Professional Documents

Culture Documents

Basic Savings Bank Deposit Account Socs

Uploaded by

true chartCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Savings Bank Deposit Account Socs

Uploaded by

true chartCopyright:

Available Formats

Basic Savings Bank Account

Available to All Cities

Eligibility All Indian residents

Minimum Monthly Nil

Average Balance (MAB)

Charges for non- Nil

maintenance of MAB

Cash Transaction Charges Nil

(Cumulative of Deposit and

Withdrawal)

ATM interchange Nil

(transactions at Non-ICICI

Bank ATMs)

Transactions at ICICI Bank Nil

ATMs/Cash Recycler

Machines (cash withdrawals)

Issue of DD drawn on ICICI Nil

Bank by cheque/transfer

Statement Passbook facility available free of cost

Debit Card annual fees Nil

Debit Card limit Daily spending/withdrawal limit: Rs 10,000/ Rs 10,000

Cheque Books Nil

Charges for Multicity cheque Nil

payment

Value Added SMS alert Nil

facility

(For transactions other than

specified by regulatory

guidelines, SMS alerts will be

triggered only if the

transaction value is greater

than Rs.5,000)

National Automated Clearing Nil

House (NACH) Mandate. One

time mandate authorisation

charges (physical/online).

Deliverable returned by Nil

courier

Deliverables at branches Nil

Address change request at Nil

branches

Cash deposit charges - Cash Nil

Acceptor/Recycler machines

Account closure Nil

Note - Common service charges applicable to all Savings Account variants except for

Wealth Management / ICICI Bank Private Banking

Common Service Charges

Common ICICI Bank savings account facilities for all products except for Wealth

Management / ICICI Bank Private Banking and unless specified product-wise

Service Charges

Statement Free Quarterly Statement

Free monthly e-mail statement on request

Passbook facility available at base branch

View and download statement facility available on the website

Issue of Duplicate Rs.100 per statement at branch or Customer Care (non-IVR), Rs.

Statement 50 per statement through Customer Care (IVR), ATM and Net

banking

Issue of pass book Nil

Issue of duplicate Rs 100 for issuance and Rs 25 per page for Updation

pass book

DD / PO – Issue Rs.50 per D.D/PO up to Rs.10,000;Rs.5 per thousand rupees or

Issue by deposit of part thereof for DD/PO of more than Rs.10,000, subject to a

cash/cheque/transfe minimum of Rs.75 and maximum of Rs. 15,000

r For Senior Citizen, Student & Rural locations : For amounts up to

Rs.10,000– Rs.40, For amounts above Rs.10,000 till Rs.50,000 –

Rs.60, For amounts above Rs.50,000– Rs.5 per thousand rupees

or part thereof (maximum of Rs.15,000)

DD / PO - Rs.100 per instance

Cancellation /

Duplicate /

Revalidation

(With effect from 1st

May 2024)

NEFT Charges - Through Online Channel – Nil

Outward Through Branch Channel -

Up to Rs 10,000 – Rs 2.25 per transaction

Rs 10,001 to Rs 1 lakh – Rs 4.75 per transaction

Above Rs 1 lakh to Rs 2 lakh – Rs 14.75 per transaction

Above Rs 2 lakh and up to Rs 10 lakh – Rs 24.75 per transaction

NEFT Charges - Nil

Inward

RTGS - Outward Through Online Channel – Nil

Through Branch Channel –

Rs 2 lakh to Rs 5 lakh – Rs 20 per transaction

Above Rs 5 lakh - Rs 45 per transaction

RTGS - Inward Nil

IMPS – Outward Amount up to Rs 1 thousand - Rs 2.50 per transaction

(With effect from 1st Amount above Rs 1 thousand to Rs 25 thousand - Rs 5 per

May 2024) transaction

Amount above Rs 25 thousand to Rs 5 lakhs - Rs 15 per

transaction

IMPS - Inward Nil

UPI transaction Nil

charges

Inter-branch funds Nil

transfer charges

Bill Pay Charges Nil

Charges for Nil

certifying or verifying

customer ECS

mandates

Cheque Collection Nil

Local

Cheque Collection Nil

Outstation

Account closure Nil

(With effect from 1st

May 2024)

Debit Card

Debit Card Issuing Nil

Fee

Enrolment fee Nil

Late Payment N.A.

Charges

Replacement Card Rs. 200 per card

fees (Lost /

Damaged card)

ATM Balance Rs 25

Enquiry charges

from ATMs outside

India

Cross-currency 3.5% of transaction amount

mark-up charges on

foreign currency

transactions

Surcharge on Fuel Fuel Surcharge Waiver is applicable when both the below

purchases mentioned conditions are fulfilled

1. ICICI Debit card is used on ICICI Bank terminal (On-Us

transaction)

2. Transaction is done on select government petrol pumps.

Please note, the Acquirer/Fuel pump may levy surcharge at its

own discretion

Surcharge on 1.8% of bookings as per Visa regulations

railway bookings

Debit Card PIN re- Nil

generation Charges

(With effect from 1st

May 2024)

Debit Card de – Nil

hotlisting

(With effect from 1st

May 2024)

Balance Certificate Nil

(With effect from 1st

May 2024)

Interest Certificate Nil

(With effect from 1st

May 2024)

Retrieval of old Nil

transactional

documents /

Enquiries related to

old records

(With effect from 1st

May 2024)

Photo attestation Rs. 100 per application/letter

Signature Rs. 100 per application/letter

attestation

(With effect from 1st

May 2024)

Address Nil

confirmation

(With effect from 1st

May 2024)

Inoperative account Nil

Stop Payment Particular cheque - Rs.100

charges (Free through customer care IVR & Net banking)

(With effect from 1st

May 2024)

Stop Payment For ECS is not present as customer is required to maintain

Charges - ECS requisite balances to honour the EMI txns

Lien marking and Nil

unmarking of

savings account

(With effect from 1st

May 2024)

Locker Rent Annual Locker rentals starting from

Semi - Metro

Location Rural Urban Urban Metro +

Small 1,200 2,000 3,000 3,500 4,000

Medium 2,500 5,000 6,000 7,500 9,000

Large 4,000 7,000 10,000 13,000 15,000

Extra

Large 10,000 15,000 16,000 20,000 22,000

Rentals may vary between branches under same location

Locker rentals vary based on locker size and branch

location

Locker rent is charged annually and is collected in

advance

Reissue of Internet Nil

user id or password

(Branch or non IVR

Customer Care)

(With effect from 1st

May 2024)

Standing Nil

Instructions -

Setting-up-charge

(With effect from 1st

May 2024)

Address change Nil

request at branches

(With effect from 1st

May 2024)

ECS/NACH setup Nil

charges

National Automated Nil

Clearing House

(NACH) Mandate.

One time mandate

authorisation

charges (physical)

(With effect from 1st

May 2024)

Cash deposit Charges of Rs 50 per transaction, will be levied on cash

charges - Cash deposited in the Cash Acceptor/Recycler machines on bank

Acceptor/Recycler holidays and between 06:00 p.m. and 08:00 a.m. on working

machines days. The charges would be applicable if the cash deposit in the

Cash Acceptor/Recycler machines on bank holidays and

between 6 pm and 8 am on working days exceeds Rs 10,000 per

month either as a single transaction or multiple transactions

Above charges will not be applicable to Senior Citizens, Basic

Savings Bank Account, Jan Dhan Accounts, Accounts held by

incapacitated and visually impaired persons, Student Accounts

or any other Accounts identified by ICICI Bank

Penal Charges

ECS / NACH Debit Rs 500 per instance for financial reasons. Maximum recovery will

Returns be done for 3 instances per month for the same mandate

(With effect from 1st

May 2024)

Cheque return Rs 200 per instance for financial reasons

outward (cheque

deposited by

customer)

Cheque return Rs 500 per instance for financial reasons.

inward (cheque Rs.50 for non-financial reasons except for signature verification

issued by customer)

Decline of Rs. 25 per transaction

transaction at other

bank ATMs or point

of sale (POS) due to

insufficient balance

in the account

Standing Rs 200 per instance for financial reasons

Instructions

Rejection

Deliverable returned Any deliverable returned by courier due to consignee or address

by courier specific reasons (no such consignee/ consignee shifted and no

such address, etc.) – Rs 50 per instance

Deliverables Any deliverable not picked up (within the stipulated time) - Rs 50

destroyed at per instance

Branches

1. Locker rates vary for different branches, hence customers are requested to get in

touch with respective branch.

2. Taxes at prevailing rates as per Govt rules shall be applicable over and above the

mentioned charges. The charges indicated above are subject to periodic revision.

You might also like

- Catalogue Mauritius 2017 FeldmanDocument128 pagesCatalogue Mauritius 2017 FeldmanAnton AntonNo ratings yet

- Elements of Banking & InsuranceDocument77 pagesElements of Banking & InsuranceMADHULIKAANo ratings yet

- Sap Fico Complete End User ManualDocument374 pagesSap Fico Complete End User ManualAsma Jamshaid100% (3)

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inJatin BindalNo ratings yet

- At&tDocument4 pagesAt&tmario abregoNo ratings yet

- Account Tariff Structure Basic Savings AccountDocument1 pageAccount Tariff Structure Basic Savings Accountgaddipati_ramuNo ratings yet

- ICICI Bank Current Account ChargesDocument3 pagesICICI Bank Current Account Chargesashishtiwari92100% (1)

- All User ExitsDocument100 pagesAll User ExitsShaffiullahNo ratings yet

- Bank Reconciliation ActivitiesDocument3 pagesBank Reconciliation ActivitiesRheu ReyesNo ratings yet

- Useful Reports Tcode in SAP Financial AccountingDocument2 pagesUseful Reports Tcode in SAP Financial AccountingHuseyn Ismayilov50% (2)

- Seaoil Petroleum Vs Autocorp GroupDocument3 pagesSeaoil Petroleum Vs Autocorp GroupAlexPamintuanAbitanNo ratings yet

- SAP FICO Transaction Codes - ERP Financials - SCN Wiki PDFDocument17 pagesSAP FICO Transaction Codes - ERP Financials - SCN Wiki PDFmaheshbantaramNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Yes Bank Smart SalaryDocument2 pagesYes Bank Smart SalaryVicky SinghNo ratings yet

- Lab Volt 91004Document24 pagesLab Volt 91004Anonymous BJMvQF3OmNo ratings yet

- Airtex Aviation CaseDocument34 pagesAirtex Aviation Caseakkihbk0% (1)

- Regular Saving AccountDocument92 pagesRegular Saving AccountSimu MatharuNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Document5 pagesSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuNo ratings yet

- From Kotak WebsiteDocument20 pagesFrom Kotak WebsiteHimadri Shekhar VermaNo ratings yet

- PK Saadiq EnglishDocument53 pagesPK Saadiq EnglishZeeshan AshrafNo ratings yet

- New Dgtca SocDocument2 pagesNew Dgtca SocchintankantariaNo ratings yet

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDocument13 pagesSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNo ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDocument2 pagesTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNo ratings yet

- Schedule of Charges Branchless Banking Apr To Jun 2019 EnglishDocument2 pagesSchedule of Charges Branchless Banking Apr To Jun 2019 EnglishJahangirNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- No Frill EnglishDocument2 pagesNo Frill EnglishRupali WaliaNo ratings yet

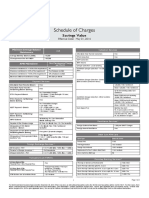

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- Sabka Basic Savings Account Complete KYC 10-10-2013Document2 pagesSabka Basic Savings Account Complete KYC 10-10-2013Nikhil Raj SharmaNo ratings yet

- Regular Salary Account Service ChargesDocument2 pagesRegular Salary Account Service ChargesGunde Hari BabuNo ratings yet

- Savings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Document15 pagesSavings Accounts: Non Resident External Savings Account (NRE) Non Resident Ordinary Savings Account (NRO)Jennifer AguilarNo ratings yet

- Tariff Guide: Account ServicesDocument3 pagesTariff Guide: Account ServicesabidredaNo ratings yet

- Rca SocDocument3 pagesRca SocKrishna Kiran VyasNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- Schedule of Charges Yes Bank 6Document2 pagesSchedule of Charges Yes Bank 6Sayantika MondalNo ratings yet

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDocument3 pagesPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNo ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- PK Saadiq Soc Jan To July 2024 EngDocument48 pagesPK Saadiq Soc Jan To July 2024 Engwaqas wattooNo ratings yet

- ADC (Alternate Delivery Channel) : Bank AL Habib LimitedDocument9 pagesADC (Alternate Delivery Channel) : Bank AL Habib LimitedZainab RiazNo ratings yet

- Yes Bank - Schedule of Charges - Savings Select AccountDocument2 pagesYes Bank - Schedule of Charges - Savings Select AccountBOOMTIMENo ratings yet

- Service Charges Annexure-A Revised 18-7-11Document28 pagesService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNo ratings yet

- Crown Salary Account 01042014Document2 pagesCrown Salary Account 01042014Vikram IsgodNo ratings yet

- Particulars Sanman Savings Bank Account Standard Charges (RS.)Document2 pagesParticulars Sanman Savings Bank Account Standard Charges (RS.)Bella BishaNo ratings yet

- Annex 2 Super Savings AccountDocument2 pagesAnnex 2 Super Savings AccountPhani BhupathirajuNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Au Digital Savings AccountDocument5 pagesAu Digital Savings AccountQuaint ZoneNo ratings yet

- Pocket Savings Account Final UpdatedDocument3 pagesPocket Savings Account Final UpdatedDAYA VNo ratings yet

- Schedule of Charges: Smart Salary ExclusiveDocument2 pagesSchedule of Charges: Smart Salary ExclusivevedavakNo ratings yet

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDocument6 pagesTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- RBI SBI Demand Draft Exchange RatesDocument11 pagesRBI SBI Demand Draft Exchange RatesJithin VijayanNo ratings yet

- Islamic SOC Jan June 2013 FinalDocument16 pagesIslamic SOC Jan June 2013 Finalfaisal_ahsan7919No ratings yet

- KioskDocument21 pagesKioskgollamandalaappaiahNo ratings yet

- Schedule of ChargesDocument14 pagesSchedule of ChargeskrishmasethiNo ratings yet

- Sbprime - Bde'sDocument16 pagesSbprime - Bde'sParteek JangraNo ratings yet

- Super Savings NewDocument2 pagesSuper Savings NewwinnermeNo ratings yet

- Preferred AccountDocument2 pagesPreferred AccountaurummaangxinchenNo ratings yet

- RSPDocument24 pagesRSPMassrNo ratings yet

- Bajaj Tiger CC MITC NewDocument12 pagesBajaj Tiger CC MITC NewMinatiNo ratings yet

- UBL Ameen Islamic Banking-Schedule of Bank Charges (July-December 2013)Document19 pagesUBL Ameen Islamic Banking-Schedule of Bank Charges (July-December 2013)Faizan MughalNo ratings yet

- Personal Banking Personal Banking Personal BankingDocument1 pagePersonal Banking Personal Banking Personal BankingSaravanan ParamasivamNo ratings yet

- EDB Service Charges2011Document8 pagesEDB Service Charges2011Imran Ali MirNo ratings yet

- FAQs On Cash Withdrawal11july2022Document2 pagesFAQs On Cash Withdrawal11july2022Ravi KumarNo ratings yet

- Services ProvidedDocument15 pagesServices ProvidedParul AroraNo ratings yet

- Schedule of Charges (Standard Charterd)Document0 pagesSchedule of Charges (Standard Charterd)Kiran Maruti ShindeNo ratings yet

- Mitc RupifiDocument13 pagesMitc RupifiKARTHIKEYAN K.DNo ratings yet

- Ready Line SOC Jan June 2024Document1 pageReady Line SOC Jan June 2024umarNo ratings yet

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekNo ratings yet

- Key Fact Statement CorporateDocument7 pagesKey Fact Statement CorporateRAM MAURYANo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Aclaracion Vs Gatmaitan 64 SCRA 131, 135 (May 26 1975)Document10 pagesAclaracion Vs Gatmaitan 64 SCRA 131, 135 (May 26 1975)Keith RabinaNo ratings yet

- CA INTER Super 30 Questions - (01-70)Document70 pagesCA INTER Super 30 Questions - (01-70)Jalaludeen SNo ratings yet

- Labour Welfare Fund Form DDocument9 pagesLabour Welfare Fund Form DDeepak ThakranNo ratings yet

- Dear Mayoor MehraDocument1 pageDear Mayoor MehramayoorNo ratings yet

- Arif CV 2020 NewDocument5 pagesArif CV 2020 NewMuhammad arifNo ratings yet

- Global FinanceDocument5 pagesGlobal FinanceJean AlburoNo ratings yet

- David Chnowski ResumeDocument3 pagesDavid Chnowski Resumeapi-282311989No ratings yet

- Deposit Mobilization by IBsDocument17 pagesDeposit Mobilization by IBsAAM26No ratings yet

- DD Europe 2015Document144 pagesDD Europe 2015Namrata ShettiNo ratings yet

- Intacc 1 Cash and Cash Equivalents-1Document10 pagesIntacc 1 Cash and Cash Equivalents-1randel10caneteNo ratings yet

- 015 SLLR SLLR 1994 v2 Hemas Marketing PVT Ltd. v. Chandrasiri and OthersDocument7 pages015 SLLR SLLR 1994 v2 Hemas Marketing PVT Ltd. v. Chandrasiri and OthersMini KNo ratings yet

- Fact Sheet: What Is InstapayDocument4 pagesFact Sheet: What Is InstapayARNo ratings yet

- NIT38HYDIV 52 CRDocument252 pagesNIT38HYDIV 52 CRRanjan SinghNo ratings yet

- SBI Home Loan Process Explained in Steps JerinjosephDocument25 pagesSBI Home Loan Process Explained in Steps JerinjosephRoshan MalhotraNo ratings yet

- "Marketing Ofbaroda Cash Management Services by Neelam NiveditaDocument60 pages"Marketing Ofbaroda Cash Management Services by Neelam NiveditaAakash JadiyaNo ratings yet

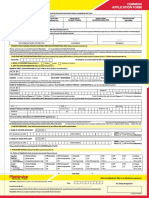

- Mahindra MF Application FromDocument4 pagesMahindra MF Application FromnanduvermaNo ratings yet

- Abante v. Lamadrid, G.R. No. 159890, May 28, 2004, 430 SCRA 368 (2004)Document26 pagesAbante v. Lamadrid, G.R. No. 159890, May 28, 2004, 430 SCRA 368 (2004)MishNo ratings yet