Professional Documents

Culture Documents

Boston Hololens

Boston Hololens

Uploaded by

Jordan MorrisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boston Hololens

Boston Hololens

Uploaded by

Jordan MorrisCopyright:

Available Formats

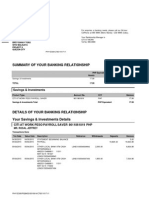

CDM Smith Inc.

Weekly Expense Report

Report Type

Business Unit

Full Reimbursement

Per Diem

CCI

COR

NAU

TSU

ISU

$0.00

By signing this expense report , the employee certifies that all expenses comply with CDM Smith's expense reporting policies ,

Code of Ethics and Standards of Business Conduct , and client-specific policies

for gifts and entertainment.

$1,532.11

PAID BY EMPLOYEE

$0.00

ADVANCE AMOUNT

Morris

Jordan

LAST

FIRST

Phoenix

MI

LOCATION

91795

17-Oct-15

EMPLOYEE NUMBER

WEEK ENDING DATE

Client

Project

SIGNATURE

DUE TO CDM SMITH

APPROVAL

Client and Purpose

Expense Types

Project/Account

Subtask

Per Diem Location

Exp

Typ

Expense Explanation

Expenses by Day

10/11/2015

10/12/2015

10/13/2015

10/14/2015

10/15/2015

10/16/2015

10/17/2015

Total By

Expense

Total by

Project/

Sun

Mon

Tue

Wed

Thu

Fri

Sat

Type

Account

9998

109843 2015.USECASES

Boston, MA

9998

109843 2015.USECASES

Boston, MA

1 Mileage (Home-Airport-Home)

12 miles EW

3 Hotel

9998

109843 2015.USECASES

Boston, MA

4 Subway & Parking

$6.90

9998

109843 2015.USECASES

Boston, MA

10 Airfare

$621.20

9998

109843 2015.USECASES

Boston, MA

30 Meals

$34.08

$18.73

9998

109843 2015.USECASES

Boston, MA

41 Hotel Taxes

$50.43

$50.43

$1,066.91

$418.16

$349.00

$6.90

$0.00

$0.00

FORWARD TO CORPORATE ACCOUNTING

$13.80

$349.00

$5.30

TOTALS

Meeting with Object Theory

Page 1

$1,532.11

DUE TO EMPLOYEE(OR)

$698.00

$27.00

$32.30

$621.20

$13.14

$65.95

$100.86

$47.04

$0.00

$0.00

$1,532.11

10/16/2015

You might also like

- Bank Statement 4Document4 pagesBank Statement 4Jardan Nelli88% (8)

- Your Business Advantage Checking: Account SummaryDocument7 pagesYour Business Advantage Checking: Account SummaryMucho FacerapeNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Bplo - OpcrDocument6 pagesBplo - OpcrMecs Nid67% (3)

- Architect Invoice TemplateDocument5 pagesArchitect Invoice TemplateVholts Villa VitugNo ratings yet

- Ucp 600 & New Isbp 2013 - OctDocument4 pagesUcp 600 & New Isbp 2013 - OctReshmaShresthaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Branch MemoDocument20 pagesBranch MemoDenzel Edward CariagaNo ratings yet

- Check Register September 2015 11-02-15Document11 pagesCheck Register September 2015 11-02-15L. A. PatersonNo ratings yet

- Summary of Your Banking Relationship: Savings & InvestmentsDocument4 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- Project Closure Summary Report S151805-49-00Document2 pagesProject Closure Summary Report S151805-49-00jaswinderNo ratings yet

- Narender Resume Final PDFDocument2 pagesNarender Resume Final PDFnarender singhNo ratings yet

- Ideposit Merchant ApplicationDocument4 pagesIdeposit Merchant Applicationcris4455No ratings yet

- APARNote 1560149945966Document4 pagesAPARNote 1560149945966Rinesh ChandNo ratings yet

- Summary of Your Banking Relationship: Savings & InvestmentsDocument3 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- CRM ModuleDocument10 pagesCRM ModuleSarika MishraNo ratings yet

- B 73 C 604 C 20110218Document4 pagesB 73 C 604 C 20110218ALine QueiRozNo ratings yet

- 7110 s10 QP 11Document12 pages7110 s10 QP 11mstudy123456No ratings yet

- Payment Stub: Total Amount Due 2,554.73Document8 pagesPayment Stub: Total Amount Due 2,554.73Jornie Marie W. LagunaNo ratings yet

- 7110 w09 QP 1Document12 pages7110 w09 QP 1mstudy123456No ratings yet

- LCLM Soa Jun01-15Document12 pagesLCLM Soa Jun01-15Anonymous ciRKBHHQNo ratings yet

- Chapter 9 Signature AssignmentDocument17 pagesChapter 9 Signature Assignmentapi-270738730No ratings yet

- Avinash Mohamme1Document6 pagesAvinash Mohamme1anon-380727No ratings yet

- Service Plan: Sales Order FormDocument1 pageService Plan: Sales Order FormZizi IndraNo ratings yet

- The Senior ManagerDocument52 pagesThe Senior ManagerShreepathi AdigaNo ratings yet

- Sept 26 2010Document3 pagesSept 26 2010Tin ReyesNo ratings yet

- Compliance To Commercial - FinalDocument5 pagesCompliance To Commercial - FinalAndrew JepsonNo ratings yet

- Aug 2011Document8 pagesAug 2011Erez SharabiNo ratings yet

- Oscar CVDocument7 pagesOscar CVOscar LoredoNo ratings yet

- VMPM Income Statement Questionnaire For Self EmployedDocument3 pagesVMPM Income Statement Questionnaire For Self EmployeddamoydskeeneNo ratings yet

- GaapDocument20 pagesGaapDebbie LangolfNo ratings yet

- Contractor'S Pre-Qualification Checklist: WWW - Stevenson.mb - CaDocument2 pagesContractor'S Pre-Qualification Checklist: WWW - Stevenson.mb - CaVerjz SoldevillaNo ratings yet

- Contractor'S Pre-Qualification Checklist: WWW - Stevenson.mb - CaDocument2 pagesContractor'S Pre-Qualification Checklist: WWW - Stevenson.mb - CaVerjz SoldevillaNo ratings yet

- Accounting, Tax and Payroll Services - Lani-Rose Shipping PDFDocument6 pagesAccounting, Tax and Payroll Services - Lani-Rose Shipping PDFjohnkurt catipayNo ratings yet

- 50 Cent Attorney FeesDocument99 pages50 Cent Attorney Feesefuchs160No ratings yet

- Hhfa10 ch03 Student PPTDocument91 pagesHhfa10 ch03 Student PPTnoblevermaNo ratings yet

- Summary of Your Banking Relationship: Savings & InvestmentsDocument3 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- Account Receivable ManagementDocument24 pagesAccount Receivable ManagementMaKayla De JesusNo ratings yet

- Revenue Recognition: 12/18/20 Intermediate 2Document5 pagesRevenue Recognition: 12/18/20 Intermediate 2Om BasimNo ratings yet

- Revenue Reconigtion Principle - ExamplesDocument4 pagesRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Grex InvoiceDocument1 pageGrex InvoiceGuillermo OcampoNo ratings yet

- CH 7 IntermediateDocument21 pagesCH 7 IntermediateArely ChapaNo ratings yet

- 1 Ayzed Financial Cement Sco 22812 PDFDocument5 pages1 Ayzed Financial Cement Sco 22812 PDFYanniLagoutarisNo ratings yet

- Is A Current Year Ira Deduction The Best Long-Term Tax Strategy?Document21 pagesIs A Current Year Ira Deduction The Best Long-Term Tax Strategy?Anggita LianiNo ratings yet

- FalseDocument5 pagesFalseclarissay_1No ratings yet

- Client Information SheetDocument2 pagesClient Information SheetMatt TupperNo ratings yet

- Pac Ver Finalans KeyDocument10 pagesPac Ver Finalans KeyArun LalNo ratings yet

- Efilling ProjectDocument22 pagesEfilling ProjectTaiyab SiddiqueNo ratings yet

- Questionaires Od Secret ExamsDocument34 pagesQuestionaires Od Secret ExamsAlyssa Joy Servano VillaricaNo ratings yet

- 0452 w09 QP 1Document12 pages0452 w09 QP 1MahmozNo ratings yet

- My ResumeDocument3 pagesMy ResumeThanigaivel BheemarajNo ratings yet

- Service Plan: Sales Order FormDocument1 pageService Plan: Sales Order FormZizi IndraNo ratings yet

- Book 4Document9 pagesBook 4bharatkhati996No ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Yates Logistics BofA SepDocument7 pagesYates Logistics BofA SepJonathan Seagull LivingstonNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456No ratings yet

- Howtosetupa Trading Business: (Interactive Brokers Webinar)Document49 pagesHowtosetupa Trading Business: (Interactive Brokers Webinar)Barack ObamaNo ratings yet