Professional Documents

Culture Documents

Chapter 8

Chapter 8

Uploaded by

Clyette Anne Flores BorjaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8

Chapter 8

Uploaded by

Clyette Anne Flores BorjaCopyright:

Available Formats

CHAPTER 8

INVESTMENT PROPERTY, OTHER NONCURRENT FINANCIAL ASSETS

AND NONCURRENT ASSETS HELD FOR SALE

PROBLEMS

8-1

Investment Property

(a), (b), (c), (e), (g), (o), (r) with option to or not to report as investment property

(d)

(f)

(h)

(i)

(j)

(k)

(l)

(m)

(n)

(p)

(q)

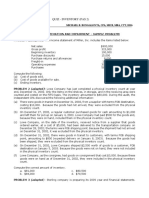

8-2

(Sebastian Corporation)

a.

Purchase price

Commission to real estate agent

Costs of clearing the land (net of timber and gravel recovered

amounting to P65,000)

Total cost

.

b.

8-3

not shown in the financial statements

Property, Plant and Equipment

Property, Plant and Equipment, until consummation of lease

Inventories

Inventories

Construction in Progress (Inventories)

Property, Plant and Equipment

Property, Plant and Equipment

Property, Plant and Equipment

Property, Plant and Equipment

not shown, unless leased under finance lease (PPE)

P 8,600,000

430,000

70,000

P 9,100,000

Down payment

Market value of shares issued (20,000 x 240)

Present value of non-interest bearing note issued

(2,000,000 x 2.4869)

Total cost of land and building

P 4,000,000

4,800,000

Cost allocated to land (30% x 13,773,800)

Cost allocated to building (70% x 13,773,800)

P 4,132,140

P 9,641,660

(Precious Realty Corporation)

1/2/12

Buildings

Accumulated Depreciation Building Held as

Investment Property

Buildings Held as Investment Property

Accumulated Depreciation - Buildings

12/31/12

Depreciation Expense Buildings

Accumulated Depreciation - Buildings

4,973,800

P13,773,800

8,200,000

4,200,000

8,200,000

4,200,000

200,000

200,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

8-4

Absolute Corporation

Cost Model

(a)

Investment Property at December 31, 2012

Land

Building

Cost

Accumulated Depreciation

20,000,000/40 x 3

Total Investment Property

(b)

Amounts and Accounts Taken to Profit or Loss

Rent Revenue

Depreciation Expense

Administrative and Security Salaries

Property Taxes

Maintenance

Profit

Fair Value Model

(a)

Investment Property at December 31, 2012

Land

Building

Total Investment Property

(b)

8-5

Amounts and Accounts Taken to Profit or Loss

Rent Revenue

Change in Fair Value of Investment Property

Land

Building

Depreciation Expense

Administrative and Security Salaries

Property Taxes

Maintenance

Profit

Raymond Company

1.

Building Construction Fund Cash

Cash

2.

Building Expansion Fund Securities

Building Expansion Fund Cash

3.

Building Expansion Fund Securities

Interest Receivable Building Expansion Fund

Building Expansion Fund Cash

4.

Building Expansion Fund Cash

Dividend Income

5.

Building Expansion Fund Expenses

Building Expansion Fund Cash

83

P 5,000,000

P20,000,000

1,500,000

18,500,000

P23,500,000

P 3,000,000

(500,000)

(200,000)

(120,000)

(340,000)

P1,960,000

P6,800,000

20,000,000

P26,800,000

P 3,000,000

800,000

1,000,000

(500,000)

(200,000)

(120,000)

(340,000)

P3,760,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

6.

Building Expansion Fund Cash

Interest Receivable Building Expansion Fund

Interest Income

7.

Building Expansion Fund Securities

Building Expansion Fund Cash

8.

Building Expansion Fund Cash

Building Expansion Fund Securities

Gain on Sale of Building Expansion Fund Securities

Interest Income

9.

Building Expansion Fund Cash

Dividend Income

10.

Building Expansion Fund Cash

Building Expansion Fund Securities

Gain on Sale of Building Expansion Fund Securities

11.

Buildings

Building Expansion Fund Cash

12.

Cash

Building Expansion Fund Cash

8-6

Cordero Corporation

a.

Required Semiannual Deposit

= P15,000,000/ FV of annuity of 1 discounted at 4% for 20 periods

= P15,000,000 / 29.7781 = P503,726

b.

1/2/12

Bond Sinking Fund Cash

Cash

503,726

503,726

6/30/12

Bond Sinking Fund Cash

Cash

Interest Income (503,726 x 4%)

12/31/12

Bond Sinking Fund Cash

Cash

Interest Income

4% ( 503,726 + 523,875) = 41,104

8-7

523,875

503,726

20,149

544,830

503,726

41,104

Dorina Company

a.

Entries for 2008 through 2013

7/01/08

Prepaid Life Insurance

Cash

120,000

120,000

12/31/08 Life Insurance Expense

Prepaid Life Insurance

60,000

60,000

84

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

06/30/09 Prepaid Life Insurance

Cash

120,000

12/31/09 Life Insurance Expense

Prepaid Life Insurance

120,000

06/30/10 Prepaid Life Insurance

Cash

12/31/10 Life Insurance Expense

Prepaid Life Insurance

120,000

06/30/11 Prepaid Life Insurance

Cash

120,000

12/31/11 Life Insurance Expense

Prepaid Life Insurance

120,000

120,000

120,000

120,000

120,000

120,000

120,000

120,000

12/31/11 Cash Surrender Value*

Life Insurance Expense

36,000

36,000

06/30/12 Prepaid Life Insurance

Cash

120,000

12/31/12 Life Insurance Expense

Prepaid Life Insurance

120,000

3/31/13

120,000

120,000

Cash Surrender Value

Life Insurance Expense

13,000

Life Insurance Expense

Prepaid Life Insurance

30,000

13,000

30,000

Receivable from Insurance Company

Prepaid Life Insurance

Cash Surrender Value

Gain on Insurance Settlement

4,000,000

30,000

49,000

3,921,000

*The cash surrender value of life insurance may be recognized on the anniversary date

(June 30, 2011 and every June 30 thereafter). No proportionate adjustment, however, is

necessary at year end because there is no actual increase in cash surrender between

anniversary dates.

b.

8-8

If the president or his heirs were the beneficiaries of the policy, the premiums paid shall

be charged to employees benefit expense and no cash surrender value will be set up by

the company.

Solidbank

a.

b.

c.

P10,000,000 x 0.3220 = P3,220,000

Interest Income in 2011 = 12% x P3,220,000 = P386,400

1/1/11

Advances to Officers

3,220,000

Prepaid Compensation Expense

6,780,000

Cash

10,000,000

85

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

12/31/11 Advances to Officers

Interest Revenue

386,400

386,400

Compensation Expense

678,000

Prepaid Compensation Expense

6,780,000/10 = 678,000

12/31/ Advances to Officers

432,768

Interest Revenue

(3,220,000 + 386,400) x 12% = 432,768

Compensation Expense

Prepaid Compensation Expense

678,000

432,768

678,000

678,000

d.

8-9

Amortized Cost at December 31, 2012 = 3220,000 + 386,400 + 432,768 =

4,039,168

Patriarch, Inc.

a

12/31/11 Machinery Group Held For Sale

1,400,000

Accumulated Depreciation Machinery

1,200,000

Impairment Loss Machinery

200,000

Machinery

2,200,000

Machinery Tools

380,000

Machinery Parts

220,000

b.

8-10

07/17/12 Cash (1,520,000 60,000)

Machinery Group Held For Sale

Gain on Sale of Machinery

(Invecargill Ltd.)

a.

08/01/12 Impairment Loss Equipment

Loss from Decline in NRV of Inventory

Accumulated Depr- Equipment

Inventory

b.

c.

Assets Held for Sale

Accumulated Depreciation

Impairment Loss

Plant

Equipment

Inventory

Goodwill

02/01/13 Cash (380,000 30,000)

Assets Held For Sale

86

1,460,000

1,400,000

60,000

15,000

5,000

15,000

5,000

350,000

95,000

30,000

220,000

160,000

75,000

20,000

350,000

350,000

Chapter 8 Investment Property, Other Non-current Financial Assets & Non-current Assets Held for Sale

8-11

Correction: Change March 1 to March 31

Cost = 42,000

3/5) = 70,000 Accumulated Depreciation = 70,000 42,000 = 28,000

(a)

Mar. 31 Depreciation Expense (14,000 x 3/12)

Accumulated Depreciation

Asset Held for Sale

Impairment Loss

Accumulated Depreciation

Equipment

(b)

3,500

3,500

36,000

2,500

31,500

70,000

Dec. 31 Asset Held for Sale

Recovery of Previous Impairment

2,500

Dec. 31 Impairment Loss

Asset Held for Sale

1,000

2,500

1,000

MULTIPLE CHOICE

MC1

MC2

MC3

MC4

MC5

MC6

MC7

MC8

MC9

MC10

MC11

MC12

MC13

MC14

MC15

MC16

MC17

MC18

MC19

MC20

MC21

MC22

MC23

C

C

B

A

B

C

C

D

B

A

B

A

D

B

C

A

B

A

D

D

C

A

D

MC24

MC25

D

C

MC26

MC27

MC28

MC29

B

D

B

C

10M + 20M = 30M

Revaluation surplus is credited; transfer is from owner-occupied property.

20,000,000 15,000,000

18,000,000 x 39/40 = 17,550,000; depreciation = 18,000,000/40 = 450,000

FV = 20,000,000; gain = 20,000,000 18,000,000 = 2,000,000

110,000 (115,000 80,000) = 75,000

9,000,000 1,500,000 = 7,500,000 which is lower than carrying amount of

P8,000,000.

(9,200,000 1,300,000) 7,500,000 = 400,000

2,000,000 x 0.7972 = 1,594,400

1,594,400 x 12% x 6/12 = 95,664; 1,594,400 + 95,664 = 1,690,064

100,000 + (200,000 160,000) = 140,000

40,000 (108,000 87,000) 6,000 = 13,000

2,250,000 + 450,000 + 75,000 + 150,000 25,000 = 2,900,000

5,000,000/ 5.11 = 978,500

87

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Momentum-Trading PDFDocument40 pagesMomentum-Trading PDFNDamean100% (1)

- PP Vs DioDocument2 pagesPP Vs DioPrincessAngelaDeLeon100% (2)

- Quiz in Corporation LawDocument8 pagesQuiz in Corporation LawPrincessAngelaDeLeon100% (3)

- CMA - Event Management 21.05.2019Document22 pagesCMA - Event Management 21.05.2019madhukar sahayNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- StudentDocument45 pagesStudentJoel Christian MascariñaNo ratings yet

- 2014 Vol 1 CH 6 AnswersDocument6 pages2014 Vol 1 CH 6 AnswersSimoun Torres100% (2)

- Answers - Chapter 4 Vol 2 RvsedDocument15 pagesAnswers - Chapter 4 Vol 2 Rvsedjamflox50% (2)

- Week 2 Output-KingDocument4 pagesWeek 2 Output-KingAlexis KingNo ratings yet

- 5BMAS5D03 ABMandABCDocument5 pages5BMAS5D03 ABMandABCCykee Hanna Quizo LumongsodNo ratings yet

- Answer Key For EmpleoDocument17 pagesAnswer Key For EmpleoAdrian Montemayor100% (2)

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Quiz in PartnershipDocument5 pagesQuiz in PartnershipPrincessAngelaDeLeon0% (1)

- Quiz in AgencyDocument3 pagesQuiz in AgencyPrincessAngelaDeLeonNo ratings yet

- Technical Analysis of StockDocument77 pagesTechnical Analysis of StockBhavesh RogheliyaNo ratings yet

- CRISIL Research Ier Report Chamanlal SetiaDocument18 pagesCRISIL Research Ier Report Chamanlal Setiabharat005No ratings yet

- Fin Ac Robles Empleo CH 5 Vol 1 Answers2012Document18 pagesFin Ac Robles Empleo CH 5 Vol 1 Answers2012Engel Ken Castro71% (7)

- 2014 Vol 1 CH 7 AnswersDocument18 pages2014 Vol 1 CH 7 AnswersSimoun Torres83% (6)

- Property, Plant and Equipment Problems 5-1 (Uy Company)Document14 pagesProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Chapter 15-Financial Planning: Multiple ChoiceDocument22 pagesChapter 15-Financial Planning: Multiple ChoiceadssdasdsadNo ratings yet

- Cost Ac Rante Chap 1Document17 pagesCost Ac Rante Chap 1Charlene Baldera0% (2)

- Answers - V2Chapter 3 2012 PDFDocument17 pagesAnswers - V2Chapter 3 2012 PDFkea paduaNo ratings yet

- Provisions, Contingent Liabilities and Contingent Asset MillanDocument5 pagesProvisions, Contingent Liabilities and Contingent Asset MillanRhodelyn BananiaNo ratings yet

- PUP-GovAct-Syllabus - 2020 PDFDocument6 pagesPUP-GovAct-Syllabus - 2020 PDFAngela QuililanNo ratings yet

- Examination About Investment 4Document3 pagesExamination About Investment 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- ReviewerDocument5 pagesReviewermaricielaNo ratings yet

- MAS CompiledDocument5 pagesMAS CompiledadorableperezNo ratings yet

- CH 6 Answers Vol 1Document6 pagesCH 6 Answers Vol 1Jully GonzalesNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123No ratings yet

- AP Equity 1Document3 pagesAP Equity 1Mark Michael Legaspi100% (1)

- 2019 Intacc2A MA1 CLiabilitiesDocument1 page2019 Intacc2A MA1 CLiabilitiesAlyssa MabalotNo ratings yet

- Armhyla Olivar FM Taxation 8Document4 pagesArmhyla Olivar FM Taxation 8Grace Umbaña YangaNo ratings yet

- Investments in Debt Securities: Problem 1: True or FalseDocument27 pagesInvestments in Debt Securities: Problem 1: True or FalseAlarich CatayocNo ratings yet

- Pre-Test 7Document3 pagesPre-Test 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- LEC 5 Standard Costing and Variance AnalysisDocument33 pagesLEC 5 Standard Costing and Variance AnalysisKelvin CulajaráNo ratings yet

- CH 9 AnswersDocument3 pagesCH 9 AnswersRaymundo VyNo ratings yet

- Chapter 20 - Teacher's Manual - Far Part 1BDocument8 pagesChapter 20 - Teacher's Manual - Far Part 1BPacifico HernandezNo ratings yet

- Chapter 9 - Auditing ResourcesDocument10 pagesChapter 9 - Auditing ResourcesSteffany RoqueNo ratings yet

- Advanced Financial Accounting and Reporting (CPALE Review)Document3 pagesAdvanced Financial Accounting and Reporting (CPALE Review)Micko LagundinoNo ratings yet

- Pre-Test 10Document2 pagesPre-Test 10BLACKPINKLisaRoseJisooJennieNo ratings yet

- Comprehensive Topics HandoutsDocument16 pagesComprehensive Topics HandoutsGrace CorpoNo ratings yet

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDocument7 pages2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- CH 8 AnswersDocument5 pagesCH 8 Answersmharieee13No ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Investment Property, Other Noncurrent Financial Assets and Noncurrent Assets Held For Sale Problems 8-1 (Sebastian Corporation)Document5 pagesInvestment Property, Other Noncurrent Financial Assets and Noncurrent Assets Held For Sale Problems 8-1 (Sebastian Corporation)ExequielCamisaCrusperoNo ratings yet

- 2021 - A2S2 Solution-OplossingDocument19 pages2021 - A2S2 Solution-OplossingmeghdyckNo ratings yet

- Acc01b1 Rek1b01 Main PDFDocument10 pagesAcc01b1 Rek1b01 Main PDFLebohang NgubaneNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- ReviewerDocument4 pagesReviewerDrie LimNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Chapter18 BuenaventuraDocument6 pagesChapter18 BuenaventuraAnonnNo ratings yet

- Fra 300 January - June 2016 Mid - Semester Exams - Marking SchemeDocument6 pagesFra 300 January - June 2016 Mid - Semester Exams - Marking SchemeTissie MkumbadzalaNo ratings yet

- Final ReviewDocument53 pagesFinal ReviewLalalaNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- Intermediate Accounting 2 Quiz #3Document4 pagesIntermediate Accounting 2 Quiz #3Claire Magbunag AntidoNo ratings yet

- LatihanDocument7 pagesLatihanDeny WilyartaNo ratings yet

- Baleros Vs PeopleDocument4 pagesBaleros Vs PeoplePrincessAngelaDeLeonNo ratings yet

- People V AguilosDocument2 pagesPeople V AguilosPrincessAngelaDeLeon100% (5)

- People Vs DecenaDocument1 pagePeople Vs DecenaPrincessAngelaDeLeonNo ratings yet

- People V. Narvaez GR. Nos. L-33466-67 Makasiar, J.: FactsDocument3 pagesPeople V. Narvaez GR. Nos. L-33466-67 Makasiar, J.: FactsPrincessAngelaDeLeonNo ratings yet

- People V SaladinoDocument1 pagePeople V SaladinoPrincessAngelaDeLeon100% (1)

- Mamangun V People - GR NO 149152Document2 pagesMamangun V People - GR NO 149152PrincessAngelaDeLeon100% (2)

- Valenzuela Vs PeopleDocument2 pagesValenzuela Vs PeoplePrincessAngelaDeLeon100% (5)

- Sulpico Intod Vs CADocument1 pageSulpico Intod Vs CAPrincessAngelaDeLeonNo ratings yet

- Mamangun V People - GR NO 149152Document2 pagesMamangun V People - GR NO 149152PrincessAngelaDeLeon100% (2)

- People v. IliganDocument2 pagesPeople v. IliganPrincessAngelaDeLeonNo ratings yet

- Ivler vs. San Pedro (Martin)Document3 pagesIvler vs. San Pedro (Martin)PrincessAngelaDeLeonNo ratings yet

- People vs. Sy PioDocument3 pagesPeople vs. Sy PioPrincessAngelaDeLeon100% (2)

- People V KalaloDocument2 pagesPeople V KalaloPrincessAngelaDeLeon100% (1)

- Quiz in SalesDocument5 pagesQuiz in SalesPrincessAngelaDeLeonNo ratings yet

- The People of The Philippine Islands VsDocument2 pagesThe People of The Philippine Islands VsPrincessAngelaDeLeonNo ratings yet

- Assurance Engagement and Related ServicesDocument5 pagesAssurance Engagement and Related ServicesPrincessAngelaDeLeonNo ratings yet

- People Vs PunoDocument1 pagePeople Vs PunoPrincessAngelaDeLeon100% (1)

- Alejandro Estrada Vs Soledad EscritorDocument2 pagesAlejandro Estrada Vs Soledad EscritorPrincessAngelaDeLeonNo ratings yet

- People Vs Oanis and GalantaDocument1 pagePeople Vs Oanis and GalantaPrincessAngelaDeLeonNo ratings yet

- Quiz in Contracts of Pledge and MortgageDocument4 pagesQuiz in Contracts of Pledge and MortgagePrincessAngelaDeLeon100% (1)

- Quiz in ObligationDocument7 pagesQuiz in ObligationPrincessAngelaDeLeonNo ratings yet

- Quiz in Negotiable Instuments LawDocument10 pagesQuiz in Negotiable Instuments LawPrincessAngelaDeLeonNo ratings yet

- Quiz in ContractsDocument5 pagesQuiz in ContractsPrincessAngelaDeLeonNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- Alinma Annual 2015-English 19062016Document96 pagesAlinma Annual 2015-English 19062016Md Fouad Bin AminNo ratings yet

- RBI Balance SheetDocument10 pagesRBI Balance SheetporuterNo ratings yet

- Assignment On Cost Profit Volume Analysis of Proposed Bba CollegeDocument8 pagesAssignment On Cost Profit Volume Analysis of Proposed Bba CollegeKrishna GurungNo ratings yet

- Advanced Acct PP CH08Document42 pagesAdvanced Acct PP CH08Jose TNo ratings yet

- Computer Related White Collar Crimes & LawDocument3 pagesComputer Related White Collar Crimes & LawasddhghNo ratings yet

- ROC FeesDocument8 pagesROC FeesabhayNo ratings yet

- Intermediate Accounting 2008 SolutionDocument6 pagesIntermediate Accounting 2008 Solutionchin leaNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNo ratings yet

- DipIFR 2012 Dec AnswersDocument7 pagesDipIFR 2012 Dec AnswersRicardo Augusto Rodriguez MiñanoNo ratings yet

- Seminar Paper: Bookkeeping Compliance ProgramDocument26 pagesSeminar Paper: Bookkeeping Compliance Programjack lukeNo ratings yet

- Earnings Management Are View of LiteratureDocument13 pagesEarnings Management Are View of LiteratureLujin MukdadNo ratings yet

- 2 - List of StandardsDocument7 pages2 - List of StandardsDave Peralta100% (1)

- ACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsDocument5 pagesACCT2201me: ACCT2201 Tutorial 1 Solutions - PDF Tutorial 1 SolutionsNatalie Laurent SiaNo ratings yet

- CPAR AP - Audit of ReceivablesDocument3 pagesCPAR AP - Audit of ReceivablesJohn Carlo CruzNo ratings yet

- Press Release Q1 - 2012-13Document4 pagesPress Release Q1 - 2012-13Santosh Kumar SumanNo ratings yet

- Application For LoanDocument1 pageApplication For LoandexterNo ratings yet

- Capital Maintenance Approach PDFDocument1 pageCapital Maintenance Approach PDFAnDrea ChavEzNo ratings yet

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Document11 pages1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahNo ratings yet

- AssigmentDocument20 pagesAssigmentEricka SantiagoNo ratings yet

- Income Tax Act IT - MauritiusDocument299 pagesIncome Tax Act IT - MauritiusVicky MurthyNo ratings yet

- Quiz Inventory-Fa1Document9 pagesQuiz Inventory-Fa1penny coronado100% (1)

- Chapt-5 Exclude From Gross IncomeDocument4 pagesChapt-5 Exclude From Gross IncomehumnarviosNo ratings yet

- Merchandising and Manufacturing Activities: Petter James C. Benaldo FM 22Document15 pagesMerchandising and Manufacturing Activities: Petter James C. Benaldo FM 22Ian CalinawanNo ratings yet

- Impact of Brexit On TataDocument2 pagesImpact of Brexit On TataSaransh SethiNo ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet