Professional Documents

Culture Documents

Kotak Mahindra Bank Limited Payslip For The Month of FEBRUARY - 2015

Uploaded by

priyadarshiniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Mahindra Bank Limited Payslip For The Month of FEBRUARY - 2015

Uploaded by

priyadarshiniCopyright:

Available Formats

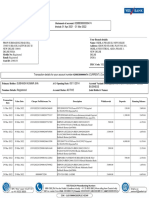

Kotak Mahindra Bank Limited

Payslip for the month of FEBRUARY - 2015

Em p. No

: 30231

Gender

: M

Old Id

Nam e

PAN No:

PF No.

ESI No.

PRAN No

:

:

:

:

:

:

Designation

Grade

Division

Location

BankA/Cno.

:

:

:

:

:

HITENDRA CHAVAN

AGQPC7439R

MH/35415/30231

Earnings

Basic

House Rent Allow.

Professional Allowance

Transport Allowance

Medical Reimbursement Month

Advance Against Lta

CHIEF MANAGER

M5

RETAIL LIABILITIES

MUMBAI

06420050003966

Monthly

Rate

Current

Month

Arrears

36425.00

18213.00

25468.00

1500.00

1333.00

2000.00

36425.00

18213.00

25468.00

1500.00

1333.00

2000.00

Bank Nam e.

Paym ent Mode

Dt.of Joining

Standard days

Days w orked

LOP Days

Refund Days

:

:

:

:

:

:

KOTAK MAHINDRA

BANK LTD

BANK - OTHERS

08/10/2010

28.00

28.00

0

0

Total Deductions

Total

36425.00 Income Tax

18213.00 Provident Fund

25468.00 Profession Tax

1500.00 Cell Phone Recovery

1333.00 Bus Recovery

2000.00 Mediclaim Premium Recovery

84939.00

Gross Deductions

36894.00

4371.00

300.00

148.00

1200.00

400.00

43313.00

Gross Earnings

Total

41626.00

Net Salary Payable

Net Salary Payable(In Words) Fourty One Thousand Six Hundred Tw enty Six Only

Incom e Tax Calculation for the Financial Year 2014 - 2015

Incom e Tax Calculation

Details of Exem ption U/S 10

Particulars

TRANSPORT EXEMPTION

Cum m ulativeAdd:ProjectedAdd:Current

Annual

36425.00

0.00

18213.00

434638.00

2462.00

217325.00

0.00

1231.00

1500.00

25468.00

18000.00

303567.00

0.00

0.00

2000.00

1035920.00

Income Tax Payable

NET INCOME TAX PAYABLE

EDUCATION CESS

TOTAL INCOME TAX & S/C PAYABLE

I TAX & S/C TO BE RECOVERED

MARGINAL TAX TO BE RECOVERED FOR THIS MONTH

Less Tax Deducted at source till current month

Balance Tax Payable/Refundable

Av erage Tax Payable per Month

:

PROVIDENT FUND

MEDICLAIM PREMIUM RECOVER :

102000.00

Start Date

24000.00

1105272.00

0.00

Start Date

1105272.00 LOP Dates

9600.00 Refund Dates

0.00

2500.00

0.00

1093172.00

52452.00

Incom e Tax Deduction

135776.00

135776.00

4073.00

139849.00

139849.00

0.00

102956.00

36893.00

36893.00

Investment Details

Start Date

2049.00 01-Apr-2014

4800.00

9600.00

Details of Perquisites

Loan Perquisites

361788.00

36425.00

BASIC

BASIC ARREAR

2462.00

0.00

180899.00

18213.00

HOUSE RENT ALLOW.

HOUSE RENT ALLOW.

1231.00

0.00

ARREAR

TRANSPORT ALLOWANCE

15000.00

1500.00

252631.00

25468.00

PROFESSIONAL ALLOWANCE

PROFESSIONAL ALLOWANCE

2049.00

0.00

ARR

ANNUAL INCENTIVE

102000.00

0.00

20000.00

2000.00

ADVANCE AGAINST LTA

SALARY FOR THE YEAR

Add : Income received from Previous Employer Salary

NET TAXABLE INCOME

Less: Deduction u/s 10

Less : Prof. Tax recovered by Previous Employer

Less : Prof. Tax recovered by Current Employer

Add : Other Taxable Income reported by the Employee

GROSS TAXABLE INCOME

LESS : DEDUCTION UNDER SECTION 80C

Less: Deductions U/s 80CCD, 80D, 80DD, 80DDB, 80E, 80G, 80GG,

80U,80CCG,80EE,80TTA

INCOME CHARGABLE TO TAX (ROUNDED OFF)

52452.00

4800.00

Rent Details

End Date

31-Mar-2015

Amount

0.00

CLA Details

End Date

Amount

Car Perk Details

End Date

:

:

Car CC

You might also like

- Pay Slip for Kelly Services India Pvt Ltd employee in December 2013Document1 pagePay Slip for Kelly Services India Pvt Ltd employee in December 2013adtyshkhrNo ratings yet

- Payslip MultiDocument2 pagesPayslip Multiviju5291No ratings yet

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDocument1 pageFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairNo ratings yet

- Bank StatementDocument1 pageBank StatementsachinrmishraNo ratings yet

- Payslip On DeputationDocument86 pagesPayslip On DeputationAnonymous pKsr5vNo ratings yet

- Salary Slip For The Month of March 2010-2011Document2 pagesSalary Slip For The Month of March 2010-2011Dinesh MircheNo ratings yet

- QUA06673 Feb-2016Document1 pageQUA06673 Feb-2016AmitNo ratings yet

- Date:27 12 2015Document1 pageDate:27 12 2015Anonymous pKsr5vNo ratings yet

- S Reg Payslp MarDocument3 pagesS Reg Payslp Marjaggu_gramNo ratings yet

- Earnings Deductions: ITZ Cash Card LTDDocument1 pageEarnings Deductions: ITZ Cash Card LTDPramit SaranNo ratings yet

- FT036B W 28 Aug2015Document1 pageFT036B W 28 Aug2015srivardanNo ratings yet

- EPFO ChallanDocument1 pageEPFO ChallanDalwinder SinghNo ratings yet

- Spl729 Payslip1 Feb 2015Document1 pageSpl729 Payslip1 Feb 2015Salil GuptaNo ratings yet

- FT036B W 26 Aug 2015Document1 pageFT036B W 26 Aug 2015srivardanNo ratings yet

- May 2014 Payslip for IndiaMART EmployeeDocument1 pageMay 2014 Payslip for IndiaMART Employeeabdul87s0% (1)

- 2 SM HDFC-impDocument3 pages2 SM HDFC-impHARSHAL MITTALNo ratings yet

- 2070 201503 PDFDocument1 page2070 201503 PDFDhondiram Maruthi KakreNo ratings yet

- 1396086940101Document5 pages1396086940101Jignesh PatelNo ratings yet

- December 2012 payslip for IndiaMART employee Bharat SinghDocument1 pageDecember 2012 payslip for IndiaMART employee Bharat SinghAshutosh SharmaNo ratings yet

- Payslip 635005165463798108Document1 pagePayslip 635005165463798108suyashyashsinghNo ratings yet

- 1396010413162Document7 pages1396010413162Shailendra Dwiwedi100% (1)

- SasssDocument1 pageSasssAdil SyedNo ratings yet

- Larsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Document2 pagesLarsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Nidharshan Selvaraj RNo ratings yet

- QUA04354 SalarySlipwithTaxDetailsmarchDocument1 pageQUA04354 SalarySlipwithTaxDetailsmarchrajanNo ratings yet

- BSNL BillDocument3 pagesBSNL BillTakpire DrMadhukar50% (2)

- QUA06673 Dec-2015Document1 pageQUA06673 Dec-2015AmitNo ratings yet

- S Reg PayslpDocument3 pagesS Reg Payslpjaggu_gram0% (1)

- 01 Apr 2021 - 31 Mar 2022Document48 pages01 Apr 2021 - 31 Mar 2022Subhash JhaNo ratings yet

- Pay-Slip: Name: Ajay Kumar Behera Designation: Month: CL SL PLDocument1 pagePay-Slip: Name: Ajay Kumar Behera Designation: Month: CL SL PLSibu SahuNo ratings yet

- QM NC 8 N8 ZFX9 Z 4 CWVDocument1 pageQM NC 8 N8 ZFX9 Z 4 CWVmath_mallikarjun_sapNo ratings yet

- Apr Final RecoDocument252 pagesApr Final RecoVivek PatilNo ratings yet

- QUA05432 SalarySlip March 15Document1 pageQUA05432 SalarySlip March 15Deepak KumarNo ratings yet

- Apr FinalDocument48 pagesApr FinalVivek PatilNo ratings yet

- Date:02 02 2016Document1 pageDate:02 02 2016Anonymous pKsr5vNo ratings yet

- QUA06194 SalarySlipwithTaxDetails23 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails23 PDFUtsabNo ratings yet

- QUA06184 SalarySlipwithTaxDetails2 PDFDocument1 pageQUA06184 SalarySlipwithTaxDetails2 PDFVivek KumarNo ratings yet

- QUA05432 SalarySlipwithTax FEB15Document1 pageQUA05432 SalarySlipwithTax FEB15Deepak KumarNo ratings yet

- Pay Slip For March 2013: ADOR Welding LimitedDocument1 pagePay Slip For March 2013: ADOR Welding LimitedDushyant BhosaleNo ratings yet

- QUA04047 Mar15Document1 pageQUA04047 Mar15Mehtab saifiNo ratings yet

- ALRexDocument1 pageALRexChris D'MelloNo ratings yet

- Rosemount Shipping (India) Pvt. LTD: Payslip For The Month of February-2015Document1 pageRosemount Shipping (India) Pvt. LTD: Payslip For The Month of February-2015saranNo ratings yet

- QUA06706 - SalarySlipwithTaxDetails Jan PDFDocument1 pageQUA06706 - SalarySlipwithTaxDetails Jan PDFmrugeshkateNo ratings yet

- 1418736962963Document3 pages1418736962963Rahul SakareyNo ratings yet

- (259097026) SMDocument1 page(259097026) SMrampw14581No ratings yet

- QUA05432 SalarySlipwithTax JAN 15Document1 pageQUA05432 SalarySlipwithTax JAN 15Deepak KumarNo ratings yet

- Emp July To SepDocument3 pagesEmp July To SepsivagamipalaniNo ratings yet

- December 2013 Salary SlipDocument1 pageDecember 2013 Salary SlipEdwin GarciaNo ratings yet

- Date:26 02 2016Document1 pageDate:26 02 2016Anonymous pKsr5vNo ratings yet

- 2070 201504 PDFDocument1 page2070 201504 PDFDhondiram Maruthi KakreNo ratings yet

- QUA06194 SalarySlipwithTaxDetails21 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails21 PDFUtsabNo ratings yet

- QUA06706 - SalarySlipwithTaxDetails Feb PDFDocument1 pageQUA06706 - SalarySlipwithTaxDetails Feb PDFmrugeshkateNo ratings yet

- QUA06706 - SalarySlipwithTaxDetails March PDFDocument1 pageQUA06706 - SalarySlipwithTaxDetails March PDFmrugeshkateNo ratings yet

- F N F PayslipDocument1 pageF N F PayslipsovitNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountbhawanachitlangiaNo ratings yet

- WelcomeKit - T02972221022093313 - 2 Feb 2023Document3 pagesWelcomeKit - T02972221022093313 - 2 Feb 2023rajkumar sainiNo ratings yet

- Payslip MayDocument1 pagePayslip Mayabdul87sNo ratings yet

- QUA06702 SalarySlipwithTaxDetailsDocument1 pageQUA06702 SalarySlipwithTaxDetailsZubairsaeedNo ratings yet

- Jpqr9l104xgdt5lvxacedw IV GP PyslpDocument1 pageJpqr9l104xgdt5lvxacedw IV GP PyslpAsim JavedNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- HDFC Bank Limited - Placement Document - Feb 2015 PDFDocument589 pagesHDFC Bank Limited - Placement Document - Feb 2015 PDFpriyadarshiniNo ratings yet

- 23 July 2015 Page 23Document1 page23 July 2015 Page 23priyadarshiniNo ratings yet

- Chapter-Ii Review of LiteratureDocument33 pagesChapter-Ii Review of LiteraturepriyadarshiniNo ratings yet

- 17 August 2015 Page 11Document1 page17 August 2015 Page 11priyadarshiniNo ratings yet

- HDFC Bank PDFDocument73 pagesHDFC Bank PDFpriyadarshini100% (1)

- Chapter-Ii Review of LiteratureDocument33 pagesChapter-Ii Review of LiteraturepriyadarshiniNo ratings yet

- Chapter-Ii Review of LiteratureDocument33 pagesChapter-Ii Review of LiteraturepriyadarshiniNo ratings yet

- 11 Chemistry Notes Ch10 S BlockDocument11 pages11 Chemistry Notes Ch10 S BlockpriyadarshiniNo ratings yet

- Ijrcm 2 IJRCM 2 - Vol 3 - 2013 - Issue 10 Art 13 PDFDocument16 pagesIjrcm 2 IJRCM 2 - Vol 3 - 2013 - Issue 10 Art 13 PDFpriyadarshiniNo ratings yet

- 11 Chemistry Notes Ch10 S BlockDocument11 pages11 Chemistry Notes Ch10 S BlockpriyadarshiniNo ratings yet

- 11 Chemistry Notes Ch10 S BlockDocument11 pages11 Chemistry Notes Ch10 S BlockpriyadarshiniNo ratings yet