Professional Documents

Culture Documents

Tor Summer 2014 HTML Final

Uploaded by

api-231386021Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tor Summer 2014 HTML Final

Uploaded by

api-231386021Copyright:

Available Formats

TENANT OUTLOOK REPORT

SUMMMER 2014 | OFFICE

TENANT ADVISORY SERVICES

SAN DIEGO COUNTY

San Diegos office space vacancy lowest since 2006

MARKET OVERVIEW

San Diegos office market continues to strengthen with 210,000 SF of absorption in Q2 2014 thus increasing

the YTD total to 810,000 SF and causing office vacancy to drop to 13.4%, the lowest level since 2006.

North City West, consisting of Carmel Valley (8.2%), Sorrento Mesa (8.1%) and UTC (6.1%) continues to

outperform the market with a combined 7.5% direct Class A vacancy. Other tight Class A office markets

include Mission Valley (6.3%), Kearny Mesa (7.0%) and Rancho Bernardo Mesa (7.6%). As you would

expect, rental rates for these markets are increasing. However opportunities can be found in the Class B

office sector were the difference between Class A and B rental rates can reach 30%.

VACANCY BY SPACE TYPE

Q2 2014

Q1 2014

DIRECT

12.77%

12.90%

SUBLEASE

0.63%

0.71%

3.0

13.40%

13.61%

CHANGE

In June 2014, San Diego added 9,700 employees lowering the unemployment level to 6.1%. The job gains

were led by healthcare and the high-paying professional STEM fields (Science, Technology, Engineering,

& Math). Venture Capital (VC) investment for startup companies made gains in San Diego during Q2.

According to The Money Tree survey, 26 local companies raised $222 million last quarter. Most notably

were Otonomy ($49M), Verdezyne ($48M), Cidara Therapeutics ($32M), Sotera Wireless ($21M) and

Tealium ($20M). Furthermore, Illumina announced that it will increase its local operations by 300

employees.

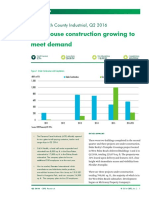

NEW SUPPLY, ABSORPTION AND VACANCYHowever,

RATES Omnitracs, Websense and

HISTORICAL

RENTALwill

RATE

Active Network

be TRENDS

relocating a significant portion of their

TOTAL

A & Overall Office Rates

employees to Texas for tax incentive Class

perks.

Others, such as Microsoft, will be reducing their workforce at

Quarterly Average Asking Rate Per SF Per Month (Full Service)

20%

their Rancho Bernardo location and Allergen will be cutting 100 jobs in Carlsbad. Large office sublease

$3.10

vacancies, such 18%

as Cricket/AT&T (200,000

SF) in Kearny Mesa and American Specialty Health (190,000

$3.00

SF) in Sorrento 16%

Mesa have yet to be leased.

$2.90

2.5

14%

1.0

0.5

VACANCY

BY CLASS

0.0

Q2 2014

-0.5

Q1 2014

13.24%

CLASS A

-1.0

CHANGE

13.77%

$ / SF / Month (FS)

NET ABSORPTION

AND VACANCY

12%

1.5

Vacancy Rate

SF (Millions)

2.0

$2.80

$2.70

The Class A office

10% segment saw the most

$2.60 demand during Q2 with 167,000 SF of net absorption. Class C

office absorbed 8%

79,000 SF while Class$2.50

B office lost 36,000 SF. Carmel Valley (+77,000 SF) and Mission

$2.40positive net absorption in Q2. In Carmel Valley, Perkins Coie

Valley (+74,000 6%SF) recorded the most

$2.30

expanded and now

4% occupies 34,000 SF at Del Mar Gateway while iTron moved into 20,000 SF at Del Mar

$2.20

Tech Center. In 2%

Mission Valley, San Diego

Unified School District purchased the 40,000 SF River Bank

$2.10

Plaza as an owner/user.

$2.00

0%

Q2 Q3 of

Q4 117,000

Q1 Q2 Q3 Q4

Q4 Q1 Q2 Q3

Q4 Q1

Q2 Q3 Bank

Q4 Q1 Q2

posted negative net absorption

SFQ1inQ2Q2Q3primarily

from

Chase

vacating

09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14

131,000 SF.Q2The suburban submarkets of Campus

Point (31.6%), Torrey Pines (24.7%) and Scripps Ranch

(20.5%)Vacancy

maintain the highest vacancy rates in the county. Class A

All Classes

14.36%

2005 2006 14.15%

2007 2008 2009

2012 2013

2014

CLASS B 2003 2004

2010 2011

Rancho

Bernardo

11.50%

CLASS C

12.01%

Net Absorption

New Supply

Most of the Downtown (CBD) leasing activity continues to be the smaller 2,000 to 5,000 SF tenants with

landlords responding by creating speculative office space to fuel this demand. Many of these smaller firms

are startups that cater to the Gen Y offering unique perks and the buzz of working in the CBD. As a

bonus, the lease rates are more affordable as compared to the suburbs.

OFFICE LEASING ACTIVITY BY TENANT SIZE

OFFICE VACANCY RATES

OFFICE

VACANCY RATES

Q2 2014

Total Leases Completed

Q2 2014

Countywide Class A ($2.90/SF) and Percentage

Class Bof($2.25/SF)

ratesinincreased.

For Class A asking rates, Carmel

Valley averages $3.70/SF; UTC averages $3.35/SF; Sorrento Mesa averages $3.15/SF; Mission Valley

averages $2.80/SF and Downtown (CBD) averages $2.65/SF.

Q2 2014

27.9%

13.4%

13.2%

S.D. County

LARGE TENANT ACTIVITY AND OPPORTUNITIES

12.6%

11.9%

Suburban

18.8%

17.9%

Downtown

0%

5%

All Classes

10%

15%

20%

7.2%

2.7%

The largest signed lease transactions include: Synthetic Genomics1.9%

(70,000 <=

SF),

Human Longevity

2,000 SF [375]

(56,000 SF), Intercept Pharmaceuticals (47,000 SF) and Pathway Genomics (45,000 SF) all within the

2,001 - 5,000

SF [174](31,000

UTC area; the GSA Immigration Services (53,000 SF), AECOM (47,000 SF) and Arbor

Education

SF) in the CBD; Sheppard Mullins (54,000 SF) early lease renewal in Carmel Valley;

and

The

of

5,001 - 10,000 SF County

[45]

San Diego (33,000 SF) in City Heights. Several tenants are in negotiations at various projects throughout

10,001 - 20,000 SF [17]

San Diego, most notably the State of Californias Attorney General for over 100,000

SF in the CBD.

20,001 SF [12]

Executive suite operators have been absorbing a sizable amount of office space>=in

San Diego recently.

Specifically, Regus has construction underway at 3 new sites in Mission Valley, Kearny Mesa and Sorrento

Mesa bringing their San Diego total to 16. Real Office Centers is expanding with their 3rd location in the

CBD. Premier Business Centers has 4 locations, and Barrister

Executive Suites has 3 locations.

60.2%

Class A

TENANT ADVISORY SERVICES

Future CBD vacancy may be affected as the new landlord at 625 Broadway is planning to convert their

223,000 SF office building into residential units.

NEW SUPPLY AND CONSTRUCTION

CLICK

HERE

Colliers International

In Q2 2014, the 34,000 SF Quail Garden Corporate Center in Encinitas was completed with 24,000 SF

absorbed. In Carmel Valleys Torrey Reserve, American Assets has three additional office/medical/retail

buildings totaling 45,000 SF under construction.

Additionally, The Irvine Company is well underway on One La Jolla Center in UTC, a 306,000 SF Class

A office building targeted for completion in mid-2015. Cisterras 320,000 SF build-to-suit office tower

for Sempra Energy in Downtown is expected to be completed in late-2015. Construction is also nearing

completion on Qualcomms 410,000 SF building in Sorrento Mesa.

Accelerating success.

www.colliersTAS.com

TENANT OUTLOOK REPORT

SUMMER 2014 | OFFICE

TENANT ADVISORY SERVICES

SAN DIEGO COUNTY

OFFICE OVERVIEW

San Diego County Office Market

Q2 2014

EXISTING PROPERTIES

Submarket / Class

Bldgs

DOWNTOWN

A

B

C

TOTAL

VACANCY

NET ABSORPTION

Total

Direct

Sublease

Total

Prior Qtr

Net Abs

Net Abs

Inventory

Vacancy

Vacancy

Vacancy

Vacancy

Current Qtr

YTD

SF

Rate

Rate

Rate

Rate

SF

SF

20

25

13

58

7,257,266

2,231,597

683,662

10,172,525

16.8%

20.1%

24.4%

18.1%

1.0%

0.1%

0.0%

0.8%

17.9%

20.2%

24.4%

18.8%

18.6%

20.2%

24.5%

19.4%

54,316

(98)

542

54,760

(53,231)

2,791

6,134

(44,306)

MISSION VALLEY

A

B

C

TOTAL

13

64

67

144

2,017,208

3,454,191

1,606,330

7,077,729

6.3%

9.2%

8.4%

8.2%

1.0%

0.6%

0.1%

0.6%

7.4%

9.7%

8.4%

8.8%

8.6%

11.4%

8.2%

9.8%

23,873

57,119

(3,860)

77,132

1,931

67,167

(3,334)

65,764

KEARNY MESA

A

B

C

TOTAL

15

106

91

212

1,858,959

5,225,351

1,875,982

8,960,292

7.0%

13.4%

17.8%

13.0%

0.6%

0.2%

0.0%

0.2%

7.6%

13.7%

17.8%

13.3%

6.9%

13.7%

18.5%

13.3%

(11,951)

2,105

13,038

3,192

(16,973)

100,949

37,713

121,689

UTC

A

B

C

TOTAL

21

12

6

39

3,504,970

1,105,799

320,381

4,931,150

6.1%

22.3%

3.4%

9.6%

0.6%

0.0%

0.0%

0.4%

6.7%

22.3%

3.4%

10.0%

6.9%

20.0%

3.2%

9.6%

6,220

(26,004)

(518)

(20,302)

420,785

(67,517)

582

353,850

SORRENTO MESA

A

B

C

TOTAL

23

51

42

116

3,819,784

3,878,029

866,951

8,564,764

8.1%

8.3%

8.3%

8.2%

0.8%

0.4%

0.0%

0.5%

8.9%

8.7%

8.3%

8.7%

8.7%

8.1%

9.6%

8.5%

(8,221)

(23,188)

10,976

(20,433)

(57,133)

(51,107)

20,005

(88,235)

CARMEL VALLEY

A

B

C

TOTAL

44

25

1

70

3,787,819

1,253,709

13,914

5,055,442

8.2%

14.6%

0.0%

9.8%

2.6%

3.0%

0.0%

2.7%

10.9%

17.7%

0.0%

12.5%

12.2%

19.6%

0.0%

14.0%

49,295

24,323

0

73,618

194,778

1,912

0

196,690

RANCHO BERNARDO

A

B

C

TOTAL

19

58

25

102

2,232,431

2,651,871

490,093

5,374,395

7.6%

13.6%

9.1%

10.7%

0.8%

0.0%

0.0%

0.3%

8.4%

13.6%

9.1%

11.0%

9.1%

8.4%

10.2%

8.8%

15,720

(137,851)

5,383

(116,748)

(1,551)

(112,012)

8,148

(105,415)

CARLSBAD

A

B

C

TOTAL

44

108

36

188

2,000,467

2,939,858

512,717

5,453,042

19.8%

15.4%

16.4%

17.1%

1.4%

1.1%

0.4%

1.1%

21.2%

16.5%

16.8%

18.3%

21.9%

16.7%

19.0%

18.8%

14,699

3,328

11,136

29,163

SAN DIEGO COUNTY OFFICE

A

275

B

970

C

1,145

TOTAL

2,390

31,374,544

35,329,524

15,370,182

82,074,250

12.2%

13.9%

11.3%

12.8%

1.0%

0.5%

0.2%

0.6%

13.2%

14.4%

11.5%

13.4%

13.8%

14.2%

12.0%

13.6%

166,825

(35,824)

78,557

209,558

Average rental rates are defined as the average asking monthly rate per square foot normalized to a full service gross basis.

Colliers International

Accelerating success.

www.colliersTAS.com

(9,222)

24,060

692

15,530

463,493

253,890

86,231

803,614

TENANT OUTLOOK REPORT | SUMMER 2014 | OFFICE | SAN DIEGO COUNTY

RENTAL RATES

Y RATES

HISTORICAL RENTAL RATE TRENDS

HISTORICAL RENTAL RATE TRENDS

For the last two years, the

countywide average asking

rental rate has steadily

increasing from a low of

$2.10/SF on a full service

gross basis. Q2 2014 was

the tenth consecutive

quarter where the rate has

either increased or remained

flat with the current rate of

$2.24/SF exhibiting a $0.04

increase during the quarter.

The Class A rate also posted

quarterly

Q2 aQ3large

Q4 Q1

Q2 Q3 Q4increase

Q1 Q2 of

12 $0.04

12 12 to

13 $2.86/SF.

13 13 13 14 14

Class A & Overall Office Rates

Class A & Overall Office Rates

Quarterly

Average Asking Rate Per SF Per Month (Full Service)

Quarterly Average

(Full Service)

20%Asking Rate Per SF Per Month

18%

$3.10

$3.00

$ / SF / Month (FS)

Vacancy Rate

$ / SF / Month (FS)

$3.10

$3.00

16%

$2.90

$2.90

14%

$2.80

$2.80

12%

$2.70

$2.70

10%

$2.60

$2.60

$2.50

8%

$2.50

$2.40

$2.40

6%

$2.30

$2.30

4%

$2.20

$2.20

2%

$2.10

$2.10

$2.00

0%

$2.00

Q2 Q2

Q3 Q3

Q4 Q4

Q1 Q1

Q2 Q2

Q3 Q3

Q4 Q4

Q1 Q1

Q2 Q2

Q3 Q4 Q1

011 2012 2013 2014 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

09 12

09 12

09 12

10 13

10 13

10 13

10 13

11 14

11 14

11 11 12

Q2 09 09 09 10 10 10 10 11 11 11 11 12

Vacancy

Class A

All Classes

Class A

All Classes

485 offices in

63 countries on

6 continents

United States: 140

Canada: 42

Latin America: 20

Asia Pacific: 195

EMEA: 85

$2.1

billion square feet under

management

Over

$75

LEASING ACTIVITY

LEASING

OFFICE LEASING ACTIVITY BYOFFICE

TENANT

SIZE ACTIVITY BY TENANT SIZE

Percentage of Total Leases Completed in Q2 2014

A total

of 623

leases

were

Percentage

of Total

Leases

Completed in Q2 2014

completed in Q2 totaling 1.9

million square feet. This

7.2%

7.2%

equated to 27.9%

a 12% increase in

27.9%

2.7%

total leases compared to Q1

2.7%

2014. Leasing volume will

1.9%

1.9%

<= 2,000 SF [375]

likely continue to be robust in

2014, allowing vacancy to

continue to decrease while

fueling rental increases due to

the accelerated demand.

billion in annual revenue

1.46

15,800 professionals

billion USD in total transaction value

Tenant Advisory Services

www.ColliersTAS.com

<= 2,000 SF [375]

2,001 - 5,000 SF [174]

2,001 - 5,000 SF [174]

5,001 - 10,000 SF [45]

5,001 - 10,000 SF [45]

10,001 - 20,000 SF [17]

10,001 - 20,000 SF [17]

>= 20,001 SF [12]

>= 20,001 SF [12]

> Only represent tenants in their

office lease and purchase

negotiations

> Provide objective conflict-free

advice with full service

resources

> Increase profitability &

mitigate risk

60.2%

60.2%

RON MILLER

Senior Director

Tenant Advisory

Services

OFFICE SPACE TIME-ON-THE-MARKET

Average Months by Submarket and Class

858.677.5363

LIC # 00874868

35

30

21.4

13.1

16.9

Carmel

Valley

Rancho

Bernardo

17.1

16.1

15.4

Sorrento

Mesa

Class B

19.2

29.4

Class A

UTC

16.5

Kearny

Mesa

www.ronmillersd.com

18.1

16.0

17.1

Downtown

17.5

14.4

15.3

Mission

Valley

9.6

14.9

10.5

16.7

21.3

17.9

10

20.7

14.7

13.8

15

19.8

23.3

17.1

Months

25

20

Carlsbad

San Diego

County

All Classes

TIME ON MARKET

Time-on-the-market for Class A office space is averaging 17.1 months countywide.

Ron Miller is a tenant advisory

specialist. His expertise encompasses

relocation/expansion/contraction

strategies, lease renewal and

restructuring, market analysis, and

user purchase opportunities. With

his extensive career experience

in representing both tenants

and landlords, Ron offers a

unique perspective and valuable

insight to his tenant clients.

COLLIERS INTERNATIONAL

4660 La Jolla Village Drive, Suite 100 San Diego, CA 92122 | USA

TEL +1 858.677.5363

This report has been prepared by Colliers International for general information only. Information contained herein has been obtained from sources deemed reliable and no representation is made

as to the accuracy thereof. Colliers International does not guarantee, warrant or represent that the information contained in this document is correct. Any interested party should undertake their

own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes

all liability for loss and damages arising there from.

Colliers International

Accelerating success.

www.colliersTAS.com

Accelerating success.

You might also like

- DunesDocument12 pagesDunesMiguel Angel100% (3)

- Telecom MetricsDocument8 pagesTelecom Metricsamit.dhingra73595No ratings yet

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5No ratings yet

- Extending Criminal LiabilityDocument14 pagesExtending Criminal LiabilitymaustroNo ratings yet

- Tor q1 2015 FinalDocument3 pagesTor q1 2015 Finalapi-231386021No ratings yet

- Executive Summary: Positive Momentum: Building SpotlightDocument6 pagesExecutive Summary: Positive Momentum: Building SpotlightScott W. JohnstoneNo ratings yet

- CCNKF Northbay Office Q2 2012Document10 pagesCCNKF Northbay Office Q2 2012mark_carrington_5No ratings yet

- Office Market - Panama City: Quick Stats (Class A)Document4 pagesOffice Market - Panama City: Quick Stats (Class A)Fernando Rivas CortesNo ratings yet

- DTZ MD Survey 2q15Document24 pagesDTZ MD Survey 2q15William HarrisNo ratings yet

- CT DC 2Q14 SnapshotDocument2 pagesCT DC 2Q14 SnapshotWilliam HarrisNo ratings yet

- Steady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterDocument5 pagesSteady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterAnonymous Feglbx5No ratings yet

- MD Market ReportDocument24 pagesMD Market ReportWilliam HarrisNo ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- Palm BeachDocument5 pagesPalm BeachAnonymous Feglbx5No ratings yet

- Office Market Snapshot: Washington, DCDocument2 pagesOffice Market Snapshot: Washington, DCAnonymous Feglbx5No ratings yet

- Miami Office Insight Q3 2013Document4 pagesMiami Office Insight Q3 2013Bea LorinczNo ratings yet

- OfficeDocument6 pagesOfficeAnonymous Feglbx5No ratings yet

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisNo ratings yet

- Office Market Snapshot: Northern VirginiaDocument2 pagesOffice Market Snapshot: Northern VirginiaAnonymous Feglbx5No ratings yet

- The Real Report Q3 Ending 2011, Bridge Commercial PropertiesDocument6 pagesThe Real Report Q3 Ending 2011, Bridge Commercial PropertiesScott W JohnstoneNo ratings yet

- Council Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentDocument5 pagesCouncil Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentcityhallblogNo ratings yet

- Greater Downtown Dayton FactsDocument38 pagesGreater Downtown Dayton Factsfortheloveofdayton100% (1)

- Cleveland Office 2nd Quarter 2011Document2 pagesCleveland Office 2nd Quarter 2011julie_lynch5049No ratings yet

- Fourth Quarter 2012: Office Market Dashboard - Greater Toronto AreaDocument5 pagesFourth Quarter 2012: Office Market Dashboard - Greater Toronto Areaapi-26443221No ratings yet

- Tre Ends Sheet T: Office Space Monito Or: April-June 20 014Document2 pagesTre Ends Sheet T: Office Space Monito Or: April-June 20 014M-NCPPCNo ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- WiredScore Digital Connectivity Whitepaper 2Document11 pagesWiredScore Digital Connectivity Whitepaper 2abudabeejajaNo ratings yet

- Office Market Snapshot: Suburban MarylandDocument2 pagesOffice Market Snapshot: Suburban MarylandAnonymous Feglbx5No ratings yet

- Riverside County Response To Grand Jury Report On KPMGDocument11 pagesRiverside County Response To Grand Jury Report On KPMGThe Press-Enterprise / pressenterprise.comNo ratings yet

- CAN Toronto Office Insight Q2 2018 JLL PDFDocument4 pagesCAN Toronto Office Insight Q2 2018 JLL PDFMichaelNo ratings yet

- Coronado Unified Bond Measure PublicDocument13 pagesCoronado Unified Bond Measure Publicapi-214709308No ratings yet

- Q3 2012 OfficeSnapshotDocument2 pagesQ3 2012 OfficeSnapshotAnonymous Feglbx5No ratings yet

- Alameda County Budget Update 5/17/10Document44 pagesAlameda County Budget Update 5/17/10oaklocNo ratings yet

- Riverside County FY 2020-21 First Quarter Budget ReportDocument50 pagesRiverside County FY 2020-21 First Quarter Budget ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- 4.13 Population, Housing, and Employment: World Logistics Center ProjectDocument16 pages4.13 Population, Housing, and Employment: World Logistics Center ProjectDavid DanelskiNo ratings yet

- 2016 TRENDS OfficeDocument21 pages2016 TRENDS OfficeGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionNo ratings yet

- SCV Econ Snapshot JUL2011Document5 pagesSCV Econ Snapshot JUL2011jeff_wilsonNo ratings yet

- Ayor S Ffice Udget ReviewDocument6 pagesAyor S Ffice Udget Reviewapi-237071663No ratings yet

- 2014-08 BARTPropValues Final 0Document39 pages2014-08 BARTPropValues Final 0NurSyuhadaAhmad100% (1)

- WashingtonDocument2 pagesWashingtonAnonymous Feglbx5No ratings yet

- Transcript America Movil 1Q24 Earnings CallDocument18 pagesTranscript America Movil 1Q24 Earnings CalljonathanmaldNo ratings yet

- 1st Quarter 2003 Earnings Conference Call: Doreen A. TobenDocument41 pages1st Quarter 2003 Earnings Conference Call: Doreen A. TobenJohn LeeNo ratings yet

- Toronto: OntarioDocument8 pagesToronto: Ontarioapi-26443221No ratings yet

- Star River Bradley DianneDocument10 pagesStar River Bradley DianneffforgetttNo ratings yet

- 2015 ANNUAL: Industrial SnapshotDocument2 pages2015 ANNUAL: Industrial Snapshotapi-259396700No ratings yet

- Mack-Cali Realty Corporation Reports First Quarter 2020 ResultsDocument9 pagesMack-Cali Realty Corporation Reports First Quarter 2020 ResultsKevin ParkerNo ratings yet

- Budget Responses 04-03-2023Document6 pagesBudget Responses 04-03-2023Caitlyn FroloNo ratings yet

- Writers Guild of America, West, Inc.: Annual Financial ReportDocument29 pagesWriters Guild of America, West, Inc.: Annual Financial ReportTHR100% (1)

- Energy Corridor Market Overview Q2 2010Document1 pageEnergy Corridor Market Overview Q2 2010lkgallagher1No ratings yet

- Cincinnati Office MarketView Q4 2020Document6 pagesCincinnati Office MarketView Q4 2020WCPO 9 NewsNo ratings yet

- Development of Services in The CaribbeanDocument36 pagesDevelopment of Services in The CaribbeanJoshua HamletNo ratings yet

- Collier 1ce Solutions Ch04Document10 pagesCollier 1ce Solutions Ch04Oluwasola OluwafemiNo ratings yet

- Sun Microsystems Q107 Quarterly Results Release: Investor RelationsDocument39 pagesSun Microsystems Q107 Quarterly Results Release: Investor RelationsjohnachanNo ratings yet

- Q1 2014 - CBRE HCMC Office Tenants Evening enDocument22 pagesQ1 2014 - CBRE HCMC Office Tenants Evening enKIM DYNo ratings yet

- FNF Final ExamDocument5 pagesFNF Final ExamThandar Swe ZinNo ratings yet

- Office Market Report: Baltimore Metro Economic Outlook (A Little) BrighterDocument4 pagesOffice Market Report: Baltimore Metro Economic Outlook (A Little) BrighterAnonymous Feglbx5No ratings yet

- VAW Desk Form 1Document3 pagesVAW Desk Form 1Tess Aboc100% (1)

- Feasibility Study For Crosscalls FinalDocument4 pagesFeasibility Study For Crosscalls FinalCecile NatividadNo ratings yet

- Ahip 2018 Q1 ErDocument10 pagesAhip 2018 Q1 ErangadNo ratings yet

- Riverside County FY 2020-21 Mid-Year Budget ReportDocument39 pagesRiverside County FY 2020-21 Mid-Year Budget ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Ethics of Ethical HackingDocument3 pagesEthics of Ethical HackingnellutlaramyaNo ratings yet

- Questionaire Cetpg 2013Document470 pagesQuestionaire Cetpg 2013Abhishek Thakur100% (1)

- As 1788-2-1987 Abrasive Wheels Selection Care and UseDocument6 pagesAs 1788-2-1987 Abrasive Wheels Selection Care and UseyowiskieNo ratings yet

- Unit 6 Citizenship ReadingDocument4 pagesUnit 6 Citizenship Readingtuokafonmon268No ratings yet

- Alfonso Rodriquez - The Murder of Dru SjodinDocument14 pagesAlfonso Rodriquez - The Murder of Dru SjodinMaria AthanasiadouNo ratings yet

- Iit Jam - Emt 2021 PDFDocument5 pagesIit Jam - Emt 2021 PDFNishit DasNo ratings yet

- Annual Work Accident Illness Exposure Data Report PDFDocument1 pageAnnual Work Accident Illness Exposure Data Report PDFedz100% (1)

- Mactan Cebu Air V Heirs of IjordanDocument13 pagesMactan Cebu Air V Heirs of Ijordanmonkeypuzzle93No ratings yet

- Mepa Unit 5Document18 pagesMepa Unit 5Tharaka RoopeshNo ratings yet

- Model Question Solution Made By: Krishna Shah Group 'A': Answer ExplanationDocument22 pagesModel Question Solution Made By: Krishna Shah Group 'A': Answer ExplanationKrishna ShahNo ratings yet

- Philippine Bus Rabbot V PeopleDocument3 pagesPhilippine Bus Rabbot V PeopleRostum AgapitoNo ratings yet

- Norman Dreyfuss 2016Document17 pagesNorman Dreyfuss 2016Parents' Coalition of Montgomery County, MarylandNo ratings yet

- Asme B5.38-1958Document14 pagesAsme B5.38-1958vijay pawarNo ratings yet

- Rubio vs. AlabataDocument9 pagesRubio vs. AlabataCathy BelgiraNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- 9707 s12 Ms 13Document7 pages9707 s12 Ms 13Muhammad Salim Ullah KhanNo ratings yet

- Body Art EstablishmentDocument1 pageBody Art Establishmentmilagro AlleyneNo ratings yet

- Foreign Investment Is Boon or Bane For IndiaDocument19 pagesForeign Investment Is Boon or Bane For IndiaAbhimanyu SinghNo ratings yet

- Introduction and Summary: ListedDocument118 pagesIntroduction and Summary: Listedkcc2012No ratings yet

- Using The PN5180 Without Library: Rev. 1.0 - 7 January 2020 Application Note 581710 Company PublicDocument20 pagesUsing The PN5180 Without Library: Rev. 1.0 - 7 January 2020 Application Note 581710 Company PublicvishnurajNo ratings yet

- Company Law - Lecture Notes Definition of A "Company"Document105 pagesCompany Law - Lecture Notes Definition of A "Company"namukuve aminaNo ratings yet

- Moz PROCUREMENT COORDINATOR JOB DESCRIPTIONDocument2 pagesMoz PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloNo ratings yet

- Grade 11 Entreprenuership Module 1Document24 pagesGrade 11 Entreprenuership Module 1raymart fajiculayNo ratings yet

- Deoband Anti Sufi 1 1Document18 pagesDeoband Anti Sufi 1 1Herb NazheNo ratings yet

- Limited ContractDocument2 pagesLimited ContractMajid ImranNo ratings yet

- Reyes v. RTC of Oriental Mindoro PDFDocument6 pagesReyes v. RTC of Oriental Mindoro PDFMark Jeson Lianza PuraNo ratings yet

- Islamic Finance On BNPL - The Opportunity AheadDocument14 pagesIslamic Finance On BNPL - The Opportunity AheadFaiz ArchitectsNo ratings yet

- Extraordinary: Government of GoaDocument4 pagesExtraordinary: Government of GoatrajrajNo ratings yet