Professional Documents

Culture Documents

Areola Vs CA

Areola Vs CA

Uploaded by

Abbot Reyes0 ratings0% found this document useful (0 votes)

28 views1 pagerrrr

Original Title

Areola vs CA

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrrrr

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pageAreola Vs CA

Areola Vs CA

Uploaded by

Abbot Reyesrrrr

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 1

SANTOS B. AREOLA and LYDIA D.

AREOLA vs CA and PRUDENTIAL GUARANTEE

AND ASSURANCE, INC (Romero, 1994)

The receipt of premium payments by an agent/officer duly authorized by the insurer to receive

such payments is receipt by the insurer himself. When the agent fails to remit the premiums,

the insured will not be held liable for failure to pay and the insurer may not unilaterally cancel

the contract. Unilateral cancellation will make the insurer liable for breach of contract.

FACTS: Santos Areola, a lawyer from Dagupan City, availed of a Personal Accident Insurance

Policy from Prudential, but seven months after the issuance of the policy, On June 29, 1985,

Prudential unilaterally cancelled the policy because company records revealed that Areola

failed to pay his premiums.

A few days later, however, Prudential found out that Areola actually paid the premiums and

that the branch manager, Teofilo Malapit, failed to remit them. Thus, Prudential offered to

reinstate the policy and even proposed to extend its lifetime to December 17, 1985.

Areola filed a suit for breach of contract and damages against Prudential.

(Some details about the policy)

Obtained from Baguio branch of Prudential, for one year (Nov 1984-Nov 1985), premium of

1470 but total monthly was 1609.5 (doc stamp 110.25, 2% premium tax of 29.4). The policy

states that the Statement of Account is not a receipt and an official receipt will be given after

payment but if payment is done through a representative, payor will be given a provisional

receipt. Areola was given provisional receipt but Malapit just failed to remit and therefore

Areola received no official receipt. Areola sent demand letters for immediate reinstatement,

bank apologized but did not immediately reinstate, so he filed the case. The insurance agent

was Carlito Ang.

ISSUES:

WON Prudential is liable for damages for unilaterally cancelling the policy.

WON Prudential's reinstatement of the policy absolved it from damages.

HELD: YES/NO

1. Branch Manager was agent of corporation and the receipt of payment was well within

his authority.

2. Therefore, his receipt of the premiums was, in effect, receipt by the corporation itself.

3. Thus, Areola fulfilled his obligations under the contract i.e. the payment of premiums.

4. The cancellation, therefore, was unwarranted and injurious to Areola; that it was

perpetrated by the Branch Manager is not material, a corporation can only act through

its individual employees. It must therefore bear the negligence of the Branch manager

in misappropriating the premiums.

DISPOSITIVE: Arreola's suit granted, Court warded nominal damages (30K)

CASE DIGEST by Ronald

You might also like

- Apple Strategic AuditDocument14 pagesApple Strategic AuditShaff Mubashir BhattiNo ratings yet

- Intestate Estate of The Deceased Luz Garcia. Pablo G. UTULO, Applicant-Appellee, VsDocument75 pagesIntestate Estate of The Deceased Luz Garcia. Pablo G. UTULO, Applicant-Appellee, VsMary Carmille DauloNo ratings yet

- Areola Vs CA, 236 SCRA 643Document2 pagesAreola Vs CA, 236 SCRA 643rengieNo ratings yet

- Actions and Damages in Case of BreachDocument8 pagesActions and Damages in Case of BreachMALALA MALALANo ratings yet

- Leyte-Samar-Sales and K. Tomassi vs. S. Cea and O. Castrilla, 93 Phil. 100Document7 pagesLeyte-Samar-Sales and K. Tomassi vs. S. Cea and O. Castrilla, 93 Phil. 100Veepee PanzoNo ratings yet

- A.M. No. 10-3-10-SC RULES OF PROCEDURE For IP Cases PDFDocument43 pagesA.M. No. 10-3-10-SC RULES OF PROCEDURE For IP Cases PDFNikki MendozaNo ratings yet

- Article1767 JarantillavsJarantillaDocument3 pagesArticle1767 JarantillavsJarantillaAna leah Orbeta-mamburamNo ratings yet

- IpDocument42 pagesIpJeff SantosNo ratings yet

- Iron CurtainDocument2 pagesIron CurtainEarl TabasuaresNo ratings yet

- Obli Con ReviewerDocument8 pagesObli Con ReviewerJohn Felix Morelos DoldolNo ratings yet

- KTRL Corpo Samplex Part 2Document9 pagesKTRL Corpo Samplex Part 2Kevin G. PerezNo ratings yet

- Velasco Vs MeralcoDocument3 pagesVelasco Vs MeralcoJanine IsmaelNo ratings yet

- Agency and Partnership Digests #3Document4 pagesAgency and Partnership Digests #3Janz SerranoNo ratings yet

- Copyright Notes - Kat NietoDocument55 pagesCopyright Notes - Kat NietoMarianne Tubay MacarilayNo ratings yet

- No. L-45101. November 28, 1986. ROSARIO C. MAGUAN (Formerly ROSARIO C. TAN), Petitioner, LUCHAN, RespondentsDocument13 pagesNo. L-45101. November 28, 1986. ROSARIO C. MAGUAN (Formerly ROSARIO C. TAN), Petitioner, LUCHAN, RespondentsMichael De CastroNo ratings yet

- Pioneer Insurance and Surety Corp vs. Yap: 61 Warranties Effect of BreachDocument1 pagePioneer Insurance and Surety Corp vs. Yap: 61 Warranties Effect of BreachKim CajucomNo ratings yet

- (C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Document8 pages(C. Insurable Interest) Tai Tong Chuache & Co. vs. Insurance Commission, 158 SCRA 366, No. L-55397 February 29, 1988Alexiss Mace JuradoNo ratings yet

- PLDT vs. NTCDocument9 pagesPLDT vs. NTCflorangelineNo ratings yet

- CENOMAR Application Form PDFDocument1 pageCENOMAR Application Form PDFIdsil Cabredo0% (1)

- Geluz vs. CADocument5 pagesGeluz vs. CAEhna DaguploNo ratings yet

- AMERICAN HOME ASSURANCE COMPANY v. ANTONIO CHUADocument2 pagesAMERICAN HOME ASSURANCE COMPANY v. ANTONIO CHUAKarl CabarlesNo ratings yet

- Heirs of Ureta Vs Heirs of Ureta DGDocument1 pageHeirs of Ureta Vs Heirs of Ureta DGeNo ratings yet

- IPL Case DigestDocument16 pagesIPL Case DigestKrizmariNo ratings yet

- 5 - Compania Maritima V Insurance CompanyDocument4 pages5 - Compania Maritima V Insurance CompanyLAW10101No ratings yet

- DigestsDocument10 pagesDigestsBernadette RacadioNo ratings yet

- Philamlife Vs PinedaDocument4 pagesPhilamlife Vs PinedaAllen OlayvarNo ratings yet

- Verendia vs. CA & Fidelity Surety CoDocument1 pageVerendia vs. CA & Fidelity Surety CoJessie Albert CatapangNo ratings yet

- Partnership, Trust, Agency ReviewerDocument44 pagesPartnership, Trust, Agency ReviewerVerified IdentityNo ratings yet

- SSC vs. AzoteDocument1 pageSSC vs. AzoteJamie Dilidili-TabiraraNo ratings yet

- Corporation Law - My DigestDocument26 pagesCorporation Law - My DigestGlargo GlargoNo ratings yet

- Cuadra Vs MonfortDocument1 pageCuadra Vs Monfortines_junioNo ratings yet

- Tolentino Vs Secretary of Finance PDFDocument82 pagesTolentino Vs Secretary of Finance PDFCJ CasedaNo ratings yet

- Manungas V LoretoDocument2 pagesManungas V LoretoLarryNo ratings yet

- Civil Law Compile 07-18 PDFDocument95 pagesCivil Law Compile 07-18 PDFOshin Noleal SabacoNo ratings yet

- The Authors Guild vs. Google, Inc. Facts: Plaintiffs, Who Are Authors of Published Books UnderDocument15 pagesThe Authors Guild vs. Google, Inc. Facts: Plaintiffs, Who Are Authors of Published Books UnderElead Gaddiel S. AlbueroNo ratings yet

- Coronel Vs Court of Appeals PDFDocument7 pagesCoronel Vs Court of Appeals PDFDianalyn QuitebesNo ratings yet

- 4) Development Bank of The Philippines vs. Court of Appeals, 231 SCRA 370, G.R. No. 109937 March 21, 1994Document6 pages4) Development Bank of The Philippines vs. Court of Appeals, 231 SCRA 370, G.R. No. 109937 March 21, 1994Alexiss Mace JuradoNo ratings yet

- Ang Giok Chip V Springfield GDocument6 pagesAng Giok Chip V Springfield GLiDdy Cebrero BelenNo ratings yet

- Arce Sons V Selecta Biscuits 1961Document10 pagesArce Sons V Selecta Biscuits 1961Jorel Andrew FlautaNo ratings yet

- Ago vs. CADocument3 pagesAgo vs. CAJan Carlo SanchezNo ratings yet

- Partnerships, Agency, and TrustsDocument3 pagesPartnerships, Agency, and TrustsGloriette Marie AbundoNo ratings yet

- Agustin Vs CA, Prollamante DigestDocument2 pagesAgustin Vs CA, Prollamante DigestSyElfredGNo ratings yet

- Edades Vs Edades - G.R. No. L-8964. July 31, 1956Document2 pagesEdades Vs Edades - G.R. No. L-8964. July 31, 1956Ebbe DyNo ratings yet

- Doctrine:: CASE 1 UY V PUZON - Carlo GuevaraDocument7 pagesDoctrine:: CASE 1 UY V PUZON - Carlo GuevaraKre GLNo ratings yet

- Torts Case Digest Damages 1st PartDocument50 pagesTorts Case Digest Damages 1st PartJanice DulotanNo ratings yet

- Sabio v. SandiganbayanDocument7 pagesSabio v. SandiganbayanFidel Rico NiniNo ratings yet

- Cir V AcostaDocument2 pagesCir V AcostaMemey C.No ratings yet

- Nikko Hotel Manila Garden Vs Roberto ReyesDocument20 pagesNikko Hotel Manila Garden Vs Roberto ReyesJes MinNo ratings yet

- Tirazona Vs CADocument2 pagesTirazona Vs CAManz Edam C. JoverNo ratings yet

- Heirs of Ildelfonso CoscolluelaDocument1 pageHeirs of Ildelfonso CoscolluelaMaricar Corina CanayaNo ratings yet

- Siena Realty vs. Gal-LangDocument2 pagesSiena Realty vs. Gal-LangZhai RaNo ratings yet

- Figueroa vs. BarrancoDocument8 pagesFigueroa vs. BarrancoAji AmanNo ratings yet

- 09 Roa, Jr. Vs CADocument17 pages09 Roa, Jr. Vs CAJanine RegaladoNo ratings yet

- L.G. Foods Corp and Gabor v. Hon Pagapong and Sps. VallejeraDocument1 pageL.G. Foods Corp and Gabor v. Hon Pagapong and Sps. VallejeraJ. LapidNo ratings yet

- Angelita Simundac-Keppel vs. Georg KeppelDocument4 pagesAngelita Simundac-Keppel vs. Georg KeppelErxha LadoNo ratings yet

- 70.1 Areola V CA DigestDocument4 pages70.1 Areola V CA DigestEstel TabumfamaNo ratings yet

- Areola Vs CADocument4 pagesAreola Vs CAJosephineFadulNo ratings yet

- Areolavsca&prudential CDDocument3 pagesAreolavsca&prudential CDAudrey MartinNo ratings yet

- Areola Vs CADocument2 pagesAreola Vs CAEarlcen MinorcaNo ratings yet

- Areola V CADocument3 pagesAreola V CARufino Gerard MorenoNo ratings yet

- Areola V CADocument2 pagesAreola V CAJosef BunyiNo ratings yet

- 01 Ong V PcibDocument3 pages01 Ong V PcibRonald SarcaogaNo ratings yet

- 48 FilipinasTextile Mills v. CA (2003)Document3 pages48 FilipinasTextile Mills v. CA (2003)Ronald SarcaogaNo ratings yet

- Perla Compania v. CADocument1 pagePerla Compania v. CARonald SarcaogaNo ratings yet

- Harry Keeler V Rodriguez - Jimenez V RabotDocument5 pagesHarry Keeler V Rodriguez - Jimenez V RabotRonald Sarcaoga100% (1)

- David vs. ArroyoDocument24 pagesDavid vs. ArroyoRonald SarcaogaNo ratings yet

- Republic of The Philippines ManilaDocument34 pagesRepublic of The Philippines ManilaRonald SarcaogaNo ratings yet

- Mirasol vs. Court of AppealsDocument7 pagesMirasol vs. Court of AppealsArmil Busico PuspusNo ratings yet

- Criminal Law IDocument98 pagesCriminal Law IRonald SarcaogaNo ratings yet

- Non Disclosure AgreementDocument6 pagesNon Disclosure AgreementRana GurtejNo ratings yet

- Index: Srno. Topics Page NoDocument2 pagesIndex: Srno. Topics Page NoMukesh ManwaniNo ratings yet

- EDITED LEC 2016 - Review Notes in Cor Ad 1 & 2Document61 pagesEDITED LEC 2016 - Review Notes in Cor Ad 1 & 2criminologyallianceNo ratings yet

- Virtues of The Shahadah Dr. Falaah MundakaarDocument26 pagesVirtues of The Shahadah Dr. Falaah MundakaarPurwanto SutiyoNo ratings yet

- J.S. MillDocument9 pagesJ.S. MillprathameshNo ratings yet

- 2017 Summer Zervos V Donald J Trump Memorandum of Law I 192Document34 pages2017 Summer Zervos V Donald J Trump Memorandum of Law I 192eriqgardnerNo ratings yet

- 1st Set Credit TransactionDocument113 pages1st Set Credit TransactionLiz Matarong BayanoNo ratings yet

- Bharat Glass Tube Limited Vs Gopal Glass Works LimitedDocument23 pagesBharat Glass Tube Limited Vs Gopal Glass Works LimitedprakashprabumNo ratings yet

- Environment and Christian EthicsDocument19 pagesEnvironment and Christian Ethicslbrecht100% (1)

- Badminton HistoryDocument6 pagesBadminton HistoryEduardoAlejoZamoraJr.No ratings yet

- Test Bank For Behavioral Sciences Stat New Engaging Titles From 4ltr Press 2nd EditionDocument36 pagesTest Bank For Behavioral Sciences Stat New Engaging Titles From 4ltr Press 2nd Editionempericetagragyj6f8100% (30)

- The Complex Feminist Ideal in The Wife of Bath's PrologueDocument3 pagesThe Complex Feminist Ideal in The Wife of Bath's PrologueLuminaNo ratings yet

- Vocabulary - Crime & Criminals EngVidDocument5 pagesVocabulary - Crime & Criminals EngVidLuis Agustin CorazzaNo ratings yet

- Model Course 6.09Document101 pagesModel Course 6.09Lyka Nimpha100% (6)

- Butler Pitch & Putt Disqualification LetterDocument5 pagesButler Pitch & Putt Disqualification LetterAnonymous Pb39klJNo ratings yet

- Music Publishing 101Document2 pagesMusic Publishing 101Free PantheraNo ratings yet

- ISO 9001 & 14001 Document ChecklistDocument6 pagesISO 9001 & 14001 Document ChecklistIgnacio Luis Reig Mataix100% (1)

- 1 Properties of Real Numbers WorksheetDocument4 pages1 Properties of Real Numbers WorksheetKarlz100% (1)

- Axis Bank - Marketing of ServicesDocument58 pagesAxis Bank - Marketing of ServicesUtkarsh Jaiswal100% (1)

- Maribel - r92 - El Chico Que DetestoDocument443 pagesMaribel - r92 - El Chico Que DetestoFranNo ratings yet

- HILLDABEAST JW v. State Karin Lang Deposition 01363Document755 pagesHILLDABEAST JW v. State Karin Lang Deposition 01363BigMamaTEANo ratings yet

- Randy Ankeney Case: Answering BriefDocument64 pagesRandy Ankeney Case: Answering BriefMichael_Lee_RobertsNo ratings yet

- My Neta Info Thane - Candidates - Report - FinalDocument74 pagesMy Neta Info Thane - Candidates - Report - Finalwahida.kazi100% (1)

- Bar Clays Transmission UkDocument3 pagesBar Clays Transmission UkJoze AbednegoNo ratings yet

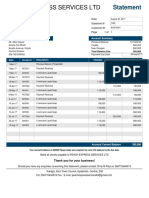

- Acacia Car Wash Account StatementDocument1 pageAcacia Car Wash Account StatementkajtheviroNo ratings yet

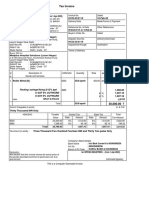

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Kendall Jenner Inc. v. Cutera, CD California, 16-00936.Document11 pagesKendall Jenner Inc. v. Cutera, CD California, 16-00936.MAWLAW Marie-Andree Weiss100% (1)

- Land Reforms in KarnatakaDocument15 pagesLand Reforms in Karnatakapshettigar142No ratings yet

- Stephen Njogu Gichuru Degree and CertificatesDocument3 pagesStephen Njogu Gichuru Degree and CertificatesHerbertNo ratings yet