Professional Documents

Culture Documents

Income-Based Valuation Methods

Uploaded by

Azi Lhey0 ratings0% found this document useful (0 votes)

10 views2 pagesChapter 4- Valuation Concept & Methods Reviewer

Original Title

CHAPTER-4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 4- Valuation Concept & Methods Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesIncome-Based Valuation Methods

Uploaded by

Azi LheyChapter 4- Valuation Concept & Methods Reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

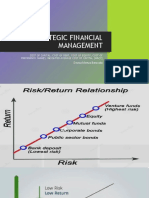

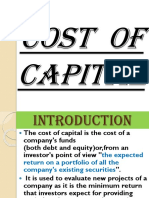

CHAPTER 4: INCOME-BASED VALUATION - In income-based valuation, a key driver id the cost

of capital or the required return for a venture.

- Many investors and analysts find that the best - COST OF CAPITAL can be computed through:

estimate for the value of the company or an asset is A.) Weighted Average Cost of Capital (WACC)

the value of the returns that it will yield or the

o Can be used in determining the

income that it will generate.

minimum required return.

- Income – is based in the amount of money that the

o It can be used to determine the

company or the assets will generate over the period appropriate cost of capital by

of time. weighing the portion of the asset

o These amounts will be reduced by the funded through equity and debt.

costs that they need to incur in order to

o FORMULA:

realize the cash inflows and operate the

assets. WACC = (Ke x We) + (Kd x Wd)

- In income-based valuation, investors consider two Ke = Cost of Equity

opposing theories: We = Weight of the equity financing

Kd = Cost of debt after tax

1.) Dividend Irrelevance Theory Wd = Weight of the debt financing

o Introduced by Modigliani and Miller

B.) Capital Asset Pricing Model (CAPM)

o Believes that the stock prices are not

o FORMULA:

affected by dividends or the returns on the

stock but more on the ability and

Re = Rf + β × (Rm − Rf)

sustainability of then asset or company.

2.) Bird-in-the-hand Theory

Rf = Risk free rate

o Also known as dividend relevance β = beta

theory. Rm = Market return

o Developed by Myron Gordon

o Believes that dividends or capital Kd = Rf + DM

gains has an impact on the price of the

stock. Rf = Risk free rate

- Once the value of the asset has been established, DM = Debt margin

investors and analysts are also particular about

certain factors that can be considered to properly ECONOMIC VALUED ADDED

value the asset. - the most conventional way to determine the value

of the asset is through its EVA.

1.) Earning accretion – the additional value

inputted in the calculation that would - In Economics and Financial Management, EVA is

account for the increase in the value of a convenient metric in evaluating investment as it

the firm due to other quantifiable quickly measures the ability of the firm to support

attributes like: its cost of capital using its earnings.

Potential growth

- EVA – is the excess of the company earnings after

Increase in prices and even

deducting the cost of capital.

Operating efficiencies – The excess earnings shall be

2.) Earnings dilution – will reduce value if accumulated for the firm.

there are future circumstances that will NOTE: Higher excess earnings is

affect the firm negatively. better for the firm.

3.) Equity control premium – the amount - Elements that must be considered in using EVA

that is added to the value of the firm in are:

order to gain control of it. Reasonableness of earnings or returns

4.) Precedent Transaction – are previous

Appropriate cost of capital

deals or experiences that can be similar

- FORMULA:

with the investment being evaluated.

NOTE: these transactions are EVA = Earnings - Cost of Capital

considered risks that may affect

further the ability to realize the Cost of Capital = Investment Value X Rate of

projected earnings. ` Cost of Capital

CAPITALIZATION OF EARNINGS METHOD

- The value of the company can also be associated

with the anticipated returns or income earnings on

the historical earnings and expected earnings.

- For greenfield investment which do not normally

have historical reference, it will only rely on its

projected earnings.

- Earnings – are typically interpreted as resulting

cash flows from operations but net income may

also be used if cash flow information is not

available.

- In capitalized earnings method, the value of the

asset or the investment is determined using the

anticipated earnings of the company divided by the

capitalization rate (cost of capital)

- This method provides for the relationship of the:

1.) Estimated Earnings of the company

2.) Expected yield or the required rate of

the return

3.) Estimated equity value

- EQUITY VALUE FORMULA:

Equity Value = Equity Value

Required Return

DISCOUNTED CASH FLOWS METHOD

o Is the most popular method of determining the

value.

o The most sophisticated approach in

determining the corporate value.

o More verifiable since this allows for a more

detailed approach in valuation.

You might also like

- Chapter 4 - NotesDocument2 pagesChapter 4 - NotesLovely CabardoNo ratings yet

- Referencer For Strategic Financial ManagementDocument24 pagesReferencer For Strategic Financial ManagementgauravNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementJwzNo ratings yet

- Chapter 5 - NotesDocument2 pagesChapter 5 - NotesLovely CabardoNo ratings yet

- STRATEGIC FINANCIAL MANAGEMENT CAPSULEDocument22 pagesSTRATEGIC FINANCIAL MANAGEMENT CAPSULEZafar IqbalNo ratings yet

- Strategic Financial Management: A Capsule For Quick RevisionDocument22 pagesStrategic Financial Management: A Capsule For Quick RevisionدهانوجﻛﻮﻣﺎﺭNo ratings yet

- Income Based Valuation-WordDocument1 pageIncome Based Valuation-WordMaribel TicnangNo ratings yet

- Capital Structure OptimizationDocument9 pagesCapital Structure OptimizationKimberly LimNo ratings yet

- Degerleme GelismeDocument32 pagesDegerleme GelismeferahNo ratings yet

- Understanding the Cost of CapitalDocument20 pagesUnderstanding the Cost of CapitalSufyan ImranNo ratings yet

- 07 Cafmst14 - CH - 05Document52 pages07 Cafmst14 - CH - 05Mahabub AlamNo ratings yet

- Fin Man Reviewer CH 14Document2 pagesFin Man Reviewer CH 14Kriz Genesis BurgosNo ratings yet

- Resumen FinancesDocument11 pagesResumen Financesfranchesca guillenNo ratings yet

- AB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RDocument18 pagesAB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RElaine TohNo ratings yet

- FinQuiz Curriculum Note Study Session 11 Reading 36 PDFDocument7 pagesFinQuiz Curriculum Note Study Session 11 Reading 36 PDFKdot KdotNo ratings yet

- Market Multiple Valuation Models-Mod - 4Document20 pagesMarket Multiple Valuation Models-Mod - 4Ravichandran RamadassNo ratings yet

- AFMDocument7 pagesAFMAbinash MNo ratings yet

- Valuation Models for Security AnalysisDocument44 pagesValuation Models for Security AnalysisArun KumarNo ratings yet

- Fin Mar ReviewerDocument2 pagesFin Mar ReviewerPixie CanaveralNo ratings yet

- Financial Management Cost of CapitalDocument66 pagesFinancial Management Cost of CapitalMohamed NabilNo ratings yet

- Cost of Capital - MarkedDocument8 pagesCost of Capital - MarkedSundeep MogantiNo ratings yet

- FM Unit4 NewDocument6 pagesFM Unit4 NewHariom lohiaNo ratings yet

- Topic 4 - Valuation of SharesDocument26 pagesTopic 4 - Valuation of SharesMiera FrnhNo ratings yet

- Session 03 Corporate Finance WRDS.Document64 pagesSession 03 Corporate Finance WRDS.moadNo ratings yet

- FNCE 100 FINAL CHEAT SHEET GUIDEDocument3 pagesFNCE 100 FINAL CHEAT SHEET GUIDEhung TranNo ratings yet

- 2 - Cost of CapitalDocument20 pages2 - Cost of CapitalSaYeD SeeDooNo ratings yet

- MnA ValuationDocument47 pagesMnA ValuationKemal AlNo ratings yet

- VCM reviewerDocument2 pagesVCM reviewerChristen HerceNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- Recognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationDocument7 pagesRecognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationMikaela LacabaNo ratings yet

- Strategic Financial ManagementDocument28 pagesStrategic Financial ManagementDayana MasturaNo ratings yet

- Financial Management Chapter 12 IM 10th EdDocument29 pagesFinancial Management Chapter 12 IM 10th EdDr Rushen SinghNo ratings yet

- Unit 6Document4 pagesUnit 610.mohta.samriddhiNo ratings yet

- Cost of CapitalDocument28 pagesCost of Capitalmeakki1100% (3)

- Cost of CapitalDocument26 pagesCost of CapitalShaza NaNo ratings yet

- Cost of Capital ExplainedDocument31 pagesCost of Capital ExplainedMerlin Gey BlessingsNo ratings yet

- Fin 081Document8 pagesFin 081Renalyn SanchezNo ratings yet

- Topic 09 Copia 2Document43 pagesTopic 09 Copia 2marvalle2001No ratings yet

- Calculating Cost of Capital for Various SourcesDocument6 pagesCalculating Cost of Capital for Various SourcessachinrdkhNo ratings yet

- Cost of Capital _ E-Notes __ Udesh Regular- Group 2Document11 pagesCost of Capital _ E-Notes __ Udesh Regular- Group 2ManavNo ratings yet

- SBA-chap 8-10Document7 pagesSBA-chap 8-10Bea Cassandra DaellaNo ratings yet

- Approach of The Cost of Capital As A Weighted Average Cost and As A Marginal CostDocument6 pagesApproach of The Cost of Capital As A Weighted Average Cost and As A Marginal CostPopescu IonNo ratings yet

- Discounted Cash Flow ModelDocument21 pagesDiscounted Cash Flow Modelvaibhavsachdeva0326No ratings yet

- Valuation Methods for Income-Based Asset ValuationDocument17 pagesValuation Methods for Income-Based Asset ValuationMika MolinaNo ratings yet

- Cost of CapitalDocument21 pagesCost of Capitalshan07011984No ratings yet

- Week 4 To 8Document8 pagesWeek 4 To 8Ray MundNo ratings yet

- Unit 2 - CFDocument74 pagesUnit 2 - CFRajat SharmaNo ratings yet

- COST OF CAPITAL Notes QnsDocument17 pagesCOST OF CAPITAL Notes QnschabeNo ratings yet

- Financial Statement Analysis and RatiosDocument6 pagesFinancial Statement Analysis and Ratiosshazlina_liNo ratings yet

- Cost of CapitalDocument14 pagesCost of CapitalShardulNo ratings yet

- Absolute vs Relative Valuation MethodsDocument3 pagesAbsolute vs Relative Valuation MethodsLilliane EstrellaNo ratings yet

- Module in Financial Management - 08Document15 pagesModule in Financial Management - 08Karla Mae GammadNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Mas Notes Rev - FinmanDocument4 pagesMas Notes Rev - FinmanPineda, Paula MarieNo ratings yet

- Valuation of Firms in Mergers and Acquisitions: Okan BayrakDocument27 pagesValuation of Firms in Mergers and Acquisitions: Okan Bayrakneha1001No ratings yet

- FM 2marks AllDocument22 pagesFM 2marks AllMohamed AbzarNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Sol. Man. - Chapter 7 Leases Part 1Document12 pagesSol. Man. - Chapter 7 Leases Part 1Miguel Amihan100% (1)

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Chapter 3Document2 pagesChapter 3Azi LheyNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- AIS Manzano 2aDocument1 pageAIS Manzano 2aAzi LheyNo ratings yet

- Pasig, Other Philippine Rivers Among Biggest Contributors To Ocean Plastic PollutionDocument1 pagePasig, Other Philippine Rivers Among Biggest Contributors To Ocean Plastic PollutionAzi LheyNo ratings yet

- Protestantism Is A Form of Christianity That Originated With The 16th-Century ReformationDocument5 pagesProtestantism Is A Form of Christianity That Originated With The 16th-Century ReformationAzi LheyNo ratings yet

- Paris To BerlinDocument3 pagesParis To BerlinAzi LheyNo ratings yet

- Protestantism Is A Form of Christianity That Originated With The 16th-Century ReformationDocument5 pagesProtestantism Is A Form of Christianity That Originated With The 16th-Century ReformationAzi LheyNo ratings yet

- Paris To BerlinDocument3 pagesParis To BerlinAzi LheyNo ratings yet

- FinMan Chapter 2 ObjectivesDocument10 pagesFinMan Chapter 2 ObjectivesAzi LheyNo ratings yet

- Chapter 6 Framework and Principles Lesson 3: Kenneth D. Mallari Azalea C. ManzanoDocument6 pagesChapter 6 Framework and Principles Lesson 3: Kenneth D. Mallari Azalea C. ManzanoAzi LheyNo ratings yet

- 21 OSINT Research Tools For Threat Intelligence 1643105531Document15 pages21 OSINT Research Tools For Threat Intelligence 1643105531dbfgablxzanbqtvybx100% (2)

- BUHAY NI Apolinario Mabini PDFDocument12 pagesBUHAY NI Apolinario Mabini PDFHelen SabuquelNo ratings yet

- Sannyasi and Fakir RebellionDocument17 pagesSannyasi and Fakir RebellionNityapriyaSrivastavaNo ratings yet

- Law Making Process or Legislative Procedure in PakistanDocument3 pagesLaw Making Process or Legislative Procedure in PakistanAbdullah FaizNo ratings yet

- Lecture Notes in Evidence-BarDocument33 pagesLecture Notes in Evidence-BarSherily CuaNo ratings yet

- Carlos TRABAJO FINAL INGLES 1 1Document7 pagesCarlos TRABAJO FINAL INGLES 1 1Greis sayuri Arellano AvendañoNo ratings yet

- INGLES - STUART MILL Volume 27 Journals and Debating Speeches Part II (1827) PDFDocument319 pagesINGLES - STUART MILL Volume 27 Journals and Debating Speeches Part II (1827) PDFEduardo SandezNo ratings yet

- History of Education TimelineDocument13 pagesHistory of Education Timelineapi-557136175No ratings yet

- Risa 3D ManualDocument335 pagesRisa 3D ManualanandNo ratings yet

- Supreme Court Rules on Chain of Custody in Drug CasesDocument15 pagesSupreme Court Rules on Chain of Custody in Drug CasesFacio BoniNo ratings yet

- Solutions For RefugeesDocument24 pagesSolutions For RefugeesjacquelineNo ratings yet

- Maurices Code of Conduct - PT. Pan Pacific Jakarta - EncryptedDocument4 pagesMaurices Code of Conduct - PT. Pan Pacific Jakarta - EncryptedAchmad Diky IrawanNo ratings yet

- Moving Up Ceremony SpeechDocument3 pagesMoving Up Ceremony SpeechJhei AfableNo ratings yet

- Íu:T - È8Â Gumapac Daniloâââââââ M ÇJ) &5sî Mr. Danilo Mirano GumapacDocument2 pagesÍu:T - È8Â Gumapac Daniloâââââââ M ÇJ) &5sî Mr. Danilo Mirano GumapacjpierceNo ratings yet

- SBI Print Ad Banker To Every Indian - ReportDocument2 pagesSBI Print Ad Banker To Every Indian - ReportSuraj Dikonda100% (1)

- The Boston Globe - 10 October 2022Document37 pagesThe Boston Globe - 10 October 2022Lemelin GauthierNo ratings yet

- US V RuizDocument2 pagesUS V RuizCristelle Elaine ColleraNo ratings yet

- Unit 9Document3 pagesUnit 9LexNo ratings yet

- TN Comptroller's Report: Volunteer Energy CooperativeDocument6 pagesTN Comptroller's Report: Volunteer Energy CooperativeDan LehrNo ratings yet

- Constitutional Law of India - Old Question PapersDocument114 pagesConstitutional Law of India - Old Question PapersSrinivasa RaoNo ratings yet

- Armorial Zim RhodesiaDocument141 pagesArmorial Zim RhodesiaG. Mac AoidhNo ratings yet

- The History of The Treman, Tremaine, Truman Family in AmericaDocument1,324 pagesThe History of The Treman, Tremaine, Truman Family in AmericaJakob AyresNo ratings yet

- Business Law FinalDocument1 pageBusiness Law FinalpohweijunNo ratings yet

- Unethical Issues in Marketing ManagementDocument14 pagesUnethical Issues in Marketing ManagementSreejith VrNo ratings yet

- Q1 WK 8 Activity Sheets - HousekeepingDocument14 pagesQ1 WK 8 Activity Sheets - Housekeepingmarissa clateroNo ratings yet

- TANGEDCO Officers Pay Revision 2018Document33 pagesTANGEDCO Officers Pay Revision 2018KARTHIKEYANNo ratings yet

- Bsba - Curriculum MapDocument2 pagesBsba - Curriculum Mapxxxx100% (2)

- Boone 19e c04 PPTDocument40 pagesBoone 19e c04 PPTJohn RitssNo ratings yet

- Oblicon HandoutsDocument15 pagesOblicon HandoutsCrisselJalbuna100% (2)

- Distinguishing The Types of Historical SourcesDocument3 pagesDistinguishing The Types of Historical SourcesCassandraNo ratings yet