Professional Documents

Culture Documents

Sa Nov09 Garrett2

Sa Nov09 Garrett2

Uploaded by

JasonSpringCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sa Nov09 Garrett2

Sa Nov09 Garrett2

Uploaded by

JasonSpringCopyright:

Available Formats

01

technical

THere are two ways of estimating the cost of equity (the return

required by shareholders). Can this measurement of a companys cost

of equity be used as the discount rate with which to appraise capital

investments? Yes it can, but only if certain conditions are met.

cost of capital,

part 2 RELEVANT to ACCA QUALIFICATION papers f9 and P4

project appraisal 1 pure equity finance

So now we have two ways of estimating the cost of

equity (the return required by shareholders). Can

this measurement of a companys cost of equity

be used as the discount rate with which to appraise

capital investments? Yes it can, but only if certain

conditions are met:

1 A new investment can be appraised using the

cost of equity only if equity alone is being used

to fund the new investment. If a mix of funds is

being used to fund a new investment, then the

investment should be appraised using the cost of

the mix of funds, not just the cost of equity.

2 The gearing does not change. If the gearing

changes, the cost of equity will change and its

current value would no longer be applicable.

3 The nature of the business is unchanged. The

new project must be more of the same so

that the risk arising from business activities is

unchanged. If the business risk did change, once

again the old cost of equity would no longer

beapplicable.

These conditions are very restrictive and would

apply only when an all-equity company issued

more equity to do more of the same type of

activity. Our approach needs to be developed if we

are going to be able to appraise projects in more

generalenvironments.

In particular, we have to be able to deal with more

general sources of finance, not just pure equity, and

it would also be good if we could deal with projects

which have different risk characteristics from

existing activities.

PROJECT APPRAISAL 2 SAME BUSINESS ACTIVITIES,

A MIX OF FUNDS AND CONSTANT GEARING

Let us look at appraising a project which uses a

mix of funds, but where those funds are raised

so as to maintain the companys gearing ratio.

Remember, where there is a mix of funds, the funds

are regarded as going into a pool of finance and

a project is appraised with reference to the cost

of that pool of finance. That cost is the weighted

average cost of capital (WACC). As a preliminary

to this discussion, we need briefly to revise how

gearing can affect the various costs of capital,

particularly the WACC. The three possibilities are

set out in Example 1.

EXAMPLE 1

ke = cost of equity; kd = pre-tax cost of debt; Vd =

market value debt; Ve = market value equity. T is the

tax rate.

Cost %

ke

WACC

kd

Gearing = Vd/Ve

Conventional

theory of

cost capital

andgearing

student accountant 11/2009

Studying Papers F9 or P4?

Performance objectives 15 and 16 are linked

02

gearing and capm

Cost %

Modigliani

and Miller

withouttax

ke

WACC

kd

Gearing = Vd/Ve

Cost %

Modigliani and

Miller with tax

ke

WACC

kd (1-T)

Gearing = Vd/Ve

All three versions show that the cost of debt (Kd) is

lower than the cost of equity (Ke). This is because

debt is inherently less risky than equity (debt has

constant interest; interest is paid before dividends;

debt is often secured on assets; on liquidation

creditors are repaid before equity shareholders). In the

third version, cost of debt is further reduced because

in an environment with corporation tax, interest

payments enjoy tax relief.

Conventional theory dictates that as the more expensive equity

finance is replaced by cheaper debt finance, the wacc decreases.

download part 1 here

Looking at the three cases in a little more detail:

Conventional theory

When there is only equity, the WACC starts at the

cost of equity. As the more expensive equity finance

is replaced by cheaper debt finance, the WACC

decreases. However, as gearing increases further,

both debt holders and equity shareholders will

perceive more risk, and their required returns both

increase. Inevitably, WACC must increase at some

point. This theory predicts that there is an optimum

gearing ratio at which WACC is minimised.

Modigliani and Miller (M&M) without tax

M&M were able to demonstrate that as gearing

increases, the increase in the cost of equity

precisely offsets the effect of more cheap debt so

that the WACC remains constant.

Modigliani and Miller (M&M) with tax

Debt, because of tax relief on interest, becomes

unassailably cheap as a source of finance. It

becomes so cheap that even though the cost of

equity increases, the balance of the effects is to

keep reducing the WACC.

(Note: the M&M diagrams shown in Example 1

hold only for moderate levels of gearing. At very

high levels of gearing, other costs come into play

and the WACC can be shown to increase again

looking rather like the conventional theory.)

technical

Whichever theory you believe, whether there is

or isnt tax, provided the gearing ratio does not

change the WACC will not change. Therefore,

if a new project consisting of more business

activities of the same type is to be funded so as

to maintain the present gearing ratio, the current

WACC is the appropriate discount rate to use.

In the special case of M&M without tax, you can

do anything you like with the gearing ratio as the

WACC will remain constant and will be equal to

the ungeared cost of equity.

The condition that gearing is constant does not

have to mean that upon every issue of capital both

debt and equity also have to be issued. That would

be very expensive in terms of transaction costs.

What it means is that over the long term the gearing

ratio will not change. That would certainly be the

companys ambition if it believed it was already at

the optimum gearing ratio and minimum WACC.

Therefore, this year, it might issue equity, the next

debt and so on, so that the gearing and WACC hover

around a constant position.

Different business activities will have different risk characteristics and hence

any business carrying on those activities will have a different beta factor.

The new funds being put into the new project are subject to the risk inherent

In that project, and so should be discounted at a rate which reflects that risk.

03

PROJECT APPRAISAL 3 DIFFERENT

BUSINESS ACTIVITIES, A MIX OF FUNDS AND

CHANGINGGEARING

Lets deal with different business activities

first. Different activities will have different risk

characteristics and hence any business carrying

on those activities will have a different beta factor.

The new funds being put into the new project are

subject to the risk inherent in that project, and so

should be discounted at a rate which reflects that

risk. The formula:

E(ri) = Rf + i(E(rm) - Rf)

predicts the return that equity holders should

require from a project with a given risk, as

measured by the beta factor of that activity.

Note that we are doing something quite radical

here: CAPM is allowing us to calculate a risk

adjusted return on equity, tailor-made to fit the

characteristics of the project being funded. All

projects consist of capital being supplied, being

invested and therefore being subject to risk, but the

risk is determined by the nature of the project, not

the company undertaking the project. The existing

return on equity of the company that happens to be

the vehicle for the project has become irrelevant.

We can extend this argument as follows. If the

company doing the project is irrelevant theres no

reason why you cant view the project as being

undertaken by a new company specially set up for

that project. The way the project is funded is the

way the company is funded and, in particular, the

appropriate discount rate to apply to the project

is the WACC of the company/project, not its cost

of equity which would take into account only one

component of the funding.

So we can calculate the cost of equity component

which reflects project risk by using a beta value

appropriate to that risk. The final steps are to

adjust the cost of equity to reflect the gearing and

then to calculate the appropriate discount rate, the

WACC. The diagrams shown in Example 1 show

(qualitatively) how the rates might move. No matter

how reasonable the conventional theory seems,

its big drawback is that it makes no quantitative

predictions. However, the Modigliani and Miller

theory does make quantitative predictions, and

when combined with CAPM theory it allows the beta

factor to be adjusted so that it takes into account

not only business risk but also financial (gearing)

risk. The formula you need is provided in the

PaperF9 exam formula sheet:

a =

Ve

e

Ve + Vd (1 - T)

[ [

+

Vd (1-T) d

Ve + Vd(1 - T)

Where:

Ve = market value of equity

Vd= market value of debt

T = corporation tax rate

a = the asset beta

e = the equity beta

d = the debt beta

d, the debt beta, is nearly always assumed to be

zero, so the formula simplifies to:

we can calculate the cost of equity component which reflects project

risk by using a beta value appropriate to that risk. The final steps are to adjust

the cost of equity to reflect the gearing and then to calculate the

appropriate discount rate, the WACC.

student accountant 11/2009

a =

04

Vee

Ve + Vd (1 - T)

What is meant by a (the asset beta), and e (the

equity beta)?

The asset beta is the beta (a measure of risk)

which arises from the assets and the business the

company is engaged in. No heed is paid to the

gearing. An alternative name for the asset beta is

the ungeared beta.

The equity beta is the beta which is relevant to

the equity shareholders. It takes into account

the business risk and the financial (gearing) risk

because equity shareholders risk is affected by

both business risk and financial (gearing) risk.

An alternative name for the equity beta is the

geared beta.

Note that the formula shows that if Vd = 0 (iethere

is no debt), then the two betas are the same. If

there is debt, the asset beta will always be less

than the equity beta because the latter contains an

additional component to account for gearing risk.

The formula is extremely useful as it allows us

to predict the beta, and hence the cost of equity,

for any level of gearing. Once you have the cost of

equity, it is a straightforward process to calculate

the WACC and hence discount the project.

technical

To illustrate the use of CAPM in determining a

discount rate, we will work through the following

example, Example 2.

EXAMPLE 2

Emway Co is a company engaged in road building.

Its equity shares have a market value of $200

million and its 6% irredeemable bonds are valued at

par, $50m. The companys beta value is 1.3. Its cost

of equity is 21.1%. ( Note: this figure is quite high

in the current economic situation and is used for

illustration purposes. Currently, in a real situation,

the cost of equity would be lower.)

The company is worried about the recession and

is considering diversifying into supermarkets. It

has investigated listed supermarkets and found

one, Foodoo Co, which quite closely matches its

plans. Foodoo has a beta of 0.9 and the ratio of the

market value of its equity to its debt is 7:5. Emway

plans that its new venture would be financed with a

market value of equity to market value of debt ratio

of 1:1.

The corporation tax rate is 20%. The risk free rate

is 5.5%. The market return is 17.5%.

What discount rate should be used for the

evaluation of the new venture?

Solution:

1 We have information supplied about a company in

the right business but with the wrong gearing for

our purposes. To adjust for the gearing we plan

to have, we must always go through a theoretical

ungeared company in the same business.

Again the beta supplied to us will be the beta

measured in the market, so it will be an equity

(geared) beta. Were Foodoo to be ungeared, its

asset beta would be given by:

a =

Ve

e =

7

x 0.9

Ve + Vd (1 - T)

7 + 5 (1 - 0.2)

= 0.5727

This asset beta (ungeared beta) can now be

adjusted to reflect the gearing ratio planned in

the new venture:

0.5727 =

1

e

1 + 1(1 - 0.2)

So the planned e will be 0.5727 x 1.8 = 1.03

Check that this makes sense. Foodoo has a

gearing ratio of 7:5, equity to debt, a current beta

of 0.9, and a cost of equity of 16.30 (calculated

from CAPM as 5.5 + 0.9(17.5 - 5.5)). Were

Foodoo ungeared, its beta would be 0.5727, and

its cost of equity would be 12.37 (calculated

from CAPM as 5.5 + 0.5727(17.5 - 5.5)).

Emway is planning a supermarket with a gearing

ratio of 1:1. This is higher gearing, so the equity

beta must be higher than Foodoos 0.9.

In example 2, The appropriate rate at which to evaluate the project is the

WACC of the finance. Again, in the Paper F9 exam formula sheet you will find a

formula for WACC consisting of equity and irredeemabledebt.

05

06

2 To calculate the return required by the suppliers

of equity to the new project:

Required return = Risk free rate + (Return from

market - Risk free rate)

= 5.5 + 1.03 (17.5 - 5.5) = 17.86%

3 17.86 is the return required by equity holders,

but the new venture is being financed by a mix

of debt and equity, and we need to calculate the

cost of capital of this pool of finance.

Note that while Paper F9 does not require students

to undertake calculations of a project-specific

WACC, they are required to understand it from a

theoretical perspective.

The appropriate rate at which to evaluate the

project is the WACC of the finance. Again, in the

Paper F9 and Paper P4 exam formula sheet you

will find a formula for WACC consisting of equity

and irredeemabledebt.

Ke = 17.86%

Kd = 6% (from the cost of the debentures already

issued by Emway)

WACC =

1 x 17.86 + 1 x 6 (1 - 0.2) = 11.33%

1+1

1+1

in example 2, finally take account of the cheap debt finance that is mixed with

this equity finance by calculating the WACC of 11.33%. this is the rate which

should be used to evaluate the new supermarket project, funded

by debt:equity of 1:1.

student accountant 11/2009

In terms of the diagram used in Example 1, for

Modigliani and Miller with tax, what we have done

for Foodoos figures is set out below. We started

with information relating to a supermarket with a

gearing ratio of debt:equity of 5:7, and an implied

cost of equity of 16.30%. We strip out the gearing

effect to arrive at an ungeared cost of equity of

12.37, then we project this forward to whatever

level of gearing we want. In this example, this is

a gearing ratio of 1:1 and this implies a cost of

equity of 17.86%.

Finally, we take account of the cheap debt finance

that is mixed with this equity finance, by calculating

the WACC of 11.33%. This is the rate which should

be used to evaluate the new supermarket project,

funded by debt:equity of 1:1.

Cost %

ke

17.86

16.30

12.37

WACC

11.33

Kd (1-T)

5/7

1/1

Gearing = MVd/MVe

Ken Garrett is a freelance author and lecturer

You might also like

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceFrom EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNo ratings yet

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- Economic and Financial TermsDocument10 pagesEconomic and Financial Termsvica3_100% (4)

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- 24 Fischer10e SM Ch21 FinalDocument29 pages24 Fischer10e SM Ch21 Finalvivi anggiNo ratings yet

- Borrowing CostsDocument17 pagesBorrowing CostsJatin SunejaNo ratings yet

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- Cost of CapitalDocument7 pagesCost of CapitalRatheesh KumarNo ratings yet

- Optimum Capital StructureDocument7 pagesOptimum Capital StructureSajid Baloch100% (1)

- Capital Project Appraisal 2Document4 pagesCapital Project Appraisal 2Little JainNo ratings yet

- F14 Fin PDFDocument13 pagesF14 Fin PDFNageshwar SinghNo ratings yet

- Financial Education Association Journal of Financial EducationDocument4 pagesFinancial Education Association Journal of Financial EducationAkm EngidaNo ratings yet

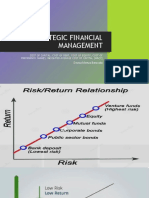

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- Ias 23 Borrowing CostsDocument4 pagesIas 23 Borrowing CostsIrina BanăNo ratings yet

- Unit 2: Step 2 - Create Value From Technologic Innovation Valuation and Negotiation of Technology CODE: 212032A - 611Document4 pagesUnit 2: Step 2 - Create Value From Technologic Innovation Valuation and Negotiation of Technology CODE: 212032A - 611Pato PatoNo ratings yet

- E10 Cost of Capital Gearing and CAPM Part 2Document6 pagesE10 Cost of Capital Gearing and CAPM Part 2TENGKU ANIS TENGKU YUSMANo ratings yet

- Equity ValDocument7 pagesEquity ValUdayan KarnatakNo ratings yet

- Module 4 - The Cost of CapitalDocument10 pagesModule 4 - The Cost of CapitalMarjon DimafilisNo ratings yet

- Capital Budgeting: Parvesh AghiDocument78 pagesCapital Budgeting: Parvesh Aghiparvesh aghiNo ratings yet

- CapitalizationDocument15 pagesCapitalizationbosodo2870No ratings yet

- Notes To Task 1Document3 pagesNotes To Task 1Marvic CabangunayNo ratings yet

- 04.04.2016 F3 Exam Techniques WebinarDocument11 pages04.04.2016 F3 Exam Techniques WebinarHusnina FakhiraNo ratings yet

- Intermediate Accounting - Borrowing CostsDocument2 pagesIntermediate Accounting - Borrowing Costs22100629No ratings yet

- Cost of Capital 45Document6 pagesCost of Capital 45kamal joshiNo ratings yet

- AFMDocument7 pagesAFMAbinash MNo ratings yet

- AB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RDocument18 pagesAB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RElaine TohNo ratings yet

- Quizlet Test 2 WACC PDFDocument1 pageQuizlet Test 2 WACC PDFAPRATIM BHUIYANNo ratings yet

- Borrowing Costs - ACTNG203notesDocument3 pagesBorrowing Costs - ACTNG203notesPgumballNo ratings yet

- Session 03 Corporate Finance WRDS.Document64 pagesSession 03 Corporate Finance WRDS.moadNo ratings yet

- Investment Decision RulesDocument33 pagesInvestment Decision RulesFarzad TouhidNo ratings yet

- Slide Title Subtitles Notes: Capital Bugeting Techniques Msac-301 Financial Management By: Vidal W. Badival, JRDocument5 pagesSlide Title Subtitles Notes: Capital Bugeting Techniques Msac-301 Financial Management By: Vidal W. Badival, JRMariel TinolNo ratings yet

- Chapter 05Document18 pagesChapter 05Muhammad IrfanNo ratings yet

- Cost of CapitalDocument10 pagesCost of CapitalAyush MishraNo ratings yet

- J CFM StudyText Chapter 6 PDFDocument16 pagesJ CFM StudyText Chapter 6 PDFgizzarNo ratings yet

- Capital Structure.. 10542022063Document25 pagesCapital Structure.. 10542022063Pari KNo ratings yet

- Week 05 Risk ManagementDocument26 pagesWeek 05 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Capital CostDocument11 pagesCapital CostAdeline XuNo ratings yet

- Accountng PrincipiesDocument2 pagesAccountng Principiesanvitag697No ratings yet

- CH 8 Cost of CapitalDocument18 pagesCH 8 Cost of CapitalJohn DavidsonNo ratings yet

- Chapter 4Document2 pagesChapter 4Azi LheyNo ratings yet

- Unit 4: Indian Accounting Standard 23: Borrowing Costs: Learning OutcomesDocument29 pagesUnit 4: Indian Accounting Standard 23: Borrowing Costs: Learning OutcomesYashviNo ratings yet

- Sa Oct09 Garrett2Document4 pagesSa Oct09 Garrett2Pawan_Vaswani_9863No ratings yet

- Clase III - Information For Investment and ValuationDocument208 pagesClase III - Information For Investment and ValuationMiguel Vega OtinianoNo ratings yet

- P4 Chapter 03 WACCDocument38 pagesP4 Chapter 03 WACCasim tariqNo ratings yet

- Corporate Finance Equations Notes 5Document13 pagesCorporate Finance Equations Notes 5Sotiris HarisNo ratings yet

- 7fab25fa-89b8-4495-88e8-da1026945df9Document14 pages7fab25fa-89b8-4495-88e8-da1026945df9MuhasinHaneefaNo ratings yet

- Wacc Example HBRDocument7 pagesWacc Example HBRJunaid MalikNo ratings yet

- Ind AS 23Document36 pagesInd AS 23stutisinha.chandraNo ratings yet

- Cost of CapitalDocument31 pagesCost of CapitalMerlin Gey BlessingsNo ratings yet

- 4 FundraisingDocument16 pages4 FundraisingGaurav SwamyNo ratings yet

- SBA-chap 8-10Document7 pagesSBA-chap 8-10Bea Cassandra DaellaNo ratings yet

- 07 Cafmst14 - CH - 05Document52 pages07 Cafmst14 - CH - 05Mahabub AlamNo ratings yet

- Chapter10 - Cost of CapitalDocument28 pagesChapter10 - Cost of CapitalchandoraNo ratings yet

- 10 Borrowing CostsDocument12 pages10 Borrowing CostsEJ EugenioNo ratings yet

- Cost of Capital Lecture NotesDocument10 pagesCost of Capital Lecture NotesATHARVA KALAMBENo ratings yet

- Week 04 Risk ManagementDocument16 pagesWeek 04 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet