Professional Documents

Culture Documents

India Stock Markets

Uploaded by

Abbas Ansari0 ratings0% found this document useful (0 votes)

157 views8 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

157 views8 pagesIndia Stock Markets

Uploaded by

Abbas AnsariCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

Stock markets in India

Emerging Asia: This links

with WJEC A2 Geography

Theme India.

1.2 How and why is the

economy changing ? Factors

affecting the growth of

financial industries

India: The big picture

Measure of development India

Population 1.1 billion

Population growth rate 1.38%

GDP $ 3.161 trillion

GDP per capita $ 3.300

GDP growth 7.6%

Land area 2,937,190 sq km

Unemployment 9.9%

Internet users 50.6 million

Random Commercial facts

Are these points significant to a consideration of Indian commerce

and trade? If so, why?

Nokia have 78% of the mobile handset market in India

20 million Indians live in countries other than India

17,000 Indian citizens attend British universities each year

Currently there are 9 million university students in India

A considerable proportion of India’s budget for scientific

research is spent on defence and military applications

India is in the top 14 markets for pharmaceutical products

such as medical drugs and its market position is rising.

India Stock markets

India's stock markets have been on the rise

since May 2004.

The benchmark Bombay Stock Exchange (BSE)

index, the Sensex, has shot up by over 100%

to cross 9,000 points for the first time in its

history.

Buyers, like the aggressive foreign institutional

investors who have pumped in more than

$10bn this calendar year, are excited about

India's growing economic strength.

India Stock markets

Others are convinced that

the economy is

fundamentally strong

They believe that the

country's financial markets

are more mature than those

of other emerging

economies.

India Stock markets

Many believe that the

Sensex is proof of India's

economic strength.

Most global reports have

indicated that the Indian

economy will be larger

than the developed ones,

except China, in the next

few decades.

India Stock markets 4

But this logic falls flat when one

realises that, unlike the Dow or

Footsie, less than 5% of Indian

companies are listed on Indian stock

exchanges.

A better indication of the health of

India's economy would be the

collective movement of the 2,500

shares that are regularly traded,

rather than the Sensex.

What have you learned?

Summarise the key

issues in your own

words

You might also like

- Impact of Investor Sentiments on Indian Stock ReturnsDocument25 pagesImpact of Investor Sentiments on Indian Stock ReturnsSuraj KashyapNo ratings yet

- The Impact of Stock Market On Indian Economy Introduction: Conference PaperDocument11 pagesThe Impact of Stock Market On Indian Economy Introduction: Conference PaperfunnyNo ratings yet

- Components of Indian Stock MarketDocument13 pagesComponents of Indian Stock MarketHarmender Singh SalujaNo ratings yet

- Indian Stock Market and Investors StrategyFrom EverandIndian Stock Market and Investors StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- 07 - Chapter IDocument18 pages07 - Chapter IwinningfavasNo ratings yet

- StockMarketVolatility-AStudyofIndianStockExchangeDocument9 pagesStockMarketVolatility-AStudyofIndianStockExchangeMandeep SinghNo ratings yet

- S. No. Topic Page NoDocument11 pagesS. No. Topic Page NoShreya MahourNo ratings yet

- 2009 India Presentation - TimesDocument84 pages2009 India Presentation - TimesDesh Deepak SharmaNo ratings yet

- Impact of COVID - 19 Pandemic and Its Impact On Financial MarketsDocument6 pagesImpact of COVID - 19 Pandemic and Its Impact On Financial MarketsEditor IJTSRDNo ratings yet

- Research Paper On Stock Market in IndiaDocument4 pagesResearch Paper On Stock Market in Indiaadyjzcund100% (1)

- Dissertation On Stock Market in IndiaDocument5 pagesDissertation On Stock Market in IndiaBuyPsychologyPapersUK100% (1)

- Sensex Crosses 52,600 for First Time as Nifty Breaches 15,800Document10 pagesSensex Crosses 52,600 for First Time as Nifty Breaches 15,800Dhruv BhandariNo ratings yet

- Report On KomalDocument188 pagesReport On KomalkomalvagelaNo ratings yet

- Report On Indian Stock ExchangeDocument11 pagesReport On Indian Stock ExchangeMini GoelNo ratings yet

- Financial Market (WWW - Writekraft.com)Document26 pagesFinancial Market (WWW - Writekraft.com)Vikas KhannaNo ratings yet

- Anfle PresaDocument12 pagesAnfle PresaAkash45 ThakurNo ratings yet

- MBA Project On Fundamental and Technical Analysis of Kotak BankDocument109 pagesMBA Project On Fundamental and Technical Analysis of Kotak BankSneha MaskaraNo ratings yet

- Why I Believe The Winds of Opportunity Are Well and Truly Blowing in India's Direction - Navneet MunotDocument2 pagesWhy I Believe The Winds of Opportunity Are Well and Truly Blowing in India's Direction - Navneet MunotSiddharthNo ratings yet

- Project Report On Capital MarketDocument16 pagesProject Report On Capital MarketHarsha Vardhan Reddy0% (1)

- 9 Juhi Ahuja 812 Research Communication MBA July 2012Document13 pages9 Juhi Ahuja 812 Research Communication MBA July 2012snreddy85No ratings yet

- Final Project 2017Document56 pagesFinal Project 2017abhishek kalbaliaNo ratings yet

- Iip ArticlesDocument12 pagesIip ArticlesManoj AwasthiNo ratings yet

- Project 2 Nse BseDocument12 pagesProject 2 Nse BseIshita BansalNo ratings yet

- Forex Market in IndiaDocument17 pagesForex Market in Indiaamitwadhwa01100% (8)

- SIP Proposal ResearchDocument2 pagesSIP Proposal Researchmanku88No ratings yet

- Final Project Report VishnuDocument95 pagesFinal Project Report VishnuVishnu VishnuNo ratings yet

- Conclusion of BseDocument12 pagesConclusion of BseAnas AliNo ratings yet

- Introduction to the Indian Financial Market and Role of LICDocument49 pagesIntroduction to the Indian Financial Market and Role of LICAvinash ShettyNo ratings yet

- Increasing Online Trading Volume in IndiaDocument47 pagesIncreasing Online Trading Volume in Indiasonabeta07No ratings yet

- Indian Capital Market ReviewDocument6 pagesIndian Capital Market ReviewArindam BanerjeeNo ratings yet

- Financial Markets FinalDocument70 pagesFinancial Markets FinalHarveen BachherNo ratings yet

- Indian Economy Is The Third Largest Economy in The World in Terms of PurchasingDocument49 pagesIndian Economy Is The Third Largest Economy in The World in Terms of PurchasingchokhalalNo ratings yet

- Indian Stock Broking IndustryDocument49 pagesIndian Stock Broking Industrysatya_choubisa89% (9)

- FII's & DII's: Impact On Indian Stock MarketDocument31 pagesFII's & DII's: Impact On Indian Stock Marketpranav2411No ratings yet

- Introduction To Indian Stock ExchangeDocument23 pagesIntroduction To Indian Stock ExchangeManan JainNo ratings yet

- Origin and Development of The IndustryDocument9 pagesOrigin and Development of The IndustryDiwakar SinghNo ratings yet

- Research Paper On FIIDocument20 pagesResearch Paper On FIIchitkarashellyNo ratings yet

- SIP ProjectDocument26 pagesSIP ProjectsherryNo ratings yet

- Profits in IndiaDocument13 pagesProfits in Indiaamit_pustiNo ratings yet

- India Market Outlook 2024Document18 pagesIndia Market Outlook 2024arpit2mutha2No ratings yet

- Capital MarketDocument23 pagesCapital MarketlibnizNo ratings yet

- Impact of Macro Factors on Indian Stock MarketDocument16 pagesImpact of Macro Factors on Indian Stock MarketYulia FitriNo ratings yet

- Indian Capital MarketDocument70 pagesIndian Capital MarketSudha Devendran100% (10)

- India PresentationDocument84 pagesIndia Presentationnishantraj94No ratings yet

- India's Path to Becoming a Global Financial Services HubDocument13 pagesIndia's Path to Becoming a Global Financial Services HubPankaj KhatriNo ratings yet

- Stock ExchangeDocument20 pagesStock ExchangeVinayak YadavNo ratings yet

- Scope If If in IndiaDocument3 pagesScope If If in Indiapurple0123No ratings yet

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocument108 pagesFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- India Financial Market: Types, Role and Scope in Indian EconomyDocument5 pagesIndia Financial Market: Types, Role and Scope in Indian EconomyJayant BasnetNo ratings yet

- Understanding The Sensex.: What Is A Stock Index?Document4 pagesUnderstanding The Sensex.: What Is A Stock Index?Sonal JainNo ratings yet

- Study of Volatility and Its Factors On Indian Stock MarketDocument58 pagesStudy of Volatility and Its Factors On Indian Stock MarketjayminashahNo ratings yet

- Analysis of Indian Stock Market 2009-10Document65 pagesAnalysis of Indian Stock Market 2009-10s_sannit2k9No ratings yet

- Comparing Indian, US & Chinese stock exchangesDocument19 pagesComparing Indian, US & Chinese stock exchangesVencyNo ratings yet

- Sensex and The EconomyDocument5 pagesSensex and The EconomyAnkit PatiyatNo ratings yet

- 09 Chapter 1Document11 pages09 Chapter 1Ankit SinghNo ratings yet

- Final Report FileDocument96 pagesFinal Report Fileamazing_1No ratings yet

- Stock Market Income Genesis: Internet Business Genesis Series, #8From EverandStock Market Income Genesis: Internet Business Genesis Series, #8No ratings yet

- HLL and Project Sting ...Document11 pagesHLL and Project Sting ...Abbas AnsariNo ratings yet

- HLL and Project Sting ...Document11 pagesHLL and Project Sting ...Abbas AnsariNo ratings yet

- Term Paper On Inventory Management W.R.T. Retail IndustryDocument17 pagesTerm Paper On Inventory Management W.R.T. Retail IndustryAbbas Ansari100% (4)

- Innovation at Harley Davidson Case Study PresentationDocument12 pagesInnovation at Harley Davidson Case Study PresentationAbbas AnsariNo ratings yet

- Customer Analysis of Fine SwitchesDocument5 pagesCustomer Analysis of Fine SwitchesAbbas AnsariNo ratings yet

- Training Program of SAFENET Company...Document10 pagesTraining Program of SAFENET Company...Abbas AnsariNo ratings yet

- Pension Funds Boosting Indian Social Security SystemDocument22 pagesPension Funds Boosting Indian Social Security SystemAbbas AnsariNo ratings yet

- Impact of Celebrity Endorsement On Overall BrandDocument18 pagesImpact of Celebrity Endorsement On Overall BrandAbbas AnsariNo ratings yet

- Ipo ...... Details of Adani Power Ltd.Document11 pagesIpo ...... Details of Adani Power Ltd.Abbas AnsariNo ratings yet

- FM Term Paper On Capital Structure of DCMDocument17 pagesFM Term Paper On Capital Structure of DCMAbbas AnsariNo ratings yet

- Innovation at Harley Davidson Case Study PresentationDocument12 pagesInnovation at Harley Davidson Case Study PresentationAbbas AnsariNo ratings yet

- Term Paper On HRM in Small and Medium Enterprises......Document28 pagesTerm Paper On HRM in Small and Medium Enterprises......Abbas Ansari50% (8)

- OligopolyDocument15 pagesOligopolyAbbas AnsariNo ratings yet

- Classical TheoryDocument5 pagesClassical Theoryraj_sahu1823100% (2)

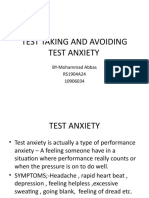

- Test Taking and Avoiding Test AnxietyDocument7 pagesTest Taking and Avoiding Test AnxietyAbbas AnsariNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Econ IntroDocument8 pagesEcon IntroRajeepan SuntharalingamNo ratings yet

- MonopolyDocument47 pagesMonopolyAbbas AnsariNo ratings yet

- Econ IntroDocument8 pagesEcon IntroRajeepan SuntharalingamNo ratings yet

- DemandDocument21 pagesDemandAbbas AnsariNo ratings yet

- Indian Economy OverviewDocument42 pagesIndian Economy OverviewAbbas AnsariNo ratings yet

- Recent Developments in Political, Economical & FinancialDocument5 pagesRecent Developments in Political, Economical & FinancialAbbas AnsariNo ratings yet

- BE Privatisation Liberal Is at IonDocument18 pagesBE Privatisation Liberal Is at IonAbbas AnsariNo ratings yet

- PLanningDocument4 pagesPLanningAbbas AnsariNo ratings yet

- Indian Economy OverviewDocument42 pagesIndian Economy OverviewAbbas AnsariNo ratings yet

- BE Industrial PolicyDocument25 pagesBE Industrial PolicyAbbas AnsariNo ratings yet

- Industrial Policy of IndiaDocument35 pagesIndustrial Policy of IndiaAbbas AnsariNo ratings yet

- Business Environment (BE) MGT511: Keshri Nandan ChaudharyDocument14 pagesBusiness Environment (BE) MGT511: Keshri Nandan ChaudharyAbbas AnsariNo ratings yet

- Business Environment (BE) MGT511Document13 pagesBusiness Environment (BE) MGT511Abbas AnsariNo ratings yet

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- Finance Interview Questions: Infosys BrigadeDocument13 pagesFinance Interview Questions: Infosys Brigadevivekp987No ratings yet

- Description: S&P Bse TeckDocument5 pagesDescription: S&P Bse TeckNeelkanth DaveNo ratings yet

- Bba Winter Project SahilDocument54 pagesBba Winter Project Sahilvaghasiyadixa1No ratings yet

- Birch CourtDocument16 pagesBirch CourtPrime Realty100% (1)

- 50 Bank Book IndexDocument2 pages50 Bank Book IndexAshutosh KumarNo ratings yet

- List of The Empaneled Project Management Consultants (PMC) For Mega Food Parks Scheme As On 09.05.2018Document2 pagesList of The Empaneled Project Management Consultants (PMC) For Mega Food Parks Scheme As On 09.05.2018Sunny Singh100% (1)

- Auto UpdatedDocument8 pagesAuto UpdatedAmitesh AgrawalNo ratings yet

- Stock Market - Black BookDocument82 pagesStock Market - Black BookHrisha Bhatt62% (52)

- H.G. Infra Engg. Result Analysis 2021-11-08Document13 pagesH.G. Infra Engg. Result Analysis 2021-11-08ab sajNo ratings yet

- Stocks with over 20% volume surgeDocument2 pagesStocks with over 20% volume surgeH3muPlayzGamez YTNo ratings yet

- SF Sonic Battery LogDocument6 pagesSF Sonic Battery LogSø MűNo ratings yet

- Accounts 2190 06042017Document245 pagesAccounts 2190 06042017shahbaz khanNo ratings yet

- Car Owners Email SampleDocument4 pagesCar Owners Email SamplegururajbNo ratings yet

- Fund Flow Statement - Kotak MahindraDocument79 pagesFund Flow Statement - Kotak MahindraRaghu VeerNo ratings yet

- Organisational Study of Hedge Equities LtdDocument56 pagesOrganisational Study of Hedge Equities LtdAju K Raju67% (6)

- Vishal Sood CVDocument9 pagesVishal Sood CVprofvishalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- CAV PG Mocat 7Document30 pagesCAV PG Mocat 7Mahesh ChavanNo ratings yet

- 2 Simhadri STPP (Stage I & II) Bhel 3 Sipat STPP (Stage - I) DoosanDocument9 pages2 Simhadri STPP (Stage I & II) Bhel 3 Sipat STPP (Stage - I) DoosanKoushik DeyNo ratings yet

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocument108 pagesFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- Name Contact No. Segment City/State PaymentDocument12 pagesName Contact No. Segment City/State Paymentshalabh chopraNo ratings yet

- Airtel Postpad Database SampleDocument8 pagesAirtel Postpad Database SampleBinduPrakashBhattNo ratings yet

- Harsh AlDocument128 pagesHarsh AlRavish KumarNo ratings yet

- Markets surge on easing yields, stimulus hopesDocument18 pagesMarkets surge on easing yields, stimulus hopesAnaya PatuchaNo ratings yet

- Financial Market Study MaterialDocument32 pagesFinancial Market Study MaterialSunil Kumar PatroNo ratings yet

- List of Thermal Power Stations As On 31.03.2019: Appendix-ADocument3 pagesList of Thermal Power Stations As On 31.03.2019: Appendix-ApragyanNo ratings yet

- UntitledDocument88 pagesUntitledJacob PriyadharshanNo ratings yet

- DLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroDocument143 pagesDLF - Building India: Achintya PR Ankit Uttam Arun Ks Manish Watharkar Nishigandha Pankaj Kumar Prashant PatroAshish AggarwalNo ratings yet

- Project Report by MeDocument103 pagesProject Report by MeRashmi Ranjan PanigrahiNo ratings yet