Professional Documents

Culture Documents

Risks and Rewards of Option Writing

Uploaded by

avinash008jha6735Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risks and Rewards of Option Writing

Uploaded by

avinash008jha6735Copyright:

Available Formats

Posted: Fri Mar 02, 2012 8:58 am

Dear Friends,

Option writing

Margin Required : Almost equal to the margin required for buy/sell the futures c

ontract - Premium on writing(will be credited on next trading day only)

Risk Reward : Maximum Profit - Premium Received

Maximum Loss - Unlimited

If one person passively writing the option(not following technicals or News) the

succees ratio will be 80% of times small profit and 20% time Mega losses..It is

entirely opposite to options buying 80% time losses 20% mega profits

Theoritically options selling is more riskier than option buying but practically

buying is more riskier than selling since the time value will evaporate daily w

ill go in favour of option seller.

Follow the technicals along with the strategies in option writing will definitel

y give handsome profits

Regards

Raj

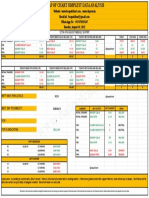

-------------------------------------------------------------------------------------------------------------------------------------------------------------Nifty Options: (Use this when there is Uncertainty)

Price per lot @ Rs.40 = 50x40 = 2000

Brokrage and SST = 113 X 2 (therefore a gain of Rs.4 gives no profit/loss)

To get profit of Rs.500 = gain of Rs.14 (Most Likely)

To get profit of Rs.1000 = gain of Rs.24 (Likely)

To get profit of Rs.1500 = gain of Rs.34 (Less Likely)

Nifty Futures: (Use this when market is in a certain trend)

Price per lot

Brokerage and

To get Profit

To get Profit

To get Profit

To get Profit

= 297500 - 30,000

STT = 350 (therefore

of Rs. 500 = gain of

of Rs.1000 = gain of

of Rs.1500 = gain of

of Rs.2000 = gain of

a gain of Rs.7 gives no profit/loss)

Rs. 17 (Most Likely)

Rs.27 (Likely)

Rs.37 (Likely)

Rs.47 (Less Likely)

You might also like

- USDINR Option StrategyDocument1 pageUSDINR Option Strategynarendra_pNo ratings yet

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083No ratings yet

- Whatsapp No: +917670919347 Tuesday, August 10, 2021: 12Th of August Weekly ExpiryDocument1 pageWhatsapp No: +917670919347 Tuesday, August 10, 2021: 12Th of August Weekly ExpiryKrishna SharmaNo ratings yet

- Options Basics Tutorial: Best Brokers For Options TradingDocument33 pagesOptions Basics Tutorial: Best Brokers For Options TradingasadrekarimiNo ratings yet

- Advancedoptionsspreads 141218174938 Conversion Gate01 PDFDocument4 pagesAdvancedoptionsspreads 141218174938 Conversion Gate01 PDFManoj Kumar SinghNo ratings yet

- Market Mantra: Prime IndicatorsDocument3 pagesMarket Mantra: Prime IndicatorsvivekNo ratings yet

- Nifty Options Writing StrategyDocument8 pagesNifty Options Writing Strategyfrank georgeNo ratings yet

- Basic Option Strategies Guide for DerivativesDocument22 pagesBasic Option Strategies Guide for DerivativesarmailgmNo ratings yet

- OptionsDocument13 pagesOptionsashraf240881No ratings yet

- Iron Condor Option StrategyDocument6 pagesIron Condor Option Strategyarjun lakhani0% (1)

- Option GreeksDocument2 pagesOption GreeksajjupNo ratings yet

- Trading Calls by Ravi PalwankarDocument118 pagesTrading Calls by Ravi PalwankarronaldsacsNo ratings yet

- Options Strategies Explained in DetailDocument22 pagesOptions Strategies Explained in DetailMahesh GujarNo ratings yet

- Moneyblock Option StrategiesDocument15 pagesMoneyblock Option Strategiespipgorilla100% (1)

- Learn the Basics of Buying Put OptionsDocument11 pagesLearn the Basics of Buying Put OptionsRajan kumar singhNo ratings yet

- Traders CodeDocument7 pagesTraders CodeHarshal Kumar ShahNo ratings yet

- Pre Webinar Presentation 4th 5th JanDocument11 pagesPre Webinar Presentation 4th 5th JanJenny JohnsonNo ratings yet

- Options Basics - How To Pick The Right Strike PriceDocument14 pagesOptions Basics - How To Pick The Right Strike PricealokNo ratings yet

- Nifty Index Options: Open Interest Analysis of Options ChainDocument34 pagesNifty Index Options: Open Interest Analysis of Options ChainPraveen Rangarajan100% (1)

- Understanding Options Trading: The Australian SharemarketDocument43 pagesUnderstanding Options Trading: The Australian SharemarketAndrewcaesarNo ratings yet

- 5paisa DerivativesDocument129 pages5paisa DerivativespkkothariNo ratings yet

- Professional Options Trading StrategiesDocument53 pagesProfessional Options Trading StrategiesRaj ShahNo ratings yet

- Delta Neutral Strategy using Future SyntheticsDocument4 pagesDelta Neutral Strategy using Future SyntheticsAsokaran PraveenNo ratings yet

- 2562 TheoryDocument3 pages2562 Theorymaddy_i5No ratings yet

- Synthetic Options ExplainedDocument6 pagesSynthetic Options ExplainedSamuelPerezNo ratings yet

- Nifty Options ProfitDocument16 pagesNifty Options ProfitMohanNo ratings yet

- Pathfinders Traders TrainingsDocument58 pagesPathfinders Traders TrainingsSameer ShindeNo ratings yet

- Trading System Based on Price-Indicator DivergenceDocument2 pagesTrading System Based on Price-Indicator DivergenceSPIMYSNo ratings yet

- Only Α- Sniper Shot 3: MyfnoDocument10 pagesOnly Α- Sniper Shot 3: MyfnoPhani KrishnaNo ratings yet

- Strategy Guide: Bull Call SpreadDocument14 pagesStrategy Guide: Bull Call SpreadworkNo ratings yet

- WWW Investopedia Com MACD PrimulDocument10 pagesWWW Investopedia Com MACD PrimulAvram Cosmin GeorgianNo ratings yet

- Vijay ThakkarDocument41 pagesVijay Thakkarfixemi0% (1)

- Option GreeksDocument2 pagesOption GreeksYarlagaddaNo ratings yet

- Trading Nifty Futures For A Living by Chartless Trader Vol Book 1Document3 pagesTrading Nifty Futures For A Living by Chartless Trader Vol Book 1Anantha TheerthanNo ratings yet

- Mastering Expiry Day Trading PDFDocument126 pagesMastering Expiry Day Trading PDFpr9cdfrz7pNo ratings yet

- Learn options trading and strategies onlineDocument8 pagesLearn options trading and strategies onlinekrana26No ratings yet

- Ichimoku Kinko Hyo StrategiesDocument3 pagesIchimoku Kinko Hyo StrategiesCarlos Jose MárquezNo ratings yet

- Decision Point Trading SystemDocument3 pagesDecision Point Trading SystemVinayak MegharajNo ratings yet

- F&O NotescombinedDocument200 pagesF&O NotescombinedMunish GuptaNo ratings yet

- Risk Management & Journal For Options Trading - 021726Document9 pagesRisk Management & Journal For Options Trading - 021726Aanindya ChoudhuryNo ratings yet

- Derivative StrategyDocument1 pageDerivative StrategyvadlapatisNo ratings yet

- Q: A Brief Background and Your Tryst With Markets: Manu Bhatia'sDocument3 pagesQ: A Brief Background and Your Tryst With Markets: Manu Bhatia'sSavan JaviaNo ratings yet

- Date Open High Low Close PP Gain/ (Loss)Document6 pagesDate Open High Low Close PP Gain/ (Loss)Mrdilipa DilipaNo ratings yet

- Piyush PPT of ZRAMDocument16 pagesPiyush PPT of ZRAMPiyush SharmaNo ratings yet

- Options Education Essential Basics: Avoiding The #1 Option Trading MistakeDocument7 pagesOptions Education Essential Basics: Avoiding The #1 Option Trading MistakeChidambara StNo ratings yet

- Option Trading Work BookDocument28 pagesOption Trading Work BookpierNo ratings yet

- A Simple Options Trading Strategy Based On Technical IndicatorsDocument4 pagesA Simple Options Trading Strategy Based On Technical IndicatorsMnvd prasadNo ratings yet

- Option Strategies Kay 2016Document78 pagesOption Strategies Kay 2016ravi gantaNo ratings yet

- Yogeeswar Interview MoneycontrolDocument12 pagesYogeeswar Interview MoneycontrolAllah Duhai haiNo ratings yet

- MF Ebook EngDocument46 pagesMF Ebook EngvrmallikNo ratings yet

- Turn Your Trading Easy With Automated Trading SystemDocument1 pageTurn Your Trading Easy With Automated Trading Systemtico ortiz aguilarNo ratings yet

- Bank Nifty Weekly FnO Hedging StrategyDocument5 pagesBank Nifty Weekly FnO Hedging StrategySanju GoelNo ratings yet

- MCX Silver: 31 July, 2012Document2 pagesMCX Silver: 31 July, 2012arjbakNo ratings yet

- 1) - Introduction To Price ActionDocument7 pages1) - Introduction To Price ActionNagabhooshan HegdeNo ratings yet

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayNo ratings yet

- Swing Trading Bootcamp For Traders & Investors (NEW 2021Document10 pagesSwing Trading Bootcamp For Traders & Investors (NEW 2021mytemp_01No ratings yet

- Daytrade Master Indicator: Entry SetupDocument7 pagesDaytrade Master Indicator: Entry SetupyaxaNo ratings yet

- Understanding Option'sDocument42 pagesUnderstanding Option'sPARTH DHULAMNo ratings yet

- Deepak Chopra - Spiritual LawsDocument3 pagesDeepak Chopra - Spiritual Lawsavinash008jha6735No ratings yet

- Ash Tava KraDocument62 pagesAsh Tava Kraavinash008jha6735No ratings yet

- WisdomDocument2 pagesWisdomavinash008jha6735No ratings yet

- Deepak Chopra - Spiritual LawsDocument3 pagesDeepak Chopra - Spiritual Lawsavinash008jha6735No ratings yet

- Notes - Shiv SamhitaDocument7 pagesNotes - Shiv Samhitaavinash008jha6735No ratings yet

- Kālī Mantras and Spiritual PracticesDocument7 pagesKālī Mantras and Spiritual Practicesavinash008jha6735100% (1)

- Poirot-The Complete Seasons 01-12Document2 pagesPoirot-The Complete Seasons 01-12avinash008jha673550% (2)

- Investment Ideas and Stock Recommendations from Motilal Oswal SecuritiesDocument16 pagesInvestment Ideas and Stock Recommendations from Motilal Oswal Securitiesavinash008jha6735No ratings yet

- Kalpataru ProcessDocument4 pagesKalpataru Processavinash008jha6735No ratings yet

- Why Do The Rich Get RicherDocument2 pagesWhy Do The Rich Get Richeravinash008jha6735No ratings yet

- Self Love SecretsDocument20 pagesSelf Love Secretsavinash008jha6735100% (1)

- Mind Your Mind: How to Control Your Thoughts and Find Inner PeaceDocument9 pagesMind Your Mind: How to Control Your Thoughts and Find Inner Peaceavinash008jha6735No ratings yet

- Lalita TrishatiDocument176 pagesLalita Trishatideepa2106100% (2)

- Kālī Mantras and Spiritual PracticesDocument7 pagesKālī Mantras and Spiritual Practicesavinash008jha6735100% (1)

- Chapter 3 - 19 - 176pDocument161 pagesChapter 3 - 19 - 176pavinash008jha6735No ratings yet

- Nse Options Strategies Explanation With ExamplesDocument60 pagesNse Options Strategies Explanation With ExamplesVatsal ShahNo ratings yet

- Ashtavakra Gita - Bart MarshallDocument60 pagesAshtavakra Gita - Bart Marshallமோகன் புதுவைNo ratings yet

- Magic of ReceivingDocument20 pagesMagic of Receivingavinash008jha6735100% (2)