yet

- Topic 2 - Bond Valuation-A132Document58 pagesTopic 2 - Bond Valuation-A132Baby KhorNo ratings yet

- BondDocument44 pagesBondSumit VaishNo ratings yet

- Principles of Business Finance: Lecture 6: Interest Rates and Bond ValuationDocument28 pagesPrinciples of Business Finance: Lecture 6: Interest Rates and Bond ValuationAmandaNo ratings yet

- Bonds Valuation 2017 STUDocument4 pagesBonds Valuation 2017 STUAnissa GeddesNo ratings yet

- Valuing BondsDocument42 pagesValuing BondsEssue KediaNo ratings yet

- Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument28 pagesKey Features of Bonds Bond Valuation Measuring Yield Assessing RiskShuja GhayasNo ratings yet

- The Valuation of Bonds PPT at Bec Doms FinanceDocument37 pagesThe Valuation of Bonds PPT at Bec Doms FinanceBabasab Patil (Karrisatte)No ratings yet

- Im 03 (Bond Valuation)Document80 pagesIm 03 (Bond Valuation)Afif Abdur RahmanNo ratings yet

- MBA FM Lec 4 Bonds S22016 LinhDocument43 pagesMBA FM Lec 4 Bonds S22016 LinhKhi CongNo ratings yet

- Baf 361 Introduction To Corporate Finance and Banking: LECTURE 5-Valuation of SecuritiesDocument43 pagesBaf 361 Introduction To Corporate Finance and Banking: LECTURE 5-Valuation of SecuritiesRevivalist Arthur - GeomanNo ratings yet

- Chapter 6 - Bond Valuation and Interest RatesDocument36 pagesChapter 6 - Bond Valuation and Interest RatesAmeer B. BalochNo ratings yet

- Valuation of Fixed Income InvestmentsDocument37 pagesValuation of Fixed Income InvestmentsSanjit SinhaNo ratings yet

- Chapter Seven: The Risk and Term Structure of Interest RatesDocument67 pagesChapter Seven: The Risk and Term Structure of Interest RatesAhmedShaweshNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument49 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskIrwan CrewNo ratings yet

- The Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Document50 pagesThe Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Trúc Ly Cáp thịNo ratings yet

- Debt ValuationDocument39 pagesDebt Valuationdianne878No ratings yet

- Abdul Qadir Khan (Fixed Income Assignement No.5)Document10 pagesAbdul Qadir Khan (Fixed Income Assignement No.5)muhammadvaqasNo ratings yet

- Bond ValuationDocument78 pagesBond ValuationSarikaNo ratings yet

- CH 05Document40 pagesCH 05bodyelkasabyNo ratings yet

- Introduction To Fixed Income Products: Charlotte Scott July 2007Document64 pagesIntroduction To Fixed Income Products: Charlotte Scott July 2007LmoorjaniNo ratings yet

- BondsDocument6 pagesBondsAli Akbar MalikNo ratings yet

- How Do Risk and Term Structure Affect Interest Rates?Document70 pagesHow Do Risk and Term Structure Affect Interest Rates?Meha KohliNo ratings yet

- Bond ValuationDocument51 pagesBond ValuationRudy Putro100% (1)

- BondsDocument55 pagesBondsfecaxeyivuNo ratings yet

- Bonds CH08Document16 pagesBonds CH08Hendrickson Cruz SaludNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- How Do Risk and Term Structure Affect Interest Rates?Document70 pagesHow Do Risk and Term Structure Affect Interest Rates?Khawaja Muhammad HamzaNo ratings yet

- Introduction To Bonds PayableDocument2 pagesIntroduction To Bonds PayableMarko Zero FourNo ratings yet

- Solutions BD3 SM24 GEDocument4 pagesSolutions BD3 SM24 GEAgnes ChewNo ratings yet

- BONDrevised For En9Document16 pagesBONDrevised For En9leylaNo ratings yet

- G SecDocument14 pagesG SecDhairya VinayakNo ratings yet

- Minimum Attractive Rate of Return (MARR)Document31 pagesMinimum Attractive Rate of Return (MARR)AdiNo ratings yet

- Valuation of BondsDocument49 pagesValuation of BondsSanjit SinhaNo ratings yet

- Debt ValuationDocument30 pagesDebt ValuationSiddharth BirjeNo ratings yet

- Bond Analysis and ValuationDocument7 pagesBond Analysis and ValuationmessylacesNo ratings yet

- Group 3 - AK. 2019I - Paper of 11th Meetings (1) - 2-11Document10 pagesGroup 3 - AK. 2019I - Paper of 11th Meetings (1) - 2-11Marsha CantikaNo ratings yet

- Credit Default Swap Pricing ModelDocument34 pagesCredit Default Swap Pricing ModeldovidsteinbergNo ratings yet

- Fi CH 3Document54 pagesFi CH 3Gena AlisuuNo ratings yet

- No Kode Pendaftaran Nama Peserta Jenis Kelamin Kode Jenis KelaminDocument4 pagesNo Kode Pendaftaran Nama Peserta Jenis Kelamin Kode Jenis KelaminSDW7No ratings yet

- Special Annuities 2Document22 pagesSpecial Annuities 2SDW7No ratings yet

- Merchandising 6Document39 pagesMerchandising 6SDW7No ratings yet

- Kelompok 1 Unit 1Document19 pagesKelompok 1 Unit 1SDW7No ratings yet

- Depreciation, 5Document36 pagesDepreciation, 5SDW7No ratings yet

- Ammortization of Loan 3Document24 pagesAmmortization of Loan 3SDW7No ratings yet

- A066 LODR DisclosuresDocument13 pagesA066 LODR DisclosuresNeel NarsinghaniNo ratings yet

- Sample CD LadderDocument6 pagesSample CD Ladderbee benNo ratings yet

- Fundamental Analysis: Lynn GilletteDocument36 pagesFundamental Analysis: Lynn GilletteMuhammad Abu BakrNo ratings yet

- MAINDocument80 pagesMAINNagireddy KalluriNo ratings yet

- FM09-CH 07Document9 pagesFM09-CH 07Mukul KadyanNo ratings yet

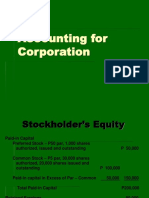

- Accounting For CorporationDocument11 pagesAccounting For CorporationMaricar D. VillarazaNo ratings yet

- Basics On Stock Market IndexDocument4 pagesBasics On Stock Market Indexben kookNo ratings yet

- First Chicago MethodDocument4 pagesFirst Chicago MethodRounak ChandakNo ratings yet

- 7.2 Options - Valuation & Put-Call Parity-1Document36 pages7.2 Options - Valuation & Put-Call Parity-1Siva SankarNo ratings yet

- Value of Bonds and Common Stocks: Eighth EditionDocument26 pagesValue of Bonds and Common Stocks: Eighth EditionFelix Owusu DarteyNo ratings yet

- Chap4 SolutionDocument3 pagesChap4 SolutionTrudy YayraNo ratings yet

- Riskometer - SEBI CircularDocument23 pagesRiskometer - SEBI CircularT SrinivasanNo ratings yet

- CAL Top 100 Stockholders As of 06.30.17Document4 pagesCAL Top 100 Stockholders As of 06.30.17Edgar LayNo ratings yet

- Chapter 5Document99 pagesChapter 5firdausismadi100% (1)

- Homework 3Document2 pagesHomework 3Ishrat PopyNo ratings yet

- Module 1Document27 pagesModule 1bhumiNo ratings yet

- Awareness of Commodity Market A Project Report On Mba FinanceDocument85 pagesAwareness of Commodity Market A Project Report On Mba FinanceBabasab Patil (Karrisatte)80% (5)

- STOCK VICHAR Calculator PDFDocument35 pagesSTOCK VICHAR Calculator PDFSantosh ThakurNo ratings yet

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainNo ratings yet

- Commodities For DummiesDocument43 pagesCommodities For DummiesXiaohu ZhangNo ratings yet

- Reading 56 Option Replication Using Put-Call ParityDocument6 pagesReading 56 Option Replication Using Put-Call ParityNeerajNo ratings yet

- Annual Report INDS 2021Document151 pagesAnnual Report INDS 2021Kholifatul MuawanahNo ratings yet

- Investors Unearth Financial Irregularities at Healthtech Startup MojocareDocument3 pagesInvestors Unearth Financial Irregularities at Healthtech Startup Mojocarebardhan09No ratings yet

- Idx Statistics 3rd Quarter 2009Document92 pagesIdx Statistics 3rd Quarter 2009Devryl Hubbye WilliamNo ratings yet

- Fina 3010 Assignment 3Document8 pagesFina 3010 Assignment 3EricYiuNo ratings yet

- Selected Topic: The Role of Financial Derivatives in Emerging MarketsDocument18 pagesSelected Topic: The Role of Financial Derivatives in Emerging MarketsAna RomeroNo ratings yet

- DCF AnalysisDocument7 pagesDCF AnalysisRiazul Islam TuhinNo ratings yet

- Annexure J and Demat Account Opening Form-IndividualsDocument18 pagesAnnexure J and Demat Account Opening Form-Individualssvm kishoreNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet