Professional Documents

Culture Documents

Fundamental Analysis of Public Sector Banks

Fundamental Analysis of Public Sector Banks

Uploaded by

satishdinakarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Analysis of Public Sector Banks

Fundamental Analysis of Public Sector Banks

Uploaded by

satishdinakarCopyright:

Available Formats

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

ISSN: 2319-4421

Fundamental Analysis of Public Sector Banks

Deepika Dhingra, Research Scholar, Faculty of Management Studies-University of Delhi

ABSTRACT

INTRODUCTION OF BANKING SECTOR

The study represents the brief idea about Indian banking

sector and fundamental analysis of public sector banks. In

fundamental analysis an attempt is made to analyze

various fundamental or basic factors that affect the riskreturn of the securities. The analysis of economy, industry

and company fundamental is the main ingredient of the

fundamental approach. The analyst should take into

account the entire three constituent that form different but

special steps in making various decisions. Fundamental

analysis helps to analyze the strength of basics of Indian

banking sector. It provides the information on the long

term stability of banking sector and future growth

prospects in banking sector. Fundamental analysis can

help the various interested parties by providing relevant

information to them, which can help them to take informed

decision. Investors can find out the past performance of

the banking sector, recent changes and their impact on

this sector, and future prospects of higher return and

stability in this sector. Banks can find out the

opportunities available in the market, perception of

customers, weaknesses and ways to improve in future, It

focuses on the emergence of Indian banking sector, its

reform over the period, its connection with the world

economic

conditions,

banking

sector

analysis,

environmental analysis and the analysis of performance of

the top public sector banks. Economic analysis covers the

recent changes in the world economy and its impact on

Indian banking sector. It includes macro economic

analysis and micro economic analysis (fiscal and

monetary policy changes).

Without a sound and effective banking system in India it

cannot have a healthy economy. The banking system of

India should not only be hassle free but it should be able

to meet new challenges posed by the technology and any

other

external

and

internal

factors.

For the past three decades India's banking system has

several outstanding achievements to its credit. The most

striking is its extensive reach. It is no longer confined to

only metropolitans or cosmopolitans in India. In fact,

Indian banking system has reached even to the remote

corners of the country. This is one of the main reason of

India's growth process. The government's regular policy

for Indian bank since 1969 has paid rich dividends with

the nationalization of 14 major private banks of India.

Banking sector analysis involves the stage of banking

sector life cycle, banking sector performance.

Environmental analysis includes attitude of government

towards public banks, competitors and technology

progress and SWOT analysis of public sector banks

Performance of the top public sector banks is analyzed on

the basis of ratio analysis, non performing assets, profits

and capital adequacy ratio etc. The performance of public

sector banks is also compared with the private sector

banks to understand the perception of customers and to

measure the competitiveness of public sector banks. It can

help to understand the shortcomings of public sector

banks and find out the ways to improve performance.

i-Xplore International Research Journal Consortium

Not long ago, an account holder had to wait for hours at

the bank counters for getting a draft or for withdrawing

his own money. Today, he has a choice. Gone are days

when the most efficient bank transferred money from one

branch to other in two days. Now it is simple as instant

messaging or dial a pizza. Money has become the order of

the day.

The first bank in India, though conservative, was

established in 1786. From 1786 till today, the journey of

Indian Banking System can be segregated into three

distinct phases. They are as mentioned below:

Early phase from 1786 to 1969 of Indian Banks

Nationalization of Indian Banks and up to 1991

prior to Indian banking sector Reforms.

New phase of Indian Banking System with the

advent of Indian Financial & Banking Sector

Reforms after 1991.

To make this write-up more explanatory, I prefix the

scenario as Phase I, Phase II and Phase-in.

Phase I

Banking in India originated in the last decades of the 18th

century. The first banks were The General Bank of India,

which started in 1786, and the Bank of Hindustan, both of

which are now defunct. The oldest bank in existence in

India is the State Bank of India, which originated in the

Bank of Calcutta in June 1806, which almost immediately

became the Bank of Bengal. This was one of the three

presidency banks, the other two being the Bank of

Bombay and the Bank of Madras, all three of which were

established under charters from the British East India

Company. For many years the Presidency banks acted as

www.irjcjournals.org

19

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

ISSN: 2319-4421

quasi-central banks, as did their successors. The three

banks merged in 1925 to form the Imperial Bank of India,

which, upon India's independence, became the State Bank

of India.

process of nationalisation was carried out. It was the effort

of the then Prime Minister of India, Mrs. Indira Gandhi.

14 major commercial banks in the country was

nationalized.

Indian merchants in Calcutta established the Union Bank

in 1839, but it failed in 1848 as a consequence of the

economic crisis of 1848-49. The Allahabad Bank,

established in 1865 and still functioning today, is the

oldest Joint Stock bank in India. When the American Civil

War stopped the supply of cotton to Lancashire from the

Confederate States, promoters opened banks to finance

trading in Indian cotton. With large exposure to

speculative ventures, most of the banks opened in India

during that period failed. The depositors lost money and

lost interest in keeping deposits with banks. Subsequently,

banking in India remained the exclusive domain of

Europeans for next several decades until the beginning of

the 20th century.

Second phase of nationalization Indian Banking Sector

Reform was carried out in 1980 with seven more banks.

This step brought 80% of the banking segment in India

under Government ownership.

Foreign banks too started to arrive, particularly in

Calcutta, in the 1860s. The Comptoire d'Escompte de

Paris opened a branch in Calcutta in 1860, and another in

Bombay in 1862; branches in Madras and Pondicherry,

then a French colony, followed. Calcutta was the most

active trading port in India, mainly due to the trade of the

British Empire, and so became a banking center.

During the first phase the growth was very slow and banks

also experienced periodic failures between 1913 and 1948.

There were approximately 1100 banks, mostly small. To

streamline the functioning and activities of commercial

banks, the Government of India came up with The

Banking Companies Act, 1949 which was later changed to

Banking Regulation Act 1949 as per amending Act of

1965 (Act No. 23 of 1965). Reserve Bank of India was

vested with extensive powers for the supervision of

banking in India as the Central Banking Authority.

During those days public has lesser confidence in the

banks. As an aftermath deposit mobilization was slow.

Abreast of it the savings bank facility provided by the

Postal department was comparatively safer. Moreover,

funds were largely given to traders.

Phase II

Government took major steps in this Indian Banking

Sector Reform after independence. In 1955, it nationalized

Imperial Bank of India with extensive banking facilities

on a large scale especially in rural and semi-urban areas. It

formed State Bank of india to act as the principal agent of

RBI and to handle banking transactions of the Union and

State Governments all over the country.

Seven banks forming subsidiary of State Bank of India

was nationalised in 1960 on 19th July, 1969, major

i-Xplore International Research Journal Consortium

The following are the steps taken by the Government of

India to Regulate Banking Institutions in the Country:

1949: Enactment of Banking Regulation Act.

1955: Nationalization of State Bank of India.

1959: Nationalisation of SBI subsidiaries.

1961: Insurance cover extended to deposits.

1969: Nationalisation of 14 major banks.

1971: Creation of credit guarantee corporation.

1975: Creation of regional rural banks.

1980: Nationalisation of seven banks with deposits

over 200 crore.

After the nationalisation of banks, the branches of the

public sector bank India rose to approximately 800% in

deposits and advances took a huge jump by 11,000%.

Banking in the sunshine of Government ownership gave

the public implicit faith and immense confidence about

the sustainability of these institutions.

Phase III

This phase has introduced many more products and

facilities in the banking sector in its reforms measure. In

1991, under the chairmanship of M Narasimham, a

committee was set up by his name which worked for the

liberalisation of banking practices.

The country is flooded with foreign banks and their ATM

stations. Efforts are being put to give a satisfactory service

to customers. Phone banking and net banking is

introduced. The entire system became more convenient

and swift. Time is given more importance than money.

The financial system of India has shown a great deal of

resilience. It is sheltered from any crisis triggered by any

external macroeconomics shock as other East Asian

Countries suffered. This is all due to a flexible exchange

rate regime, the foreign reserves are high, the capital

account is not yet fully convertible, and banks and their

customers have limited foreign exchange exposure. The

Bank of Bengal, which later became the State Bank of

India.

The amendment of Banking Regulation Act in 1993 saw

the entry of new private sector banks.Banking Segment in

India functions under the umbrella of Reserve Bank of

India - the regulatory, central bank. This segment broadly

consists of:

www.irjcjournals.org

20

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

Regulatory framework for banks was one area which has

seen a sea-change after the financial sector reforms and

economic liberalisation and globalisation measures were

introduced in 1992-93. Most of the recommendations

made by the two Expert Committees which continued to

be subject matter of close monitoring by the Government

of India as well as RBI have been implemented.

Governments of India and RBI have taken several steps

to:

(a) Strengthen the banking sector.

(b) Provide more operational flexibility to banks.

(c) Enhance the competitive efficiency of banks, and

(d) Strengthen the legal framework governing

operations of banks.

CONSOLIDATION OF INDIAN BANKING

SECTOR

As mentioned by Governor Jalan in his address to this

forum in 2002, "In financial systems worldwide, todays

buzzwords are competition, consolidation and stability".

There has been impressive stability and considerable

competition in India but the process of consolidation in

banking industry has just commenced. The issue of

consolidation has been addressed by the Narasimham

Committee Report on Banking Sector Reforms (1998) but

the issue in regard to policy is yet to be pursued

vigorously.

There are three aspects to consolidation viz.

clear cut legal and regulatory regime governing

consolidation,

enabling policy framework especially where

several banks are owned by Government,

and market conditions that facilitate such

consolidation,

Recognizing that all mergers and acquisitions may not

necessarily be in the interests of either the parties

concerned or the system as a whole. RBI's stated policy

currently would permit acquisitions of any Indian private

sector bank after 2009. As per the policy in 2009, a

determined foreign player could acquire any Indian

private sector bank, the best assets in the market place.

Current banking sector can be divided in the following

categories

ISSN: 2319-4421

Development banks

a) Industrial finance corporation of India

b) Industrial development bank of India(

c) Industrial credit and investment corporation of

India(ICICI)

d) Industrial investment bank of India(IIBI)

e) Small industries development bank of India(SIDBI)

f) SCICI ltd.

g) National bank for agriculture and rural

development

h) Export import bank of India

i) National housing bank

ECONOMIC ANALYSIS

Economic analysis will help to understand the relationship

between the economic conditions and banking sector.

Economic analysis is done to analyze the impact of

various economic changes on the performance of the

banking sector.

Economic analysis can be further subdivided into two

main categories:

Macro economic analysis

Micro economic analysis

These two categories can explain the impact of global

economic changes and the changes in national economic

environment more effectively and clearly.

Macro economic analysis

Macro economic analysis is done to find out the

correlation between global economic scenario and its

impact on Indian banking sector. Banking sector reforms

in India are aimed at induction of best international

practices and technological changes for competing

globally. The reserve bank of India has time and again

emphasized transparency, diversification of ownership

and strong corporate governance to mitigate the prospects

of systematic risk in the banking sector. Banking sector

reforms have supported the transition of the Indian

economy to a higher growth path, while significantly

improving the stability of the financial system. In

comparison with the pre-reform period, the Indian

banking system today is more stable and efficient.

However the gains of the past decade need to be

consolidated, so that these could be translated to derive

the institutions, market and practices into a mature

financial system that can meet the challenges of

globalisation. The banking system would, therefore, not

only need to be stable, but also supportive of still higher

levels of planned investments by channeling financial

resources more efficiently from surplus to deficit sectors.

Basel II and India

RBIs association with the Basel Committee on Banking

Supervision dates back to 1997 as India was among the 16

i-Xplore International Research Journal Consortium

www.irjcjournals.org

21

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

non-member countries that were consulted in the drafting

of the Basel Core Principles. Reserve Bank of India

became a member of the Core Principles Liaison Group in

1998 and subsequently became a member of the Core

Principles Working Group on Capital. Within the

Working Group, RBI has been actively participating in the

deliberations on the New Accord and had the privilege to

lead a group of six major non-G-10 supervisors which

presented a proposal on a simplified approach for Basel II

to the Committee.

Commercial banks in India started implementing Basel II

with effect from March 31, 2007. They adopted

Standardized Approach for credit risk and Basic Indicator

Approach for operational risk, initially. After adequate

skills are developed, both at the banks and also at

supervisory levels, some banks may be allowed to migrate

to the Internal Rating Based (IRB) Approach.

The steps were taken for implementation of Basel II and

the emerging issues. The RBI had announced in its annual

policy statement in May 2004 that banks in India should

examine in depth the options available under Basel II and

draw a road-map by end-December 2004 for migration to

Basel II and review the progress made at quarterly

intervals. The Reserve Bank organized a two-day seminar

in July 2004 mainly to sensitize the Chief Executive

Officers of banks to the opportunities and challenges

emerging from the Basel II norms. Soon thereafter all

banks were advised in August 2004 to undertake a selfassessment of the various risk management systems in

place, with specific reference to the three major risks

covered under the Basel II and initiate necessary remedial

measures to update the systems to match up to the

minimum standards prescribed under the New

Framework. Banks have also been advised to formulate

and operationalise the Capital Adequacy Assessment

Process (CAAP) within the banks as required under Pillar

II of the New Framework.

It is appropriate to list some of the other regulatory

initiatives taken by the Reserve Bank of India, relevant for

Basel II. First, RBI has tried to ensure that the banks have

suitable risk management framework oriented towards

their requirements dictated by the size and complexity of

business, risk philosophy, market perceptions and the

expected level of capital. Second, Risk Based Supervision

(RBS) in 23 banks has been introduced on a pilot basis.

Third, RBI has been encouraging banks to formalize their

capital adequacy assessment process (CAAP) in alignment

with their business plan and performance budgeting

system. This, together with the adoption of RBS would

aid in factoring the Pillar II requirements under Basel II.

Fourth, RBI has been expanding the area of disclosures

(Pillar III), so as to have greater transparency in the

financial position and risk profile of banks. Finally, RBI

i-Xplore International Research Journal Consortium

ISSN: 2319-4421

has tried to build capacity for ensuring the regulators

ability for identifying and permitting eligible banks to

adopt IRB / Advanced Measurement approaches.

As per normal practice, and with a view to ensuring

migration to Basel II in a non-disruptive manner, a

consultative and participative approach has been adopted

for both designing and implementing Basel II. A Steering

Committee comprising senior officials from 14 banks

(public, private and foreign) has been constituted wherein

representation from the Indian Banks Association and the

RBI has also been ensured. The Steering Committee had

formed sub-groups to address specific issues. On the basis

of recommendations of the Steering Committee, draft

guidelines to the banks on implementation of the New

Capital Adequacy Framework have been issued.

Implementation of Basel II will require more capital for

banks in India due to the fact that operational risk is not

captured under Basel I, and the capital charge for market

risk was not prescribed until recently. Though last year

has not been a very good year for banks, they are

exploring all avenues for meeting the capital requirements

under Basel II. The cushion available in the system, which

has a CRAR of over 12 per cent now, is, however,

comforting.

Basel II provides some scope to extend the rating of issues

to issuers, this would only be an approximation and it

would be necessary for the system to move to rating of

issuers. Encouraging rating of issuers would be essential

in this regard. In this context, current non-availability of

acceptable and qualitative historical data relevant to

ratings, along with the related costs involved in building

up and maintaining the requisite database, does influence

the pace of migration to the advanced approaches

available under Basel II.

Above all, capacity building, both in banks and the

regulatory bodies is a serious challenge, especially with

regard to adoption of the advanced approaches. RBI in

India has initiated supervisory capacity-building measures

to identify the gaps and to assess as well as quantify the

extent of additional capital which may be required to be

maintained by such banks.

Current global economic conditions

In the current scenario, banks are constantly pushing the

frontiers of risk management. Compulsions arising out of

increasing competition, as well as agency problems

between management, owners and other stakeholders are

inducing banks to look at newer avenues to augment

revenues, while trimming costs. Consolidation,

competition and risk management are no doubt critical to

the future of banking but it is believed that governance

and financial inclusion would also emerge as the key

www.irjcjournals.org

22

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

issues for a country like India, at this stage of socioeconomic development.

The global economic outlook deteriorated sharply over the

last one year. In a sign of the ferocity of the down turn,

the IMF made a marked downward revision of its

estimate:

In market exchange rate terms, the downturn is

sharper global GDP is projected to actually

shrink by 0.6 per cent.

With all the advanced economies the United

States, Europe and Japan - having firmly gone into

recession, the contagion of the crisis from the

financial sector to the real sector has been

unforgiving and total.

Due to the slump in demand the output growth in

the whole world has reduced especially in

developed countries. The output growth in the

world has reduced from 5.1 to 3 percent over the

last four years (2006 to 2009).

Impact on Indian financial market

India's financial markets - equity markets, money markets,

forex markets and credit markets - had all come under

pressure from a number of directions.

As a consequence of the global liquidity squeeze,

Indian banks and corporates found their overseas

financing drying up, forcing corporates to shift

their credit demand to the domestic banking sector.

Also, in their frantic search for substitute financing,

corporates withdrew their investments from

domestic money market mutual funds putting

redemption pressure on the mutual funds and down

the line on non-banking financial companies

(NBFCs) where the MFs had invested a significant

portion of their funds. This substitution of overseas

financing by domestic financing brought both

money markets and credit markets under pressure.

The forex market came under pressure because of

reversal of capital flows as part of the global

deleveraging process. Simultaneously, corporates

were converting the funds raised locally into

foreign currency to meet their external obligations.

Both these factors put downward pressure on the

rupee.

The Reserve Bank's intervention in the forex

market to manage the volatility in the rupee further

added to liquidity tightening.

India's integration into the world economy over the

last decade has been remarkably rapid. Integration

into the world implies more than just exports.

Going by the common measure of globalization,

India's two-way trade (merchandize exports plus

imports), as a proportion of GDP, grew from 21.2

per cent in 1997-98, the year of the Asian crisis, to

34.7 per cent in 2008-09.

i-Xplore International Research Journal Consortium

ISSN: 2319-4421

India's financial integration with the world has been

as deep as India's trade globalization, if not deeper.

If we take an expanded measure of globalization,

that is the ratio of total external transactions (gross

current account flows plus gross capital flows) to

GDP, this ratio has more than doubled from 46.8

per cent in 1997-98 to 117.4 per cent in 2008-09.

Micro economic analysis

Micro economic analysis reflects the changes in the

national economic policies and role of public sector banks

in the implementation of those changes effectively. Major

micro economic policies are:

Monetary policy

Fiscal policy

a)

Monetary policy

The Reserve Bank's policy response is aimed at

containing the contagion from the outside - to keep the

domestic money and credit markets functioning normally

and see that the liquidity stress did not trigger solvency

cascades. In particular, RBI targeted three objectives:

1. To maintain a comfortable rupee liquidity position;

2. To augment foreign exchange liquidity; and

3. To maintain a policy framework that would keep

credit delivery on track so as to arrest the

moderation in growth.

This marked a reversal of Reserve Bank's policy stance

from monetary tightening in response to heightened

inflationary pressures of the previous period to monetary

easing in response to easing inflationary pressures and

moderation in growth in the current cycle. RBIs measures

to meet the above objectives came in several policy

packages starting mid-September 2009, on occasion in

response to unanticipated global developments and at

other times in anticipation of the impact of potential

global developments on the Indian markets.

RBIs policy packages included, like in the case of other

central banks, both conventional and unconventional

measures.

On the conventional side, RBI reduced the policy interest

rates aggressively and rapidly, reduced the quantum of

bank reserves impounded by the central bank and

expanded and liberalized the refinance facilities for export

credit. Measures aimed at managing forex liquidity

included an upward adjustment of the interest rate ceiling

on the foreign currency deposits by non-resident Indians,

substantially relaxing the external commercial borrowings

(ECB) regime for corporates, and allowing non-banking

financial companies and housing finance companies

access to foreign borrowing.

www.irjcjournals.org

23

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

The important among the many unconventional

measures taken by the Reserve Bank of India are a rupeedollar swap facility for Indian banks to give them comfort

in managing their short-term foreign funding

requirements, an exclusive refinance window as also a

special purpose vehicle for supporting non-banking

financial companies, and expanding the lendable

resources available to apex finance institutions for

refinancing credit extended to small industries, housing

and exports.

The Union government, in its recent decision, has

announced capital infusion in three public sector banks

namely UCO Bank, Central Bank of India and Vijaya

Bank. The Kolkata based UCO bank would get capital

worth Rs 1,200 crore, through UCO's non-convertible

preference shares, from center government in two

installments, Rs 450 crore immediately and the balance Rs

750 crore in 2009-10.

It may be noted that almost all bank loans are linked to the

PLR, and every rate fall would really affect the interest

rate, which consumer is paying However, at present,

prime lending rates (PLR) of most of the banks are in the

range of 11.5% and 12.5% while the same was between

10.25%

and

11.50%

as

on

April

1,

2006.

It be noted that Last fiscal in September, the rate of

interest on home loans was in the range of 9.25% to 12%,

but due to RBI's smart move for rate reduction and lower

demand has caused the rate to drop to 8-11%.

Impact of monetary measures

Taken together, the measures put in place since midSeptember 2008 have ensured that the Indian financial

markets continue to function in an orderly manner. The

cumulative amount of primary liquidity potentially

available to the financial system through these measures is

over US$ 75 billion or 7 per cent of GDP. This sizeable

easing has ensured a comfortable liquidity position

starting mid-November 2009 as evidenced by a number of

indicators including the weighted-average call money rate,

the overnight money market rate and the yield on the 10year benchmark government security. Taking the signal

from the policy rate cut, many of the big banks have

reduced their benchmark prime lending rates. Bank credit

has expanded too, faster than it did last year. However,

Reserve Banks rough calculations show that the overall

flow of resources to the commercial sector is less than

what it was last year. This is because, even though bank

credit has expanded, it has not fully offset the decline in

non-bank flow of resources to the commercial sector.

b)

Fiscal policy

Fiscal policy measures can be defined as the use of tax

and expenditure powers by a government. Government all

i-Xplore International Research Journal Consortium

ISSN: 2319-4421

over the world, are vested with the task of creating

infrastructure (e.g., roads, ports, power plants, etc.) and

are also required to ensure internal and external security.

These responsibilities entail government expenditures on

various fronts capital outlays, the defense forces, police,

the administrative services and others. Taxes are a major

source of revenue to meet these outflows. Thus, the Union

Government collects income tax, excise duty, customs

duty, etc., through its different arms.

An increase in government spending without a matching

increase in inflows may cause or exacerbate a DEFICIT.

But, government spending also contributes to aggregate

demand for goods and services directly, and indirectly

by increasing private incomes which stimulates private

demand.

Over the last five years, both the central and state

governments in India have made a serious effort to reverse

the fiscal excesses of the past. At the heart of these efforts

was the Fiscal Responsibility and Budget Management

(FRBM) Act which mandated a calibrated road map to

fiscal sustainability. However, recognizing the depth and

extraordinary impact of this crisis, the central government

invoked the emergency provisions of the FRBM Act to

seek relaxation from the fiscal targets and launched two

fiscal stimulus packages in December 2008 and January

2009. These fiscal stimulus packages, together amounting

to about 3 per cent of GDP, included additional public

spending,

particularly

capital

expenditure,

government guaranteed funds for infrastructure

spending, cuts in indirect taxes, expanded guarantee

cover for credit to micro and small enterprises, and

additional support to exporters. These stimulus

packages came on top of an already announced expanded

safety-net for rural poor, a farm loan waiver package and

salary increases for government staff, all of which too

should stimulate demand.

The Interim Budget did not have any proposal for revision

in tax rates, direct or indirect. The revised estimate for tax

collections forecast a Rs 60,000 crore (Rs 600 billion)

shortfall in the estimated tax collection targets, primarily

on account of the government's pro-active fiscal measures

initiated to counter the impact of the global slowdown on

the Indian economy.

A substantial relief of about Rs 40,000 crore (Rs 400

billion) has been extended through tax cuts, including a

fairly steep, across-the-board reduction in central excise

rates in December, 2009.

Public sector banks help government to channelize the

expenditure of the government for the development and

maintenance of the equilibrium in the economy.

www.irjcjournals.org

24

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

ISSN: 2319-4421

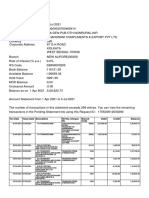

PERFORMANCE OF PUBLIC SECTOR

BANKS

OTHER ENVIRONMENTAL FACTORS

Brand Finance PLC, UK based brand Valuation

Company has released the BrandFinance Global

Ranking 500. This list gives a comprehensive list of all

the banks across the world with the rankings based on

their methodology. The methodology is more toward

brand related and is not based on market valuations alone.

Only HSBC and American Express received a

AAA credit rating. The AAA (triple A) credit rating is the

highest rating any bank or a company can receive. It

indicates the companys credit worthiness which is almost

synonymous to doing business with that company or

predicting the future business. Very few companies

achieve that rating. The highest rating an Indian bank got

in the list is AA for State Bank of India.

HSBC, Bank of America and Wells Fargo

topped the list. The top Indian bank in the list is State

Bank of India ranked at 69. It is ranked at 60 in 2008

because the valuation was done for the group of all the

State Banks. Valuation for 2009 is done for SBI alone.

The next bank in the list is ICICI Bank which is

the largest private sector lender. ICICI bank has witnessed

a steep decline in its rankings. It was ranked 64 in 2008

and now it is ranked 104. HDFC bank is the 3rd Indian

bank in the list.

Canara Bank and Oriental bank of Commerce

made their first entry into the list indicating the growing

presence of Indian banks in the global scenario.

Legal environment

As regards the legal framework, the Reserve Bank is not

very comfortable with lack of clear statutory provision

regarding takeover of management of banks. In 1970, the

Reserve Bank had issued directions to the banks requiring

them to seek the Reserve Banks permission or

acknowledgement before effecting any transfer of shares

in favour of any person which would take the holding of

shares to more than one per cent (subsequently raised to

five per cent) of the total paid up capital of such banking

company. Since shares are acquired first and then lodged

for registration, the Reserve Banks directions create a

somewhat piquant situation. To plug the gap, a Bill has

now been introduced in the Parliament relating to banking

regulation. The RBIs proposals in this regard should

reasonably take care of takeover of the management by

one from another and Reserve Bank will have appropriate

regulatory power to satisfy itself that persons proposing to

acquire such shares are fit and proper persons. The State

Bank of India Act, 1955, empowers the State Bank of

India with the consent of the management of any banking

institution (which would also include a banking company)

to acquire the business, including the assets and liabilities

of any bank. Under this provision, what is required is the

consent of the concerned bank and the approval of the

Reserve Bank and the sanction of such acquisition by the

Central Government. Several banks were acquired by the

State Bank of India by invoking this section.

List of 17 Indian banks in the global 500:

1. State Bank of India

2. ICICI Bank

3. HDFC Bank

4. Punjab National Bank

5. Bank of India

6. Canara Bank

7. Bank of Baroda

8. Axis Bank

9. Kotak Bank

10. Union Bank of India

11. Indian Overseas Bank

12. IDBI Bank Limited

13. State Bank of Patiala

14. Indian Bank

15. Power Finance Corp

16. Oriental Bank of Commerce

17. Syndicate Bank

The list is dominated by the public sector banks

punctuated by a few known private sector banks. IT

majors and other companies have made it clear that they

trust the PSUs over private banks for their savings.

i-Xplore International Research Journal Consortium

Section 23A of the Regional Rural Banks Act, 1976

(RRBs Act), empowers the Central Government, in

consultation with the NABARD, concerned State

Government and sponsored bank, to amalgamate two

RRBs, by issue of notification in the official gazette, with

such liabilities, duties and obligations as may be specified

in the notification. As in the case of amalgamation of a

nationalised bank under Section 9(2) of the

Nationalisation Act, every notification under this section

is also required to be laid before both the Houses of

Parliament.

Political environment

The government has told public sector banks (PSBs) to

extend credit to fund-starved Indian industry, especially

exporters and small and medium sector enterprises to

address their credit needs. SIDBI would be lending US$

1.33 billion out of US$ 1.47 billion credit from RBI to

public sector banks. This is being provided to the PSBs at

6.5 per cent (SIDBI is getting the credit at 5.5 per cent)

under the condition that the banks will have to lend this

credit to the medium and small-scale industry units at an

interest rate of 10 per cent before March 31, 2010.

www.irjcjournals.org

25

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

Technical environment

Technological upgradation in working of rural regional

banks (RRBs) is being implemented. As a first step, RRBs

which have either 100 per cent computerization or are

being opened from September 2009 need to be CBS

compliant.

The number of automated teller machines (ATMs) has

risen and the usage of ATMs has gone up substantially

during the last few years. Use of other banks ATMs

would also not attract any fee except when used for cash

withdrawal for which the maximum charge levied was

brought down to US$ .409 per withdrawal by March 31,

2008. Further, all cash withdrawals from all ATMs would

be free with effect from April 1, 2009.

Porters Five Force Model

Threat of New Entrants. The average person

can't come along and start up a bank, but there are

services, such as internet bill payment, on which

entrepreneurs can capitalize. Banks are fearful of being

squeezed out of the payments business, because it is a

good source of fee-based revenue. Another trend that

poses a threat is companies offering other financial

services. What would it take for an insurance company to

start offering mortgage and loan services? Not much.

Also, when analyzing a regional bank, remember that

the possibility of a mega bank entering into the market

poses a real threat.

Power of Suppliers. The suppliers of capital

might not pose a big threat, but the threat of suppliers

luring away human capital does. If a talented individual is

working in a smaller regional bank, there is the chance

that person will be enticed away by bigger banks,

investment firms, etc.

Power of Buyers. The individual doesn't pose

much of a threat to the banking industry, but one major

factor affecting the power of buyers is relatively high

switching costs. If a person has a mortgage, car loan,

credit card, checking account and mutual funds with one

particular bank, it can be extremely tough for that

person to switch to another bank. In an attempt to lure in

customers, banks try to lower the price of switching, but

many people would still rather stick with their current

i-Xplore International Research Journal Consortium

ISSN: 2319-4421

bank. On the other hand, large corporate clients have

banks wrapped around their little fingers. Financial

institutions - by offering better exchange rates, more

services, and exposure to foreign capital markets - work

extremely hard to get high-margin corporate clients.

Availability of Substitutes. As you can

probably imagine, there are plenty of substitutes in the

banking industry. Banks offer a suite of services over and

above taking deposits and lending money, but whether it

is insurance, mutual funds or fixed income securities,

chances are there is a non-banking financial services

company that can offer similar services. On the lending

side of the business, banks are seeing competition rise

from unconventional companies. Sony (NYSE: SNE),

General

Motors

(NYSE:GM) and

Microsoft

(NASDAQ:MSFT) all offer preferred financing to

customers who buy big ticket items. If car companies are

offering 0% financing, why would anyone want to get a

car loan from the bank and pay 5-10% interest?

Competitive Rivalry. The banking industry is

highly competitive. The financial services industry has

been around for hundreds of years, and just about

everyone who needs banking services already has them.

Because of this, banks must attempt to lure clients away

from competitor banks. They do this by offering lower

financing, preferred rates and investment services. The

banking sector is in a race to see who can offer both the

best and fastest services, but this also causes banks to

experience a lower ROA. They then have an incentive to

take on high-risk projects. In the long run, we're likely to

see more consolidation in the banking industry. Larger

banks would prefer to take over or merge with another

bank rather than spend the money to market and advertise

to people.

CONCLUSION

The Indian banking sector is connected to the

world economy but the Indian banking system has had no

direct exposure to the sub-prime mortgage assets or to the

failed institutions. It has very limited off-balance sheet

activities or securitized assets. In fact, our banks continue

to remain safe and healthy. The Indian banking sector has

been well shielded by the central bank and has managed to

sail through most of the crisis with relative ease.

Improvements in the regulatory and supervisory

framework encompassed a greater degree of compliance

with Basel Core Principles. Some recent initiatives in this

regard include consolidated accounting for banks along

with a system of Risk-Based Supervision (RBS) for

intensified monitoring of vulnerabilities.

With most private sector banks and the PSU ones

that have complied with Basel II having sufficient capital

in their books; it will be a challenge to deploy the same

safely and profitably in the event of economic slowdown.

www.irjcjournals.org

26

International Journal of Management and Social Sciences Research (IJMSSR)

Volume 2, No. 6, June 2013

Banks are likely to concentrate more on non funded

income in this scenario.

Public sector banks help the government to

implement monetary and fiscal policies by modifying

their policies and priorities.

Public sector banks have been very proactive in

their restructuring initiatives be it in technology

implementation or pruning their loss assets. While the

likes of SBI have made already attempts towards

consolidation, others are keen to take off in that direction.

RBIs roadmap for the entry of foreign banks and

the acquisition of stake by the foreign entities in Indian

private banks seems to be a step towards facilitating entry

of foreign banks into India. However, the same is set to

aggravate the tussle for market share in the already

fragmented sector.

The private sector banks have made tremendous

strides in the last few years. It was in mid 1990's when

Indian banking scenario witnessed the entry of some new

private sector banks and in the period between 2002 -2009

these banks have grown by leaps and bounds. They have

increased their incomes, asset sizes and outperformed

their public sector counterparts in many areas. This

growth was accompanied by a rapid branch expansion.

The network of private sector bank grew at almost three

times of all scheduled commercial banks and more than

four times that of public sector banks.

In the current scenario, banks are constantly

pushing the frontiers of risk management. Compulsions

arising out of increasing competition, as well as agency

problems between management, owners and other

stakeholders are inducing banks to look at newer avenues

to augment revenues, while trimming costs.

Consolidation, competition and risk management are no

doubt critical to the future of banking but I believe that

governance and financial inclusion would also emerge as

the key issues for a country like India, at this stage of

socio-economic development.

The NPA growth involves the necessity of

provisions, which reduces the overall profits and

shareholders value. The issue of Non Performing Assets

has been discussed at length for financial system all over

the world. The problem of NPAs is not only affecting the

banks but also the whole economy. In fact high level of

NPAs in Indian banks is nothing but a reflection of the

state of health of the industry and trade.

ISSN: 2319-4421

conglomerates that are engaged in cross-border

transactions.

The banks which are diversified into areas other

than conventional banking, are parts of a large

group/conglomerate, undertake significant cross-border

transactions, act as market makers, and are counter-parties

to complex transactions. Since these banks would be

exposed to the complexities of various risks. The RBI may

consider prescribing a higher minimum capital ratio for

these banks.

It has also stressed the need to raise corporate

governance standard in public sector banks with the aim

of ensuring operational autonomy and equipping them to

compete with other banks as equals.

BIBLIOGRAPHY

Economic times

Competition refresher

Webliography

http://pnbindia.in/financial_results_sep_08.pdf

http://crpd.sbi.co.in/uploads/forms/Consolidated_Account

_20080610.pdf

http://www.sbi.co.in/result/SBI2007-Annexures.pdf

http://www.sbi.co.in/result/SBI2007-StateBankofIndia.pdf

http://www.sbi.co.in/result/SBI2007StateBankGroup(Consolidated).pdf

RECOMMENDATIONS

Recommending a change in capital adequacy

framework, it has suggested that the banking system

should move towards differential capital regime for

complex banks from the current practice of having a 9%

CAR

requirement

for

all

banks.

The banks like State Bank of India, ICICI Bank, HDFC

Bank among others to maintain higher CAR as they are

i-Xplore International Research Journal Consortium

www.irjcjournals.org

27

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Inglese - Methods of PaymentDocument2 pagesInglese - Methods of PaymentWood_GirlNo ratings yet

- Credorax DM (Mar 2021)Document29 pagesCredorax DM (Mar 2021)csh011235No ratings yet

- Your Quarterly Bill: How To PayDocument2 pagesYour Quarterly Bill: How To PayPaul ClimasNo ratings yet

- Financial Analysis of Public Sector Bank and Private Sector BankDocument42 pagesFinancial Analysis of Public Sector Bank and Private Sector BankVishal Patil100% (1)

- 1429256427963Document4 pages1429256427963Aman VermaNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- Your Personal Chequing Account StatementDocument1 pageYour Personal Chequing Account Statementwalid djelataNo ratings yet

- Receivable Financing Sample ProblemDocument3 pagesReceivable Financing Sample ProblemKathleen FrondozoNo ratings yet

- SanskritDocument2 pagesSanskritprinces242No ratings yet

- Nine Seeds PDFDocument1 pageNine Seeds PDFprinces242No ratings yet

- Huge Collection of 900s Finacle MenuDocument26 pagesHuge Collection of 900s Finacle Menuprinces242No ratings yet

- Size Chart: A. Measure An Existing RingDocument2 pagesSize Chart: A. Measure An Existing Ringprinces242No ratings yet

- Watering The Mango Tree आ麫�से कᚆपतृ तपꚦ覄 ण: Ganesh Stotram Pranamya Shirasa DevamDocument1 pageWatering The Mango Tree आ麫�से कᚆपतृ तपꚦ覄 ण: Ganesh Stotram Pranamya Shirasa Devamprinces242No ratings yet

- LirilDocument5 pagesLirilprinces242No ratings yet

- Process ArchitecturesDocument1 pageProcess Architecturesprinces242No ratings yet

- Oracle Database: From Wikipedia, The Free EncyclopediaDocument1 pageOracle Database: From Wikipedia, The Free Encyclopediaprinces242No ratings yet

- Physical and Logical StructuresDocument1 pagePhysical and Logical Structuresprinces242No ratings yet

- IES Mechanical Engineering 2011 PDFDocument40 pagesIES Mechanical Engineering 2011 PDFprinces242No ratings yet

- Master Formula To Calculate Square in 10 SecondsDocument3 pagesMaster Formula To Calculate Square in 10 Secondsprinces242No ratings yet

- The BSP's Organ-WPS OfficeDocument4 pagesThe BSP's Organ-WPS OfficeAthEna EirAm AterualNo ratings yet

- Timmy LiewDocument2 pagesTimmy LiewRachaelNo ratings yet

- Account StatementDocument14 pagesAccount StatementBude Singh BamniyaNo ratings yet

- Quantitative Problems Chapter 3Document5 pagesQuantitative Problems Chapter 3Khadija ShabbirNo ratings yet

- IEP Report - 18781Document28 pagesIEP Report - 18781Jeevan RegmiNo ratings yet

- Ar Rahnu ThesisDocument7 pagesAr Rahnu ThesisWriteMyPaperForMoneySingapore100% (4)

- Customer Satisfaction: Punjab National BankDocument59 pagesCustomer Satisfaction: Punjab National BankvivekNo ratings yet

- C-ASBA Registration FormDocument2 pagesC-ASBA Registration Formsachinn7No ratings yet

- Presentation ON Rural BankDocument13 pagesPresentation ON Rural BankJiten AgrawalNo ratings yet

- Icici Bank Balance Sheet 2019Document2 pagesIcici Bank Balance Sheet 2019Smart Earn 2020 ONLINENo ratings yet

- Internship Report On at Siddhart Bank Limited JanakpurdhamDocument39 pagesInternship Report On at Siddhart Bank Limited JanakpurdhamAshish Kumar100% (1)

- Understanding FX RatesDocument3 pagesUnderstanding FX Ratespavie rajaNo ratings yet

- Sample Cir BSPDocument1 pageSample Cir BSPAngelo SandovalNo ratings yet

- Procedure For Bank ReconciliationDocument2 pagesProcedure For Bank ReconciliationFiafsz75% (4)

- Promotion Study Material For BankDocument271 pagesPromotion Study Material For BankJack Meena100% (1)

- Government of Bihar: Office of The CMBD Based Detailed Re-Tender Notice Inviting TenderDocument4 pagesGovernment of Bihar: Office of The CMBD Based Detailed Re-Tender Notice Inviting TenderJAIMANGAL SINGHNo ratings yet

- Chapter 7 Terms of PaymentDocument20 pagesChapter 7 Terms of Paymentmatthew kobulnickNo ratings yet

- 89th BDExam Time AbleDocument1 page89th BDExam Time AblePair AhammedNo ratings yet

- Buyer's - Seller's INTERNAL ADJDocument2 pagesBuyer's - Seller's INTERNAL ADJVishwanathNo ratings yet

- Feb 222021 DMD 01Document17 pagesFeb 222021 DMD 01TopuNo ratings yet

- Ch4 Introduction To Valuation The Time Value of Money - FacebookDocument16 pagesCh4 Introduction To Valuation The Time Value of Money - FacebookHothaefa AbdulrahmnNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument12 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceRaju RoyNo ratings yet