Professional Documents

Culture Documents

Module 3: Audit Objectives, Evidence, Procedures, and Documentation

Module 3: Audit Objectives, Evidence, Procedures, and Documentation

Uploaded by

Kiều Thảo AnhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 3: Audit Objectives, Evidence, Procedures, and Documentation

Module 3: Audit Objectives, Evidence, Procedures, and Documentation

Uploaded by

Kiều Thảo AnhCopyright:

Available Formats

file:///F|/Courses/2010-11/CGA/AU1/06course/m03intro.

htm

Module 3: Audit objectives, evidence, procedures, and documentation

Overview

Module 3 explains the difference between the objective of an audit (which is to express an opinion on the financial statements) and

specific audit objectives (which are to identify the relevant management assertions embodied in the financial statements and to

ensure that those assertions are not materially misstated). You learn what is required for evidence to be sufficient and appropriate

to afford a reasonable basis for supporting the content of the auditors report, as well as the general audit procedures used to

gather evidence. This module also covers the requirements for the form and content of working papers so that evidence can be

properly documented, as well as pre-engagement activities.

When you have completed this module, you should have a good understanding of both the auditors and managements

responsibilities. Throughout the module, you apply what you have learned about the audit objectives and evidence to mini-scenarios

that outline situations faced by auditors.

Assignment reminder: Assignment 1 in Module 5 is due at the end of Week 5 (see Course Schedule). You may wish to take a look at

the assignment now to familiarize yourself with the requirements and to prepare for any work that may be required in advance.

Test your knowledge

Begin your work on this module with a set of test-your-knowledge questions designed to help you gauge the depth of study required.

Learning objectives

3.1

Audit objectives

Describe the auditors responsibility to consider fraud and error and

the consequences of illegal acts, in order to achieve the objective of

financial statement audits. (Level 2)

3.2

Specific audit objectives

Explain the various types of management assertions and their

relationship to specific audit objectives. (Level 1)

3.3

Audit evidence

Explain how an auditor determines what and how much evidence is

required. (Level 1)

3.4

Evidence-gathering audit procedures

Identify and apply evidence-gathering audit procedures commonly

used to obtain audit evidence, and describe the strengths and

weaknesses of each procedure. (Level 1)

3.5

Documentation

Explain the purpose and key elements of audit working papers, and

describe the form and content of documentation required in a

professional engagement. (Level 1)

3.6

Pre-engagement arrangements

Identify the main pre-engagement activities and the factors to

consider when deciding whether to accept a new audit engagement.

(Level 1)

3.7

Engagement letters

Describe the purpose and main features of an engagement letter.

(Level 2)

Module summary

Print this module

file:///F|/Courses/2010-11/CGA/AU1/06course/m03intro.htm (1 of 2) [04/10/2010 2:57:37 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03intro.htm

file:///F|/Courses/2010-11/CGA/AU1/06course/m03intro.htm (2 of 2) [04/10/2010 2:57:37 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01.htm

3.1 Audit objectives

Learning objective

Describe the auditors responsibility to consider fraud and error and the consequences of illegal acts, in order to

achieve the objective of financial statement audits. (Level 2)

Required reading

Chapter 9, pages 348350, Auditors Responsibility to Report Internal Control Deficiencies and Fraud Risks

Chapter 17, pages 682686, Auditors Responsibility to Consider Fraud and Error in an Audit of Financial Statements

and Illegal Acts by Clients

CAS 260.10.13 (CICA Handbook

Assurance

,

paragraphs 5751.17.19)

CAS 200 (CICA Handbook

, section 5090)

CAS 240 (CICA Handbook,

section 5135)

CAS 250 (CICA Handbook,

section 5136)

Reading 3-1: AuG-8, The Auditors Responsibility for the Detection of Fraud and Other Irregularities

Reading 3-2: AuG-9, The Auditors Responsibility for the Detection and Reporting of Illegal Acts

LEVEL 2

Overall objective of an audit

The objective of an audit is to express an appropriate opinion as to whether the financial statements present fairly, in all

material respects, the financial position, the results of operations, and the cash flows of the auditee. To say that the financial

statements present fairly, in all material respects, is equivalent to stating that they are free from material misstatements

whether due to error, fraud, or as a consequence of an illegal act by the client.

Responsibility to detect errors or fraud

Management is responsible for producing the financial statements and for implementing controls that will prevent and detect

errors or fraud. The auditor is responsible for detecting material misstatements from errors or fraud in order to achieve the

objective of the audit.

Professional skepticism requires the auditor to be alert to any factors that could increase the risk of material misstatements,

paragraphs

whether caused by fraud or error (CAS 240.12.14; CICA Handbook

5135.023.024 and CAS 200.15 and 200.A18A22; CICA Handbook

paragraphs 5090.04.06).

For example, while conducting an audit, an auditor reviews an original copy of a $5 million sales agreement and it appears

that the terms of the sale may be falsified. The auditor would respond with a heightened level of professional skepticism and

would seek additional evidence to confirm or dispel the concern about falsification. This could be done by directly confirming

the terms of the contract with the customer.

Scenario 3.1-1

Lazlo, CGA and auditor for World Communications Inc., has scheduled a meeting with the CFO during the initial stages of the

audit engagement. In addition to other information, the CFO tells Lazlo that no significant capital assets were acquired during

the year. In accordance with CAS 200 (CICA Handbook

section 5090), should Lazlo believe the

CFO and not bother checking the facts himself?

Solution

Responsibility to detect illegal acts

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01.htm (1 of 2) [04/10/2010 2:57:39 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01.htm

Management is responsible for identifying and complying with laws and regulations that affect the entity, as well as

preventing and detecting illegal acts.

CAS 250.A7 explains how the auditor can obtain an understanding of the laws and regulations that, if violated, could result in

, paragraph 5136.09) requires that the

material misstatement. CAS 250.13 (CICA Handbook

auditor design procedures so as to obtain sufficient evidence regarding compliance with the provisions of those laws and

regulations generally recognized to have a direct effect on the determination of material amounts and disclosures in the

financial statements. The auditor must reduce the risk of not detecting a material misstatement to an acceptably low level,

recognizing that such a misstatement may arise from the consequences of an illegal act. CAS 250.A9 and 250.A15.A16

(CICA Handbook

, paragraphs 5136.11.22) provide guidance on how to reduce this risk to an

acceptably low level.

Scenario 3.1-2

Natasha, CGA and auditor for Rose Industries Inc., discovers that a relatively small bribe is paid in a foreign country to a

government official of that country. Even though the bribe is not material, Natasha considers assessing the impact on the

financial statements because of this illegal act. Do you agree with her?

Solution

Responsibility to communicate material misstatements

If the auditor obtains evidence confirming that a misstatement does exist, the auditor should promptly communicate the

misstatement to the appropriate level of management and to the audit committee (or equivalent). See CAS 240.40.42 and

CAS 260.A20 (CICA Handbook,

paragraphs 5135.093.101 and 5751.17), if applicable.

Discovery of possible illegal acts should be communicated to the audit committee and other appropriate levels of

management. The auditor is also required to advise the audit committee (or equivalent) of any questions regarding

management competence and integrity.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01.htm (2 of 2) [04/10/2010 2:57:39 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02.htm

3.2 Specific audit objectives

Learning objective

Explain the various types of management assertions and their relationship to specific audit objectives. (Level 1)

Required reading

Chapter 6, pages 195202

CAS 315.A105.A112 (CICA Handbook

, paragraph 5300.21)

LEVEL 1

Auditors usually find it more efficient to audit components all the related accounts in a cycle with coordinated

procedures, instead of performing separate audit procedures on each account in isolation.

CAS 315 provides a detailed listing of audit assertions, which may be about

classes of transactions (income statement balances)

balance sheet items

presentation and disclosure

In the conduct of an audit, the auditor will assess the risk of material misstatement at the account balance and assertion

level.

Be sure you understand the difference between the overall objective of an audit and the audit objective itself. The following

exhibit summarizes the relationship between the objective and its place within the audit.

Exhibit 3.2-1: Audit objectives

Objective type

What it relates to

What it refers to

Objective of an audit

Expressing the appropriate

opinion on the financial

statements.

The audit as a whole.

Audit objectives

The definition of auditing, which

states that auditing is a

systematic process of objectively

obtaining and evaluating evidence

regarding assertions about

economic actions and events to

ascertain the degree of

correspondence between the

assertions and [GAAP] (text,

page 7).

The financial statements that

embody the following management

assertions:

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02.htm (1 of 2) [04/10/2010 2:57:40 PM]

existence (occurrence)

completeness

ownership (rights and

obligations)

valuation and allocation

(accuracy and

measurement)

cut-off

classification and

understandability

statement presentation

(disclosure)

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02.htm

Specific audit objectives

The auditors goals in examining

account balances and

transactions in each cycle.

Obtaining and evaluating evidence

about each account balance, class

of transaction, or disclosure at the

assertion level.

In preparing financial statements, management makes assertions about the amounts and disclosures contained in those

statements. For example, when the balance sheet shows accounts receivable at $400,000, management is asserting that

these amounts actually exist, that they reflect appropriate allowances for uncollectible accounts, and that the company does

indeed own the receivables.

Occurrence and existence assertions are closely related. Occurrence relates to authentic transactions experienced during

the period (for example, recorded sales transactions made to actual customers), and existence relates to an account

balance at a point in time (for example, all customer receivable balances at year end).

Accuracy relates to transactions during the period, and valuation pertains to an account balance at a point in time (for

example, merchandise inventory transactions are measured at actual cost for recording, and the year-end inventory account

balance is valued at net realizable value for reporting).1

Scenario 3.2-1

Elise, CGA and auditor for More Productions Ltd., makes note of the objective Obtain evidence to ensure completeness

(ensure liabilities are not understated) as she prepares the audit working papers for the accounts payable section. What

procedure could Elise use to support this objective?

Solution

T. Shasti and R. Chandra, Independent Audit and

Review Services: Theory and Practice

(University of Windsor, 1997), pages 111 and 177.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02.htm (2 of 2) [04/10/2010 2:57:40 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t03.htm

3.3 Audit evidence

Learning objective

Explain how an auditor determines what and how much evidence is required. (Level 1)

Required reading

Chapter 8, pages 288291

CAS 500 (CICA Handbook

5300.01.22)

Assurance

, paragraphs

LEVEL 1

What is appropriate evidence?

Audit objectives are achieved by gathering and evaluating evidence about management assertions. Auditors need to obtain

evidence on a cost-effective basis, and consequently, the nature of audit evidence is persuasive rather than conclusive. Just

as it is not possible to eliminate the risk that financial statements contain material misstatements, it is not feasible to expect

to obtain evidence that conclusively supports each assertion. For that reason, the auditor often uses evidence from different

sources to support the same assertion.

Scenario 3.3-1

Mohan, CGA and auditor for Active Building Inc., notes the objective Obtain evidence to ensure completeness (ensure

liabilities are not understated) in preparing the audit working papers for the accounts payable section. One of the

procedures Mohan would use is to examine invoices paid after year end to make sure those invoices related to the year

under audit are properly included as accounts payable. What other procedures could Mohan perform?

Solution

Appropriateness and sufficiency of evidence

The appropriateness and sufficiency of evidence are interrelated and a matter of auditor judgment (CAS 500.6, CAS 500.A1.

A6, and CAS 500.A27.A33; CICA Handbook,

paragraphs 5300.07.09).

Appropriateness of audit evidence is related to the nature and timing of audit procedures. Appropriateness (that is, the

quality of evidence) is achieved if the evidence obtained is relevant and reliable.

There are various degrees of reliability that can be achieved; not all evidence is equally strong. Exhibit 8-5 on Page 290 of

the text presents a hierarchy of sources and characteristics of evidence from strongest to weakest. Timeliness is also an

important dimension of appropriateness. Clearly, observing an inventory count three months after year-end (without

additional roll-back auditing procedures) would not provide appropriate evidence regarding the amounts in inventory at yearend.

Sufficiency of evidence relates to the extent of audit procedures and the quantity of evidence obtained. How many questions

should the auditor ask through enquiry? How many confirmations should be sent? How many different audit procedures

should be used to support the valuation assertion?

The concept of sufficiency arises from the fact that the auditor does not examine all the evidence available. You should be

aware of the reasons for accumulating limited amounts of evidence, which are outlined in CAS 500.A1500.A6

paragraphs 5300.14.16). Sufficiency is achieved through an adequate

(CICA Handbook

quantity of evidence obtained by testing specific items and representative items.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t03.htm [04/10/2010 2:57:41 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t04.htm

3.4 Evidence-gathering audit procedures

Learning objective

Identify and apply evidence-gathering audit procedures commonly used to obtain audit evidence, and describe the

strengths and weaknesses of each procedure. (Level 1)

Required reading

Chapter 8, pages 275281

CAS 500.A10.A25 (CICA Handbook

paragraphs 5300.30.42)

CAS 520 (CICA Handbook

CAS 505.A3.A7 (CICA Handbook

CAS 540 (CICA Handbook

CAS 402 (CICA Handbook

Assurance,

, paragraphs 5301.10.24)

, paragraphs 5303.11.13)

, section 5305)

, section 5310)

LEVEL 1

Pages 275281 of the textbook covers the evidence-gathering audit procedures used to obtain and evaluate audit evidence.

Exhibit 8-1 on page 275 shows the type of evidence obtained and gives an example of a specific audit procedure.

paragraphs

As you read through the text and CAS 500.A10A.25 (CICA Handbook,

5300.30.42), you should understand the nature of each method, its strengths and weaknesses, and the types of assertions

supported by the evidence each method produces. For example,

The nature of observation is to look at the application of procedures and policies at a given point in time.

Evidence produced by computation mainly supports the assertions of existence and valuation.

One of the weaknesses of enquiry is that it produces evidence that is rarely sufficient to support an assertion by

itself.

The other three techniques are explained below.

Confirmation is a method of obtaining evidence from third parties regarding specific balances, contractual terms, titles to

assets, and pending litigation. The text mentions that the main assertions supported by evidence from confirmation are

existence and ownership, but it also supports completeness when confirmations are used to obtain evidence about liabilities

(for example, accounts payable).

Positive and negative confirmations are described in CAS 505.15, 505.A5, and 505.A23 (CICA

Handbook

, paragraphs 5303.11.13). However, you do not need to read the rest of CAS 505

(CICA Handbook,

section 5303) until Module 8, when you learn the details of how

confirmations are applied to the audit of cash and accounts receivable.

Inspection

The three principal means of inspection are vouching, tracing, and scanning. One important concept to note from the texts

explanation is that of direction.

Analysis

In this topic, you focus on analysis used to provide audit evidence. CAS 520.5 and 520.A4.A10 and 520.A20.A21

(CICA Handbook

, paragraphs 5301.15 and .20) outline what the auditor must do if the analysis

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t04.htm (1 of 2) [04/10/2010 2:57:42 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t04.htm

is used as primary evidence. If the analysis is used as primary evidence (the main or only evidence, as opposed to

corroborating evidence), the results must provide higher assurance than if it is used in conjunction with other procedures.

Consider the situation in the following example.

Example 3.4-1: ABC Company

ABC Company invested $1,000,000 in treasury bills at the beginning of the year and at year end. None of this money was

used by the company during the year; that is, the company made no withdrawals. The average yield on 90-day treasury bills

during the year was 6%.

Based on these facts, the auditor could reasonably assume that the relationship between the average yield rate and the

investment balance at year end could provide reasonable expectations about the interest revenue earned by ABC during the

year.

In this case, the auditor would choose to perform analysis to provide primary evidence regarding the occurrence of interest

revenue ($1,000,000 6% = $60,000).

Because there were no fluctuations in investment (that is, $1,000,000 throughout the year), the high level of assurance

provided by the auditors expectations on revenue would be consistent with the objective of the analytical procedure used,

which is to provide primary evidence.

paragraph 5301.14) outlines matters that are relevant in making

CAS 520 (CICA Handbook,

the assessments described here. In addition to making the assessments regarding expectations and levels of assurance, the

auditor also needs to consider the reliability of the data used to perform the analysis.

Accounting estimates and service organizations

CAS 540 (CICA Handbook,

section 5305) provides guidance for auditing managements

estimates, perhaps one of the more difficult aspects of the audit. Read that section carefully. CAS 402 (CICA

Handbook

, section 5310) provides guidance for obtaining evidence when the enterprise uses a service

organization, such as using a bank or trust company to provide custodial services, or using a data centre to provide data, section 5310) has been revised to expand on

processing services. CAS 402 (CICA Handbook

the requirements for an auditor who uses a service auditors report when planning the audit, assessing control risk, using

audit evidence obtained from substantive procedures performed by service auditors, and evaluating audit evidence.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t04.htm (2 of 2) [04/10/2010 2:57:42 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t05.htm

3.5 Documentation

Learning objective

Explain the purpose and key elements of working papers in auditing, and describe the form and content of

documentation required in a professional engagement. (Level 1)

Required reading

Chapter 8, pages 296301

CAS 230 (CICA Handbook

Reading 3-3: AuG-5, Auditor Working Paper Files

Assurance,

section 5145)

LEVEL 1

Under new auditing standards (CAS 230; CICA Handbook,

section 5145), auditors are

required to document matters that, in their professional judgment, are important in providing evidence to support the content

of the audit report (CAS 230.5; CICA Handbook

Assurance,

paragraph 5145.04). CAS 230.6 (CICA Handbook,

paragraphs 5145.05.14) describes the

purpose of audit working papers (documentation) and outlines matters affecting the form and content of working papers.

Working papers document the work done during the audit and support the conclusions based on that work. The auditors

working papers are an integral part of the audit. Documentation should not be hurried and incomplete; such practices are

inefficient and risky. Problems are caused by incomplete documentation for the following reasons:

The auditor is forced to rely on memory to support decisions made and conclusions reached during the audit, and the

auditor may make errors in assessing the accumulated evidence, thus rendering an inappropriate opinion on the

financial statements.

It is difficult to defend work done and demonstrate due care or lack of negligence in court without a record of the

work performed.

A meaningful file review becomes almost impossible. The reviewer must rely on the memories of the staff who

conducted the audit and their memories may be faulty; major problems may never come to the reviewers attention.

Planning for the current years audit may not lead to the most efficient and effective audit possible because the

current years auditors will not be able to take advantage of the experience gained by last years audit team.

If problems discovered during the prior years audit were not recorded, the current years audit staff will not be able

to take them into account. No matter how well planned and executed the current years audit is, it would be deficient.

Form and content of documentation

The form and content of documentation included in working paper files are covered on pages 296 to 302 of the text, CAS 230

(CICA Handbook,

section 5145), and CGA Auditing Guideline No. 5 (Reading 3-3).

All working papers should be neat, understandable, accurate, concise, and complete. A working paper should stand on its

own that is, an adequate trail should be provided to find the details supporting the information on the working paper.

As a minimum, each working paper should contain certain key elements, which are highlighted in Exhibit 8-8 on page 300 of

the text.

Computer-generated working papers

Electronic working papers using specialized working paper software can boost audit productivity by automating many

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t05.htm (1 of 2) [04/10/2010 2:57:43 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t05.htm

documentation tasks (for example, automatically carrying over adjustments to related working paper documents and the

financial statements). For example, a working paper program can directly import a trial balance from Sage Accpac ERP and

generate leadsheets automatically.

Common working paper software used in public practice includes CaseWare, WISPR, and IDEA. In Public

Practice Audit Case [BC2]

, you will learn to use working paper

software to prepare your audit file.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t05.htm (2 of 2) [04/10/2010 2:57:43 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06.htm

3.6 Pre-engagement arrangements

Learning objective

Identify the main pre-engagement activities and the factors to consider when deciding whether to accept a new audit

engagement. (Level 1)

Required reading

Chapter 6, pages 172175

LEVEL 1

The auditor needs to determine whether it is feasible to accept a new audit or continue an existing one, then to formalize the

terms of the engagement and gain a preliminary understanding of the clients business in order to identify potential obstacles

to accepting an engagement.

Accepting or continuing an engagement

The first consideration in accepting a new audit client is to determine why or if a client needs audit services (notwithstanding

statutory requirements). A CICA study entitled The First Audit

Engagement

states that an audit may not be called for in the following circumstances:

The owners of the business participate actively in management and exercise effective control over operations.

It is not required to satisfy creditors and other financing sources.

There is no reason to believe that audited financial statements will be required in the near future in order to meet

requirements, statutory or otherwise.

As a CGA, you are required to act in the best interest of your clients; accordingly, you need to provide professional advice

that is best suited to your clients needs. In many cases, a less costly review engagement provides sufficient assurance,

depending on the clients circumstances.

Assuming that the clients circumstances do warrant an audit, the auditor must then decide whether or not it is feasible to

accept the engagement. Before accepting the engagement, auditors must ensure that they are independent in fact (mental

attitude) and in appearance (avoiding financial and managerial relationships). Auditors must be able to maintain financial,

investigative, and reporting independence as long as a professional relationship exists. They would also review available

financial information primarily to assess the size of the client and the types of the financial statements users. Finally, auditors

would look at prior years audit reports for any reservations resulting from scope limitations or GAAP departures.

One of the most important activities before accepting an audit engagement is the communication with the predecessor

auditor. The rules of professional conduct and the Canada Business

Corporations Act

require the successor to enquire about the predecessor auditors

understanding of the reasons for changing auditors. Also, an auditor cannot accept an engagement until the client has

formally terminated its relationship with the predecessor. The information obtained from the predecessor auditor is very

useful for deciding whether or not to accept the engagement. This information includes

any scope limitations imposed by the client

significant differences over applicability of accounting principles

difficulties in collecting audit fees from the client

indications of unethical management practices, and

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06.htm (1 of 2) [04/10/2010 2:57:44 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06.htm

managements attempt to influence the audit report (such as opinion shopping)

In the majority of cases, a change of auditors arises from legitimate circumstances such as

a change in ownership

concerns over audit fees

company growth beyond the resources available to the current auditors

company requirement to periodically change auditors

A meeting should be arranged between the auditor and the client to determine the complexity of the companys organization

and business transactions. This knowledge will affect the requirement for specialized staff on the audit team and help the

auditor to consider potential scope limitations, anticipated form of opinion, and time constraints.

The auditor is not obligated to accept undesirable clients. The most common reasons for rejecting clients include the

following:

business and/or financial relationships between the accounting firm personnel (or their immediate families) and the

client (that is, self-interest or familiarity threat to independence)

lack of client integrity (part of the audit process relies on the belief that the client will act and provide information in

good faith)

high business risk faced by the client

likelihood of significant reservations in the audit report

Activity 3.6-1

A CGA who is approached by a prospective client to perform an audit engagement can immediately accept the engagement,

provided the CGA has the knowledge and skill necessary to conduct the audit in an effective and efficient manner. Is this

statement true or false?

Solution

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06.htm (2 of 2) [04/10/2010 2:57:44 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t07.htm

3.7 Engagement letters

Learning objective

Describe the purpose and main features of an engagement letter. (Level 2)

Required reading

Chapter 6, pages 175179

CAS 210 and Appendix 1 (Example of an Audit Engagement Letter) (CICA Handbook

Assurance

, section 5110 and Appendix, Example of an engagement letter)

LEVEL 2

An engagement letter defines the terms of the audit engagement that have been agreed to, in principle, during meetings

and conversations with the client. Engagement letters are essential to minimize the risk of misunderstanding between the

auditor and the client. They should be obtained for any new client and also for existing clients if the nature of the

engagement changes over time. For example, a significant change in management or in the nature, size, or structure of the

organization may require a new engagement letter.

Exhibit 6-1 on text page 176 and Appendix 1 in CAS 210 (the Appendix to CICA Handbook

section 5110) provide examples of engagement letters for audit engagements that can be used in practice. As you read these

examples, notice that engagement letters typically refer to

the nature of a financial statement audit and its objective

the fact that management is responsible for the financial statements and for adequate internal controls

the scope of the audit with reference to the applicable professional standards, which will be GAAS in most cases

the risk that a material misstatement may not be detected because the audit is conducted on a test basis, together

with the inherent limitations of internal control

details regarding the fee structure for the performance of the audit

confirmation of acceptance of the terms of the engagement from the client

The engagement letter will vary from client to client, but the elements listed above would normally be included. Details

regarding client assistance in the preparation of working papers, arrangements with outside specialists, communication with

the predecessor auditor, and the expected form of the audit report are sometimes included in the engagement letter.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t07.htm [04/10/2010 2:57:45 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm

Module 3 summary

Describe the auditors responsibility to consider fraud and error and the consequences of

illegal acts, in order to achieve the objective of financial statement audits.

Misstatements can arise from error or fraud. (Fraud may be either fraudulent financial reporting or misappropriation

of assets.)

It is the auditors responsibility to detect material misstatements, however caused.

If an auditor detects a misstatement (that is, either a misstatement resulting from a non-trivial error, or one

indicating a serious weakness in internal controls), the auditor should immediately bring it to the attention of the

appropriate level of management and the audit committee (or equivalent).

Any evidence of fraud discovered or suspected should be communicated to the appropriate level of management and

the audit committee (or equivalent).

Any questions regarding management competence and integrity should be communicated to the audit committee (or

equivalent).

The CICA Handbook

defines illegal acts as violations of domestic or foreign statutory

law or government regulation attributable to the entity under audit, or to management or employees acting on the

entitys behalf.

Management is responsible for identifying and complying with laws and regulations that affect the entity, as well as

preventing and detecting illegal acts. Management is responsible for establishing policies and procedures to

accomplish this aim.

The auditor should attempt to identify laws and regulations that, if violated, could be expected to result in a material

misstatement in the financial statements.

Discovery of possible illegal acts should be communicated to the audit committee and other appropriate levels of

management.

Explain the various types of management assertions and their relationship to specific

audit objectives.

Assertions about classes of transactions and events for the period under audit include

occurrence

completeness

accuracy

cut-off

classification

Assertions about account balances at the period end include

existence

rights and obligations

completeness

valuation and allocation

Assertions about presentation and disclosure include

occurrence

rights and obligations

completeness, classification, and understandability

accuracy and valuation

Specific audit objectives are to obtain and evaluate sufficient appropriate evidence about each assertion.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm (1 of 3) [04/10/2010 2:57:46 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm

Explain how an auditor determines what and how much evidence is required.

The appropriateness and sufficiency of evidence are a matter of judgment and are influenced by the following factors:

materiality

inherent risk and control risk considerations

experience from prior audits

the persuasiveness of the evidence

error or fraud found during the audit

Identify and apply evidence-gathering audit procedures commonly used to obtain audit

evidence, and describe the strengths and weaknesses of each procedure.

Audit procedures (also called techniques or methods) include computation, observation, confirmation, enquiry, inspection

(including tracing, scanning, and vouching), and analysis.

Computation by the auditor is strong evidence for the valuation assertion but does not provide evidence of

existence or completeness. Computation can be evidence for existence when the financial statement element is one

that is principally a calculation, for example, amortization.

Observation by the auditor is strong evidence for the assertion of existence. Observation, however, does not

provide evidence on any other level. The existence of an asset, for example, does not prove ownership.

Confirmation from third parties (if the auditor has control over mailing and receipt) constitutes strong evidence of

existence and valuation because of the independent form of the evidence. If, however, the auditor does not have

control over mailing and receipt, then the clients opportunity to alter the responses lessens the strength of the

evidence obtained by the procedure.

Direct enquiry by the auditor to third parties can be strong evidence, but direct enquiry of internal parties is

considered weaker evidence. An assessment of the source on the basis of integrity, independence from the entity,

and knowledge of the audit entity must always accompany the use of direct enquiry.

Inspection consists of looking at records and documents or at assets having physical substance. It encompasses the

following procedures:

Vouching is used to examine documents that provide evidence supporting the assertion of existence.

Tracing provides evidence of completeness. Documents held by third parties (bank loan documents on file at the

bank, for example) are most reliable. Third-party documents held internally are less reliable, and documents

prepared by the entity and held by the entity are the least reliable as they can be subject to manipulation.

Scanning alerts auditors to unusual items and events in the clients documentation.

When using analysis, the auditor must ensure that there really is a meaningful relationship between amounts in the

data to allow the development of reasonable expectations. It is also important to ensure that the level of assurance

that the expectations provide is consistent with the objective of the analytical procedure. Analysis is best used to

highlight areas in the financial statements that require further investigation and is less valuable as hard evidence.

Explain the purpose and key elements of audit working papers, and describe the form

and content of documentation required in a professional engagement.

Working papers document the work done during the audit and the conclusions based on that work.

They provide evidence that the audit was carried out in accordance with generally accepted auditing standards.

Good working papers should normally include

evidence of adequate audit planning

a description of audit evidence obtained

evidence of adequate supervision and review

evidence that the financial statements agree with the supporting records

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm (2 of 3) [04/10/2010 2:57:46 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm

evidence of evaluation and disposition of misstatements

copies of correspondence with the client

The form and content of documentation included in working paper files are covered on pages 296 to 301 of the text, CAS 230

section 5145), and CGA Auditing Guideline No. 5 (Reading 3-3).

(CICA Handbook,

The form and content of working papers are affected by such factors as

the

the

the

the

terms of the engagement and the type of report required

nature and complexity of the clients business

nature and condition of the clients control environment and control system

need for review and supervision of work carried out by assistants

Identify the main pre-engagement activities and the factors to consider when accepting

a new audit engagement.

The main pre-engagement activities performed before accepting an engagement include

1.

2.

3.

4.

5.

6.

assessing independence between the firm and client

obtaining information such as past financial statements and annual reports

communicating with the previous auditor

communicating with the clients bankers, lawyers, and so on

considering any special requirements or risks related to the engagement

assessing if the firm has the necessary resources to complete the assignment

The factors to consider when deciding to accept a new engagement include

business and/or financial relationships between the firms personnel and the client

client integrity

business risk facing the client (that is, risk of business failure), and

the likelihood of significant reservations in the auditors report.

Describe the purpose and main features of an engagement letter.

An engagement letter defines the terms of the audit engagement to which the auditor and the client have agreed. They

usually refer to

the nature and objectives of the audit

managements responsibility for the financial statements

the risk that the audit will not identify all material misstatements

the fee structure

a list of working papers for the client to prepare

a confirmation of the terms of engagement by the client

Assurance,

section 5110), Terms

CAS 210 (CICA Handbook

of Engagement, provides guidance on establishing an understanding of, and agreement on, the terms of the engagement for

the audit of financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03summary.htm (3 of 3) [04/10/2010 2:57:46 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01sol1.htm

Scenario 3.1-1 solution

That the client tells the auditor that no significant capital assets were acquired during the year should not prevent the auditor

from reviewing other evidence to make sure that the clients claim is truthful. This could include a review of the minutes of

directors meetings noting approvals for investments in capital assets, a review of the repairs and maintenance account to

identify capital items expensed in error, or a tour of the facilities with an operations manager in order to corroborate the

CFOs statement. To detect material misstatements, the auditor needs to maintain an attitude of professional skepticism.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01sol1.htm [04/10/2010 2:57:47 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01sol2.htm

Scenario 3.1-2 solution

The bribe may not be material, but should the foreign government discover the bribe, the loss to the company could be

significant (for example, confiscation of the companys assets). In addition, there may be domestic legislation in the client

companys home country that forbids bribery abroad. Thus, per CAS 250 (CICA Handbook

section 5136), Misstatements Illegal Acts, it is not the illegal act itself but the consequences of the illegal act that may

affect the financial statements.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t01sol2.htm [04/10/2010 2:57:48 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02sol.htm

Scenario 3.2-1 solution

Elise could use the audit procedure of examining invoices paid after year-end to make sure those invoices related to the year

under audit are properly included as accounts payable. (She could also review suppliers statements as of the companys yearend and compare them to recorded amounts.) Thus, it is the audit objective related to an assertion that dictates the type of

audit procedures to be used in examining financial statement items.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t02sol.htm [04/10/2010 2:57:49 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t03sol.htm

Scenario 3.3-1 solution

To support the assertion of completeness of accounts payable, Mohan may obtain confirmations from vendors for whom the

companys accounts payable records show a zero balance at year-end, while at the same time looking at cash disbursements

made subsequent to year-end. Audit evidence may be documentary, oral, or visual, and it can come from the auditors, the

entity, or third parties.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t03sol.htm [04/10/2010 2:57:50 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06sol.htm

Activity 3.6-1 solution

This statement is false. As set out on page 175 of the text, if a CGA is replacing another auditor, the CGA must contact the

predecessor, before accepting the engagement, to inquire whether there is any reason why the appointment should not be

accepted.

In addition, if the CGA immediately agrees to perform the audit without some investigation of the nature of the business, it is

unlikely that he or she would have adequate information to determine whether the engagement could be performed

effectively and efficiently.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03t06sol.htm [04/10/2010 2:57:51 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftest.htm

Module 3 self-test

Question 1

Evidence-gathering audit procedures, or methods, are used to produce evidence about the principal management assertions

embodied in the financial statements. Some of these procedures are useful for producing evidence about certain assertions,

while others are more useful for producing evidence about other assertions. Appropriateness of evidence requires the auditor

to choose the procedure(s) that will best support the assertion being audited.

Required

Prepare a two-column table with the general audit procedures listed on the left. (Refer to text, Exhibit 8-1, page 275.)

Opposite each one, write the management assertion(s) most usefully audited by using each procedure.

Solution

Question 2

You are engaged to audit the financial statements for Great Big Corporation Ltd. (GBC) for the year ending December 31,

20X0. The unaudited balance sheet shows that, at year end, GBC has $285,950 worth of capital assets (net of amortization).

Required

a. What is the overall objective for the audit of GBC?

b. Describe the auditors specific audit objectives with respect to the capital assets.

Solution

Question 3

Evaluate the statement: Its not what you do on an audit; its how you document it thats important.

Solution

Question 4

Problem EP 7, page 311

Solution

Question 5

Analysis seems to be a cost-effective way of obtaining evidence. When analysis is used to obtain primary evidence to support

financial statement amounts, the level of assurance provided from analysis must be consistent with that purpose. Describe

some difficulties the auditor may encounter when using analysis to gain a level of assurance consistent with the objective of

primary evidence.

Solution

Question 6

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftest.htm (1 of 2) [04/10/2010 3:28:39 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftest.htm

Discussion Case 2, page 211

Solution

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftest.htm (2 of 2) [04/10/2010 3:28:39 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol1.htm

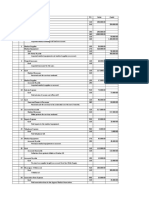

Self-test 3

Solution 1

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol1.htm [04/10/2010 3:28:41 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol2.htm

Self-test 3

Solution 2

a. The objective for the audit of GBC is to express an opinion about whether GBCs financial statements present fairly, in

all material respects, the companys financial position as of December 31, 20X0, and the results of operations and

changes in financial position for the year then ended. In doing so, the overall objective is to detect material

misstatements in the most effective and efficient manner.

b. The auditors specific audit objectives with respect to capital assets are to ensure that all relevant management

assertions are supported by appropriate audit evidence. The relevant assertions are as follows:

The assets represented by the amount indicated ($285,950) actually exist (existence).

The amount shown ($285,950) includes all assets acquired (completeness).

The company has clear title to the assets represented by the amount shown ($285,950); any liens or other

encumbrances have been disclosed (rights or ownership).

The assets are accurately valued at $285,950; the cost is correct and accumulated amortization has been

deducted (valuation).

The capital assets and accumulated amortization, including appropriate information on useful life and

amortization rates, have been properly disclosed (presentation and disclosure).

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol2.htm [04/10/2010 3:28:41 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol3.htm

Self-test 3

Solution 3

The statement is an oversimplification, but it does convey an important point: documentation on an audit is very important. If

a junior does the wrong tests in a particular area but documents what was done, the person reviewing the file can ascertain

that the wrong tests were done and remedy the situation. If the junior did not properly document what he or she did, the

reviewer would not be made aware that there was a problem, and the situation would not be corrected. In addition, if the

audit work done is ever challenged, it is only the working papers that will provide evidence that adequate work was done in

accordance with GAAS.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol3.htm [04/10/2010 3:28:42 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol4.htm

Self-test 3

Solution 4

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol4.htm [04/10/2010 3:28:44 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol5.htm

Self-test 3

Solution 5

In considering whether analysis provides a level of assurance consistent with the objective of primary evidence, the auditor

must first ensure that meaningful relationships exist and can be properly evaluated. Such a relationship might not exist, and

if it does, its nature may be such that the auditor could not develop reasonable expectations that provide a level of assurance

adequate for primary evidence. For example, the relationships may exist only in dynamic circumstances, such as unstable

sales levels throughout the period, fluctuating balances in investments, and fluctuating cash flows. Another problem may be

that relationships can only be considered at highly aggregated levels and would not be able to detect offsetting material

misstatements occurring at a more disaggregated level.

For analysis to provide the appropriate level of assurance, the auditor must choose the right analytical procedure(s). In

certain circumstances, this choice may be difficult to make. For example, where an auditor lacks the experience and

appropriate professional judgment, he or she may be unable to select the procedures consistent with the level of assurance

required.

Furthermore, the auditor can only obtain the appropriate level of assurance from analysis when the data used to develop

expectations are reliable. It may be difficult, or even impossible, for the auditor to find sufficiently reliable data for the

purpose of analysis as primary evidence. For example, the data may be available only from within the entity as opposed to

from independent sources; the data may be produced by systems lacking appropriate internal controls; or the data may

never have been subject to audit in either the current or prior period.

Note: The auditor may use analysis as the only procedure (primary evidence) to audit some account balances because of

their nature (low or negligible risk of misstatement) and size (small and immaterial in amount) in relation to other account

balances.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol5.htm [04/10/2010 3:28:45 PM]

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol6.htm

Self-test 3

Solution 6

a. The sources of information and types of enquiries are listed below.

Financial information prepared by the prospective client:

annual reports to shareholders

interim financial statements

securities registration statements

reports to regulatory agencies

Enquiries directed to the prospects business associates:

banker

legal counsel

underwriter

other persons, for example, customers and suppliers

Predecessor auditors communication, if any, regarding:

integrity of management

disagreements with management

Analysis:

special or unusual risk related to the prospect

need for special skills (such as computer or industry expertise)

Internal search for relationships that would compromise independence.

b. No, but quality control standards require firms to investigate prospective audit clients. The Auditing Assurance

Standards Board (AASB) has issued standards [CAS 220 (section 5030)] that are relevant to quality control at both

firm and assurance engagement level. The standards provide guidance on the acceptance and continuance of client

relationships and specific assurance engagements.

c. This acceptance question could be decided either way, although the brief facts prejudice the conclusion toward nonacceptance. Consider that your own firm decided to resign only 10 years ago, presumably over matters of ownermanager integrity. Yet, Mr. Shine appears to be a respected member of his new community. Maybe his "fast and

loose" accounting past is behind him, but maybe not.

file:///F|/Courses/2010-11/CGA/AU1/06course/m03selftestsol6.htm [04/10/2010 3:28:45 PM]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- AdverbsDocument4 pagesAdverbsxxxfarahxxxNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form OneDocument8 pagesBOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form Oneoctavian ibrahimNo ratings yet

- A Guide To The Bach Flower Remedies Julian Barnard.10778 1contentsDocument3 pagesA Guide To The Bach Flower Remedies Julian Barnard.10778 1contentsxxxfarahxxx0% (2)

- Nursery Rhyme MassDocument8 pagesNursery Rhyme MassxxxfarahxxxNo ratings yet

- Electronicboards - Q Management Accounting FunctionsDocument2 pagesElectronicboards - Q Management Accounting FunctionsBhavik Thakkar0% (1)

- Auditing Fixed Assets and Capital Work in ProgressDocument23 pagesAuditing Fixed Assets and Capital Work in ProgressMM_AKSI87% (15)

- SMGA Spring Meeting & Breakfast (10:00am) : Open Day - Mixed Bag Open Day - Mixed BagDocument1 pageSMGA Spring Meeting & Breakfast (10:00am) : Open Day - Mixed Bag Open Day - Mixed BagxxxfarahxxxNo ratings yet

- School Website: WWW - Salesbury.lancs - Sch.uk: Salesbury C.E. Primary School Worship Theme: Good To Be Me and TrustDocument1 pageSchool Website: WWW - Salesbury.lancs - Sch.uk: Salesbury C.E. Primary School Worship Theme: Good To Be Me and TrustxxxfarahxxxNo ratings yet

- Upcoming Events WebApril2013Document1 pageUpcoming Events WebApril2013xxxfarahxxxNo ratings yet

- Jain University Puts Indian Traditional Knowledge Into The SpotlightDocument2 pagesJain University Puts Indian Traditional Knowledge Into The SpotlightxxxfarahxxxNo ratings yet

- Saltvedt 140116 Olje Og Natural Gas Green Tech NordeaDocument10 pagesSaltvedt 140116 Olje Og Natural Gas Green Tech NordeaxxxfarahxxxNo ratings yet

- Rose Lane Sadliers Crossing Residential Buy Print Brochure 6836577Document2 pagesRose Lane Sadliers Crossing Residential Buy Print Brochure 6836577xxxfarahxxxNo ratings yet

- Whole Wheat Date SconesDocument2 pagesWhole Wheat Date SconesxxxfarahxxxNo ratings yet

- Ra FellaDocument23 pagesRa FellaxxxfarahxxxNo ratings yet

- Chapter 4 of Mice and Men Vocabulary Vocabulary Dictionary Synonym Antonym Class 1. MauledDocument1 pageChapter 4 of Mice and Men Vocabulary Vocabulary Dictionary Synonym Antonym Class 1. MauledxxxfarahxxxNo ratings yet

- Enp Invitation enDocument2 pagesEnp Invitation enxxxfarahxxxNo ratings yet

- Asus CP Cp6230-Bn005o (90pd78da41543k40gckz)Document3 pagesAsus CP Cp6230-Bn005o (90pd78da41543k40gckz)xxxfarahxxxNo ratings yet

- Course Guide Internship at ENP November 2012Document6 pagesCourse Guide Internship at ENP November 2012xxxfarahxxxNo ratings yet

- EPC Issue Paper 54 - Reassessing The ENPDocument35 pagesEPC Issue Paper 54 - Reassessing The ENPxxxfarahxxxNo ratings yet

- PC Core Volunteer ExpectationsDocument1 pagePC Core Volunteer ExpectationsxxxfarahxxxNo ratings yet

- 2013 Memo Armenia enDocument4 pages2013 Memo Armenia enxxxfarahxxxNo ratings yet

- NGP TS 1100uDocument2 pagesNGP TS 1100uxxxfarahxxxNo ratings yet

- Life Is Calling. Life Is Calling.: Fact SheetDocument2 pagesLife Is Calling. Life Is Calling.: Fact SheetxxxfarahxxxNo ratings yet

- Peace Corps Top Colleges 2013: Large Colleges and UniversitiesDocument1 pagePeace Corps Top Colleges 2013: Large Colleges and UniversitiesxxxfarahxxxNo ratings yet

- Sana Ullah Resume - UpdatedDocument2 pagesSana Ullah Resume - Updatedsanaullah shoukatNo ratings yet

- FABM 2 Closing-Entries 1Document3 pagesFABM 2 Closing-Entries 1ariannekaryllemercadoNo ratings yet

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplateSardar A A KhanNo ratings yet

- Journal Ledger and Trial BalanceDocument13 pagesJournal Ledger and Trial Balanceamitabh kumarNo ratings yet

- Goodwill Accounting - See's CandyDocument2 pagesGoodwill Accounting - See's CandyNishant SinghaniaNo ratings yet

- Auditing I Course OutlineDocument3 pagesAuditing I Course OutlineMeseret AsefaNo ratings yet

- Ayala Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument6 pagesAyala Corporation and Subsidiaries Consolidated Statements of Financial PositionbyuntaexoNo ratings yet

- TerukiDocument2 pagesTerukikaswade BrianNo ratings yet

- BPZ6B Bpf6a BPW6C A12Document8 pagesBPZ6B Bpf6a BPW6C A12aditya pandianNo ratings yet

- MGT101 Solved Long Questions For Final Term ExamDocument37 pagesMGT101 Solved Long Questions For Final Term Examkamran kamiNo ratings yet

- Module 1 - Fundamental Principles of Assurance EngagementsDocument10 pagesModule 1 - Fundamental Principles of Assurance EngagementsLysss EpssssNo ratings yet

- Cit U Bsais ProspectusDocument5 pagesCit U Bsais ProspectusAtty. Rheneir MoraNo ratings yet

- Mas Lecture Brad DelacruzDocument4 pagesMas Lecture Brad DelacruzAnnyeong AngeNo ratings yet

- RM - Assignment 04 - CH 04 - Omar Refaat - 21123007Document6 pagesRM - Assignment 04 - CH 04 - Omar Refaat - 21123007Omar RefaatNo ratings yet

- Principles of Accounting Problem 8Document13 pagesPrinciples of Accounting Problem 8Carlo AbrinaNo ratings yet

- Pa1 Group-1 P4Document9 pagesPa1 Group-1 P4Phuong Nguyen MinhNo ratings yet

- Final Assignment Report 2Document11 pagesFinal Assignment Report 2Atiqah Fairuz AlisaNo ratings yet

- InventoryDocument8 pagesInventoryDianna DayawonNo ratings yet

- CF 19-03-21 (BudgetDocument21 pagesCF 19-03-21 (BudgetTarisya PermatasariNo ratings yet

- Menahga School District Executive Audit Summary 2023Document22 pagesMenahga School District Executive Audit Summary 2023Shannon GeisenNo ratings yet

- 04 - Cost Accounting by Usry (Part2)Document3 pages04 - Cost Accounting by Usry (Part2)AkiNo ratings yet

- Business Finance - ACC501 Handouts PDFDocument194 pagesBusiness Finance - ACC501 Handouts PDFHamid Mahmood100% (1)

- InventoryDocument139 pagesInventoryJeanetteNo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- New StatementDocument9 pagesNew StatementShiva KumarNo ratings yet

- The Review of Management Accounting: Niu Shuo, Du JianDocument3 pagesThe Review of Management Accounting: Niu Shuo, Du JianJannat JavedNo ratings yet

- Opening & Closing Journal EntriesDocument16 pagesOpening & Closing Journal EntriesDHIVAHAR MNo ratings yet