Professional Documents

Culture Documents

Hyrothetical Ltd.

Hyrothetical Ltd.

Uploaded by

Hari Chandan0 ratings0% found this document useful (0 votes)

9 views2 pagesSolution to hypothetical case

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSolution to hypothetical case

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesHyrothetical Ltd.

Hyrothetical Ltd.

Uploaded by

Hari ChandanSolution to hypothetical case

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

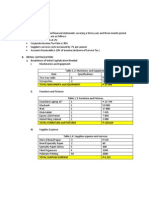

In the books of Hypothetical Limited

Calculation of Cost of goods sold

Items

Cost (in Rs.)

Direct Material

Direct Labor

Variable Overhead

Fixed Overhead

15\unit

5\unit

9\unit

6\unit

Total Cost

Therefore, cost of goods sold = 9000*35= Rs.315000

35\unit

Budgeted Profit and Loss

Item

Sales(9000*50)

Less: Discount

Net Sales

Less: Expenses

COGS(9000*35)

Capacity Variance

Selling and Administrative expenses

Profit before Tax

Tax payable

Profit after tax

Amount(RS.)

4,50,000

2,700

4,47,300

3,15,000

2,400

65,000

3,82,400

64,900

32,450

32,450

Cash Budget for January

Item

Receipt from Debtors

Previous Month

Current month without discount

Current month with discount

Payment to suppliers and other parties

Creditors

Previous month

Current month

Labor

Variable overhead

Sales and administrative expenses

Manufacturing overhead(60-20)

Outstanding taxes(December)

Net Cash Flow

Opening Cash Balance

Closing Cash Balance

Amount(rs.)

2,50,000

1,35,000

1,32,300

40,000

1,02,400

48,000

86,400

65,000

40,000

25,000

Amount(rs.)

5,17,300

4,06,800

1,10,500

3,00,000

4,10,500

You might also like

- Case 08-29 Cravat Sales CompanyDocument5 pagesCase 08-29 Cravat Sales Companysubash1111@gmail.comNo ratings yet

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- OpsMgmt M10923Document4 pagesOpsMgmt M10923Raj Kumar100% (1)

- An Exercise On Ratio AnalysisDocument2 pagesAn Exercise On Ratio AnalysisjiteshjacobNo ratings yet

- Chap 015Document31 pagesChap 015magic1111No ratings yet

- Budgetery Control & ABCDocument41 pagesBudgetery Control & ABCanupams3No ratings yet

- Exercise Financial Ratio AnalysisDocument1 pageExercise Financial Ratio Analysiswalixz_8750% (2)

- Budgetery Control & ABCDocument41 pagesBudgetery Control & ABCRohit ChandakNo ratings yet

- Excel Project EntrepreneurDocument21 pagesExcel Project EntrepreneurshumailshauqueNo ratings yet

- Total Machinery and Equipment P 25 098Document9 pagesTotal Machinery and Equipment P 25 098Hannah BarrantesNo ratings yet

- Ratio Analysis AssignmentDocument4 pagesRatio Analysis AssignmentMark Adrian ArellanoNo ratings yet

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDocument6 pagesFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraNo ratings yet

- YYY Yyyy Y Yyy Yy Yyyyy Yyy Y Yyyy YDocument17 pagesYYY Yyyy Y Yyy Yy Yyyyy Yyy Y Yyyy Yjanna777No ratings yet

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- FM HardDocument9 pagesFM HardKiran DalviNo ratings yet

- Seminar 11answer Group 11Document115 pagesSeminar 11answer Group 11Shweta SridharNo ratings yet

- Installment Sales - ReportDocument50 pagesInstallment Sales - ReportDanix Acedera100% (1)

- Microsoft PowerPoint - BPK3013 - T5Document29 pagesMicrosoft PowerPoint - BPK3013 - T5Muhammad AimiNo ratings yet

- Arctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetDocument4 pagesArctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetbgamejNo ratings yet

- Canopy Walk-Financial DataDocument3 pagesCanopy Walk-Financial DataPrincess_Wedne_3276No ratings yet

- Financial ComponentsDocument9 pagesFinancial ComponentsHannah BarrantesNo ratings yet

- BAO6504 Lecture 2, 2014Document20 pagesBAO6504 Lecture 2, 2014LindaLindyNo ratings yet

- Cash Flows From Operating ActivitiesDocument3 pagesCash Flows From Operating ActivitiesYvonne Ng Ming HuiNo ratings yet

- Holding Co. QuestionsDocument77 pagesHolding Co. Questionsअक्षय गोयलNo ratings yet

- BM B-Plann FinalDocument18 pagesBM B-Plann FinalSumit SalianNo ratings yet

- CH 14Document6 pagesCH 14Aminul Haque RusselNo ratings yet

- Question Set For Working Capital Management: Particulars Amt (In RS.) Opening Balance ofDocument2 pagesQuestion Set For Working Capital Management: Particulars Amt (In RS.) Opening Balance ofAmmar KanchwalaNo ratings yet

- Hillyard Master BudgetDocument4 pagesHillyard Master Budgetyuikokhj75% (4)

- Tutorial 3 AnswerDocument4 pagesTutorial 3 Answerwilliamnyx100% (1)

- Acc For Busi AssignmentDocument12 pagesAcc For Busi Assignmentpramodh kumarNo ratings yet

- Author: Author:: 290000 0.75 Due To Resale at Lesser Than Market PriceDocument16 pagesAuthor: Author:: 290000 0.75 Due To Resale at Lesser Than Market PricektsnlNo ratings yet

- Income From Business and Profession: Add: Inadmissiable ExpensesDocument8 pagesIncome From Business and Profession: Add: Inadmissiable ExpensessanamdadNo ratings yet

- Working Capital Management PDFDocument46 pagesWorking Capital Management PDFNizar AhamedNo ratings yet

- Master BudgetingDocument11 pagesMaster BudgetingsulavnepalNo ratings yet

- FI-Training OverviewDocument78 pagesFI-Training OverviewMajut AlenkNo ratings yet

- Accounting Standard (AS) - 3 Cash Flow StatementDocument13 pagesAccounting Standard (AS) - 3 Cash Flow StatementDivyanshu KumarNo ratings yet

- Numerical On Profits and Gains From Business and PDocument3 pagesNumerical On Profits and Gains From Business and PSumit SinghNo ratings yet

- Gastronaut Ice CreamDocument4 pagesGastronaut Ice CreamNAYANNo ratings yet

- CummingmDocument259 pagesCummingmfasanoj5211No ratings yet

- 07 11 2014 CA FINAL FR Nov 14 Guideline AnswersDocument16 pages07 11 2014 CA FINAL FR Nov 14 Guideline AnswersAmol TambeNo ratings yet

- Clark Paints ProjectDocument4 pagesClark Paints ProjectShaziel FranquiNo ratings yet

- Financial Template GuidelineDocument8 pagesFinancial Template GuidelineMcIman95No ratings yet

- Format For Financial StatementsDocument2 pagesFormat For Financial StatementsMin ZenNo ratings yet

- Cash and Accrual BasisDocument36 pagesCash and Accrual BasisHoney LimNo ratings yet

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDocument39 pagesConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNo ratings yet

- NumberDocument2 pagesNumberHelplineNo ratings yet

- Fa 2 - Vertical Financial StatementsDocument7 pagesFa 2 - Vertical Financial StatementsEduwiz Mänagemënt EdücatîonNo ratings yet

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoNo ratings yet

- 3 Income Statement ExamplesDocument3 pages3 Income Statement Examplesapi-299265916100% (1)

- Financial StatementsDocument7 pagesFinancial Statementsbim269No ratings yet

- Working Capital Estimation ProblemsDocument3 pagesWorking Capital Estimation ProblemsBunny MathaiNo ratings yet

- October 21, 2020 Financial AssetDocument12 pagesOctober 21, 2020 Financial AssetareebNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Module 5 Cash Flow Test Solution Posted Fall 2011Document6 pagesModule 5 Cash Flow Test Solution Posted Fall 2011sonic763No ratings yet

- Financial StatementDocument15 pagesFinancial StatementPankaj SharmaNo ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Smart City PressDocument15 pagesSmart City PressRaj Kumar100% (1)

- Risk Management at Wellfleet BankDocument21 pagesRisk Management at Wellfleet BankRaj KumarNo ratings yet

- Presentation m01 02Document11 pagesPresentation m01 02Raj KumarNo ratings yet

- Status of Elementary Education in Uttar PradeshDocument5 pagesStatus of Elementary Education in Uttar PradeshRaj KumarNo ratings yet

- MSCI 306S - Operations Management of Services - Summer 2002: Instructor: Professor Avi DechterDocument4 pagesMSCI 306S - Operations Management of Services - Summer 2002: Instructor: Professor Avi DechterRaj KumarNo ratings yet

- ArundelPartner PGP30121Document2 pagesArundelPartner PGP30121Raj KumarNo ratings yet

- UK Stewardship CodeDocument32 pagesUK Stewardship CodeRaj KumarNo ratings yet

- Atal Pension YojanaDocument2 pagesAtal Pension YojanaRaj KumarNo ratings yet

- The Relationship Between Information Asymmetry and Dividend PolicyPapDocument56 pagesThe Relationship Between Information Asymmetry and Dividend PolicyPapRaj KumarNo ratings yet

- Role of Institutional Investors in Corporate GovernanceDocument17 pagesRole of Institutional Investors in Corporate GovernanceRaj KumarNo ratings yet

- Demerger of South32 by BHP Billiton: Vote in FavourDocument196 pagesDemerger of South32 by BHP Billiton: Vote in FavourRaj KumarNo ratings yet

- United Kingdom and Ireland: Proxy Voting GuidelinesDocument35 pagesUnited Kingdom and Ireland: Proxy Voting GuidelinesRaj KumarNo ratings yet

- What Are The Objectives of The Various Database Marketing (DBM) Programs and Are They Working?Document5 pagesWhat Are The Objectives of The Various Database Marketing (DBM) Programs and Are They Working?Raj KumarNo ratings yet

- The Future of Private LabelDocument88 pagesThe Future of Private LabelRaj KumarNo ratings yet

- Aids DayDocument17 pagesAids DayRaj KumarNo ratings yet