Professional Documents

Culture Documents

I - Individual: Seal and Signature of Receiving Official Receipt No/ Date

I - Individual: Seal and Signature of Receiving Official Receipt No/ Date

Uploaded by

Naveen Krishna0 ratings0% found this document useful (0 votes)

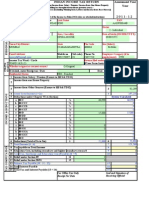

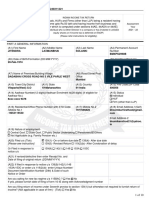

5 views1 pageThe document is an Indian Income Tax Return form (ITR-1) for individuals with income from salary, one house property, and other sources of income. It collects personal information such as name, address, date of birth, employment details. It then collects income and deduction details across various categories to compute total income, tax payable, applicable reliefs and interest. The form is used to file original or revised tax returns for assessment year 2011-12 under section 139(1) of the Income Tax Act.

Original Description:

itr 111

Original Title

2011_ITR1_r10_1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an Indian Income Tax Return form (ITR-1) for individuals with income from salary, one house property, and other sources of income. It collects personal information such as name, address, date of birth, employment details. It then collects income and deduction details across various categories to compute total income, tax payable, applicable reliefs and interest. The form is used to file original or revised tax returns for assessment year 2011-12 under section 139(1) of the Income Tax Act.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageI - Individual: Seal and Signature of Receiving Official Receipt No/ Date

I - Individual: Seal and Signature of Receiving Official Receipt No/ Date

Uploaded by

Naveen KrishnaThe document is an Indian Income Tax Return form (ITR-1) for individuals with income from salary, one house property, and other sources of income. It collects personal information such as name, address, date of birth, employment details. It then collects income and deduction details across various categories to compute total income, tax payable, applicable reliefs and interest. The form is used to file original or revised tax returns for assessment year 2011-12 under section 139(1) of the Income Tax Act.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

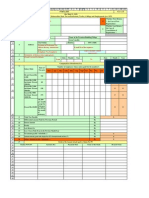

SAHAJ

FORM

ITR-1

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property

(excluding loss brought forward from previous years) /

Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)]

Assessment Year

Year

2011-12

(Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

PERSONAL INFORMATION

First Name

Middle Name

Last Name

PAN

Flat / Door / Building

Status

I - Individual

Road / Street

Area / Locallity

Town/City/District

State

Email Address

Mobile no

Pin Code

FILING

STATUS

INCOME & DEDUCTIONS

TAX COMPUTATION

Employer Category (if in

employment) OTH

Return filed under section

[Pl see Form Instruction] 11 - u/s 139(1)

O-Original

If revised, enter Receipt no / Date

RES - Resident

Residential Status

1 Income from Salary / Pension (Ensure to fill Sch TDS1)

Income from one House Property

2

3

Sex (Select)

M-Male

(Std code) Phone No

Income Tax Ward / Circle

Whether original or revised return?

Date of birth (DD/MM/YYYY)

00/00/0000

Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c)

5 Deductions under Chapter VI A (Section)

5a

a 80 C

5b

b 80 CCC

5c

c 80 CCD

5d

d 80 CCF

5e

e 80 D

5f

f 80 DD

5g

g 80 DDB

5h

h 80 E

5i

i 80 G (Eligible Amount)

5j

j 80 GG

5k

k 80 GGA

5l

l 80 GGC

5m

m 80 U

6

6 Deductions (Total of 5a to 5m)

7 Total Income (4 - 6)

8 Tax payable on Total Income

9 Education Cess, including secondary and higher secondary cess on 8

10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9)

11

11 Relief under Section 89

12

12 Relief under Section 90/91

13 Balance Tax Payable (10 - 11 - 12)

14 Total Interest Payable

15 Total Tax and Interest Payable (13 + 14)

For Office Use Only

Receipt No/ Date

Date

1

2

3

0

4

System Calculated

0

0

0

0

0

0

0

0

0

0

0

0

0

0 6

7

8

9

10

0

0

13

14

15

Seal and Signature of

Receiving Official

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

You might also like

- Form IiibDocument2 pagesForm Iiibvishnucnk25% (4)

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- 2015 Itr1 PR3Document18 pages2015 Itr1 PR3shubham sharmaNo ratings yet

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Document22 pagesSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaNo ratings yet

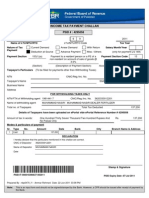

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Please Tick As ApplicableDocument4 pagesPlease Tick As ApplicableAnand ThackerNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

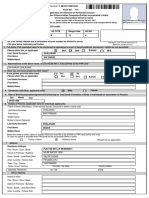

- Form 49a Wef 08042012Document2 pagesForm 49a Wef 08042012m_veluNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument1 pageAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSudeshNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- Saral-Ii Indian Income Tax Return Assessment Year Year: Quick Guide To Using This Utility For Efiling of Your ReturnsDocument9 pagesSaral-Ii Indian Income Tax Return Assessment Year Year: Quick Guide To Using This Utility For Efiling of Your ReturnsSales CTO LucknowNo ratings yet

- 49A 49AA in Excel FormatDocument7 pages49A 49AA in Excel Formatneedhikhurana@gmail.comNo ratings yet

- Pan 49 ADocument4 pagesPan 49 ARajasekhar KollaNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2Zafar IqbalNo ratings yet

- Income Tax Returns Filing: Marked Fields Are MandatoryDocument18 pagesIncome Tax Returns Filing: Marked Fields Are MandatoryashwinmjoshiNo ratings yet

- New Pan Card Application Form 49aDocument2 pagesNew Pan Card Application Form 49ahindeazadNo ratings yet

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Pannew 1Document2 pagesPannew 1Anonymous czrvb3hNo ratings yet

- 2018 Itr4 PR2Document32 pages2018 Itr4 PR2pingbadriNo ratings yet

- ITR Form 1Document7 pagesITR Form 1gj29hereNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Sudha Singh Itr V 13Document1 pageSudha Singh Itr V 13Anurag SinghNo ratings yet

- Pan Card Application FormDocument2 pagesPan Card Application FormKaran AggarwalNo ratings yet

- XXXPH2966X ITRV - UnlockedDocument1 pageXXXPH2966X ITRV - UnlockedVivek HaldarNo ratings yet

- Krishna Final ItrDocument27 pagesKrishna Final ItrKrishna RajputNo ratings yet

- XXXPD3353X Itrv PDFDocument1 pageXXXPD3353X Itrv PDFDaljeet KaurNo ratings yet

- Assessing Officer (AO Code)Document2 pagesAssessing Officer (AO Code)SivaShankarNo ratings yet

- NTN FormDocument1 pageNTN FormAdeel NaveedNo ratings yet

- Assessing Officer (AO Code)Document2 pagesAssessing Officer (AO Code)Subbaraju GvNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58No ratings yet

- Assessing Officer (AO Code)Document2 pagesAssessing Officer (AO Code)DineshNo ratings yet

- ITR-2 Form PDFDocument22 pagesITR-2 Form PDFChandra SekaranNo ratings yet

- Auto Pan FormDocument13 pagesAuto Pan FormKulbhushan SharmaNo ratings yet

- New PAN Form 49A V1.07Document2 pagesNew PAN Form 49A V1.07vermanavalNo ratings yet

- Form ITR-VDocument1 pageForm ITR-VSanjeev BansalNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- It 000018390637 2011 00Document1 pageIt 000018390637 2011 00AMMAR REHMANINo ratings yet

- Form PDF 688428240311221Document10 pagesForm PDF 688428240311221bhoomika rathodNo ratings yet