Professional Documents

Culture Documents

The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For Risk

Uploaded by

Chajar Matari Fath MalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For Risk

Uploaded by

Chajar Matari Fath MalaCopyright:

Available Formats

CHAPTER 9

The Cost of Capital

Sources of capital

Component costs

WACC

Adjusting for flotation costs

Adjusting for risk

9-1

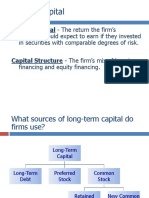

What sources of long-term

capital do firms use?

Long-Term Capital

Capital

Long-Term

Long-Term Debt

Debt Preferred

Preferred Stock

Stock Common

Common Stock

Stock

Long-Term

Retained Earnings

Earnings

Retained

New Common

Common Stock

Stock

New

9-2

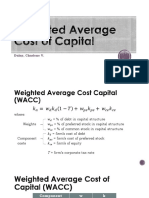

Calculating the weighted

average cost of capital

WACC = wdkd(1-T) + wpkp + wcks

The ws refer to the firms capital

structure weights.

The ks refer to the cost of each

component.

9-3

Should our analysis focus on

before-tax or after-tax capital

costs?

Stockholders focus on A-T CFs.

Therefore, we should focus on A-T

capital costs, i.e. use A-T costs of

capital in WACC. Only kd needs

adjustment, because interest is tax

deductible.

9-4

Should our analysis focus on

historical (embedded) costs or

new (marginal) costs?

The cost of capital is used

primarily to make decisions that

involve raising new capital. So,

focus on todays marginal costs

(for WACC).

9-5

How are the weights

determined?

WACC = wdkd(1-T) + wpkp + wcks

Use accounting numbers or market

value (book vs. market weights)?

Use actual numbers or target

capital structure?

9-6

Component cost of debt

WACC = wdkd(1-T) + wpkp + wcks

kd is the marginal cost of debt

capital.

The yield to maturity on outstanding

L-T debt is often used as a measure

of kd.

Why tax-adjust, i.e. why k d(1-T)?

9-7

A 15-year, 12% semiannual

coupon bond sells for

$1,153.72. What is the cost of

(k

)?

debt

d

Remember, the bond pays a

semiannual coupon, so kd = 5.0% x

2 = 10%.

INPUTS

30

N

OUTPUT

I/YR

-1153.72

60

1000

PV

PMT

FV

5

9-8

Component cost of debt

Interest is tax deductible, so

A-T kd = B-T kd (1-T)

= 10% (1 - 0.40) = 6%

Use nominal rate.

Flotation costs are small, so ignore

them.

9-9

Component cost of preferred

stock

WACC = wdkd(1-T) + wpkp + wcks

kp is the marginal cost of

preferred stock.

The rate of return investors

require on the firms preferred

stock.

9-10

What is the cost of preferred

stock?

The cost of preferred stock can be

solved by using this formula:

kp = Dp / Pp

= $10 / $111.10

= 9%

9-11

Component cost of preferred

stock

Preferred dividends are not taxdeductible, so no tax adjustments

necessary. Just use kp.

Nominal kp is used.

Our calculation ignores possible

flotation costs.

9-12

Is preferred stock more or

less risky to investors than

debt?

More risky; company not required

to pay preferred dividend.

However, firms try to pay preferred

dividend. Otherwise, (1) cannot

pay common dividend, (2) difficult

to raise additional funds, (3)

preferred stockholders may gain

control of firm.

9-13

Why is the yield on preferred

stock lower than debt?

Corporations own most preferred stock,

because 70% of preferred dividends are

nontaxable to corporations.

Therefore, preferred stock often has a

lower B-T yield than the B-T yield on debt.

The A-T yield to an investor, and the A-T

cost to the issuer, are higher on preferred

stock than on debt. Consistent with

higher risk of preferred stock.

9-14

Illustrating the differences

between A-T costs of debt and

preferred stock

Recall, that the firms tax rate is 40%, and its

before-tax costs of debt and preferred stock

are kd = 10% and kp = 9%, respectively.

A-T kp = kp kp (1 0.7)(T)

= 9% - 9% (0.3)(0.4)

A-T kd = 10% - 10% (0.4)

= 7.92%

= 6.00%

A-T Risk Premium on Preferred = 1.92%

9-15

Component cost of equity

WACC = wdkd(1-T) + wpkp + wcks

ks is the marginal cost of common

equity using retained earnings.

The rate of return investors

require on the firms common

equity using new equity is ke.

9-16

Why is there a cost for

retained earnings?

Earnings can be reinvested or paid out as

dividends.

Investors could buy other securities, earn a

return.

If earnings are retained, there is an

opportunity cost (the return that stockholders

could earn on alternative investments of

equal risk).

Investors could buy similar stocks and earn ks.

Firm could repurchase its own stock and earn ks.

Therefore, ks is the cost of retained earnings.

9-17

Three ways to determine

the cost of common

equity,

k

s

CAPM: ks = kRF + (kM kRF)

DCF:

ks = D 1 / P0 + g

Own-Bond-Yield-Plus-Risk Premium:

ks = kd + RP

9-18

If the kRF = 7%, RPM = 6%, and the

firms beta is 1.2, whats the cost of

common equity based upon the

CAPM?

ks = kRF + (kM kRF)

= 7.0% + (6.0%)1.2 = 14.2%

9-19

If D0 = $4.19, P0 = $50, and g = 5%,

whats the cost of common equity

based upon the DCF approach?

D1 = D0 (1+g)

D1 = $4.19 (1 + .05)

D1 = $4.3995

ks = D 1 / P0 + g

= $4.3995 / $50 + 0.05

= 13.8%

9-20

What is the expected future growth

rate?

The firm has been earning 15% on equity

(ROE = 15%) and retaining 35% of its

earnings (dividend payout = 65%). This

situation is expected to continue.

g = ( 1 Payout ) (ROE)

= (0.35) (15%)

= 5.25%

Very close to the g that was given before.

9-21

Can DCF methodology be

applied if growth is not

constant?

Yes, nonconstant growth stocks are

expected to attain constant growth

at some point, generally in 5 to 10

years.

May be complicated to compute.

9-22

If kd = 10% and RP = 4%, what is ks

using the own-bond-yield-plus-riskpremium method?

This RP is not the same as the

CAPM RPM.

This method produces a ballpark

estimate of ks, and can serve as a

useful check.

ks = kd + RP

ks = 10.0% + 4.0% = 14.0%

9-23

What is a reasonable final

estimate of ks?

Method

CAPM

DCF

kd + RP

Average

Estimate

14.2%

13.8%

14.0%

14.0%

9-24

Why is the cost of retained earnings

cheaper than the cost of issuing new

common stock?

When a company issues new common

stock they also have to pay flotation

costs to the underwriter.

Issuing new common stock may send

a negative signal to the capital

markets, which may depress the stock

price.

9-25

If issuing new common stock incurs

a flotation cost of 15% of the

proceeds, what is ke?

D0 (1 g)

ke

g

P0 (1- F)

$4.19(1.05

)

5.0%

$50(1- 0.15)

$4.3995

5.0%

$42.50

15.4%

9-26

Flotation costs

Flotation costs depend on the risk of the

firm and the type of capital being raised.

The flotation costs are highest for

common equity. However, since most

firms issue equity infrequently, the perproject cost is fairly small.

We will frequently ignore flotation costs

when calculating the WACC.

9-27

Ignoring floatation costs, what

is the firms WACC?

WACC = wdkd(1-T) + wpkp + wcks

= 0.3(10%)(0.6) + 0.1(9%) +

0.6(14%)

= 1.8% + 0.9% + 8.4%

= 11.1%

9-28

What factors influence a

companys composite

WACC?

Market conditions.

The firms capital structure and

dividend policy.

The firms investment policy.

Firms with riskier projects

generally have a higher WACC.

9-29

Should the company use the

composite WACC as the hurdle

rate for each of its projects?

NO! The composite WACC reflects the

risk of an average project undertaken

by the firm. Therefore, the WACC only

represents the hurdle rate for a

typical project with average risk.

Different projects have different risks.

The projects WACC should be adjusted

to reflect the projects risk.

9-30

Risk and the Cost of

Capital

Rate of Return

(%)

Acceptance Region

WACC

12.0

8.0

Rejection Region

10.5

10.0

9.5

B

L

RiskL

RiskA

RiskH

Risk

9-31

What are the three types of

project risk?

Stand-alone risk

Corporate risk

Market risk

9-32

How is each type of risk

used?

Market risk is theoretically best in

most situations.

However, creditors, customers,

suppliers, and employees are more

affected by corporate risk.

Therefore, corporate risk is also

relevant.

9-33

Problem areas in cost of

capital

Depreciation-generated funds

Privately owned firms

Measurement problems

Adjusting costs of capital for

different risk

Capital structure weights

9-34

How are risk-adjusted costs of

capital determined for specific

projects or divisions?

Subjective adjustments to the firms

composite WACC.

Attempt to estimate what the cost of

capital would be if the project/division

were a stand-alone firm. This

requires estimating the projects beta.

9-35

Finding a divisional cost of capital:

Using similar stand-alone firms to

estimate a projects cost of capital

Comparison firms have the

following characteristics:

Target capital structure consists of

40% debt and 60% equity.

kd = 12%

kRF = 7%

RPM = 6%

DIV = 1.7

Tax rate = 40%

9-36

Calculating a divisional cost of

capital

Divisions required return on equity

ks = kRF + (kM kRF)

= 7% + (6%)1.7 = 17.2%

Divisions weighted average cost of capital

WACC = wd kd ( 1 T ) + wc ks

= 0.4 (12%)(0.6) + 0.6 (17.2%) =13.2%

Typical projects in this division are

acceptable if their returns exceed 13.2%.

9-37

You might also like

- Case Analysis - Cost of CapitalDocument5 pagesCase Analysis - Cost of CapitalHazraphine Linso50% (2)

- Eva ProblemsDocument10 pagesEva Problemsazam4989% (9)

- LN06-Miller and Modigliani PropositionsDocument27 pagesLN06-Miller and Modigliani PropositionsBowen QinNo ratings yet

- Test 5Document4 pagesTest 5leylaNo ratings yet

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- Syndicate 7 - Nike Inc. Cost of CapitalDocument8 pagesSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- FM11 CH 09 Cost of CapitalDocument54 pagesFM11 CH 09 Cost of CapitalMadeOaseNo ratings yet

- Chapter 4 Cost of CapitalDocument19 pagesChapter 4 Cost of CapitalmedrekNo ratings yet

- WACC Summary SlidesDocument29 pagesWACC Summary SlidesclaeNo ratings yet

- Cost of CapitalDocument37 pagesCost of Capitalrajthakre81No ratings yet

- Chap 014Document79 pagesChap 014hanguyenhihiNo ratings yet

- Capital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional ApproachDocument50 pagesCapital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional Approachthella deva prasadNo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalJoshua CabinasNo ratings yet

- Cost of CapitalDocument21 pagesCost of Capitalshan07011984No ratings yet

- The Capital Structure TheoriesDocument61 pagesThe Capital Structure TheoriesAayushNo ratings yet

- Introduction To Corporate FinanceDocument29 pagesIntroduction To Corporate FinanceRifki AyyashNo ratings yet

- Risk and The Required Rate of ReturnDocument31 pagesRisk and The Required Rate of Returngellie villarinNo ratings yet

- Current Liabilities and Contingencies: HapterDocument58 pagesCurrent Liabilities and Contingencies: Haptergellie mare floresNo ratings yet

- Long Term Notes PayableDocument11 pagesLong Term Notes PayableMuhammad Zikri ErnansyaNo ratings yet

- Cost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast UniversityDocument23 pagesCost of Capital: Dr. Md. Anwar Ullah, FCMA Southeast Universityasif rahanNo ratings yet

- Capital StructureDocument41 pagesCapital StructureRAJASHRI SNo ratings yet

- Company Accounting - Powerpoint PresentationDocument29 pagesCompany Accounting - Powerpoint Presentationtammy_yau3199100% (1)

- Presentation On WACCDocument12 pagesPresentation On WACCIF387No ratings yet

- Risk, Cost of Capital, and ValuationDocument34 pagesRisk, Cost of Capital, and ValuationNguyễn Cẩm HươngNo ratings yet

- CH 09 RevisedDocument36 pagesCH 09 RevisedNiharikaChouhanNo ratings yet

- Chapter Three: Valuation of Financial Instruments & Cost of CapitalDocument68 pagesChapter Three: Valuation of Financial Instruments & Cost of CapitalAbrahamNo ratings yet

- Risk, Cost of Capital, and Valuation: Mcgraw-Hill/IrwinDocument35 pagesRisk, Cost of Capital, and Valuation: Mcgraw-Hill/IrwinThế Vũ100% (1)

- Cost of Capital and Capital StructureDocument40 pagesCost of Capital and Capital StructureJames NgonyaniNo ratings yet

- Bonds, Bond Valuation, and Interest RatesDocument52 pagesBonds, Bond Valuation, and Interest RatesAli JumaniNo ratings yet

- CVP Analysis Final 1Document92 pagesCVP Analysis Final 1Utsav ChoudhuryNo ratings yet

- Leasing RossDocument15 pagesLeasing Rosstinarosa13No ratings yet

- Cost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitDocument54 pagesCost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitArundhati SinhaNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Accounting BasicsDocument68 pagesAccounting BasicsEd Caty100% (1)

- Estimating The Optimal Capital StructureDocument22 pagesEstimating The Optimal Capital StructureAqeel Ahmad KhanNo ratings yet

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaNo ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Cost of CapitalDocument19 pagesCost of Capitalshraddha amatyaNo ratings yet

- Equity and Debt: First Some RevisionDocument44 pagesEquity and Debt: First Some RevisionHay JirenyaaNo ratings yet

- Debt MarketDocument15 pagesDebt MarketChetal BholeNo ratings yet

- Bonds and Their ValuationDocument50 pagesBonds and Their ValuationhumaidjafriNo ratings yet

- Chapter 2 - The Business Plan Road Map To SuccessDocument52 pagesChapter 2 - The Business Plan Road Map To SuccessFanie SaphiraNo ratings yet

- Liablities Provision and Contingences Suger FactoryDocument49 pagesLiablities Provision and Contingences Suger FactorynatiNo ratings yet

- UNIT - 8 Cost of CapitalDocument38 pagesUNIT - 8 Cost of Capitalhanatasha25No ratings yet

- Capital GainsDocument22 pagesCapital Gainsswathi aluruNo ratings yet

- Definition, Nature & Scope of WCDocument12 pagesDefinition, Nature & Scope of WCAshish Gautam0% (1)

- The Cost of Capital: All Rights ReservedDocument56 pagesThe Cost of Capital: All Rights ReservedANISA RABANIANo ratings yet

- Unit6 2-ValuationofPreferredandCommonStockDocument77 pagesUnit6 2-ValuationofPreferredandCommonStockHay JirenyaaNo ratings yet

- Corporate Finance Chapter6Document20 pagesCorporate Finance Chapter6Dan688No ratings yet

- Lec7 - Account ReceivablesDocument33 pagesLec7 - Account ReceivablesDylan Rabin PereiraNo ratings yet

- Risk Adjusted Discount Rate Method: Presented By: Vineeth. KDocument13 pagesRisk Adjusted Discount Rate Method: Presented By: Vineeth. KathiranbelliNo ratings yet

- Intercorporate Acquisitions and Investments in Other EntitiesDocument56 pagesIntercorporate Acquisitions and Investments in Other EntitiesErawati KhusnulNo ratings yet

- Week 9: Ross, Westerfield and Jordan 7e Cost of CapitalDocument42 pagesWeek 9: Ross, Westerfield and Jordan 7e Cost of CapitalYasir RahimNo ratings yet

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNo ratings yet

- Capital StructureDocument41 pagesCapital StructurethejojoseNo ratings yet

- Chapter-4: Fixed Income SecuritiesDocument52 pagesChapter-4: Fixed Income SecuritiesNati YalewNo ratings yet

- Current LiabilitiesDocument111 pagesCurrent LiabilitiesMikaela LacabaNo ratings yet

- 6may IIBF ALMDocument62 pages6may IIBF ALMmevrick_guyNo ratings yet

- Cost of CapitalDocument15 pagesCost of Capitalpratz2706No ratings yet

- Nature and Definition of AccountingDocument17 pagesNature and Definition of AccountingEdward Magat100% (1)

- AccountDocument37 pagesAccountGaurang MakwanaNo ratings yet

- WACC or Cost of CapitalDocument19 pagesWACC or Cost of CapitalSaeed Agha AhmadzaiNo ratings yet

- Creating Value Through Required ReturnDocument74 pagesCreating Value Through Required Returnriz4winNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument37 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskMohammed MiftahNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument30 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSoorajKumarMenghwarNo ratings yet

- Financial System&banking Reg.: Global Finance Crises 1928 To 2008Document11 pagesFinancial System&banking Reg.: Global Finance Crises 1928 To 2008AhsanNo ratings yet

- Global Financial Crisis 1929 and 2008Document10 pagesGlobal Financial Crisis 1929 and 2008AhsanNo ratings yet

- Assignment-01: Name: Sheraz Ahmed Roll No: 20021554-048 Submitted To: Sir AhsanDocument11 pagesAssignment-01: Name: Sheraz Ahmed Roll No: 20021554-048 Submitted To: Sir AhsanAhsanNo ratings yet

- Basic Approaches To Leadership: Organizational BehaviorDocument16 pagesBasic Approaches To Leadership: Organizational BehaviorAhsanNo ratings yet

- Assignment # 1: Financial Crisis 1929Document13 pagesAssignment # 1: Financial Crisis 1929AhsanNo ratings yet

- Letter of RecommendationDocument1 pageLetter of RecommendationAhsanNo ratings yet

- NBP Internship UOGDocument39 pagesNBP Internship UOGAhsanNo ratings yet

- Warid Internship UOGDocument56 pagesWarid Internship UOGAhsanNo ratings yet

- MCB Internship UOGDocument49 pagesMCB Internship UOGAhsanNo ratings yet

- Master Tile Internship UOGDocument54 pagesMaster Tile Internship UOGAhsanNo ratings yet

- HBL Internship UOGDocument34 pagesHBL Internship UOGAhsanNo ratings yet

- SSC UOG Internship UOGDocument44 pagesSSC UOG Internship UOGAhsanNo ratings yet

- UBL Internship UOGDocument35 pagesUBL Internship UOGAhsanNo ratings yet

- UBL Internship UOGDocument36 pagesUBL Internship UOGAhsanNo ratings yet

- Capital Structure of TCSDocument36 pagesCapital Structure of TCSpassinikunj50% (2)

- Fin410 Repot Final File Group 3Document28 pagesFin410 Repot Final File Group 3Shouvo Kumar Kundu 2012347630No ratings yet

- CC and CSDocument45 pagesCC and CSIsaack MgeniNo ratings yet

- Module B Dec 2017answerDocument10 pagesModule B Dec 2017answerConnieChoiNo ratings yet

- Methods InventoryDocument12 pagesMethods InventoryJocelyn LimaNo ratings yet

- Long QuestionsDocument18 pagesLong Questionssaqlainra50% (2)

- 7SOGSS FM LECTURE 7 Sources of Finance 1Document60 pages7SOGSS FM LECTURE 7 Sources of Finance 1Right Karl-Maccoy HattohNo ratings yet

- Cost of Capital Problems - Solved - FINANCIAL MANAGEMENT Solved ProblemsDocument13 pagesCost of Capital Problems - Solved - FINANCIAL MANAGEMENT Solved ProblemsMohitAhujaNo ratings yet

- Strategic Management PDFDocument7 pagesStrategic Management PDFSyrel SantosNo ratings yet

- Wacc DiscussionDocument15 pagesWacc DiscussionLiza Mae MirandaNo ratings yet

- The Cost of Capital (WACC)Document3 pagesThe Cost of Capital (WACC)hira shaikhNo ratings yet

- Table of Contents - Valuation and Common Sense (8th Edition)Document13 pagesTable of Contents - Valuation and Common Sense (8th Edition)meditationinstitute.netNo ratings yet

- Cost of CapitalDocument16 pagesCost of Capitalsarvan kumarNo ratings yet

- Quiz 6 Financial MarketDocument2 pagesQuiz 6 Financial MarketjanuaryNo ratings yet

- Topic 5 - WACC Ans 2019-20Document4 pagesTopic 5 - WACC Ans 2019-20Gaba RieleNo ratings yet

- BOEING 7e7Document5 pagesBOEING 7e7EVA Rental AdminNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- Useful Formulas: C C C R C CDocument4 pagesUseful Formulas: C C C R C CSebine MemmedliNo ratings yet

- Net Economic Value Added From Year To Year: Group 7Document17 pagesNet Economic Value Added From Year To Year: Group 7James Ryan AlzonaNo ratings yet

- Charlene DulayDocument19 pagesCharlene DulayJerome MontoyaNo ratings yet

- Level II - Equity: Free Cash Flow ValuationDocument52 pagesLevel II - Equity: Free Cash Flow Valuationjawadatatung100% (1)

- Ramco Cements Ar 2020Document259 pagesRamco Cements Ar 2020AmanVatsNo ratings yet

- V2 Exam 1 PMDocument30 pagesV2 Exam 1 PMNeerajNo ratings yet

- Ecos Plastics CompanyDocument2 pagesEcos Plastics CompanyRAJUNo ratings yet