Professional Documents

Culture Documents

00-Text-Ch1 Additional Problems Updated

Uploaded by

zombies_meCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

00-Text-Ch1 Additional Problems Updated

Uploaded by

zombies_meCopyright:

Available Formats

ANALYSIS FOR FINANCIAL MANAGEMENT

10TH Edition

Robert C. Higgins

Additional Problems

Chapter 1

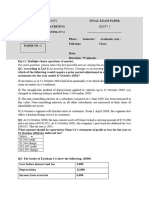

1) The following are the Balance Sheet and Income Statement for XYZ Corp.

December 31st

Year 0

Year 1

Current Assets

Cash

Accounts Receivable

Inventories

Total current assets

Noncurrent Assets

Land

Buildings

Equipment

Patent

Accumulated depreciation

Total noncurrent assets

Total Assets

Current Liabilities

Accounts payable to suppliers

Income taxes payable

Total current liabilities

Noncurrent Liabilities

Long term debt

Total liabilities

Shareholders Equity

Common Stock

Retained Earnings

Total shareholders equity

Total Liabilities and Shareholders Equity

$100,000

$95,000

$195,000

$132,000

$85,000

$75,000

$292,000

$30,000

200,000

120,000

10,000

(20,000)

340,000

$535,000

$30,000

310,000

130,000

10,000

(25,000)

455,000

$747,000

$100,000

100,000

$50,000

20,000

70,000

200,000

300,000

250,000

320,000

235,000

327,000

100,000

427,000

$747,000

235,000

$535,000

Income statement for Year 1

Sales revenue

Cost of good Sales

Depreciation expenses

Net interest expenses

Other expenses

Income before taxes

Provision for income taxes

Net income

Dividends paid

Additions to retained earnings

$335,000

(95,000)

(5,000)

(4,000)

(11,000)

220,000

(80,000)

$140,000

40,000

$100,000

a) Looking at the changes in balance sheet accounts, prepare a sources and uses statement for XYZ in

year 1.

b) Prepare a cash flow statement for XYZ in year 1.

2) Use the following information to estimate DTV Corporation's net cash flow from operations as it would

appear on the company's 2010 cash flow statement.

Net sales

Cost of goods sold

Gross income

Depreciation

General, selling expenses

Income before tax

Provision for taxes @ 40%

Income after tax

2009

$300

160

140

30

20

60

36

$54

2010

$400

200

200

40

20

140

66

$84

Cash

Accounts receivable

Inventory

$100

50

60

$50

100

40

Accrued taxes

Accrued wages

Accounts payable

$100

60

30

$120

30

40

3) Below is selected information about UVW Corporations financial statements for 2009 and 2010. All

other company accounts are the same for reporting and tax purposes. Use this information to do the

following:

a) Fill in the blanks in the companys 2010 data.

b) Show that the cash flow from operations in 2010 is the same whether one looks at the reporting

books or the tax books.

2009 Books of Account

Accrued taxes

Gross fixed assets

Accumulated depreciation

Reporting

Purposes

$150

1,000

300

Net sales

Operating costs

Depreciation

Income before tax

Provision for tax @ 34%

Income after tax

Reporting

Purposes

$100

50

10

40

?

$?

Tax

Purposes

$0

1,000

700

2010 Books of Account

Accrued taxes

Gross fixed assets

Accumulated depreciation

Net fixed assets

Taxes due @ 34%

Tax

Purposes

$100

50

30

20

?

$?

?

1,000

?

$?

?

1,000

?

$?

4). a. Is a company better or worse off when the market value of its liabilities falls $10

million? Why?

b. If you owned a company, would you prefer the market value of its assets to rise $10

million or the market value of its liabilities to fall $10 million? Why?

You might also like

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- F1 November 2010 AnswersDocument11 pagesF1 November 2010 AnswersmavkaziNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- HW#2Document6 pagesHW#2Kristy WuNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- AC327PracticeQuiz4 Chapter24 20141129WithoutAnswersDocument6 pagesAC327PracticeQuiz4 Chapter24 20141129WithoutAnswersJuanita Ossa Velez100% (1)

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- ACCT 310 Fall 2011 Midterm ExamDocument12 pagesACCT 310 Fall 2011 Midterm ExamPrince HakeemNo ratings yet

- PROBLEM Tugas AKM 2Document33 pagesPROBLEM Tugas AKM 2Dina Dwi Ningrum67% (3)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDocument13 pagesSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNo ratings yet

- Practical Accounting Problems 1Document4 pagesPractical Accounting Problems 1Eleazer Ego-oganNo ratings yet

- ACT3391 Spring 2013 Traditional HWItem Nos 1 To 5 SolutionsDocument2 pagesACT3391 Spring 2013 Traditional HWItem Nos 1 To 5 SolutionsAdrianna Nicole HatcherNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument8 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnwingssNo ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- Cash and Accrual BasisDocument36 pagesCash and Accrual BasisHoney LimNo ratings yet

- Solutions Guide: Key Differences Between IFRS and US GAAPDocument3 pagesSolutions Guide: Key Differences Between IFRS and US GAAPWilsonNo ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Financial Statements Practice ProblemsDocument5 pagesFinancial Statements Practice ProblemsnajascjNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Documents Subject Accounts Form4 9PartnershipAccountsDocument16 pagesDocuments Subject Accounts Form4 9PartnershipAccountsCartello008No ratings yet

- Assignment 01 Financial StatementsDocument5 pagesAssignment 01 Financial StatementsAzra MakasNo ratings yet

- Exam 1Document17 pagesExam 1chel5353No ratings yet

- Final - Problem Set FM FinalDocument25 pagesFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Ch02 P14 Build A Model (3) - SolutionDocument2 pagesCh02 P14 Build A Model (3) - SolutiongnoctunalNo ratings yet

- Chapter 2 Financial Statement and Analysis PDFDocument26 pagesChapter 2 Financial Statement and Analysis PDFRagy SelimNo ratings yet

- 2010-03-30 141643 Diane 3Document4 pages2010-03-30 141643 Diane 3Aarti JNo ratings yet

- Balance SheetDocument16 pagesBalance SheetFam Sin YunNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- Funds Flow StatementDocument4 pagesFunds Flow Statementsoumya_2688No ratings yet

- Financial Statement AnalysisDocument80 pagesFinancial Statement AnalysisSujatha SusannaNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJelwin Enchong BautistaNo ratings yet

- Calculate Working Capital Cycle & Cash Operating CycleDocument6 pagesCalculate Working Capital Cycle & Cash Operating CyclethomaspoliceNo ratings yet

- Mock Test 2 Review TestDocument8 pagesMock Test 2 Review TestYing LiuNo ratings yet

- Microsoft Corporation Financial StatementDocument6 pagesMicrosoft Corporation Financial StatementMega Pop LockerNo ratings yet

- ACC121 FinalExamDocument13 pagesACC121 FinalExamTia1977No ratings yet

- Week 13 Techniques of Financial Analysis (Lecture Note)Document19 pagesWeek 13 Techniques of Financial Analysis (Lecture Note)wawa1303No ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsSergei DragunovNo ratings yet

- Chapter 14 HomeworkDocument22 pagesChapter 14 HomeworkCody IrelanNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Mid-semester exam questions for business reporting and analysisDocument11 pagesMid-semester exam questions for business reporting and analysisb393208No ratings yet

- ACCT557 W2 AnswersDocument5 pagesACCT557 W2 AnswersDominickdad86% (7)

- T1.Tutorials 1 Introduction To Fin STMDocument4 pagesT1.Tutorials 1 Introduction To Fin STMmohammad alawadhiNo ratings yet

- False (Only Profit Increases Owner's Equity Not Cash Flow)Document6 pagesFalse (Only Profit Increases Owner's Equity Not Cash Flow)Sarah GherdaouiNo ratings yet

- FfsDocument9 pagesFfsDivya PoornamNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Financial Statement Analysis: Compute Missing Information Given A Set of RatiosDocument1 pageFinancial Statement Analysis: Compute Missing Information Given A Set of Ratiosshah md musleminNo ratings yet

- Acct101 Practice Exam Chapters 1 and 2Document15 pagesAcct101 Practice Exam Chapters 1 and 2leoeoa100% (2)

- RMCF 10-Q 20110831Document22 pagesRMCF 10-Q 20110831mtn3077No ratings yet

- A Level Accounting 31 Nov2011Document12 pagesA Level Accounting 31 Nov2011frieda20093835No ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- CIO Perspectives July 2015 NotesDocument2 pagesCIO Perspectives July 2015 Noteszombies_meNo ratings yet

- RIght Here Right Now - BluffmasterDocument2 pagesRIght Here Right Now - Bluffmasterzombies_meNo ratings yet

- ReadmeDocument35 pagesReadmeBugmenooootNo ratings yet

- Amazon & Leadership - The 14 Leadership Principles (Part 1) - Will Trevor MA - BSC Econ - Chartered Marketer - Pulse - LinkedInDocument6 pagesAmazon & Leadership - The 14 Leadership Principles (Part 1) - Will Trevor MA - BSC Econ - Chartered Marketer - Pulse - LinkedInzombies_meNo ratings yet

- Vennela Vennela Mellaga Raave LyricsDocument1 pageVennela Vennela Mellaga Raave Lyricszombies_meNo ratings yet

- 00-Text-Ch3 Additional Problems UpdatedDocument6 pages00-Text-Ch3 Additional Problems Updatedzombies_meNo ratings yet

- 00-Text-Ch5 Answers To Additional Problems UpdatedDocument2 pages00-Text-Ch5 Answers To Additional Problems Updatedzombies_meNo ratings yet

- 00-Text-Ch5 Answers To Additional Problems UpdatedDocument2 pages00-Text-Ch5 Answers To Additional Problems Updatedzombies_meNo ratings yet

- 00-Text-Ch4 Additional Problems UpdatedDocument1 page00-Text-Ch4 Additional Problems Updatedzombies_meNo ratings yet

- ExecuNet Sample Decent JobDocument2 pagesExecuNet Sample Decent Jobzombies_meNo ratings yet

- Financial Functions Excel TutorialDocument5 pagesFinancial Functions Excel Tutorialpleasetryagain12345No ratings yet

- 00-Text-Ch9 Additional Problems UpdatedDocument3 pages00-Text-Ch9 Additional Problems Updatedzombies_me0% (1)

- Mirza Ghalib Poetry Collection and Life OverviewDocument7 pagesMirza Ghalib Poetry Collection and Life Overviewzombies_me0% (1)

- 00-Text-Ch6 Additional Problems UpdatedDocument1 page00-Text-Ch6 Additional Problems Updatedzombies_meNo ratings yet

- Financial Analysis & Management TipsDocument1 pageFinancial Analysis & Management Tipszombies_meNo ratings yet

- SWOT Planner TemplateDocument9 pagesSWOT Planner Templatezombies_meNo ratings yet

- 00-Text-Ch6 Additional Problems UpdatedDocument1 page00-Text-Ch6 Additional Problems Updatedzombies_meNo ratings yet

- Appreciative Inquiry Positive QuestionDocument4 pagesAppreciative Inquiry Positive Questionzombies_meNo ratings yet

- Pricing DecisionsDocument34 pagesPricing Decisionszombies_meNo ratings yet

- Building The Skills of InsightsDocument6 pagesBuilding The Skills of Insightszombies_meNo ratings yet

- IAGB BylawsDocument11 pagesIAGB Bylawszombies_meNo ratings yet

- 00-Text-Ch9 Answers To Additional Problems UpdatedDocument949 pages00-Text-Ch9 Answers To Additional Problems Updatedzombies_meNo ratings yet

- Targeted Resume WritingDocument19 pagesTargeted Resume Writingzombies_meNo ratings yet

- 00 FinalPrep CheatSheet Raj 1.rock Final Cheat SheetDocument3 pages00 FinalPrep CheatSheet Raj 1.rock Final Cheat Sheetzombies_meNo ratings yet

- Finance Strategy Cheat SheetDocument2 pagesFinance Strategy Cheat Sheetzombies_meNo ratings yet

- 00-Text-Ch2 Additional Problems UpdatedDocument3 pages00-Text-Ch2 Additional Problems Updatedzombies_meNo ratings yet

- My Board ResolutionDocument2 pagesMy Board Resolutionzombies_meNo ratings yet

- Club, Wacker at Michigan: QuartersDocument1 pageClub, Wacker at Michigan: Quarterszombies_meNo ratings yet

- Cornell Note Pages X 2 Text Reading Notes1Document2 pagesCornell Note Pages X 2 Text Reading Notes1zombies_meNo ratings yet