Professional Documents

Culture Documents

EQ RSCH ANALY INTRO

Uploaded by

dushyantkr0 ratings0% found this document useful (0 votes)

18 views2 pagesThis document outlines the topics and recommended study time for an equity research course divided into chapters. The chapters cover an introduction to equity research, understanding financial statements, analyzing the economy, industry and company, ratio analysis, valuation, and report writing. The total recommended study time is 25.5 hours. Key topics include the role of research analysts, different types of research, understanding annual reports and financial statements, economic and industry analysis, company analysis, various financial ratios, valuation methods like DCF and relative valuation, and report writing guidelines.

Original Description:

su

Original Title

Course Outline

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the topics and recommended study time for an equity research course divided into chapters. The chapters cover an introduction to equity research, understanding financial statements, analyzing the economy, industry and company, ratio analysis, valuation, and report writing. The total recommended study time is 25.5 hours. Key topics include the role of research analysts, different types of research, understanding annual reports and financial statements, economic and industry analysis, company analysis, various financial ratios, valuation methods like DCF and relative valuation, and report writing guidelines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesEQ RSCH ANALY INTRO

Uploaded by

dushyantkrThis document outlines the topics and recommended study time for an equity research course divided into chapters. The chapters cover an introduction to equity research, understanding financial statements, analyzing the economy, industry and company, ratio analysis, valuation, and report writing. The total recommended study time is 25.5 hours. Key topics include the role of research analysts, different types of research, understanding annual reports and financial statements, economic and industry analysis, company analysis, various financial ratios, valuation methods like DCF and relative valuation, and report writing guidelines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

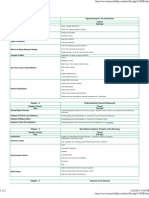

Course Outline

Chapter

Topics

Recommended

Study

Time(Hours)

Overview: What is equity research? Goal of an equity research

analyst.

Market Participants: The research providers and the research

users.

Types of Research: Buy side research and Sell side research.

Equity Research - An

Introduction

Role of an Analyst: How do analysts go about research?, Front end

and back end research, equity research as a cost and revenue

center.

Concept of Alpha: Importance of alpha in equity research.

Key Terms used in Equity Markets, Stocks Classification.

Annual Report Overview: Understanding key sections of an Annual

Understanding

Financial Statements

report.

4

Profit & Loss Statement, Balance Sheet, Cash Flow Statement.

Introduction: Stages of the qualitative analysis process - EIC

framework.

Economic Cycles: How valuation of a company gets affected by

economic activities?

Analysis of the

Economy

Key Economic Factors: GDP, Industrial Production, Inflation,

Unemployment, Business and consumer confidence and Oil prices.

Stock Indices: Different benchmark indices across the globe, How

do share prices and stock indices move? How are stock indices

interlinked?

Process: Identifying sub-sectors, Key revenue drivers, Key

concerns.

Analysis of the

Industry

Specific Industry Analysis: Oil & Gas, IT, Telecom, Banking and

Autos.

2.5

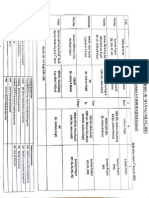

Chapter

Topics

Recommended

Study

Time(Hours)

Process: Analyzing the business, Revenue drivers, competitors,

Analysis of the

Company

Management team.

1.5

Case Study: A detailed analysis of Shiv Vani Industries.

Profitability Ratios: Profit Margins - Gross margin, EBITDA margin,

Net Profit margin.

Return Ratios: Return on Equity (ROE), Return on Common Equity

(ROCE), Return on Total Capital (RTC) and Return on Assets

(ROA).

Liquidity Ratios: Current ratio, Quick ratio and Cash ratio.

Activity Ratios: Account receivables turnover & Days of

Ratio Analysis

receivables, Inventory turnover & Days of inventory, Account

4.5

payables turnover & Days of payables.

Solvency Ratios: Debt-to-Equity ratio, Interest coverage ratio and

Financial leverage.

Valuation Ratios: Price to Earnings (P/E) ratio, P/E re-rating and

de-rating, PEG ratio, EV/EBITDA, Price to Book Value (P/BV) ratio.

Case Study: Pantaloons vs. Titan Industries.

Concept: Definition and need for Valuations.

Methods: DCF, Relative Valuation.

Valuation

6

Case Study: A detailed exercise of valuation using DCF for Titan

Industries.

Report Writing

Types of reports, Format,Dos and Dontss of report writing.

TOTAL RECOMMENDED LEARNING HOURS

3

25.5

You might also like

- Analysing Common Stocks - FUNDAMENTAL ANALYSISDocument47 pagesAnalysing Common Stocks - FUNDAMENTAL ANALYSISAarthi SutharNo ratings yet

- Fundamental vs Technical Analysis Key DifferencesDocument12 pagesFundamental vs Technical Analysis Key DifferencesShakti ShuklaNo ratings yet

- Training The Street PrimersDocument30 pagesTraining The Street PrimersRyan MarloweNo ratings yet

- Aima Asset Pricing and Fund Valuation in The Hedge Fund Industry Exec Summary April 2005Document12 pagesAima Asset Pricing and Fund Valuation in The Hedge Fund Industry Exec Summary April 2005Marilyn Ramplin100% (1)

- Guide to Oil, Gas & Mining Interview QuestionsDocument34 pagesGuide to Oil, Gas & Mining Interview QuestionsalexNo ratings yet

- Equity Research QsDocument12 pagesEquity Research QsIpsita PatraNo ratings yet

- Fundamental Analysis of PETROLEUM SectorDocument31 pagesFundamental Analysis of PETROLEUM SectorAbhay Kapkoti0% (1)

- Fundamental AnalysisDocument23 pagesFundamental AnalysisAdarsh JainNo ratings yet

- Economic and Industry Analysis Co Combined 9-2010Document62 pagesEconomic and Industry Analysis Co Combined 9-2010Rohit BansalNo ratings yet

- Jorion FRM Exam QuestionsDocument96 pagesJorion FRM Exam QuestionsAbhijeet ZanwarNo ratings yet

- Flow of Accounting Entries in Oracle ApplicationsDocument99 pagesFlow of Accounting Entries in Oracle ApplicationsRaj100% (5)

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- R28 Financial Analysis Techniques IFT Notes PDFDocument23 pagesR28 Financial Analysis Techniques IFT Notes PDFNoor Salman83% (6)

- Fundamental AnalysisDocument25 pagesFundamental AnalysisVishal MalikNo ratings yet

- Fundamental Analysis of ICICI BankDocument79 pagesFundamental Analysis of ICICI BanksantumandalNo ratings yet

- Fundamental Analysis of ICICI BankDocument70 pagesFundamental Analysis of ICICI BankAnonymous TduRDX9JMh0% (1)

- Accounting and Auditing Training for Oil and Gas ProfessionalsDocument5 pagesAccounting and Auditing Training for Oil and Gas ProfessionalsafzaljamilNo ratings yet

- Course Outline: Chapter - 1 Equity Research: An IntroductionDocument2 pagesCourse Outline: Chapter - 1 Equity Research: An IntroductionPulkit Bansal VirgoNo ratings yet

- FINANCIAL ANALYSIS COURSE OUTLINE TOPICSDocument5 pagesFINANCIAL ANALYSIS COURSE OUTLINE TOPICSjamalzareenNo ratings yet

- FUNDAMENTAL ANALYSIS OF COMPANY AmitDocument8 pagesFUNDAMENTAL ANALYSIS OF COMPANY Amitamitratha77No ratings yet

- 2 FA Course ENG Final PDFDocument142 pages2 FA Course ENG Final PDFAudra GreenNo ratings yet

- Managerial Financial Analysis RatiosDocument36 pagesManagerial Financial Analysis RatiosShreyans JainNo ratings yet

- RONIN petroleum performance evaluation using trend percentageDocument36 pagesRONIN petroleum performance evaluation using trend percentageRayan ShamsadenNo ratings yet

- Learning Goals: - Fundamental - Technical AnalysisDocument12 pagesLearning Goals: - Fundamental - Technical AnalysisZafar AhmedNo ratings yet

- LUX HoiseryDocument143 pagesLUX HoiseryJayakrishnan Marangatt100% (1)

- AbcdDocument3 pagesAbcdAshwin NairNo ratings yet

- Afs Lect 1 Ver 1Document31 pagesAfs Lect 1 Ver 1rafay khawajaNo ratings yet

- IJRPR18248Document5 pagesIJRPR18248mudrankiagrawalNo ratings yet

- Fundamental AnalysisDocument27 pagesFundamental AnalysisMuntazir HussainNo ratings yet

- PGDM 2013-15 Ratio AnalysisDocument5 pagesPGDM 2013-15 Ratio AnalysisAkshat SaxenaNo ratings yet

- Fundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisDocument27 pagesFundamental Analysis: Macroeconomic Factors Fiscal & Monetary Policy Industry / Company AnalysisshesadevnaNo ratings yet

- 2 FS Analysis USTDocument22 pages2 FS Analysis USTFk TnccNo ratings yet

- Financial Statement Analysis: Fin-4201 Financial Analysis Fourth Year / Eight Semesters Major-FinanceDocument19 pagesFinancial Statement Analysis: Fin-4201 Financial Analysis Fourth Year / Eight Semesters Major-FinanceorkoNo ratings yet

- INTRODUCTIONDocument2 pagesINTRODUCTIONIffah IffahNo ratings yet

- FSA Course Outline 10-06-2016Document6 pagesFSA Course Outline 10-06-2016Supreet NarangNo ratings yet

- Financial Analysis GuideDocument6 pagesFinancial Analysis GuideRomelyn Joy JangaoNo ratings yet

- Syllabus EMBA12weeksDocument19 pagesSyllabus EMBA12weeksakcelik04No ratings yet

- International Financial Statement Analysis: ResumeDocument8 pagesInternational Financial Statement Analysis: ResumeQhu Luph CmuanyaNo ratings yet

- Financial Planning & Strategy ForDocument36 pagesFinancial Planning & Strategy ForNageshwar SinghNo ratings yet

- Fundamental and Technical Analysis of Oil and Gas Sector SipDocument32 pagesFundamental and Technical Analysis of Oil and Gas Sector Siphaveuever910No ratings yet

- Analysis of Financial Statements Course Notes Week 5Document10 pagesAnalysis of Financial Statements Course Notes Week 5Navin GolyanNo ratings yet

- Unit 3Document35 pagesUnit 3Barath LNo ratings yet

- IBIG 04 08 Natural Resources Questions Answers PDFDocument34 pagesIBIG 04 08 Natural Resources Questions Answers PDFEmanuil SirakovNo ratings yet

- Example Assignment 7003Document14 pagesExample Assignment 7003Javeriah Arif75% (4)

- Internship Report - 03 June 22Document12 pagesInternship Report - 03 June 22Alina KujurNo ratings yet

- CFA Level 1 SyllabusDocument3 pagesCFA Level 1 Syllabusjohn ramboNo ratings yet

- Dipti MohantyDocument63 pagesDipti MohantySomnath DasNo ratings yet

- Fundamental Analysis of FMCG Companies. (New)Document67 pagesFundamental Analysis of FMCG Companies. (New)AKKI REDDYNo ratings yet

- SM (MGT502) Lect # 6Document18 pagesSM (MGT502) Lect # 6Avinash KumarNo ratings yet

- Chapter - 11 Financial Statement AnalysisDocument14 pagesChapter - 11 Financial Statement AnalysisAntora Hoque100% (1)

- Chapter 2Document31 pagesChapter 2Maryam AlaleeliNo ratings yet

- FINA2004 Unit 5Document11 pagesFINA2004 Unit 5Taedia HibbertNo ratings yet

- 2012v1 FTT Chapter TwoDocument18 pages2012v1 FTT Chapter TwoAvinash DasNo ratings yet

- ALK-20-WPh-final Week 12Document9 pagesALK-20-WPh-final Week 12Melvina WijayaNo ratings yet

- Interpreting Financial StatementsDocument16 pagesInterpreting Financial Statementsmucio.t.mattosNo ratings yet

- Equity Research Interview Questions and AnswersDocument22 pagesEquity Research Interview Questions and AnswersHarsh JainNo ratings yet

- Financial Analysis: Mohamed EL AOUFI Email: Melaoufi@bmcebank - Co.maDocument36 pagesFinancial Analysis: Mohamed EL AOUFI Email: Melaoufi@bmcebank - Co.maBachirovicNo ratings yet

- Financial Analysis Session 4 & 5Document36 pagesFinancial Analysis Session 4 & 5Sakshi SharmaNo ratings yet

- Ratio AnalysisDocument25 pagesRatio Analysisdeba1644No ratings yet

- Strategic Business Reporting - UIA20502J: Unit 3Document22 pagesStrategic Business Reporting - UIA20502J: Unit 3MohanrajNo ratings yet

- Stage 5 Syllabus - 2006Document9 pagesStage 5 Syllabus - 2006Ishfaq KhanNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Bro123 PDFDocument1 pageBro123 PDFdushyantkrNo ratings yet

- Bro PDFDocument1 pageBro PDFdushyantkrNo ratings yet

- FRM School ListDocument48 pagesFRM School ListdushyantkrNo ratings yet

- Bro10 PDFDocument1 pageBro10 PDFdushyantkrNo ratings yet

- Myplan CORP - DelhiDocument9 pagesMyplan CORP - DelhiAbhimanyu 'Chulbul' RaiNo ratings yet

- August Mess BillDocument1 pageAugust Mess BilldushyantkrNo ratings yet

- Chandan IDocument2 pagesChandan IdushyantkrNo ratings yet

- Rupee DepreciationDocument11 pagesRupee DepreciationlapogkNo ratings yet

- Class RoutineDocument1 pageClass RoutinedushyantkrNo ratings yet

- Myplan CORP - DelhiDocument9 pagesMyplan CORP - DelhiAbhimanyu 'Chulbul' RaiNo ratings yet

- FORM ProblemsDocument4 pagesFORM ProblemsdushyantkrNo ratings yet

- Joy Joy Nobojato Bangladesh Joy Joy Mukti Bahini ... Written On The War of Liberation ofDocument2 pagesJoy Joy Nobojato Bangladesh Joy Joy Mukti Bahini ... Written On The War of Liberation ofdushyantkrNo ratings yet

- No Dues FormDocument1 pageNo Dues FormdushyantkrNo ratings yet

- August Mess BillDocument1 pageAugust Mess BilldushyantkrNo ratings yet

- Lab 1 Introduction To DataDocument11 pagesLab 1 Introduction To DatadushyantkrNo ratings yet

- Internship Report Format13.6.13Document5 pagesInternship Report Format13.6.13dushyantkrNo ratings yet

- Ibps Clerk 4 GK BoosterDocument60 pagesIbps Clerk 4 GK BoosterMukul NigamNo ratings yet

- Final Annual Report13-14Document210 pagesFinal Annual Report13-14dushyantkrNo ratings yet

- I I o I T: Ndian Nstitute F Nformation Echnology AllahabadDocument7 pagesI I o I T: Ndian Nstitute F Nformation Echnology AllahabaddushyantkrNo ratings yet

- Distributed: Digital SignaturesDocument21 pagesDistributed: Digital SignaturesdushyantkrNo ratings yet

- Adoption Intention of Digital Signature in IndiaDocument11 pagesAdoption Intention of Digital Signature in IndiadushyantkrNo ratings yet

- Final Annual Report13-14Document210 pagesFinal Annual Report13-14dushyantkrNo ratings yet

- 120 XtrugDocument532 pages120 XtrugMahesh TalupuruNo ratings yet

- FCI CalanderDocument1 pageFCI CalanderdushyantkrNo ratings yet

- Macro 7Document31 pagesMacro 7dushyantkrNo ratings yet

- Inflation,-Fiscal and Monetary Policies.: Dr. Seema SinghDocument25 pagesInflation,-Fiscal and Monetary Policies.: Dr. Seema SinghdushyantkrNo ratings yet