Professional Documents

Culture Documents

Super Savings Account

Super Savings Account

Uploaded by

AayushCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Super Savings Account

Super Savings Account

Uploaded by

AayushCopyright:

Available Formats

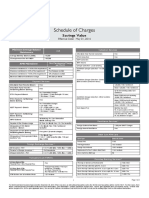

Super Savings Account

(April 01, 2012)

Schedule of Facilities

Charges are Inclusive of Service tax.

Scheme Code - RSNEW/RSNRE/RSNRO

AOA Eligibility (Account Opening Amount)

AQB Requirement (Average Quartely Balance)

Any amount less than Rs. 50,000/AQB: Tier A Rs 5,000/-, Tier B Rs 2,500/-

International Debit Cum ATM Card

Till (May 31, 2012)

w.e.f. (June 01, 2012)

Annual Fee

Free

Rs 110/- (Second Year Onwards*)

One/additional add-on card per account

Free

Rs 110/- (Second Year Onwards*)

Replacement of Lost/ Stolen card

Free

Rs 110/-

Re - generation of Pin/ Copy retrieval

Free

Free

IDBI Bank ATM Non Financial / Financial Transaction

Free

Free

Other Bank ATM

5 transactions Free per month, thereafter

Non Financial - Rs 8 per transaction

Financial - Rs 20 per transaction

International ATM

Non Financial - Rs 30 per transaction

Financial- Rs 140 per transaction

ATM Cash Withdrawal Limit

Rs 25,000/- (Per Day)

POS Limit (Point of Sale)

Rs 25,000/- (Per Day)

Cheque Book

Personalised Multicity /Local cheque book

20 leaves per quarter free and Rs 2 per cheque leaf above free limit.

Account statements

Passbook

Free

Monthly statement by e-mail

Free

Duplicate Statement at the branch

Free

Duplicate Passbook

Free

Hold mail facility

Free

Overseas mailing

Free

Request for duplicate statement through Phone banking & ATM

Free

Account closure charges

Nil

Certificates

Standing instructions

Free

Balance/Interest/Signature verification certificate/Banker's report

Free

Foreign inward remittance certificate

As per Trade Finance guidelines

Remittances

Demand Drafts (Branch/Non Branch)/ Payorder

10 Transactions Free per month (Both inclusive)

Above free limit Rs 2.50/1000, (Min.- Rs 25/- and Max. Rs 10,000/-)

Payable at Par utilisation

Free

Foreign currency demand drafts / international money orders

As per Trade Finance guidelines

DD/ payorder cancellation (Domestic/Foreign Currency)

Domestic :Free /Foreign Currency: As per Trade Finance Guidelines

NEFT (w.e.f from 20th June 2012)

Upto Rs 1 Lakh - Free

above Rs 1 Lakh to 2 Lakhs Rs 15 per transaction

above Rs 2 Lakhs - Rs 25 per transaction

NEFT (Net Banking)

Free

RTGS

Rs 2 lakh to Rs 5 Lakh - Rs 25 per transaction,

Above Rs 5 lakh - Rs 50 per transaction.

Any Branch Banking*

Any branch cheque deposits and account to account transfers

Free

15 transactions per month free Excess charged @Rs 2/1000. (Min. 25 and Max Rs. 10,000/-)

(15 transactions includes both Home - Non Home Cash deposit)

Cash deposits (Home Branch)

Cash deposits (Non - Home Branch) (Max. Rs. 50,000/- per day)

Any Branch Cash withdrawal

Free (upto Rs 50,000/- per day only)

(By self only)

The services allows you to operate your account from any IDBI bank branch across India.

This service is not available for encashing FD, issuance of DD/PO and third party bearer cheque. These can be done only at Home Branch.

Third party cash withdrawal is not allowed at Non-Home branch.

Third party cash deposit is allowed to the maximum of Rs 50,000/- per day per account.

NRE/NRO customers will get faciltiies as per RBI rules.

Cheque transaction charges

Cheque collections (Branch/Non branch locations)/Speed Clearing

Only other bank commission will be recovered

Foreign currency cheque collection

As per Trade Finance guidelines

Cheque stop payment instructions

Free

Old records / copies of paid cheques

Free

Alternate Channel Banking

Internet / Mobile / Phone/ SMS Alerts

Free

Charges

ECS/ Cheque issued and returned

Financial reasons

Rs 225

Technical reasons

Free

Cheque deposited and returned

Local cheque

Rs 60

Outstation cheque

Rs.115

Technical reasons(Local or Outstation)

Free

Unarranged overdraft / Cheque Purchase (A + B) (Subject to

approval)

Per occasion (A)

Rs.115

Interest (B)

19.75%

Demand Drafts/ Pay Orders/ Omni Pay

(Non IDBI Bank Account Holders)

Upto 25,000: Rs.70

Above Rs.25,000 upto Rs.1 Lac: Rs.2.50/1000 (Min Rs.70 & Max Rs.250)

Above Rs.1 Lac Rs: 2 /1000 ( Min Rs.280 & Max Rs.5000)

* Reckoned from the date of issuance of card

1. The Savings Bank Account should be used to route transactions of only nonbusiness/ non-commercial nature. In the event of occurrence of such transactions or any other such

transactions that may be construed as dubious or undesirable, the Bank reserves the right to unilaterally freeze operations in such accounts.

2. If there are no transactions in the account for a period of two years, the account will be treated as an inoperative account. The customer should thus transact on the account

periodically, so that it does not become inoperative. In case there are no customer induced debit, credit and/or third party transactions in the account, it may be classified as

inoperative. The service charges levied by the Bank and/or interest credited by the Bank would not be considered as customer induced transactions.

3. Satisfactory conduct of the account entails maintaining stipulated minimum quarterly average balance as well as sufficient balance to honour cheques issued to third parties. If

there are high incidences to the contrary, the Bank reserves the right to close the account under intimation to the customer.

4. Availing of the Anywhere Banking facility and the At Par Cheque facility is contingent upon the limits and service charges stipulated for these facilities.

5. Any change of address should be immediately communicated in writing to the Bank.

6. Opening of the Saving Account tantamount to deemed acceptance of the aforesaid rule & regulations as well as the fact of being informed about the various service charges

being levied by the Bank and the terms and conditions guiding related products and services.

You might also like

- Yes Bank Smart SalaryDocument2 pagesYes Bank Smart SalaryVicky SinghNo ratings yet

- ICICI Bank Current Account ChargesDocument3 pagesICICI Bank Current Account Chargesashishtiwari92100% (1)

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- Regular Saving AccountDocument92 pagesRegular Saving AccountSimu MatharuNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Sabka Basic Savings Account Complete KYC 10-10-2013Document2 pagesSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNo ratings yet

- Crown Salary Account 01042014Document2 pagesCrown Salary Account 01042014Vikram IsgodNo ratings yet

- Super Savings NewDocument2 pagesSuper Savings NewwinnermeNo ratings yet

- Savings Account DetailsDocument2 pagesSavings Account Detailsmysto9No ratings yet

- "Being Me" Savings Account: W.E.F. 1st April 2014Document2 pages"Being Me" Savings Account: W.E.F. 1st April 2014praveenpersonelNo ratings yet

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- Annex 3 Prime Salary AccountDocument1 pageAnnex 3 Prime Salary Accountfr123No ratings yet

- New Schedule of Charges - Value Based Current Accounts - 15 Dec 2012Document2 pagesNew Schedule of Charges - Value Based Current Accounts - 15 Dec 2012anon_948025741No ratings yet

- Islamic SOC Jan June 2013 FinalDocument16 pagesIslamic SOC Jan June 2013 Finalfaisal_ahsan7919No ratings yet

- No Frill EnglishDocument2 pagesNo Frill EnglishRupali WaliaNo ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- New Schedule of Charges For Current AccountDocument2 pagesNew Schedule of Charges For Current AccountKishan DhootNo ratings yet

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Document15 pagesSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNo ratings yet

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Document2 pagesParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNo ratings yet

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Document5 pagesSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Schedule of ChargesDocument14 pagesSchedule of ChargeskrishmasethiNo ratings yet

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDocument6 pagesTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDocument13 pagesSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNo ratings yet

- Schedule of Charges: Smart Salary ExclusiveDocument2 pagesSchedule of Charges: Smart Salary ExclusivevedavakNo ratings yet

- Mitc For Bob Lite Savings AccountDocument4 pagesMitc For Bob Lite Savings AccountramsanjayyNo ratings yet

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENo ratings yet

- (1.) Service Charges To Maintain A Ledger Accounts: P A G eDocument17 pages(1.) Service Charges To Maintain A Ledger Accounts: P A G eshaantnuNo ratings yet

- HSBC Savings AccountDocument3 pagesHSBC Savings AccountLavanya VitNo ratings yet

- Schedule of Charges Deutsche Bank 3Document3 pagesSchedule of Charges Deutsche Bank 3Sayantika MondalNo ratings yet

- Schedule of Charges Deutsche Bank 4Document3 pagesSchedule of Charges Deutsche Bank 4Sayantika MondalNo ratings yet

- Multicity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesDocument6 pagesMulticity Cheque Facility-Current Account-Lakshmi Supreme: Details ChargesEraivan EraiNo ratings yet

- Saadiq SOCDocument28 pagesSaadiq SOCAamir ShehzadNo ratings yet

- Schedule of Charges Deutsche BankDocument3 pagesSchedule of Charges Deutsche BankSayantika MondalNo ratings yet

- Notification FinalDocument4 pagesNotification FinalBrahmanand DasreNo ratings yet

- Value Based Current Accounts Schedule of ChargesDocument2 pagesValue Based Current Accounts Schedule of ChargesDhawan SandeepNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardAnandraojs JsNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Basic Savings Bank Deposit Account SocsDocument6 pagesBasic Savings Bank Deposit Account Socstrue chartNo ratings yet

- Pocket Savings Account Final UpdatedDocument3 pagesPocket Savings Account Final UpdatedDAYA VNo ratings yet

- KioskDocument21 pagesKioskgollamandalaappaiahNo ratings yet

- RB Chapter 2 - Current DepositsDocument3 pagesRB Chapter 2 - Current DepositsRohit KumarNo ratings yet

- Fees and ChargesDocument59 pagesFees and ChargesgivamathanNo ratings yet

- EDB Service Charges2011Document8 pagesEDB Service Charges2011Imran Ali MirNo ratings yet

- SOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsDocument26 pagesSOC Final July December 2014 For OSC Approval AHB 3 After Additions and DelitionsZeynab AbrezNo ratings yet

- Presented By:-Shubham Maheshwari Sudheer YadavDocument13 pagesPresented By:-Shubham Maheshwari Sudheer YadavArun KumarNo ratings yet

- Select ChargesDocument1 pageSelect ChargesMd Imran ImuNo ratings yet

- Schedule of Charges Yes Bank 6Document2 pagesSchedule of Charges Yes Bank 6Sayantika MondalNo ratings yet

- SuperCard MITC PDFDocument47 pagesSuperCard MITC PDFPrudhvi RajNo ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- Landbank AccountsDocument17 pagesLandbank AccountscammiecazzieNo ratings yet

- Sme BookDocument397 pagesSme BookVivek Godgift J0% (1)

- Bank of BarodaDocument99 pagesBank of BarodaYash Parekh100% (2)

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- Pakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument38 pagesPakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- Business LoanDocument1 pageBusiness Loank kaulNo ratings yet