Professional Documents

Culture Documents

FORM Problems

Uploaded by

dushyantkr0 ratings0% found this document useful (0 votes)

7 views4 pagesform problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentform problem

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesFORM Problems

Uploaded by

dushyantkrform problem

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 4

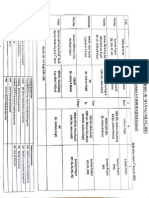

Problem 3.16.

‘The standard deviation of monthly changes in the spot price of live cattle is (in cents

per pound) 1.2. The standard deviation of monthly changes in the futures price of live

cattle for the closest contract is 14. The correlation between the futitres price changes

and the spot price changes is 0.7. It is now October 15. A beef producer is committed to

purchasing 200,000 pounds of live cattle on November 15. The producer wauis to use the

December live-cattle futures contracts to hedge its risk. Each contract is for the delivery

of 40,000 pounds of cattle. What strategy should the beef producer follow?

‘The optimal hedge ratio is

12

14

‘The beef producer requires a long position in 200000 x 0.6 = 120,000 Ibs of cattle. The

beef producer should therefore take a long position in 3 December contracts closing out

the position on November 15.

o7x 06

Problem 3.24.

It is July 16. A company has a portfolio of stocks worth $100 million. The beta of

the portfolio is 1.2. The company would like to use the CME) December futures contract

on the S&P 500 to change the beta of the portfolio to 0.5 during the period July 16 to

November 16. The index futures price is currently 1,000, and each contract is on $250

times the index.

a. What position should the company take?

b. Suppose that the company changes its mind and decides to increase the beta of

the portfolio from 1.2 to 1.5. What position in futures contracts should it take?

(a) The company should short

(2

x 100,000,000

1000 = 350

or 280 contracts.

(b) The company should take a long, position in

(

«100, 000, 000

1000 x 250

Problem 5.11.

Assume that the risk-free interest rate is 9% per annum with continuous compounding

and that the dividend yield on a stock index varies throughout ihe year. In February, May,

August, and November, dividends are paid at a rate of 5% per annuzn. In other months,

dividends are paid at @ rate of 2% per annum. Suppose that the value of the index on

July 31 is 1,300. What is the futures price for a contract deliverable an December $1 of

the same year?

‘The futures contract lasts for five months. The dividend yield is 2% for three of the

imonths and 5% for two of the months. The average dividend yield is therefore

3G x24-2%5) 3.2%

‘The futures price is therefore

0 032) x0 4167

1300e"°

, 331.80

or $1331.80

Problem 5.15.

‘The spot price of silver is $9 per ounce, The storage costs are $0.24 per ounce per

year payable quarterly in advance. Assuming that inicrest rates are 10% per annurn for

‘ll maturities, calculate the futures price of silver for delivery in nine months

‘The present value of the storage costs for nine months are

0.06 + 0.0670 19% 4 0,06¢7919%9* = 0.176

or $0.178. The futures price is from equation (5.11) given by Fy where

e., it is 89.89 per ounce.

Problem 5.24.

A stock is expected to pay a dividend of $1 per share in two months and in five

months. The stock price is $50, and the risk-froe rate of interest is 8% per annum with

continuous compounding for all maturities. An investor has just taken a short position in

a six-month forward contract on the stock.

a, What are the forward price and the initial value of the forward contract?

b. Three months later, the price of the stock is $48 and the risk-free rate of interest

is still 8% per annum. What are the forward price and the value of the short position in

the forward contract?

(a) The present. value, J, of the income from the security is given by:

Da Lx OOBI8 4 1 yg OBEN 1 onan

From equation (5.2) the forward price, Fo, Is given by:

Fo = (50 — 1.9540)e98*9® = 50.01

or $50.01. The initial value of the forward contract is (by design) zero. The fact that

the forward price is very close to the spot price should come as no surprise. When the

‘compounding frequency is ignored the dividend yield on the stock equals the risk-free

rate of interest

(b) In three months:

1 = ¢ 0 08x2/12 — 0.9868

The delivery price, K’, 's 50.01. From equation (5.6) the value of the short. forward

contract, f, is given by

f =—(48 ~ 0.9868 — 50.01e-9°8*5/22) = 2.01

and the forward price is

(48 — 0.9868) e°°**9/!? — 47.96

Problem 9.13.

Give an intuitive explanation of why the early exercise of an American put becomes

more attractive as the risk-free rate increases and volatility decreases.

‘The early exercise of an American put is attractive when the interest earned on the

strike price is greater than the insurance element lost. When interest rates increase, the

value of the interest earned on the strike price increases making early exercise more attrac-

tive. When volatility decreases, the insurance element. is less valuable. Again this makes

early exercise more attractive.

Problem 9.14.

The price of a European call that expires in six months and has a strike price of $30 is:

$2. The underlying stock price is $29, aud a dividend of $0.50 is expected in two months

and again in five months. The term structure is lat, with all risk-ftee interest rates being

10%. What is the price of a European put option that expires in six months and has a

strike price of $30?

ion (9.7)] gives

Using the notation in the chapter, put-call parity [equ

OF may 4

e+ Ke? +D=p+ So

or

p=c+Ke'™+D-S

In this case

PH 24306 862 4 (6,5¢-9 HAM? 4 Q,5¢-1 5/92) _ 99 2.51

In other words the put price is $2.51

You might also like

- Bro123 PDFDocument1 pageBro123 PDFdushyantkrNo ratings yet

- Bro PDFDocument1 pageBro PDFdushyantkrNo ratings yet

- Flow of Accounting Entries in Oracle ApplicationsDocument99 pagesFlow of Accounting Entries in Oracle ApplicationsRaj100% (5)

- FRM School ListDocument48 pagesFRM School ListdushyantkrNo ratings yet

- Bro10 PDFDocument1 pageBro10 PDFdushyantkrNo ratings yet

- Myplan CORP - DelhiDocument9 pagesMyplan CORP - DelhiAbhimanyu 'Chulbul' RaiNo ratings yet

- No Dues FormDocument1 pageNo Dues FormdushyantkrNo ratings yet

- Rupee DepreciationDocument11 pagesRupee DepreciationlapogkNo ratings yet

- EQ RSCH ANALY INTRODocument2 pagesEQ RSCH ANALY INTROdushyantkrNo ratings yet

- Chandan IDocument2 pagesChandan IdushyantkrNo ratings yet

- Myplan CORP - DelhiDocument9 pagesMyplan CORP - DelhiAbhimanyu 'Chulbul' RaiNo ratings yet

- Joy Joy Nobojato Bangladesh Joy Joy Mukti Bahini ... Written On The War of Liberation ofDocument2 pagesJoy Joy Nobojato Bangladesh Joy Joy Mukti Bahini ... Written On The War of Liberation ofdushyantkrNo ratings yet

- August Mess BillDocument1 pageAugust Mess BilldushyantkrNo ratings yet

- Lab 1 Introduction To DataDocument11 pagesLab 1 Introduction To DatadushyantkrNo ratings yet

- Class RoutineDocument1 pageClass RoutinedushyantkrNo ratings yet

- August Mess BillDocument1 pageAugust Mess BilldushyantkrNo ratings yet

- Internship Report Format13.6.13Document5 pagesInternship Report Format13.6.13dushyantkrNo ratings yet

- Ibps Clerk 4 GK BoosterDocument60 pagesIbps Clerk 4 GK BoosterMukul NigamNo ratings yet

- Final Annual Report13-14Document210 pagesFinal Annual Report13-14dushyantkrNo ratings yet

- I I o I T: Ndian Nstitute F Nformation Echnology AllahabadDocument7 pagesI I o I T: Ndian Nstitute F Nformation Echnology AllahabaddushyantkrNo ratings yet

- Distributed: Digital SignaturesDocument21 pagesDistributed: Digital SignaturesdushyantkrNo ratings yet

- Jorion FRM Exam QuestionsDocument96 pagesJorion FRM Exam QuestionsAbhijeet ZanwarNo ratings yet

- Adoption Intention of Digital Signature in IndiaDocument11 pagesAdoption Intention of Digital Signature in IndiadushyantkrNo ratings yet

- Final Annual Report13-14Document210 pagesFinal Annual Report13-14dushyantkrNo ratings yet

- 120 XtrugDocument532 pages120 XtrugMahesh TalupuruNo ratings yet

- FCI CalanderDocument1 pageFCI CalanderdushyantkrNo ratings yet

- Macro 7Document31 pagesMacro 7dushyantkrNo ratings yet

- Inflation,-Fiscal and Monetary Policies.: Dr. Seema SinghDocument25 pagesInflation,-Fiscal and Monetary Policies.: Dr. Seema SinghdushyantkrNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)