Professional Documents

Culture Documents

Cus Not NT 63 18 06 15

Uploaded by

RKOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cus Not NT 63 18 06 15

Uploaded by

RKCopyright:

Available Formats

CUSTOMS NOTIFICATION

N.T. SERIES

-COPY OFNOTIFICATION

NO.63/2015-Customs (N.T.)

Dated 18th June, 2015

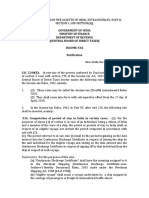

In exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and in super

session of the notification of the Central Board of Excise & Customs No.52/2015-CUSTOMS (N.T.), dated

18th June, 2015, except as respects things done or omitted to be done before such supersession, the Central

Board of Excise & Customs hereby determines that the rate of exchange of conversion of each of the foreign

currencies specified in column (2) of each of Schedule I and Schedule II annexed hereto, into Indian currency

or vice versa, shall, with effect from 19th June, 2015, be the rate mentioned against it in the corresponding

entry in column (3) thereof, for the purpose of the said section, relating to imported and export goods.

SCHEDULE-I

S.

No.

(1)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Foreign Currency

(2)

Australian Dollar

Bahrain Dinar

Canadian Dollar

Danish Kroner

EURO

Hong Kong Dollar

Kuwait Dinar

New Zealand Dollar

Norwegian Kroner

Pound Sterling

Singapore Dollar

South African Rand

Saudi Arabian Riyal

Swedish Kroner

Swiss Franc

UAE Dirham

US Dollar

Rate of exchange of one unit of foreign currency

equivalent to Indian rupees

(3)

(a)

(b)

(For Imported Goods)

(For Export Goods)

50.15

48.75

174.65

165.10

53.00

51.75

9.90

9.60

73.55

71.75

8.35

8.20

218.70

205.55

44.85

43.65

8.50

8.25

102.60

100.35

48.45

47.40

5.35

5.05

17.55

16.60

8.00

7.80

70.50

68.65

17.95

16.95

64.55

63.50

SCHEDULE-II

S.

No.

(1)

1.

2.

Foreign Currency

(2)

Japanese Yen

Kenya Shilling

Rate of exchange of 100 units of foreign currency

equivalent to Indian rupees

(3)

(a)

(b)

(For Imported Goods)

(For Export Goods)

52.55

51.40

67.35

63.55

Sd/(Satyajit Mohanty)

Director (ICD)

F.No.468/01/2015-Cus.V

Issued by:

Ministry of Finance

(Department of Revenue)

(Central Board of Excise and Customs)

New Delhi

** ** **

Information on this page is provided by Shakun & Company (Services) Private Limited, New Delhi, India to

its subscribers against the annual subscription. Non-subscribers may visit www.shakun.com for more details.

You might also like

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Document5 pagesIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Notification No. 41/2016 - Customs (N.T.)Document2 pagesNotification No. 41/2016 - Customs (N.T.)Anupam BaliNo ratings yet

- 17th July - Gazette 2184.21 - EDocument122 pages17th July - Gazette 2184.21 - EShami MudunkotuwaNo ratings yet

- csnt63 2013Document2 pagescsnt63 2013stephin k jNo ratings yet

- Exchange RateDocument3 pagesExchange Ratekoolmanoj27No ratings yet

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Document5 pagesDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jNo ratings yet

- csnt54 2013Document2 pagescsnt54 2013stephin k jNo ratings yet

- Customs Tariff Notification No.22/2014 Dated 11th July, 2014Document2 pagesCustoms Tariff Notification No.22/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- Notification No. 11/2014-Customs (ADD)Document3 pagesNotification No. 11/2014-Customs (ADD)stephin k jNo ratings yet

- 30th June - 2182-10 - EDocument26 pages30th June - 2182-10 - EShami MudunkotuwaNo ratings yet

- Master Circular On Export of GoodsDocument107 pagesMaster Circular On Export of GoodsArindam BiswasNo ratings yet

- RBI Master Direction on Export of Goods and ServicesDocument52 pagesRBI Master Direction on Export of Goods and Services8557994207No ratings yet

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Document3 pagesClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainNo ratings yet

- 2016 P T D 648Document4 pages2016 P T D 648haseeb AhsanNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- Circular No. 36 /2020-CustomsDocument16 pagesCircular No. 36 /2020-CustomsAshok KumarNo ratings yet

- 01-10 Feb 2013eximDocument16 pages01-10 Feb 2013eximgopvij1No ratings yet

- Handbook of Procedures GuideDocument174 pagesHandbook of Procedures GuideKrishna SinghNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2Hr legaladviserNo ratings yet

- Advisory 2710 2Document20 pagesAdvisory 2710 2Pushpraj SinghNo ratings yet

- Circular No 70 - NewDocument3 pagesCircular No 70 - NewHr legaladviserNo ratings yet

- Amendment May 22Document42 pagesAmendment May 22ASNo ratings yet

- DGFT Public Notice No.12/2015-2020 Dated 18th May, 2015Document10 pagesDGFT Public Notice No.12/2015-2020 Dated 18th May, 2015stephin k jNo ratings yet

- 01.02.2019 CGST Rules-2017 (Part-A Rules) PDFDocument149 pages01.02.2019 CGST Rules-2017 (Part-A Rules) PDFsridharanNo ratings yet

- Circular CGST 88Document8 pagesCircular CGST 88sanjitaNo ratings yet

- CGST Rules 2017: Key highlightsDocument163 pagesCGST Rules 2017: Key highlightsRakshit AgarwalNo ratings yet

- Explanation: For The Purposes of This RuleDocument2 pagesExplanation: For The Purposes of This Rulesanchu1981No ratings yet

- Operating InstructionsDocument3 pagesOperating InstructionsShami MudunkotuwaNo ratings yet

- Amendment in TDS Rules - Notification 41-2010Document15 pagesAmendment in TDS Rules - Notification 41-2010Nidhi MalhotraNo ratings yet

- CGST Rules 2017 SummaryDocument159 pagesCGST Rules 2017 SummaryVeli RangeNo ratings yet

- CGST Rules, 2017Document159 pagesCGST Rules, 2017Rahul RockzzNo ratings yet

- Anti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014Document9 pagesAnti Dumping Duty Notifications (Customs) No.35/2014 Dated 24th July, 2014stephin k jNo ratings yet

- 'RULE96Document3 pages'RULE96naren.invincible244No ratings yet

- Customs Tariff Notification No.25/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.25/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- Find Export PolicyDocument40 pagesFind Export PolicyMukaram Irshad NaqviNo ratings yet

- Customs Tariff Notification No.21/2014 Dated 11th July, 2014Document2 pagesCustoms Tariff Notification No.21/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Master Circular On ExportDocument42 pagesMaster Circular On ExportAJAY KUMAR JAINNo ratings yet

- GST Procedural UpdatesDocument15 pagesGST Procedural UpdatesSP CONTRACTORNo ratings yet

- Duty Drawback Feb 2020Document192 pagesDuty Drawback Feb 2020AkashAgarwalNo ratings yet

- Notifications Gist Upto 30.09.2020Document2 pagesNotifications Gist Upto 30.09.2020NishthaNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Advisory On GSTR-2B Dated 02.04.2021Document6 pagesAdvisory On GSTR-2B Dated 02.04.2021V RawalNo ratings yet

- Notification No. 9/2013-Customs (ADD)Document3 pagesNotification No. 9/2013-Customs (ADD)stephin k jNo ratings yet

- Highlights of Key Changes in GST W.E.F January 01, 2022Document5 pagesHighlights of Key Changes in GST W.E.F January 01, 2022sumathiravirajNo ratings yet

- Circular CGST 113Document7 pagesCircular CGST 113C DavidNo ratings yet

- Off Odr 14mar2013 2Document1 pageOff Odr 14mar2013 2stephin k jNo ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument88 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri Lankaharsha.dilan4320No ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- 2.vol I Section II ITBDocument26 pages2.vol I Section II ITBAnonymous LSYdi2yNo ratings yet

- Hand Book of Procedures Export & Import - Volume 1, India 2009 - 2014Document157 pagesHand Book of Procedures Export & Import - Volume 1, India 2009 - 2014focusindiagroupNo ratings yet

- Cir 170 02 2022 CGSTDocument7 pagesCir 170 02 2022 CGSTTushar AgrawalNo ratings yet

- FORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedDocument4 pagesFORM GSTR-2B - Advisory (Available Under "Advisory" Tab of GSTR-2B) Terms UsedSachin KNNo ratings yet