Professional Documents

Culture Documents

Social Security Act of 1997 (R.A. No. 1161, As Amended by R.A. No. 8282)

Uploaded by

maanyag6685Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Social Security Act of 1997 (R.A. No. 1161, As Amended by R.A. No. 8282)

Uploaded by

maanyag6685Copyright:

Available Formats

Social Security Act of 1997 (R.A. No. 1161, as amended by R.A. No.

8282)

A. Coverage

1. Compulsory coverage

a.

all employees not over sixty (60) years of age and their employers

domestic helpers, their monthly income shall not be less than One thousand pesos (P1,000.00)

a month

Provided:

- any benefit already earned by the employees under private benefit plans existing at the time of

the approval of this Act shall not be discontinued, reduced or otherwise impaired

- That private plans which are existing and in force at the time of compulsory coverage shall be

integrated with the plan of the SSS in such a way where the employers contribution to his private

plan is more than that required of him in this Act, he shall pay to the SSS only the contribution

required of him and he shall continue his contribution to such private plan less his contribution to

the SSS so that the employers total contribution to his benefit plan and to the SSS shall be the

same as his contribution to his private benefit plan before the compulsory coverage

- That any changes, adjustments, modifications, eliminations or improvements in the benefits to be

available under the remaining private plan, which may be necessary to adopt by reason of the

reduced contributions thereto as a result of the integration, shall be subject to agreements between

the employers and employees concerned

- That the private benefit plan which the employer shall continue for his employees shall remain

under the employers management and control unless there is an existing agreement to the

contrary

b. Spouses who devote full time to managing the household and family affairs, unless they are also

engaged in other vocation or employment

c. Filipinos recruited by foreign-based employers for employment abroad

2. Compulsory coverage of self-employed

rules and regulations as it may prescribe, including but not limited to the following:

1. All self-employed professionals;

2. Partners and single proprietors of businesses;

3. Actors and actresses, directors, scriptwriters and news correspondents who do not fall within the

definition of the term employee in Section 8 (d) of this Act;

4. Professional athletes, coaches, trainers and jockeys; and

5. Individual farmers and fishermen

3. Voluntary coverage

4. Effective date of coverage

5. Effect of separation from employment

6. Effect of interruption of business or professional income

You might also like

- Labor Advisory On Payment of Salaries Through AtmDocument1 pageLabor Advisory On Payment of Salaries Through Atmmaanyag6685No ratings yet

- GSIS LawDocument25 pagesGSIS LawJake AriñoNo ratings yet

- Social Security System 2017Document35 pagesSocial Security System 2017NJ Geerts100% (1)

- Agra - SSS Law - 102017Document34 pagesAgra - SSS Law - 102017Andrea DeloviarNo ratings yet

- Social Security Law-2Document97 pagesSocial Security Law-2Shannen SagunNo ratings yet

- Chapter 4.social Welfare LegislationDocument98 pagesChapter 4.social Welfare LegislationFelix III AlcarezNo ratings yet

- Title: Sss Gsis Pag-Ibig PhilhealthDocument15 pagesTitle: Sss Gsis Pag-Ibig PhilhealthLudica OjaNo ratings yet

- A. Sss Law (R.a. No. 8282)Document14 pagesA. Sss Law (R.a. No. 8282)new covenant churchNo ratings yet

- Social Security LawDocument11 pagesSocial Security LawmarkNo ratings yet

- Upload 3Document11 pagesUpload 3maanyag66850% (1)

- Salient Feature of SSS LawDocument3 pagesSalient Feature of SSS LawJoyjoy C LbanezNo ratings yet

- RevenueRegulations1 68Document4 pagesRevenueRegulations1 68lorkan19No ratings yet

- Case Digest # VII-1 - GR No. 160073 - Barayoga V Asset Privatization Trust - PanganibanDocument1 pageCase Digest # VII-1 - GR No. 160073 - Barayoga V Asset Privatization Trust - Panganibanmaanyag6685No ratings yet

- Comparative Matrix of Social Legislation in The PhilippinesDocument14 pagesComparative Matrix of Social Legislation in The PhilippinesHowie Malik100% (2)

- Sss CoverageDocument2 pagesSss CoverageKirt CatindigNo ratings yet

- Ecc Basics 1Document26 pagesEcc Basics 1Anton FortichNo ratings yet

- Employed. Professional IncomeDocument2 pagesEmployed. Professional IncomeJohn Paul GarciaNo ratings yet

- 13TH MONTH PAY (Highlights)Document3 pages13TH MONTH PAY (Highlights)XIANo ratings yet

- 13th-Month Pay LawDocument2 pages13th-Month Pay LawKim SalvoroNo ratings yet

- 13th Month PayDocument2 pages13th Month PayRodel De GuzmanNo ratings yet

- 13th Month Paw Law and Its Revised GuidelinesDocument5 pages13th Month Paw Law and Its Revised GuidelinesEi Ar TaradjiNo ratings yet

- 13 Moth Pay LawDocument2 pages13 Moth Pay LawRouella May AltarNo ratings yet

- PD 851Document4 pagesPD 851Rodney S. ZamoraNo ratings yet

- Presidential Decree No. 851 Presidential Decree No. 851 "Decree"Document3 pagesPresidential Decree No. 851 Presidential Decree No. 851 "Decree"Marjorie MayordoNo ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawPrncssbblgmNo ratings yet

- Social Legislation DummyDocument91 pagesSocial Legislation DummyMylesGernaleNo ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawRaffy PangilinanNo ratings yet

- 13th Month and Kasambahay LawDocument14 pages13th Month and Kasambahay Lawrico eugenioNo ratings yet

- The Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxDocument18 pagesThe Proceeds of Life Insurance Policies They Do The Heirs or Beneficiaries Upon Death of The Insured Shall Be Exempt From Income TaxXhien YeeNo ratings yet

- Ra 7641Document6 pagesRa 7641Iller Anne AniscoNo ratings yet

- 13th Month Pay TentativeDocument13 pages13th Month Pay TentativeHardlyjun NaquilaNo ratings yet

- Declaration of Policy.: Power and DutiesDocument4 pagesDeclaration of Policy.: Power and DutiesMidzmar KulaniNo ratings yet

- Compulsory Coverage Under RA 11199 and RA 8291Document1 pageCompulsory Coverage Under RA 11199 and RA 8291Kaye ArendainNo ratings yet

- 13th Month Pay LawDocument9 pages13th Month Pay LawLantong JbNo ratings yet

- 13th Month Pay (PD 851)Document18 pages13th Month Pay (PD 851)Sj EclipseNo ratings yet

- R.A. No. 1161 (The Social Security Act of 1997)Document7 pagesR.A. No. 1161 (The Social Security Act of 1997)nicole coNo ratings yet

- 13th Month Pay LawDocument7 pages13th Month Pay LawOrlando O. Calundan100% (1)

- 13th Month RuleDocument8 pages13th Month Rulej L.T.No ratings yet

- Republic Act No. 9679: Page 1 of 8Document8 pagesRepublic Act No. 9679: Page 1 of 8Jeremiah ReynaldoNo ratings yet

- IRR of PD 851-1Document3 pagesIRR of PD 851-1Jansen OuanoNo ratings yet

- Wage Distortion and 13th Month PayDocument16 pagesWage Distortion and 13th Month PayJennybabe PetaNo ratings yet

- Empoly EmplerDocument20 pagesEmpoly EmplerAlapati Sridhar Nag100% (2)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument23 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJayMichaelAquinoMarquezNo ratings yet

- De Minimis Benifit AssignmentDocument9 pagesDe Minimis Benifit AssignmentJoneric RamosNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument22 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledTeresa CardinozaNo ratings yet

- Gsis LawDocument17 pagesGsis LawJohn Ree Esquivel DoctorNo ratings yet

- Sss and Gsis LawDocument61 pagesSss and Gsis LawNikki BorcenaNo ratings yet

- P.D. 851 (13th Month Pay Law)Document3 pagesP.D. 851 (13th Month Pay Law)Anonymous HWfwDFRMPsNo ratings yet

- Presidential Decree No. 851Document4 pagesPresidential Decree No. 851Dianne BayNo ratings yet

- CHAPTER 8 Compensation Income (Module)Document6 pagesCHAPTER 8 Compensation Income (Module)Shane Mark CabiasaNo ratings yet

- UP Agrarian & Social LegislationDocument29 pagesUP Agrarian & Social LegislationJesa FormaranNo ratings yet

- Gsis LawDocument24 pagesGsis LawEdsoul Melecio EstorbaNo ratings yet

- Soc LegDocument144 pagesSoc LegHaru RodriguezNo ratings yet

- Search For Deployment Abroad - JICADocument4 pagesSearch For Deployment Abroad - JICAJurisprudence LawNo ratings yet

- Government Service Insurance SystemDocument24 pagesGovernment Service Insurance SystemSam SamNo ratings yet

- Who Are Subject To Compulsory Coverage Under The Government Service Insurance System?Document12 pagesWho Are Subject To Compulsory Coverage Under The Government Service Insurance System?nimfasfontaineNo ratings yet

- Revised Guidelines PD 851Document4 pagesRevised Guidelines PD 851Abegail LeriosNo ratings yet

- Revised Guidelines On The Implementation of The 13Th Month Pay LawDocument4 pagesRevised Guidelines On The Implementation of The 13Th Month Pay Lawnhizza dawn DaligdigNo ratings yet

- Reporting 13 Mo Pay & KasambahayDocument12 pagesReporting 13 Mo Pay & KasambahayRegina CoeliNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

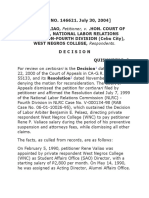

- Union of Filipro Employees v. VivarDocument1 pageUnion of Filipro Employees v. Vivarmaanyag6685No ratings yet

- Chanrobles Law Lib Rary: RedDocument5 pagesChanrobles Law Lib Rary: Redmaanyag6685No ratings yet

- Chanro Blesvirtua Llawlibra RyDocument7 pagesChanro Blesvirtua Llawlibra Rymaanyag6685No ratings yet

- Chanroblesv Irtua1awlibra RyDocument14 pagesChanroblesv Irtua1awlibra Rymaanyag6685No ratings yet

- AGRIPINO V. MOLINA, Petitioner, v. PACIFIC PLANS, INC., Respondent. Decision Callejo, SR., J.Document12 pagesAGRIPINO V. MOLINA, Petitioner, v. PACIFIC PLANS, INC., Respondent. Decision Callejo, SR., J.maanyag6685No ratings yet

- Upload 3Document1 pageUpload 3maanyag6685No ratings yet

- Philippine National Construction Corporation v. NLRCDocument1 pagePhilippine National Construction Corporation v. NLRCmaanyag6685No ratings yet

- (G.R. NO. 148105. July 22, 2004) Francisco Reyno, Petitioner, V. Manila Electric COMPANY, Respondent. Decision Sandoval-Gutierrez, J.Document12 pages(G.R. NO. 148105. July 22, 2004) Francisco Reyno, Petitioner, V. Manila Electric COMPANY, Respondent. Decision Sandoval-Gutierrez, J.maanyag6685No ratings yet

- Upload 3Document1 pageUpload 3maanyag6685No ratings yet

- G.R. NO. 140689. February 17, 2004Document1 pageG.R. NO. 140689. February 17, 2004maanyag6685No ratings yet

- Bankard Employees Union vs. NLRCDocument1 pageBankard Employees Union vs. NLRCmaanyag6685No ratings yet

- Bankard Employees Union-Workers Alliance Trade Unions v. NLRCDocument1 pageBankard Employees Union-Workers Alliance Trade Unions v. NLRCmaanyag6685No ratings yet

- Case: Jose Rizal Colleges vs. NLRC: Labor Arbiter's DecisionDocument1 pageCase: Jose Rizal Colleges vs. NLRC: Labor Arbiter's Decisionmaanyag6685No ratings yet

- ISSUE: Whether or Not MERALCO Is The Employer of The Fired Security GuardsDocument1 pageISSUE: Whether or Not MERALCO Is The Employer of The Fired Security Guardsmaanyag6685No ratings yet

- Upload 6Document4 pagesUpload 6maanyag6685No ratings yet

- Certiorari: G.R. No. 144664 March 15, 2004Document1 pageCertiorari: G.R. No. 144664 March 15, 2004maanyag6685No ratings yet

- Upload 5Document1 pageUpload 5maanyag6685No ratings yet

- Upload 3Document8 pagesUpload 3maanyag6685No ratings yet

- G.R. No. 114337 Nitto Enterprises NLRC and Roberto Capili First Division / Kapunan, J.: Daylo, Jerome Dela Cruz September 29, 1995 Series: 6Document1 pageG.R. No. 114337 Nitto Enterprises NLRC and Roberto Capili First Division / Kapunan, J.: Daylo, Jerome Dela Cruz September 29, 1995 Series: 6maanyag6685No ratings yet

- Placewell International Services CorpDocument1 pagePlacewell International Services Corpmaanyag6685No ratings yet

- Cralaw Virtua1aw Lib RaryDocument1 pageCralaw Virtua1aw Lib Rarymaanyag6685No ratings yet

- Placewell International Services CorpDocument1 pagePlacewell International Services Corpmaanyag6685No ratings yet

- Cralaw Virtua1aw Lib RaryDocument1 pageCralaw Virtua1aw Lib Rarymaanyag6685No ratings yet

- Statement of ObjectivesDocument1 pageStatement of Objectivesmaanyag6685No ratings yet