Professional Documents

Culture Documents

GST An Opportunity To Reassess Your Supply Chain

GST An Opportunity To Reassess Your Supply Chain

Uploaded by

Vineet MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST An Opportunity To Reassess Your Supply Chain

GST An Opportunity To Reassess Your Supply Chain

Uploaded by

Vineet MishraCopyright:

Available Formats

GST: An Opportunity to reassess your Supply Chain

The cascading effect of local taxes and complex regulatory structure of central and state bodies have

added to the inefficiencies for businesses. The proposed GST augurs well for businesses through

simplified processes.

This can create competitive advantage for those who move early, say

Siddharth Paradkar (Principal Logistics) and Pratik Kadakia (Practice Head

Chemical & Energy) of Tata Strategic Management Group.

Introduction

of taxation. Under this, a value added tax would be

The dual governance structure of central and

levied at every point of the supply chain providing

state bodies make the current tax system very

for credit for any / all taxes paid previously.

complicated. The multi-layered system, with both

Central and State governments having the power

Keeping in line with the governance structure of the

to levy taxes brings about many inefficiencies in

country GST would be levied simultaneous by the

the system. The double taxation policy also adds

Centre and State (CGST and SGST respectively). All

cost as the tax paid earlier in the value chain

essential characteristics in terms of its structure,

gets re-taxed and firms end up paying tax on the

design applicability, etc. would be common between

tax paid.

CGST and SGST, across all states.

The government over the past years has tried to

GST is expected to replace most of the current

bring about some changes to try and minimize

applicable indirect taxes as listed in the table below

this cascading impact, however this is not to the

(Exhibit 1).

same extent as the new Goods and Services Tax

(GST) intends to do.

Impact of GST

Implementation of GST will have significant impact

GST is expected to be the next big bang fiscal

and will change the manner in which business is

reform

carried out in comparison with the ways of the

in

the

Indian

context.

GST,

if

implemented in the true spirit of its intent, will

bring

about

major

change

and

result

in

rationalizing and simplifying the tax structure at

both the Central and State levels

(even across state borders).

What is Goods and Services

Tax (GST)

current tax regime.

With a single rate being applied to all goods and

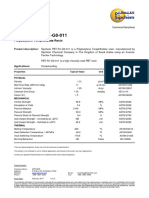

Exhibit 1: Taxes subsumed under GST

Central Taxes

State Taxes

Central Excise Duty

VAT / Sales Tax

Service Tax

Entertainment Tax

Additional customs Duty

Entry Tax (not in lieu of Octroi)

Surcharge and cesses

Other Taxes and Duties (includes Luxury Tax,

Taxes on lottery, betting and gambling, and all

cesses and surcharges by States)

GST is an evolution of the current

tax

regime,

transforming

the

complex and cascading structure

into a unified value added system

1

Tata Strategic Management Group

services there will be a significant redistribution

Business implication of GST

of taxes across all categories resulting in

Logistics and supply chains will therefore see a

reduction in taxes on manufactured goods and

major

hence impacting the pricing of the product.

warehousing decisions which are currently planned

change;

sourcing,

distribution

and

based on state level tax avoidance mechanisms

The integration of tax on Goods and Services

instead

through GST would provide the additional benefit

reorganized

of providing credit for service tax paid by

location and other factors relevant to the business.

of

operational

to

leverage

efficiencies

efficiencies

will

of

be

scale,

manufacturers. Both CENVAT & VAT which are in

practice now, give tax credit to the manufacturer

Rationalization of Warehouses and Transport

for the tax paid for raw materials (hence a tax is

network

charged only on the value added by the

GST would eliminate the existing penalties on inter

manufacturer). More often than not, there are

state sales transactions and facilitate consolidation

various services including logistics involved in

of vendors and suppliers. This will eliminate the

getting the input material to its final customers.

need to have state wise warehouses to avoid CST

Service tax is paid on the cost of such services.

and

With the implementation of GST, cost of any

elimination of one extra, redundant level of

services, including logistics, will be considered a

warehousing in the supply chain. This will result in

value add, and the manufacturer will get tax

a reduction in the number of warehouses (Exhibit

credit for the service tax paid.

2),

the

associated

improved

paperwork,

efficiencies,

better

leading

control

to

and

reduction in inventory due to lesser numbers of

Inter-state transactions to become tax

stocking points and cases of stock outs. This would

neutral

allow a firm to take advantage of economies of

Under GST inter-state sales transactions between

scale and consolidate warehouses at the same time

two dealers would be cost equivalent compared

reduce capital deployed in the business. Larger

with stock transfers / branch transfers. According

warehouses

to the proposed model, Centre would levy IGST

sophistication by deploying state-of-the-art planning

which would be CGST plus SGST on all inter-

and warehousing systems which are not feasible in

state transactions of taxable goods and services.

smaller, scattered warehouses. At the same time IT

The inter-state seller will pay IGST on value

costs of having ERPs deployed at many small

addition after adjusting available credit of IGST,

warehouses can be saved. This will pave the way

CGST, and SGST on his purchases. Similarly the

for improved service levels at lower cost in the

importing dealer will claim credit of IGST while

overall supply chain.

can

benefit

from

technological

discharging his output tax liability in his own

State.

This will result

in

inter-state sales

A rationalization similar to warehousing can also be

when

done in distribution and transportation routes as tax

compared to intra-state sales. India would

ceases to become the deciding factor. Since the tax

become one single common market no longer

rates across states are envisaged to be uniform,

divided by state borders.

state boundaries will no longer be the parameter for

transaction

becoming

tax

neutral

Tata Strategic Management Group

Exhibit 2: GST will enable manufacturers to realize higher margins

A Current Scenario- Companies have depots in destination states to counter CST

INDICATIVE

All figures in Rs. / Unit

State Border

Manufacturer

Landed cost

100

Margin

30

CST

0

Final Price

130

Depot

Landed cost

Depot cost

Margin

VAT

Final Price

Distributor

Landed cost

140.4

Margin

5

VAT credit

5.4

VAT

5.6

Final Price

145.6

130

5

0

5.4

140.4

Retailer

Landed cost

145.6

Margin

25

VAT credit

5.6

VAT

6.6

MRP

171.6

B Post GST Scenario- Zero CST on inter-state sales

State Border

Distributor

Landed cost

135

Margin

5

VAT

5.6

Final Price

145.6

Manufacturer

Landed cost

100

Margin

35

Final Price

135

Retailer

Landed cost

145.6

Margin

25

VAT credit

5.6

VAT

6.6

MRP

171.6

Post-GST the supply chain can be designed purely on logistics cost and customer service considerations

that will positively impact the business

deciding routes. At the same time, with larger

down for all to see. We expect GST to be

warehouses,

implemented during the course of the financial year

transportation

lot

sizes

will

automatically increase, making way for more

efficient bigger trucks.

2012-13.

The optimization and

rationalization that these options can bring about

Thus GST offers a great opportunity to revisit your

in the supply chains of a firm on account of GST

Supply Chain & Distribution strategy, and identify

will provide a competitive advantage to the

what is required to become GST ready. Those who

business through better service and faster

move early are likely to gain an advantage on cost

turnaround times at lower costs.

and service levels over their competitors and deliver

a better value proposition to the customer.

Opportunity

to

explore

alternate

distribution models

Organizations will now be able to explore

_______________________________________________________

Tata Strategic Management Group, 2011. No part of it may be

circulated or reproduced for distribution without prior written

approval from Tata Strategic Management Group.

different distribution models such as setting up

mother warehouse and regional distribution hubs

and possibly step away from traditional C&F and

distributor based models currently adopted. This

will lead to logistics and distribution to evolve

more strongly as a competitive advantage. The

government has already begun the process of

amending the constitution and getting the

necessary consensus from all the stake holders.

Though the exact details are still sketchy, the

structure and deliverables have been clearly laid

3

Tata Strategic Management Group

ABOUT TATA STRATEGIC

Tata Strategic Management Group is the largest Indian Owned Management Consulting Firm. Set up in 1991,

Tata Strategic has completed over 500 engagements with more than 100 Clients across countries and

industry sectors, addressing the business concerns of the top management. Today more than half the

revenue of Tata Strategic Management Group comes from working with companies outside the Tata Group.

We enhance client value by providing creative strategy advice, developing innovative solutions and

partnering effective implementation.

OUR OFFERINGS

Strategy

Set Direction

Vision

Market insights : B2B, Urban, Rural

Competitive Strategy

Growth/Business Plans

New Media Strategy

Organization Effectiveness

Drive Strategic

Initiatives

Organization Structure

Roles & Decision rules

Workforce Productivity

Performance Management

Capability Assessment

Talent Management

Delegation & MIS

Support

Implementation

India Entry

Alliance & Acquisition Planning

Strategic due diligence

Scenario Planning

Manufacturing Strategy

Operations

Marketing & Sales

Product Innovation

Market Share

Rural/Urban

Route-to-Market

Brand Strategy

Sales & Distribution

Processes

Marketing Effectiveness

Technology Upgradation

Logistics Optimization

Throughput enhancement

Fulfillment Leadership

Project Excellence

Strategic Sourcing

Procurement Costs

Implementation Support

Implementation Plan

Program Management

Refinements/Course Corrections

ABOUT THE AUTHOR

Siddharth Paradkar is Principal of the Logistics practice at Tata Strategic Management Group. He completed

his post graduation in Business Administration from Symbiosis, Pune in 2002 and has a Bachelors Degree in

Computer Science from Pune University. Siddharth has over 9 years of experience in the Logistics space and

related industries, working with different MNC organizations - holding various roles at regional and national

level.

B-1001 Marathon Futurex, NM Joshi Marg, Lower Parel (E)

Mumbai 400013, India

Tel 91 - 22 - 66376739 Fax 91 22 - 66376600

Url : www.tsmg.com Email : siddharth.paradkar@tsmg.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Indemnity Letter For Wrong Neft-1-1Document3 pagesIndemnity Letter For Wrong Neft-1-1Avinash Chandra100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Deed of Assignment of AtmDocument2 pagesDeed of Assignment of AtmMartin Martel100% (3)

- Resume - ShampitaDocument3 pagesResume - Shampitaapi-395838203No ratings yet

- Norma ASTM C1171-16Document3 pagesNorma ASTM C1171-16Cristian DiazNo ratings yet

- Cable Tool DrillingDocument13 pagesCable Tool DrillingAHMED100% (2)

- Commission On Audit Audit Team 4, Ngs-Sucs Bicol State College of Applied Sciences and Technology Naga CityDocument2 pagesCommission On Audit Audit Team 4, Ngs-Sucs Bicol State College of Applied Sciences and Technology Naga Cityjaymark camachoNo ratings yet

- Sipchem PBT-R1-G0-011: Polybutylene Terephthalate ResinDocument1 pageSipchem PBT-R1-G0-011: Polybutylene Terephthalate ResinTahir IqbalNo ratings yet

- Vijayalakshmi.G-AI Based Rush Collision Prevention in RailwaysDocument9 pagesVijayalakshmi.G-AI Based Rush Collision Prevention in RailwaysAnil KumarNo ratings yet

- Inception ReportDocument27 pagesInception ReportHenry AwuahNo ratings yet

- Cause List, C-2 (23.02.2023)Document6 pagesCause List, C-2 (23.02.2023)Prakalathan BatheyNo ratings yet

- Term Premium Notes ErsDocument21 pagesTerm Premium Notes ErsElice YumiNo ratings yet

- Essential Steps To Prepare For and Complete Proctored TUS ExamsDocument5 pagesEssential Steps To Prepare For and Complete Proctored TUS ExamsMohamed mohaNo ratings yet

- Automobile: Semi Floating Suspension System in AutomobileDocument30 pagesAutomobile: Semi Floating Suspension System in AutomobileFarhanNo ratings yet

- Right To Information and TourismDocument49 pagesRight To Information and TourismEquitable Tourism Options (EQUATIONS)No ratings yet

- Virtual Library System Internship ReportDocument16 pagesVirtual Library System Internship Reportfiker123No ratings yet

- Transfer of Cases: Deputy Public Prosecutor (DPP) Can Transfer The Case Thru by The SC/MC/PP)Document6 pagesTransfer of Cases: Deputy Public Prosecutor (DPP) Can Transfer The Case Thru by The SC/MC/PP)Bobo KhoNo ratings yet

- Grand Ledge High School Newsletter March 2014Document7 pagesGrand Ledge High School Newsletter March 2014Beagle Elementary SchoolNo ratings yet

- Bar 2021 - Data Privacy ActDocument7 pagesBar 2021 - Data Privacy Act김비앙카No ratings yet

- Cbe 107 Sterile Products FinalDocument68 pagesCbe 107 Sterile Products Finalto van trungNo ratings yet

- Ace-Pro Fire-Rating Cerificate With Technical SpecificationsDocument3 pagesAce-Pro Fire-Rating Cerificate With Technical SpecificationsrenjuNo ratings yet

- CDADocument6 pagesCDACouturier Pierre-GuillaumeNo ratings yet

- LaserStar Technologies Product Catalog 9.16Document74 pagesLaserStar Technologies Product Catalog 9.16Dejan BlanušaNo ratings yet

- Beachem v. Department of Corrections Et Al - Document No. 8Document2 pagesBeachem v. Department of Corrections Et Al - Document No. 8Justia.comNo ratings yet

- Characteristics of A Good Literature ReviewDocument7 pagesCharacteristics of A Good Literature Reviewdrnpguwgf100% (1)

- ASSE 1050-2021: American National StandardDocument24 pagesASSE 1050-2021: American National Standardไพบูลย์ เดชกล้าหาญNo ratings yet

- Research ProposalDocument14 pagesResearch Proposalcassim matolaNo ratings yet

- MGP1-BOC1888PO001-H02-0001 - 003 - Overall - Code 1 - MK - 150823Document10 pagesMGP1-BOC1888PO001-H02-0001 - 003 - Overall - Code 1 - MK - 150823jobertNo ratings yet

- Absorption and Marginal Costing - Additional QuestionsDocument6 pagesAbsorption and Marginal Costing - Additional Questionsunique gadtaulaNo ratings yet

- Middleville Regional Health Care Is OneDocument4 pagesMiddleville Regional Health Care Is OneEli Koech100% (2)

- Full Download pdf of (eBook PDF) Data Analysis and Decision Making 4th Edition all chapterDocument43 pagesFull Download pdf of (eBook PDF) Data Analysis and Decision Making 4th Edition all chaptertrassifoziya100% (10)