Professional Documents

Culture Documents

Inputs: Just For Your Edification

Inputs: Just For Your Edification

Uploaded by

Bilguun Batbayar0 ratings0% found this document useful (0 votes)

16 views2 pagesFinance

Original Title

Implied Roc Roe

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesInputs: Just For Your Edification

Inputs: Just For Your Edification

Uploaded by

Bilguun BatbayarFinance

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

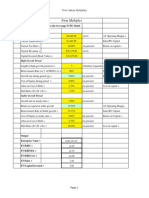

Inputs

Enter your

Enter your

Enter your

Enter your

after-tax operating earnings (EBIT (1-t)) in your terminal year =

free cashflow to firm in your terminal year =

perpetual growth rate=

cost of capital in perpetuity =

1035

750

4%

9.35%

Output

Your reinvestment rate in perpetuity is =

Your return on capital (equity) in perpetuity has to be =

27.54%

14.53%

Just for your edification

If your return on capital = cost of capital, your reinvestment rate would be

42.78%

! If you are doing an equity valuation, enter the net income

! If you are doing an equity valuation, enter the FCFE

! If you are doing an equity valuation, enter the cost of equity

! With equity valuation, return on equity = cost of equity

You might also like

- EM302 Formula Sheet 2013Document4 pagesEM302 Formula Sheet 2013Jeff JabeNo ratings yet

- Corporate ValuationDocument23 pagesCorporate ValuationPari GanganNo ratings yet

- SmartDocument2 pagesSmartudelkingkongNo ratings yet

- Leverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. TypesDocument17 pagesLeverage: Leverage Is That Portion of The Fixed Costs Which Represents A Risk To The Firm. Typessameer0725No ratings yet

- Intercompany Sales and Foreign Exchange TransactionsDocument212 pagesIntercompany Sales and Foreign Exchange TransactionsPrincessa Lopez MasangkayNo ratings yet

- Cost of Capital ppt-157233Document20 pagesCost of Capital ppt-157233kuldipNo ratings yet

- Inputs: Just For Your EdificationDocument2 pagesInputs: Just For Your EdificationyrperdanaNo ratings yet

- SprintDocument15 pagesSprintEli KoechNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosArun PanwarNo ratings yet

- Exam #1 ReviewDocument5 pagesExam #1 ReviewThùy DươngNo ratings yet

- Vale Conservative Valuation 2014Document8 pagesVale Conservative Valuation 2014Alok P SinghNo ratings yet

- Practice of Profitability RatiosDocument11 pagesPractice of Profitability RatiosZarish AzharNo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputssambarocksNo ratings yet

- FirmmultDocument2 pagesFirmmultPro ResourcesNo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputszNo ratings yet

- Economic Value AddedDocument3 pagesEconomic Value AddedNoor Mohd AzadNo ratings yet

- Inputs: Starting NumbersDocument3 pagesInputs: Starting NumbersShubham SharmaNo ratings yet

- Corporate FinanceDocument10 pagesCorporate Financeandrea figueroaNo ratings yet

- Analysis and Impact of Leverage: Operating Leverage Financial Leverage Combined LeverageDocument98 pagesAnalysis and Impact of Leverage: Operating Leverage Financial Leverage Combined Leveragethella deva prasadNo ratings yet

- Key Assumptions: Investment DetailsDocument3 pagesKey Assumptions: Investment DetailsZulqarnainNo ratings yet

- Profitability Ratios Are Financial Metrics That Help To Measure and Evaluate The Ability of A Company To Generate Profits Relative To Its RevenueDocument4 pagesProfitability Ratios Are Financial Metrics That Help To Measure and Evaluate The Ability of A Company To Generate Profits Relative To Its Revenuealena persadNo ratings yet

- Equity Valuation MathDocument10 pagesEquity Valuation MathMd. Asadujjaman SaheenNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisMizanur RahmanNo ratings yet

- FirmmultDocument2 pagesFirmmultapi-3763138No ratings yet

- CFV600 Cash Flow Modeling Part 1Document33 pagesCFV600 Cash Flow Modeling Part 1Jermaine hammondNo ratings yet

- Operating and Financial Leverages - FinalDocument51 pagesOperating and Financial Leverages - Finalchittesh23No ratings yet

- Analysis and Impact of Leverages DR Pawan GuptaDocument53 pagesAnalysis and Impact of Leverages DR Pawan Guptamithunbanerjee2009No ratings yet

- FcffevaDocument6 pagesFcffevaMarcos Rassi JuniorNo ratings yet

- FcffevaDocument6 pagesFcffevaDenish AbrahamNo ratings yet

- Key Concepts of Finance: Understanding MoneyDocument4 pagesKey Concepts of Finance: Understanding MoneyAkshay HemanthNo ratings yet

- CW3 AppDocument2 pagesCW3 AppSamir IsmailNo ratings yet

- Cv. Chapter 3Document29 pagesCv. Chapter 3VidhiNo ratings yet

- Chapter 4 Capital Structure PolicyDocument17 pagesChapter 4 Capital Structure PolicyAndualem ZenebeNo ratings yet

- FORMULAEDocument3 pagesFORMULAEmikaenonNo ratings yet

- Chapter 12 - Leverage - Text and End of Chapter Questions - 1Document39 pagesChapter 12 - Leverage - Text and End of Chapter Questions - 1naimenimNo ratings yet

- CMA II - Chapter 1, CVP RelationshipsDocument46 pagesCMA II - Chapter 1, CVP RelationshipsLakachew GetasewNo ratings yet

- Statement of Financial Position (S.F.P)Document3 pagesStatement of Financial Position (S.F.P)Emar KimNo ratings yet

- Formula Sheet FIN 300Document3 pagesFormula Sheet FIN 300Stephanie NaamaniNo ratings yet

- Inputs: Before Restructuring After RestructuringDocument4 pagesInputs: Before Restructuring After Restructuringapi-3763138No ratings yet

- Markowitz Portfolio TheoryRDocument9 pagesMarkowitz Portfolio TheoryRShafiq KhanNo ratings yet

- (Resume) YolanSagitaPujakusuma - C1B018004Document6 pages(Resume) YolanSagitaPujakusuma - C1B018004arief taufiqqurrakhmanNo ratings yet

- CVP. Latest. MGMTDocument48 pagesCVP. Latest. MGMTbethanyafesehaNo ratings yet

- MAF CH 5Document20 pagesMAF CH 5Asegid H/meskelNo ratings yet

- FCFF 2 STDocument24 pagesFCFF 2 STapi-3701114No ratings yet

- EuroTunnDCFDocument11 pagesEuroTunnDCFNgọc Hiền Nguyễn PhanNo ratings yet

- Rate of Return Net Annual Profit / Capital InvestedDocument11 pagesRate of Return Net Annual Profit / Capital InvestedAira_DirectonerNo ratings yet

- Return On Sales X Asset Turnover: ROS 0.3 or 30%Document5 pagesReturn On Sales X Asset Turnover: ROS 0.3 or 30%Elisha Lois ManluluNo ratings yet

- CFA Level 1: Financial Statements - Free Cash FlowDocument2 pagesCFA Level 1: Financial Statements - Free Cash Flowpallakobhan_12100399No ratings yet

- CH 4 Solutions To Questions and ProblemsDocument24 pagesCH 4 Solutions To Questions and ProblemsJane Ming0% (1)

- Important FormulasDocument4 pagesImportant FormulasRakesh Ranjan JhaNo ratings yet

- Narayana Engineering College Autonomous-Nellore: Prepared by M.Bhargav Charan 20711E0054Document15 pagesNarayana Engineering College Autonomous-Nellore: Prepared by M.Bhargav Charan 20711E0054CH ANIL VARMANo ratings yet

- Breakeven Analysis: EBIT $0Document5 pagesBreakeven Analysis: EBIT $0Nouman MujahidNo ratings yet

- Session Ratios SummaryDocument2 pagesSession Ratios SummaryAlly DeanNo ratings yet

- Breakeven Where No Profit No Loss. Cost Meet Up Cost: Variable Cost: Vary With Units Produced Fixed CostDocument11 pagesBreakeven Where No Profit No Loss. Cost Meet Up Cost: Variable Cost: Vary With Units Produced Fixed CostNouman SheikhNo ratings yet

- Entrep ComputationDocument18 pagesEntrep ComputationEmman RevillaNo ratings yet

- Focused Finance & Eva: Naina Adarsh Tanvi Chaudhary Pushpak Roy ManishwarDocument23 pagesFocused Finance & Eva: Naina Adarsh Tanvi Chaudhary Pushpak Roy ManishwarNaina Singh AdarshNo ratings yet

- Beams11 ppt05Document39 pagesBeams11 ppt05Christian TambunanNo ratings yet

- Financial LeverageDocument18 pagesFinancial LeverageSTEVE ROGERSNo ratings yet

- Mba 2009 FM II - LeverageDocument39 pagesMba 2009 FM II - Leverageabhay_prakash_ranjanNo ratings yet

- 5.1 Basic Methods For Eng'g Eco StudyDocument16 pages5.1 Basic Methods For Eng'g Eco StudyVinceNo ratings yet

- Caiib-Abm-Important FormulaDocument3 pagesCaiib-Abm-Important FormulaVasimNo ratings yet

- VXA-2 Packet Tape DriveDocument2 pagesVXA-2 Packet Tape DriveudelkingkongNo ratings yet

- Title: Poor Infrastructure May Lead Indonesia To Middle-Income Trap Date: 3 Mar 2014 Media: The Jakarta Post: 6 Author: Nurkholisoh Ibnu AmanDocument1 pageTitle: Poor Infrastructure May Lead Indonesia To Middle-Income Trap Date: 3 Mar 2014 Media: The Jakarta Post: 6 Author: Nurkholisoh Ibnu AmanudelkingkongNo ratings yet

- Valuation Notes Basix Before-And-After Conrail Cost of The Deal Borrowing Capacity Capital Structure LBO Cash FlowsDocument9 pagesValuation Notes Basix Before-And-After Conrail Cost of The Deal Borrowing Capacity Capital Structure LBO Cash FlowsudelkingkongNo ratings yet

- Understanding CMDB: by Nandini Krishnan Business AnalystDocument21 pagesUnderstanding CMDB: by Nandini Krishnan Business AnalystudelkingkongNo ratings yet

- Buying House: Utomo S Putro SBM ItbDocument4 pagesBuying House: Utomo S Putro SBM ItbudelkingkongNo ratings yet

- Balanced Scorecard SCMDocument5 pagesBalanced Scorecard SCMudelkingkongNo ratings yet

- Countrycode Long Name Income Group Region Lending Category Idn Republic of Indonesia Lower Middle Income East Asia & Pacific IbrdDocument19 pagesCountrycode Long Name Income Group Region Lending Category Idn Republic of Indonesia Lower Middle Income East Asia & Pacific IbrdudelkingkongNo ratings yet

- Developing Negotiation Case Studies: James K. SebeniusDocument15 pagesDeveloping Negotiation Case Studies: James K. SebeniusudelkingkongNo ratings yet

- Rsis Commentaries: Indonesia's Rising Middle Class: Tweeting To Be HeardDocument2 pagesRsis Commentaries: Indonesia's Rising Middle Class: Tweeting To Be HeardudelkingkongNo ratings yet

- Indra Riady 29111049 R45A Strategic and Decision Making: Representative HeuristicDocument2 pagesIndra Riady 29111049 R45A Strategic and Decision Making: Representative HeuristicudelkingkongNo ratings yet

- (Tugas) P10-26Document2 pages(Tugas) P10-26udelkingkongNo ratings yet

- McKinsey and Company Managing Knowledge and LearningDocument2 pagesMcKinsey and Company Managing Knowledge and Learningudelkingkong100% (1)

- AxsymmetrikDocument3 pagesAxsymmetrikudelkingkongNo ratings yet