Professional Documents

Culture Documents

03.06.13 Mercury Athletic Slides

03.06.13 Mercury Athletic Slides

Uploaded by

08bch022Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03.06.13 Mercury Athletic Slides

03.06.13 Mercury Athletic Slides

Uploaded by

08bch022Copyright:

Available Formats

Mercury Athletic Footwear

Discussion Materials

For Additional Coverage of the Topics

Please See Your Professor

Or

E-mail me at jheilprin@hbs.edu

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Active Gear:

Active Gear is a relatively small athletic and casual

footwear company

$470.3 million of revenue and $60.4 million of EBIT

compared to typical competitors that sold well over a $1.0

billion annually

Company executives felt its small size was becoming

more of a disadvantage due to consolidation among

Chinese contract manufacturers

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Active Gear:

Products:

Specialty athletic footwear that evolved from high performance

to athletic fashion wear with a classic appeal

Casual/recreational footwear for walking, hiking, boating, etc.

Customers:

Affluent urban & suburbanites in the 25-45 age range (i.e.

Yuppies)

Brands are associated with upwardly mobile lifestyle

Distribution:

Department & specialty stores no big box retailers

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Active Gear:

Company strengths:

By focusing on a portfolio of classic brands, Active Gear has

been able to lengthen its product lifecycle

In turn, this has led to less operating volatility and better

supply chain management as well as lower DSI

Company weaknesses:

By avoiding the chase for the latest fashion trend and

avoiding big box retailers, the company has had very low

growth

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Mercury Athletic:

Mercury was a subsidiary of a large apparel company

As a result of a strategic realignment, the division was

considered to be non-core

2006 revenue and EBITDA were $431.1 million and

$51.8 million respectively

Under the egis of WCF, Mercurys performance was

mixed

WCF was able to expand sales of footwear, but was never able

to establish the hoped for apparel line

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Mercury Athletic:

Products:

Mens and womens athletic and casual footwear

Most products were priced in the mid-range

More contemporary fashion orientation

Customers:

Typical customers were in the 15-25 age range

Primarily associated with X-games enthusiasts and youth culture

Distribution:

Products were sold primarily through a wide range of retail,

department, and specialty stores including discount retailers

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Overview of Mercury Athletic:

Company strengths:

Established brand and identity within a well defined niche market that

seems to be growing

Strong top-line growth resulting from inroads with major retailers

Products were less complex; and therefore, cheaper to produce

Company weaknesses:

Increased sales came as a result of pricing concessions to large retailers

Proliferation of brands led to decreased operating efficiency and a

longer DSI

Womens casual footwear was a disaster

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Strategic Considerations:

Central Question: What Are the Likely Rationales for

a Combination of Active Gear and Mercury?

How do the acquirer and target fit together?

What are the potential sources of value?

How would any potential sources of value be realized?

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Strategic Considerations:

Potential sources of value creation:

Operating synergies coming from economies of scale with

respect to contract manufacturers

Perhaps some economies of scope with respect to

distribution extending the distribution network

Possible combination of the womens casual lines

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Strategic Considerations:

Counter arguments to value creation:

Poor strategic fit Mercurys focus is on a totally different

market demographic

Likewise, Mercurys niche maybe significantly more prone

to fashion fads

Continued growth of extreme sports category may make

Mercurys business vulnerable to the large athletic shoe

companies

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Explicit forecast period is based on the analysts judgment

TV is the going concern value at the end of

the explicit forecast period

Mercury Athletic Footwear

Firm Value & Cash Flows:

As a starting point, lets start with a basic valuation

paradigm

Annual Forecasts

Terminal Value

Note that the sole determinant of value is the generation of cash

flow

Further the only relevant factors are the amounts, timing and

risks of the cash flows

FCF is assumed to be the mean of an a random distribution

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

NOPAT

Net reinvestment

Mercury Athletic Footwear

Firm Value & Cash Flows:

Determination of FCF

To begin, the preceding equation led to a value of the entire

enterprise, meaning V = D + E

Thus, we are interested in what the total business is worth

irrespective of who gets the cash or how its financed

In turn, this means we are interested in the un-levered FCF

Un-Levered FCF = EBIT(1-t) + Depr - WC Cap-x

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Firm Value & Cash Flows:

Determination of FCF

In case Exhibit 6, Liedtke provides a set of projections for

each of the operating segments Thus,

Segment Revenue

Multiplying EBIT by (1-t) yields Consolidated

Less: Segment Operating Expenses

Corporate Overhead

the first term in the FCF equation Less:

Operating Income = EBIT

Question: Are taxes being overstated?

It is true that interest expense creates a tax shield

However, the value of the tax shield is acknowledged in the

WACC or in a separate calculation when using APV

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Firm Value & Cash Flows:

Determination of FCF

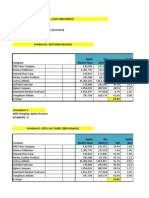

Having calculated NOPAT, we should have the following results, and are now in a position to proceed to

the next step in FCF determination

Note that the administrative charge has not been included in operating expenses

This is because the new owner would not incur the cost, and youll note that its not included in Liedtkes projection

To move from NOPAT to FCF we will simply subtract all of the net reinvestment in the firms operations

This is the same as subtracting the NOA; or in our case, (Cap-x + Depr WC)

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Note that cash for larger firms with

access to capital markets may not

be part of working capital

Net Fixed Assets

Mercury Athletic Footwear

Firm Value & Cash Flows:

Determining FCF - WC

By reorganizing the balance sheet as shown, the

net operating assets and liabilities can be

quickly segregated

Based on Exhibit 7, the working capital assets are

cash, accounts receivable, inventory, prepaid

expenses

The WC liabilities are accounts payable and accrued

expenses

Of course, the same excise can be used to

determine the net investment in fixed assets

(cap-x Depreciation)

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Firm Valuation & Cash Flows:

Determining FCF final thoughts

Based on the preceding exercise involving the reorganized

balance sheet, we can see that the DCF methodology is aimed at

valuing the operations of the firm (left side of B/S)

Further, we can see

FCF = EBIT(1-t) - WC - Net Fixed Assets

By forcing every line item to be placed in one of the B/S

buckets, we ensure that ALL of the changes in operating assets

& liabilities are reflected in FCF

Not just those included in working capital, cap-x or depreciation

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Liedtkes Projections:

Using the information contained in Exhibit 6, the following

set of FCF projections can be developed:

Are Liedtkes projections reasonable?

Consider the revenue growth rates & operating margins

What about the changes in working capital?

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Liedtkes Projections:

To begin with, the EBIT

margins are highly simplified

though not unreasonable

There is a tapering off of

growth in athletic shoes

Mens casual is assumed to

grow at what might be the

The relatively high growth rates in athletic shoes

long-term rate of the industry for the early years are presumably a result of

continued expansion into large discount retailers

Womens casual is to be

discontinued

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Liedtkes Projections:

Changes in net working capital

Notice that the increase in 2008 is smaller than that of 2007, and that the

rate of increases again in 2009 and falls in 2010-2011

Liedtke has based his WC projections on historical cash cycle ratios

The volatility is the result of discontinuing the womens casual line along with a

lagging effect from changes in revenue growth

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Cost of Capital:

Exhibit 3, provides some comparable company

information that includes observed equity betas along

with the market values for debt and equity

Using that information each comparable firms asset beta

can be obtained using one of the following

asset = (E/V)equity or asset = (E/(E + net Debt(1-t)))equity

Assumes a constant D/V ratio

and a debt of zero

Harvard Business School

Assumes a changing capital structure with a debt

of zero

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Cost of Capital:

Based on the preceding, the following average unlevered beta can be obtained

If a changing capital

structure had been

assumed, the un-levered

beta would have been 1.37

A constant capital structure was used based on Liedtkes

choice of a WACC based on a 20% D/V ratio

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

If the d > 0

Mercury Athletic Footwear

Cost of Capital:

With an average asset beta in hand, a new equity beta

can be obtained based on Liedtkes assumed 20% D/V

equity = assets(V/E) => 1.28(1/.8) = 1.6

Using CAPM, the required return on equity is

re = rf + e(EMRP) => 4.93% + (1.6)(5%) = 12.92%

The complete WACC is

Harvard Business School

Joel L. Heilprin

Assumes the Equity Market

Risk Premium is 5% and the

tax rate is 40%

59th Street Partners LLC

Mercury Athletic Footwear

Terminal Value:

If Mercury has indeed reached a steady state by 2011,

then we can envision the firm as providing a stream of

cash flows that grows at a constant rate forever

This would imply that the going concern could be valued as

a growth perpetuity

PV2011 = (FCF2011)(1+g)/(r g)

Given that we have already developed estimates for FCF

and WACC, an estimate of the long-term growth rate needs

to be calculated

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Terminal Value:

Estimating the long term growth rate

As a starting point, no business can grow faster than the macro

economy on a continuous basis

Thus, an upper-bound equal to the long-run macro economic growth rate

must exist

In terms of lower bounds, the long-term growth rate must be positive

or else the firm would not be a going concern (i.e. it would have a

finite life)

A growth rate equal to the long-run rate of inflation would suggest a

zero real growth rate

In the case of Mercury, this would seem to be the lower bound

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Terminal Value:

Estimating the long-term growth rate

Conceptually, the growth rate should be tied to estimates of

long-term profitability and reinvestment Specifically:

(Return on Capital)(Net Reinvestment Rate) = EBIT growth

Obviously, Liedtkes forecasted cash flows violate the above

assumptions in the near-term; but, that does not mean the

above equation doesnt hold after 2011

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Terminal Value:

Based on the 2011 projections, Mercurys long-term

growth rate would be as follows:

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Completed Valuation:

Below is a completed valuation of Mercury based on a

WACC of 11.06% and a long run growth rate of 2.78%

Firm value is equal to the value of the operations plus the

value of net non-operating assets (i.e. 2006 excess cash)

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

Mercury Athletic Footwear

Completed Valuation:

The table below shows the sensitivity to growth rates

and discount rates

Note the extreme variance of results even if the range is tightened to a

growth rate of 2.78% - 4% and a discount rate from 10% - 12%

Harvard Business School

Joel L. Heilprin

59th Street Partners LLC

You might also like

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- New Heritage Doll CompanyDocument12 pagesNew Heritage Doll CompanyRafael Bosch60% (5)

- Mercury Athletic Footwear Case SolutionDocument3 pagesMercury Athletic Footwear Case SolutionDI WU100% (2)

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- New DollDocument2 pagesNew DollJuyt HertNo ratings yet

- New Heritage Doll Company:: Capital BudgetingDocument27 pagesNew Heritage Doll Company:: Capital BudgetingInêsRosário100% (8)

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyAnonymous xJLJ4CKNo ratings yet

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Mercury Athletic (Student Templates) FinalDocument6 pagesMercury Athletic (Student Templates) FinalGarland GayNo ratings yet

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- New Heritage Doll CaseDocument9 pagesNew Heritage Doll Caseapi-30934141185% (13)

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Document5 pagesQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenNo ratings yet

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Mercury Athletic Case PDFDocument6 pagesMercury Athletic Case PDFZackNo ratings yet

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Mercury AthleticDocument8 pagesMercury AthleticVaidya Chandrasekhar100% (1)

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- New Heritage Doll Company Case SolutionDocument31 pagesNew Heritage Doll Company Case SolutionSoundarya AbiramiNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- Midland Energy ReportDocument13 pagesMidland Energy Reportkiller dramaNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic Footwearandy117950% (2)

- New Heritage Doll CompanyDocument5 pagesNew Heritage Doll CompanyRahul LalwaniNo ratings yet

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- New Heritage Doll (NHD) : Figure 1: The Current ProcessDocument2 pagesNew Heritage Doll (NHD) : Figure 1: The Current Processrath3477100% (4)

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- Air Thread ReportDocument13 pagesAir Thread ReportDHRUV SONAGARA100% (2)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- Chapter 15 Company AnalysisDocument51 pagesChapter 15 Company Analysissharktale282850% (2)

- A Special Message - The 1% SolutionDocument27 pagesA Special Message - The 1% SolutionRaju Mahato0% (1)

- 711 Business Description and BCGDocument10 pages711 Business Description and BCGKhalilBenlahccenNo ratings yet

- Walmart's Acquisition of FlipkartDocument10 pagesWalmart's Acquisition of FlipkartAnuj SohaniNo ratings yet

- Mercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinDocument7 pagesMercury Athletics Footwear Case: B52.FIN.448 Advanced Financial Management Professor Roni KisinFaith AllenNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- Mercury Case Report Vedantam GuptaDocument9 pagesMercury Case Report Vedantam GuptaVedantam GuptaNo ratings yet

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic FootwearJon BoNo ratings yet

- Mercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentDocument9 pagesMercury Athletic Footwear - Valuing The Opportunity: FINS 3625 - Case Study Written ComponentBharat KoiralaNo ratings yet

- Mercury Athletic Case SectionBDocument15 pagesMercury Athletic Case SectionBVinith VemanaNo ratings yet

- Fin 321 Case PresentationDocument19 pagesFin 321 Case PresentationJose ValdiviaNo ratings yet

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Mercury Athletic Footwear: Ashutosh DashDocument49 pagesMercury Athletic Footwear: Ashutosh DashSaurabh ChhabraNo ratings yet

- Mercury Athletic QuestionsDocument1 pageMercury Athletic QuestionsRazi UllahNo ratings yet

- Mercury QuestionsDocument6 pagesMercury Questionsapi-239586293No ratings yet

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearMahnoor MaalikNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Heritage Doll CompanyDocument11 pagesHeritage Doll CompanyDeep Dey0% (1)

- Valuation of AirThreadConnectionsDocument3 pagesValuation of AirThreadConnectionsmksscribd100% (1)

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- ACC501 - Lecture 22Document45 pagesACC501 - Lecture 22Shivati Singh Kahlon100% (1)

- Brand Finance Global 500Document40 pagesBrand Finance Global 500JulianNo ratings yet

- Airline or Aviation Business PlanDocument25 pagesAirline or Aviation Business PlanUtkarsh Choudhary100% (1)

- Earnings and Cash Flow Analysis: SlidesDocument6 pagesEarnings and Cash Flow Analysis: Slidestahera aqeelNo ratings yet

- From Business Activities To Financial Statements: Four Key Components of Effective Financial Statement AnalysisDocument30 pagesFrom Business Activities To Financial Statements: Four Key Components of Effective Financial Statement Analysis10061979No ratings yet

- Strategy - Chapter 5Document5 pagesStrategy - Chapter 532_one_two_threeNo ratings yet

- Profit and Loss Statement MeaningDocument6 pagesProfit and Loss Statement MeaningjohannaNo ratings yet

- Week 2Document9 pagesWeek 2Angelina ThomasNo ratings yet

- Working Capital Report - Finance Dept. DUDocument23 pagesWorking Capital Report - Finance Dept. DUAhmed RezaNo ratings yet

- Takaful Companies and Products in MalaysiaDocument55 pagesTakaful Companies and Products in MalaysiaMohammed AlshuaibiNo ratings yet

- Georgetown Case Competition: ConfidentialDocument17 pagesGeorgetown Case Competition: ConfidentialPatrick BensonNo ratings yet

- Ranjan Sir Lecture - Details - UnlockedDocument77 pagesRanjan Sir Lecture - Details - UnlockedTumpakuri67% (6)

- The Working Group On Money Supply Analytics and Methodology of CompilationDocument116 pagesThe Working Group On Money Supply Analytics and Methodology of Compilationlionshare148No ratings yet

- Company Overview and HistoryDocument4 pagesCompany Overview and HistoryCA Deepak AgarwalNo ratings yet

- Delhi Science Forum V Union of India 1996Document17 pagesDelhi Science Forum V Union of India 1996Manisha SinghNo ratings yet

- Project Report On NPA Policies of Bank of MaharashtraDocument64 pagesProject Report On NPA Policies of Bank of MaharashtraAMIT K SINGH88% (8)

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- Bukidnon State University: ALLADO, GLAIZA MAE B. MM208 Philippine Business EnvironmentDocument2 pagesBukidnon State University: ALLADO, GLAIZA MAE B. MM208 Philippine Business EnvironmentMary Rose JotaNo ratings yet

- Chapter 14Document7 pagesChapter 14adam610No ratings yet

- (A CASE STUDY IN CIVIL LINES, ALLAHABADDocument13 pages(A CASE STUDY IN CIVIL LINES, ALLAHABADGanesh PandeyNo ratings yet

- Balance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Document10 pagesBalance Sheets: The Basics: Balance Sheet Reporting - Who, When and Where?Rama KrishnanNo ratings yet

- Vijaya Sampath PresentationDocument15 pagesVijaya Sampath PresentationManjinder SinghNo ratings yet

- Balance Sheet 1.infosysDocument10 pagesBalance Sheet 1.infosysmoonlight3t31No ratings yet

- RocDelhiSTK5 24112017Document32 pagesRocDelhiSTK5 24112017Ronit KumarNo ratings yet

- AssumptionsDocument3 pagesAssumptionsShaheen MahmudNo ratings yet

- ??. Wired USA. December 2019Document102 pages??. Wired USA. December 2019Enrique Gonzalez De Gor CrookeNo ratings yet

- Session 5b Cash Flow Statement: HI5020 Corporate AccountingDocument18 pagesSession 5b Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Teleperformance Press Release 2018 Full Year Results VDEFDocument18 pagesTeleperformance Press Release 2018 Full Year Results VDEFahmed abhdaNo ratings yet

- Bus Com 5Document4 pagesBus Com 5Chabelita MijaresNo ratings yet

- Scovia PDFDocument25 pagesScovia PDFlaniNo ratings yet

- Quiz Questions: (1 Point)Document5 pagesQuiz Questions: (1 Point)nainNo ratings yet

- The Role of Stock Market Development in InfluencinDocument11 pagesThe Role of Stock Market Development in InfluencinShahab ShafiNo ratings yet

- Shareholders Equity Part 1Document57 pagesShareholders Equity Part 1AlliahDataNo ratings yet

- Business Finance II: Course Title: Course ID: FIN302 Section: 02 Semester: Spring, 2022Document25 pagesBusiness Finance II: Course Title: Course ID: FIN302 Section: 02 Semester: Spring, 2022gaja babaNo ratings yet

- Women's Jobs in The 16th CenturyDocument5 pagesWomen's Jobs in The 16th CenturyJuanNo ratings yet

- Chapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument15 pagesChapter 14 Interest Rate and Currency Swaps Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsBijay AgrawalNo ratings yet