Professional Documents

Culture Documents

Annexure - B

Uploaded by

Prashant0 ratings0% found this document useful (0 votes)

23 views1 pageMaritime Commissioner of Central Excise. Mumbai-IV Commissionerate, 2nd Floor, Estrella Batteries Compound, Dharavi - Matunga, Mumbai - 400 019. Exporters intend / have field claim of rebate of Central Excise duty with your office. They are furnishing following information / documents to enable your office to register us on your record.

Original Description:

Original Title

ANNEXURE - B.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMaritime Commissioner of Central Excise. Mumbai-IV Commissionerate, 2nd Floor, Estrella Batteries Compound, Dharavi - Matunga, Mumbai - 400 019. Exporters intend / have field claim of rebate of Central Excise duty with your office. They are furnishing following information / documents to enable your office to register us on your record.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views1 pageAnnexure - B

Uploaded by

PrashantMaritime Commissioner of Central Excise. Mumbai-IV Commissionerate, 2nd Floor, Estrella Batteries Compound, Dharavi - Matunga, Mumbai - 400 019. Exporters intend / have field claim of rebate of Central Excise duty with your office. They are furnishing following information / documents to enable your office to register us on your record.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

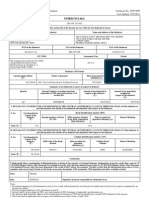

ANNEXURE B

(to be submitted in duplicate)

(Refer Trade Notice No.26/2004 dtd. 08.06.2004 of commissioner, Central Excise, Mumbai - IV)

(PROFORMA OF INFORMATION OF EXPORTERS)

To,

Maritime Commissioner of Central Excise.

Mumbai-IV Commissionerate,

2nd Floor, Estrella Batteries Compound,

Dharavi - Matunga,

Mumbai - 400 019.

Sir,

We are regular Exporter. We intend / have field claim of rebate of central excise duty with your office. We are furnishing following

information / documents to enable your office to register us on your record.

Name of the Applicant

Category of Exporter

Legal Status

Status as exporter

Whether registered with C.Ex.

If Registered with C.Ex, Regn.No.

Complete Address : Office

Name of the contact person

Phone Nos. Office

Fax Nos : Office

E-mail address

PAN No.

Detail of income Tax assessment office

Imp-Exp. Code No.(IEC No.)

Bank Name and Account No.

M/s. THYKN (INDIA) INTERNATIONAL

Merchant

Partnership

Yes

S.T./M-ll/BAS/REGN/1914/2004-05

202,Kuntal,Mody Estate, L.B.S. Marg, Ghatkoper (W), 400086

PRASHANT DINGANKAR

022 67033666

022 67033663

info@thykn.com

AADFT8545J

Mumbai

0303001844

CORPORATION BANK & A/C No. 4263

We are enclosing a copy of IE Code, Pan Card, Audited balance sheets and P & L Account for last three years & Partnership Deed

(Self attested).

We are also enclosing an authorization letter (for collection of cheques) duly attested by Bankers

Date:

Sd/(Name and designation of the person signing)

Seal of the organization

For Office Use

Entered at SL No.__________________________ / _______________________ of the registered of Exporters.

Date:

Inspector, Central Excise

Maritime Commissioner, Mumbai IV

Suptd. Of Central Excise

Mumbai IV

You might also like

- The Numbers Refer To Section A-B Sheet, Section A DetailDocument41 pagesThe Numbers Refer To Section A-B Sheet, Section A DetailenyonyoziNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Export Incentive SchemesDocument5 pagesExport Incentive SchemesPrashantNo ratings yet

- Application For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationDocument3 pagesApplication For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationPrashantNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormDanish Naeem LambeNo ratings yet

- Service Tax Registration - Form ST-2Document2 pagesService Tax Registration - Form ST-2benedictprasadNo ratings yet

- Treasury Database FormDocument12 pagesTreasury Database Formrendanin100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Manual Book 1770 PDFDocument46 pagesManual Book 1770 PDFHafiedz SNo ratings yet

- MP EnterprisesDocument1 pageMP Enterprisesmerchantraza14No ratings yet

- EFPS Letter of Intent SampleDocument1 pageEFPS Letter of Intent SampleBernardino PacificAceNo ratings yet

- ST 1 (Service Tax Reg)Document10 pagesST 1 (Service Tax Reg)praveensaxena2009No ratings yet

- VAT 101e: Value-Added TaxDocument5 pagesVAT 101e: Value-Added TaxKuben NaidooNo ratings yet

- VAT 101e: Value-Added TaxDocument5 pagesVAT 101e: Value-Added Taxdarl1No ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- RMC No. 5-2009Document1 pageRMC No. 5-2009CROCS Acctg & Audit Dep'tNo ratings yet

- Private Limited Company RegistrationDocument14 pagesPrivate Limited Company RegistrationPrasad IslavathNo ratings yet

- Notice 138Document13 pagesNotice 138Farhan AliNo ratings yet

- Annexure 6 & Annexure 7 - Remittance - 04 06 2015Document3 pagesAnnexure 6 & Annexure 7 - Remittance - 04 06 2015Vishvajit PatilNo ratings yet

- National Multi-Commodity Exchange of India Limited: CircularDocument16 pagesNational Multi-Commodity Exchange of India Limited: CircularDrRahul ChopraNo ratings yet

- Ecil - Ecit Business Associate Information & EoiDocument3 pagesEcil - Ecit Business Associate Information & EoiVarun ChandraNo ratings yet

- Rmo 5-2017Document12 pagesRmo 5-2017Romer LesondatoNo ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasJanice BautistaNo ratings yet

- Application For Registration As A Vendor: Next PageDocument4 pagesApplication For Registration As A Vendor: Next PageMark KNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Anf 1 Andanf 2 ADocument10 pagesAnf 1 Andanf 2 Atasneem89No ratings yet

- Vendor Registration FormDocument2 pagesVendor Registration FormVivek GosaviNo ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document6 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Nandish EthirajNo ratings yet

- Abcl Proprietor-New IecDocument14 pagesAbcl Proprietor-New IecMehul ManiarNo ratings yet

- Persons Required To File and Pay Under EfpsDocument2 pagesPersons Required To File and Pay Under EfpsTokha YatsurugiNo ratings yet

- Real Estate Marketing Agent Registration Form: Important InstructionsDocument7 pagesReal Estate Marketing Agent Registration Form: Important InstructionsAshok KumarNo ratings yet

- KWSP Form 1 Registration of New EmployersDocument5 pagesKWSP Form 1 Registration of New EmployersKavitha NadarajahNo ratings yet

- MEMORANDUM D17-1-5: in BriefDocument39 pagesMEMORANDUM D17-1-5: in Briefbiharris22No ratings yet

- Borang KWSP 1 - V23092014 PDFDocument5 pagesBorang KWSP 1 - V23092014 PDFMax Aditya Tantari100% (1)

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Letter To FBR Extension of Time For E-Filing of Sales Tax Return Tax Period Jul.20Document1 pageLetter To FBR Extension of Time For E-Filing of Sales Tax Return Tax Period Jul.20Lahore TaxationsNo ratings yet

- Service TaxDocument2 pagesService TaxManoj BishtNo ratings yet

- Form of Application For Registration-Cum-Membership (RCMC) With EEPC INDIA (Formerly Engineering Export Promotion Council)Document4 pagesForm of Application For Registration-Cum-Membership (RCMC) With EEPC INDIA (Formerly Engineering Export Promotion Council)ramsayliving2No ratings yet

- Jinny ClaimDocument49 pagesJinny ClaimTutor Seri KembanganNo ratings yet

- KAM ClaimDocument32 pagesKAM ClaimTutor Seri KembanganNo ratings yet

- Ut I Email Id Mobile Form Up DationDocument2 pagesUt I Email Id Mobile Form Up DationanuragjohriNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Instructions 2k23 FinalDocument29 pagesInstructions 2k23 FinalRAYZON ENERGIESNo ratings yet

- ERD.2.F.001 - Application For Income Tax HolidayDocument3 pagesERD.2.F.001 - Application For Income Tax Holidayprinces100% (1)

- Application For Business License and PermitDocument2 pagesApplication For Business License and PermitEdward Aguirre PingoyNo ratings yet

- BCIFDocument1 pageBCIFLeyCodes LeyCodesNo ratings yet

- SCI Tax Clearance CertificateDocument1 pageSCI Tax Clearance Certificatekenneth tamalaNo ratings yet

- Vihaan Chemie Pharm 27/14, Malaygiri BLDG, Navare Nagar, B Cabin Road, Ambarnath (East), Thane Maharashtra 4 2 1 5 0 1Document5 pagesVihaan Chemie Pharm 27/14, Malaygiri BLDG, Navare Nagar, B Cabin Road, Ambarnath (East), Thane Maharashtra 4 2 1 5 0 1Prashant DingankarNo ratings yet

- BIRForm 1905 e TIS1Document2 pagesBIRForm 1905 e TIS1Anonymous NAlWIFI56% (16)

- Bureau of Customs Super Green Lane Application Change FormDocument4 pagesBureau of Customs Super Green Lane Application Change FormLovely Anne SagaoNo ratings yet

- SdvgzxfbxdfafdbcvbDocument1 pageSdvgzxfbxdfafdbcvbMuhammad Waqas MunirNo ratings yet

- Multiple Bank Account Mapping Request Form PDFDocument1 pageMultiple Bank Account Mapping Request Form PDFDhritimanDasNo ratings yet

- BirDocument6 pagesBirbge5No ratings yet

- ABL Modification FormDocument1 pageABL Modification FormPochender VajrojNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- APPENDIX 25 B (Legal Agreement-Undertaking Format)Document4 pagesAPPENDIX 25 B (Legal Agreement-Undertaking Format)PrashantNo ratings yet

- APPENDIX 11A (Datasheet For Advance Authorization Application On Self Declaration Basis)Document2 pagesAPPENDIX 11A (Datasheet For Advance Authorization Application On Self Declaration Basis)PrashantNo ratings yet

- General Instruction For App of Schemes (APPENDIX 1)Document6 pagesGeneral Instruction For App of Schemes (APPENDIX 1)PrashantNo ratings yet

- APPENDIX 25 B (Legal Agreement-Undertaking Format)Document4 pagesAPPENDIX 25 B (Legal Agreement-Undertaking Format)PrashantNo ratings yet

- Epcg Licence Issuance Information EfilingDocument12 pagesEpcg Licence Issuance Information EfilingAnupam BaliNo ratings yet