Professional Documents

Culture Documents

Evaluate Earnings Per Share

Uploaded by

Sivakumar KanchirajuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluate Earnings Per Share

Uploaded by

Sivakumar KanchirajuCopyright:

Available Formats

202589-18-35E

AID: 7725 | 1/06/2015

Calculate the Basic EPS:

Basic earnings per share is the amount of a company's profit or loss for a reporting

period that is available to the shares of its common stock that are outstanding during

the reporting period.

It is calculated by dividing net income from the business after extra ordinary items

with the common stock.

Net Income for common stock holders

Common stock

664,000

=

270,000

Basic EPS =

=$ 2.46 Rouded

Working notes:

Calculate net income for common stockholders:

Particulars

Amount ($)

Net income

760,000

Less: Preferred stock dividend

96,000

Net income to common stock holders

664,000

$2.46 Per share

Therefore, the Basic EPS is

Calculate diluted earnings per share:

The convertible securities are dilutive or not are determined as below:

Incremental

Net Income Number of EPS'

Impact Shares Impact

Convertible preferred stock

Convertible bonds

$96,000

= $2

$48,000

$47,250

= $1.82

$26,000

They are both potentially dilutive because both convertible securities are lower than

basic EPS whether the securities are actually dilutive depends on the comparison with

the Recomputed EPS:

24,000 $ 4 = $96,000

Interest on bonds = Face value of the bonds Interest rate Tax rate

= $900,000 0.075 0.70

= $47,250

Interest on bonds is an allowable expenditure while calculating the net income but due

conversion of bonds to equity the tax will be paid on interest

Calculate the diluted EPS:

Diluted EPS is a measurement which is used to evaluate the quality of a

company's earnings per share.

Diluted EPS is calculated by the firm's net income divided by the sum of its average

shares and other convertible instruments.

Net income after adjestments

Adjested common stock

807,250

=

354,667

Dilued EPS =

Dilued EPS=$2.27 Rouded

Number

Net of

Description Income Shares EPS

Basic EPS

$664,000

= $2.461

$270,000

Stock options:1

Number of shares

Assume share warrant excised 32,000

Number of treasury share

Re purchased

$32, 000 $12

= $21.333

18

Incremental shares 10,667

$664, 000

= $2.361

$280, 667

7.5% Convertible bonds 47,250, 26,000

$711, 250

= $2.31

306, 667

Convertible preferred stock $96,000, $48,000

'Diluted EPS

$807,250

= $2.271

354,667

Therefore, the diluted EPS is

$2.27 Per share

You might also like

- Partnership NotesDocument31 pagesPartnership NotesAimee100% (1)

- Solution Manual For Financial Management Theory and Practice Third Canadian EditionDocument36 pagesSolution Manual For Financial Management Theory and Practice Third Canadian Editionejecthalibutudoh0100% (31)

- Earnings Per Share PDFDocument56 pagesEarnings Per Share PDFYuan ZhongNo ratings yet

- Corporate Finance Final ExamDocument30 pagesCorporate Finance Final ExamJobarteh FofanaNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Evaluate Earnings Per ShareDocument2 pagesEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Evaluate Earnings Per ShareDocument2 pagesEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Oct. 1-Conversion71,500: Evaluate Earnings Per ShareDocument2 pagesOct. 1-Conversion71,500: Evaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Calculate The Diluted EPS in The Following Manner:: Evaluate Earnings Per ShareDocument1 pageCalculate The Diluted EPS in The Following Manner:: Evaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Chapter 15 PDFDocument49 pagesChapter 15 PDFSyed Atiq TurabiNo ratings yet

- Sec: B Financial AnalysisDocument8 pagesSec: B Financial AnalysisSaifiNo ratings yet

- 9 - Earnings Per ShareDocument30 pages9 - Earnings Per ShareRifky ApriandiNo ratings yet

- Accounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1Document15 pagesAccounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1RabinNo ratings yet

- Module 15 Eps BvpsDocument10 pagesModule 15 Eps BvpsLilyNo ratings yet

- Net Income Basic EPS Common Stock $850,000 250,000 $3.4Document2 pagesNet Income Basic EPS Common Stock $850,000 250,000 $3.4Sivakumar KanchirajuNo ratings yet

- Financial Statement Analysis: Solutions To QuestionsDocument48 pagesFinancial Statement Analysis: Solutions To QuestionsAldrich AmoguisNo ratings yet

- Evaluate Earnings Per ShareDocument2 pagesEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- Module 2 2 Eps BVPSDocument9 pagesModule 2 2 Eps BVPSFujoshi BeeNo ratings yet

- Financial Reporting and Accountability: Earnings Per Share (Ias 33)Document11 pagesFinancial Reporting and Accountability: Earnings Per Share (Ias 33)Anthony OtiatoNo ratings yet

- ACCT 412 Chapter 7 SolutionsDocument13 pagesACCT 412 Chapter 7 SolutionsJose T100% (2)

- 227,800 /140,000 Extraordinary Gain 43,520 /140, 000 0.31Document2 pages227,800 /140,000 Extraordinary Gain 43,520 /140, 000 0.31Sivakumar KanchirajuNo ratings yet

- Eps Ias 33Document7 pagesEps Ias 33Blessing Timothy 180174No ratings yet

- AS 20 Earnings Per ShareDocument14 pagesAS 20 Earnings Per Sharefar_07No ratings yet

- CHAPTER 14 Non. 14Document6 pagesCHAPTER 14 Non. 14Ahmed AymanNo ratings yet

- Earnings Per Share Is Computed by Dividing Net Income Available For CommonDocument2 pagesEarnings Per Share Is Computed by Dividing Net Income Available For CommonlbNo ratings yet

- Saksham K Joshi's Presentation On As 13 & As 20Document16 pagesSaksham K Joshi's Presentation On As 13 & As 20Saksham JoshiNo ratings yet

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocument39 pagesWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNo ratings yet

- Unit 3 - IAS 33 KamothoDocument83 pagesUnit 3 - IAS 33 KamothoGrechen UdigengNo ratings yet

- Accounting Standard - 20 Earnings Per ShareDocument34 pagesAccounting Standard - 20 Earnings Per ShareVelayudham ThiyagarajanNo ratings yet

- 202589-18-39P AID: 7725 - 1/06/2015: $455,000 Diluted EPS 187,387 $ 2.43Document1 page202589-18-39P AID: 7725 - 1/06/2015: $455,000 Diluted EPS 187,387 $ 2.43Sivakumar KanchirajuNo ratings yet

- AS20Document10 pagesAS20Selvi balanNo ratings yet

- Diluted Earnings Per Share ReportingDocument20 pagesDiluted Earnings Per Share Reportingroaaa0261No ratings yet

- Assignment - Chapter 5 (Due 10.11.20)Document4 pagesAssignment - Chapter 5 (Due 10.11.20)Tenaj KramNo ratings yet

- Topic 7 Earnings Per ShareDocument69 pagesTopic 7 Earnings Per SharePatricia TangNo ratings yet

- Chapter 2 Buiness FinanxceDocument38 pagesChapter 2 Buiness FinanxceShajeer HamNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingLoudie Ann MarcosNo ratings yet

- Basic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingDocument4 pagesBasic Earnings Per Share: Eps Net Income Preferred Dividends) End of Period Shares OutstandingSamsung AccountNo ratings yet

- Earnings Per Share Is Computed by Dividing Net Income Available For CommonDocument2 pagesEarnings Per Share Is Computed by Dividing Net Income Available For CommonLarry BalanovskyNo ratings yet

- Problem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsDocument13 pagesProblem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsRose Mae GaleroNo ratings yet

- Full Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter Chapterzanycofferswubjt100% (10)

- Accounting AnswersDocument6 pagesAccounting AnswersSalman KhalidNo ratings yet

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- Chapter 16Document19 pagesChapter 16Sid Tushaar SiddharthNo ratings yet

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Chaklala Polymers LTD: Definition of 'Dividend'Document4 pagesChaklala Polymers LTD: Definition of 'Dividend'Habib TayyabNo ratings yet

- CH 2 SolutionDocument7 pagesCH 2 SolutionJohnNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- Earnings Per Share (2021Document60 pagesEarnings Per Share (2021Elago IilongaNo ratings yet

- Dividendtheorypolicy 170303055735 PDFDocument29 pagesDividendtheorypolicy 170303055735 PDFShubham AroraNo ratings yet

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (50)

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (20)

- Equity Capital: Shari WatersDocument6 pagesEquity Capital: Shari WatersMirza ShoaibbaigNo ratings yet

- Financial Concepts: Weighted Average Cost of Capital (WACC)Document6 pagesFinancial Concepts: Weighted Average Cost of Capital (WACC)koshaNo ratings yet

- Ratio Analysis Is A Form of FinancialDocument18 pagesRatio Analysis Is A Form of FinancialAmrutha AyinavoluNo ratings yet

- Aakarsh - Report EVA and VASDocument20 pagesAakarsh - Report EVA and VASaakarshbhardwajNo ratings yet

- CH 05Document50 pagesCH 05Gaurav KarkiNo ratings yet

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDocument4 pagesName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNo ratings yet

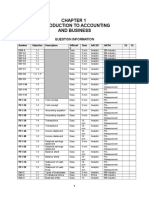

- Introduction To Accounting and Business: Question InformationDocument56 pagesIntroduction To Accounting and Business: Question InformationSivakumar KanchirajuNo ratings yet

- Brewer Chapter 6Document8 pagesBrewer Chapter 6Sivakumar KanchirajuNo ratings yet

- 108ea2000a689bdf0a74f76303cb78b5_0da8ce56f2b2d7fd9c16dd7b4abd58f8Document3 pages108ea2000a689bdf0a74f76303cb78b5_0da8ce56f2b2d7fd9c16dd7b4abd58f8Sivakumar KanchirajuNo ratings yet

- 3da169e4de675e4085032da676a206fd_19ec2e36ff18d17acd0c2d809651d487Document2 pages3da169e4de675e4085032da676a206fd_19ec2e36ff18d17acd0c2d809651d487Sivakumar KanchirajuNo ratings yet

- KeyDocument10 pagesKeySivakumar KanchirajuNo ratings yet

- 45b8032661810b33936df337987c2e28_71535d959934b4a0f2e79209acd2584dDocument3 pages45b8032661810b33936df337987c2e28_71535d959934b4a0f2e79209acd2584dSivakumar KanchirajuNo ratings yet

- 2dd91c8892c55864fdfda2f8323a2b3c_b97bebdf2b5ce459d392d92d045a658aDocument4 pages2dd91c8892c55864fdfda2f8323a2b3c_b97bebdf2b5ce459d392d92d045a658aSivakumar KanchirajuNo ratings yet

- SL.N O. Finger Prints (Left Thumb) Name & Permanent Postal Address of Partners Passport Size PhotoDocument1 pageSL.N O. Finger Prints (Left Thumb) Name & Permanent Postal Address of Partners Passport Size PhotoSivakumar KanchirajuNo ratings yet

- Kaveri Industries Line of Business: Manufacturing of Agarbatthis ParticularsDocument1 pageKaveri Industries Line of Business: Manufacturing of Agarbatthis ParticularsSivakumar KanchirajuNo ratings yet

- Affidavit: D. No. 4-37, Society Street, Tanuku, West Godavari Dist. Andhra Pradesh - 534 211Document2 pagesAffidavit: D. No. 4-37, Society Street, Tanuku, West Godavari Dist. Andhra Pradesh - 534 211Sivakumar KanchirajuNo ratings yet

- DeedDocument5 pagesDeedSivakumar KanchirajuNo ratings yet

- Form No.1Document2 pagesForm No.1Sivakumar KanchirajuNo ratings yet

- Prepare A Statement To Show The EPS For Last 3 YearsDocument1 pagePrepare A Statement To Show The EPS For Last 3 YearsSivakumar KanchirajuNo ratings yet

- Certificate of IncorporationDocument1 pageCertificate of IncorporationGirish SharmaNo ratings yet

- 18 42PDocument1 page18 42PSivakumar KanchirajuNo ratings yet

- Calculate The Diluted EPS in The Following Manner:: Evaluate Earnings Per ShareDocument1 pageCalculate The Diluted EPS in The Following Manner:: Evaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- 202589-18-39P AID: 7725 - 1/06/2015: $455,000 Diluted EPS 187,387 $ 2.43Document1 page202589-18-39P AID: 7725 - 1/06/2015: $455,000 Diluted EPS 187,387 $ 2.43Sivakumar KanchirajuNo ratings yet

- The Basic EPS Is Determined As Below: The Net Income For 2015 Is: Description Amount $ Less: Operating Expenses Less: Income Taxes (30%)Document1 pageThe Basic EPS Is Determined As Below: The Net Income For 2015 Is: Description Amount $ Less: Operating Expenses Less: Income Taxes (30%)Sivakumar KanchirajuNo ratings yet

- Net Income Basic EPS Common Stock $850,000 250,000 $3.4Document2 pagesNet Income Basic EPS Common Stock $850,000 250,000 $3.4Sivakumar KanchirajuNo ratings yet

- State Capital Structure Is Complex or Not:: Less Dividends On Preferred Stock 35,000Document1 pageState Capital Structure Is Complex or Not:: Less Dividends On Preferred Stock 35,000Sivakumar KanchirajuNo ratings yet

- 18 38PDocument2 pages18 38PSivakumar KanchirajuNo ratings yet

- Calculate The Weighted-Average Number of Shares For The Year 2013Document1 pageCalculate The Weighted-Average Number of Shares For The Year 2013Sivakumar KanchirajuNo ratings yet

- Calculate Weighted Average Number of Shares As Follows:: Tax Rate Is 30% Test The Bonds To Identify The Dilutive or NotDocument2 pagesCalculate Weighted Average Number of Shares As Follows:: Tax Rate Is 30% Test The Bonds To Identify The Dilutive or NotSivakumar KanchirajuNo ratings yet

- Evaluate Earnings Per ShareDocument2 pagesEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet